As filed with the Securities and Exchange Commission on December 12, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Herc Holdings Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 20-3530539 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

27500 Riverview Center Blvd. Bonita Springs, Florida 34134 (239) 301-1000 |

| (Address of principal executive offices) (Zip Code) |

| | |

| HERC HOLDINGS INC. 2018 OMNIBUS INCENTIVE PLAN |

| (Full title of the plan) |

| | |

S. Wade Sheek

Senior Vice President, Chief Legal Officer and Secretary Herc Holdings Inc. 27500 Riverview Center Blvd. Bonita Springs, Florida 34134 |

| (Name and address of agent for service) |

| | |

| (239) 301-1000 |

| (Telephone number, including area code, of agent for service) |

| | |

Copies of all communications, including communications sent to agent for service, should be sent to:

Rikki Sapolich-Krol Coleman Wombwell K&L Gates LLP 300 South Tryon Street, Suite 1000

Charlotte, North Carolina 28202 (704) 331-7400 |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | |

Large accelerated filer ☒ | Accelerated filer ☐ |

Non-accelerated filer ☐ | Smaller reporting company ☐ |

| Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

EXPLANATORY NOTE

Herc Holdings Inc. (the “Registrant”) is filing this Registration Statement on Form S-8 for the purpose of registering 900,000 shares of common stock, par value $0.01 per share (“Common Stock”), that were previously issued as awards under the Herc Holdings Inc. 2018 Omnibus Incentive Plan, as amended (the “Plan”), but which (i) subsequently expired according to their terms, lapsed or terminated, or which were subsequently canceled, forfeited, or surrendered, in each case without such shares having been issued, (ii) were subsequently settled in cash, (iii) were tendered to or withheld by the Company to pay the exercise price of an option granted under the Plan or to satisfy any tax withholding obligations with respect to an award granted under the Plan, or (iv) are expected to so expire, lapse, terminate, be canceled, forfeited, or surrendered, be settled in cash, or be tendered or withheld, and in each case are or will become available for issuance for future awards under the Plan in accordance with its terms.

Pursuant to General Instruction E to Form S-8, the contents of the Registrant’s Registration Statement on Form S-8 filed with the Securities and Exchange Commission (the “Commission”) on May 24, 2018 (File No. 333-225164) is hereby incorporated by reference into this Registration Statement on Form S-8 (except to the extent expressly superseded herein).

PART II

INFORMATION REQUIRED IN REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The Registrant hereby incorporates by reference in this Registration Statement the following documents previously filed by the Registrant with the Commission:

| | |

•the Registrant’s Annual Report on Form 10-K for the year ended December 31, 2022 filed with the Commission on February 14, 2023; |

•the Registrant’s Quarterly Reports on Form 10-Q for (i) the quarter ended March 31, 2023 filed with the Commission on April 20, 2023 (ii) the quarter ended June 30, 2023 filed with the Commission on July 25, 2023, (iii) the quarter ended September 30, 2023 filed with the Commission on October 24, 2023;

•the Registrant’s Current Reports on Form 8-K as filed with the Commission on March 6, 2023, March 9, 2023, March 16, 2023, May 15, 2023 and September 6, 2023; and

•the description of the Registrant’s Common Stock set forth in Exhibit 4.2 to the Registrant’s Annual Report on Form 10-K filed with the Commission on February 27, 2020, including any amendment or report filed for the purpose of updating such description.

All documents filed by the Registrant with the Commission pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), subsequent to the date of this Registration Statement shall be deemed to be incorporated herein by reference and to be a part hereof from the date of the filing of such documents until such time as there shall have been filed a post-effective amendment that indicates that all securities offered hereby have been sold or which deregisters all securities remaining unsold at the time of such amendment.

Any statement contained in the documents incorporated or deemed to be incorporated by reference in this Registration Statement shall be deemed to be modified, superseded or replaced for purposes of this Registration Statement to the extent that a statement contained herein or in any other subsequently filed document which also is incorporated or deemed to be incorporated by reference in this Registration Statement modifies, supersedes or replaces such statement. Any such statement so modified, superseded or replaced shall not be deemed, except as so modified, superseded or replaced, to constitute a part of this Registration Statement.

No document or information deemed to be furnished and not filed in accordance with rules of the Commission shall be deemed to be incorporated herein by reference unless such document or information expressly provides to the contrary.

Item 8. Exhibits.

| | | | | | | | |

Exhibit

Number | | Description |

| 4.1 | | |

| 4.2 | | |

| 4.3 | | |

| 4.4 | | |

| 4.5 | | |

| 4.6 | | |

| 4.7 | | |

| 5.1* | | |

| 23.1* | | |

| 23.2* | | |

| 24.1* | | |

| 107* | | |

* Filed herewith.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Bonita Springs, State of Florida, on December 12, 2023.

| | | | | | | | |

| | HERC HOLDINGS INC. |

| | By: | /s/ Mark Humphrey |

| | | Mark Humphrey Senior Vice President and Chief Financial Officer (On behalf of the Registrant) |

POWER OF ATTORNEY

Each of the undersigned officers and directors of Herc Holdings Inc. hereby constitutes and appoints Mark Humphrey and Wade Sheek, and each of them, his or her true and lawful attorneys-in-fact and agents, each with full power of substitution and resubstitution, for him or her and in his or her name, place and stead, in any and all capacities, to sign any and all (i) amendments (including post-effective amendments) and additions to this Registration Statement of Herc Holdings Inc. on Form S-8 and (ii) to file the same, with all exhibits thereto, and other documents in connection therewith, with the Commission, granting unto said attorneys-in-fact and agents, and each of them, full power and authority to do and perform each and every act and thing requisite or necessary to be done in connection therewith, as fully and to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that each of said attorneys-in-fact and agents, or his or her substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities set forth opposite their names and on December 12, 2023.

| | | | | | | | | | | | | | |

| | |

| Name | | Title |

| | | |

| /s/ LAWRENCE H. SILBER | | President and Chief Executive Officer, Director |

| Lawrence H. Silber | | (Principal Executive Officer) |

| | | |

| /s/ MARK HUMPHREY | | Senior Vice President and Chief Financial Officer |

| Mark Humphrey | | (Principal Financial Officer) |

| | | |

| /s/ MARK SCHUMACHER | | Vice President, Chief Accounting Officer |

| Mark Schumacher | | (Principal Accounting Officer) |

| | |

| /s/ PATRICK D. CAMPBELL | | Non-Executive Chairman of the Board |

| Patrick D. Campbell | | |

| | | |

| /s/ JAMES H. BROWNING | | Director |

| James H. Browning | | |

| | | |

| /s/ SHARI L. BURGESS | | Director |

| Shari L. Burgess | | |

| | |

| /s/ JEAN K. HOLLEY | | Director |

| Jean K. Holley | | |

| | | |

| /s/ MICHAEL A. KELLY | | Director |

| Michael A. Kelly | | |

| | | |

| /s/ RAKESH SACHDEV | | Director |

| Rakesh Sachdev | | |

| | |

Calculation of Filing Fee Tables

Form S-8

(Form Type)

Herc Holdings Inc.

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered and Carry Forward Securities

| | | | | | | | | | | | | | | | | | | | | | | |

| Security Type | Security Class Title | Fee Calculation or Carry Forward Rule | Amount Registered(1) | Proposed Maximum Offering Price Per Unit(2) | Maximum Aggregate Offering Price | Fee Rate | Amount of Registration Fee |

| Equity | Common Stock, part value $0.01 per share | Rule 457(c) and (h) | 900,000(3) | $122.66 | $110,394,000.00 | 0.00014760 | $16,294.15 |

| — | — | — | — | | — | | — |

| — | — | — | — | | — | | |

| Total Offering Amounts | | $110,394,000.00 | | $16,294.15 |

| Total Fee Offsets | | | | — |

| Net Fees Due | | | | $16,294.15 |

(1) Any additional shares of common stock of Herc Holdings Inc. (the “Registrant”) to be issued as a result of stock dividends, stock splits or similar transactions shall be covered by this Registration Statement as provided in Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”).

(2) Calculated in accordance with Rule 457(c) and (h) under the Securities Act solely for the purpose of calculating the registration fee, which is based on the average of the high and low market prices of the shares of common stock of the Registrant as reported on the New York Stock Exchange on December 6, 2023.

(3) Represents 900,000 shares of common stock of the Registrant previously issued as awards under the Herc Holdings Inc. 2018 Omnibus Incentive Plan, as amended (the “Plan”), but which (i) subsequently expired, lapsed or terminated, were cancelled, forfeited or surrendered, were settled in cash, or were tendered to or withheld by the Company to pay the exercise price or to satisfy tax withholding obligations, or are expected to so expire, lapse or terminate, be cancelled, forfeited or surrendered, be settled in cash, or be tendered or withheld and (ii) in each case, are or will become available for issuance for future awards under the Plan in accordance with its terms.

December 12, 2023

Herc Holdings Inc.

27500 Riverview Center Blvd.

Bonita Springs, Florida 34134

Ladies and Gentlemen:

We have acted as special counsel to Herc Holdings Inc., a Delaware corporation (the “Company”), in connection with the Registration Statement on Form S-8 (the “Registration Statement”) filed on the date hereof with the Securities and Exchange Commission (the “SEC”) under the Securities Act of 1933, as amended (the “Securities Act”), and the rules and regulations promulgated thereunder for the registration of an aggregate of 900,000 shares (the “Shares”) of common stock, par value $0.01 per share (“Common Stock”), of the Company issuable pursuant to the Herc Holdings Inc. 2018 Omnibus Incentive Plan, as amended (the “Plan”), which underlie Awards (as defined in the Plan) previously issued under the Plan but which (i) subsequently expire according to their terms, lapsed or terminated, or which were subsequently canceled, forfeited, or surrendered, in each case without such shares having been issued, (ii) were or are subsequently settled in cash, (iii) were or are tendered to or withheld by the Company to pay the exercise price of an option granted under the Plan or to satisfy any tax withholding obligations with respect to an award granted under the Plan, or (iv) are expected to so expire, lapse, terminate, be canceled, forfeited, or surrendered, be settled in cash, or be tendered or withheld.

You have requested our opinion as to the matters set forth below in connection with the Registration Statement. For purposes of rendering that opinion, we have examined (i) the Registration Statement, (ii) the Company’s Amended and Restated Certificate of Incorporation, as amended through the date hereof, (iii) the Company’s Amended and Restated Bylaws, as amended through the date hereof, (iv) the Company’s stock ledger; (v) corporate actions of the Company’s Board of Directors relating to the issuance of the Shares and the Registration Statement and (vi) the Plan, and we also have made such investigation of law as we have deemed appropriate. We have examined and relied on certificates of public officials and, as to certain matters of fact that are material to our opinion, we have also relied on a certificate of an officer of the Company. Other than our review of the documents listed in (i) through (vi) above, we have not reviewed any other documents or made any independent investigation for the purpose of rendering this opinion.

For the purposes of this opinion letter, we have made assumptions that are customary in opinion letters of this kind, including the assumptions that each document submitted to us is accurate and complete, that each such document that is an original is authentic, that each such

K&L GATES LLP

300 SOUTH TRYON STREET, SUITE 1000 CHARLOTTE NC 28202

T +1 704 331 7400 F +1 704 331 7598 klgates.com

Herc Holdings Inc.

December 12, 2023

Page 2

document that is a copy conforms to an authentic original, that all signatures on each such document are genuine and that the Company is and shall remain at all times a corporation duly incorporated, validly existing and in good standing under the laws of the State of Delaware. We have further assumed the legal capacity of natural persons, and we have assumed that each party to the documents we have examined or relied on has the legal capacity or authority and has satisfied all legal requirements that are applicable to that party to the extent necessary to make such documents enforceable against that party. We have not verified any of those assumptions.

In rendering our opinion below, we also have assumed that: (a) the Company will have sufficient authorized and unissued or treasury shares of Common Stock at the time of each issuance or delivery of a Share under the Plan; (b) the Shares will be evidenced by appropriate certificates, duly executed and delivered, or the Company’s Board of Directors will adopt a resolution providing that all shares of common stock shall be uncertificated in accordance with Section 158 of the Delaware General Corporation Law (the “DGCL”) prior to their issuance; (c) the issuance or distribution of each Share will be duly noted in the Company’s stock ledger upon its issuance; (d) the Plan constitutes the valid and binding agreement of the Company, enforceable against the Company in accordance with its terms; (e) the Company will receive consideration for each Share at least equal to the par value of such share of Common Stock and in the amount required by the Plan (or the applicable award agreement thereunder) and in the amount required by the Authorizing Resolutions; (f) prior to the issuance or delivery of any Shares under the Plan, the Company’s Board of Directors will duly authorize each award granted under the Plan, pursuant to an award agreement and in accordance with the DGCL and the Plan (the “Authorizing Resolutions”) and such Authorizing Resolutions will not have been revoked; and (g) the reacquisition of the Shares by the Company following such Shares’ initial issuance complied or will comply in all respects with the DGCL and any other law, rule or regulation applicable to the Company or its securities. We have not verified any of the foregoing assumptions.

Our opinion set forth below is limited to the DGCL and reported judicial decisions interpreting the DGCL.

Based on and subject to the foregoing, it is our opinion that the Shares are duly authorized for issuance by the Company pursuant to, and on the terms set forth in, the Plan and, when, and if, issued pursuant to the terms of the Plan, the Authorizing Resolutions and the applicable award agreement, will be validly issued, fully paid, and non-assessable.

We hereby consent to the filing of this opinion letter with the SEC as Exhibit 5.1 to the Registration Statement. In giving this consent, we do not thereby admit that we are within the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations of the SEC promulgated thereunder.

Very truly yours,

/s/ K&L Gates LLP

K&L Gates LLP

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We hereby consent to the incorporation by reference in this Registration Statement on Form S-8 of Herc Holdings, Inc. of our report dated February 14, 2023 relating to the financial statements, financial statement schedule and the effectiveness of internal control over financial reporting, which appears in Herc Holdings, Inc.'s Annual Report on Form 10-K for the year ended December 31, 2022.

/s/ PricewaterhouseCoopers LLP

Tampa, Florida

December 12, 2023

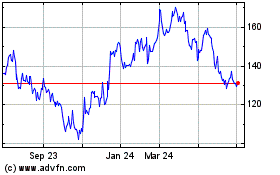

Herc (NYSE:HRI)

Historical Stock Chart

From Dec 2024 to Jan 2025

Herc (NYSE:HRI)

Historical Stock Chart

From Jan 2024 to Jan 2025