0001128361false00011283612025-02-282025-02-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

February 28, 2025

Date of Report (Date of earliest event reported)

| | |

| HOPE BANCORP INC |

| (Exact name of registrant as specified in its charter) |

| | | | | | | | | | | | | | |

| Delaware | 000-50245 | 95-4849715 |

| (State of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

3200 Wilshire Boulevard, Suite 1400

Los Angeles, California 90010

(Address of principal executives offices, including zip code)

(213) 639-1700

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Common Stock | , | par value $0.001 per share | HOPE | NASDAQ Global Select Market |

| (Title of class) | (Trading Symbol) | (Name of exchange on which registered) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

As previously announced, on April 26, 2024, Hope Bancorp, Inc., a Delaware corporation (the “Company”), and Territorial Bancorp Inc., a Maryland corporation (“Territorial”), entered into an Agreement and Plan of Merger (the “Merger Agreement”), pursuant to which Territorial will merge with and into the Company, with the Company continuing as the surviving entity (the “Merger”). Following the Merger, Territorial Savings Bank, a wholly owned subsidiary of Territorial, will merge with and into Bank of Hope, a wholly owned subsidiary of the Company, with Bank of Hope continuing as the surviving bank (the “Bank Merger”).

On March 3, 2025, the Company and Territorial issued a joint press release announcing receipt of all required regulatory approvals for the Merger and the Bank Merger. Completion of the Merger and the Bank Merger remain subject to the satisfaction of customary closing conditions set forth in the Merger Agreement. The Merger is currently expected to be completed in April 2025.

A copy of the joint press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description of Exhibit |

| | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | HOPE BANCORP, INC. |

| | | |

| Date: March 3, 2025 | By: | /s/ Kevin S. Kim | |

| | Kevin S. Kim | |

| | Chairman, President and Chief Executive Officer |

News Release

HOPE BANCORP RECEIVES REGULATORY APPROVALS

FOR ITS MERGER WITH TERRITORIAL BANCORP

LOS ANGELES AND HONOLULU, March 3, 2025—Hope Bancorp, Inc. (“Hope Bancorp”) (NASDAQ: HOPE), the holding company of Bank of Hope, and Territorial Bancorp Inc. (“Territorial”) (NASDAQ: TBNK), the holding company of Territorial Savings Bank, today jointly announced receipt of all required regulatory approvals to complete their previously announced merger (the “Merger”). Upon completion of the Merger, it is intended that the legacy Territorial franchise in Hawai‘i will operate under the trade name Territorial Savings, a division of Bank of Hope, preserving the 100-plus year legacy of the Territorial brand, culture and commitment to local communities. The combination of the two banks is expected to create the largest regional bank catering to multi-cultural customers across the continental United States and the Hawaiian Islands.

“We are very pleased to have received the required regulatory approvals,” stated Kevin S. Kim, Chairman, President and Chief Executive Officer of Hope Bancorp. “We believe this combination will strengthen our position as one of the leading Asian American banks in the country, add a stable, low-cost deposit base to the combined company, and accelerate the diversification of our loan mix with the addition of a residential mortgage portfolio with excellent asset quality. We look forward to building on Territorial’s legacy of exemplary customer service and support of local communities in a strategically important market.”

“This combination effectively enhances the opportunity to grow Territorial’s market share and elevate the customer experience by leveraging the combined company’s larger balance sheet, greater resources and more extensive array of banking products and services,” said Allan S. Kitagawa, Chairman, President and Chief Executive Officer of Territorial. “We expect a seamless transition for our customers, and we believe our employees and shareholders stand to enjoy greater long-term benefits as part of a larger organization.”

The Merger is expected to be completed at the beginning of April 2025, subject to the satisfaction of customary closing conditions.

2-2-2 NASDAQ:HOPE & NASDAQ:TBNK

About Hope Bancorp, Inc.

Hope Bancorp, Inc. (NASDAQ: HOPE) is the holding company of Bank of Hope, the first and only super regional Korean American bank in the United States with $17.05 billion in total assets as of December 31, 2024. Headquartered in Los Angeles and serving a multi-culture population of customers across the nation, the Bank provides a full suite of commercial, corporate and consumer loans, including commercial and commercial real estate lending, SBA lending, residential mortgage and other consumer lending; deposit and fee-based products and services; international trade financing; and cash management services, foreign currency exchange solutions, and interest rate derivative products, among others. Bank of Hope operates 46 full-service branches in California, Washington, Texas, Illinois, New York, New Jersey, Alabama, and Georgia. The Bank also operates SBA loan production offices, commercial loan production offices, and residential mortgage loan production offices in the United States; and a representative office in Seoul, Korea. Bank of Hope is a California-chartered bank, and its deposits are insured by the FDIC to the extent provided by law. Bank of Hope is an Equal Opportunity Lender. For additional information, please go to www.bankofhope.com. By including the foregoing website address link, Hope Bancorp does not intend to and shall not be deemed to incorporate by reference any material contained or accessible therein.

About Territorial Bancorp Inc.

Territorial Bancorp Inc. (NASDAQ: TBNK), headquartered in Honolulu, Hawai‘i, is the stock holding company for Territorial Savings Bank. Territorial Savings Bank is a state-chartered savings bank which was originally chartered in 1921 by the Territory of Hawai‘i. Territorial Savings Bank conducts business from its headquarters in Honolulu, Hawai‘i and has 29 branch offices in the state of Hawai‘i. For additional information, please visit Territorial’s website at: https://www.tsbhawaii.bank. By including the foregoing website address link, Territorial does not intend to and shall not be deemed to incorporate by reference any material contained or accessible therein.

Forward-Looking Statements

Some statements in this news release may constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include, but are not limited to, statements preceded by, followed by or that include the words “will,” “believes,” “expects,” “anticipates,” “intends,” “plans,” “estimates” or similar expressions. With respect to any such forward-looking statements, each of Hope Bancorp and Territorial claims the protection provided for in the Private Securities Litigation Reform Act of 1995. These statements involve risks and uncertainties. Hope Bancorp and Territorial’s actual results, performance or achievements may differ significantly from the results, performance or achievements expressed or implied in any forward-looking statements. The closing of the Merger is subject to customary closing conditions. There is no assurance that such conditions will be met or that the pending Merger will be consummated within the expected time frame, or at all. If the transaction is consummated, factors that may cause actual outcomes to differ from what is expressed or forecasted in these forward-looking statements include, among things: difficulties and delays in integrating Hope Bancorp and Territorial and achieving anticipated synergies, cost savings and other benefits from the transaction; higher than anticipated transaction costs; and deposit attrition, operating costs, customer loss and business disruption following the Merger, including difficulties in maintaining relationships with employees and customers, may be greater than expected. Other risks and uncertainties include, but are not limited to: possible renewed deterioration in economic conditions in Hope Bancorp’s or Territorial’s areas of operation or elsewhere; interest rate risk associated with volatile interest rates and related asset-liability matching risk; liquidity risks; risk of significant non-earning assets, and net credit losses that could occur, particularly in times of weak economic conditions or times of rising interest rates; the failure of or changes to assumptions and estimates underlying Hope Bancorp’s or Territorial’s allowances for credit losses; potential increases in deposit insurance assessments and regulatory risks associated with current and future regulations; the outcome of any legal proceedings that may be instituted against Hope Bancorp or Territorial; the risk that any announcements relating to the pending transaction could have adverse effects on the market price of the common stock of Hope Bancorp or Territorial; diversion of either bank’s management’s attention from ongoing business operations and opportunities; and risks from natural disasters. For additional information concerning these and other risk factors, see Hope Bancorp’s and Territorial’s most recent Annual Report on Form 10-K. Each of Hope Bancorp and Territorial does not undertake, and specifically disclaims any obligation, to update any forward-looking statements to reflect the occurrence of events or circumstances after the date of such statements except as required by law.

3-3-3 NASDAQ:HOPE & NASDAQ:TBNK

Contacts:

| | | | | | | | |

| For Hope Bancorp, Inc. | | For Territorial Bancorp Inc. |

Julianna Balicka | | Walter Ida |

| EVP & Chief Financial Officer | | SVP, Director of Investor Relations |

213-235-3235 | | 808-946-1400 |

julianna.balicka@bankofhope.com | | walter.ida@territorialsavings.net |

| | |

Angie Yang | | |

SVP, Director of Investor Relations & Corporate Communications | | |

213-251-2219 | | |

angie.yang@bankofhope.com | | |

# # #

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

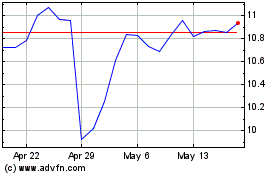

Hope Bancorp (NASDAQ:HOPE)

Historical Stock Chart

From Feb 2025 to Mar 2025

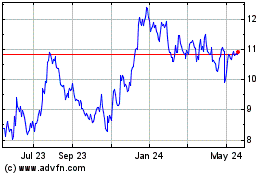

Hope Bancorp (NASDAQ:HOPE)

Historical Stock Chart

From Mar 2024 to Mar 2025