Clariant Q2 2023 sales and FY 2023 outlook weaker, Catalysts improvement on track

07 July 2023 - 3:00PM

Clariant Q2 2023 sales and FY 2023 outlook weaker, Catalysts

improvement on track

AD HOC ANNOUNCEMENT PURSUANT TO ART. 53 LR

MUTTENZ, July 7,

2023

Clariant, a sustainability-focused specialty

chemical company, today provided a trading update based on a

preliminary assessment of its Q2 2023 results and adjusted its

expectations for FY 2023.

The ongoing macro-economic challenges, the slow

pace of recovery in China, and the prolonged destocking cycle

continues to impact demand in key end markets in the Care Chemicals

and the Additives businesses. The strength of the Swiss Franc is

creating significant translation impacts in Q2 2023 and

FY 2023. However, the improvement of the Catalysts business is

on track (excluding sunliquid®). The strong order book in Catalysts

is being executed and pricing measures are having positive impacts

on the top-line and profitability.

Q2 2023 preliminary sales at

CHF 1 084 million (compared to

CHF 1 301 million in Q2 2022 and

CHF 1 200 million in Q1 2023) resulting from

improved Catalysts sales which partly compensate very weak demand

in Care Chemicals and Additives as well as an approximate

CHF – 30 million net top-line impact from

divestments/acquisition and around 10 % negative FX

translation effects.

Q2 2023 reported EBITDA is expected between

CHF 155 – 165 million (14.4 % –

15.4 % reported EBITDA margin) compared to

CHF 216 million (16.6 %) in Q2 2022, which

included CHF 23 million gain from the Scientific Design

divestment, and CHF 167 million (13.9 %) in Q1 2023.

The Q2 2023 reported EBITDA will include a

CHF 55 million gain from the Quats divestment closed on 1

June 2023 (recognized in Care Chemicals),

~ CHF 20 million restructuring charges, and between

negative CHF 5 – 10 million other exceptional items.

sunliquid® update: In Q2 2023, a slightly

improved operational EBITDA impact of

CHF – 11 million is expected. Clariant has continued

its efforts to address the mechanical, bio-chemical, and

operational challenges involved in the ramp-up of this

first-of-a-kind technology. In addition, Clariant initiated

structural measures to further focus its bio-technology activities

on second generation bioethanol and adjust the cost structure to

lower run-rates which resulted in a restructuring charge of

CHF 8 million in Q2 2023. Clariant is actively

evaluating strategic options for sunliquid® and will provide an

update by end of 2023.

In order to address the short-term demand

challenges, particularly in the Care Chemicals and Additives

businesses, Clariant has initiated further cost reduction measures

in addition to the previously announced activities related to the

implementation of the new operating model. This will result in a

total expected restructuring charge of

~ CHF 30 million for FY 2023 (compared to

CHF 15 – 25 million previously announced).

Based on the preliminary assessment of

Q2 2023 results and given limited indications for a recovery

in the second half, except in the Catalysts business, FY 2023

sales are expected between

CHF 4.55 – 4.65 billion (previously guided:

around CHF 5 billion). This includes a net

divestments/acquisition impact of CHF – 150 million

relating to the Quats, NORAM Land Oil, and Attapulgite transactions

as well as an expected approximately 5 – 10 %

negative FX translation impact.

Given the ongoing Catalysts profitability

improvement and muted recovery in Care Chemicals and Additives, FY

2023 reported EBITDA is expected between

CHF 650 – 700 million (14.3 % – 15.1 %

reported EBITDA margin; previously guided: slight improvement vs.

15.6 % reported in 2022) including a CHF 55 million

gain from the Quats divestment and the

~ CHF 30 million restructuring charges outlined

above.

“The uncertainties and risks related to the

economic environment, including the pace of a recovery in China,

which we had indicated at the start of this year have unfortunately

materialized and are weighing on the industry as a whole. This

development impacts demand in both industrial and consumer end

markets. Although the top-line stabilized during the second quarter

and prices were largely maintained, our preliminary Q2 2023

top-line and estimated profitability is below current market

consensus.

Excluding sunliquid®, for FY 2023, we assume the

Catalysts business will deliver the expected continued improvement,

partly compensating for weaker trading in the other business units.

By accelerating our Group restructuring efforts, we are addressing

short-term demand dynamics while remaining well positioned to

benefit from a market recovery once the near-term challenges are

behind us,” said Conrad Keijzer, Chief Executive Officer

of Clariant.

Clariant will report its Q2/HY 2023 results on

Friday, 28 July 2023.

|

CORPORATE MEDIA RELATIONS Jochen DubielPhone +41 61 469 63

63jochen.dubiel@clariant.com Anne SchäferPhone +41 61 469 63

63anne.schaefer@clariant.com Ellese CaruanaPhone +41 61 469 63

63ellese.caruana@clariant.com Follow us on

Twitter, Facebook, LinkedIn, Instagram. |

INVESTOR RELATIONS Andreas Schwarzwälder Phone +41 61 469

63 73andreas.schwarzwaelder@clariant.com Maria IvekPhone +41

61 469 63 73maria.ivek@clariant.com Thijs BouwensPhone +41 61

469 63 73thijs.bouwens@clariant.com |

|

This media release contains certain statements that are

neither reported financial results nor other historical

information. This document also includes forward-looking

statements. Because these forward-looking statements are subject to

risks and uncertainties, actual future results may differ

materially from those expressed in or implied by the statements.

Many of these risks and uncertainties relate to factors that are

beyond Clariant’s ability to control or estimate precisely, such as

future market conditions, currency fluctuations, the behavior of

other market participants, the actions of governmental regulators

and other risk factors such as: the timing and strength of new

product offerings; pricing strategies of competitors; the Company’s

ability to continue to receive adequate products from its vendors

on acceptable terms, or at all, and to continue to obtain

sufficient financing to meet its liquidity needs; and changes in

the political, social and regulatory framework in which the Company

operates or in economic or technological trends or conditions,

including currency fluctuations, inflation and consumer confidence,

on a global, regional or national basis. Readers are cautioned not

to place undue reliance on these forward-looking statements, which

speak only as of the date of this document. Clariant does not

undertake any obligation to publicly release any revisions to these

forward-looking statements to reflect events or circumstances after

the date of these materials. www.clariant.com Clariant is

a focused specialty chemical company led by the overarching purpose

of ‘Greater chemistry – between people and planet’. By connecting

customer focus, innovation, and people the company creates

solutions to foster sustainability in different industries. On 31

December 2022, Clariant totaled a staff number of 11 148 and

recorded sales of CHF 5.198 billion in the fiscal year

for its continuing businesses. As of January 2023, the Group

conducts its business through the three newly formed Business Units

Care Chemicals, Catalysts, and Adsorbents & Additives. Clariant

is based in Switzerland. |

- CLARIANT MEDIA RELEASE TRADING UPDATE EN_20230707

- CLARIANT MEDIA RELEASE TRADING UPDATE DE_20230707

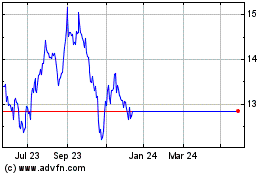

Clariant (LSE:0QJS)

Historical Stock Chart

From Feb 2025 to Mar 2025

Clariant (LSE:0QJS)

Historical Stock Chart

From Mar 2024 to Mar 2025