Genworth Financial Plans IPO of Australian Unit

08 April 2014 - 1:50PM

Dow Jones News

MELBOURNE, Australia--Genworth Financial Inc. (GNW) said it

plans to sell as much as 40% of its Australian insurance business

through an initial public offering in the first half of the

year.

The move represents Genworth's latest attempt at securing an

Australian listing for the unit, which rivals QBE Insurance Group

(QBE.AU) as the dominant mortgage insurance provider by market

share. Genworth put plans to raise as much as US$850 million

through an IPO of its Australian business on hold two years ago,

after forecasting the unit would make a quarterly loss.

In a U.S. regulatory filing, the Virginia-based company said

Genworth Australia wouldn't keep any proceeds from the IPO, which

is subject to market conditions. Funds raised would instead be used

to repay debts between Genworth and its other units.

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

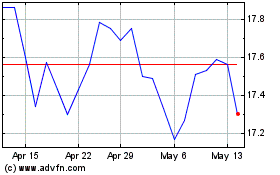

QBE Insurance (ASX:QBE)

Historical Stock Chart

From Oct 2024 to Nov 2024

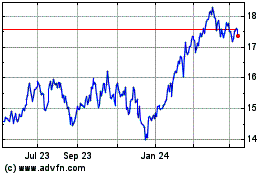

QBE Insurance (ASX:QBE)

Historical Stock Chart

From Nov 2023 to Nov 2024

Real-Time news about QBE Insurance Group Limited (Australian Stock Exchange): 0 recent articles

More QBE Insurance News Articles