Granite Point Mortgage Trust Inc. Announces Patrick Halter and Lazar Nikolic Appointed to the Board of Directors

16 January 2025 - 8:15AM

Business Wire

Granite Point Mortgage Trust Inc. (NYSE: GPMT) ("GPMT,"

"Granite Point" or the "Company”) today announced that Patrick

Halter and Lazar Nikolic have been appointed to the Company’s Board

of Directors, effective immediately. Mr. Halter will serve on the

Compensation Committee and Mr. Nikolic will serve on the Nominating

and Corporate Governance Committee. With the additions of Mr.

Halter and Mr. Nikolic, the Granite Point Board now comprises eight

directors, seven of whom are independent.

“We are pleased to welcome two new highly qualified independent

directors to the Granite Point Board,” said Stephen Kasnet,

Chairman of the Granite Point Board of Directors. “Pat’s experience

building and growing a preeminent commercial real estate investment

management business will be tremendously valuable to the Board, as

will Lazar’s investment background in various real estate asset

classes and his perspective as a large shareholder. These

appointments reflect our commitment to regularly enhancing and

refreshing the Board to ensure it is best positioned to advance our

shareholders’ interests. We look forward to benefiting from the new

directors’ insights as Granite Point navigates the current

environment and pursues opportunities to drive profitable growth

and shareholder value creation.”

“I have known and admired Granite Point’s CEO, Jack Taylor, for

decades. I’m excited to join the Board and help the Company build

on its resilient business model and momentum to capture growth

opportunities as the market recovers,” said Mr. Halter.

“As one of Granite Point’s significant shareholders, I believe

in the value of the business and am confident in the opportunities

ahead,” said Mr. Nikolic. “I appreciate the Board’s constructive

engagement with shareholders and am eager to work with my fellow

board members in furthering shareholder value.”

About Patrick Halter

Patrick Halter is a veteran real estate investment leader who

spent more than four decades in various leadership positions with

Principal Financial Group, most recently serving, from 2018 to

2024, as President and CEO of Principal Asset Management, its

global investment management business, then managing over $650

billion in assets. In that role, he was responsible for overseeing

globally the firm’s operations, and its investment and distribution

teams. Halter was previously Chief Operating Officer of Principal

Global Investors and served on the Board of Principal’s fourteen

investment teams. He also served on the Principal Mutual Fund Board

and held board responsibilities with various international

ventures. Prior to that, Halter was the Chief Executive Officer and

Senior Executive Director of Principal Real Estate Investors from

2003 to 2016, where, under his leadership, he and his team built it

to a top 10 global real estate manager.

About Lazar Nikolic

Lazar Nikolic is a seasoned real estate investment expert with

over two decades of industry experience. Mr. Nikolic co-founded JPL

Advisors in 2016 and serves as a Managing Member overseeing the

firm’s portfolio management, investment analysis and risk

management with a focus in mortgage REITs, equity REITs, closed end

funds business development companies, specialty finance companies

and special situations. Prior to founding JPL, Mr. Nikolic was a

portfolio manager at Adler & Co from 2009 to 2015.

About Granite Point Mortgage Trust Inc.

Granite Point Mortgage Trust Inc. is a Maryland corporation

focused on directly originating, investing in and managing senior

floating rate commercial mortgage loans and other debt and

debt-like commercial real estate investments. Granite Point is

headquartered in New York, NY. Additional information is available

at www.gpmtreit.com.

Forward-Looking Statements

This press release contains, or incorporates by reference, not

only historical information, but also forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995. Forward-looking statements involve numerous risks and

uncertainties. Our actual results may differ from our beliefs,

expectations, estimates, projections and illustrations and,

consequently, you should not rely on these forward-looking

statements as predictions of future events. Forward-looking

statements are not historical in nature and can be identified by

words such as “anticipate,” “estimate,” “will,” “should,” “expect,”

“target,” “believe,” “outlook,” “potential,” “continue,” “intend,”

“seek,” “plan,” “goals,” “future,” “likely,” “may” and similar

expressions or their negative forms, or by references to strategy,

plans or intentions. The illustrative examples herein are

forward-looking statements. By their nature, forward-looking

statements speak only as of the date they are made, are not

statements of historical facts or guarantees of future performance

and are subject to risks, uncertainties, assumptions or changes in

circumstances that are difficult to predict or quantify. Our

expectations, beliefs and estimates are expressed in good faith and

we believe there is a reasonable basis for them. However, there can

be no assurance that management's expectations, beliefs and

estimates will prove to be correct or be achieved, and actual

results may vary materially from what is expressed in or indicated

by the forward-looking statements.

These forward-looking statements are subject to risks and

uncertainties, including, among other things, those described in

our Annual Report on Form 10-K for the year ended December 31,

2023, under the caption “Risk Factors,” and any subsequent Form

10-Q or other filings made with the SEC. Forward-looking statements

speak only as of the date they are made, and we undertake no

obligation to update or revise any such forward-looking statements,

whether as a result of new information, future events or

otherwise.

This press release is for informational purposes only and shall

not constitute, or form a part of, an offer to sell or buy or the

solicitation of an offer to sell or the solicitation of an offer to

buy any securities.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250115187504/en/

Investors: Chris Petta Investor Relations, Granite Point

Mortgage Trust Inc., (212) 364-5500, investors@gpmtreit.com.

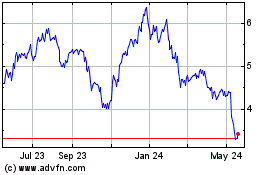

Granite Point Mortgage (NYSE:GPMT)

Historical Stock Chart

From Dec 2024 to Jan 2025

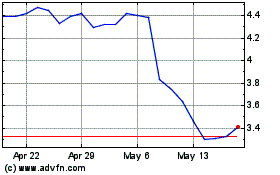

Granite Point Mortgage (NYSE:GPMT)

Historical Stock Chart

From Jan 2024 to Jan 2025