China remains an economic behemoth that dominates the broad

emerging market discussion. For good reason too, as the nation is

currently the 2nd largest economy in the world and is

expected to pass the U.S. in terms of total GDP within a

decade.

Still, many are starting to grow quite concerned over the

short-term health of the Chinese market. Debt concerns are building

over local municipalities while the inability of China to focus

more on consumption leaves the nation dangerously dependent on

exports, many of which go to countries—especially those in the

EU—which are at or already in a recession.

If that wasn’t enough, a general slowdown is already starting to

afflict the China market as well, leaving the country even more

dependent on stimulus to jumpstart growth prospects. However, it

remains to be seen how the new Chinese leadership will handle this

crisis and how they can boost growth without increasing inflation

to intolerable levels (read Forget FXI: Try These China ETFs

Instead).

Given these trends, some investors are beginning to reconsider

their investment in China, at least in the short-term. Fortunately

with the rise of Exchange-Traded Funds, exposure to various

emerging markets beyond the People’s Republic is quite easy.

ETFs now exist that represent a variety of small markets that

investors were once unable to tap into. This is great news for

those seeking emerging market holdings that go beyond China as

several of these markets are still going strong and could be poised

for solid returns in the months ahead as well.

In light of this, we have highlighted three of the top ETFs that

are tracking emerging markets from around the world. Not only have

all three of these ETFs been solid performers, but they all receive

a Zacks ETF Rank of 2 or better, suggesting that, according to our

analysis, they are poised to outperform their peers in the short to

medium time frame.

Thailand- THD

The entire Southeast Asian market has done quite well so far in

2012, although Thailand has certainly led the way. The country has

rebounded from severe floods and riots to be a king in terms of

market returns with the country expected to grow at a robust 7.5%

rate in 2013.

In order to target this market, ETF investors should look to the

solid performer of the MSCI Thailand Investable Market Index Fund

(THD) for exposure. The ETF holds 85 stocks in its basket and

charges investors 59 basis points a year in fees (read Is the

Thailand ETF Unstoppable?).

The ETF is concentrated on financials (38%), but energy (19.9%),

and materials (11%), also receive double-digit weightings as well.

While the yield isn’t too impressive at 1.9% in 30 Day SEC terms,

the performance has been solid as the product has risen by over 22%

in the past 52 week period.

Currently, THD receives a Zacks ETF Rank of 1 or ‘Strong

Buy’.

Chile- ECH

For investors seeking South American exposure, a closer look at

the Chilean market could be a great idea. The nation is heavily

focused on commodities which have been doing well as of late, while

despite the slowdown in some markets, growth rates have been

holding up quite well, suggesting that the Chilean economy is more

immune to global shocks than some might think.

For investors who want this market in their portfolio,

the MSCI Chile Investable Market Index Fund (ECH)

is a great choice. The product holds just 40 securities in its

basket and charges investors 59 basis points a year in fees (Andean

ETFs: A Better Way To Play Emerging Markets?).

In terms of sector exposure, assets are well spread out as

utilities and industrials both make up slightly more than 20% while

financials and materials also account for over 15% each as well.

ECH has been much more volatile and its yield comes in at just

1.7%, but it could be presenting a solid value to investors looking

for a Latin American play at this time.

Currently, ECH receives a Zacks ETF Rank of 2 or ‘Buy’.

South Korea- EWY

While some may not consider South Korea to be an emerging market

any more, many do, suggesting that the country is a lower risk

choice in the broader developing market world. Unlike many markets

in the region, inflation is quite low while rates are still

reasonable, meaning that the central bank still has plenty of tools

at its disposal to help keep growth rates at a solid level.

Access to this market can easily be achieved by iShares’ ultra

popular MSCI South Korea Index Fund (EWY). This

product has close to $3 billion in AUM, holds just over 100 stocks,

and like the other two ETFs on this list, charges 59 basis points

in fees per year (read South Korea ETF Investing 101).

Top sectors for this fund include a nearly 32% allocation to

technology and then an 18% weight to consumer discretionary, while

industrials, financials, and materials all have a double digit

weighting as well. Yield is rather low on this fund, but it does

offer up an exposure profile that is quite different from others in

the country-specific ETF world and it has performed in line with

the S&P 500 over the past 52 weeks, although it has

outperformed in the most recent quarter.

Currently, EWY receives a Zacks ETF Rank of 1 or ‘Buy’.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

Follow @Eric Dutram on Twitter

ISHARS-MSCI CHL (ECH): ETF Research Reports

ISHARS-S KOREA (EWY): ETF Research Reports

ISHARS-FT CH25 (FXI): ETF Research Reports

ISHRS-MSCI THAI (THD): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

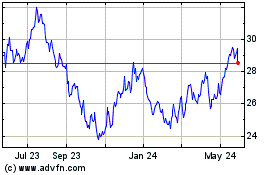

iShares MSCI Chile ETF (AMEX:ECH)

Historical Stock Chart

From Dec 2024 to Jan 2025

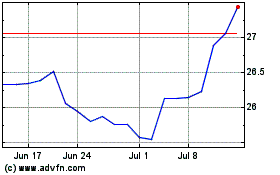

iShares MSCI Chile ETF (AMEX:ECH)

Historical Stock Chart

From Jan 2024 to Jan 2025