Form 8-K - Current report

27 December 2024 - 8:29AM

Edgar (US Regulatory)

false

0001072379

0001072379

2024-12-19

2024-12-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported):

December 19, 2024

Northwest Biotherapeutics, Inc.

(Exact name of registrant as specified in

its charter)

| Delaware |

|

0-35737 |

|

94-3306718 |

| (State or other jurisdiction |

|

(Commission |

|

(IRS Employer |

| of incorporation) |

|

File Number) |

|

Identification No.) |

4800 Montgomery Lane, Suite 800

Bethesda, Maryland 20814

(Address of Principal Executive Offices)

(240) 497-9024

(Registrant’s telephone number, including

area code)

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

| Title of each class: |

|

Trading Symbol(s) |

|

Name of each exchange on which

registered: |

| Common Stock, par value, $0.001 per share |

|

NWBO |

|

OTCQB |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

Growth Company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01. |

Entry Into A

Material Definitive Agreement. |

On December

26, 2024, Northwest Biotherapeutics (OTCQB:NWBO) (the “Company”) issued a press release, attached hereto as Exhibit 99.1,

in which it provided information regarding its entry into a convertible note financing and standy equity purchase agreement.

| Item 2.03. |

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

The information

included in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

| Item 9.01 | Financial Statements and Exhibits |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| |

NORTHWEST BIOTHERAPEUTICS, INC. |

| |

|

|

| |

|

|

| Date: December 26, 2024 |

By: |

/s/ Linda Powers |

| |

Name: |

Linda Powers |

| |

Title: |

Chief Executive Officer and Chairman |

Exhibit 99.1

| 4800

Montgomery Lane

Suite 800

Bethesda, MD 20814 | t

(240) 497-9024

f (240) 627-4121 |

www.nwbio.com

OTCQB: NWBO |

For release at 9:30 a.m. EST on December 26, 2024

Northwest Biotherapeutics

Announces $5 Million Convertible Note Financing and Standby Facility for Up to $50 Million Additional Financing

BETHESDA, Md., December 26, 2024 -- Northwest

Biotherapeutics (OTCQB:NWBO) (the “Company” or "NW Bio"), a biotechnology company developing DCVax® personalized

immune therapies for solid tumor cancers, today announced that on December 19, 2024 it entered into a $5 million convertible Promissory

Note financing with YA II PN, Ltd., an investment fund managed by Yorkville Advisors Global, LP (“Yorkville”). The term of

the Note is 13 months. The Note carries an Original Issue Discount of seven percent but no interest. Repayment of all outstanding amounts

is due at maturity; no payments by the Company are due until maturity. The Note includes customary default provisions. During the term

of the Note, it is convertible at the option of the holder, at a small discount to the then prevailing market price. The amounts of such

conversions are limited to one sixth (1/6) of the overall Note amount in any given calendar month unless the conversion price is above

$0.315. The Company plans to use the proceeds for general corporate purposes, including both its lead product and its in-licensed portfolios.

The Company and Yorkville also entered into a

standby equity subscription agreement (the “Subscription Agreement”) which the Company may use after the Note is repaid or

converted. Under this Subscription Agreement, NW Bio has the option, in its discretion, to require Yorkville to subscribe for up to $50

million of common shares in the Company at any time during the 24-month term of the Subscription Agreement at a small discount to the

then prevailing market price, after the Note is repaid or converted. The Company has no obligation to make any such use of this arrangement,

and the Company can cancel the arrangement at any time after the Note is repaid or converted. The Company has no current plans to draw

upon this standby facility; however, the Company believes it will be useful to have this facility available for special funding needs

in connection with certain key potential upcoming milestones.

Joseph Gunnar & Co., LLC acted as the exclusive placement agent

for the offering.

About Northwest Biotherapeutics

Northwest Biotherapeutics

is a biotechnology company focused on developing personalized immunotherapy products that are designed to treat cancers more effectively

than current treatments, without toxicities of the kind associated with chemotherapies, and on a cost-effective basis. The Company has

a broad platform technology for DCVax® dendritic cell-based vaccines. The Company's lead program involves DCVax®-L

treatment for glioblastoma (GBM). GBM is the most aggressive and lethal form of primary brain cancer, and is an "orphan disease."

The Company has completed a 331-patient Phase III trial of DCVax-L for GBM, presented the results in scientific meetings, published the

results in JAMA Oncology and submitted a MAA for commercial approval in the UK. The MAAA is currently undergoing review. The Company

has also developed DCVax®-Direct for inoperable solid tumor cancers. It has completed a 40-patient Phase I trial and,

as resources permit, plans to pursue Phase II trials. The Company previously conducted a Phase I/II trial with DCVax-L for advanced ovarian

cancer together with the University of Pennsylvania.

Disclaimer

Statements

made in this news release that are not historical facts, including statements concerning plans for DCVax® are forward-looking

statements within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as "expect," "believe,"

"intend," "design," "plan," "continue," "may," "will," "anticipate,"

and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these

identifying words. Actual results may differ materially from those projected in any forward-looking statement. Readers should not rely

upon forward-looking statements. There are a number of important factors that could cause actual results to differ materially from those

anticipated, including, without limitation, risks related to delays or uncertainties in regulatory processes and decisions, risks related

to the Company's ability to achieve timely performance of third parties, risks related to whether the Company's products will be viewed

as demonstrating safety and efficacy, risks related to the Company's ongoing ability to raise additional capital, and other risks included

in the Company's Securities and Exchange Commission ("SEC") filings. Additional information on the foregoing risk factors and

other factors, including Risk Factors, which could affect the Company's results, is included in its SEC filings. Finally, there may be

other factors not mentioned above or included in the Company's SEC filings that may cause actual plans, results or timelines to differ

materially from those projected in any forward-looking statement. The Company assumes no obligation to update any forward-looking statements

as a result of new information, future events or developments, except as required by securities laws.

CONTACTS

Northwest Biotherapeutics

Dave Innes

804-513-6758

dinnes@nwbio.com

Les Goldman

240-234-0059

lgoldman@nwbio.com

v3.24.4

Cover

|

Dec. 19, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 19, 2024

|

| Entity File Number |

0-35737

|

| Entity Registrant Name |

Northwest Biotherapeutics, Inc.

|

| Entity Central Index Key |

0001072379

|

| Entity Tax Identification Number |

94-3306718

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

4800 Montgomery Lane

|

| Entity Address, Address Line Two |

Suite 800

|

| Entity Address, City or Town |

Bethesda

|

| Entity Address, State or Province |

MD

|

| Entity Address, Postal Zip Code |

20814

|

| City Area Code |

240

|

| Local Phone Number |

497-9024

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value, $0.001 per share

|

| Trading Symbol |

NWBO

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

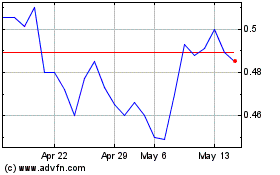

Northwest Biotherapeutics (QB) (USOTC:NWBO)

Historical Stock Chart

From Feb 2025 to Mar 2025

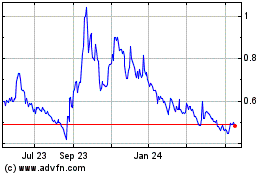

Northwest Biotherapeutics (QB) (USOTC:NWBO)

Historical Stock Chart

From Mar 2024 to Mar 2025