TIDMKIBO

RNS Number : 8433A

Kibo Energy PLC

14 September 2018

Kibo Energy PLC (Incorporated in Ireland)

(Registration Number: 451931)

(External registration number: 2011/007371/10) Share code on the

JSE Limited: KBO

Share code on the AIM: KIBO ISIN: IE00B97C0C31

("Kibo" or "the Group" or "the Company")

Unaudited Interim results for the six months ended 30 June

2018

Dated 14 September 2018

Kibo Energy PLC ("Kibo" or the "Company"), the multi-asset,

Africa focused, energy company, is pleased to announce its

unaudited half year results for the period ended 30 June 2018.

Highlights

-- Considerable progress being made on transforming Kibo into a

focused diversified energy development company in Africa

-- Expansion of the Company's energy project footprint outside

of Tanzania with the acquisition of the Mabesekwa Coal Independent

Power Project ("MCIPP") in Botswana, and joint venture on the Benga

Independent Power Project ("BIPP") in Mozambique

-- Kibo remains confident in the commitment and support of the

Tanzanian Government for the Mbeya Coal to Power Project

("MCPP")

-- Strengthened international partnership team with Strategic

Development Agreement signed with SEPCOIII - represents a major

endorsement of Kibo's ability to source, develop and construct

major energy projects globally

-- Placings to raise GBP2.25 million and shares issued for

settlement of outstanding balance on the Sanderson forward payment

facility provided stable funding for the on-going work on existing

projects and costs associated with the new acquisitions during the

first half of 2018

-- Name change to Kibo Energy PLC to more accurately reflect the

Company's new focus on energy development

-- Administrative expense down 46.5% year on year and loss per share down 58% year on year

Chairman's Statement

This has been a very active period for the Company, during which

we have expanded our portfolio, signed additional strategic

agreements with international blue chips and solidified our

position in the African energy market. I am therefore pleased to

present our half-year accounts for the period ending 30 June 2018

and provide a summary of these developments, which I believe

underline the strength of our offering and its potential.

There is a significant and expanding opportunity in the African

energy sector due to the acute shortage of power. We aim to

participate in the solution and now have the Mbeya Coal to Power

Project ("MCPP") in Tanzania, the Mabesekwa Coal Independent Power

Project ("MCIPP") in Botswana and the Benga Independent Power

Project ("BIPP") in Mozambique. Additionally, with the inclusion of

our recent Memorandum of Understanding ("MOU") with Mast Energy

Developments in the UK, we have further expanded our offering and

successfully transformed Kibo from a multi-commodity exploration

company to a diversified energy development company in Africa with

a broad-based platform from which to build value.

Operations

As you are aware, we have been engaged in continual discussion

with the Tanzanian Government on the Power Purchase Agreement

("PPA") for the MCPP, following the signing of a MOU on the PPA in

mid-February. Agreement on a follow-up definitive PPA, based on the

terms of the MOU, is currently at an advanced stage of negotiation

and, while taking longer to conclude than anticipated, the Company

remains confident in the commitment and support of the Tanzanian

Government for the MCPP, notwithstanding its complex nature and

scale and the additional requirements needed from Kibo necessitated

by the recent changes to the Tanzanian mining legislation. This

situation is clear from both our private discussions with Tanzanian

Government officials and their public announcements. The country's

commitment to private sector input to national development projects

includes those that address the country's growing energy deficit.

Indeed, President Magufuli's recent pronouncements at the Tanzanian

National Business Council meeting in March is an example of this

commitment and further underpins our confidence in the process.

On a wider level, during the period, your Company continued to

deepen and expand its relationship with Chinese based international

EPC contractor SEPCOIII, already a key partner in the development

of the MCPP, following Kibo awarding it the EPC contract to build

the MCPP power plant in November 2016. Both parties agreed that PPA

discussions with the Tanzanian Government had advanced sufficiently

to warrant signing of the second part of the contract. This was

signed in May thereby awarding SEPCOIII the EPC contract for the

construction of the power line that will evacuate power from the

proposed Mbeya Power Plant to the nearest sub-station in Mbeya.

This is contingent on a successful Financial Close.

In early July, Kibo further cemented its relationship with

SEPCOIII by signing a Strategic Development Agreement ("SDA") which

commits SEPCOIII to a direct equity investment in Kibo and an

option to make a second equity investment within 18 months of the

first. The investment amounts constitute 10% to 15% of Kibo's share

capital for the first investment and 5% to 10% for the second, with

the precise amounts and share subscription price to be negotiated

between the parties at the respective investment dates (refer to

our RNS of the 3rd July for full details). In consideration for

these equity investments, Kibo has granted SEPCOIII the right to

become the sole bidder for all EPC contracts pertaining to its

existing and future energy development projects anywhere in the

world, subject to its bids meeting strict EPC-specifications

developed by Kibo and its engineers. I believe this SDA with a

proven international energy developer represents a major

endorsement of our ability to source, develop and construct major

energy projects globally and will significantly empower the

Company's ability to bring projects to Financial Close.

In April, the Company completed the acquisition of an 85%

interest in the MCIPP in Botswana in an all share transaction which

we first announced in November 2017. This marked the first step in

the diversification of our asset portfolio outside of Tanzania and

in realizing our new strategy of becoming a diversified energy

developer with a primary focus on sub-Saharan Africa. I believe

that the MCIPP is a particularly well considered acquisition

because of its similarity with MCPP in terms of size, projected

development path, a demand-led electricity market and government

support. Additionally, there is considerable scope for Kibo to

leverage its existing expertise and partner networks from the MCPP.

Work by Kibo on MCIPP commenced immediately post acquisition and on

21 June 2018 we published a SAMREC-compliant maiden Coal Resource

Statement[1] of approximately 303 million tonnes on a 100% basis

(approximately 258Mt on an 85% attributable basis) of thermal coal

underpinning the MCIPP of which Kibo holds an 85% interest.

Pleasingly, the results of further technical studies on the coal

are showing that improved coal yields and lower sulphur contents

can be achieved by industry standard beneficiation processes prior

to burning. I also welcome our project partner, Shumba Energy

("Shumba"), which has completed significant feasibility work on the

project and which will shortly be nominating a new director to our

board in line with the terms of the MCIPP acquisition. Shumba bring

a long history of operating in Botswana and have a strong

institutional investor base and now, as a significant Kibo

shareholder, will substantially benefit from Kibo's on-going

development of the MCIPP.

Further expanding on our African energy project footprint, we

announced our second major acquisition outside of Tanzania in June

with the signing of a joint venture agreement ("JV") with

Mozambican company Termoeléctrica de Benga S.A ("Termoeléctrica").

Under the terms of the JV, Kibo and Termoeléctrical will hold

participating interests in the BIPP in the proportions of 65% and

35% respectively. The BIPP shares many similarities with the MCPP

and the MCIPP and comprises an advanced proposal for the

development of a 150 MW to 300 MW thermal power plant in Mozambique

close to current thermal coal producers. Termoeléctrica already has

various authorisations and agreements in place pertaining to the

development of a thermal power plant. This includes, inter alia,

permission from the Mozambique Government to proceed with a final

Definitive Feasibility Study ("DFS"), an MOU with the state

electricity distribution company, in-principle confirmation of

water availability from the local water authority, and, lease title

over land for project construction. Letters of comfort from

potential coal suppliers and power off-takers are also in place for

the project. Kibo's initial funding commitment is a maximum GBP1

million to fund the DFS and so maintain its 65% interest in the JV;

thereafter both parties to the JV will fund development on a

pro-rata basis save for Kibo's right to increase its JV interest to

85% within a year of producing a positive DFS at a price to be

agreed between the parties. I am pleased to note that we have

already embarked on a DFS path for this project building on the

pre-feasibility work carried out to date by Termoeléctrica and we

look forward to providing shareholders with updates on progress as

we proceed.

Further to the acquisition and joint ventures discussed above,

we also announced the sale of our Haneti Nickel Project ("Haneti")

to Katoro Gold Limited in June in an all share transaction. Kibo

will receive 15,384,615 new Katoro shares at a price of 1.3p per

Katoro share (which values Haneti at GBP200,000) upon successful

completion of the transaction. Additionally, Kibo will retain a 2%

Net Smelter Royalty from any concentrates produced from the Haneti

mineral licenses. This divestment will free up Company resources to

focus on its expanding energy project portfolio while retaining a

significant on-going interest in the future development of Haneti

through its major shareholding in Katoro. This will ensure Kibo

shareholders benefit from the Company's investment in the project

to date and from any future upside following on-going exploration

by Katoro.

Corporate

In addition to the corporate activity associated with the new

acquisitions discussed above, the Company complemented two placings

during the first half of 2018 to fund its on-going operations

across its growing energy portfolio. These were undertaken in March

(see RNS dated 27 February 2018) and April (see RNS dated 10 April

2018) for GBP750,000 and GBP1,500,000 respectively (total of

GBP2.25 million). The placing subscription prices were 4.25p (March

placing) and 5.25p (April Placing) and a total of 46,218,488 new

Kibo shares were issued to subscribers. The March placing

overlapped with our broker at the time, Beaufort Securities Limited

("Beaufort") being put into insolvency which necessitated the

appointment of a new broker, SVS Securities Limited ("SVS")

pursuant to AIM rule 35 to replace Beaufort. Fortunately, SVS were

able to complete the placing for the full amount. The April placing

was completed jointly by both SVS and Novum Securities Limited

("Novum"). Coinciding with this placing, Novum were appointed joint

brokers. The proceeds of these placings have provided stable

funding for the on-going work on existing projects and costs

associated with the new acquisitions during the first half of 2018.

Also, in April, we announced changes in responsibilities among our

board members and reconstituted our executive management team to

align better with the current strategy of the Company and the skill

sets required to take it to the next stage of development. In this

regard, I would like to welcome Pieter Krugel to the executive

management team who was appointed as Kibo's Chief Financial

Officer. Mr. Krugel, a qualified Chartered Accountant, brings a

broad range of financial management experience to Kibo and I wish

him well in his new role.

During May, the Company issued 8,370,716 shares in partial

settlement on the balance of funds drawn down under the forward

payment facility agreed with Sanderson Capital Partners

("Sanderson") in December 2016. These shares were issued at a price

of 5p per share and in lieu of a repayment amount of USD 568,712.

On the 9th July, after reporting period end, the Company issued an

additional 21,239,375 shares to Sanderson as full and final

settlement under the forward payment facility. These shares were

issued at a price of 5.25p per share in lieu of a repayment amount

of GBP1,115,067. I am happy to note that these payments have now

settled all outstanding payments from Kibo to Sanderson under the

forward payment facility and the pending $3.7 million due to Kibo

from SEPCOIII at Financial Close of the MCPP will now be wholly

received by Kibo unencumbered.

Kibo also participated in a placing by Katoro in June for an

amount of GBP75,000. The subscription price was 1.3p and Kibo

received 5,769,231 shares bringing its current percentage

shareholding in Katoro to 50.43%.

Recent Developments

Post period end, the Company has gained significant momentum in

its transformation to become a diversified energy developer and at

the AGM, shareholders approved to change the name from Kibo Mining

PLC to Kibo Energy PLC to reflect its sole focus on energy

projects. The appointment of Crowe UK LLP ("Crowe") as the

Company's auditors was also confirmed, and the board believes that

Crowe is well placed to serve our needs within the energy

development sector and with future business plans. I would like to

thank our previous auditors Saffery Champness for its contribution

to Kibo's development over the last few years.

I would also like to take this opportunity to remind

shareholders of recent developments on the MCPP in relation to the

Special Mining Licence Application ("SMLA") and Water Permits. The

relevant Tanzanian authorities have recently indicated a readiness

to consider the SMLA following receipt of some final documentation

necessitated by the recent changes to the Tanzanian mining

legislation (now submitted) and have also provisionally approved

water permits relevant to the water requirements of the MCPP. This

engagement with the Company on its SMLA and Water Permits reflects

our advanced stage of PPA negotiations with the Government and I

believe shows its commitment to ensure all critical path ancillary

documentation and permits are in place in preparation for the

finalization of the PPA.

Our recent announcement of a Memorandum of Understanding with UK

Mast Energy Developments ("MED") to acquire a 60% interest in the

Company, and its subsequent potential to generate revenue streams

for Kibo in the short term at relatively modest cost to the

Company, is a welcome development and I believe further underpins

our commitment to seek out attractive projects in the energy

sector. We look forward to reporting on further progress on this

exciting project which, while initially based in the UK, has

exciting upside potential for the transfer of the technology and

the Reserve Energy market model to the emerging energy markets in

Africa. This model has the potential to complement and provide a

further value generation component to our existing flagship energy

projects.

I conclude by thanking our CEO, Louis Coetzee, and his executive

management team for their persistent and dedicated commitment in

stewarding Kibo along a path to becoming a major African focused

energy development company and power producer with an additional

European presence. I believe we are well on the way to realizing

this vision.

________________________

Christian Schaffalitzky

Chairman

This announcement contains inside information as stipulated

under the Market Abuse Regulations (EU) no. 596/2014 ("MAR").

For further information please visit www.kibomining.com or

contact:

Louis Coetzee info@kibo.energy Kibo Energy PLC Chief Executive Officer

Andreas Lianos +27 (0) 83 4408365 River Group Corporate and Designated

Adviser on JSE

---------------------- -------------------------- ----------------------------

Ben Tadd / +44 (0) 20 3700 SVS Securities Limited Joint Broker

Tom Curran 0093

---------------------- -------------------------- ----------------------------

Jon Belliss +44 (0) 20 7399 Novum Securities Joint Broker

9400 Ltd

---------------------- -------------------------- ----------------------------

Andrew Thomson +61 8 9480 2500 RFC Ambrian Limited NOMAD on AIM

---------------------- -------------------------- ----------------------------

Priit Piip +44 (0) 20 7236 St Brides Partners Investor and Media

1177 Ltd Relations Adviser

---------------------- -------------------------- ----------------------------

Unaudited Interim Results for the six months ended 30 June

2018

Unaudited condensed consolidated interim Statement of

Comprehensive Income

For the six months ended 30 June 2018

6 months to 6 months to 12 months to

30 June 30 June 31 December

Note 2018 2017 2017

(Unaudited) (Unaudited) (Audited)

GBP GBP GBP

Revenue - 1,001 -

Administrative expenses (924,829) (1,730,200) (1,871,697)

Exploration Expenditure (402,609) (634,141) (1,741,018)

Capital raising fees - - (908,543)

Operating Loss (1,327,438) (2,363,340) (4,521,258)

Other Income 578 - 1,445

------------ ------------ -------------

Loss before Tax (1,326,860) (2,363,340) (4,519,813)

Tax - - -

------------ ------------ -------------

Loss for the period (1,326,860) (2,363,340) (4,519,813)

Other comprehensive

income:

Exchange differences

on translating of

foreign operations,

net of taxes (247,108) 50,148 16,985

Total Comprehensive

Loss for the Period (1,573,968) (2,313,192) (4,502,828)

------------ ------------ -------------

Loss for the period

attributable to (1,326,860) (2,363,340) (4,519,813)

------------ ------------ -------------

Owners of the parent (1,250,934) (1,900,505) (3,712,707)

Non-controlling interest (75,926) (462,835) (807,106)

------------ ------------ -------------

Total comprehensive

loss attributable

to (1,573,968) (2,313,192) (4,502,828)

------------ ------------ -------------

Owners of the parent (1,578,376) (1,850,357) (3,689,196)

Non-controlling interest 4,408 (462,835) (813,632)

------------ ------------ -------------

Basic loss per share 5 (0.0025) (0.0052) (0.010)

Diluted loss per share 5 (0.0025) (0.0052) (0.010)

Unaudited condensed consolidated interim Statement of Financial

Position

As at 30 June 2018

Note 30 June 30 June 30 December

2018 2017 2017

(Unaudited) (Unaudited) (Audited)

GBP GBP GBP

Assets

Non-current assets

Property, plant and equipment 7,847 11,085 7,650

Intangible assets 8 26,972,417 17,596,105 17,596,105

Total non-current assets 26,980,264 17,607,190 17,603,755

------------- ------------- ----------------

Current assets

Trade and other receivables 78,631 117,453 59,046

Cash and cash equivalents 1,679,453 1,946,688 766,586

------------- ------------- ----------------

Total current assets 1,758,084 2,064,141 825,632

------------- ------------- ----------------

Total assets 28,738,348 19,671,331 18,429,387

------------- ------------- ----------------

Equity

Called up share capital 6 16,756,351 13,607,630 14,015,670

Share premium 6 37,719,010 27,327,791 28,469,750

Common control reserve 2,097,442 2,156,726 2,097,442

Translation reserve (595,948) (235,343) (268,506)

Share based payment reserve 556,086 514,279 556,086

Retained deficit (27,785,587) (24,722,536) (26,534,653)

------------- ------------- ----------------

Attributable to equity holders

of the parent 28,747,354 18,648,547 18,335,789

------------- ------------- ----------------

Non-controlling interest (1,378,980) (1,032,591) (1,383,388)

Total Equity 27,368,374 17,615,956 16,952,401

Liabilities

Current liabilities

Trade and other payables 470,646 343,312 266,218

Borrowings 9 899,328 1,712,063 1,210,768

Total current liabilities 1,369,974 2,055,375 1,476,986

------------- ------------- ----------------

Total equity and liabilities 28,738,348 19,671,331 18,429,387

------------- ------------- ----------------

Unaudited Condensed Consolidated Statement of Changes in

Equity

Share Share Share Control Foreign Retained Non-controlling Total

Capital Premium based Reserve currency deficit interest

payment translation

reserve reserve

GBP GBP GBP GBP GBP GBP GBP

Balance at 31 December 2017

(audited) 14,015,670 28,469,750 556,086 2,097,442 (268,506) (26,534,653) (1,383,388) 16,952,401

Loss for the year - - - - - (1,250,934) (75,926) (1,326,860)

Other comprehensive income-

exchange differences on

translating of foreign

operations - - - - (327,442) - 80,334 (247,108)

Proceeds of share issue of

share capital 2,740,681 9,249,260 - - - - - 11,989,941

------------ ----------- -------- ---------- ------------ ------------- ---------------- ------------

Balance as at 30 June 2018 16,756,351 37,719,010 556,086 2,097,442 (595,948) (27,785,587) (1,378,980) 27,368,374

(unaudited)

------------ ----------- -------- ---------- ------------ ------------- ---------------- ------------

Balance at 1 January 2017

(audited) 13,603,965 27,318,262 514,279 - (285,491) (23,625,367) (1,435) 17,524,213

Loss for the year - - - - - (1,900,505) (462,835) (2,363,340)

Other comprehensive income-

exchange differences on

translating of foreign

operations - - - - 50,148 - - 50,148

Adjustment arising from

acquisition of subsidiary - - 41,808 2,114,918 - 803,336 (568,321) 2,391,741

Proceeds of share issue of

share capital 3,665 9,529 - - - - - 13,194

------------ ----------- -------- ---------- ------------ ------------- ---------------- ------------

Balance at 30 June 2017

(unaudited) 13,607,630 27,327,791 514,279 2,156,726 (235,343) (24,722,536) (1,032,591) 17,615,956

------------ ----------- -------- ---------- ------------ ------------- ---------------- ------------

Balance at 1 January 2017

(audited) 13,603,965 27,318,262 514,279 - (285,491) (23,625,367) (1,435) 17,524,213

Loss for the year - - - (3,712,707) (807,106) (4,519,813)

Other comprehensive income

- exchange differences - - - - 319,102 - (6,526) 312,576

Adjustment arising from

acquisition of subsidiary - - - 2,097,442 (302,117) 803,421 (568,321) 2,030,425

Share options issued during

the current period - - 41,807 - - - - 41,807

Proceeds of share issue of

share capital 411,705 1,151,488 - - - - - 1,563,193

------------ ----------- -------- ---------- ------------ ------------- ---------------- ------------

Balance at 31 December 2017

(audited) 14,015,670 28,469,750 556,086 2,097,442 (268,506) (26,534,653) (1,383,388) 16,952,401

------------ ----------- -------- ---------- ------------ ------------- ---------------- ------------

Unaudited condensed consolidated interim statement of cash

flow

For the six months ended 30 June 2018

6 months 6 months 12 months

to to to

30 June 30 June 31 December

2018 2017 2017

(Unaudited) (Unaudited) (Audited)

GBP GBP GBP

Loss for the period before taxation (1,326,860) (2,363,340) (4,519,813)

Adjusted for:

Foreign exchange gain/(loss) (129,425) 48,236 249,437

Depreciation on property, plant

and equipment - 2,420 2,738

Provisions - (115,663) (115,663)

Shares based remuneration to directors - - 260,000

Deemed cost of listing - - 206,680

Deal cost settled in shares - - 155,539

Liabilities settled in shares - 357,002 -

Operating income before working

capital changes (1,456,285) (2,071,345) (3,761,082)

Increase in trade and other receivables (19,585) (66,820) (8,413)

Increase in trade and other payables 204,428 196,961 119,838

Net cash outflows from operating

activities (1,271,442) (1,941,204) (3,649,657)

Cash flows from investing activities

Purchase of property, plant and

equipment - - (1,175)

Net cash flow from acquisition of

subsidiaries - 2,045,418 465,408

Net cash used in investing activities - 2,045,418 464,233

Cash flows from financing activities

Repayment of borrowings (199,709) - -

Proceeds from borrowings 251,565 1,460,135 1,751,326

Proceeds from issue of share capital* 2,132,453 - 1,818,345

Net cash proceeds from financing

activities 2,184,309 1,460,135 3,569,671

Net increase in cash and cash equivalents 912,867 1,564,349 384,247

Cash and cash equivalents at beginning

of period 766,586 382,339 382,339

------------ ------------ --------------

Cash and cash equivalents at end

of period 1,679,453 1,946,688 766,586

------------ ------------ --------------

*During the period, the Group had concluded significant non-cash

transactions related to the acquisition of a 85% interest in the

Mabesekwa Independent Coal to Power Project (MICPP) in the amount

of GBP9.3mil as well as a partial settlement of the Sanderson

Capital Partners Limited forward payment facility in the amount of

EUR0.4mil. Note 6 provides further information on these

transactions, and the impact thereof on the capital in issue.

Notes to the unaudited condensed consolidated interim financial

statements

For the six months ended 30 June 2018

1. General information

Kibo Energy plc ("formerly Kibo Mining plc") is a public limited

company incorporated in Ireland. Kibo Mining plc announced its

change of name to Kibo Energy plc effective from 3 August 2018

onward. The condensed consolidated interim financial results

consolidate those of the Company and its subsidiaries (together

referred to as the "Group"). The Company's shares are listed on the

AIM of the London Stock Exchange and the Alternative Exchange of

the JSE Limited (AltX). The principal activities of the Company and

its subsidiaries are related to the exploration for and development

of coal and other minerals in Tanzania.

2. Statement of Compliance and Basis of Preparation

The condensed consolidated interim financial results are for the

six months ended 30 June 2018, and have been prepared using the

same accounting policies as those applied by the Group in its

December 2017 consolidated annual financial statements, which are

in accordance with the framework concepts and the recognition and

measurement criteria of the International Financial Reporting

Standards and Financial Reporting Pronouncements as issued by the

Financial Reporting Standards Council issued by the International

Accounting Standards Board ("IASB") as adopted for use in the EU

("IFRS"), including the SAICA Financial Reporting Guides as issued

by the Accounting Practices Committee, IAS 34 - Interim Financial

Reporting, the Listings Requirements of the JSE Limited, the AIM

rules of the London Stock Exchange and the Irish Companies Act

2015.

These condensed consolidated interim financial statements do not

include all the notes presented in a complete set of consolidated

annual financial statements, as only selected explanatory notes are

included to explain key events and transactions that are

significant to obtaining an understanding of the changes throughout

the financial period, accordingly the report must be read in

conjunction with the annual report for the year ended 31 December

2017.

The comparative amounts in the consolidated financial results

include extracts from the consolidated annual financial statements

for the period ended 31 December 2017.

These extracts do not constitute statutory accounts in

accordance with the Irish Companies Acts 2015. All monetary

information is presented in the presentation currency of the

Company being Pound Sterling. The Group's principal accounting

policies and assumptions have been applied consistently over the

current and prior comparative financial period.

3. Use of estimates and judgements

Preparing the condensed consolidated interim financial

statements requires management to make judgements, estimates and

assumptions that affect the application of accounting policies and

the reported amounts of assets and liabilities, income and

expenses. Actual results may differ from these estimates.

In preparing these condensed consolidated interim financial

statements, significant judgements made by management in applying

the Group's accounting policies and the key sources of estimation

uncertainty were the same as those applied to the consolidated

financial statements as at and for the year ended 31 December

2017.

Exploration and evaluation expenditure

The Group's accounting policy for exploration and evaluation

expenditure results in the capitalisation of certain intangible

mineral resources which are identified through business

combinations or equivalent acquisitions. This policy requires

management to make certain estimates and assumptions as to future

events and circumstances, in particular whether an economically

viable extraction operation can be established based on the

separately identified mineral resources. Any such estimates and

assumptions may change as new information becomes available. If,

after having capitalised the intangible mineral resources under the

policy, a judgement is made that recovery of the intangible asset

is unlikely, the relevant capitalised amount will be written off to

the income statement.

4. Adoption of new and revised standards

From 1 January 2018 the following standards, amendments and

interpretations were adopted by the group:

- IFRS 9: Financial instruments

- IFRS 15: Revenue from contracts with Customers

The adoption of the above has not had a significant impact on

the group's result for the period under review or for any

comparative period presented.

5. Loss per share

Basic, dilutive and headline loss per share

The basic and weighted average number of ordinary shares used in

the calculation of basic earnings per share is as follows:

6 months to 6 months 12 months

to to

30 June 30 June 31 December

2018 2017 2017

GBP GBP GBP

Loss for the year attributable

to equity holders of the parent (1,250,934) (1,900,505) (3,712,707)

Weighted average number of

ordinary shares for the purposes

of basic and dilutive loss

per share 496,954,459 364,254,364 372,255,127

Basic loss per share (0.0025) (0.0052) (0.010)

6 months 6 months 12 months

to to to

Reconciliation of Headline loss per share 30 June 30 June 31 December

2018 2017 2017

GBP GBP GBP

Loss for the year attributable to equity

holders of the parent (1,250,934) (1,900,505) (3,712,707)

Deemed cost of listing - - 206,680

Headline loss per share (1,250,934) (1,900,505) (3,506,027)

------------ ------------ ------------

Weighted average number of ordinary shares

for the purposes of headline loss per

share (revised) 496,954,459 364,254,364 372,255,127

Headline loss per share (0.0025) (0.0052) (0.010)

Headline earnings per share (HEPS) is calculated using the

weighted average number of ordinary shares in issue during the

period and is based on the earnings attributable to ordinary

shareholders, after excluding those items as required by Circular

4/2018 issued by the South African Institute of Chartered

Accountants (SAICA).

6. Called up share capital and share premium

Authorised ordinary share capital of the company is

1,000,000,000 ordinary shares of EUR0.015 each and 3,000,000,000

deferred shares of EUR0.009 each.

Detail of issued capital is as follows:

Number of

Ordinary Share Deferred Share

Share

shares Capital Capital Premium

GBP GBP GBP

Balance at 31 December

2016 363,976,596 4,346,890 9,257,075 27,318,262

Shares issued in period

(net of expensed for cash) 31,277,768 411,705 - 1,151,488

Balance at 31 December

2017 395,254,364 4,758,595 9,257,075 28,469,750

------------ ---------- ---------- -----------

Shares issued in period

(net of expensed for cash) 208,299,234 2,740,681 - 9,249,260

------------ ---------- ---------- -----------

Balance at 30 June 2018 603,553,598 7,499,276 9,257,075 37,719,010

------------ ---------- ---------- -----------

The company issued the following ordinary shares during the

period, with regard to key transactions:

- 17,647,060 ordinary shares were issued on 27 February 2018 at

4.25p per share. The GBP750,000 raised was utilised to advance the

company's strategy to create a strategic regional electricity

supplier;

- 153,710,030 new ordinary shares in the company were issued on

3 April 2018 at GBP0.061 per share. The shares were issued under

the agreement with Sechaba Natural Resources Limited whereby the

company acquired an 85% interest in the Mabesekwa Independent Coal

to Power Project, located in Botswana;

- 28,571,428 ordinary shares were issued on 10 April 2018 at

5.25p per share. The GBP1,500,000 received went towards general

working capital and expediting ongoing advanced feasibility studies

at the Mabesekwa Independent Coal to Power Project as well as

strengthening the company's financial position ahead of the

commencement of further work at the Mbeya Coal to Power Project;

and

- 8,370,716 ordinary shares were issued on 1 May 2018 at 5p per

share as a partial settlement on the balance of funds drawn down

under the forward payment facility between the company and

Sanderson Capital Partners Limited.

7. Segment analysis

IFRS 8 requires an entity to report financial and descriptive

information about its reportable segments, which are operating

segments or aggregations of operating segments that meet specific

criteria. Operating segments are components of an entity about

which separate financial information is available that is evaluated

regularly by the chief operating decision maker. The Chief

Executive Officer is the Chief Operating decision maker of the

Group.

Management currently identifies two divisions as operating

segments - mining and corporate. These operating segments are

monitored and strategic decisions are made based upon them together

with other non-financial data collated from exploration activities.

Principal activities for these operating segments are as

follows:

30 June 2018 Mining and 30 June 2018

Exploration Corporate (GBP)

Group Group Group

Revenue - - -

Administrative cost - (924,829) (924,829)

Exploration expenditure (402,609) - (402,609)

Investment and other income 578 - 578

Loss after tax (402,031) (924,829) (1,326,860)

------------- ---------- -------------

30 June 2017 Mining and 30 June 2017

Exploration Corporate (GBP)

Group Group Group

Revenue 1,001 - 1,001

Administrative cost - (1,730,200) (1,730,200)

Exploration expenditure (634,141) - (634,141)

Investment and other income - - -

Loss after tax - - -

(633,140) (1,730,200) (2,363,340)

------------- ------------ -------------

30 June 2018 30 June 2018

Mining Corporate (GBP)

Group Group Group

----------- ---------- -------------

Assets

Segment assets 19,206,661 9,531,687 28,738,348

Liabilities

Segment liabilities 391,334 978,640 1,369,974

Other Significant items

Depreciation - - -

31 December 2017 31 December

Mining Corporate 2017 (GBP)

Group Group Group

----------- ---------- ------------

Assets

Segment assets 18,423,284 6,103 18,429,387

Liabilities

Segment liabilities 264,562 1,297,504 1,562,066

Other Significant items

Depreciation 2,738 - 2,738

8. Intangible assets

6 months 6 months 12 months

to to to

Composition of Intangible assets 30 June 30 June 31 December

2018 2017 2017

GBP GBP GBP

Mbeya Coal to Power Project 15,896,105 15,896,105 15,896,105

Lake Victoria 1,700,000 1,700,000 1,700,000

Mabesekwa Coal Independent Power Project 9,376,312 - -

26,972,417 17,596,105 17,596,105

----------- ----------- ------------

Intangible assets are not amortised, due to the indefinite

useful life which is attached to the underlying prospecting rights,

until such time that active mining operations commence, which will

result in the intangible asset being amortised over the useful life

of the relevant mining licences.

Intangible assets with an indefinite useful life are assessed

for impairment on an annual basis, against the prospective fair

value of the intangible asset. The valuation of intangible assets

with an indefinite useful life is reassessed on an annual basis

through valuation techniques applicable to the nature of the

intangible assets.

Refer to note 11 for more information on the Mabesekwa Coal

Independent Power Project.

9. Borrowings

6 months 6 months 12 months

to to to

Amounts falling due within one year 30 June 30 June 31 December

2018 2017 2017

GBP GBP GBP

Short term borrowings 899,328 1,712,063 1,210,768

899,328 1,712,063 1,210,768

--------- ---------- ------------

The borrowings relate to the unsecured interest free loan

facility from Sanderson Capital Partners Limited which was

repayable either through the issue of cash or ordinary shares in

the Company.

Refer also to note 6 for detail on the shares issued during the

period as partial settlement of the facility.

10. Financial instruments

6 months 6 months 12 months

to to to

30 June 30 June 31 December

2018 2017 2017

GBP GBP GBP

Financial assets - carrying amount

Loans and receivable held at amortised

cost

Trade and other receivables 78,631 117,453 59,046

Cash and cash equivalents 1,679,453 1,946,688 766,586

---------- ---------- ------------

1,758,084 2,064,141 825,632

---------- ---------- ------------

Financial liabilities - carrying amount

Financial liabilities held at amortised

cost

Trade and other payables 470,646 343,312 266,218

Borrowings 899,328 1,712,063 1,210,768

---------- ---------- ------------

1,369,974 2,055,375 1,476,986

---------- ---------- ------------

The Board of Directors considers that the fair values of

financial assets and liabilities approximate their carrying values

at each reporting date.

11. Corporate transactions

Kibo Nickel Disposal

The Group has entered into an agreement to dispose 100% of Kibo

Nickel Limited ("Kibo Nickel"), a wholly owned subsidiary of Kibo

(Cyprus) Limited, to Katoro Gold Limited ("Katoro"), also a

subsidiary of the company. Consideration for the sale will be

settled by the issue of 15,384,615 new ordinary shares in Katoro at

a price of 1.3p per share (valued at GBP200,000) ("Consideration

shares"). The consideration shares will be issued to Kibo upon

transaction completion and will rank pari passu with the existing

ordinary shares. Kibo will also retain a 2% NSR royalty in respect

of the nickel or mineral concentrates produced and sold from any of

Kibo Nickel's property.

As at interim reporting period end, the suspensive conditions

had not been fulfilled, and control was not lost, thus the

transaction had not become effective. As at the date of this

report, the main suspensive condition, being the successful

completion of a due diligence, is well advanced and, pending the

outcome, it is expected that the transaction will be completed

shortly.

Shumba Acquisition

On 3 April 2018, the Group completed the acquisition of an 85%

interest in the Mabesekwa Coal Independent Power Project, located

in Botswana. This acquisition is in line with the Group's strategy

of positioning itself as a strategic regional electricity supplier

in Southern Africa and creates many synergies with the MCPP in

Tanzania.

As a result of the acquisition, 153,710,030 ordinary shares in

Kibo were issued to Sechaba Natural Resources Limited ("Sechaba").

Sechaba retained a 15% interest in the Mabesekwa Coal Independent

Power Project and gained a seat on Kibo's board of directors.

Benga Power Joint Venture

The Company concluded the Joint Venture Agreement (the 'Benga

Power Joint Venture' or 'JV') with Mozambique energy company

Termoeléctrica de Benga S.A. ('Termoeléctrica') to participate in

the further assessment and potential development of the Benga

Independent Power Project ('BIPP'), including the right to

construct and operate a 150-300MW coal fired power station. Kibo

and Termoeléctrica shall hold initial Participation Interests in

the unincorporated joint venture of 65% and 35% respectively. In

order to maintain this 65% interest, Kibo must fund a maximum of

GBP1 million towards the completion of a Definitive Feasibility

Study for the BIPP. As at 30 June 2018, operations of the Joint

Venture had not yet commenced, and as such expenditure incurred to

this date is insignificant.

12. Unaudited results

These condensed consolidated interim financial results have not

been audited or reviewed by the Group's auditors.

13. Dividends

No dividends were declared during the interim period.

14. Board of Directors

Mr. Tinus Maree, previously non-executive director, joined the

executive committee ("EXCO") of Kibo. Mr. Maree has a robust and

complete understanding of the Company and Kibo will continue to

benefit from Mr. Maree's extensive experience as a corporate lawyer

as he will continue to provide internal legal advice and review in

his new position. Mr. Noel O'Keefe and Mr. Andreas Lianos

transitioned to a non-executive role with the Company. Mr. O'Keefe

shall continue to provide the Company with invaluable technical

advice and oversight and Mr. Lianos will be instrumental in the

Company's financial oversight as non-executive Financial Director

(see RNS dated 10 April 2018).

15. Subsequent events

Share placements

Subsequent to the interim reporting date, the company has raised

the following share placement:

-- GBP500,000 in the placement of 9,523,810 ordinary Kibo shares

at 5.25p per share (see RNS dated 30 July 2018).

Strategic Development Agreement with SEPCOIII

The company has signed a Strategic Development Agreement (SDA)

with China based SEPCOIII, one of the world's largest power EPC

contractors, to work with Kibo towards enhancing its strategy and

the development of its portfolio of energy projects. As part of the

SDA, SEPCOIII has committed to a two-stage equity investment into

Kibo, endorsing the company's strategy and its position in the

African power market (see RNS dated 3 July 2018).

Full settlement of the Sanderson Capital Partners Limited

Facility

On 9 July 2018, Kibo and Sanderson Capital Partners Limited

settled the outstanding balance of GBP 1,115,067.17 on the forward

payment facility agreed on 20 December 2016. Sanderson will be

issued 21,239,375 new ordinary Kibo shares of par value GBP0.015

each, at a price of 5.25p per Kibo share, a 13% premium to the

closing price of 4.65p on Friday 6 July 2018 (see RNS dated 9 July

2018).

Acquisition of 60% Interest in UK Project Development

Company

A Memorandum of Understanding ("MOU") for the acquisition of a

60% equity interest in Mast Energy Developments ("MED"), a private

UK registered company targeting the development and operation of

flexible power plants to service the Reserve Power generation

market. Under the terms of the MOU, the company can acquire a 60%

shareholding in MED for a consideration of GBP300,000 payable to

existing MED shareholders in new Kibo shares and a share of future

project revenue royalties, which will be reinvested in the company

in the short term to an amount of GBP2.2 million (see RNS dated 15

August 2018).

16. Going concern

The condensed consolidated interim financial results are

prepared in accordance with the going concern principle under the

historical cost basis as modified by the fair value accounting of

certain assets and liabilities where required or permitted by IFRS

in the EU.

17. Commitments and contingencies

There are no material commitments, contingent assets or

contingent liabilities as at 30 June 2018.

14 September 2018

By order of the board:

Christian Schaffalitzky Chairman (Non-Executive)

Louis Coetzee Chief Executive Officer (Executive)

Noel O'Keeffe Technical Director (Executive)

Andreas Lianos Chief Financial Officer (Executive)

Lukas Maree Non-Executive Director

Wenzel Kerremans Non-Executive Director

Company Secretary: Noel O'Keeffe

Auditors: Crowe U.K. LLP

Brokers: SVS Securities Limited

20 Ropemaker Street

London EC2Y 9AR

United Kingdom

Novum Securities Limited

London SW1W ODH

UK Nominated Adviser: RFC Ambrian Limited

Level 28, QV1 Building

250 St Georges Terrace

Perth WA 6000

JSE Designated Adviser: River Group

211 Kloof Street

Waterkloof

Pretoria, South Africa

Johannesburg

14 September 2018

Corporate and Designated Adviser

River Group

[1] Reference should be made to the Company's RNS announcement

of the 21(st) June 2018 for details of Kibo's Mabesekwa Coal

Resource, a Competent Person's Statement and the Company's

attributable interest. The Company confirms that there has been no

update to Kibo's Mabesekwa Coal Resource Statement since 21 June

2018.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR BGGDCCXBBGIS

(END) Dow Jones Newswires

September 14, 2018 07:00 ET (11:00 GMT)

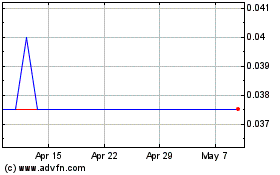

Kibo Energy (LSE:KIBO)

Historical Stock Chart

From Aug 2024 to Sep 2024

Kibo Energy (LSE:KIBO)

Historical Stock Chart

From Sep 2023 to Sep 2024