UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 9)*

VNET Group, Inc.

(Name of Issuer)

Class A Ordinary Shares, Par Value US$0.00001

Per Share

(Title of Class of Securities)

G91458 102**

(CUSIP Number)

Mr. Sheng Chen

Guanjie Building, Southeast 1st Floor, 10# Jiuxianqiao East Road

Chaoyang District, Beijing 100016

People’s Republic of China

Phone: (+86) 10 8456-2121

(Name,

Address and Telephone Number of Person Authorized to Receive Notices and Communications)

August 22, 2024

(Date of Event Which Requires Filing of This Statement)

If the filing person has previously filed a statement on Schedule

13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box. x

Note: Schedules filed in paper format shall include a signed

original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom copies are to be sent.

*This statement on Schedule 13D constitutes Amendment No.9 to the

initial Schedule 13D (the “Original Schedule 13D”) filed on April 8, 2022 on behalf of each of Mr. Sheng

Chen and GenTao Capital Limited, as amended by the Amendment No.1 filed on September 14, 2022 (the “Amendment No.1”),

Amendment No.2 filed on February 17, 2023 (the “Amendment No.2”), Amendment No.3 filed on July 12, 2023

(the “Amendment No.3”), Amendment No.4 filed on August 1, 2023 (the “Amendment No.4”), Amendment

No. 5 filed on November 16, 2023 (the “Amendment No. 5”), Amendment No. 6 filed on December 28,

2023 (the “Amendment No. 6”), Amendment No. 7 filed on February 6, 2024 (the “Amendment No. 7”)

and Amendment No. 8 filed on July 8, 2024 (the “Amendment No. 8”, and together with the Original Schedule

13D, Amendment No.1, Amendment No.2, Amendment No.3, Amendment No.4, Amendment No. 5, Amendment No. 6 and Amendment No. 7,

the “Original 13D Filings”), with respect to ordinary shares (“Ordinary Shares”), comprising Class A

ordinary shares, par value of $0.00001 per share (“Class A Ordinary Shares”), Class B ordinary shares, par

value of $0.00001 per share (“Class B Ordinary Shares”), and Class C ordinary shares, par value of $0.00001

per share (“Class C Ordinary Shares”) of VNET Group, Inc., a Cayman Islands company (“Issuer”).

**This CUSIP number applies to the Issuer’s American Depositary

Shares (“ADSs”), each representing six Class A Ordinary Shares of the Issuer.

The information required on the remainder of this cover page shall

not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however,

see the Notes).

| 1. |

NAMES OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE

PERSONS (ENTITIES ONLY)

Sheng Chen |

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(see instructions)

(a) ¨

(b) x |

| 3. |

SEC USE ONLY

|

| 4. |

SOURCE OF FUNDS (see instructions)

PF, OO , SC |

| 5. |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) or 2(e) ¨

|

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION

People’s Republic of China |

| |

7. |

SOLE

VOTING POWER |

| |

|

|

| NUMBER OF |

|

553,737,207 (1) |

| SHARES |

8. |

SHARED VOTING POWER |

| BENEFICIALLY |

|

|

| OWNED BY |

|

0 |

| EACH |

9. |

SOLE DISPOSITIVE POWER |

| REPORTING |

|

|

| PERSON WITH: |

|

553,737,207(1) |

| |

10. |

SHARED DISPOSITIVE POWER |

| |

|

|

| |

|

0 |

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON |

| |

|

| |

553,737,207(1) |

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions) ¨ |

| |

|

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

| |

|

| |

34.6% (2) (representing

43.2% of the total outstanding voting power (3)) |

| 14. |

TYPE OF REPORTING PERSON (see instructions) |

| |

|

| |

IN |

(1) Representing (i) 33,628,927 Class A

Ordinary Shares held by GenTao Capital Limited (“GenTao”), (ii) 19,670,117 Class B Ordinary Shares held by

Fast Horse Technology Limited (“Fast Horse”), (iii) 8,087,875 Class B Ordinary Shares held by Sunrise Corporate

Holding Ltd. (“Sunrise”), (iv) four Class A Ordinary Shares, 769,486 Class B Ordinary Shares and 60,000

Class C Ordinary Shares held by Personal Group Limited (“Personal Group”), (iv) 1,479,660 Class A Ordinary

Shares issuable under Mr. Sheng Chen’s restricted share units at his election, (v) 34,744,206 Class A Ordinary Shares acquired by

Beacon Capital Group Inc. (“Beacon”) from the vesting of performance-based restricted share units on February 2, 2024

(these units were granted to Mr. Sheng Chen and issued to Beacon at his direction), and (vi) 455,296,932 Class A Ordinary Shares

held by Success Flow International Investment Limited (“Investor A”), representing all of the Class A Ordinary Shares

held by the entity in the Issuer, pursuant to which Mr. Sheng Chen has the power to give Investor A voting instructions on certain matters.

Mr. Sheng Chen is the sole and direct shareholder of GenTao, Fast Horse, Sunrise, Personal Group and Beacon and may be deemed to

have beneficial ownership of the shares held by them.

(2) Calculation based on 1,601,797,098 outstanding Ordinary Shares

as a single class, being the sum of (i) 1,571,015,375 outstanding Class A Ordinary Shares (excluding treasury shares and Class A

Ordinary Shares in the form of ADSs that are reserved for issuance upon the exercise of share incentive awards), (ii) 30,721,723

outstanding Class B Ordinary Shares, (iii) 60,000 outstanding Class C Ordinary Shares, (iv) no outstanding Class D

Ordinary Share, par value of $0.00001 per share (“Class D Ordinary Shares”) of the Issuer, and (v) 1,479,660

Class A Ordinary Shares issuable under Mr. Sheng Chen’s restricted share units at his election, assuming conversion of

all outstanding Class B Ordinary Shares and Class C Ordinary Shares into Class A Ordinary Share. Each Class B Ordinary

Share or each Class C Ordinary Share is convertible into one Class A Ordinary Share at any time by the holder thereof. Class A

Ordinary Shares are not convertible into Class B Ordinary Shares or Class C Ordinary Shares under any circumstances.

(3) Each Class A Ordinary Share is entitled to one vote,

each Class B Ordinary Share is entitled to ten votes, each Class C Ordinary Shares is entitled to one vote and each Class D

Ordinary Share is entitled to 500 votes on all matters subject to shareholder vote at general meetings of the Issuer, except that the

Issuer may only proceed with certain corporate matters with the written consent of the holders holding a majority of the issued and outstanding

Class C Ordinary Shares or with the sanction of a special resolution passed at a separate meeting of the holders of the issued and

outstanding Class C Ordinary Shares.

| 1. |

NAMES OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE

PERSONS (ENTITIES ONLY)

GenTao Capital Limited |

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(see instructions)

(a) ¨

(b) x |

| 3. |

SEC USE ONLY

|

| 4. |

SOURCE OF FUNDS (see instructions)

AF, OO |

| 5. |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) or 2(e) ¨

|

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION

British Virgin Islands |

| |

7. |

SOLE

VOTING POWER |

| |

|

|

| |

|

488,925,859(1) |

| NUMBER OF |

8. |

SHARED VOTING POWER |

| SHARES |

|

|

| BENEFICIALLY |

|

0 |

| OWNED BY |

9. |

SOLE DISPOSITIVE POWER |

| EACH |

|

|

| REPORTING |

|

488,925,859 (1) |

| PERSON WITH: |

10. |

SHARED DISPOSITIVE POWER |

| |

|

|

| |

|

0 |

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON |

| |

|

| |

488,925,859(1) |

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions) ¨ |

| |

|

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

| |

|

| |

30.5%(2) (representing

26.0% of the total outstanding voting power (3)) |

| 14. |

TYPE OF REPORTING PERSON (see instructions) |

| |

|

| |

CO |

(1) Representing 33,628,927 Class A Ordinary Shares held

by GenTao and 455,296,932 Class A Ordinary Shares held by Investor A, representing all of the Class A Ordinary Shares held by the entity

in the Issuer, pursuant to which GenTao has the power to give Investor A voting instructions on certain matters..

(2) Calculation based on 1,601,797,098 outstanding Ordinary Shares

as a single class, being the sum of (i) 1,571,015,375 outstanding Class A Ordinary Shares (excluding treasury shares and Class A

Ordinary Shares in the form of ADSs that are reserved for issuance upon the exercise of share incentive awards), (ii) 30,721,723

outstanding Class B Ordinary Shares, (iii) 60,000 outstanding Class C Ordinary Shares, (iv) no outstanding Class D

Ordinary Share, and (v) 1,479,660 Class A Ordinary Shares issuable under Mr. Sheng Chen’s restricted share units

at his election, assuming conversion of all outstanding Class B Ordinary Shares and Class C Ordinary Shares into Class A

Ordinary Share. Each Class B Ordinary Share or each Class C Ordinary Share is convertible into one Class A Ordinary Share

at any time by the holder thereof. Class A Ordinary Shares are not convertible into Class B Ordinary Shares or Class C

Ordinary Shares under any circumstances.

(3) Each Class A Ordinary Share is entitled to one vote, each Class B

Ordinary Share is entitled to ten votes, each Class C Ordinary Shares is entitled to one vote and each Class D Ordinary Share is

entitled to 500 votes on all matters subject to shareholder vote at general meetings of the Issuer, except that the Issuer may only proceed

with certain corporate matters with the written consent of the holders holding a majority of the issued and outstanding Class C Ordinary

Shares or with the sanction of a special resolution passed at a separate meeting of the holders of the issued and outstanding Class C

Ordinary Shares.

| 1. |

NAMES OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE

PERSONS (ENTITIES ONLY)

Fast Horse Technology Limited |

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(see instructions)

(a) ¨

(b) x |

| 3. |

SEC USE ONLY

|

| 4. |

SOURCE OF FUNDS (see instructions)

AF, OO |

| 5. |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) or 2(e) ¨

|

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION

British Virgin Islands |

| |

7. |

SOLE

VOTING POWER |

| |

|

|

| |

|

474,967,049(1) |

| NUMBER OF |

8. |

SHARED VOTING POWER |

| SHARES |

|

|

| BENEFICIALLY |

|

0 |

| OWNED BY |

9. |

SOLE DISPOSITIVE POWER |

| EACH |

|

|

| REPORTING |

|

474,967,049 (1) |

| PERSON WITH: |

10. |

SHARED DISPOSITIVE POWER |

| |

|

|

| |

|

0 |

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON |

| |

|

| |

474,967,049 (1) |

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions) ¨ |

| |

|

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

| |

|

| |

29.7%(2) (representing

34.7% of the total outstanding voting power (3)) |

| 14. |

TYPE OF REPORTING PERSON (see instructions) |

| |

|

| |

CO |

(1) Representing 19,670,117 Class B Ordinary Shares held by Fast Horse

and 455,296,932 Class A Ordinary Shares held by Investor A, representing all of the Class A Ordinary Shares held by the entity in the

Issuer, pursuant to which Fast Horse has the power to give Investor A voting instructions on certain matters..

(2) Calculation based on 1,601,797,098 outstanding Ordinary Shares

as a single class, being the sum of (i) 1,571,015,375 outstanding Class A Ordinary Shares (excluding treasury shares and Class A

Ordinary Shares in the form of ADSs that are reserved for issuance upon the exercise of share incentive awards), (ii) 30,721,723

outstanding Class B Ordinary Shares, (iii) 60,000 outstanding Class C Ordinary Shares, (iv) no outstanding Class D

Ordinary Share, and (v) 1,479,660 Class A Ordinary Shares issuable under Mr. Sheng Chen’s restricted share units

at his election, assuming conversion of all outstanding Class B Ordinary Shares and Class C Ordinary Shares into Class A

Ordinary Share. Each Class B Ordinary Share or each Class C Ordinary Share is convertible into one Class A Ordinary Share

at any time by the holder thereof. Class A Ordinary Shares are not convertible into Class B Ordinary Shares or Class C

Ordinary Shares under any circumstances.

(3) Each Class A Ordinary Share is entitled to one vote,

each Class B Ordinary Share is entitled to ten votes, each Class C Ordinary Shares is entitled to one vote and each Class D

Ordinary Share is entitled to 500 votes on all matters subject to shareholder vote at general meetings of the Issuer, except that the

Issuer may only proceed with certain corporate matters with the written consent of the holders holding a majority of the issued and outstanding

Class C Ordinary Shares or with the sanction of a special resolution passed at a separate meeting of the holders of the issued and

outstanding Class C Ordinary Shares.

| 1. |

NAMES OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE

PERSONS (ENTITIES ONLY)

Sunrise Corporate Holding Ltd. |

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(see instructions)

(a) ¨

(b) x |

| 3. |

SEC USE ONLY

|

| 4. |

SOURCE OF FUNDS (see instructions)

AF, OO |

| 5. |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) or 2(e) ¨

|

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION

British Virgin Islands |

| |

7. |

SOLE

VOTING POWER |

| |

|

|

| |

|

463,384,807 (1) |

| NUMBER OF |

8. |

SHARED VOTING POWER |

| SHARES |

|

|

| BENEFICIALLY |

|

0 |

| OWNED BY |

9. |

SOLE DISPOSITIVE POWER |

| EACH |

|

|

| REPORTING |

|

463,384,807 (1) |

| PERSON WITH: |

10. |

SHARED DISPOSITIVE POWER |

| |

|

|

| |

|

0 |

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON |

| |

|

| |

463,384,807 (1) |

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions) ¨ |

| |

|

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

| |

|

| |

28.9%(2) (representing

28.6% of the total outstanding voting power (3)) |

| 14. |

TYPE OF REPORTING PERSON (see instructions) |

| |

|

| |

CO |

(1) Representing 8,087,875 Class B Ordinary Shares held by Sunrise

and 455,296,932 Class A Ordinary Shares held by Investor A, representing all of the Class A Ordinary Shares held by the entity in the

Issuer, pursuant to which Sunrise has the power to give Investor A voting instructions on certain matters..

(2) Calculation based on 1,601,797,098 outstanding Ordinary Shares

as a single class, being the sum of (i) 1,571,015,375 outstanding Class A Ordinary Shares (excluding treasury shares and Class A

Ordinary Shares in the form of ADSs that are reserved for issuance upon the exercise of share incentive awards), (ii) 30,721,723

outstanding Class B Ordinary Shares, (iii) 60,000 outstanding Class C Ordinary Shares, (iv) no outstanding Class D

Ordinary Share, and (v) 1,479,660 Class A Ordinary Shares issuable under Mr. Sheng Chen’s restricted share units

at his election, assuming conversion of all outstanding Class B Ordinary Shares and Class C Ordinary Shares into Class A

Ordinary Share. Each Class B Ordinary Share or each Class C Ordinary Share is convertible into one Class A Ordinary Share

at any time by the holder thereof. Class A Ordinary Shares are not convertible into Class B Ordinary Shares or Class C

Ordinary Shares under any circumstances.

(3) Each Class A Ordinary Share is entitled to one vote,

each Class B Ordinary Share is entitled to ten votes, each Class C Ordinary Shares is entitled to one vote and each Class D

Ordinary Share is entitled to 500 votes on all matters subject to shareholder vote at general meetings of the Issuer, except that the

Issuer may only proceed with certain corporate matters with the written consent of the holders holding a majority of the issued and outstanding

Class C Ordinary Shares or with the sanction of a special resolution passed at a separate meeting of the holders of the issued and

outstanding Class C Ordinary Shares.

| 1. |

NAMES OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE

PERSONS (ENTITIES ONLY)

Personal Group Limited |

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(see instructions)

(a) ¨

(b) x |

| 3. |

SEC USE ONLY

|

| 4. |

SOURCE OF FUNDS (see instructions)

AF, OO |

| 5. |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) or 2(e) ¨

|

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION

British Virgin Islands |

| |

7. |

SOLE

VOTING POWER |

| |

|

|

| |

|

456,126,422 (1) |

| NUMBER OF |

8. |

SHARED VOTING POWER |

| SHARES |

|

|

| BENEFICIALLY |

|

0 |

| OWNED BY |

9. |

SOLE DISPOSITIVE POWER |

| EACH |

|

|

| REPORTING |

|

456,126,422 (1) |

| PERSON WITH: |

10. |

SHARED DISPOSITIVE POWER |

| |

|

|

| |

|

0 |

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON |

| |

|

| |

456,126,422 (1) |

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions) ¨ |

| |

|

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

| |

|

| |

28.5%(2) (representing

24.7% of the total outstanding voting power (3)) |

| 14. |

TYPE OF REPORTING PERSON (see instructions) |

| |

|

| |

CO |

(1) Representing four Class A Ordinary Shares, 769,486 Class B

Ordinary Shares, 60,000 Class C Ordinary Shares held by Personal Group, and 455,296,932 Class A Ordinary Shares held by Investor

A, representing all of the Class A Ordinary Shares held by the entity in the Issuer, pursuant to which Personal Group has the power to

give Investor A voting instructions on certain matters..

(2) Calculation based on 1,601,797,098 outstanding Ordinary Shares

as a single class, being the sum of (i) 1,571,015,375 outstanding Class A Ordinary Shares (excluding treasury shares and Class A

Ordinary Shares in the form of ADSs that are reserved for issuance upon the exercise of share incentive awards), (ii) 30,721,723

outstanding Class B Ordinary Shares, (iii) 60,000 outstanding Class C Ordinary Shares, (iv) no outstanding Class D

Ordinary Share, and(v) 1,479,660 Class A Ordinary Shares issuable under Mr. Sheng Chen’s restricted share units

at his election, assuming conversion of all outstanding Class B Ordinary Shares and Class C Ordinary Shares into Class A

Ordinary Share. Each Class B Ordinary Share or each Class C Ordinary Share is convertible into one Class A Ordinary Share

at any time by the holder thereof. Class A Ordinary Shares are not convertible into Class B Ordinary Shares or Class C

Ordinary Shares under any circumstances.

(3) Each Class A Ordinary Share is entitled to one vote,

each Class B Ordinary Share is entitled to ten votes, each Class C Ordinary Shares is entitled to one vote and each Class D

Ordinary Share is entitled to 500 votes on all matters subject to shareholder vote at general meetings of the Issuer, except that the

Issuer may only proceed with certain corporate matters with the written consent of the holders holding a majority of the issued and outstanding

Class C Ordinary Shares or with the sanction of a special resolution passed at a separate meeting of the holders of the issued and

outstanding Class C Ordinary Shares.

| 1. |

NAMES OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS

(ENTITIES ONLY)

Beacon Capital Group Inc. |

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(see instructions)

(a) ¨

(b) x |

| 3. |

SEC USE ONLY

|

| 4. |

SOURCE OF FUNDS (see instructions)

AF, OO |

| 5. |

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2(d) or 2(e) ¨

|

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION

British Virgin Islands |

| |

7. |

SOLE

VOTING POWER |

| |

|

|

| |

|

34,744,206 (1) |

| NUMBER OF |

8. |

SHARED VOTING POWER |

| SHARES |

|

|

| BENEFICIALLY |

|

0 |

| OWNED BY |

9. |

SOLE DISPOSITIVE POWER |

| EACH |

|

|

| REPORTING |

|

34,744,206 (1) |

| PERSON WITH: |

10. |

SHARED DISPOSITIVE POWER |

| |

|

|

| |

|

0 |

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

| |

|

| |

34,744,206 (1) |

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions) ¨ |

| |

|

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

| |

|

| |

2.2%(2) (representing 1.9% of the total outstanding voting power (3)) |

| 14. |

TYPE OF REPORTING PERSON (see instructions) |

| |

|

| |

CO |

(1) Representing 34,744,206 Class A Ordinary Shares acquired

by Beacon.

(2) Calculation based on 1,601,797,098 outstanding Ordinary Shares

as a single class, being the sum of (i) 1,571,015,375 outstanding Class A Ordinary Shares (excluding treasury shares and Class A

Ordinary Shares in the form of ADSs that are reserved for issuance upon the exercise of share incentive awards), (ii) 30,721,723

outstanding Class B Ordinary Shares, (iii) 60,000 outstanding Class C Ordinary Shares, (iv) no outstanding Class D

Ordinary Share, and (v) 1,479,660 Class A Ordinary Shares issuable under Mr. Sheng Chen’s restricted share units

at his election, assuming conversion of all outstanding Class B Ordinary Shares and Class C Ordinary Shares into Class A

Ordinary Share. Each Class B Ordinary Share or each Class C Ordinary Share is convertible into one Class A Ordinary Share

at any time by the holder thereof. Class A Ordinary Shares are not convertible into Class B Ordinary Shares or Class C

Ordinary Shares under any circumstances.

(3) Each Class A Ordinary Share is entitled to one vote, each Class B

Ordinary Share is entitled to ten votes, each Class C Ordinary Shares is entitled to one vote and each Class D Ordinary Share is

entitled to 500 votes on all matters subject to shareholder vote at general meetings of the Issuer, except that the Issuer may only proceed

with certain corporate matters with the written consent of the holders holding a majority of the issued and outstanding Class C Ordinary

Shares or with the sanction of a special resolution passed at a separate meeting of the holders of the issued and outstanding Class C

Ordinary Shares.

CUSIP No. G91458 102

Pursuant to Rule 13d-2 promulgated under the Act, this amendment

to Schedule 13D (this “Amendment No.9”) amends and supplements the Original 13D Filings. Except as specifically provided herein,

this Amendment No.9 does not modify any of the information previously reported in the Original 13D Filings. All capitalized terms used

herein which are not otherwise defined herein have the meanings given to such terms in the Original 13D Filings.

| Item 4. |

Purpose of Transaction. |

Item 4 is further supplemented

by the following.

On August 21, 2024, Mr. Sheng Chen, GenTao, Fast Horse, Sunrise, Personal

Group, Investor A and Choice Faith Group Holdings Limited (“Investor B”) entered into a letter agreement (the “Letter

Agreement”) pursuant to which the parties confirmed that a Triggering Event under the VCA had occurred as a result of the Issuer’s

entry into an overseas business expansion strategic cooperation agreement with LERETECH (HONGKONG) CO., LIMITED and that

the Voting Term therefore had commenced simultaneously.

As stated in the press release published by the

Issuer on July 10, 2024, Mr. Sheng Chen will continue his roles as a controlling person and long-term investor of the Issuer.

Mr. Sheng Chen believes that maintaining the Issuer’s listing status is better aligned with its long-term interests given current

market conditions.

The Reporting Persons reserve their right to change

their plans and intentions in connection with any of the actions discussed in this Item 4. Any action taken by the Reporting Persons may

be effected at any time or from time to time, subject to any applicable limitations imposed thereon by any applicable laws.

| Item 5. | Interest in Securities of the Issuer. |

As a result of the transactions between the Reporting

Persons, on the one hand, and Shandong Hi-Speed Holdings Group Limited (the “Investor Parent”), Investor A and Investor

B (collectively the “Investor Filers”), on the other, the Reporting Persons believe that they may be deemed to be part

of a group with the Investor Filers, on the other for purposes of Section 13(d)(3) of the Securities Act. Based on the information disclosed

by the Investor Filers in their Schedule 13D, filed on December 28, 2023, immediately after the commencement of the Voting Term on August

21, 2024, the “group” may be deemed to have beneficial ownership of the 720,276,989 Class A Ordinary Shares, 28,527,478 Class

B Ordinary Shares and 60,000 Class C Ordinary Shares, representing 46.8% of the issued and outstanding share capital of the Ussyer and

53.5% of the total voting power.

None of the Reporting Persons affirms the existence

of a group, either or individually or collectively with the Investor Filers. The Reporting Persons also disclaim any beneficial ownership

over the 195,127,260 Class A Ordinary Shares beneficially owned by Investor B and Investor Parent, which are not subject to the voting

arrangement described in Item 4.

| Item 6. |

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer. |

Item 6 is further supplemented by the following.

The information set forth

in Item 4 is hereby incorporated by reference in its entirety in this Item 6.

| Item 7. |

Material to Be Filed as Exhibits. |

Item 7 is supplemented by adding the following:

SIGNATURE

After reasonable inquiry and to the best of my

knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: August 22, 2024

| Sheng Chen |

By |

/s/ Sheng Chen |

| |

|

Sheng Chen |

| |

|

|

| GenTao Capital Limited |

By |

/s/ Sheng Chen |

| |

|

Name: Sheng Chen |

| |

|

Title: Director |

| |

|

|

| Fast Horse Technology Limited |

By |

/s/ Sheng Chen |

| |

|

Name: Sheng Chen |

| |

|

Title: Director |

| Sunrise Corporate Holding Ltd. |

By |

/s/ Sheng Chen |

| |

|

Name: Sheng Chen |

| |

|

Title: Director |

| |

|

|

| Personal Group Limited |

By |

/s/ Sheng Chen |

| |

|

Name: Sheng Chen |

| |

|

Title: Director |

| |

|

|

| Beacon Capital Group Inc. |

By |

/s/ Sheng Chen |

| |

|

Name: Sheng Chen |

| |

|

Title: Director |

Exhibit 99.33

LETTER AGREEMENT

This letter agreement (this “Letter Agreement”)

is made on 21 August, 2024 between:

| 1. | Mr. Sheng Chen, citizen of the PRC with ID Card No.; |

| 2. | GenTao Capital Limited, a business company with limited liability incorporated under the Laws of British

Virgin Islands; |

| 3. | Fast Horse Technology Limited, a business company with limited liability incorporated under the Laws

of British Virgin Islands; |

| 4. | Sunrise Corporate Holding Ltd., a business company with limited liability incorporated under the Laws

of British Virgin Islands; |

| 5. | Personal Group Limited, a business company with limited liability incorporated under the Laws of British

Virgin Islands; |

| 6. | Success Flow International Investment Limited, a BVI Business Company incorporated under the Laws of

the British Virgin Islands; and |

| 7. | Choice Faith Group Holdings Limited, a BVI Business Company incorporated under the Laws of the British

Virgin Islands. |

WHEREAS, the Parties entered into the Voting and Consortium

agreement dated November 16, 2023, as supplemented by a supplemental agreement dated December 28, 2023 (the “Voting and Consortium

Agreement”). The Parties agreed to confirm the commencement of the Voting Term (as defined in the Voting and Consortium Agreement)

as set out in this Letter Agreement.

IT IS HEREBY AGREED:

| 1. | Capitalized terms used but not defined in this Letter Agreement shall have the

meanings given to them in the Voting and Consortium Agreement. |

| 2. | A Triggering Event occurred on 21 August 2024 when the Company entered into

Overseas Business Expansion Strategic Cooperation Agreement with LERETECH (HONGKONG) CO., LIMITED.

Pursuant to clause 1.1 of the Voting and Consortium Agreement, the Voting Term became effective concurrently therewith. |

[Signature page follows]

IN WITNESS WHEREOF,

the Parties have executed and delivered this Letter Agreement on the date first above written

| SHENG CHEN |

|

|

| |

|

|

| /s/ SHENG CHEN |

|

|

| GENTAO CAPITAL LIMITED |

|

FAST HORSE TECHNOLOGY LIMITED |

| |

|

|

| /s/ Sheng CHEN |

|

/s/ Sheng CHEN |

| Name: Sheng CHEN |

|

Name: Sheng CHEN |

| Title: Director |

|

Title: Director |

| SUNRISE CORPORATE HOLDING

LTD. |

|

PERSONAL GROUP LIMITED |

| |

|

|

| /s/ Sheng CHEN |

|

/s/ Sheng CHEN |

| Name: Sheng CHEN |

|

Name: Sheng CHEN |

| Title: Director |

|

Title: Director |

| SUCCESS FLOW INTERNATIONAL INVESTMENT LIMITED |

|

CHOICE FAITH GROUP HOLDINGS LIMITED |

| |

|

|

| /s/ Liu Yao |

|

/s/ Liu Yao |

| Name: |

|

Name: |

| Title: |

|

Title: |

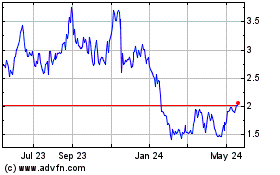

VNET (NASDAQ:VNET)

Historical Stock Chart

From Nov 2024 to Dec 2024

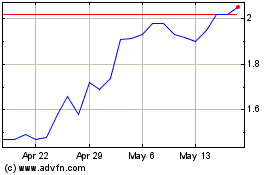

VNET (NASDAQ:VNET)

Historical Stock Chart

From Dec 2023 to Dec 2024