FALSE000183163100018316312024-09-202024-09-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM 8-K

_____________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (or date of earliest event reported): September 20, 2024

_____________________

loanDepot, Inc.

(Exact Name of Registrant as Specified in its Charter)

_____________________

| | | | | | | | | | | | | | |

| Delaware | | 001-40003 | | 85-3948939 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification Number) |

6561 Irvine Center Drive

Irvine, California 92618

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: (888) 337-6888

_____________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

| ☐ | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | | | |

| ☐ | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | | | |

| ☐ | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | | | |

| ☐ | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A Common Stock, $0.001 Par Value | | LDI | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 1.01 Entry into a Material Definitive Agreement.

Amendment No. 8 to Second Amended and Restated Master Repurchase Agreement with Bank of America, N.A.

On September 20, 2024, loanDepot.com, LLC (the “Company”), a Delaware limited liability company and an indirect subsidiary of loanDepot. Inc., as guarantor and pledgor, and loanDepot BA Warehouse, LLC, a Delaware limited liability company and a direct wholly-owned subsidiary of the Company (the “Seller”), as seller, entered into Amendment No. 8 (“Amendment No. 8”) to the Second Amended and Restated Master Repurchase Agreement, dated as of August 20, 2021 (as amended, restated, supplemented or otherwise modified from time to time), with Bank of America, N.A., a national banking association (“BANA”), as buyer, pursuant to which the Seller may sell to BANA, and later repurchase, participation interests in residential mortgage loans that were issued to the Seller by the Company. The primary purpose of Amendment No. 8 and certain ancillary agreements, effective September 23, 2024, are to (a) extend the expiration date to September 22, 2025, and (b) revise certain definitions related to the interest rate benchmark and make certain other compliance and administrative revisions.

The foregoing description of Amendment No. 8 is not complete and is qualified in its entirety by reference to the full text of Amendment No. 8, a copy of which is attached hereto as Exhibit 10.1 and is incorporated herein by reference

Amendment No. 6 to Second Amended and Restated Mortgage Loan Purchase and Sale Agreement with Bank of America, N.A.

On September 20, 2024, the Company, as seller, entered into Amendment No. 6 (“Amendment No. 6”) to the Second Amended and Restated Master Mortgage Loan Purchase and Sale Agreement, dated as of February 2, 2022 (as amended, restated, supplemented or otherwise modified from time to time), with BANA, as purchaser, pursuant to which the Company may sell to, and later repurchase from, BANA the Company’s beneficial right, title and interest in and to certain designated pools of fully amortizing first lien residential mortgage loans eligible in the aggregate to back securities and the servicing rights related thereto in exchange for a participation certificate. The primary purposes of Amendment No. 6, effective September 23, 2024, are to (a) extend the expiration date to September 22, 2025, and (b) revise certain definitions related to the interest rate benchmark and make certain other compliance and administrative revisions.

The foregoing description of Amendment No. 6 is not complete and is qualified in its entirety by reference to the full text of Amendment No. 6, a copy of which is attached hereto as Exhibit 10.2 and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

| Exhibit No. | Description |

| 10.1# | |

| 10.2# | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

# Confidential information has been omitted because it is both (i) not material and (ii) is the type of information that the Company treats as private or confidential pursuant to Item 601(b)(10) of Regulation S-K.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

loanDepot, Inc. |

| |

By: | /s/ David Hayes | |

Name: David Hayes |

Title: Chief Financial Officer |

Date: September 24, 2024

Certain confidential information contained in this document, marked by “[***]”, has been omitted because it is both (i) not material and (ii) would be competitively harmful if publicly disclosed.

EXECUTION

AMENDMENT NO. 8 TO

SECOND AMENDED AND RESTATED MASTER REPURCHASE AGREEMENT

THIS AMENDMENT NO. 8 TO SECOND AMENDED AND RESTATED MASTER REPURCHASE AGREEMENT (this “Amendment”) is made and entered into as of September 20, 2024, by and between Bank of America, N.A. (“Buyer”) and loanDepot BA Warehouse, LLC (“Seller”), and acknowledged and agreed to by loanDepot.com, LLC, as guarantor and pledgor (“loanDepot” and together with the Seller, each a “loanDepot Party” and collectively, the “loanDepot Parties”). This Amendment amends that certain Second Amended and Restated Master Repurchase Agreement by and between Buyer and Seller, and acknowledged and agreed to by loanDepot, dated as of August 20, 2021 (as amended, restated, supplemented or otherwise modified from time to time, the “Agreement”).

R E C I T A L S

Buyer and loanDepot Parties have previously entered into the Agreement pursuant to which Buyer may, from time to time, purchase certain Eligible Participation Interests from Seller and Seller agrees to sell certain Eligible Participation Interests to Buyer under a master repurchase facility. Buyer and loanDepot Parties hereby agree that the Agreement shall be amended as more fully provided herein.

In consideration of the mutual promises contained herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, Buyer and loanDepot Parties hereby agree as follows:

1.Amendments. Effective as of September 23, 2024 (the “Amendment Effective Date”), the Agreement is hereby amended as follows:

(a)Section 14.11 of the Agreement is hereby amended by:

(i)deleting the notice information for Buyer in subsection (a) in its entirety and replacing it with the following:

If to Buyer: Bank of America, N.A.

31303 Agoura Road

Mail Code: CA6-917-02-63

Westlake Village, California 91361

[***]

With copies to:

Bank of America, N.A.

620 S. Tryon Street

Mail Code: NC1-030-21-01

Charlotte, North Carolina 28255

[***]

and

Bank of America, N.A.

One Bank of America Center

150 North College Street

Mail Code: NC1-028-29-04

Charlotte, North Carolina 28255

[***]

(ii)deleting the notice information for Buyer in subsection (b) in its entirety and replacing it with the following:

If to Buyer: [***]

(b)Section 14.17 of the Agreement is hereby amended by adding the following new paragraph at the end thereof:

For the avoidance of doubt, nothing herein prohibits any individual from communicating or disclosing information regarding suspected violations of laws, rules, or regulations to a governmental, regulatory, or self-regulatory authority without any notification to any Person.

(c)Exhibit A to the Agreement is hereby amended by:

(i)deleting the definitions of “Daily Simple SOFR” and “U.S. Government Securities Business Day” in their respective entireties and replacing them with the following, respectively:

Daily Simple SOFR: With respect to any applicable determination date means the secured overnight financing rate published on such date by the Federal Reserve Bank of New York, as the administrator of the benchmark (or a successor administrator) on the Federal Reserve Bank of New York’s website (or any successor source), plus the applicable SOFR Adjustment.

U.S. Government Securities Business Day: Any day except for (a) a Saturday, (b) a Sunday or (c) a day on which SIFMA recommends that the fixed income departments of its members be closed for the entire day for purposes of trading in United States government securities.

(ii)adding the following definitions in their proper alphabetical order:

Committed Amount: The portion of the Aggregate Transaction Limit that is committed, as set forth in the Transactions Terms Letter.

Loan Program Authority: With respect to Agency Eligible Mortgage Loans and Government Mortgage Loans, the applicable Agency, or with respect to Closed-End Second Lien Mortgage Loans, the applicable underwriting guidelines as approved by Buyer in its sole discretion.

Uncommitted Amount: The amount of the Aggregate Transaction Limit that is uncommitted, as set forth in the Transactions Terms Letter, or such other amount as may be determined by the Buyer in its sole discretion.

(d)The Representations and Warranties Concerning Seller section of Exhibit L to the Agreement is hereby amended by deleting clause (u) thereof in its entirety and replacing it with the following:

(u) No Sanctions. Neither any loanDepot Party nor any of its Affiliates, officers, directors, partners or members, (i) is an entity or person (or to such loanDepot Party’s knowledge, owned or controlled by an entity or person) that (A) is currently the subject of any economic sanctions administered or imposed by the Office of Foreign Assets Control of the U.S. Department of the Treasury, the U.S. Department of State, the United Nations Security Council, the European Union, His Majesty’s Treasury or any other relevant authority (collectively, “Sanctions”) or (B) resides, is organized or chartered, or has a place of business in a country or territory that is currently the subject of Sanctions or (ii) is engaging or will engage in any dealings or transactions prohibited by Sanctions or will directly or indirectly use the proceeds of any Transactions contemplated hereunder, or lend, contribute or otherwise make available such proceeds to or for the benefit of any person or entity, for the purpose of financing or supporting, directly or indirectly, the activities of any person or entity that is currently the subject of Sanctions.

(e)The Representations and Warranties Concerning Underlying Assets section of Exhibit L to the Agreement is hereby amended by deleting clause (bb) thereof in its entirety and replacing it with the following:

(bb) Appraisal. The Mortgage Loan File with respect to such Underlying Asset contains either a valuation or an appraisal of the related Mortgaged Property meeting the requirements set forth by the Financial Institutions Reform, Recovery, and Enforcement Act of 1989, unless such valuation or appraisal, as applicable, is not required by the applicable Loan Program Authority, or applicable regulatory or licensing body. Such valuation or appraisal was made and signed, prior to the approval of the application for such Underlying Asset, by a qualified appraiser (a) who, at the time of such valuation or appraisal, met the minimum qualifications of the applicable Loan Program Authority and (b) who satisfied (and which valuation or appraisal, as applicable, was conducted in accordance with) all of the applicable requirements of the Uniform Standards of Professional Appraisal Practice and all applicable federal and state laws and regulations in effect at the time of such appraisal. Such appraiser was licensed in the state where the Mortgaged Property is located, had no interest, direct or indirect, in such Mortgaged Property or in any loan made on the security thereof, and such appraiser’s compensation was not affected by the approval or disapproval of such

Underlying Asset. If the Mortgage Loan is an Agency Eligible Mortgage Loan and is subject to a property inspection waiver, the property valuation was the subject of a duly issued appraisal waiver offer that was not more than four months old as of the date of the Mortgage Note and Mortgage.

2.Fees and Expenses. The Seller agrees to pay to Buyer all fees and out of pocket expenses incurred by Buyer in connection with this Amendment, including all reasonable fees and out of pocket costs and expenses of the legal counsel to Buyer incurred in connection with this Amendment, in accordance with Section 11.7 of the Agreement.

3.Conditions Precedent. This Amendment shall be effective as of the Amendment Effective Date, upon Buyer’s receipt of this Amendment, executed and delivered by a duly authorized officer of the loanDepot Parties and Buyer.

4.No Other Amendments; Conflicts with Previous Amendments. Other than as expressly modified and amended herein, the Agreement shall remain in full force and effect and nothing herein shall affect the rights and remedies of Buyer as provided under the Agreement. To the extent any amendments to the Agreement contained herein conflict with any previous amendments to the Agreement, the amendments contained herein shall control.

5.Capitalized Terms. Any capitalized term used herein and not otherwise defined herein shall have the meaning ascribed to such term in the Agreement.

6.Representations. In order to induce Buyer to execute and deliver this Amendment, loanDepot Parties hereby represent to Buyer that as of the Amendment Effective Date, after giving effect to this Amendment, (i) loanDepot Parties are in full compliance with all of the terms and conditions of the Principal Agreements and remain bound by the terms thereof, and (ii) no Potential Default or Event of Default has occurred and is continuing under the Principal Agreements.

7.Governing Law. This Amendment shall be construed in accordance with the laws of the State of New York without regard to any conflicts of law provisions (except for Sections 5-1401 and 5-1402 of the New York General Obligations Law which shall govern). All legal actions between or among the parties regarding the Agreement, including, without limitation, legal actions to enforce the Agreement or because of a dispute, breach or default of the Agreement, shall be brought in the federal or state courts located in New York County, New York, which courts shall have sole and exclusive in personam, subject matter and other jurisdiction in connection with such legal actions and the parties acknowledge and agree that venue in such courts shall be convenient and appropriate for all purposes.

8.Severability. Each provision and agreement herein shall be treated as separate and independent from any other provision or agreement herein and shall be enforceable notwithstanding the unenforceability of any such other provision or agreement.

9.Counterparts. This Amendment and any document, amendment, approval, consent, information, notice, certificate, request, statement, disclosure or authorization related to this Amendment (each a “Communication”) may be in the form of an Electronic Record and may be executed using Electronic Signatures (including, without limitation, facsimile and .pdf) and shall be considered

an original, and shall have the same legal effect, validity and enforceability as a paper record. This Amendment may be executed simultaneously in as many counterparts as necessary or convenient, including both paper and electronic counterparts, but each counterpart shall be deemed to be an original and all such counterparts shall constitute one and the same agreement. For the avoidance of doubt, the authorization under this paragraph may include, without limitation, use or acceptance by Buyer of a manually signed paper Communication which has been converted into electronic form (such as scanned into PDF format), or an electronically signed Communication converted into another format, for transmission, delivery and/or retention. Electronic Signatures and facsimile signatures shall be deemed valid and binding to the same extent as the original. For purposes hereof, “Electronic Record” and “Electronic Signature” shall have the meanings assigned to them, respectively, by 15 USC §7006, as it may be amended from time to time.

[signature page follows]

IN WITNESS WHEREOF, Buyer and loanDepot Parties have caused their names to be signed hereto by their respective officers thereunto duly authorized as of the date first written above. Buyer shall have no obligation to honor the terms and conditions of this Amendment if loanDepot Parties fail to fully execute and return this document to Buyer within three (3) days after the date hereof.

| | | | | |

BANK OF AMERICA, N.A., as Buyer

By:/s/ Adam Robitshek Name: Adam Robitshek Title: Director | LOANDEPOT BA WAREHOUSE, LLC, as Seller

By:/s/David Hayes Name: David Hayes Title: President |

| Acknowledged and Agreed to by:

LOANDEPOT.COM, LLC, as loanDepot

By:/s/David Hayes Name: David Hayes Title: CFO |

Signature Page to Amendment No. 8 to Second A&R MRA (BANA/loanDepot)

Certain confidential information contained in this document, marked by “[***]”, has been omitted because it is both (i) not material and (ii) would be competitively harmful if publicly disclosed.

EXECUTION

AMENDMENT NUMBER SIX

to the

Second Amended and Restated Mortgage Loan Participation Purchase and Sale Agreement

dated as of February 2, 2022

between

BANK OF AMERICA, N.A.

and

LOANDEPOT.COM, LLC

THIS AMENDMENT NUMBER SIX (this “Amendment”) is made as of September 20, 2024, by and between Bank of America, N.A. (“Purchaser”) and loanDepot.com, LLC (“Seller”) to the Second Amended and Restated Mortgage Loan Participation Purchase and Sale Agreement, dated as of February 2, 2022 (as amended, restated, supplemented or otherwise modified from time to time, the “Agreement”), between Purchaser and Seller.

WHEREAS, Seller has requested and Purchaser agrees to amend the Agreement as more specifically set forth herein; and

WHEREAS, as of the date hereof, Seller represents to Purchaser that, after giving effect to this Amendment, it is in compliance with all of the representations and warranties and all of the affirmative and negative covenants set forth in the Agreement and is not in default under the Agreement.

NOW THEREFORE, for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, and for the mutual covenants herein contained, the parties hereto hereby agree as follows:

SECTION 1.Amendments. Effective as of September 23, 2024 (the “Amendment Effective Date”), the Agreement is hereby amended as follows:

(a)Section 1 of the Agreement is hereby amended by deleting the definitions of “Daily Simple SOFR”, “Expiration Date” and “U.S. Government Securities Business Day” thereof in their respective entireties and replacing them with the following, respectively:

“Daily Simple SOFR”: With respect to any applicable determination date means the secured overnight financing rate published on such date by the Federal Reserve Bank of New York, as the administrator of the benchmark (or a successor administrator) on the Federal Reserve Bank of New York’s website (or any successor source), plus the applicable SOFR Adjustment.

“Expiration Date”: The earliest of (i) September 22, 2025, (ii) at Purchaser’s option, upon the occurrence of an Event of Default, and (iii) the date on which this Agreement shall terminate in accordance with the provisions hereof or by operation of law.

“U.S. Government Securities Business Day”: Any day except for (a) a Saturday, (b) a Sunday or (c) a day on which SIFMA recommends that the fixed income

departments of its members be closed for the entire day for purposes of trading in United States government securities.

(b)Section 9(a)(xi) of the Agreement is hereby amended by deleting such section in its entirety and replacing it with the following:

(xi)Neither Seller nor any of its Affiliates, officers, directors, partners or members, (i) is an entity or person (or to the Seller’s knowledge, owned or controlled by an entity or person) that (A) is currently the subject of any economic sanctions administered or imposed by the Office of Foreign Assets Control of the U.S. Department of the Treasury, the U.S. Department of State, the United Nations Security Council, the European Union, His Majesty’s Treasury or any other relevant authority (collectively, “Sanctions”) or (B) resides, is organized or chartered, or has a place of business in a country or territory that is currently the subject of Sanctions or (ii) is engaging or will engage in any dealings or transactions prohibited by Sanctions or will directly or indirectly use the proceeds of any transactions contemplated hereunder, or lend, contribute or otherwise make available such proceeds to or for the benefit of any person or entity, for the purpose of financing or supporting, directly or indirectly, the activities of any person or entity that is currently the subject of Sanctions;

(c)Annex A to the Agreement is hereby amended by deleting such annex in its entirety and replacing it with Exhibit A hereto.

SECTION 2.Fees and Expenses. The Seller agrees to pay to Purchaser all fees and out of pocket expenses incurred by Purchaser in connection with this Amendment, including all reasonable fees and out of pocket costs and expenses of the legal counsel to Purchaser incurred in connection with this Amendment, in accordance with Section 22(a) of the Agreement.

SECTION 3.Conditions Precedent. This Amendment shall be effective as of the Amendment Effective Date, upon Purchaser’s receipt of this Amendment, executed and delivered by a duly authorized officer of Seller and Purchaser.

SECTION 4.Defined Terms. Any terms capitalized but not otherwise defined herein should have the respective meanings set forth in the Agreement.

SECTION 5.Limited Effect. Except as amended hereby, the Agreement shall continue in full force and effect in accordance with its terms. Reference to this Amendment need not be made in the Agreement or any other instrument or document executed in connection therewith, or in any certificate, letter or communication issued or made pursuant to, or with respect to, the Agreement, any reference in any of such items to the Agreement being sufficient to refer to the Agreement as amended hereby.

SECTION 6.Representations. In order to induce Purchaser to execute and deliver this Amendment, Seller hereby represents to Purchaser that as of the Amendment Effective Date, after giving effect to this Amendment, (i) Seller is in full compliance with all of the terms and conditions of the Program Documents and remains bound by the terms thereof, and (ii) no Potential Default or Event of

Default or servicing termination event (as described in Section 6(f) of the Agreement) has occurred and is continuing under the Program Documents.

SECTION 7.Governing Law. This Amendment shall be construed in accordance with the laws of the State of New York without regard to any conflicts of law provisions (except for Sections 5-1401 and 5-1402 of the New York General Obligations Law) and the obligations, rights and remedies of the parties hereunder shall be determined in accordance with the laws of the State of New York, except to the extent preempted by federal law.

SECTION 8.Severability. Each provision and agreement herein shall be treated as separate and independent from any other provision or agreement herein and shall be enforceable notwithstanding the unenforceability of any such other provision or agreement.

SECTION 9.Counterparts. This Amendment and any document, amendment, approval, consent, information, notice, certificate, request, statement, disclosure or authorization related to this Amendment (each a “Communication”) may be in the form of an Electronic Record and may be executed using Electronic Signatures (including, without limitation, facsimile and .pdf) and shall be considered an original, and shall have the same legal effect, validity and enforceability as a paper record. This Amendment may be executed simultaneously in as many counterparts as necessary or convenient, including both paper and electronic counterparts, but each counterpart shall be deemed to be an original and all such counterparts shall constitute one and the same agreement. For the avoidance of doubt, the authorization under this paragraph may include, without limitation, use or acceptance by Purchaser of a manually signed paper Communication which has been converted into electronic form (such as scanned into PDF format), or an electronically signed Communication converted into another format, for transmission, delivery and/or retention. Electronic Signatures and facsimile signatures shall be deemed valid and binding to the same extent as the original. For purposes hereof, “Electronic Record” and “Electronic Signature” shall have the meanings assigned to them, respectively, by 15 USC §7006, as it may be amended from time to time.

[REMAINDER OF THIS PAGE LEFT INTENTIONALLY BLANK]

IN WITNESS WHEREOF, Purchaser and Seller have caused this Amendment to be executed and delivered by their duly authorized officers as of the day and year first above written.

| | | | | |

BANK OF AMERICA, N.A.,

as Purchaser By:/s/ Adam Robitshek Name: Adam Robitshek Title: Director | LOANDEPOT.COM, LLC,

as Seller By:/s/David Hayes Name: David Hayes Title: CFO |

Signature Page to Amendment No. 6 to Second A&R Purchase and Sale Agreement (BANA/loanDepot)

EXHIBIT A

Annex A

PURCHASER NOTICES

[***]

SELLER NOTICES

[***]

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

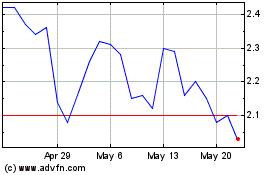

loanDepot (NYSE:LDI)

Historical Stock Chart

From Aug 2024 to Sep 2024

loanDepot (NYSE:LDI)

Historical Stock Chart

From Sep 2023 to Sep 2024