Wesfarmers Plans to Spin Off Coles Grocery Unit -- Update

16 March 2018 - 4:28PM

Dow Jones News

By Mike Cherney

SYDNEY-Australian conglomerate Wesfarmers Ltd. on Friday laid

out plans for the biggest spinoff in Australian corporate history:

a listing of its Coles supermarket chain with a potential value of

as much as US$15 billion.

Wesfarmers shares rose more than 6% after the announcement,

suggesting investors agreed it is a good time for the company to

reduce its grocery exposure after acquiring Coles in 2007.

Australia's supermarket sector, long dominated by Coles and chief

rival Woolworths Group Ltd., has attracted foreign competition from

German discount brand Aldi and others recently, and there is

speculation Amazon.com Inc. could eventually sell groceries

here.

The largest spinoff previously in Australia was in 2015 when BHP

Billiton Ltd. unloaded what is now South32 Ltd., and was valued at

about US$9 billion at the time, according to Dealogic.

Wesfarmers could retain a minority stake of up to 20% in Coles.

But the company said the spinoff would allow it to focus on

businesses that have more growth potential. Wesfarmers also owns

the Bunnings hardware chain, Target and Kmart discount department

stores, office-supply chain Officeworks, as well as coal-mine

assets and chemical and fertilizer businesses.

Managing Director Rob Scott told reporters on a conference call

that superior returns at Wesfarmers's other businesses "doesn't

mean the returns from Coles wouldn't be good returns, they just

will be more moderate." Since 2009, Coles has grown earnings before

income and tax at a 9.5% annual rate, though Wesfarmers has

invested eight billion Australian dollars (US$6.2 billion) into the

business over the years.

Wesfarmers said Coles would be a top-30 company listed on the

Australian Securities Exchange and that it expected the spinoff to

be completed in the 2019 financial year. Wesfarmers shareholders

will receive shares in Coles proportional to their existing

Wesfarmers holdings. The new company would include more than 800

supermarkets nationally, as well as liquor stores, Coles Express

convenience stores, a financial-services unit and hotel chain

Spirit Hotels.

The spinoff is still subject to shareholder and other approval,

and on a conference call with reporters, Mr. Scott said Wesfarmers

would be open to a bid for Coles from a private-equity firm or

other buyer. He didn't suggest, however, that a bid had been

received.

Daniel Mueller, a portfolio manager and analyst at Wesfarmers

shareholder Vertium Asset Management, said the spinoff is a "bit of

a masterstroke by management," saying Coles appears undervalued

compared with Woolworths.

Woolworths's market capitalization was A$34.5 billion as of

Thursday's close, compared with A$46.7 billion for Wesfarmers.

"We've always argued that Wesfarmers is very difficult to value

given the conglomerate nature of it," said Jun Bei Liu, deputy

portfolio manager at Tribeca Investment Partners, another

Wesfarmers shareholder. She said the spinoff is a pretty good

strategy move.

Coles, which counts for about a third of Wesfarmers's current

earnings, previously was the company's top earner, but was

overtaken by Bunnings in Australia and New Zealand in its recent

half-year result. Wesfarmers said the earnings decline at Coles in

the half year reflected costs from investing in the business during

the previous financial year, and that food and liquor revenue had

in fact increased.

Wesfarmers had been focusing lately on its retail chains,

agreeing in December to sell its Curragh coal mine to a U.S. coal

producer. Not all its retail forays have been a success. Wesfarmers

recently bought U.K. hardware chain Homebase and booked a major

write-down on that unit, now called Bunnings U.K. and Ireland, in

its half-year result last month. Mr. Scott told reporters that

spinning off Coles shouldn't affect the company's ability to absorb

weakness elsewhere, such as the Bunnings U.K. unit, which the

company has placed under review.

"The intent to demerge Coles has no bearing at all on what we

do" with Bunnings U.K., Mr. Scott said.

Also Friday, Wesfarmers said that Steven Cain would be the new

managing director of Coles, succeeding John Durkan, who will step

down later this year after 10 years in senior leadership positions

at the grocer. Mr. Cain is currently chief executive of

supermarkets and convenience at Metcash, which supplies the IGA

supermarket brand.

Write to Mike Cherney at mike.cherney@wsj.com

(END) Dow Jones Newswires

March 16, 2018 01:13 ET (05:13 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

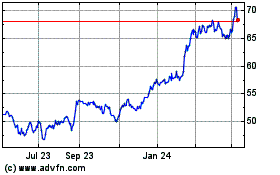

Wesfarmers (ASX:WES)

Historical Stock Chart

From Jan 2025 to Feb 2025

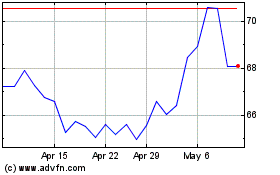

Wesfarmers (ASX:WES)

Historical Stock Chart

From Feb 2024 to Feb 2025