false

0001807846

0001807846

2024-12-10

2024-12-10

0001807846

ML:ClassCommonStockParValue0.0001PerShareMember

2024-12-10

2024-12-10

0001807846

ML:RedeemableWarrantsEachWholeWarrantExercisableFor130thOfOneShareOfClassCommonStockMember

2024-12-10

2024-12-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

December 10, 2024

MONEYLION INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-39346 |

|

85-0849243 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

249-245

West 17th Street, Floor

4

New York,

NY 10011

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including

area code: (212) 300-9865

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ | Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to

Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

☐ | Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Class A common stock, par value $0.0001 per share |

|

ML |

|

The New York Stock Exchange |

| Redeemable warrants: each whole warrant exercisable for 1/30th of one share of Class A common stock |

|

ML WS |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item

7.01 Regulation FD Disclosure.

On December 10, 2024, MoneyLion Inc., a Delaware

corporation (“MoneyLion”), and Gen Digital Inc., a Delaware corporation (“Gen Digital”), issued

a joint press release announcing the execution of an Agreement and Plan of Merger (the “Merger Agreement”), by and

among Gen Digital, Maverick Group Holdings, Inc., a Delaware corporation and a wholly owned subsidiary of Gen Digital, and MoneyLion.

A copy of the press release is furnished as Exhibit 99.1 hereto and is incorporated herein by reference.

A copy of the joint press release is attached

as Exhibit 99.1 to this report and incorporated by reference herein. The information in this Item 7.01, including Exhibit 99.1, shall

not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), nor shall they be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities

Act”), or the 1934 Act.

Cautionary Statement Regarding Forward-Looking Statements

Certain statements herein and the documents incorporated

herein by reference may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform

Act of 1995, Section 27A of the Securities Act and Rule 175 promulgated thereunder, and Section 21E of the Exchange Act and Rule 3b-6

promulgated thereunder, which statements involve inherent risks and uncertainties. Examples of forward-looking statements include, but

are not limited to, statements regarding the outlook and expectations of MoneyLion and Gen Digital, respectively, with respect to the

proposed transaction, the strategic benefits and financial benefits of the proposed transaction, including the expected impact of the

proposed transaction on the combined company’s future financial performance (including anticipated accretion to earnings per share,

the tangible book value earn-back period and other operating and return metrics), the timing of the closing of the proposed transaction,

and the ability to successfully integrate the combined businesses. Such statements are often characterized by the use of qualified words

(and their derivatives) such as “may,” “will,” “anticipate,” “could,” “should,”

“would,” “believe,” “contemplate,” “expect,” “estimate,” “continue,”

“plan,” “project,” “predict,” “potential,” “assume,” “forecast,”

“target,” “budget,” “outlook,” “trend,” “guidance,” “objective,”

“goal,” “strategy,” “opportunity,” and “intend,” as well as words of similar meaning or

other statements concerning opinions or judgment of MoneyLion, Gen Digital or their respective management about future events. Forward-looking

statements are based on assumptions as of the time they are made and are subject to risks, uncertainties and other factors that are difficult

to predict with regard to timing, extent, likelihood and degree of occurrence, which could cause actual results to differ materially from

anticipated results expressed or implied by such forward-looking statements. Such risks, uncertainties and assumptions, include, among

others, the following:

| · | the occurrence of any event, change or other circumstances that could give rise to the right of one or

both of the parties to terminate the Merger Agreement; |

| · | the failure to obtain necessary regulatory approvals (and the risk that such approvals may result in the

imposition of conditions that could adversely affect the combined company or the expected benefits of the proposed transaction) and the

possibility that the proposed transaction does not close when expected or at all because required regulatory approval, the approval by

MoneyLion’s stockholders, or other approvals and the other conditions to closing are not received or satisfied on a timely basis

or at all; |

| · | the possibility that the milestone may not be met and that payment may not be made with respect to the

contingent value rights; |

| · | the possibility that the contingent value rights may not meet the applicable listing requirements or be

accepted for listing on the Nasdaq Stock Market LLC; |

| · | the outcome of any legal proceedings that may be instituted against MoneyLion or Gen Digital or the combined

company; |

| · | the possibility that the anticipated benefits of the proposed transaction, including anticipated cost

savings and strategic gains, are not realized when expected or at all, including as a result of changes in, or problems arising from,

general economic and market conditions, interest and exchange rates, monetary policy, laws and regulations and their enforcement, and

the degree of competition in the geographic and business areas in which MoneyLion or Gen Digital operate; |

| · | the possibility that the integration of the two companies may be more difficult, time-consuming or costly

than expected; |

| · | the possibility that the proposed transaction may be more expensive or take longer to complete than anticipated,

including as a result of unexpected factors or events; |

| · | the diversion of management’s attention from ongoing business operations and opportunities; |

| · | potential adverse reactions of MoneyLion’s or Gen Digital’s customers or changes to business

or employee relationships, including those resulting from the announcement or completion of the proposed transaction; |

| · | changes in MoneyLion’s or Gen Digital’s share price before closing; |

| · | risks relating to the potential dilutive effect of shares of Gen Digital’s common stock that may

be issued pursuant to certain contingent value rights issued in connection with the proposed transaction; |

| · | other factors that may affect future results of MoneyLion, Gen Digital or the combined company. |

These factors are not necessarily all of the factors

that could cause MoneyLion’s, Gen Digital’s or the combined company’s actual results, performance or achievements to

differ materially from those expressed in or implied by any of the forward-looking statements. Other factors, including unknown or unpredictable

factors, also could harm MoneyLion’s, Gen Digital’s or the combined company’s results.

Although each of MoneyLion and Gen Digital believes that its expectations

with respect to forward-looking statements are based upon reasonable assumptions within the bounds of its existing knowledge of its business

and operations, there can be no assurance that actual results of MoneyLion or Gen Digital will not differ materially from any projected

future results expressed or implied by such forward-looking statements. Additional factors that could cause results to differ materially

from those described above can be found in MoneyLion’s most recent annual report on Form 10-K for the fiscal year ended December 31, 2023, quarterly reports on Form 10-Q, and other documents subsequently filed by MoneyLion

with the Securities Exchange Commission (the “SEC”) and Gen Digital’s most recent annual report on Form 10-K for the fiscal year ended March 29, 2024, quarterly reports on Form 10-Q, and other documents subsequently filed by Gen Digital

with the SEC. The actual results anticipated may not be realized or, even if substantially realized, they may not have the expected consequences

to or effects on MoneyLion, Gen Digital or their respective businesses or operations. Investors are cautioned not to rely too heavily

on any such forward-looking statements. Forward-looking statements speak only as of the date they are made and MoneyLion and Gen Digital

undertake no obligation to update or clarify these forward-looking statements, whether as a result of new information, future events or

otherwise, except to the extent required by applicable law.

Additional Information and Where to Find It

In connection with the proposed transaction, Gen

Digital intends to file with the SEC a Registration Statement on Form S-4 (the “Registration Statement”) to register

the contingent value rights to be issued by Gen Digital in connection with the proposed transaction and that will include a proxy statement

of MoneyLion and a prospectus of Gen Digital (the “Proxy Statement/Prospectus”), and each of MoneyLion and Gen Digital

may file with the SEC other relevant documents concerning the proposed transaction. A definitive Proxy Statement/Prospectus will be sent

to the stockholders of MoneyLion to seek their approval of the proposed transaction. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION,

INVESTORS AND STOCKHOLDERS OF MONEYLION ARE URGED TO READ THE REGISTRATION STATEMENT AND PROXY STATEMENT/PROSPECTUS REGARDING THE PROPOSED

TRANSACTION WHEN THEY BECOME AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO

THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT MONEYLION, GEN DIGITAL AND THE PROPOSED TRANSACTION AND RELATED

MATTERS.

A copy of the Registration Statement, Proxy Statement/Prospectus,

as well as other filings containing information about MoneyLion and Gen Digital, may be obtained, free of charge, at the SEC’s website

(http://www.sec.gov). You will also be able to obtain these documents, when they are filed, free of charge, from MoneyLion by accessing

MoneyLion’s website at https://investors.moneylion.com or from Gen Digital by accessing Gen Digital’s website at https://investor.gendigital.com/overview/default.aspx.

Copies of the Registration Statement, the Proxy Statement/Prospectus and the filings with the SEC that will be incorporated by reference

therein can also be obtained, without charge, by directing a request to Sean Horgan, Head of Investor Relations, at shorgan@moneylion.com,

or by calling (332) 258-7621, or to Gen Digital by directing a request to Gen Digital’s Investor Relations department at 60 East

Rip Salado Parkway, Suite 1000, Tempe, AZ 85281 or by calling (650) 527-8000 or emailing IR@gendigital.com. The information on MoneyLion’s

or Gen Digital’s respective websites is not, and shall not be deemed to be, a part of this communication or incorporated into other

filings either company makes with the SEC.

Participants in the Solicitation

MoneyLion, Gen Digital and certain of their respective

directors, executive officers and employees may be deemed to be participants in the solicitation of proxies from the stockholders of MoneyLion

in connection with the proposed transaction. Information about the interests of the directors and executive officers of MoneyLion and

Gen Digital and other persons who may be deemed to be participants in the solicitation of stockholders of MoneyLion in connection with

the proposed transaction and a description of their direct and indirect interests, by security holdings or otherwise, will be included

in the Proxy Statement/Prospectus related to the proposed transaction, which will be filed with the SEC. Information about the directors

and executive officers of MoneyLion and their ownership of MoneyLion common stock and MoneyLion’s transactions with related persons

is also set forth in the sections entitled “Executive Officers,” “Corporate Governance,” “Certain Relationships

and Related Party Transactions,” “Executive and Director Compensation” and “Beneficial Ownership of Securities”

included in the definitive proxy statement for MoneyLion’s 2024 Annual Meeting of Shareholders, as filed with the SEC on Schedule 14A on April 29, 2024. Information about the directors and executive officers of MoneyLion, their ownership of MoneyLion common stock,

and MoneyLion’s transactions with related persons is set forth in the sections entitled “Directors, Executive Officers and

Corporate Governance,” “Executive Compensation,” “Security Ownership of Certain Beneficial Owners and Management

and Related Stockholder Matters,” and “Certain Relationships and Related Transactions, and Director Independence” included

in MoneyLion’s annual report on Form 10-K for the fiscal year ended December 31, 2023, which was filed with the SEC on March 7, 2024. Information about the directors and

executive officers of Gen Digital, their ownership of Gen Digital common stock, and Gen Digital’s transactions with related persons

is set forth in the sections entitled “Corporate Governance,” “The Board and Its Committees,” “Director

Nominations and Communication with Directors,” “Our Executive Officers,” “Security Ownership of Certain Beneficial

Owners and Management,” “Executive Compensation and Related Information,” and “Certain Relationships and Related

Transactions” included in Gen Digital’s definitive proxy statementin connection with its 2024 Annual Meeting of Stockholders, as filed with the SEC on July 29, 2024.

No Offer or Solicitation

This communication is not intended to and shall

not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities or the solicitation

of any vote of approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would

be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be

made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act, or pursuant to an exemption from, or

in a transaction not subject to, such registration requirements.

ITEM

9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Exchange Act, the registrant has

duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

MONEYLION INC. |

| |

|

|

| Date: December 10, 2024 |

By: |

Richard Correia |

| |

Name: |

Richard Correia |

| |

Title: |

President, Chief Financial Officer and Treasurer |

Exhibit 99.1

| PRESS RELEASE |

|

| |

|

| Investor Contact |

Media Contact |

| Jason Starr |

Jess Monney |

| Gen |

Gen |

| IR@GenDigital.com |

Press@GenDigital.com |

Gen Extends its Financial

Wellness Offerings with the Acquisition of MoneyLion

Gen

Adds Financial Empowerment to Credit and Identity Protection Solutions

TEMPE, Ariz. & PRAGUE,

December 10, 2024 – Gen Digital Inc. (NASDAQ: GEN), a global leader dedicated to powering Digital Freedom through its family

of consumer brands, announced today that it has entered into a definitive agreement to acquire MoneyLion Inc. (NYSE: ML), a leading digital

ecosystem for consumer finance that empowers everyone to make their best financial decisions. With the addition of MoneyLion, Gen builds

upon its mission, now empowering people to grow, manage, and secure their digital and financial lives.

“Gen has a family of consumer

brands that’s dedicated to protecting people’s privacy, identity and financial assets so they can live their digital lives

securely and without worry,” said Vincent Pilette, CEO of Gen. “By bringing MoneyLion into the Gen family, we’re not

only helping people protect what they already have, we’re extending our capabilities to enable people to better manage and grow

their financial wealth. We look forward to welcoming the MoneyLion team, so together, we can power digital and financial freedom.”

MoneyLion is a leading digital

ecosystem for consumer finance. Through this acquisition, MoneyLion extends Gen's identity solutions into offering comprehensive financial

wellness through MoneyLion’s full-featured personal finance platform that includes credit building and financial management services.

Additionally, Gen acquires a scaled and proven B2B2C white-labeled AI recommendation platform that can be leveraged and enhanced by Gen’s

consumer base. MoneyLion’s over 18 million customers broaden and diversify Gen’s customer base, expanding the Company's top

of funnel for full credit and identity protection.

“MoneyLion has built a mission-driven

platform that empowers people to take control of their financial futures with confidence,” said Dee Choubey, Co-Founder and CEO

of MoneyLion. “Joining Gen accelerates our vision by leveraging their global reach, trusted brands, and powerful ecosystem. We’ll

deliver MoneyLion’s leading personal financial management tools and embedded financial marketplaces to Gen’s users while

bringing Gen’s strong identity, trust and cybersecurity solutions to our customers.

Together, we’ll create

unmatched consumer value, combining innovative fintech products and experiences with Gen’s trusted network to empower smarter financial

decisions and secure people’s digital and financial lives.”

Transaction Details and Approvals

The Board of Directors of both

Gen and MoneyLion have unanimously approved the proposed acquisition of MoneyLion by Gen for $82.00 per share in cash payable at closing,

representing a cash value of approximately $1 billion. In addition, for each share owned, MoneyLion shareholders will receive at closing

one contingent value right (“CVR”) that entitles the holder to a contingent payment of $23.00 in the form of shares of Gen

common stock (issuable based on an assumed share price of $30.48 per Gen share) if Gen’s average volume-weighted average share

price reaches at least $37.50 per share over 30 consecutive trading days from December 10, 2024 until 24 months after close. There can

be no assurance that any payments will be made with respect to CVRs. It is expected that the CVRs will be listed on the Nasdaq Stock

Market.

Closing of the proposed acquisition is

subject to customary closing conditions and is expected to occur in the first half of Gen’s fiscal year 2026, with no impact to

Gen’s fiscal year 2025 guidance as provided on October 30, 2024. The acquisition is accretive to Non-GAAP

EPS, reinforces the Company's long-term financial model, and the Company re-affirms its commitment of net leverage below 3x EBITDA by

FY27.

An investor presentation with

additional information is available on the Gen Investor Relations website located at Investor.GenDigital.com.

Advisors

Evercore is serving as financial

advisor to Gen and Kirkland & Ellis LLP is serving as its legal advisor. Keefe, Bruyette & Woods, Inc., A Stifel Company, is

serving as exclusive financial advisor to MoneyLion, and Davis Polk & Wardwell LLP is serving as legal counsel to MoneyLion.

###

About Gen

Gen™ (NASDAQ: GEN) is a

global company dedicated to powering Digital Freedom through its trusted Cyber Safety brands, Norton, Avast, LifeLock, Avira, AVG, ReputationDefender

and CCleaner. The Gen family of consumer brands is rooted in providing safety for the first digital generations. Now, Gen empowers people

to live their digital lives safely, privately, and confidently today and for generations to come. Gen brings award-winning products and

services in cybersecurity, online privacy and identity protection to nearly 500 million users in more than 150 countries. Learn more

at GenDigital.com.

About MoneyLion

MoneyLion (NYSE: ML) is a leader in financial

technology powering the next generation of personalized products, content, and marketplace technology, with a top consumer finance super

app, a premier embedded finance platform for enterprise businesses and a world-class media arm. MoneyLion’s mission is to give

everyone the power to make their best financial decisions. Through its go-to money app for consumers, MoneyLion delivers curated content

on finance and related topics, through a tailored feed that engages people to learn and share. People take control of their finances

with its innovative financial products and marketplace - including a full-fledged suite of features to save, borrow, spend, and invest

- seamlessly bringing together the best offers and content from MoneyLion and its 1,200+ Enterprise Partner network, together in one

experience. Learn more at www.moneylion.com.

Forward-Looking Statements

Certain statements herein and the documents incorporated

herein by reference may constitute “forward-looking statements” within the meaning of the Private Securities Litigation

Reform Act of 1995, Section 27A of the Securities Act and Rule 175 promulgated thereunder, and Section 21E of the Exchange Act and

Rule 3b-6 promulgated thereunder, which statements involve inherent risks and uncertainties. Examples of forward-looking statements

include, but are not limited to, statements regarding the outlook and expectations of MoneyLion and Gen Digital, respectively, with

respect to the proposed transaction, the strategic benefits and financial benefits of the proposed transaction, including the

expected impact of the proposed transaction on the combined company’s future financial performance (including anticipated

accretion to earnings per share, the tangible book value earn-back period and other operating and return metrics), the timing of the

closing of the proposed transaction, and the ability to successfully integrate the combined businesses. Such statements are often

characterized by the use of qualified words (and their derivatives) such as “may,” “will,”

“anticipate,” “could,” “should,” “would,” “believe,”

“contemplate,” “expect,” “estimate,” “continue,” “plan,”

“project,” “predict,” “potential,” “assume,” “forecast,”

“target,” “budget,” “outlook,” “trend,” “guidance,”

“objective,” “goal,” “strategy,” “opportunity,” and “intend,” as well as

words of similar meaning or other statements concerning opinions or judgments of MoneyLion, Gen Digital or their respective

management about future events. Forward-looking statements are based on assumptions as of the time they are made and are subject to

risks, uncertainties and other factors that are difficult to predict with regard to timing, extent, likelihood and degree of

occurrence, which could cause actual results to differ materially from anticipated results expressed or implied by such

forward-looking statements. Such risks, uncertainties and assumptions, include, among others, the following:

| • | the

occurrence of any event, change or other circumstances that could give rise to the right

of one or both of the parties to terminate the Merger Agreement; |

| • | the

failure to obtain necessary regulatory approvals (and the risk that such approvals may result

in the imposition of conditions that could adversely affect the combined company or the expected

benefits of the proposed transaction) and the possibility that the proposed transaction does

not close when expected or at all because required regulatory approval, the approval by MoneyLion’s

stockholders, or other approvals and the other conditions to closing are not received or

satisfied on a timely basis or at all; |

| • | the

possibility that the milestone may not be met and that payment may not be made with respect

to the contingent value rights; |

| • | the

possibility that the contingent value rights may not meet the applicable listing requirements

or be accepted for listing on the Nasdaq Stock Market LLC; |

| • | the

outcome of any legal proceedings that may be instituted against MoneyLion, Gen Digital or

the combined company; |

| • | the

possibility that the anticipated benefits of the proposed transaction, including anticipated

cost savings and strategic gains, are not realized when expected or at all, including as

a result of changes in, or problems arising from, general economic and market conditions,

interest and exchange rates, monetary policy, laws and regulations and their enforcement,

and the degree of competition in the geographic and business areas in which MoneyLion or

Gen Digital operate; |

| • | the

possibility that the integration of the two companies may be more difficult, time-consuming

or costly than expected; |

| • | the

possibility that the proposed transaction may be more expensive or take longer to complete

than anticipated, including as a result of unexpected factors or events; |

| • | the

diversion of management’s attention from ongoing business operations and opportunities; |

| • | potential

adverse reactions of MoneyLion’s or Gen Digital’s customers or changes to business

or employee relationships, including those resulting from the announcement or completion

of the proposed transaction; |

| • | changes

in MoneyLion’s or Gen Digital’s share price before closing; |

| • | risks

relating to the potential dilutive effect of shares of Gen Digital’s common stock that

may be issued pursuant to certain contingent value rights issued in connection with the proposed

transaction; and |

| • | other

factors that may affect future results of MoneyLion, Gen Digital or the combined company. |

These factors are not necessarily all of the factors

that could cause MoneyLion’s, Gen Digital’s or the combined company’s actual results, performance or achievements to

differ materially from those expressed in or implied by any of the forward-looking statements. Other factors, including unknown or unpredictable

factors, also could harm MoneyLion’s, Gen Digital’s or the combined company’s results.

Although each of MoneyLion and Gen Digital believes

that its expectations with respect to forward-looking statements are based upon reasonable assumptions within the bounds of its existing

knowledge of its business and operations, there can be no assurance that actual results of MoneyLion or Gen Digital will not differ materially

from any projected future results expressed or implied by such forward-looking statements. Additional factors that could cause results

to differ materially from those described above can be found in MoneyLion’s most recent annual report on Form 10-K for the fiscal

year ended December 31, 2023, quarterly reports on Form 10-Q, and other documents subsequently filed by MoneyLion with the SEC and

Gen Digital’s most recent annual report on Form 10-K for the fiscal year ended March 29, 2024, quarterly reports on Form

10-Q, and other documents subsequently filed by Gen Digital with the SEC. The actual results anticipated may not be realized or, even

if substantially realized, they may not have the expected consequences to or effects on MoneyLion, Gen Digital or their respective businesses

or operations. Investors are cautioned not to rely too heavily on any such forward-looking statements. Forward-looking statements speak

only as of the date they are made and MoneyLion and Gen Digital undertake no obligation to update or clarify these forward-looking statements,

whether as a result of new information, future events or otherwise, except to the extent required by applicable law.

No Offer or Solicitation

This communication

is not intended to and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer

to buy any securities or the solicitation of any vote of approval, nor shall there be any sale of securities in any jurisdiction in which

such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act, or

pursuant to an exemption from, or in a transaction not subject to, such registration requirements.

Additional Information and Where to Find It

In connection with the proposed transaction, Gen Digital intends

to file with the SEC a Registration Statement on Form S-4 (the “Registration Statement”) to register the contingent value

rights to be issued by Gen Digital in connection with the proposed transaction and that will include a proxy statement of MoneyLion and

a prospectus of Gen Digital (the “Proxy Statement/Prospectus”), and each of MoneyLion and Gen Digital may file with the SEC

other relevant documents concerning the proposed transaction. A definitive Proxy Statement/Prospectus will be sent to the stockholders

of MoneyLion to seek their approval of the proposed transaction. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS AND STOCKHOLDERS

OF MONEYLION ARE URGED TO READ THE REGISTRATION STATEMENT AND PROXY STATEMENT/PROSPECTUS REGARDING THE PROPOSED TRANSACTION WHEN THEY

BECOME AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE

THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT MONEYLION, GEN DIGITAL AND THE PROPOSED TRANSACTION AND RELATED MATTERS.

A copy of the Registration Statement,

Proxy Statement/Prospectus, as well as other filings containing information about MoneyLion and Gen Digital, may be obtained, free

of charge, at the SEC’s website (http://www.sec.gov). You will also be able

to obtain these documents, when they are filed, free of charge, from MoneyLion by accessing MoneyLion’s website at https://investors.moneylion.com or

from Gen Digital by accessing Gen Digital’s website at https://investor.gendigital.com/overview/default.aspx.

Copies of the Registration Statement, the Proxy Statement/Prospectus and the filings with the SEC that will be incorporated by

reference therein can also be obtained, without charge, by directing a request to Sean Horgan, Head of Investor Relations, at shorgan@moneylion.com,

or by calling (332) 258-7621, or to Gen Digital by directing a request to Gen Digital’s Investor Relations department at 60

East Rip Salado Parkway, Suite 1000, Tempe, AZ 85281 or by calling (650) 527-8000 or emailing IR@gendigital.com.

The information on MoneyLion’s or Gen Digital’s respective websites is not, and shall not be deemed to be, a part of

this communication or incorporated into other filings either company makes with the SEC.

Participants in the Solicitation

MoneyLion, Gen Digital and certain of their

respective directors, executive officers and employees may be deemed to be participants in the solicitation of proxies from the stockholders

of MoneyLion in connection with the proposed transaction. Information about the interests of the directors and executive officers of MoneyLion

and Gen Digital and other persons who may be deemed to be participants in the solicitation of stockholders of MoneyLion in connection

with the proposed transaction and a description of their direct and indirect interests, by security holdings or otherwise, will be included

in the Proxy Statement/Prospectus related to the proposed transaction, which will be filed with the SEC. Information about the directors

and executive officers of MoneyLion and their ownership of MoneyLion common stock and MoneyLion’s transactions with related persons

is also set forth in the sections entitled “Executive Officers,” “Corporate Governance,” “Certain Relationships

and Related Party Transactions,” “Executive and Director Compensation” and “Beneficial Ownership of Securities”

included in the definitive proxy

statement for MoneyLion’s

2024 Annual Meeting of Shareholders, as filed with the SEC on Schedule 14A on April 29, 2024. Information about the directors and executive officers of MoneyLion, their ownership of MoneyLion common

stock, and MoneyLion’s transactions with related persons is set forth in the sections entitled “Directors, Executive Officers

and Corporate Governance,” “Executive Compensation,” “Security Ownership of Certain Beneficial Owners and Management

and Related Stockholder Matters,” and “Certain Relationships and Related Transactions,

and Director Independence” included in MoneyLion’s annual report on

Form 10 K for the fiscal year ended December 31, 2023, which was filed with the SEC on March 7, 2024. Information about the directors

and executive officers of Gen Digital, their ownership of Gen Digital common stock, and Gen Digital’s transactions with related

persons is set forth in the sections entitled “Corporate Governance,” “The Board and Its Committees,” “Director

Nominations and Communication with Directors,” “Our Executive Officers,” “Security Ownership of Certain Beneficial

Owners and Management,” “Executive Compensation and Related Information,” and “Certain Relationships and Related

Transactions” included in Gen Digital’s

definitive proxy statement in connection with its 2024 Annual Meeting of Stockholders, as filed with the SEC on July 29, 2024.

v3.24.3

Cover

|

Dec. 10, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 10, 2024

|

| Entity File Number |

001-39346

|

| Entity Registrant Name |

MONEYLION INC.

|

| Entity Central Index Key |

0001807846

|

| Entity Tax Identification Number |

85-0849243

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

249-245

West 17th Street

|

| Entity Address, Address Line Two |

Floor

4

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10011

|

| City Area Code |

212

|

| Local Phone Number |

300-9865

|

| Written Communications |

true

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Class A common stock, par value $0.0001 per share |

|

| Title of 12(b) Security |

Class A common stock, par value $0.0001 per share

|

| Trading Symbol |

ML

|

| Security Exchange Name |

NYSE

|

| Redeemable warrants: each whole warrant exercisable for 1/30th of one share of Class A common stock |

|

| Title of 12(b) Security |

Redeemable warrants: each whole warrant exercisable for 1/30th of one share of Class A common stock

|

| Trading Symbol |

ML WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ML_ClassCommonStockParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ML_RedeemableWarrantsEachWholeWarrantExercisableFor130thOfOneShareOfClassCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

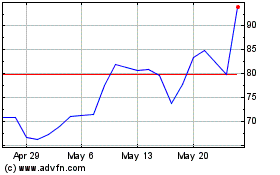

MoneyLion (NYSE:ML)

Historical Stock Chart

From Dec 2024 to Jan 2025

MoneyLion (NYSE:ML)

Historical Stock Chart

From Jan 2024 to Jan 2025