UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

TO

TENDER

OFFER STATEMENT UNDER SECTION 14(d)(1) or 13(e)(1)

OF

THE SECURITIES EXCHANGE ACT OF 1934

Osprey

Bitcoin Trust

(Name

of Subject Company (Issuer) and Filing Person (Offeror))

Common

Units of Fractional Undivided Beneficial Interest

(Title

of Class of Securities)

68839C206

(CUSIP

Number of Class of Securities)

Gregory

D. King

Osprey

Funds, LLC, as Sponsor of Osprey Bitcoin Trust

1241

Post Road, 2nd Floor

Fairfield,

CT 06824

(914)

214-4697

(Name,

address and telephone number of person authorized to receive notices and communications on behalf of filing person)

Copy

to:

Erin

E. Martin, Esq.

Morgan,

Lewis & Bockius LLP

1111

Pennsylvania Avenue, NW

Washington,

DC 20004

(202)

739-3000

January

11, 2024

(Date

Tender Offer First Published,

Sent

or Given to Security Holders)

| ☐ |

Check

the box if filing relates solely to preliminary communications made before the commencement of a tender offer. |

| |

|

| |

Check

the appropriate boxes below to designate any transactions to which the statement relates: |

| |

☐ |

third-party

tender offer subject to Rule 14d-1. |

| |

☒ |

issuer

tender offer subject to Rule 13e-4. |

| |

☐ |

going-private

transaction subject to Rule 13e-3. |

| |

☐ |

amendment

to Schedule 13D under Rule 13d-2. |

|

Check the

following box if the filing is a final amendment reporting the results of the tender offer: ☐ |

Introductory

Statement

This

Tender Offer Statement on Schedule TO relates to a tender offer by Osprey Bitcoin Trust, a Delaware Statutory Trust (the “Trust”),

to purchase common units of fractional undivided beneficial interest in the Trust (the “Units”). Subject to the conditions

set forth in the Offer to Purchase and related Letter of Transmittal (each as defined below and as attached as Exhibit (a)(1)(i) and

Exhibit (a)(1)(ii), respectively), the Trust will purchase in cash up to 20% or 1,668,107 outstanding Units that are properly tendered

and not properly withdrawn prior to the end of the day on February 9, 2024, at 12:00 midnight, New York City time, subject to any extensions

of the Offer (as defined below).

The

Offer is being made upon the terms and subject to the conditions set forth in the Offer to Purchase, dated January 11, 2024 (together

with any amendments or supplements thereto, the “Offer to Purchase”), the related Letter of Transmittal (together with any

amendments or supplements thereto, the “Letter of Transmittal”) and other related materials as may be amended or supplemented

from time to time (collectively, with the Offer to Purchase and the Letter of Transmittal, the “Offer”). This Tender Offer

Statement on Schedule TO is intended to satisfy the reporting requirements of Rule 13e-4(c)(2) under the Securities Exchange Act of 1934,

as amended (the “Exchange Act”).

The

information set forth in the Offer to Purchase and the Letter of Transmittal is incorporated herein by reference with respect to Item

1 through Item 9 and Item 11 of this Schedule TO.

| ITEM

1. |

Summary

Term Sheet. |

The

information under the heading “Summary Term Sheet” of the Offer to Purchase, a copy of which is filed with this Schedule

TO as Exhibit (a)(1)(i), is incorporated herein by reference.

| ITEM

2. |

Subject

Company Information. |

| (a) |

|

Name

and Address: The name of the issuer is Osprey Bitcoin Trust. The principal executive office of the Trust is located at 1241 Post

Road, 2nd Floor, Fairfield, Connecticut 06824 and the telephone number is (914) 214-4697. The information set forth

in “Section 8 — Certain Information About the Trust” of the Offer to Purchase is incorporated herein by reference. |

| (b) |

|

Securities:

The information set forth in “Section 9 — Interests of Executive Officers of the Sponsor” of the Offer to Purchase

is incorporated herein by reference. |

| (c) |

|

Trading

Market and Price: The information set forth in “Section 8 — Certain Information About the Trust” of the Offer

to Purchase is incorporated herein by reference. |

| ITEM

3. |

Identity

and Background of Filing Person. |

The

name of the filing person is Osprey Bitcoin Trust. Osprey Funds, LLC, a Delaware limited liability company, is the sponsor of

the Trust (the “Sponsor”). The principal executive office of the Trust and the Sponsor is located at 1241 Post Road,

2nd Floor, Fairfield, Connecticut 06824 and the telephone number is (914) 214-4697.

The

Trust does not have any directors, officers or employees. Under its Trust Agreement with the Sponsor (attached hereto as Exhibit

(d)), all management functions of the Trust have been delegated to and are conducted by the Sponsor, its agents and its affiliates.

The following individuals are officers of the Sponsor responsible for overseeing the business and operations of the Trust: Gregory

D. King, Chief Executive Officer, and Robert Rokose, Chief Financial Officer. The address of the Sponsor’s Executive Officers

is Osprey Funds, LLC, 1241 Post Road, 2nd Floor, Fairfield, Connecticut 06824. Additionally, the

information set forth in “Section 8 — Certain Information About the Trust” and “Section 9 — Interests

of Executive Officers of the Sponsor” of the Offer to Purchase is incorporated herein by reference.

| ITEM

4. |

Terms

of the Transaction. |

| (a) |

|

Material

Terms: The information set forth in the sections of the Offer to Purchase captioned “Summary Term Sheet,” “Section

1 — Background and Purpose of the Offer,” “Section 2 — Offer to Purchase and Price,” “Section

3 — Amount of Tender,” “Section 4 — Procedure for Tenders,” “Section 5 — Withdrawal Rights,”

“Section 6 — Purchases and Payment,” “Section 7 — Certain Conditions of the Offer,” “Section

10 — Certain U.S. Federal Income Tax Consequences” and “Section 11 — Disclosure Provisions” is incorporated

herein by reference. There will be no material differences in the rights of security holders as a result of this transaction. |

| (b) |

|

Purchases:

The information set forth in “Section 8 — Certain Information About the Trust” of the Offer to Purchase is incorporated

herein by reference. |

| ITEM

5. |

Past

Contracts, Transactions, Negotiations and Agreements. |

| (a) |

|

Agreements

Involving the Subject Company’s Securities: The information set forth in “Section 8 — Certain Information About

the Trust” of the Offer to Purchase is incorporated herein by reference. |

| ITEM

6. |

Purposes

of the Transaction and Plans or Proposals. |

| (a) |

|

Purposes:

The information set forth in the sections of the Offer to Purchase captioned “Summary Term Sheet” and “Section

1 — Background and Purpose of the Offer” is incorporated herein by reference. |

| (b) |

|

Use

of the Securities Acquired: The information set forth in “Section 1 — Background and Purpose of the Offer”

of the Offer to Purchase is incorporated herein by reference. |

| (c) |

|

Plans:

The information set forth in the sections of the Offer to Purchase captioned “Section 1 — Background and Purpose of the

Offer” and “Section 8 — Certain Information About the Trust” is incorporated herein by reference. |

| ITEM

7. |

Source

and Amount of Funds or Other Consideration. |

| (a) |

|

Source

of Funds: The information set forth in the sections of the Offer to Purchase captioned “Summary Term Sheet,” “Section

1 — Background and Purpose of the Offer” and “Section 6 — Purchases and Payment” is incorporated herein

by reference. |

| (b) |

|

Conditions:

The information set forth in the sections of the Offer to Purchase captioned “Summary Term Sheet,” “Section 6 —

Purchases and Payment” and “Section 7 — Certain Conditions of the Offer” is incorporated herein by reference. |

| ITEM

8. |

Interest

in Securities of the Subject Company. |

| (a) |

|

Securities

Ownership: The information set forth in “Section 9 — Interests of Executive Officers of the Sponsor” of the

Offer to Purchase is incorporated herein by reference. |

| (b) |

|

Securities

Transactions: The information set forth in “Section 9 — Certain Information About the Trust” of the Offer to

Purchase is incorporated herein by reference. |

| ITEM

9. |

Persons/Assets,

Retained, Employed, Compensated or Used. |

| (a) |

|

Solicitations

or Recommendations: The information set forth in the sections of the Offer to Purchase captioned “Summary Term Sheet,”

“Section 6 — Purchases and Payment” and “Section 12 — Fees and Expenses” is incorporated herein

by reference. |

| ITEM

10. |

Financial

Statements. |

| (a) |

|

Financial

Information: Financial statements have not been included because the consideration offered to unitholders consists solely

of cash and are not material to a determination made by a tendering holder, the Offer is not subject to any financing condition,

and the Trust is a public reporting company under Section 13(a) of the Exchange Act and the rules and regulations thereunder and

files its reports electronically on the EDGAR system. |

| (b) |

|

Pro

Forma Financial Information: Financial statements have not been included because the consideration offered to unitholders

consists solely of cash and are not material to a determination made by a tendering holder, the Offer is not subject to any financing

condition, and the Trust is a public reporting company under Section 13(a) of the Exchange Act and the rules and regulations thereunder

and files its reports electronically on the EDGAR system. |

| ITEM

11. |

Additional

Information. |

| (a) |

|

Agreements,

Regulatory Requirements and Legal Proceedings: The information set forth in the sections of the Offer to Purchase captioned “Section

8 — Certain Information About the Trust” and “Section 9 — Interests of Executive Officers of the Sponsor”

is incorporated herein by reference. |

| (a) |

|

Other

Material Information: The information in the Offer to Purchase and the Letter of Transmittal, copies of which are filed with

this Schedule TO as Exhibits (a)(1)(i) and (a)(1)(ii), respectively, is incorporated herein by reference |

| Exhibit

No |

|

Description |

| (a)(1)(i)* |

|

Offer to Purchase, dated January 11, 2024. |

| (a)(1)(ii)* |

|

Letter of Transmittal. |

| (a)(1)(iii)* |

|

Notice of Guaranteed Delivery. |

| (a)(1)(iv)* |

|

Letter to Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees, dated January 11, 2024. |

| (a)(1)(v)* |

|

Letter to Clients for use by Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees, dated January 11, 2024. |

| (a)(1)(vi)* |

|

Summary Advertisement, dated January 11, 2024. |

| (a)(2) |

|

Not

applicable. |

| (a)(3) |

|

Not

applicable. |

| (a)(4) |

|

Not

applicable. |

| (d) |

|

Second Amended and Restated Declaration of Trust and Trust Agreement (incorporated by reference to Exhibit 4.1 of the Registration Statement on Form 10 filed by the Registrant on September 21, 2022). |

| (g) |

|

Not

applicable. |

| (h) |

|

Not

applicable. |

| 107* |

|

Calculation of Filing Fees. |

*

Filed herewith

| Item 13. |

Information Required by Schedule 13E-3. |

Not

applicable.

SIGNATURE

After

due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete

and correct.

| |

Osprey Funds, LLC as Sponsor of Osprey Bitcoin Trust |

| |

|

| |

By: |

/s/

Gregory D. King |

| |

|

Gregory

D. King |

| |

|

Chief

Executive Officer |

| |

|

|

| Date:

January 11, 2024 |

|

|

Exhibit

(a)(1)(i)

Offer

to Purchase

OSPREY

BITCOIN TRUST

1241

POST ROAD, 2ND FLOOR

FAIRFIELD,

CONNECTICUT 06824

OFFER

TO PURCHASE for cash UP TO 20% or 1,668,107 OUTSTANDING

Common

units of fractional undivided BenEficial INTEREST AT NET ASSET VALUE

minus

fees payable to the sponsor

DATED

January 11, 2024

THE

OFFER AND WITHDRAWAL RIGHTS WILL EXPIRE AT THE END OF THE DAY

ON

FRIDAY, February 9, 2024, AT 12:00 MIDNIGHT, NEW YORK CITY TIME, UNLESS THE OFFER IS EXTENDED Or EARLIER terminated (such date and time,

as they may be extended, the “expiration date”)

If

you do not want to sell your Units at this time, please disregard this offer to

purchase referred to below.

To

the Investors of Osprey Bitcoin Trust:

Osprey

Bitcoin Trust, a Delaware statutory trust (the “Trust” or “we”), is offering to purchase on the terms and conditions

set forth in this offer to purchase (the “Offer to Purchase”) and the related Letter of Transmittal (together with any amendments

or supplements thereto, the “Letter of Transmittal”) and other related materials as may be amended or supplemented

from time to time (collectively, with this Offer to Purchase and Letter of Transmittal, the “Offer”) up to 20% or 1,668,107

outstanding Units (the “Offer Amount”) pursuant to tenders by investors at a purchase price equal to their net asset value

(“NAV”), less applicable fees payable to the Sponsor (as defined below) (such purchase price, the “Purchase Price”),

as of the close of business on February 14, 2024 (such date, as may be extended, the “Valuation Date”). As used in this Offer,

the term “Unit,” or “Units,” as the context requires, shall refer to the common units of fractional undivided

beneficial interest in the Trust and portions thereof representing beneficial interest in the Trust, and “you” shall refer

to investors in the Trust. If the Trust elects to extend the tender period for any reason beyond February 14, 2024, for the purpose of

determining the Purchase Price for tendered Units, the NAV of such Units will be determined at the close of business on the third (3rd)

Business Day (as defined below) after the date on which the tender offer actually expires. The Trust reserves the right to adjust the

date on which the NAV of the Units will be determined to correspond with any extension of the Offer, provided that any such extension

of the Offer and any such corresponding adjustment to the Valuation Date, as applicable, will be announced via press release as promptly

as practicable after such determination has been made and not later than 9:00 a.m., New York City time, on the first (1st)

Business Day after the previously scheduled Expiration Date. This Offer is being made to all investors of the Trust and is not conditioned

on any minimum amount of Units being tendered, but is subject to certain conditions described below. Units are quoted on the OTC Market

Group’s OTCQX® Best Marketplace (“OTCQX”) under the ticker symbol, “OBTC.” They are not traded on any

national exchange.

Investors

should realize that the NAV of the Trust (and therefore the NAV of the Units held by each investor) likely will change between January

10, 2024 (the most recent date as of which NAV is available) and February 14, 2024, when the NAV of the Units tendered to the Trust will

be determined for purposes of calculating the Purchase Price of such Units. Tendering investors should also note that although the tender

offer expires on February 9, 2024, they remain investors in the Trust until February 14, 2024, when the NAV of their Units is calculated.

The Trust’s NAV is calculated on each Business Day and is equal to the aggregate value of the Trust’s assets less its liabilities

(which include accrued but unpaid fees and expenses, both estimated and finally determined), based on the fair market value price for

Bitcoin, reflecting the execution price of Bitcoin on its principal market as determined by Lukka Inc., an independent third party digital

asset data company. The Trust calculates NAV per Unit of the Trust daily, which equals the NAV of the Trust divided by the number of

outstanding Units. The Sponsor calculates the Trust’s NAV per Unit as of 4:00 p.m., New York City time on each day that the New

York Stock Exchange is open for trading (each, a “Business Day”), and publishes the NAV per Unit on the Trust’s

website (www.ospreyfunds.io) shortly thereafter. Any tendering investors that wish to obtain the most current NAV of their Units on this

basis should refer to www.ospreyfunds.io. This website address, however, is not intended to function as a hyperlink, and the information

contained on or accessible through such website is not incorporated by reference in this Offer to Purchase and does not form part of

the Offer.

Investors

desiring to tender their Units in the Trust in accordance with the terms of the Offer should complete and sign the enclosed Letter of

Transmittal (returning the form at the end of the Letter of Transmittal will suffice) and mail or fax it to the Trust’s transfer

agent and the depositary for the Offer, Continental Stock Transfer and Trust Company (“CSTT”), in the manner set forth below.

Investors holding Units in a brokerage account or otherwise through a broker, dealer, commercial bank, trust company or other nominee

must contact their broker, dealer, commercial bank, trust company or other nominee in order to tender their Units. Investors who wish

to tender their Units but cannot comply with the procedures for book-entry transfer by the Expiration Date or other required documents

cannot be delivered by the Expiration Date may be able to still tender their Units if they comply with the guaranteed delivery

procedures described in Section 4.

IMPORTANT

Neither

the Trust, nor Osprey Funds, LLC, a Delaware limited liability company and the sponsor of the Trust (the “Sponsor”), nor

any of the executive officers of the Sponsor, nor Morrow Sodali LLC (the “Information Agent”) nor CSTT makes any recommendation

to any investor as to whether to tender or refrain from tendering Units. Investors must make their own decisions whether to tender Units,

and, if so, the portion of their Units to tender.

Because

each investor’s investment decision is a personal one, based on its financial circumstances, no person has been authorized to make

any recommendation on behalf of the Trust as to whether investors should tender Units pursuant to the Offer. No person has been authorized

to give any information or to make any representations in connection with the Offer other than those contained herein or in the Letter

of Transmittal. If given or made, such recommendation and such information and representations must not be relied on as having been authorized

by the Trust.

This

transaction has not been approved or disapproved by the Securities and Exchange Commission (the “SEC”) nor has the SEC or

any state securities commission passed on the fairness or merits of such transaction or on the accuracy or adequacy of the information

contained in this document, the Letter of Transmittal or any related documents. Any representation to the contrary is unlawful.

Questions

and requests for assistance and requests for additional copies of the Offer may be directed to the Information Agent.

The

Information Agent for the Offer is:

Morrow

Sodali LLC

333

Ludlow Street, 5th Floor, South Tower

Stamford,

CT 06902

Individuals

call toll-free (800) 662-5200

Banks

and brokers call (203) 658-9400

Email:

OBTC.info@investor.morrowsodali.com

TABLE

OF CONTENTS

| 1. |

Background

and Purpose of the Offer |

6 |

| |

|

|

| 2. |

Offer

to Purchase and Price |

6 |

| |

|

|

| 3. |

Amount

of Tender |

7 |

| |

|

|

| 4. |

Procedure

for Tenders |

7 |

| |

|

|

| 5. |

Withdrawal

Rights |

9 |

| |

|

|

| 6. |

Purchases

and Payment |

9 |

| |

|

|

| 7. |

Certain

Conditions of the Offer |

10 |

| |

|

|

| 8. |

Certain

Information About the Trust |

11 |

| |

|

|

| 9. |

Interests

of Executive Officers of the Sponsor |

13 |

| |

|

|

| 10. |

Certain

U.S. Federal Income Tax Consequences |

13 |

| |

|

|

| 11. |

Disclosure

Provisions |

14 |

| |

|

|

| 12. |

Fees

and Expenses |

14 |

| |

|

|

| 13. |

Miscellaneous |

14 |

Summary

Term Sheet

THIS

SUMMARY HIGHLIGHTS CERTAIN INFORMATION IN THIS OFFER TO PURCHASE. TO UNDERSTAND THE OFFER FULLY AND FOR A MORE COMPLETE DESCRIPTION OF

THE TERMS OF THE OFFER, YOU SHOULD CAREFULLY READ THIS ENTIRE OFFER TO PURCHASE AND THE RELATED LETTER OF TRANSMITTAL. WE HAVE INCLUDED

SECTION REFERENCES PARENTHETICALLY TO DIRECT YOU TO A MORE COMPLETE DESCRIPTION IN THE OFFER TO PURCHASE OF THE TOPICS IN THIS SUMMARY.

| |

● |

Who

is offering to purchase my securities? |

| |

|

|

| |

|

The

issuer of the Units, Osprey Bitcoin Trust (the “Trust”), a Delaware statutory trust, is offering to purchase your securities. |

| |

|

|

| |

● |

What

and how many securities is the Trust offering to purchase? (See Section 2, “Offer to

Purchase and Price” and Section 3, “Amount of Tender”) |

| |

|

|

| |

|

We will buy up to 20% or 1,668,107

(the “Offer Amount”) of our outstanding common units of fractional undivided beneficial interest (“Units”).

If the number of Units properly tendered and not properly withdrawn prior to the date and time the Offer expires is less than or

equal to the Offer Amount, we will, upon the terms and subject to the conditions of the Offer, purchase all Units tendered. If more

Units than the Offer Amount are properly tendered and not properly withdrawn prior to the date the Offer expires, we will purchase

the Offer Amount on a pro rata basis, with appropriate adjustment to avoid purchases of fractional Units. You may tender all of your

Units or a portion of your Units, but you cannot be assured that all of your tendered Units will be repurchased. |

| |

|

|

| |

● |

How

much and in what form will the Trust pay me for my Units? (See Section 2, “Offer to Purchase and Price”) |

| |

|

|

| |

|

We

will pay cash for Units purchased pursuant to the Offer at their net asset value, or “NAV” (that is, the value of the

Trust’s assets minus its liabilities, multiplied by the proportionate interest in the Trust you desire to sell), less applicable

fees payable to Osprey Funds, LLC, the sponsor of the Trust (the “Sponsor”) (such purchase price, the “Purchase

Price”). The Purchase Price will be calculated as of the close of business on February 14, 2024 (such date, as it may be extended,

the “Valuation Date”). As of January 10, 2024, the Trust’s NAV was $15.20 per Unit. Of course, the

NAV can change every Business Day. You can obtain current NAV quotations on the Trust’s website (www.ospreyfunds.io). This

website address, however, is not intended to function as a hyperlink, and the information contained on or accessible through such

website is not incorporated by reference in this Offer to Purchase and does not form part of the Offer. |

| |

● |

What

is the purpose of the Offer? (See Section 1, “Background and Purpose of the Offer”) |

| |

|

|

| |

|

The

purpose of the Offer is to provide liquidity to investors who hold Units. The Sponsor has the discretion to determine whether the

Trust will repurchase Units from investors from time to time pursuant to written tenders. Because Units of the Trust have traded

at an average discount to NAV of 25% over the past year, and because of the limited liquidity on the OTCQX, the Sponsor has

determined, after consideration of these and various additional matters, that the Offer is in the best interests of investors of

the Trust to allow for a redemption of up to 20% or 1,668,107 outstanding Units. |

| |

|

|

| |

● |

When

does the Offer expire? (See Section 2, “Offer to Purchase and Price”) |

| |

|

|

| |

|

This

Offer will remain open until the end of the day on February 9, 2024, at 12:00 midnight, New York City time, unless extended or earlier

terminated in accordance with the terms and subject to the conditions of the Offer, subject to applicable law (such date and time,

as they may be extended, the “Expiration Date”). |

| |

● |

Can

the Offer be extended, amended or terminated, and if so, under what circumstances? (See Section 5, “Withdrawal Rights”

and Section 7, “Certain Conditions of the Offer”) |

| |

|

|

| |

|

Please

note that just as you have the right to withdraw your Units, we have the right, subject to the conditions described in Section 7,

to extend, amend or terminate this Offer at any time before the end of the day on the Expiration Date. Also realize that although

the Offer expires on February 9, 2024, tendering investors remain investors in the Trust until February 14, 2024, when the NAV of

their Units is calculated. If we extend the Offer, you may withdraw your Units until the Expiration Date, as extended. |

| |

|

|

| |

|

If

we extend the Expiration Date for the Offer, we will delay the acceptance of any Units that have been tendered. If we extend the

Offer, for the purpose of determining the Purchase Price for tendered Units, the NAV of such Units will be determined at the close

of business on the first (1st) Business Day after the date on which the tender offer actually expires. We can also terminate

the Offer under certain circumstances, as provided in Section 7 of this Offer to Purchase, and subject to applicable law. |

| |

● |

How

will I be notified if you extend the Offer or amend the terms of the Offer? (See Section 7, “Certain Conditions of the

Offer”) |

| |

|

|

| |

|

If

we extend the Offer, we will make a public announcement via press release of such extension and corresponding adjustment to the Valuation

Date as promptly as practicable after such determination has been made and not later than 9:00 a.m., New York City time, on the first

(1st) Business Day after the previously scheduled Expiration Date. We will announce any amendment to the terms of the

Offer by making a public announcement via press release and filing with the SEC a corresponding amendment to our Issuer Tender Offer

Statement on Schedule TO. |

| |

|

|

| |

● |

Will

I have to pay any fees or commissions on Units I tender? (See Section 2, “Offer to Purchase and Price” and Section 6,

“Purchases and Payment”) |

| |

|

|

| |

|

The

Trust will impose a fee of two (2) percent of NAV on repurchases of Units in the Trust, which fee will be payable to the Sponsor

in part to offset expenses incurred administering the Offer, including processing of tender forms, effecting payment, postage and

handling. |

| |

|

|

| |

● |

Does

the Trust have the financial resources to pay me for my Units, and when will I be paid? (See

Section 6, “Purchases and Payment”) |

| |

|

|

| |

|

If

the Trust repurchased the total Offer Amount at their NAV of $15.20 per Unit as of

January 10, 2024, the cost of reimbursing the tendering investors would be approximately

$25,356,076. Repurchases of Units by the Trust will be paid as promptly as practicable

after the applicable Valuation Date and the guaranteed delivery period. |

| |

|

|

| |

|

The

Trust intends to sell Bitcoin to pay for Units tendered. The Trust expects that full payment of the amounts tendered will be made

promptly following the applicable Valuation Date. |

| |

|

|

| |

● |

Are

there any conditions to the Offer? (See Section 7, “Certain Conditions of the

Offer”) |

| |

|

|

| |

|

Yes.

Our obligation to accept for payment and pay for your tendered Units depends upon a number of conditions that must be satisfied in

the Sponsor’s reasonable judgement or waived on or prior to the Expiration Date, including, but not limited to: |

| |

● |

The

Trust will be able to sell Bitcoin in an orderly manner in light of existing market conditions and such liquidation would not have

an adverse effect on the NAV of the Trust to the detriment of non-tendering unitholders; |

| |

● |

No

legal action or proceeding instituted or threatened that challenges the Offer or otherwise would have a material adverse effect on

the Trust; |

| |

● |

No

declaration of a banking moratorium by federal or state authorities or any suspension of payment by banks in the United States or

New York State that is material to the Trust; |

| |

● |

No

limitation imposed by federal or state authorities on the extension of credit by lending institutions; |

| |

● |

No

suspension of trading by any dealer the Trust uses as a counterparty for Bitcoin purchases and sales; |

| |

● |

No

commencement of war, armed hostilities or other international or national calamity directly or indirectly the United States that

is reasonably likely to materially and adversely affect the Trust, the Units or the Trust’s ability to complete the

Offer; |

| |

● |

No

other event or condition that would have a material adverse effect on the Trust or its investors if Units tendered pursuant to the

Offer were purchased; |

| |

● |

Effecting

the transaction would not constitute a breach of the Sponsor’s fiduciary duty owed to the Trust or unitholders; |

| |

● |

The

Sponsor shall not have determined to liquidate the Trust after due consideration of the amount of Units being tendered in the Offer,

the amount of Units that would remain in the Trust if the Offer were completed, the ability of the Sponsor to continue to manage

effectively the Trust’s portfolio, and the projected aggregate expense ratio of the Trust following consummation of the Offer. |

Our

Offer is not conditioned on any minimum amount of Units being tendered and is not subject to a financing condition.

| |

● |

How

do I tender my Units? (See Section 4, “Procedure for Tenders”) |

If

you desire to tender all or part of your Units, you must do one of the following prior to the Expiration Date:

| |

1. |

(a)

if you hold book-entry Units registered in your own name with CSTT, our transfer agent and share registrar (such holder, a “registered

unitholder”), you must complete and sign the Letter of Transmittal in accordance with the instructions to the Letter of Transmittal,

have your signature on the Letter of Transmittal guaranteed if Instruction 1 to the Letter of Transmittal so requires, and mail or

deliver the Letter of Transmittal, together with any other required documents, to CSTT at one of its addresses shown on the Letter

of Transmittal. You should also validly complete Form W-9 or appropriate Form W-8, as applicable included in the Letter of Transmittal

to ensure no backup withholding on any payments made to you pursuant to the Offer; or |

| |

|

|

| |

|

(b)

if you are an institution participating in The Depository Trust Company (“DTC,” and such institution, a “DTC participant”)

and desire to tender Units held in book-entry form through the facilities of DTC, you must tender all such Units you desire to tender

through DTC. You must electronically transmit your acceptance of the Offer through DTC’s Automated Tender Offer Program (“ATOP”),

for which the transaction will be eligible. In accordance with ATOP procedures, DTC will then verify the acceptance of the Offer

and send an agent’s message (as hereinafter defined) to CSTT for its acceptance. An “agent’s message” is

a message transmitted by DTC, received by CSTT and forming part of the book-entry confirmation, which states that DTC has received

an express acknowledgment from you that you have received the Offer and agree to be bound by the terms of the Offer, and that the

Company may enforce such agreement against you. Alternatively, you may also confirm your acceptance of the Offer by delivering to

CSTT a duly executed Letter of Transmittal. |

| |

|

|

| |

|

A

tender will be deemed to have been received only when CSTT receives either (i) as to registered shareholders, a properly completed

Letter of Transmittal and all other documents required by the Letter of Transmittal; or (ii) as to DTC participants, (I) either a

duly completed agent’s message through the facilities of DTC at CSTT’S DTC account or a properly completed Letter of

Transmittal, and (II) confirmation of book-entry transfer of the Units into CSTT’s applicable DTC account; or |

| |

|

|

| |

2. |

if

you have Units registered in the name of a broker, dealer, commercial bank, trust company or other nominee, you must contact the nominee

if you desire to tender those Units and request that your broker, dealer, commercial bank, trust company or other nominee effects the

transaction for you. If a broker, dealer, commercial bank, trust company or other nominee holds your shares, it is likely that they

will have a deadline prior to the Expiration Time for you to act to instruct them to accept the Offer on your behalf. We urge you to

contact your broker, dealer, commercial bank, trust company or other nominee to find out their deadline. |

| |

● |

Until

what time can I withdraw tendered Units, and how can I do so? (See Section 5, “Withdrawal Rights”) |

Our

Offer remains open to you until the end of the day on the Expiration Date. Until this time, you have the right to change your mind and

withdraw your Units from consideration for purchase. In addition, after the Offer expires, you may withdraw your tendered Units if the

Trust has not yet accepted your tendered Units for payment by March 11, 2024.

If

you desire to withdraw tendered Units, you should either:

| |

● |

Give

proper written notice to CSTT; OR |

| |

|

|

| |

● |

If

your Units are held of record in the name of a broker, dealer, commercial bank, trust company or other nominee, contact that firm

or other entity to withdraw your tendered Units. |

| |

● |

Following

the Offer, will the Trust continue as a public company? |

Yes.

The completion of the Offer in accordance with its terms and conditions will not cause the Trust to stop being subject to the periodic

reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We also do not expect the

Offer to cause our common stock to cease to be quoted on the OTCQX. As of January 10, 2024, we had approximately 8,500 holders

of record of Units based on information provided by our transfer agent and by DTC.

| |

● |

Whom

should I contact with questions about the Offer? |

The

Information Agent can help answer your questions. The information agent is Morrow Sodali LLC and the contact information is set out below:

Morrow

Sodali LLC

333

Ludlow Street, 5th Floor, South Tower

Stamford,

CT 06902

Individuals

call toll-free (800) 662-5200

Banks

and brokers call (203) 658-9400

Email:

OBTC.info@investor.morrowsodali.com

THE

OFFER

1. Background

and Purpose of the Offer. The purpose of the Offer is to provide liquidity to investors who hold Units. The Sponsor has the

discretion to determine whether the Trust will repurchase Units from investors from time to time pursuant to written tenders.

Because Units of the Trust have traded at an average discount to NAV of 25% over the past year, and because of the limited

liquidity on the OTCQX, the Sponsor has determined, after consideration of these and various additional matters, that the Offer is

in the best interests of investors of the Trust to allow for a redemption of up to 20% or 1,668,107 outstanding

Units.

The

purchase of Units pursuant to the Offer will have the effect of decreasing the size of the Trust and increasing the proportionate interest

in the Trust of investors, if any, who do not tender Units and who do not otherwise sell their Units. A reduction in the aggregate assets

of the Trust may result in investors who do not tender Units and who do not otherwise sell their Units bearing higher costs to the extent

that certain expenses borne by the Trust are relatively fixed and may not decrease if assets decline. These effects may be reduced or

eliminated to the extent that additional subscriptions for Units are made from time to time; however, the Trust is not currently offering

additional Units to investors, and will not do so during the Offer. The Trust may accept additional subscriptions in the future, if market

conditions are favorable for such subscriptions, and as permitted by applicable law.

The

Offer may be terminated in the event that the Sponsor determines, in its reasonable judgment and regardless of the circumstances giving

rise to the event or events (other than any deliberate action or inaction by the Sponsor or the Trust), to liquidate the Trust after

due consideration of the amount of Units being tendered in the Offer, the amount of Units that would remain in the Trust if the Offer

were completed, and other factors considered by the Sponsor as enumerated in Section 7.

Units

that are tendered to the Trust in connection with this Offer will be retired, although the Trust may issue new Units from time to time

in transactions not involving any public offering conducted pursuant to Rule 506 of Regulation D under the Securities Act of 1933, as

amended (the “Securities Act”). The Trust is not currently offering additional Units to investors, and it will not do so

during the Offer, although the Trust may accept additional subscriptions in the future, if market conditions are favorable for such subscriptions,

and as permitted by applicable law.

2.

Offer to Purchase and Price. The Trust will purchase, upon the terms and subject to the conditions of the Offer, up to

20% or 1,668,107 outstanding Units that are properly tendered by and not properly withdrawn

(in accordance with Section 5 below) before the end of the day on the Expiration Date. The Purchase Price of a Unit tendered will be

its NAV as of the close of business on the Valuation Date or, if the Trust elects to extend the tender period beyond the initial Valuation

Date, the Purchase Price of a Unit tendered will be its NAV as of the close of business on the third (3rd) Business Day after

the date on which the tender offer actually expires, payable as set forth in Section 6, in each case minus a two (2) percent fee payable

to the Sponsor. The Trust reserves the right to adjust the date on which the NAV of Units will be determined to correspond with any extension

of the Offer, provided that any such extension of the Offer and any such corresponding adjustment to the Valuation Date, as applicable,

will be announced via press release as promptly as practicable after such determination has been made and not later than 9:00 a.m., New

York City time, on the first (1st) Business Day after the previously scheduled Expiration Date. The Trust reserves the right

to extend, amend or terminate the Offer as described in Sections 3 and 7 below.

The

aggregate NAV of the Trust, as of January 10, 2024, was $126,780,381. The Trust determines its NAV at least daily

and may determine its NAV more frequently. Investors may obtain the most current information regarding the NAV of their Units by visiting

www.ospreyfunds.io. This website address, however, is not intended to function as a hyperlink, and the information contained on or accessible

through such website is not incorporated by reference in this Offer to Purchase and does not form part of the Offer. Of course, the aggregate

NAV of the Trust (and therefore the NAV of the Units held by each investor) likely will change between January 10, 2024 and the Valuation

Date, when the value of the Units tendered by investors will be determined for purposes of calculating the Purchase Price of such Units

and the time that investors will cease to be investors in the Trust.

As of the close of business

on January 10, 2024, the Trust held approximately $126,922,290 in Bitcoin, cash and other assets.

3. Amount

of Tender. Subject to the limitations set forth below, investors may tender their entire holdings or a portion of their holdings.

The Offer is being made to all investors of the Trust and is not conditioned on any minimum amount of Units being tendered.

If

the amount of the Units that are properly tendered pursuant to the Offer and not properly withdrawn pursuant to Section 5 below is less

than or equal to 20% or 1,668,107 Units (or such greater amount as the Trust may elect

to purchase pursuant to the Offer), the Trust will, on the terms and subject to the conditions of the Offer, purchase all of the Units

so tendered unless the Trust elects to terminate or amend the Offer, or postpone acceptance of tenders made pursuant to the Offer, as

provided in Section 7 below. If more than 20% or 1,668,107 Units are duly tendered to

the Trust before the expiration of the Offer and not properly withdrawn pursuant to Section 5 below, the Trust will accept Units tendered

on or before the Expiration Date for payment on a pro rata basis based on the aggregate NAV of tendered Units. The Offer may be extended,

amended or terminated in various other circumstances described in Section 7 below. The Sponsor does not hold Units, however, an affiliate,

Anax Trading, LLC, holds 2,932,321 Units. Anax Trading, LLC has indicated that it does not intend to participate in the Offer.

4. Procedure

for Tenders.

Valid

Tender. If you desire to tender all or any portion of your Units, you must either:

(1)

(a) if you are a registered unitholder, complete and sign the Letter of Transmittal in accordance with the instructions to the Letter

of Transmittal, have your signature on the Letter of Transmittal guaranteed if Instruction 1 to the Letter of Transmittal so requires,

and mail or deliver the Letter of Transmittal, together with any other required documents, to CSTT, at one of its addresses shown on

the Letter of Transmittal. You should also validly complete Form W-9 or appropriate Form W-8, as applicable included in the Letter of

Transmittal to ensure no backup withholding on any payments made to you pursuant to the Offer, or

(b)

if you are a DTC participant and desire to tender Units held in book-entry form through the facilities of DTC, all of the Units must

be tendered through DTC. You must electronically transmit your acceptance of the Offer through DTC’s ATOP, for which the transaction

will be eligible. In accordance with ATOP procedures, DTC will then verify the acceptance of the Offer and send an agent’s message

to CSTT for its acceptance. An “agent’s message” is a message transmitted by DTC, received by CSTT and forming part

of the book-entry confirmation, which states that DTC has received an express acknowledgment from you that you have received the Offer

and agree to be bound by the terms of the Offer, and that the Company may enforce such agreement against you. Alternatively, you may

also confirm your acceptance of the Offer by delivering to CSTT a duly executed Letter of Transmittal.

A

tender will be deemed to have been received only when CSTT receives either (i) as to registered shareholders, a properly completed Letter

of Transmittal and all other documents required by the Letter of Transmittal; or (ii) as to DTC participants, (a) either a duly

completed agent’s message through the facilities of DTC at CSTT’s DTC account or a properly completed Letter of Transmittal,

and (b) confirmation of book-entry transfer of the Units into CSTT’s applicable DTC account; or

(2)

if you have Units registered in the name of a broker, dealer, commercial bank, trust company or other nominee, meaning your Units are

owned in “street name,” you must contact the nominee if you desire to tender those Units and request that your broker, dealer,

commercial bank, trust company or other nominee effects the transaction for you.

The

valid tender of Units by you via one of the procedures described in this Section 4 will constitute a binding agreement between you and

us on the terms of, and subject to the conditions to, the Offer.

If

a broker, dealer, commercial bank, trust company or other nominee holds your Units, it is likely that it has an earlier deadline for

you to act to instruct it to accept the Offer on your behalf. We urge you to contact your broker, dealer, commercial bank, trust company

or other nominee to determine its applicable deadline.

We

urge investors who hold Units through brokers, dealers, commercial banks, trust companies or other nominees to consult their respective

brokers, dealers, commercial banks, trust companies or other nominees to determine whether transaction costs are applicable if they tender

Units through such brokers, dealers, commercial banks, trust companies or other nominees and not directly to CSTT.

The

Units may be tendered and accepted only in whole Units. No alternative, conditional or contingent tenders will be accepted.

Signature

Guarantees. Except as otherwise provided below, all signatures on a Letter of Transmittal must be guaranteed by a financial institution

(including most banks, savings and loans associations and brokerage houses) that is a participant in any of the following: (i) the Securities

Transfer Agents Medallion Program; (ii) the New York Stock Exchange, Inc. Medallion Signature Program; or (iii) the Stock Exchange Medallion

Program. Signatures on a Letter of Transmittal need not be guaranteed if:

| |

(i) |

the

Letter of Transmittal is signed by a registered holder, or a participant in DTC whose name appears on a security position listing

as the owner of the Units, and such holder or DTC participant has not completed either of the box entitled “Special Delivery

Instructions” or the box entitled “Special Payment Instructions” within the Letter of Transmittal; or |

| |

|

|

| |

(ii) |

the

Units are tendered for the account of a bank, broker, dealer, credit union, savings association or other entity which is a member

in good standing of the Securities Transfer Agents Medallion Program, the New York Stock Exchange, Inc. Medallion Signature Program

or the Stock Exchange Medallion Program, or a bank, broker, dealer, credit union, savings association or other entity which is an

“eligible guarantor institution,” as such term is defined in Rule 17Ad-15 under the Exchange Act. |

The

Company will make payment for Units tendered and accepted for purchase in the Offer only after CSTT timely receives (i) as to DTC participants,

a timely confirmation of the book-entry transfer of the shares into CSTT’s account at DTC, a properly completed and a duly executed

Letter of Transmittal, or an agent’s message, and any other documents required by the Letter of Transmittal, or (ii) as to registered

shareholders, a properly completed Letter of Transmittal and all other documents required by the Letter of Transmittal.

Guaranteed

Delivery Procedure.

If

you wish to tender Units under the Offer and your book-entry Units are not immediately available or the procedures for book-entry transfer

cannot be completed on a timely basis or time will not permit all required documents to reach CSTT prior to the Expiration Time, your

tender may be effected if all the following conditions are met:

| |

(i) |

your

tender is made by or through an eligible institution; |

| |

|

|

| |

(ii) |

a

properly completed and duly executed Notice of Guaranteed Delivery, in the form we have provided, is received by CSTT, as provided

below, prior to the Expiration Time; and |

| |

|

|

| |

(iii) |

CSTT

receives, at the address set forth on the back cover of this Offer to Purchase and within the period of two (2) Business Days

after the date of execution of that Notice of Guaranteed Delivery, a Letter of Transmittal, which has been properly completed and

duly executed and includes either: (i) as to a registered shareholder, a Letter of Transmittal, which has been properly completed

and duly executed and includes all signature guarantees required thereon and all other required documents; or (ii) as to a DTC participant,

a book-entry confirmation evidencing all tendered Units, in proper form for transfer, in each case together with the Letter of Transmittal,

validly completed and duly executed, with any required signature guarantees (or an agent’s message), and any other documents

required by the Letter of Transmittal. |

Notice

of Guaranteed Delivery must be delivered to CSTT by overnight courier, facsimile transmission or mail before the Expiration Time and

must include a guarantee by an eligible institution in the form set forth in the Notice of Guaranteed Delivery.

Book-Entry

Delivery. We have been informed by CSTT that none of our Units are certificated.

As

to registered shareholders, a shareholder should deliver a completed and signed Letter of Transmittal in accordance with the instructions

to the Letter of Transmittal, have the shareholder’s signature on the Letter of Transmittal guaranteed if Instruction 1 to the

Letter of Transmittal so requires, and mail or deliver the Letter of Transmittal, together with any other required documents, to CSTT,

at one of its addresses shown on the Letter of Transmittal. Such shareholder should also validly complete IRS Form W-9 or appropriate

IRS Form W-8, as applicable, included in the Letter of Transmittal to ensure no backup withholding on any payments made to you pursuant

to the Offer.

As

to DTC participants, CSTT will establish an account with respect to the Units for purposes of the Offer at DTC within two (2)

Business Days after the date of this Offer to Purchase, and any financial institution that is a DTC participant may make

book-entry delivery of the Units by causing DTC to transfer Units into CSTT’s account in accordance with DTC’s

procedures for transfer. Although DTC participants may effect delivery of Units into CSTT’s account at DTC, such deposit must

be accompanied by a message that has been transmitted to CSTT through the facilities of DTC or “agent’s message,”

or a properly completed and duly executed Letter of Transmittal, including any other required documents, that has been transmitted

to and received by CSTT at its address set forth on the back page of this Offer to Purchase before the Expiration Time.

Method

of Delivery. The method of delivery of book-entry Units, either through the Letter of Transmittal and all other required documents

for registered shareholders, or through the DTC for DTC participants, is at the election and risk of the tendering shareholder. If you

plan to make delivery of Letter of Transmittal by mail, we recommend that you deliver by registered mail with return receipt requested

and obtain proper insurance. In all cases, sufficient time should be allowed to ensure timely delivery.

5. Withdrawal

Rights. Any investor tendering Units pursuant to this Offer may withdraw its tender (a) at any time on or before the applicable Expiration

Date and (b) at any time after March 11, 2024, if Units have not then been accepted by the Trust. To be effective, any notice of withdrawal

must be timely received by CSTT at the address or fax numbers set forth on the back cover of this Offer to Purchase. Such receipt should

be confirmed by the investor in accordance with the procedures set out in Section 4 above. A form to use to give notice of withdrawal

is available by calling the Information Agent at the phone number indicated on page 2. All questions as to the form and validity (including

time of receipt) of notices of withdrawal will be determined by the Trust, in its sole discretion, and such determination shall be final

and binding absent a finding to the contrary by a court of competent jurisdiction. Units properly withdrawn shall not thereafter be deemed

to be tendered for purposes of the Offer. However, withdrawn Units may again be tendered prior to the Expiration Date by following the

procedures described in Section 4. You are responsible for confirming that any notice of withdrawal is received by CSTT. If you fail

to confirm receipt of a notice of withdrawal by CSTT, there can be no assurance that any withdrawal you may make will be honored by the

Trust.

If

you hold Units through a broker, dealer, commercial bank, trust company or similar institution, you should consult that institution on

the procedures you must comply with and the time by which such procedures must be completed in order for that institution to provide

a written notice of withdrawal.

If

Units have been delivered in accordance with the procedures for book-entry transfer described in Section 4, any notice of withdrawal

must also specify the name and number of the account at the DTC to be credited with the withdrawn shares and otherwise comply with the

DTC’s procedures.

6. Purchases

and Payment. For purposes of the Offer, the Trust will be deemed to have accepted (and, thereby, to have agreed to purchase) Units

that are tendered as, if and when it gives written notice to the tendering investor of its election to purchase such Unit. As stated

in Section 2 above, the Purchase Price of a Unit tendered by any investor will be the NAV thereof as of the close of business on the

Valuation Date. If the Trust elects to extend the tender period for any reason beyond the Valuation Date, for the purpose of determining

the Purchase Price for tendered Units, the NAV of such Units will be determined at the close of business on the third (3rd)

Business Day after the date on which the tender offer actually expires. The Trust reserves the right to adjust the date on which the

NAV of the Units will be determined to correspond with any extension of the Offer, provided that any such extension of the Offer and

any such corresponding adjustment to the Valuation Date, as applicable, will be announced via press release as promptly as practicable

after such determination has been made and not later than 9:00 a.m., New York City time, on the first (1st) Business Day after

the previously scheduled Expiration Date.

Investors

may tender all or some of their Units. In either case, repurchases of Units by the Trust will be paid as promptly as practicable after

the applicable Valuation Date.

Upon

the terms and subject to the conditions of the Offer, the Trust will accept for payment and pay Purchase Price for all of the Units accepted

for payment pursuant to the Offer promptly after the Expiration Time. In all cases, payment for Units tendered and accepted for payment

pursuant to the Offer will be made as promptly as practicable, subject to possible delay in the event of proration, but only after timely

receipt by CSTT of:

| |

● |

as

to a DTC participant, (a) either a duly completed agent’s message through the facilities of DTC at CSTT’s DTC account

or a properly completed Letter of Transmittal, and (b) confirmation of book-entry transfer of the Units into CSTT’s applicable

DTC account; or as to a registered shareholder, a properly completed and duly executed Letter of Transmittal; and |

| |

|

|

| |

● |

any

other required documents by the Letter of Transmittal. |

The

Trust will deposit the amounts payable in separate accounts with CSTT. All cash payments described above (the “Cash Payments”)

will be made by check or wire transfer, either directly to the brokerage firm of record or, if not held at a brokerage firm, directly

to the physical address or the account, as applicable, designated by the tendering investor.

In

the event of proration, we will determine the proration factor and pay for those tendered Units accepted for payment promptly after the

Expiration Time. Units tendered and not purchased, including Units not purchased due to proration, will stay at the registered

shareholder’s book-entry account at our transfer agent, or, in the case of Units tendered by book-entry transfer through the facilities

of DTC, will be credited to the appropriate account maintained by relevant DTC participants at the DTC, in each case without expense

to the shareholder.

The

Trust will seek to obtain cash in the aggregate amount necessary to pay the Purchase Price for Units acquired pursuant to the Offer from

the sale of Bitcoin. There can be no assurances, however, that there will not be delays in the making of any of the Cash Payments provided

for above. This may occur, among other reasons, during periods of financial market stress or if the Trust, after reasonable and diligent

effort, is otherwise unable to dispose of Bitcoin.

The

Trust will impose a fee of two (2) percent of NAV on repurchases of Units in the Trust, which fee will be payable to the Sponsor in part

to offset expenses incurred administering the Offer, including processing of tender forms, effecting payment, postage and handling.

Under

no circumstances will we pay interest on the purchase price, including but not limited to, by reason of any delay in making payment.

In addition, if certain events occur, we may not be obligated to purchase Units pursuant to the Offer. See Section 7.

We

will pay all share transfer taxes, if any, payable on the transfer to us of Units purchased pursuant to the Offer. If, however, payment

of the Purchase Price is to be made to, or (in the circumstances permitted by the Offer) if unpurchased Units are to be registered in

the name of, any person other than the registered unitholder, or if tendered book-entry Units are registered in the name of any person

other than the person signing the Letter of Transmittal, the amount of all share transfer taxes, if any (whether imposed on the registered

holder or the other person), payable on account of the transfer to the person will be deducted from the Purchase Price unless satisfactory

evidence of the payment of the share transfer taxes, or exemption from payment of the share transfer taxes, is submitted. See Instruction

6 of the Letter of Transmittal.

7. Certain

Conditions of the Offer. The Trust reserves the right, at any time and from time to time, to extend the period of time during which

the Offer is pending by promptly notifying investors of such extension. If the Trust elects to extend the tender period for any reason

beyond the Valuation Date, for the purpose of determining the Purchase Price for tendered Units, the NAV of such Units will be determined

at the close of business on the third (3rd) Business Day after the date on which the tender offer actually expires. The Trust

reserves the right to adjust the date on which the NAV of the Units will be determined to correspond with any extension of the Offer,

provided that any such extension of the Offer and any such corresponding adjustment to the Valuation Date, as applicable, will be announced

via press release as promptly as practicable after such determination has been made and not later than 9:00 a.m., New York City time,

on the first (1st) Business Day after the previously scheduled Expiration Date. During any such extension, all Units previously

tendered and not properly withdrawn will remain subject to the Offer. The Trust also reserves the right, in its reasonable discretion,

at any time and from time to time up to and including acceptance of tenders pursuant to the Offer: (a) to terminate the Offer in the

circumstances set forth in the following paragraph and in the event of such termination, not to purchase or pay for any Units tendered

pursuant to the Offer; (b) to amend the Offer; or (c) to postpone the acceptance of Units. If the Trust decides to amend the Offer or

to postpone the acceptance of Units tendered, it will, to the extent necessary, extend the period of time during which the Offer is open

as provided above, and in the event that the Trust decides to terminate, amend or postpone the Offer for any reason, it will promptly

notify investors.

The

Trust may terminate the Offer, amend the Offer or postpone the acceptance of tenders made pursuant to the Offer, in each case with prompt

notice to investors, if in the Sponsor’s reasonable judgment and regardless of the circumstances giving rise to the event or events

(other than any deliberate action or inaction by the Sponsor or the Trust), any of the following have occurred: (a) the Trust would not

be able to sell Bitcoin in an orderly manner in light of the existing market conditions and such liquidation would have an adverse effect

on the NAV of the Trust to the detriment of the non-tendering unitholders; (b) there is any (i) legal action or proceeding instituted

or threatened challenging the Offer or that otherwise would have a material adverse effect on the Trust, (ii) declaration of a banking

moratorium by federal or state authorities or any suspension of payment by banks in the United States or New York State that is material

to the Trust, (iii) limitation imposed by federal or state authorities on the extension of credit by lending institutions, (iv) suspension

of trading by any dealer the Trust uses as a counterparty for Bitcoin purchases and sales, (v) commencement of war, armed hostilities

or other international or national calamity directly or indirectly involving the United States that is reasonably likely to materially

and adversely affect the Trust, the Units or the Trust’s ability to complete the Offer, or (vi) other event or condition that would

have a material adverse effect on the Trust or its investors if Units tendered pursuant to the Offer were purchased; (c) the Sponsor

determines in good faith that effecting any such transaction would constitute a breach of its fiduciary duty owned to the Trust or unitholders;

or (d) the Sponsor determines to liquidate the Trust after due consideration of the amount of Units being tendered in the Offer, the

amount of Units that would remain in the Trust if the Offer were completed, the ability of the Sponsor to continue to manage effectively

the Trust’s portfolio, and the projected aggregate expense ratio of the Trust following consummation of the Offer. However, there

can be no assurance that the Trust will exercise its right to extend, amend or terminate the Offer or to postpone acceptance of tenders

pursuant to the Offer. If conditions qualifying as war or armed hostilities as expressed in Section 7(b)(v) above occur (and, at present,

the Trust does not believe these conditions exist), and the Sponsor waives the Trust’s rights under this Section 7, they will determine

whether such waiver constitutes a material change to the Offer. If they determine that it does, the Offer will remain open for at least

five (5) Business Days following the waiver and investors will be notified of this occurrence.

8. Certain

Information About the Trust. The Trust is organized as a Delaware statutory trust, formed on January 3, 2019, which commenced operations

on January 22, 2019. In general, the Trust holds Bitcoin and, from time to time, issues Units in exchange for Bitcoin. The investment

objective of the Trust is for the Units to track the price of Bitcoin, less liabilities and expenses of the Trust. The Units are designed

as a convenient and cost-effective method for investors to gain investment exposure to Bitcoin, similar to a direct investment in Bitcoin.

The Sponsor is responsible for the day-to-day administration of the Trust pursuant to provisions of the Second Amended and Restated Declaration

of Trust and Trust Agreement dated November 1, 2020, as amended by the Amendment to the Trust Agreement dated April 15, 2022. Coinbase Custody Trust Company, LLC is the digital asset custodian of the Trust and is responsible for safeguarding the Bitcoin

held by the Trust.

The

principal executive office of the Trust and the Sponsor is located at 1241 Post Road, 2nd Floor, Fairfield, Connecticut 06824

and the telephone number is (914) 214-4697. The officers of the Sponsor are: Gregory D. King and Robert Rokose. Their address is c/o

Osprey Funds, LLC, 1241 Post Road, Street, 2nd Floor, Fairfield, Connecticut 06824.

None

of the Sponsor, its officers or affiliates intend to participate in the Offer.

The

Trust is subject to the informational filing requirements of the Exchange Act, which obligates it to file reports, statements and other

information with the SEC relating to our business, financial condition and other matters. As required by Exchange Act Rule 13e-4(c)(2),

the Trust has also filed with the SEC the Schedule TO, which includes additional information relating to the Offer. These reports, statements

and other information, including the Schedule TO, all of the exhibits to it, and documents incorporated by reference, are available to

the public on or accessible through the SEC’s site at https://www.sec.gov. This website address is not intended to function as

a hyperlink, and the information contained on or accessible through the SEC’s website is not incorporated by reference in this

Offer to Purchase and it should not be considered to be a part of this Offer to Purchase.

Units

are distributed by the Sponsor through sales in private placement transactions exempt from the registration requirements of the Securities

Act pursuant to Rule 506(c) thereunder; there are no current offerings of Units at this time.

The

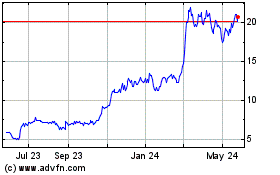

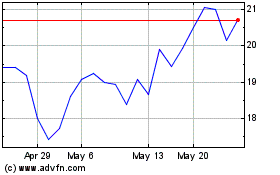

Trust’s Units have been quoted on OTC Markets since February 12, 2021, and on OTCQX since February 26, 2021, under the symbol “OBTC”.

The price of the Units as quoted on OTCQX (and OTC Markets) has varied significantly from the NAV per Unit. From February 12, 2021 to

December 31, 2023, the maximum premium of the closing price of the Units quoted on OTCQX (and OTC Markets) over the value of the Trust’s

NAV per Unit was approximately 240% and the average daily discount since the Units were first traded on OTC Markets on February 12, 2021

was approximately 14%. As of December 31, 2023, the Trust’s Units were quoted on OTCQX at a discount of approximately 10% to the

Trust’s NAV per Unit.

The

following table sets out the range of high and low closing prices for the Units as reported by OTCQX for each quarter during the past

two years:

| | |

High | | |

Low | |

| Three months ended December 31, 2021 | |

$ | 19.09 | | |

$ | 12.62 | |

| Three months ended March 31, 2022 | |

$ | 12.89 | | |

$ | 9.40 | |

| Three months ended June 30, 2022 | |

$ | 12.30 | | |

$ | 5.05 | |

| Three months ended September 30, 2022 | |

$ | 6.65 | | |

$ | 4.85 | |

| Three months ended December 31, 2022 | |

$ | 5.04 | | |

$ | 3.00 | |

| Three months ended March 31, 2023 | |

$ | 6.43 | | |

$ | 3.30 | |

| Three months ended June 30, 2023 | |

$ | 7.02 | | |

$ | 4.98 | |

| Three months ended September 30, 2023 | |

$ | 7.79 | | |

$ | 6.27 | |

| Three months ended December 31, 2023 | |

$ | 12.90 | | |

$ | 6.95 | |

The

Trust does not have any plans or proposals that relate to or would result in: (a) the acquisition by any person of additional Units (although

the Trust retains the right, which it does not currently intend to act on, to accept subscriptions for Units from time to time in the

discretion of the Trust consistent with applicable law); (b) an extraordinary transaction, such as a merger, reorganization or liquidation,

involving the Trust; (c) any material change in the present distribution policy or indebtedness or capitalization of the Trust; (d) any

change in the identity of the Sponsor of the Trust, or in the management of the Trust Sponsor; (e) a sale or transfer of a material amount

of assets of the Trust (other than as the Sponsor determine may be necessary or appropriate to fund any portion of the Purchase Price

for Units acquired pursuant to this Offer to Purchase or in connection with the ordinary portfolio transactions of the Trust); (f) any

other material change in the Trust’s structure or business, including any plans or proposals to make any changes in its fundamental

investment policy; or (g) any changes in Trust Agreement or other actions that may impede the acquisition of control of the Trust by

any person.

Rule

13e-4(f) under the Exchange Act prohibits the Trust and its affiliates from purchasing any Units, other than in the Offer, until at least

ten (10) Business Days have elapsed after the Expiration Date. Accordingly, any additional purchases outside the Offer may not

be consummated until at least ten (10) Business Days have elapsed under the Expiration Date. Beginning on the eleventh (11th)

Business Day after the Expiration Date, the Trust, at the discretion of its Sponsor, may purchase Units from time to time, including

in private transactions with affiliates, and it may consider future limited periodic redemptions of Units in compliance with applicable

law. Any of these repurchases may be on the same terms or on terms that are more or less favorable to the selling unitholders in those

transactions than the terms of the Offer. The Sponsor currently contemplates, but has not definitively determined, to cause the Trust

on or after the eleventh (11th) Business Day after the Expiration Date to negotiate an agreement or agreement(s) to

repurchase Units held by its affiliates under similar terms as the Offer. The Sponsor believes that a single, or series of, private transactions

to repurchase Units held by affiliates would be in the best interest of the Trust to mitigate against the possibility that the Offer

will be oversubscribed and subject to proration.

During

the past sixty (60) days, there were no transactions involving Units that were effected by the Trust, the Sponsor, or any person controlling,

or under common control with, the Trust or the Sponsor.

9. Interests

of Executive Officers of the Sponsor.

As

of January 10, 2024, there were 8,340,536 Units issued and outstanding. The maximum number of Units we are accepting in the Offer,

1,668,107, represents approximately 20% of our issued and outstanding Units as of January 10, 2024.

The

Trust does not have any directors, officers or employees. Under the Trust Agreement, all management functions of the Trust have been

delegated to and are conducted by the Sponsor, its agents and its affiliates. As officers of the Sponsor, Gregory D. King, Chief Executive

Officer of the Sponsor, and Robert Rokose, Chief Financial Officer of the Sponsor, serve as the principal executive officer and principal

financial officer, respectively, of the Trust. The following table sets forth information relating to the beneficial ownership of our

Units by Messrs. King and Rokose, as determined in accordance with Rule 13d-3 of the Exchange Act, as of January 10, 2024,

based on a total number of Units outstanding as of such date.

Unless

otherwise indicated, the business address of each of the persons named in the table below is: c/o Osprey Funds, LLC, 1241 Post Road,

2nd Floor, Fairfield, CT 06824.

| Name and Address of Beneficial Owner | |

Amount and Nature

of Beneficial

Ownership | | |

Percentage of

Beneficial

Ownership | |

| | |

| | |

| |

| Executive

Officers of the Sponsor: (1) | |

| | | |

| | |

| Robert Rokose | |

| 2,056 | | |

| * | % |

| Gregory King | |

| 2,936,434 | (2) | |

| 35 | % |

| Executive officers of the Sponsor as a group | |

| 2,938,490 | | |

| 35 | % |

(1)

The Trust does not have any directors, officers or employees. Under the Trust Agreement, all management functions of the Trust

have been delegated to and are conducted by the Sponsor, its agents and its affiliates.

(2)

2,932,321 Units in this column are held by an affiliate of the Sponsor, Anax Trading, LLC, and may be deemed to be beneficially

owned by Mr. King.

| * |

Represents

beneficial ownership of less than 1%. |

10.

Certain U.S. Federal Income Tax Consequences. The following discussion is a general summary of the material U.S. federal income tax

consequences of the purchase of Units by the Trust pursuant to the Offer. This summary does not address all the tax consequences that

are specific to investors in light of such investor’s particular circumstances, including tax consequences to investors that are

not U.S. persons for U.S. federal income tax purposes (including non-U.S. persons who are partnerships or hold Units in a partnership),

which consequences may be significant (including additional tax, or withholding or reporting obligations), or tax consequences to investors

subject to special rules, such as entities or arrangements classified as partnerships for U.S. federal income tax purposes. Each investor

should consult its own tax advisors about the tax consequences to it of a purchase of its Units by the Trust pursuant to the Offer given

such investor’s individual circumstances, as well as any tax consequences arising under the laws of any state, local or foreign

taxing jurisdiction. This discussion applies only to Units that are held as capital assets and does not address alternative minimum tax

consequences or consequences of the tax on net investment income. This discussion assumes the Trust only holds Bitcoin.

Subject

to certain exceptions, some of which are described below, an investor who tenders all of its Units (and whose Units are entirely repurchased)

to the Trust for repurchase generally will recognize capital gain or loss to the extent of the difference between the proceeds received

by such investor and such investor’s adjusted tax basis in its Units. Gain, if any, will be recognized by a tendering investor