Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

06 March 2025 - 11:50PM

Edgar (US Regulatory)

FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a - 16 or 15d - 16 of

the Securities Exchange Act of 1934

For the

month of March

HSBC Holdings plc

42nd

Floor, 8 Canada Square, London E14 5HQ, England

(Indicate

by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F).

Form

20-F X Form 40-F

The following is the text of an announcement released to the Stock

Exchange of Hong Kong Limited on 6 March 2025 pursuant to rules

17.06A, 17.06B and 17.06C of the Rules Governing the Listing of

Securities on The Stock Exchange of Hong Kong Limited:

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of

Hong Kong Limited take no responsibility for the contents of this

document, make no representation as to its accuracy or completeness

and expressly disclaim any liability whatsoever for any loss

howsoever arising from or in reliance upon the whole or any part of

the contents of this document.

6

March 2025

(Hong Kong Stock

Code: 5)

HSBC HOLDINGS PLC

GRANT OF CONDITIONAL AWARDS

This

announcement is made pursuant to Rules 17.06A, 17.06B and 17.06C of

the Rules Governing the Listing of Securities on The Stock Exchange

of Hong Kong Limited.

On 4 March 2025, HSBC Holdings plc (the

"Company") granted conditional awards

("Awards")

to directors, employees and former employees to subscribe for a

total of 48,366,306 ordinary shares of US$0.50 each of the Company

("Shares") under the HSBC Share Plan 2011 (the

"Plan").

The

following are the details of the grants:

Grants to

Directors:

|

Name

of grantee

|

Georges

Elhedery

|

|

Relationship

between the grantee and the Company

|

Director

of the Company

|

|

Number

of shares under Awards

|

92,447

|

|

Closing

market price of the ordinary shares on the London Stock Exchange on

the date of grant

|

GBP

9.163

|

|

Purchase

price of Awards granted

|

GBP

0

|

|

Vesting

period of the Awards

|

50%

of the 2024 annual incentive award is delivered in immediately

vested shares subject to a retention period of 12

months.

The

Company views it as appropriate for the annual incentive award to

vest immediately and not to be subject to a vesting period for two

reasons:

1)

The annual incentive is a non-deferred portion of the Directors

remuneration, which must be partly delivered in shares to comply

with UK regulation.

2)

The annual incentive share award is subject to a retention period

of 12 months, during which time the Directors cannot sell the

shares.

|

|

Performance

Targets and Clawback

|

The

immediately vested shares are not subject to forward looking

performance conditions as they form part of the annual incentive

for which performance is measured over the preceding performance

year. Clawback applies to the Plan Awards in line with the

Company's regulatory obligations as set out in the Company's

internal clawback policy.

|

|

Arrangements

for the Company or a subsidiary to provide financial assistance to

the grantees

|

None

|

|

|

|

Name

of grantee

|

Manveen

(Pam) Kaur

|

|

Relationship

between the grantee and the Company

|

Director

of the Company

|

|

Number

of shares under Awards

|

186,052

|

|

Closing

market price of the ordinary shares on the London Stock Exchange on

the date of grant

|

GBP

9.163

|

|

Purchase

price of Awards granted

|

GBP

0

|

|

Vesting

period of the Awards

|

50%

of the 2024 annual incentive award is delivered in immediately

vested shares subject to a retention period of 12

months.

The

Company views it as appropriate for the annual incentive award to

vest immediately and not to be subject to a vesting period for two

reasons:

1)

The annual incentive is a non-deferred portion of the Directors

remuneration, which must be partly delivered in shares to comply

with UK regulation.

2)

The annual incentive share award is subject to a retention period

of 12 months, during which time the Directors cannot sell the

shares.

|

|

Performance

Targets and Clawback

|

The

immediately vested shares are not subject to forward looking

performance conditions as they form part of the annual incentive

for which performance is measured over the preceding performance

year. Clawback applies to the Plan Awards in line with the

Company's regulatory obligations as set out in the Company's

internal clawback policy.

|

|

Arrangements

for the Company or a subsidiary to provide financial assistance to

the grantees

|

None

|

Grants to other

grantees:

|

Category

of grantee

|

Employees

and former employees

|

|

Number

of shares under Awards

|

48,087,807

|

|

Closing

market price of the ordinary shares on the London Stock Exchange on

the date of grant

|

GBP

9.163

|

|

Purchase

price of Awards granted

|

GBP

0

|

|

Vesting

period of the Awards

|

Under

the HSBC Group-wide deferral policy, vesting occurs over a three

year period with 33% vesting on the first and second anniversaries

of grant and 34% on the third anniversary.

Group

and local Material Risk Takers may be subject to longer vesting

periods of up to seven years, as required under the relevant

remuneration regulations. Awards may be subject to a six- or

12-month retention period following vesting.

Immediately

vested share awards may be subject to a six- or 12-month retention

period following vesting.

The

Company views it as appropriate for the immediately vested share

awards to vest immediately and not to be subject to a vesting

period for two reasons:

1)

The immediately vested share award is a non-deferred portion of the

Material Risk Takers remuneration, which must be partly delivered

in shares to comply with UK regulation; each employee will also be

granted a deferred share award for which the vesting schedule is

noted above.

2)

The immediately vested share award is subject to a retention period

of six- or 12-months, during which time the shares cannot be

sold.

The

vesting period for retention awards will align to the completion of

the relevant project for which the Award was granted.

|

|

Performance

Targets and Clawback

|

The

Group Operating Committee additionally participate in the 2025-2027

Long Term Incentive ("LTI"). The LTI award is subject to the

following performance conditions as detailed in the Directors

Remuneration Report in the Annual Report and Accounts 2024:

|

|

Measure

|

Weighting

|

|

RoTE

with CET1 underpin

|

40%

|

|

Environment

|

20%

|

|

Relative

TSR

|

40%

|

|

Certain

other awards are subject to the completion of a strategically

important project.

No

performance targets apply to any other Plan Awards on the basis

that the Awards are a form of deferred bonus to meet regulatory

requirements in the UK. Performance targets instead attach to the

initial award of the Variable Pay. C

Clawback

applies to the Plan Awards in line with the Company's regulatory

obligations as set out in the Company's internal clawback

policy.

|

|

Arrangements

for the Company or a subsidiary to provide financial assistance to

the grantees

|

None

|

|

Number

of shares available for future grant under the plan

mandate

|

The

Plan is subject to two limits on the number of Shares committed to

be issued under all Plan Awards:

1.

10% of the ordinary share capital of the Company in issue

immediately before that day, less the number of Shares which have

been issued, or may be issued, to satisfy Awards under the Plan, or

options or awards under any other employee share plan operated by

the Company granted in the previous 10 years. The number of Shares

available to issue under this limit is 990,119,439.

2.

5% of the ordinary share capital of the Company in issue

immediately before that day, less the number of Shares which have

been issued, or may be issued, to satisfy Awards under the Plan.

The number of Shares available to issue under this limit is

255,694,591.

|

For

and on behalf of

HSBC Holdings plc

Aileen Taylor

Company

Secretary

The Board of Directors of HSBC

Holdings plc as at the date of this announcement comprises: Sir

Mark Edward Tucker*, Georges Bahjat Elhedery, Geraldine Joyce

Buckingham†, Rachel Duan†, Dame Carolyn Julie

Fairbairn†, James Anthony

Forese†, Ann Frances

Godbehere†, Steven Craig

Guggenheimer†, Manveen (Pam) Kaur, Dr

José Antonio Meade Kuribreña†, Kalpana Jaisingh

Morparia†, Eileen K

Murray†, Brendan Robert

Nelson† and Swee Lian

Teo†.

* Non-executive

Group Chairman

† Independent

non-executive Director

HSBC Holdings plc

Registered Office and Group Head Office:

8 Canada Square, London E14 5HQ,

United Kingdom Web: www.hsbc.com

Incorporated in England and Wales with limited liability.

Registration number 617987

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

|

HSBC

Holdings plc

|

|

|

|

|

|

By:

|

|

|

Name:

Aileen Taylor

|

|

|

Title:

Group Company Secretary and Chief Governance Officer

|

|

|

|

|

|

Date:

06 March 2025

|

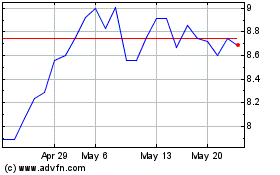

HSBC (PK) (USOTC:HBCYF)

Historical Stock Chart

From Feb 2025 to Mar 2025

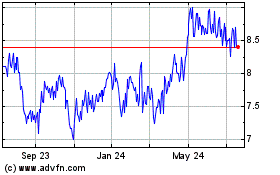

HSBC (PK) (USOTC:HBCYF)

Historical Stock Chart

From Mar 2024 to Mar 2025