Form 8-K - Current report

16 May 2024 - 10:14PM

Edgar (US Regulatory)

0000215466false00002154662024-05-142024-05-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): May 14, 2024

Coeur Mining, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware | 1-8641 | 82-0109423 |

(State or other jurisdiction

of incorporation or organization) | (Commission

File Number) | (IRS Employer

Identification No.) |

200 South Wacker Drive

Suite 2100

Chicago, Illinois 60606

(Address of Principal Executive Offices)

(312) 489-5800

(Registrant's telephone number, including area code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2 below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock (par value $.01 per share) | CDE | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.07. Submission of Matters to a Vote of Security Holders.

Coeur held its 2024 Annual Stockholders’ Meeting on May 14, 2024 (the “Annual Meeting”). Coeur’s stockholders voted on the following three proposals at the Annual Meeting. The number of votes cast for and against each proposal and the number of abstentions and broker non-votes are set forth below.

Proposal 1. Election of Directors.

The stockholders elected the following nine individuals to Coeur’s Board of Directors for one-year terms expiring at the 2025 Annual Stockholders’ Meeting. The voting results were as follows:

| | | | | | | | | | | | | | |

| For | Against | Abstain | Approval Percentage (1) |

| Linda L. Adamany | 223,589,674 | 5,593,369 | 413,946 | 97.56% |

| Paramita Das | 227,606,146 | 1,537,854 | 452,989 | 99.33% |

| Randolph E. Gress | 212,200,917 | 16,970,720 | 425,352 | 92.59% |

| Jeane L. Hull | 227,124,928 | 2,058,939 | 413,122 | 99.10% |

| Robert Krcmarov | 227,525,379 | 1,617,535 | 454,075 | 99.29% |

| Mitchell J. Krebs | 227,135,557 | 2,003,218 | 458,214 | 99.13% |

| Eduardo Luna | 228,032,773 | 1,147,677 | 416,539 | 99.50% |

| Robert E. Mellor | 200,977,004 | 28,208,850 | 411,135 | 87.69% |

| J. Kenneth Thompson | 209,647,731 | 19,532,312 | 416,946 | 91.48% |

| | | | |

| Broker Non-Votes: | 47,065,439 | |

Proposal 2. Ratification of Appointment of Independent Registered Public Accounting Firm.

The stockholders ratified the appointment of Grant Thornton LLP as Coeur’s independent registered public accounting firm for the 2024 fiscal year. The voting results were as follows:

| | | | | | | | | | | | | | |

| For | Against | Abstain | Broker Non-Votes | Approval Percentage (1) |

| 274,238,527 | 1,602,819 | 821,082 | — | 99.42% |

Proposal 3. Approval of Advisory Resolution on Named Executive Officer Compensation.

The stockholders approved an advisory resolution on named executive officer compensation. The voting results were as follows:

| | | | | | | | | | | | | | |

| For | Against | Abstain | Broker Non-Votes | Approval Percentage (1) |

| 221,226,932 | 7,633,133 | 736,924 | 47,065,439 | 96.66% |

_____________________________________________________

(1) Percentage of votes cast for the nominee or proposal (excluding abstentions and broker non-votes).

Item 8.01. Other Events.

Following the Annual Meeting, the Board and Nominating and Corporate Governance Committee reviewed the structure of the Board and Company leadership as part of its annual review of the Board succession planning process, and, upon the recommendation of the Nominating and Corporate Governance Committee, the Board determined that, given the significant tenure of the Company's President and Chief Executive Officer, it was in the best interest of the Company to elect Mitchell J. Krebs as the Chairperson of the Board in addition to his role as President and Chief Executive Officer. In addition, pursuant to the Company’s corporate governance guidelines (the “Guidelines”), the independent directors of the Board simultaneously designated J. Kenneth Thompson to serve as the independent Lead Director of the Board.

In accordance with the Guidelines, the Lead Director’s responsibilities and powers include: presiding at all meetings of the Board at which the Chairperson is not present, and each executive session of the non-management members and/or independent directors of the Board; serving as liaison between the Chairperson and the independent directors; approving information sent to the Board; approving meeting agendas for the Board; approving meeting schedules to assure sufficient time for discussion of all agenda items;

having the authority to call meetings of the independent directors; and if requested by major stockholders, ensuring that he or she is available for consultation and direct communication.

Item 9.01. Financial Statements and Exhibits.

(d) List of Exhibits

| | | | | |

| Exhibit No. | Description |

| 104 | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

Exhibit Index

| | | | | |

| Exhibit No. | Description |

| 104 | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| COEUR MINING, INC. |

| Date: May 16, 2024 | By: /s/ Casey M. Nault |

| Name: Casey M. Nault

Title: Senior Vice President, General Counsel and Chief ESG Officer |

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

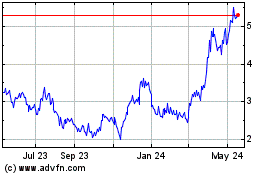

Coeur Mining (NYSE:CDE)

Historical Stock Chart

From Nov 2024 to Dec 2024

Coeur Mining (NYSE:CDE)

Historical Stock Chart

From Dec 2023 to Dec 2024