Kentucky First Federal Bancorp (Nasdaq: KFFB), (the “Company”) the

holding company for First Federal Savings and Loan Association of

Hazard and First Federal Savings Bank of Kentucky (the two banks

being collectively referred to as the “Banks”), announced net

income of $1.6 million or $0.19 diluted earnings per share for the

year ended June 30, 2022, compared to net income of $1.8 million or

$0.22 per common share for the twelve months ended June 30, 2021.

Net earnings for the quarter ended June 30, 2022 totaled $206,000

or $0.02 diluted earnings per share compared to net earnings of

$692,000 or $0.08 per common share for the quarter ended June 30,

2021.

Net income decreased $230,000 or 12.6% compared to

the fiscal year ended June 30, 2021 primarily due to decreased net

interest income, decreased non-interest income and increased income

taxes, which were somewhat offset by decreased non-interest

expenses and decreased provision for loan losses. Net interest

income decreased $851,000 or 8.5% and totaled $9.2 million for the

year just ended, as interest income decreased $1.2 million or 10.2%

to $10.9 million and interest expense decreased $387,000 or 18.1%

to $1.8 million. Interest income decreased chiefly due to lower

average rates earned on interest-earning assets, but was supported

by lower average balances as well. Loans are the largest component

of our interest-earning assets and came under pricing pressure

until March 2022 when the Federal Open Market Committee began

raising the overnight interest rates in an attempt to fight high

inflation. During that time we encountered rate competition for

existing as well as for new loans in our portfolio, which resulted

in a decreased average rate earned on the loan portfolio. In

addition to a relatively low interest rate environment in the first

nine months of our fiscal year, loans receivable, net decreased as

some borrowers decided to take advantage of high prices and sold

all or part of their real estate holdings. Some borrowers sold

their properties due to age or death and some loans were lost to

competing financial institutions who offered terms that our Banks

did not believe were prudent to match. Non-interest income

decreased $80,000 or 13.4% and totaled $515,000, primarily due to

decreased gains on loan sales. The Company sells its long-term

fixed rate loans to the Federal Home Loan Bank of Cincinnati as

part of its asset/liability management strategy and the sale of

such loans has decreased along with the rise in general interest

rates in the last few months of the fiscal year. Income tax expense

increased $125,000 or 35.5% year over year due partly to the

Company’s Banks being subject to state income tax and recognition

in the prior year of tax benefits which resulted from the ability

to file a consolidated income tax return for the group. For the

year ended June 30, 2022, non-interest expense decreased $574,000

or 7.0% and totaled $7.7 million due primarily to lower employee

compensation and benefits cost. The Company recognized a credit for

losses on loans of $60,000 for the recently-ended year compared to

a provision for loan loss of $192,000 for the prior fiscal

year.

For the three months ended June 30, 2022, net

income decreased $486,000 or 70.2%, primarily as net interest

income decreased $516,000 or 19.1% and totaled $2.2 million for the

quarterly period compared to $2.7 million for the prior year

quarter. Interest income decreased $583,000 or 18.3% to $2.6

million, while interest expense decreased $67,000 or 13.9% and

totaled $414,000. Non-interest expense decreased $189,000 or 9.0%

to $1.9 million for the quarter just ended compared to the same

quarter in 2021. There was a $46,000 provision for loan losses on

loans during the recently-ended quarter compared to no provision in

the prior year period, which Management determined was necessary in

response to increased loan volume during the period.

At June 30, 2022, assets totaled $328.1 million, a

decrease of $10.0 million or 3.0% compared to June 30, 2021. This

decrease was attributed primarily to a decrease of $23.3 million or

7.8% in loans, net, which totaled $274.6 million at June 30, 2022.

Somewhat offsetting the decrease in loans was an increase of $10.3

million in investment securities and a $4.2 million or 19.3%

increase in cash and cash equivalents. Total liabilities decreased

$9.7 million or 3.4% to $276.0 million at June 30, 2022, primarily

as a result of decreased FHLB advances, which decreased $22.8

million or 40.1% and totaled $34.1 million at June 30, 2022, and

were somewhat offset by increased deposits, which increased $13.0

million or 5.7% and totaled $239.9 million at year end.

At June 30, 2022, the Community Bank Leverage

Ratio (“CBLR”) of the Company was 15.2%, while the ratio for First

Federal Savings and Loan Association of Hazard and First Federal

Savings Bank of Kentucky were 22.0% and 12.0%, respectively. With

respect to the Banks, an interim final rule under the Coronavirus

Aid, Relief, and Economic Security (“CARES”) Act established the

current minimum ratio of 9%.

At June 30, 2022, the Company reported its book

value per share as $6.38. The change in shareholders’ equity was

primarily associated with net income for the period, less dividends

paid on common stock and cost of shares repurchased for treasury

purposes.

Certain statements contained in this release that

are not historical facts are forward-looking statements that are

subject to certain risks and uncertainties. When used herein, the

terms “anticipates,” “plans,” “expects,” “believes,” and similar

expressions as they relate to Kentucky First Federal Bancorp or its

management are intended to identify such forward-looking

statements. Kentucky First Federal Bancorp’s actual results,

performance or achievements may materially differ from those

expressed or implied in the forward-looking statements. Risks and

uncertainties that could cause or contribute to such material

differences include, but are not limited to, general economic

trends and conditions, including inflation and its impacts, prices

for real estate in the Company’s market areas, interest rate

environment, competitive conditions in the financial services

industry, changes in law, governmental policies and regulations,

rapidly changing technology affecting financial services, the

potential effects of the COVID-19 pandemic on the local and

national economic environment, on our customers and on our

operations (as well as any changes to federal, state and local

government laws, regulations and orders in connection with the

pandemic), the impacts related to or resulting from Russia’s

military action in Ukraine, including the broader impacts to

financial markets, and the other matters mentioned in Item 1A of

the Company’s Annual Report on Form 10-K for the year ended June

30, 2021. Except as required by applicable law or regulation, the

Company does not undertake the responsibility, and specifically

disclaims any obligation, to release publicly the result of any

revisions that may be made to any forward-looking statements to

reflect events or circumstances after the date of the statements or

to reflect the occurrence of anticipated or unanticipated events.

Accordingly, actual results may differ from those expressed in the

forward-looking statements, and the making of such statements

should not be regarded as a representation by the Company or any

other person that results expressed therein will be achieved.

Kentucky First Federal Bancorp is the parent

company of First Federal Savings and Loan Association of Hazard,

which operates one banking office in Hazard, Kentucky and First

Federal Savings Bank of Kentucky, which operates three banking

offices in Frankfort, Kentucky, two banking offices in Danville,

Kentucky and one banking office in Lancaster, Kentucky. Kentucky

First Federal Bancorp shares are traded on the Nasdaq National

Market under the symbol KFFB. At June 30, 2022, the Company had

approximately 8,154,695 shares outstanding of which approximately

58.0% was held by First Federal MHC.

|

SUMMARY OF FINANCIAL HIGHLIGHTS |

|

|

|

|

|

|

|

|

|

|

|

Condensed Consolidated Balance Sheets |

|

|

|

|

|

|

|

|

|

|

|

| (In

thousands, except share data) |

|

|

|

|

|

|

|

June

30, |

|

|

June

30, |

|

|

|

|

|

|

|

|

|

2022 |

|

|

2021 |

|

ASSETS |

|

|

|

|

|

|

(Unaudited) |

|

Cash and cash equivalents |

|

|

|

|

|

|

$ |

25,823 |

|

$ |

21,648 |

|

Time deposits in other financial institutions |

|

|

|

|

|

|

|

-- |

|

|

247 |

|

Investment Securities |

|

|

|

|

|

|

|

10,816 |

|

|

495 |

|

Loans available-for sale |

|

|

|

|

|

|

|

152 |

|

|

1,307 |

|

Loans, net |

|

|

|

|

|

|

|

274,583 |

|

|

297,902 |

|

Real estate acquired through foreclosure |

|

|

|

|

|

|

|

10 |

|

|

82 |

|

Goodwill |

|

|

|

|

|

|

|

947 |

|

|

947 |

|

Other Assets |

|

|

|

|

|

|

|

15,749 |

|

|

15,435 |

|

Total Assets |

|

|

|

|

|

|

$ |

328,080 |

|

$ |

338,063 |

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

|

Deposits |

|

|

|

|

|

|

$ |

239,857 |

|

$ |

226,843 |

|

FHLB Advances |

|

|

|

|

|

|

|

34,066 |

|

|

56,873 |

|

Other Liabilities |

|

|

|

|

|

|

|

2,132 |

|

|

2,051 |

|

Total liabilities |

|

|

|

|

|

|

|

276,027 |

|

|

285,767 |

|

Shareholders' Equity |

|

|

|

|

|

|

|

52,025 |

|

|

52,296 |

|

Total liabilities and shareholders' equity |

|

|

|

|

|

|

$ |

328,080 |

|

$ |

338,063 |

| Book value

per share |

|

|

|

|

|

|

$ |

6.38 |

|

$ |

6.36 |

| Tangible

book value per share |

|

|

|

|

|

|

$ |

6.26 |

|

$ |

6.25 |

| Outstanding

shares |

|

|

|

|

|

|

|

8,154,695 |

|

|

8,222,046 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Condensed Consolidated Statements of Income |

|

|

|

|

|

|

|

|

|

| (In

thousands, except share data) |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Twelve months ended

June 30, |

|

Three months ended

June 30, |

|

|

|

2022 |

|

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

(Unaudited) |

|

(Unaudited) |

| Interest

Income |

$ |

10,914 |

|

|

$ |

12,152 |

|

$ |

2,598 |

|

$ |

3,181 |

| Interest

Expense |

|

1,754 |

|

|

|

2,141 |

|

|

414 |

|

|

481 |

| Net Interest

Income |

|

9,160 |

|

|

|

10,011 |

|

|

2,184 |

|

|

2,700 |

| Provision

(credit) for Losses on Loans |

|

(60 |

) |

|

|

192 |

|

|

46 |

|

|

-- |

| Non-interest

Income |

|

515 |

|

|

|

595 |

|

|

93 |

|

|

162 |

| Other

Non-interest Expense |

|

7,668 |

|

|

|

8,242 |

|

|

1,922 |

|

|

2,111 |

| Income

Before Income Taxes |

|

2,067 |

|

|

|

2,172 |

|

|

309 |

|

|

751 |

| Income

Taxes |

|

477 |

|

|

|

352 |

|

|

103 |

|

|

59 |

| Net

Income |

$ |

1,590 |

|

|

$ |

1,820 |

|

$ |

206 |

|

$ |

692 |

| Earnings per

share: |

|

|

|

|

|

|

|

|

|

|

|

| Basic and

Diluted |

$ |

0.19 |

|

|

$ |

0.22 |

|

$ |

0.02 |

|

$ |

0.08 |

| Weighted

average outstanding shares: |

|

|

|

|

|

|

|

|

|

|

|

| Basic and

Diluted |

|

8,213,407 |

|

|

|

8,216,193 |

|

|

8,202,780 |

|

|

8,211,789 |

| Contact: |

Don Jennings,

President, or Clay Hulette, Vice President |

| |

(502) 223-1638 |

| |

216 West Main Street |

| |

P.O. Box 535 |

| |

Frankfort, KY 40602 |

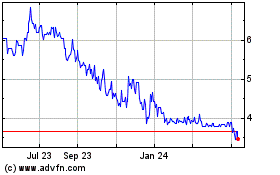

Kentucky First Federal B... (NASDAQ:KFFB)

Historical Stock Chart

From Feb 2025 to Mar 2025

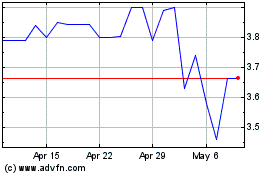

Kentucky First Federal B... (NASDAQ:KFFB)

Historical Stock Chart

From Mar 2024 to Mar 2025