false

0000820313

0000820313

2025-01-31

2025-01-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

OR 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): January 31, 2025

AMPHENOL CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware |

|

1-10879 |

|

22-2785165 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

| 358

Hall Avenue, Wallingford,

Connecticut |

|

06492 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s

telephone number, including area code: (203)

265-8900

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which

registered |

| Class A

Common Stock, $0.001 par value |

|

APH |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth

company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01. |

Regulation FD Disclosure. |

On

February 3, 2025, Amphenol Corporation, a Delaware corporation (the “Company”), issued a press release announcing

the closing of the transaction contemplated by that certain Purchase Agreement, dated as of July 18, 2024, by and between the Company

and CommScope Holding Company, Inc., a Delaware corporation. A copy of the press release is furnished as Exhibit 99.1 to this

Current Report on Form 8-K.

The

information in this Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1, is being furnished herewith and shall

not be deemed "filed" for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed

incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth

by specific reference in such filing.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

AMPHENOL CORPORATION |

| |

|

|

| Date: February 3, 2025 |

By: |

/s/ Lance E. D’Amico |

| |

Name: |

Lance E. D’Amico |

| |

Title: |

Senior Vice President, Secretary and General Counsel |

Exhibit 99.1

World

Headquarters

358

Hall Avenue

Wallingford, CT 06492

Telephone (203) 265-8900

AMPHENOL CORPORATION

COMPLETES

ACQUISITION

OF OWN AND DAS BUSINESSES FROM COMMSCOPE

Wallingford, Connecticut, February 3,

2025. Amphenol Corporation (NYSE: APH) today announced it had completed the acquisition of CommScope’s (NASDAQ: COMM) Outdoor Wireless

Networks (OWN) and Distributed Antenna Systems (DAS) businesses.

“The acquisition of the OWN and

DAS businesses brings to Amphenol a strong portfolio of innovative and advanced technologies for communications networks,” said

Amphenol President and Chief Executive Officer, R. Adam Norwitt. “We are excited to welcome nearly 4,000 talented employees to

the Amphenol family and look forward to further supporting our customers who are developing next-generation wireless networks around

the world.”

Amphenol expects the OWN and DAS businesses

to generate full-year 2025 sales of approximately $1.3 billion. Post-closing, the acquisition is expected to be approximately $0.06 accretive

to Amphenol’s 2025 earnings per share, which excludes acquisition-related expenses. The OWN and DAS businesses will be included

in the Communications Solutions Segment.

In addition, Amphenol also today announced

the closing of the acquisition of Lifesync Corporation. Lifesync, which generates annual sales of approximately $100 million, is a high-technology

provider of interconnect products for medical applications. Lifesync will be included in the Harsh Environment Solutions Segment.

About Amphenol

Amphenol

Corporation is one of the world’s largest designers, manufacturers and marketers of electrical, electronic and fiber optic connectors

and interconnect systems, antennas, sensors and sensor-based products and coaxial and high-speed specialty cable. Amphenol designs, manufactures

and assembles its products at facilities in approximately 40 countries around the world and sells its products through its own global

sales force, independent representatives and a global network of electronics distributors. Amphenol has a diversified presence as a leader

in high-growth areas of the interconnect market including: Automotive, Commercial Aerospace, Communications Networks, Defense, Industrial, Information

Technology and Data Communications and Mobile Devices. For more information, visit www.amphenol.com.

Forward-Looking Statements

This

press release includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and the

provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934,

as amended. Such forward-looking statements are based on our management’s assumptions and beliefs about future events or circumstances

using information currently available, and as a result, they are subject to risks and uncertainties. Forward-looking statements address

events or developments that Amphenol Corporation expects or believes may or will occur in the future. These forward-looking statements,

which address the Company’s expected business and financial performance and financial condition, among other matters, may contain

words and terms such as: “anticipate,” “believe,” “continue,” “could,” “estimate,”

“expect,” “forecast,” “guidance,” “intend,” “look

ahead,” “may,” “ongoing,” “optimistic,” “plan,” “potential,” “predict,”

“project,” “seek,” “should,” “target,” “will” or “would” and

other words and terms of similar meaning. Forward-looking statements by their nature address matters that are, to different degrees,

uncertain, such as statements about expected earnings, revenues, growth, liquidity, effective tax rate, interest rates, the expected

timing for the closing of certain acquisitions or other matters. Although the Company believes the expectations reflected in all forward-looking

statements, including those we may make regarding expected full year 2025 sales related to OWN/DAS as

well as expected 2025 earnings per share accretion related to the OWN/DAS acquisition, are based upon reasonable assumptions,

the expectations may not be attained or there may be material deviation. Readers and investors are cautioned not to place undue reliance

on these forward-looking statements, which speak only as of the date on which they are made.

There

are risks and uncertainties that could cause actual results to differ materially from these forward-looking

statements, which include, but are not limited to, unanticipated difficulties relating to the OWN/DAS

acquisition, the response of business partners and competitors to the announcement of the closing of the transaction, potential disruptions

to current plans and operations and/or potential difficulties in employee retention as a result of the closing of the OWN/DAS acquisition. Risks

and uncertainties also include the following: political, economic, military and other risks related to operating in countries

outside the United States, as well as changes in general economic conditions, geopolitical conditions, U.S. trade policies (including,

but not limited to, sanctions) and other factors beyond the Company’s control; uncertainties associated with an economic slowdown

or recession in any of the Company’s end markets that could negatively affect the financial condition of our customers and could

result in reduced demand; risks and impacts associated with adverse public health developments, including epidemics and pandemics; risks

associated with our inability to obtain certain raw materials and components, as well as the increasing cost of certain of the Company’s

raw materials and components; cybersecurity threats and techniques used to disrupt operations and gain unauthorized access to our information

technology systems, including, but not limited to, malware, social engineering/phishing, credential harvesting, ransomware, malfeasance

by insiders, human or technological error and other increasingly sophisticated attacks, that continue to expand and evolve, including

through the use of artificial intelligence and machine learning, which could, among other things, impair our information technology systems

and disrupt business operations, result in reputational damage that may cause the loss of existing or future customers, loss of our intellectual

property, the loss of or inability to access confidential information and critical business, financial or other data, and/or cause the

release of highly sensitive confidential information, and potentially lead to litigation and/or governmental investigations, fines and

other penalties, among other risks, and risks and impacts associated with an increasingly demanding regulatory environment surrounding

information security and privacy, including additional fines, penalties and costs; negative impacts caused by extreme weather conditions

and natural catastrophic events, including those caused or intensified by climate change and global warming; risks associated with the

increasing scrutiny and expectations regarding environmental, social and corporate governance matters that could result in additional

costs or risks or otherwise adversely impact our business; risks associated with the improper conduct by any of our employees, customers,

suppliers, distributors or any other business partners which could impair our business reputation and financial results and could result

in our non-compliance with anti-corruption laws and regulations of the U.S. government and various foreign jurisdictions; changes in

exchange rates of the various currencies in which the Company conducts business; the risks associated with the Company’s dependence

on attracting, recruiting, hiring and retaining skilled employees, including as part of our various management teams; risks and difficulties

in trying to compete successfully on the basis of technology innovation, product quality and performance, price, customer service and

delivery time; the Company’s dependence on end market dynamics to sell its products, particularly in the communications, automotive

and defense end markets, pricing pressures resulting from large customers that regularly exert pressure on their suppliers, including

the Company, and changes in defense expenditures of the U.S. and non-U.S. governments, which are subject to political and budgetary fluctuations

and constraints, all of which could adversely affect its operating results; difficulties and unanticipated expenses in connection with

purchasing and integrating newly acquired businesses, including the potential for the impairment of goodwill and other intangible assets;

events beyond the Company’s control that could lead to an inability to meet its financial and other covenants and requirements,

which could result in a default under the Company’s revolving credit facility or any of our various senior notes; risks associated

with the Company’s inability to access the global capital markets on favorable terms, including as a result of significant deterioration

of general economic or capital market conditions, or as a result of a downgrade in the Company’s credit rating; changes in interest

rates; government contracting risks that the Company may be subject to, including laws and regulations governing reporting obligations,

performance of government contracts and related risks associated with conducting business with the U.S. and other foreign governments

or their suppliers (both directly and indirectly); governmental export and import controls as well as sanctions and trade embargoes that

certain of our products may be subject to, including export licensing, customs regulations, economic sanctions and other laws; changes

in fiscal and tax policies, audits and examinations by taxing authorities, laws, regulations and guidance in the United States and foreign

jurisdictions; any difficulties in enforcing and protecting the Company’s intellectual property rights; litigation, customer claims,

voluntary or forced product recalls, governmental investigations, criminal liability or environmental matters including changes to laws

and regulations to which the Company may be subject; and incremental costs, risks and regulations associated with efforts to combat the

negative effects of climate change.

A further description of these uncertainties

and other risks can be found in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, Quarterly

Reports on Form 10-Q and the Company’s other reports filed with the Securities and Exchange Commission. These or other uncertainties

not identified in these documents (that we either currently do not expect to have an adverse effect on our business or that we are unable

to predict or identify at this time) may cause the Company’s actual future results to be materially different from those expressed

in any forward-looking statements. Our forward-looking statements may also be impacted by, among other things, future tax, regulatory

and other legal changes that may arise in any of the jurisdictions in which we operate. The Company undertakes no obligation to update

or revise any forward-looking statements except as required by law.

Contact:

Sherri Scribner

Vice President,

Strategy and Investor Relations

203-265-8820

IR@amphenol.com

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

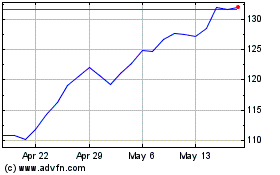

Amphenol (NYSE:APH)

Historical Stock Chart

From Feb 2025 to Mar 2025

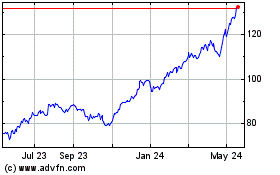

Amphenol (NYSE:APH)

Historical Stock Chart

From Mar 2024 to Mar 2025