Asian Shares Mixed With Nikkei Higher on Upbeat Data

14 November 2016 - 4:10PM

Dow Jones News

Asian equity markets were mixed early Monday, with Japan's

Nikkei outperforming regional markets following

stronger-than-expected economic data and a weaker yen.

The Nikkei Stock Average was up 1.5% in morning trade, becoming

the day's biggest outperformer by far. In other markets,

Australia's S&P/ASX 200 was down 0.8%, Singapore's FTSE Straits

Times Index was off 1.0%, and Hong Kong's Hang Seng Index declined

1.4%.

Government data in Japan showed that its third-quarter gross

domestic product expanded an annualized 2.2% in the three months

ended September, beating expectations of a 0.9% expansion, as

forecast by economists polled by The Wall Street Journal.

Monday's data also marked the third straight quarter of

expansion in Japan, after a patchy economic performance in the

three years since the summer of 2013.

Japan's economy will likely continue its gradual recovery, said

economy minister Nobuteru Ishihara in a statement on Monday, citing

"improvements in employment and wage conditions."

The latest growth figures also showed that residential

construction rose in the country, after borrowing rates fell. Lower

rates have fueled demand for property investments. Among individual

real estate companies, Mitsui Fudosan rose 3.5%, Mitsubishi Estate

added 2.1% and Sumitomo Realty & Development climbed 2.3%.

Meanwhile, the yen fell against the dollar, and was recently

down 0.7%, making it cheaper for exporters to ship their goods

around the world. Export-oriented stocks surged, with Mazda Motor

up 4.6% and Toshiba gaining 2.9%.

Elsewhere in the region, markets were under pressure as

investors clung to an optimistic view that President-elect Donald

Trump might be able to stimulate growth in the U.S. economy,

following the election last week.

This could see U.S. interest rates rise at a faster pace next

year, triggering outflows from emerging market equities, said Mixo

Das, Southeast Asia Equity Strategist at Nomura.

"Much of the pain was felt on Friday and we're just drifting

slightly lower," said Mr. Das. "I think we'll continue to see

choppy trading."

A selloff continued among Hong Kong property developers given

the concerns of a faster interest rate increase in the U.S., a move

that will hurt the city's real-estate market. The city's currency

peg to the U.S. dollar means that local monetary policies move in

lockstep to adjustments in the U.S.

The Hang Seng Property subindex was last off 2.4%. Among key

developers, Wharf Holdings fell 2.4%, while Sun Hung Kai Properties

fell 1.9%.

In mainland China, stock markets opened down but quickly began

to rally after a strong showing last week led to equities entering

a technical bull market.

A slew of data released Monday also supported a view that the

world's second-largest economy is stabilizing, with industrial

output growth stabilizing, fixed-asset investment growth lightly

accelerating, while retail sales slowed, according to official

data. The Shanghai Composite Index was last up 0.2%, while the

Shenzhen Composite Index added 0.3%.

Looking ahead, the market will remain focused on the U.S.

Federal Reserve's meeting in December, with interest rates likely

to rise, say analysts. According to CME Group's Fedwatch tool, the

probability of an increase in December has risen to 81.1% from

71.5% previously.

"The market is now focusing on...the rate hike planned for

December [by the Federal Reserve]," said Alex Wijaya, a senior

sales trader at CMC Markets, in a note.

Suryatapa Bhattacharya, Liyan Qi and Anjie Zheng contributed to

this article.

(END) Dow Jones Newswires

November 13, 2016 23:55 ET (04:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

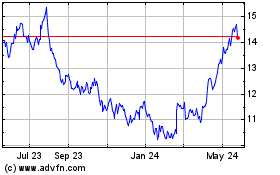

Hang Seng Bank (PK) (USOTC:HSNGY)

Historical Stock Chart

From Nov 2024 to Dec 2024

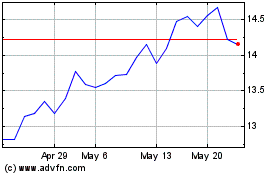

Hang Seng Bank (PK) (USOTC:HSNGY)

Historical Stock Chart

From Dec 2023 to Dec 2024