Olema Pharmaceuticals, Inc. (“Olema” or “Olema Oncology”, Nasdaq:

OLMA), a clinical-stage biopharmaceutical company focused on the

discovery, development, and commercialization of targeted therapies

for breast cancer and beyond, today announced a new clinical trial

collaboration and supply agreement with Novartis in frontline

metastatic breast cancer. Olema has also entered into a securities

purchase agreement for the private placement of approximately

$250.0 million of common stock and pre-funded warrants to purchase

common stock with new and existing institutional and accredited

investors (the “Private Placement”).

"We are now fully enabled to initiate our planned pivotal Phase

3 clinical trial, OPERA-02, for palazestrant in combination with

ribociclib in frontline ER+/HER2- metastatic breast cancer. Our new

agreement with Novartis, which includes sufficient ribociclib drug

supply for the planned approximately 1,000 patient trial, is a

major milestone. When combined with our Private Placement of $250.0

million of common stock and pre-funded warrants with high-quality,

long-term investors, Olema now expects to have the necessary

resources to execute OPERA-02, the Phase 1/2 study of OP-3136, and

the ongoing Phase 3 OPERA-01 monotherapy trial,” said Sean P.

Bohen, M.D., Ph.D., President and Chief Executive Officer of Olema

Oncology. “We remain on track to share topline data from OPERA-01

in 2026 and we are excited to present our latest data from the

ongoing Phase 1b/2 study of palazestrant in combination with

ribociclib at the San Antonio Breast Cancer Symposium (SABCS) next

week.”

New Clinical Trial Collaboration and Supply Agreement

Enables Phase 3 OPERA-02 TrialUnder the terms of the

agreement, Novartis will provide Olema with ribociclib drug supply

for the planned, Olema-sponsored, Phase 3 OPERA-02 trial of

palazestrant in combination with ribociclib in ER+/HER2- frontline

advanced or metastatic breast cancer. All clinical data and

inventions from the trial will be jointly owned while Olema

maintains global commercial and marketing rights to

palazestrant.

Private Placement Funds Expanded Clinical Development

ActivitiesThe Private Placement is expected to close on or

about December 4, 2024, subject to the satisfaction of customary

closing conditions. The financing included participation by new and

existing investors Adage Capital Partners LP, Bain Capital Life

Sciences, BVF Partners L.P., Driehaus Capital Management, Janus

Henderson Investors, Paradigm BioCapital Advisors, Wellington

Management, Woodline Partners LP, and a large investment manager.

Pursuant to the terms of the securities purchase agreement, Olema

will issue 19,928,875 shares of common stock at a purchase price of

$9.08 per share and pre-funded warrants to purchase up to an

aggregate of 7,604,163 shares of common stock at a purchase price

of $9.0799 per pre-funded warrant, for gross proceeds of

approximately $250.0 million, before deducting placement agent fees

and other offering expenses. The pre-funded warrants will have an

exercise price of $0.0001 per share of common stock, be immediately

exercisable and remain exercisable until exercised in full. The

Private Placement is being conducted in accordance with applicable

Nasdaq rules and was priced using the average Nasdaq official

closing price of Olema’s common stock for the five trading days

ended November 27, 2024.

Jefferies is acting as lead placement agent with J.P. Morgan,

Goldman Sachs & Co. LLC, Citigroup, LifeSci Capital,

Oppenheimer & Co., and H.C. Wainwright & Co. acting as

placement agents in the Private Placement.

Olema intends to use the net proceeds from the Private

Placement, together with its current cash, cash equivalents and

marketable securities, to fund the OPERA-02 trial, the Phase 1/2

study of OP-3136, and its ongoing Phase 3 OPERA-01 monotherapy

trial of palazestrant, and for working capital and general

corporate purposes.

The securities described above have not been registered under

the Securities Act of 1933, as amended (the “Securities Act”), or

any state’s securities laws, and are being issued and sold pursuant

to an exemption from registration provided for under the Securities

Act. Accordingly, these securities may not be offered or sold in

the United States, except pursuant to an effective registration

statement or an applicable exemption from the registration

requirements of the Securities Act. Olema has agreed to file a

registration statement with the U.S. Securities and Exchange

Commission (the “SEC”) registering the resale of the shares of

common stock issued and sold in the Private Placement. Any offering

of the securities under the resale registration statement will only

be made by means of a prospectus.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy, nor shall there be any sale of

these securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to the registration or

qualification under the securities laws of any such

jurisdiction.

About Palazestrant (OP-1250)Palazestrant

(OP-1250) is a novel, orally available small molecule with dual

activity as both a complete estrogen receptor (ER) antagonist

(CERAN) and selective ER degrader (SERD). It is currently being

investigated in patients with recurrent, locally advanced or

metastatic ER-positive (ER+), human epidermal growth factor

receptor 2-negative (HER2-) breast cancer. In preclinical studies,

palazestrant completely blocks ER-driven transcriptional activity

in both ESR1 wild-type and mutant forms of breast cancer. In

Olema’s ongoing clinical trials for advanced or metastatic

ER+/HER2- breast cancer, palazestrant has demonstrated anti-tumor

activity along with attractive pharmacokinetics and exposure,

favorable tolerability, and combinability with CDK4/6 inhibitors.

Palazestrant has been granted U.S. Food and Drug Administration

(FDA) Fast Track designation for the treatment of ER+/HER2-

metastatic breast cancer that has progressed following one or more

lines of endocrine therapy with at least one line given in

combination with a CDK4/6 inhibitor. It is being evaluated both as

a single agent in an ongoing Phase 3 clinical trial, OPERA-01, and

in Phase 1/2 combination studies with CDK4/6 inhibitors

(palbociclib and ribociclib), a PI3Ka inhibitor (alpelisib), and an

mTOR inhibitor (everolimus).

About Olema OncologyOlema Oncology is a

clinical-stage biopharmaceutical company committed to transforming

the standard of care and improving outcomes for women living with

cancer. Olema is advancing a pipeline of novel therapies by

leveraging our deep understanding of endocrine-driven cancers,

nuclear receptors, and mechanisms of acquired resistance. Olema’s

lead product candidate, palazestrant (OP-1250), is a proprietary,

orally available complete estrogen receptor (ER) antagonist (CERAN)

and a selective ER degrader (SERD), currently in a Phase 3 clinical

trial called OPERA-01. In addition, Olema is developing a potent

KAT6 inhibitor (OP-3136). Olema is headquartered in San Francisco

and has operations in Cambridge, Massachusetts.

Forward-Looking StatementsStatements contained

in this press release regarding matters that are not historical

facts are “forward-looking statements” within the meaning of

Section 27A of the Securities Act of 1933 and Section 21E of the

Securities Exchange Act of 1934. Words such as “anticipate,”

“expect,” “will,” “may,” “goal,” “potential” and similar

expressions (as well as other words or expressions referencing

future events, conditions or circumstances) are intended to

identify forward-looking statements. These statements include those

related to the completion of the Private Placement, the use of

proceeds therefrom, the anticipated filing of a registration

statement to cover resales of the securities issued in the Private

Placement, Olema's expectation that the proceeds from the Private

Placement, together with current cash, cash equivalents and

marketable securities, is expected to be sufficient to fund Olema’s

planned OPERA-02 trial, the Phase 1/2 study of OP-3136, and the

ongoing Phase 3 OPERA-01 trial. Because such statements deal with

future events and are based on Olema’s current expectations, they

are subject to various risks and uncertainties, and actual results,

performance or achievements of Olema could differ materially from

those described in or implied by the statements in this press

release. These forward-looking statements are subject to risks and

uncertainties, including, without limitation, those discussed in

the section titled “Risk Factors” in Olema’s Quarterly Report on

Form 10-Q for the quarter ended September 30, 2024, and future

filings and reports that Olema makes from time to time with the

U.S. Securities and Exchange Commission. Except as required by law,

Olema assumes no obligation to update these forward-looking

statements, including in the event that actual results differ

materially from those anticipated in the forward-looking

statements.

Media and Investor Relations ContactCourtney

O’KonekVice President, Corporate CommunicationsOlema

Oncologymedia@olema.com

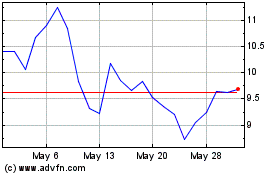

Olema Pharmaceuticals (NASDAQ:OLMA)

Historical Stock Chart

From Nov 2024 to Dec 2024

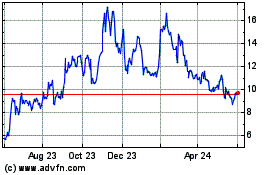

Olema Pharmaceuticals (NASDAQ:OLMA)

Historical Stock Chart

From Dec 2023 to Dec 2024