Mach Natural Resources LP (NYSE:MNR) (“Mach”) announced today

that the underwriters of its previously announced public offering

(the “Offering”) of 12,903,226 common units representing limited

partner interests in Mach (the “common units”) have fully exercised

their option to purchase an additional 1,935,483 common units at a

price to the public of $15.50 per common unit, less underwriting

discounts and commissions (the “Option”). The Option closed on

February 12, 2025.

Mach intends to use the net proceeds to repay in full the

approximately $23.0 million of borrowings outstanding under its

super priority credit facility, and the remainder to repay a

portion of its term loan credit facility. Mach expects to repay the

remainder of borrowings under and terminate its term loan credit

facility with cash on hand and proceeds from the credit facility it

intends to enter into following the date hereof.

Stifel, Nicolaus & Company, Incorporated, Raymond James

& Associates, Inc., TCBI Securities, Inc., doing business as

Texas Capital Securities, and Truist Securities, Inc. are acting as

joint book-running managers for the Offering. Johnson Rice &

Company L.L.C. and Stephens Inc. are serving as co-managers for the

Offering. The offering of these securities is being made only by

means of a prospectus meeting the requirements of Section 10 of the

Securities Act of 1933, as amended. A copy of the final prospectus

may be obtained from any of the following sources:

Stifel, Nicolaus & Company,

Incorporated

Attention: Syndicate

Department

Raymond James & Associates,

Inc.

Attention: Syndicate

TCBI Securities, Inc., doing

business as Texas Capital Securities

Attention: Prospectus

Department

Truist Securities, Inc

Attention: Equity Capital

Markets

1 South Street, 15th Floor

880 Carillon Parkway

2000 McKinney Avenue, 7th

Floor

3333 Peachtree Road NE, 9th

Floor

Baltimore, MD 21202

St. Petersburg, Florida 33716

Dallas, Texas 75201

Atlanta, GA 30326

Telephone: (855) 300-7136

Telephone: (800) 248-8863

Telephone: (866) 355-6329

Telephone: (800) 685-4786

Email:

syndprospectus@stifel.com

Email:

prospectus@raymondjames.com

Email:

prospectus@texascapital.com

Email:

truistsecurities.prospectus@truist.com

Important Information

A registration statement on Form S-3 relating to these

securities has been filed with the Securities and Exchange

Commission (the “SEC”) and has become effective. The Offering may

be made only by means of a prospectus supplement and accompanying

prospectus. Copies of the final prospectus supplement and

accompanying prospectus related to the Offering can be obtained by

visiting the SEC’s website at www.sec.gov under “Mach Natural

Resources LP.” This press release does not constitute an offer to

sell or the solicitation of an offer to buy securities, and shall

not constitute an offer, solicitation or sale in any jurisdiction

in which such offer, solicitation or sale would be unlawful.

About Mach Natural Resources LP

Mach Natural Resources LP is an independent upstream oil and gas

company focused on the acquisition, development and production of

oil, natural gas and NGL reserves in the Anadarko Basin region of

Western Oklahoma, Southern Kansas and the panhandle of Texas.

Cautionary Statement Concerning Forward-Looking

Statements

This release contains statements that express Mach’s opinions,

expectations, beliefs, plans, objectives, assumptions or

projections regarding future events or future results, in contrast

with statements that reflect historical facts. All statements,

other than statements of historical fact included in this release

regarding our strategy, future operations, financial position,

estimated revenues and losses, projected costs, prospects, plans

and objectives of management are forward-looking statements,

including, but not limited to, statements regarding the anticipated

entry into our new credit facility, including timing, ability to

close the new credit facility, anticipated terms of the new credit

facility, anticipated uses of the funds from the new credit

facility and the anticipated use of the net proceeds from the

Offering, including the Option. When used in this release, words

such as “may,” “assume,” “forecast,” “could,” “should,” “will,”

“plan,” “believe,” “anticipate,” “intend,” “estimate,” “expect,”

“project,” “budget” and similar expressions are used to identify

forward-looking statements, although not all forward-looking

statements contain such identifying words. These forward-looking

statements are based on management’s current belief, based on

currently available information as to the outcome and timing of

future events at the time such statement was made. Such statements

are subject to a number of assumptions, risk and uncertainties,

many of which are beyond the control of Mach, including prevailing

market conditions and other factors. Please read Mach’s filings

with the SEC, including “Risk Factors” in Mach’s Annual Report on

Form 10-K, which is on file with the SEC, for a discussion of risks

and uncertainties that could cause actual results to differ from

those in such forward-looking statements.

As a result, these forward-looking statements are not a

guarantee of our performance, and you should not place undue

reliance on such statements. Any forward-looking statement speaks

only as of the date on which such statement is made, and Mach

undertakes no obligation to correct or update any forward-looking

statement, whether as a result of new information, future events or

otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250212838796/en/

Mach Natural Resources LP Investor Relations Contact:

ir@machnr.com

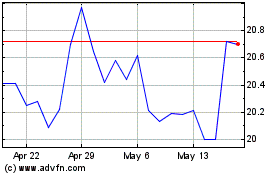

Mach Natural Resources (NYSE:MNR)

Historical Stock Chart

From Jan 2025 to Feb 2025

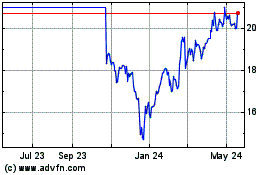

Mach Natural Resources (NYSE:MNR)

Historical Stock Chart

From Feb 2024 to Feb 2025