Tearlach Resources Limited (TSXV: TEA) (OTC: TELHF)

(FRANKFURT: V44) (“

Tearlach” or the

“

Company”) is pleased to announce it has entered

into an agreement to acquire up to 70% interest in the lithium

mining rights (the “

Option Agreement”) with

Blackrock Gold Corp. (“

Blackrock Gold”), a

wholly-owned subsidiary of Blackrock Silver Corp.

(TSXV: BRC) (“

Blackrock

Silver”).

Tonopah North / Gabriel Project

Highlights:

- Lithium values up to 1,217 ppm

lithium over 1.5 m in drill hole TN22-012 have been intercepted in

drilling, in addition to the continuity of broad zones of

mineralization up to 56.4 metres in thickness in drill hole

TN22-009;

- The average thickness of the

lithium-bearing zone is 28.1 metres;

- The lithium bearing zone comes

within 8 metres of the surface on the northeast portion of the

property and has been intersected down to 117 metres below the

surface; and

- The mineralization is similar to

the nearby TLC lithium deposit owned by American Lithium Corp,

located three kilometres to the northeast of the Company's land

holdings.

The Option Agreement outlines two stages

Tearlach must fulfill to complete its obligations to Blackrock

Gold:

- Earn 51% interest in the lithium

mineral rights of Tonopah North claims (“Optioned

Zone”) by spending an aggregative US$5M in exploration and

development work on the property.

- Earn 70% interest in the lithium

mineral rights of the Optioned Zone by spending an additional US

$10M in exploration and development work on the property.

Morgan Lekstrom, CEO of Tearlach,

commented, “This is a significant growth

step for Tearlach in becoming a leading multijurisdictional lithium

company and for Blackrock Silver diversifying

their already world-class silver project. Blackrock Silver has done

an excellent job building a strong shareholder base and discovering

a world-class silver deposit. Now Tearlach, through strong

relationships, has identified a significant shareholder opportunity

in what we believe could be an extensive lithium discovery and

district. We are excited to join the American-made history that is

Tonopah, by adding a local green energy component and

discovery.” Additionally, Morgan Lekstrom

stated, “With initial RC holes grading up

to 1217ppm and with thicknesses up to 56.4 metres

and 117m depth, we see a mirror potential of American Lithium’s TLC

deposit ($768M exploration company) directly north of us. With

initial mapping completed and our world-class-Nevada based team

with significant geological and processing experience in

lithium-bearing clays, we have a roadmap to accelerate and

aggressively drill. We plan to drill a much larger core program and

advance to the resource estimate while concurrently running

engineering and process models.”

Figure 1: BRC Tonopah North / Tearlach’s

“Gabriel Project”

Option Agreement

Under the terms of the Option Agreement,

Tearlach has the right to explore for, and the exclusive option

(the “First Option”) to earn a 51% interest

in, the lithium minerals from the topographical surface to 650 feet

below the surface of a portion of the Tonopah North Project (the

“Optioned Zone”) by incurring expenditures for

exploration and development work on the Tonopah North Project

(“Expenditures”) in the aggregative amount of at

least US$5,000,000 consisting of (i) at least US$500,000 in

Expenditures on or before January 9th, 2024; and (ii) at least

US$4,500,000 in Expenditures on or before January 09, 2026

(together, the “Initial Earn-In”).

Subject to Tearlach completing the Initial

Earn-In, under the terms of the Option Agreement, Tearlach shall

have the option (the “Second Option”) to elect

within thirty (30) days of completing the Initial Earn-In to earn

an additional 19% interest in lithium minerals in the Optioned Zone

for an aggregate interest of 70% by: (i) expending an additional

US$10,000,000 in Expenditures; and (ii) by bearing the costs of

preparation of a National Instrument 43-101 compliant bankable

feasibility study for the development and construction of a lithium

mine on the Tonopah North Project (together, the

“Additional Earn-In”), with such Second Option

terminating if not exercised by Tearlach by January 09, 2028.

In addition, pursuant to the Option Agreement,

Tearlach has agreed to pay Blackrock Silver the sum of US$100,000

in cash on or before April 30, 2024, failing which the Company

shall have the right to terminate the Option Agreement.

The exploration and development rights conferred

to Tearlach under the Option Agreement in respect of the Tonopah

North Project are exclusive to lithium minerals in the Optioned

Zone. Subject to the terms of the Option Agreement, Blackrock

retains and reserves the rights to explore for, develop, and mine

all minerals (including gold and silver) other than lithium on the

entire Tonopah North Project, including the Optioned Zone. The

Optioned Zone also includes an area of interest that includes those

lands located within one mile of the exterior boundaries of the

Tonopah North Project. The transactions contemplated by the Option

Agreement constitute an “Exempt Transaction” in accordance with

Policy 5.3 of the TSX Venture Exchange.

Joint Venture

Upon Tearlach completing the Initial Earn-In and

exercising the First Option, Tearlach and Blackrock Gold shall

enter into a definitive mining joint venture agreement (the

“Joint Venture Agreement”) in respect of the

management and ownership of the Optioned Zone of the Tonopah North

Project (the “Joint Venture”). After completion of

the Additional Earn-In, Tearlach may elect to exercise the Second

Option, upon which its participation interest in the Joint Venture

shall increase by an additional 19% to a total of 70%. The parties

to the Joint Venture shall contribute to future Expenditures in

accordance with their respective participating interests as

prescribed in the Joint Venture Agreement.

Pursuant to the Joint Venture Agreement, if at

any time a party’s participating interest in the Joint Venture is

diluted to below 5%, the diluted party shall be deemed to have

withdrawn from the Joint Venture, and its participating interest in

the Joint Venture shall be converted to a non-administrative,

non-executive and non-working mineral production royalty of two

percent 2.0% of the gross revenues from the sale of lithium

minerals and lithium mineral products produced from the Tonopah

North Project.

Subject to the terms of the Joint Venture

Agreement, Tearlach shall be the initial manager of the Joint

Venture and shall have control of the activities and operations of

the Joint Venture.

About Tearlach

Tearlach is a Canadian exploration company

engaged in the acquisition, exploration and development of lithium

projects. Tearlach holds an interest in the Final Frontier Project,

which includes the Pakwan / Margot Lake Claim block, which is

directly contiguous to Frontier Lithium’s Flagship Spark and Pag

deposits, as well as interests in the Wesley, Harth and Ferland

properties, all located in the lithium hub of northwestern Ontario,

Canada. The Wesley Property borders Green Energy Metals’ Root Lake

Project, where a 24,000 m drill program is currently underway.

Pegmatite dykes have also been encountered on the Harth Lithium

Project, which is 8 kms west of the Wesley Lithium Project.

Prospecting and mapping have also confirmed pegmatite dykes on the

Ferland Lithium Property, 10 km east of Green Technology Metals’

Seymour Lake Project. Tearlach intends to explore these assets and

develop a portfolio of projects in the Americas through

acquisition. Tearlach’s primary objective is to position itself as

the leading lithium exploration and development company in the

Americas. Additional information on the Company is available at

website at www.tearlach.ca.

Qualified Person

Julie Selway, Ph.D., P.Geo. reviewed and

approved the technical disclosure in this news release. Dr. Selway

is the VP of Exploration for Tearlach Resources and the Qualified

Person ("QP") as defined by National Instrument 43-101. Dr. Selway

completed a Ph.D. on lithium granitic pegmatites in 1999. Dr.

Selway also has twenty-three scientific journal articles on lithium

pegmatites. Dr. Selway has co-authored 29 NI 43-101 Technical

Reports on a wide variety of commodities and deposit types.

ON BEHALF OF THE BOARD OF

DIRECTORS,TEARLACH RESOURCES LTD.

Morgan LekstromChief Executive OfficerSuite 610

- 700 W. Pender StreetVancouver, BC, Canada V6C 1G8Tel:

604-688-5007

www.tearlach.cawww.tearlach.ca/contact/

Neither the TSX Venture Exchange nor its

Regulation Service provided (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Cautionary Note Regarding

Forward-Looking Statements

This news release contains forward-looking

statements and forward-looking information (collectively,

“forward-looking statements”) within the meaning of applicable

Canadian securities legislation. All statements, other than

statements of historical fact, included herein including, without

limitation, future Expenditures, exercise of the Option, entry into

the Joint Venture, future drilling activities, and the anticipated

business plans and timing of future activities of the Company are

forward-looking statements. Although the Company believes that such

statements are reasonable, it can give no assurance that such

expectations will prove to be correct. Forward-looking statements

are typically identified by words such as: “believes”, “expects”,

“anticipates”, “intends”, “estimates”, “plans”, “may”, “should”,

“would”, “will”, “potential”, “scheduled” or variations of such

words and phrases and similar expressions, which, by their nature,

refer to future events or results that may, could, would, might or

will occur or be taken or achieved. In making the forward-looking

statements in this news release, the Company has applied several

material assumptions, including without limitation, that the

Company will receive all necessary approvals in connection with the

Option Agreement and the Expenditures thereunder, market

fundamentals will result in sustained lithium demand and prices,

the receipt of any necessary permits, licenses and regulatory

approvals in connection with the future development of the

Properties in a timely manner, the availability of financing on

suitable terms for the development and continued operation of the

Company’s projects and its ability to comply with environmental,

health and safety laws.

Forward-looking statements involve known and

unknown risks, uncertainties and other factors which may cause the

actual results, performance or achievements of the Company to

differ materially from any future results, performance or

achievements expressed or implied by the forward-looking

information. Such risks and other factors include, among others,

requirements for additional capital, operating and technical

difficulties in connection with mineral exploration and development

activities, actual results of exploration activities, including on

the Tonopah North Project, the estimation or realization of mineral

reserves and mineral resources, the fact that the Company’s

interests in the Tonopah North Project are an option only and there

is no guarantee that such interests, if earned, will be certain,

the timing and amount of estimated future production, the costs of

production, capital expenditures, the costs and timing of the

development of new deposits, requirements for additional capital,

future prices of lithium, changes in general economic conditions,

changes in the financial markets and in the demand and market price

for commodities, lack of investor interest in future financings,

accidents, labour disputes and other risks of the mining industry,

delays in obtaining governmental approvals (including of the TSX

Venture Exchange), permits or financing or in the completion of

development activities, changes in laws, regulations and policies

affecting mining operations, title disputes, the inability of the

Company to obtain any necessary permits, consents, approvals or

authorizations, environmental issues and liabilities, and risks

related to joint venture operations, and other risks and

uncertainties disclosed in the company’s continuous disclosure

documents. All of the Company’s Canadian public disclosure filings

may be accessed via www.sedar.com and readers are urged

to review these materials.

Readers are cautioned not to place undue

reliance on forward-looking statements. The Company does not

undertake any obligation to update any of the forward-looking

statements in this news release or incorporated by reference

herein, except as otherwise required by law.

A photo accompanying this announcement is

available

at:https://www.globenewswire.com/NewsRoom/AttachmentNg/40a6edb2-9695-402b-85bd-32b9367c9363

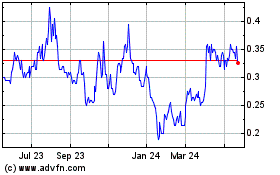

Blackrock Silver (TSXV:BRC)

Historical Stock Chart

From Nov 2024 to Dec 2024

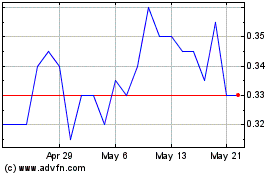

Blackrock Silver (TSXV:BRC)

Historical Stock Chart

From Dec 2023 to Dec 2024