“In the fourth quarter of 2019, Suncor generated funds from

operations of $2.6 billion, bringing annual funds from

operations to a new record of $10.8 billion,” said Mark

Little, president and chief executive officer. “In 2019, we

returned $4.9 billion in dividends and share repurchases to

shareholders, representing 45% of our total funds from operations.

Since the start of 2017, we have paid $7.1 billion in

dividends and repurchased $6.7 billion of shares, representing

over 9% of our outstanding common shares, demonstrating our

commitment to shareholder returns.”

- Funds from operations were $2.553 billion ($1.66 per

common share) in the fourth quarter of 2019, compared to

$2.007 billion ($1.26 per common share) in the prior year

quarter, marking the tenth consecutive quarter above

$2 billion. Cash flow provided by operating activities was

$2.304 billion in the fourth quarter of 2019, compared to

$3.040 billion in the prior year quarter, as the prior year

quarter included a source of cash in working capital associated

with a declining price environment.

- Operating earnings were $782 million ($0.51 per common

share) in the fourth quarter of 2019, compared to $580 million

($0.36 per common share) in the prior year quarter. The company had

a net loss of $2.335 billion ($1.52 per common share) in the

fourth quarter of 2019 due to non‑cash asset impairment charges of

$3.352 billion after-tax primarily due to lower forecasted heavy

oil prices for Fort Hills and higher capital cost estimates for the

West White Rose Project, compared to a net loss of

$280 million ($0.18 per common share) in the prior

year quarter.

- In the fourth quarter of 2019, Suncor demonstrated its

continued focus on value over volume as Oil Sands operations

achieved synthetic crude oil (SCO) production of

300,000 barrels per day (bbls/d) and upgrader utilization of

86%, compared to SCO production of 273,400 bbls/d and upgrader

utilization of 79% in the prior year period, with both periods

impacted by maintenance.

- Total Exploration and Production (E&P) production during

the fourth quarter of 2019 increased to 115,900 barrels of oil

equivalent per day (boe/d) from 90,200 boe/d in the prior year

quarter. The increase was primarily due to higher production in

East Coast Canada, which increased to 69,600 bbls/d, from

47,900 bbls/d in the prior year quarter.

- Reliable operations in Refining and Marketing drove refinery

utilization of 97% and crude throughput of 447,500 bbls/d.

- Suncor sanctioned the Forty Mile Wind Power Project, which is

expected to drive value through sustainable low‑carbon power

generation and the retention of generated carbon credits for

utilization in Suncor’s upstream business.

- Subsequent to the end of the quarter, Suncor’s Board of

Directors (the Board) approved a quarterly dividend of $0.465

per share, an increase of 11%. The Board also approved an increase

to the company’s existing share repurchase program from

$2.0 billion to $2.5 billion through to the end of

February 2020 and a further annual extension of the share

repurchase program up to $2.0 billion, beginning March 1,

2020, demonstrating confidence in the company’s ability to generate

cash flow and its commitment to return cash to shareholders.

Financial Results

Operating Earnings

Suncor’s fourth quarter 2019 operating earnings were

$782 million ($0.51 per common share), compared to

$580 million ($0.36 per common share) in the prior year

quarter. The increase was primarily a result of improved western

Canadian crude oil differentials, including a substantial narrowing

of heavy crude and SCO differentials, which more than offset lower

benchmark pricing, from the prior year quarter. This resulted in an

increase in Oil Sands price realizations and a net favourable

inventory valuation change, partially offset by lower refining

margins. Fourth quarter 2019 operating earnings were also

positively impacted by increased production at East Coast Canada

and Oda.

Operating earnings were unfavourably impacted by lower Oil Sands

production compared to the prior year quarter, primarily due to

planned maintenance and the Alberta government’s mandatory

production curtailments, higher depreciation, depletion, and

amortization (DD&A) and royalties, and lower refinery crude

throughput.

Net Loss

Suncor’s net loss was $2.335 billion ($1.52 per common

share) in the fourth quarter of 2019, compared to a net loss of

$280 million ($0.18 per common share) in the prior year

quarter. In addition to the factors impacting operating earnings

discussed above, the net loss for the fourth quarter of 2019

included $3.352 billion of non‑cash after-tax asset impairment

charges partially offset by a $235 million unrealized

after‑tax foreign exchange gain on the revaluation of

U.S. dollar denominated debt. The net loss in the prior year

quarter included an unrealized after‑tax foreign exchange loss of

$637 million on the revaluation of U.S. dollar

denominated debt and a non‑cash impairment loss of

$223 million after‑tax on one of the company’s equity

investments.

Funds from Operations and Cash Flow Provided By

Operating Activities

Funds from operations were $2.553 billion ($1.66 per common

share) in the fourth quarter of 2019, compared to

$2.007 billion ($1.26 per common share) in the fourth quarter

of 2018, and were influenced primarily by the same factors

impacting operating earnings noted above.

Cash flow provided by operating activities was

$2.304 billion ($1.50 per common share) for the fourth quarter

of 2019, compared to $3.040 billion ($1.90 per common share)

for the fourth quarter of 2018. In addition to the items impacting

operating earnings noted above, cash flow provided by operating

activities was further impacted by a use of cash from working

capital in the current quarter as compared to a source of cash in

the prior year quarter. The use of cash in the company’s non‑cash

working capital balances was primarily due to an increase in

accounts receivable related to increasing refinery margins at the

end of the quarter and higher upstream sales volumes.

Operating Results

Suncor’s total upstream production was 778,200 boe/d during

the fourth quarter of 2019, compared to 831,000 boe/d in the

prior year quarter. The decrease was primarily due to lower Oil

Sands production as a result of planned maintenance and mandatory

production curtailments in the province of Alberta. E&P

production volumes increased from the prior year quarter, primarily

due to higher production from East Coast Canada and Oda.

During the fourth quarter of 2019, the company continued to

leverage its regional footprint and asset flexibility to maximize

the value of its allotted barrels under the mandatory production

curtailment program. The company was able to optimize the transfer

of our allotted curtailment credits among the company’s assets

during planned maintenance at Oil Sands operations and Syncrude,

while continuing to focus on higher value SCO production. Upon

completion of maintenance in the quarter, the company was able to

purchase additional curtailment credits from third parties, as well

as capitalize on the Special Production Allowances announced by the

Government of Alberta on October 31, 2019 and effective

December 1, 2019. This program provides producers with

temporary relief equivalent to incremental increases in rail

shipments, which is anticipated to continue into 2020.

Oil Sands operations production was 418,100 bbls/d in the

fourth quarter of 2019, compared to 432,700 bbls/d in the

prior year quarter. The decrease in production was primarily due to

maintenance, including planned annual coker maintenance at Oil

Sands Base, increased yield loss associated with higher SCO

production, mandatory production curtailments and an outage at

MacKay River. MacKay River is expected to return to operation early

in the second quarter of 2020, after completion of planned

maintenance which has been accelerated to the first quarter of 2020

to coincide with the outage in an effort to minimize the impacts to

annual production. As a result of strong upgrader reliability, SCO

production increased to 300,000 bbls/d in the fourth quarter

of 2019, despite maintenance, compared to 273,400 bbls/d in

the fourth quarter of 2018, representing utilization rates of 86%

and 79%, respectively. Production of non‑upgraded bitumen from the

company’s In Situ assets was 118,100 bbls/d in the fourth

quarter of 2019, compared to 159,300 bbls/d in the prior year

quarter, primarily impacted by the outage at MacKay River and

management of mandatory production curtailments, which increased

volumes diverted to upgrading as we continue to focus on value over

volume through the production of higher value SCO.

Oil Sands operations cash operating costs per barrel increased

to $28.55 in the fourth quarter of 2019, from $24.50 in the prior

year quarter, reflecting the impact of lower production volumes

discussed above, higher costs associated with increased production

of higher value SCO barrels, as well as an increase in contractor

mining, shovel maintenance and commodity costs.

Suncor’s share of production from Fort Hills averaged

87,900 bbls/d in the fourth quarter of 2019, compared to

98,500 bbls/d in the prior year quarter. The decrease in

production was due to planned maintenance, which was completed

during the quarter, and mandatory production curtailments. Fort

Hills remains adversely impacted by mandatory production

curtailment due to the continued, disproportionate effect of

curtailment as it is applied on a 2018 production basis when the

asset was ramping up to full production rates. However, the company

was able to partially mitigate production impacts by internally

transferring credits from Oil Sands operations and purchasing

third‑party credits.

Fort Hills cash operating costs per barrel averaged $28.65 in

the fourth quarter of 2019, compared to $24.85 in the prior year

quarter, reflecting the impact of lower production volumes and

slightly higher cash operating costs due to the increase in planned

maintenance.

Suncor’s share of Syncrude production was 156,300 bbls/d in

the fourth quarter of 2019, compared to 209,600 bbls/d in the

prior year quarter. The decrease in production was primarily due to

planned maintenance that commenced in the third quarter of 2019 and

was completed within the fourth quarter, compared to no planned

maintenance in the fourth quarter of 2018, and mandatory production

curtailments. Upon completion of maintenance, the company was able

to partially mitigate impacts of curtailment on production by

internally transferring and purchasing third‑party curtailment

credits. Strong reliability following the maintenance was

reflective of the asset’s performance in the year, with 2019

marking the second best year of production in the asset’s history,

even when curtailed.

Syncrude cash operating costs per barrel were $39.85 in the

fourth quarter of 2019, an increase from $31.75 in the prior year

quarter, due primarily to the decrease in production, partially

offset by lower cash operating costs.

Production volumes at E&P were 115,900 boe/d in the

fourth quarter of 2019, compared to 90,200 boe/d in the prior

year quarter. The increase was primarily due to higher production

at East Coast Canada and Oda, which began production in the first

quarter of 2019, partially offset by natural declines in the

United Kingdom.

Refinery crude throughput was 447,500 bbls/d and refinery

utilization remained strong at 97% in the fourth quarter of 2019,

compared to crude throughput of 467,900 bbls/d and refinery

utilization of 101% in the prior year quarter. Refined product

sales increased in the fourth quarter of 2019 to

534,600 bbls/d, compared to 530,600 bbls/d in the prior

year quarter, reflecting strong retail volumes.

“We demonstrated solid reliability across our refineries and

upgraders during the quarter and, while we had some operational

challenges, we completed significant maintenance across our

upstream operations,” said Little. “Our strong upgrader reliability

enabled the company to opportunistically focus on value over

volume, generating higher margin production during mandatory

production curtailments.”

Strategy Update

In the fourth quarter of 2019, Suncor remained focused on

maximizing the return to its shareholders through payment of

$644 million of dividends and the repurchase of

11.1 million common shares for $452 million under the

company’s share repurchase program. In 2019, the company returned

$4.9 billion in dividends and share repurchases to

shareholders, representing 45% of total funds from operations, in

addition to a reduction of debt of $425 million, reflecting

continued flexibility in the company’s capital allocation

strategy.

In the fourth quarter of 2019, the Board approved an increase to

the company’s share repurchase program from $2.0 billion to

$2.5 billion. Following this approval, the Toronto Stock

Exchange accepted a notice to increase the maximum number of shares

the company may purchase pursuant to its normal course issuer bid.

The increase to the program demonstrates confidence in the

company’s ability to generate cash flow and its commitment to

return cash to shareholders.

Subsequent to the end of the quarter, the Board approved a

quarterly dividend of $0.465 per share, an increase of 11%, and

also approved authority to repurchase shares of up to

$2.0 billion beginning March 1, 2020.

Suncor continues to advance projects and investments intended to

incrementally and sustainably grow annual free funds flow by

reducing operating and sustainment costs, and investing in projects

that enhance value within our existing integrated asset base, while

moving forward in the areas of safety, reliability and

sustainability.

Suncor is focused on low capital intensity, value‑creating

projects including the cogeneration facility announced in the third

quarter of 2019, the continued implementation of autonomous haul

trucks, tailings technology advancements, the Syncrude

bi‑directional pipelines, and digital technology adoption, which

underscores our commitment to deliver growth that is economically

robust, technologically progressive and delivers leading

sustainable outcomes.

The company is committed to its goal to reduce total greenhouse

gas (GHG) emissions intensity by 30% by 2030 and continues to

invest in low‑carbon innovation aimed at reducing the carbon

footprint of our operations and the products we sell. In the fourth

quarter of 2019, the company sanctioned the Forty Mile Wind Power

Project in southern Alberta. This renewable power project has an

estimated total capital spend of $300 million, with 25% of the

capital spent in 2019 and the remainder to be spent over the next

two years. This investment approach in renewable energy is expected

to generate significant value through sustainable low‑carbon power

generation and the retention of generated carbon credits for

utilization in Suncor’s upstream business. Together with the

cogeneration facility, Suncor has sanctioned projects in 2019 that

are expected to achieve one‑third of our GHG emissions intensity

reduction goal.

In the fourth quarter of 2019, the company also finalized an

additional $50 million equity investment in Enerkem Inc.,

a waste‑to‑biofuels and chemicals producer, bringing the company’s

total equity investment to $73 million.

“Suncor continues to invest in high‑return projects and, in the

fourth quarter of 2019, sanctioned the Forty Mile Wind Power

Project, which is designed to provide reliable, low‑carbon power to

the Alberta power grid,” said Little. “In addition, through our

Petro‑Canada brand, we are contributing to the transformation of

Canada’s energy system through the completion of our cross Canada

network of fast‑charging electric vehicle stations. These projects

are expected to generate value for Suncor shareholders and

contribute to the company’s strategic sustainability goals.”

Within our offshore business in the E&P segment, the company

continued to focus on strategic production growth of existing

assets including developing step‑out opportunities and asset

extensions. Drilling activity at Hebron is ongoing and production

continues to ramp up with the completion of the tenth production

well during the fourth quarter of 2019. Other E&P activity in

the fourth quarter of 2019 included development drilling at

Hibernia, Hebron and Buzzard, and development work on Terra Nova,

Fenja and the West White Rose Projects.

Operating Earnings Reconciliation(1)

| |

Three months ended December 31 |

Twelve months ended December 31 |

|

|

($ millions) |

2019 |

|

2018 |

|

2019 |

|

2018 |

|

|

Net (loss) earnings |

(2 335 |

) |

(280 |

) |

2 899 |

|

3 293 |

|

|

Asset impairments(2) |

3 352 |

|

— |

|

3 352 |

|

— |

|

|

Unrealized foreign exchange (gain) loss on U.S. dollar

denominated debt |

(235 |

) |

637 |

|

(590 |

) |

989 |

|

|

Impact of income tax rate adjustment on deferred taxes(3) |

— |

|

— |

|

(1 116 |

) |

— |

|

|

Loss on equity investment and (gain) on significant

disposals(4) |

— |

|

223 |

|

(187 |

) |

30 |

|

|

Operating earnings(1) |

782 |

|

580 |

|

4 358 |

|

4 312 |

|

(1) Operating earnings is a non‑GAAP financial measure. All

reconciling items are presented on an after‑tax basis. See the

Non‑GAAP Financial Measures Advisory section of this news

release.

(2) During the fourth quarter of 2019, the company recorded

after‑tax impairment charges of $2.803 billion on its share of

the Fort Hills assets, in the Oil Sands segment, due to a decline

in forecasted long‑term heavy crude oil prices, and

$393 million against White Rose, in the E&P segment, due

to increased capital cost estimates at the West White Rose Project.

Refer to note 13 in the company’s unaudited interim

Consolidated Financial Statements for the three and twelve months

ended December 31, 2019 for further details on

this item.

(3) In the second quarter of 2019, the company recorded a

$1.116 billion deferred income tax recovery associated with

the Government of Alberta’s substantive enactment of legislation

for the staged reduction of the corporate income tax rate from 12%

to 8% over the next four years.

(4) The third quarter of 2019 included an after‑tax gain of

$48 million in the E&P segment related to the sale of

certain non‑core assets. The third quarter of 2018 included an

after‑tax gain of $60 million on the sale of the company’s

interest in the Joslyn Oil Sands mining project. In the second

quarter of 2019, Suncor sold its 37% interest in Canbriam

Energy Inc. for total proceeds and an equivalent gain of

$151 million ($139 million after‑tax), which had

previously been written down to nil in the fourth quarter of 2018

following the company’s assessment of forward natural gas prices

and the impact on estimated future cash flows.

Corporate Guidance

No changes have been made to Suncor’s previously announced 2020

guidance. For further details and advisories regarding Suncor’s

2020 annual guidance, see suncor.com/guidance.

Non-GAAP Financial Measures

Operating earnings is defined in the Non‑GAAP Financial Measures

Advisory section of Suncor’s Report to Shareholders for the Fourth

Quarter of 2019 dated February 5, 2020 (the Quarterly Report) and

reconciled to the most directly comparable GAAP measure above and

in the Consolidated Financial Information and Segment Results and

Analysis sections of the Quarterly Report. Oil Sands operations

cash operating costs, Fort Hills cash operating costs and Syncrude

cash operating costs are defined in the Non-GAAP Financial Measures

Advisory section of the Quarterly Report and reconciled to the most

directly comparable GAAP measures in the Segment Results and

Analysis section of the Quarterly Report. Funds from operations is

defined and reconciled to the most directly comparable GAAP measure

in the Non‑GAAP Financial Measures Advisory section of the

Quarterly Report. These non-GAAP financial measures are included

because management uses this information to analyze business

performance, leverage and liquidity and it may be useful to

investors on the same basis. These non-GAAP measures do not have

any standardized meaning and therefore are unlikely to be

comparable to similar measures presented by other companies and

should not be considered in isolation or as a substitute for

measures of performance prepared in accordance with GAAP.

Legal Advisory – Forward-Looking

Information

This news release contains certain forward-looking information

and forward-looking statements (collectively referred to herein as

“forward-looking statements”) within the meaning of applicable

Canadian and U.S. securities laws. Forward-looking statements in

this news release include references to: statements about the Forty

Mile Wind Power Project, including: the expectation that it will

generate significant value through sustainable low carbon power

generation and the retention of generated carbon credits for

utilization in Suncor’s upstream business, that it will provide

reliable, low carbon power to the Alberta power grid, the estimated

capital spend of the project and the timing thereof and that,

together with the completion of fast charging electric vehicle

stations across Canada, it will generate value for Suncor

shareholders and contribute to the company’s strategic

sustainability goals; Suncor’s ongoing commitment to return cash to

shareholders and focus on maximizing the return to its

shareholders; Suncor’s expectations regarding the Government of

Alberta’s mandatory production curtailments, including that both

the curtailments and the Special Production Allowances program will

continue into 2020; that Suncor will continue to advance projects

and investments intended to incrementally and sustainably grow its

annual free funds flow by reducing operating and sustainment costs,

and investing in projects that enhance value within our integrated

asset bases, while moving forward in the areas of safety,

reliability and sustainability; the expectation that the company’s

continued focus on strategic production growth of existing assets

will include developing step out opportunities and asset extensions

within its offshore business in the E&P segment; statements

about Suncor’s goal to reduce total GHG emissions intensity by 30%

by 2030, including the belief that Suncor has sanctioned projects

in 2019 that are expected to achieve one third of its GHG emissions

intensity reduction goal and that Suncor will continue to invest in

low carbon innovation aimed at lowering the carbon footprint of its

operations and the products it sells; the expectation that Suncor’s

focus on low capital intensity, value creating projects underscores

its commitment to deliver growth that is economically robust,

technologically progressive and delivers leading sustainable

outcomes; and the expectation that MacKay River will return to

operation early in the second quarter of 2020. In addition,

all other statements and information about Suncor’s strategy for

growth, expected and future expenditures or investment decisions,

commodity prices, costs, schedules, production volumes, operating

and financial results and the expected impact of future commitments

are forward-looking statements. Some of the forward-looking

statements and information may be identified by words like

“expects”, “anticipates”, “will”, “estimates”, “plans”,

“scheduled”, “intends”, “believes”, “projects”, “indicates”,

“could”, “focus”, “vision”, “goal”, “outlook”, “proposed”,

“target”, “objective”, “continue”, “should”, “may” and similar

expressions.

Forward-looking statements are based on Suncor’s current

expectations, estimates, projections and assumptions that were made

by the company in light of its information available at the time

the statement was made and consider Suncor’s experience and its

perception of historical trends, including expectations and

assumptions concerning: the accuracy of reserves and resources

estimates; commodity prices and interest and foreign exchange

rates; the performance of assets and equipment; capital

efficiencies and cost savings; applicable laws and government

policies; future production rates; the sufficiency of budgeted

capital expenditures in carrying out planned activities; the

availability and cost of labour, services and infrastructure; the

satisfaction by third parties of their obligations to Suncor; the

development and execution of projects; and the receipt, in a timely

manner, of regulatory and third-party approvals.

Forward-looking statements are not guarantees of future

performance and involve a number of risks and uncertainties, some

that are similar to other oil and gas companies and some that are

unique to Suncor. Suncor’s actual results may differ materially

from those expressed or implied by its forward-looking statements,

so readers are cautioned not to place undue reliance on them.

Suncor’s Annual Information Form, Form 40-F and Annual Report to

Shareholders, each dated February 28, 2019, and other documents

Suncor files from time to time with securities regulatory

authorities describe the risks, uncertainties, material assumptions

and other factors that could influence actual results and such

factors are incorporated herein by reference. Copies of these

documents are available without charge from Suncor at 150 6th

Avenue S.W., Calgary, Alberta T2P 3E3, by calling 1-800-558-9071,

or by email request to invest@suncor.com or by referring to the

company’s profile on SEDAR at sedar.com or EDGAR at sec.gov. Except

as required by applicable securities laws, Suncor disclaims any

intention or obligation to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise.

Legal Advisory – BOEs

Certain natural gas volumes have been converted to barrels of

oil equivalent (boe) on the basis of one barrel (bbl) to six

thousand cubic feet. Any figure presented in boe may be misleading,

particularly if used in isolation. A conversion ratio of one bbl of

crude oil or natural gas liquids to six thousand cubic feet of

natural gas is based on an energy equivalency conversion method

primarily applicable at the burner tip and does not represent a

value equivalency at the wellhead. Given that the value ratio based

on the current price of crude oil as compared to natural gas is

significantly different from the energy equivalency of 6:1,

utilizing a conversion on a 6:1 basis may be misleading as an

indication of value.

Suncor Energy is Canada's leading integrated energy company.

Suncor's operations include oil sands development and upgrading,

offshore oil and gas production, petroleum refining, and product

marketing under the Petro-Canada brand. A member of Dow Jones

Sustainability indexes, FTSE4Good and CDP, Suncor is working to

responsibly develop petroleum resources while also growing a

renewable energy portfolio. Suncor is listed on the UN Global

Compact 100 stock index. Suncor's common shares (symbol: SU) are

listed on the Toronto and New York stock exchanges.

– 30 –

For more information about Suncor, visit our website at

suncor.com, follow us on Twitter @Suncor or

together.suncor.com.

A full copy of Suncor's fourth quarter 2019 Report to

Shareholders and the financial statements and notes (unaudited) can

be downloaded at suncor.com/investor-centre/financial-reports.

Suncor’s updated Investor Relations presentation is available

online, visit suncor.com/investor-centre.

To listen to the webcast discussing Suncor's fourth quarter

results, visit suncor.com/webcasts.

Media inquiries:833-296-4570media@suncor.com

Investor inquiries:800-558-9071invest@suncor.com

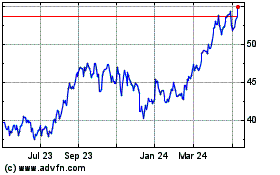

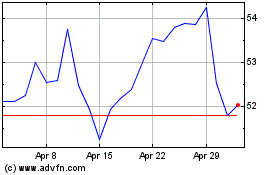

Suncor Energy (TSX:SU)

Historical Stock Chart

From Mar 2025 to Apr 2025

Suncor Energy (TSX:SU)

Historical Stock Chart

From Apr 2024 to Apr 2025