Lifecore Biomedical Announces Special Stockholder Meeting

18 January 2025 - 9:24AM

Lifecore Biomedical, Inc. (NASDAQ: LFCR) (“Lifecore”), a fully

integrated contract development and manufacturing organization

(“CDMO”), today announced that it intends to hold a special meeting

of its stockholders (the “Special Meeting”) on April 10, 2025 (the

“Special Meeting Date”), to consider and vote on a proposal to

approve, for purposes of complying with Nasdaq Listing Rule

5635(d), the issuance of shares of its common stock, par value

$0.001 per share (“Common Stock”) issuable upon conversion of

shares of Lifecore’s Series A Convertible Preferred Stock, par

value $0.001 per share (the “Convertible Preferred Stock”) in an

amount in excess of 19.99% of the number of shares of the Common

Stock outstanding immediately prior to the issuance of such

Convertible Preferred Stock (the “Proposal”).

Pursuant to the terms of the Convertible

Preferred Stock, the holders currently have the right to convert

their shares of Convertible Preferred Stock into Common Stock,

subject to certain limitations. Such limitations include limiting

the ability to convert in an amount in excess of 19.99% of the

number of shares of the Common Stock outstanding immediately prior

to the issuance of such Convertible Preferred Stock (the

“Convertible Preferred Stock Exchange Cap”). As contemplated by the

Convertible Preferred Stock Securities Purchase Agreement dated

January 9, 2023 (the “Purchase Agreement”), Lifecore is seeking

stockholder approval for the Proposal, thereby eliminating the

Convertible Preferred Stock Exchange Cap. Based on the current

conversion price of the Convertible Preferred Stock, the

maximum number of shares of Common Stock that the Convertible

Stock can be converted into is 6,056,284 shares. The Proposal, if

approved, would allow the potential conversion of Convertible

Preferred Stock beyond the current limit in accordance with its

terms. As of the date of this press release, no holders of

Lifecore’s Convertible Preferred Stock have elected to convert

their shares to Common Stock. This meeting is being held solely for

the purpose of accommodating the terms of the Purchase Agreement,

and Lifecore currently has no plans to raise additional equity

capital.

Lifecore’s board of directors has approved that

holders of record of Lifecore’s Common Stock and Convertible

Preferred Stock as of the close of business on February 18, 2025

(the “Record Date”), will be entitled to receive notice of and to

vote at the Special Meeting. The Special Meeting Date and the

Record Date are subject to change.

Lifecore plans to file a preliminary proxy

statement with the Securities and Exchange Commission (the “SEC”)

in connection with the Special Meeting. After receiving clearance

from the SEC, Lifecore will file a definitive proxy statement with

the SEC (the “Definitive Proxy Statement”), which will be sent to

stockholders. The Definitive Proxy Statement will contain further

details regarding the Special Meeting, including the meeting date

and how stockholders can participate in and vote at the

meeting.

About Lifecore Biomedical

Lifecore Biomedical, Inc. (Nasdaq: LFCR) is a

fully integrated contract development and manufacturing

organization (CDMO) that offers highly differentiated capabilities

in the development, fill and finish of sterile injectable

pharmaceutical products in syringes, vials, and cartridges,

including complex formulations. As a leading manufacturer of

premium, injectable-grade hyaluronic acid, Lifecore brings more

than 40 years of expertise as a partner for global and emerging

biopharmaceutical and biotechnology companies across multiple

therapeutic categories to bring their innovations to market. For

more information about Lifecore, visit Lifecore’s website at

www.lifecore.com.

Important Cautions Regarding

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995 regarding future

events or Lifecore’s future performance that involve certain

contingencies and uncertainties. The forward-looking statements

include, without limitation, Lifecore’s plans and expectations

regarding the proposed Special Meeting and the Proposal, and

Lifecore’s intention with respect to future capital raising

activities. These forward-looking statements are not guarantees of

future performance, and all forward-looking statements are subject

to risks and uncertainties that could cause actual results to

differ materially from those projected. Factors that could cause

such a difference include, without limitation, the ability for

Lifecore to hold the Special Meeting on the anticipated timeline,

if at all, changes in LifeCore’s liquidity needs, as well as

the other risks set forth in Lifecore’s filings with the Securities

and Exchange Commission, including Lifecore’s Annual Report on Form

10-K for the fiscal year ended May 26, 2024, and Lifecore’s

Quarterly Reports on Form 10-Q for the fiscal quarters ended August

25, 2024, and November 24, 2024. The forward-looking statements

contained herein speak only as of the date of this release.

Lifecore expressly disclaims any obligation or undertaking to

release publicly any updates or revisions to any such statement

contained herein to reflect any change in Lifecore’s expectations

or any change in events, conditions or circumstances on which any

such statement is based.

Additional Information and Where to Find

It

In connection with the Special Meeting, Lifecore intends to file

proxy materials with the SEC, including a preliminary proxy

statement and a definitive proxy statement. THIS DOCUMENT IS NOT A

SUBSTITUTE FOR THE PROXY STATEMENT OR ANY OTHER DOCUMENT THAT

LIFECORE MAY FILE WITH THE SEC. THE DEFINITIVE PROXY STATEMENT (IF

AND WHEN AVAILABLE) WILL BE MAILED TO STOCKHOLDERS OF LIFECORE.

STOCKHOLDERS OF LIFECORE AND OTHER INTERESTED PERSONS ARE URGED TO

READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME

AVAILABLE, INCLUDING THE PRELIMINARY AND DEFINITIVE PROXY

STATEMENTS TO BE FILED IN CONNECTION WITH THE SPECIAL MEETING,

BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE SPECIAL

MEETING AND THE PROPOSAL. Stockholders will be able to obtain such

documents (if and when available) free of charge at the SEC’s

website at www.sec.gov, or free of charge from Lifecore by

directing a request to Lifecore Biomedical, Inc., Attn: Secretary,

3515 Lyman Boulevard, Chaska, MN 55318 (telephone number:

952-368-4300).

Participants in the

Solicitation

Lifecore and its directors, executive officers and other members

of management and employees may be deemed, under SEC rules, to be

“participants” in the solicitation of proxies from Lifecore’s

stockholders with respect to the proposals to be submitted to

Lifecore’s stockholders at the Special Meeting. Information about

Lifecore’s directors and executive officers is set forth in

Lifecore’s Definitive Proxy Statement on Schedule 14A for its 2024

Annual Meeting of Stockholders, which was filed with the SEC on

September 23, 2024. To the extent holdings of Lifecore’s securities

by its directors or executive officers have changed from the

amounts set forth in such Definitive Proxy Statement, such changes

have been or will be reflected on Statements of Change in Ownership

on Form 4 filed with the SEC. Additional information regarding the

direct or indirect interests, by security holdings or otherwise, of

the participants in the solicitation, which may, in some cases, be

different than those of Lifecore’s stockholders generally, will be

set forth in the preliminary and definitive proxy statements to be

filed in connection with the Special Meeting.

Lifecore Biomedical, Inc. Contact Information:

Vida Strategic Partners

Stephanie Diaz (Investors)

415-675-7401

sdiaz@vidasp.com

Tim Brons (Media)

415-675-7402

tbrons@vidasp.com

Ryan D. Lake (CFO)

Lifecore Biomedical

952-368-6244

ryan.lake@lifecore.com

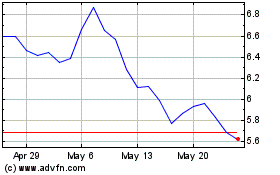

Lifecore Biomedical (NASDAQ:LFCR)

Historical Stock Chart

From Jan 2025 to Feb 2025

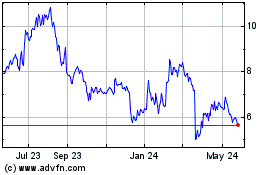

Lifecore Biomedical (NASDAQ:LFCR)

Historical Stock Chart

From Feb 2024 to Feb 2025