false000102186000010218602025-02-042025-02-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): February 4, 2025

NOV INC.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

Delaware |

|

1-12317 |

|

76-0475815 |

(State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

|

|

10353 Richmond Ave. Houston, Texas |

|

77042 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code 346-223-3000

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

☐ |

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

|

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

|

|

☐ |

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

|

|

☐ |

Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock, par value $0.01 per share |

|

NOV |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On February 4, 2025, NOV Inc. issued a press release announcing earnings for the quarter and year ended December 31, 2024 and conference call in connection therewith. A copy of the release is furnished herewith as Exhibit 99.1 and incorporated herein by reference. A presentation to accompany the conference call, which contains certain historical and forward-looking information relating to the Company (the “Presentation Materials”), has been made available on its website at www.nov.com. A copy of the Presentation Materials is attached hereto as Exhibit 99.2 and incorporated herein by reference.

Forward-Looking Statements

This report on Form 8-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such statements are subject to a number of risks, uncertainties and assumptions, including the factors described in the Company’s most recent periodic reports and other documents filed with the Securities and Exchange Commission (the “SEC”), which are available free of charge at the SEC’s website at www.sec.gov or the Company’s website at www.nov.com. The Company cautions you that forward-looking statements are not guarantees of future performance and that actual results or developments may differ materially from those projected or implied in these statements.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

The following exhibits are provided as part of the information furnished under Item 2.02 of this Current Report on Form 8-K:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

Date: February 5, 2025 |

|

|

|

NOV INC. |

|

|

|

|

|

|

|

/s/ Peter F. Vranderic |

|

|

|

|

Peter F. Vranderic |

|

|

|

|

Vice President |

Exhibit 99.1

|

|

NEWS |

Contact: Amie D'Ambrosio (713) 375-3826 |

FOR IMMEDIATE RELEASE

NOV Reports Fourth quarter and Full-Year 2024 eARNINGS

•Fourth quarter net income of $160 million, or $0.41 per diluted share

•Fourth quarter Adjusted EBITDA* of $302 million

•Fourth quarter cash flows from operations of $591 million and Free Cash Flow* of $473 million

•Fourth quarter capital equipment orders of $757 million, representing a book-to-bill of 121%

•Returned $141 million to shareholders during the fourth quarter

•Full-year net income of $635 million, or $1.60 per diluted share

•Full-year Adjusted EBITDA* of $1.11 billion

•Full-year cash flows from operations of $1.30 billion and Free Cash Flow* of $953 million

•Full-year capital equipment orders of $2.75 billion, representing a book-to-bill of 122%

•Returned $337 million to shareholders during the year

* Free Cash Flow, Excess Free Cash Flow and Adjusted EBITDA are non-GAAP measures, see “Non-GAAP Financial Measures,” “Reconciliation of Cash Flows from Operating Activities to Free Cash Flow and Excess Free Cash Flow,” and “Reconciliation of Net Income to Adjusted EBITDA” below.

HOUSTON, TX, February 4, 2025 NOV Inc. (NYSE: NOV) today reported fourth quarter 2024 revenues of $2.31 billion, a decrease of one percent compared to the fourth quarter of 2023. Net income decreased $438 million, or $1.10 per diluted share, year-over-year from $598 million, which included the release of valuation allowances on deferred tax assets of $485 million. Operating profit increased 29 percent to $207 million, or 9.0 percent of sales. The Company recorded $7 million in pre-tax charges within Other Items (see Corporate Information for additional details). Adjusted EBITDA increased three percent year-over-year to $302 million, or 13.1 percent of sales.

Revenues for the full-year 2024 were $8.87 billion, an increase of $287 million from 2023. Net income for the full-year 2024 was $635 million, a decrease of $358 million from $993 million in 2023, which included the release of valuation allowances on deferred tax assets of $485 million. Operating profit increased 35 percent to $876 million, or 9.9 percent of sales for the full-year 2024. Adjusted EBITDA increased 11 percent to $1.11 billion or 12.5 percent of sales for the full-year 2024.

“NOV’s fourth quarter rounded out a solid year during which we grew backlog and revenue, improved profitability, and generated substantial amounts of cash flow,” stated Clay Williams, Chairman, President and CEO. “Full-year revenues improved three percent with 38 percent Adjusted EBITDA flow through, and fully-diluted earnings were $1.60 per share. Our longer-cycle capital equipment businesses increased backlog by seven percent, driven by strong offshore production related demand, while market share gains from new, higher margin technologies and services continue to drive growth and improve profitability.

“Higher levels of profitability combined with normalization of the global supply chain and working capital enabled us to convert 86 percent of our Adjusted EBITDA into Free Cash Flow, and allowed us to increase our cash balance by $414 million and return $337 million in cash to our shareholders, or 41 percent of our Excess Free Cash Flow*. We remain committed to returning at least 50 percent of our Excess Free Cash Flow on an annual basis and expect to achieve that threshold for 2024 via a supplemental dividend in the first half of 2025.

“For 2025, we expect a more challenging macro environment and geopolitical uncertainties to result in flat-to-lower global industry activity. However, we expect that NOV’s growing backlog of higher margin offshore production-related capital equipment, along with continued market adoption of its new technologies, will enable NOV to continue to improve profitability and generate healthy levels of cash flow through the year.”

Energy Products and Services

Energy Products and Services generated revenues of $1.06 billion in the fourth quarter of 2024, a decrease of one percent from the fourth quarter of 2023. Operating profit increased $18 million from the prior year to $112 million, or 10.6 percent of sales, and included $3 million in Other Items. Adjusted EBITDA decreased $20 million from the prior year to $173 million, or 16.3 percent of sales. The decrease in revenue and Adjusted EBITDA was primarily due to lower levels of global drilling activity, but this was partially offset by growing adoption of the Company’s new technologically advanced product offerings.

Energy Equipment

Energy Equipment generated revenues of $1.29 billion in the fourth quarter of 2024, a decrease of one percent from the fourth quarter of 2023. The decline in revenue was due primarily to the divestiture of the Company’s Pole Products business in early 2024 and lower revenue from aftermarket support; however, this was mostly offset by higher revenue from the segment's growing backlog. Operating profit increased $31 million from the prior year to $152 million, or 11.8 percent of sales, and included $4 million in Other Items. Adjusted EBITDA increased $38 million from the prior year to $185 million, or 14.4 percent of sales. Profitability improved due to strong execution on higher margin projects from the segment’s backlog.

New orders booked during the quarter totaled $757 million, representing a book-to-bill of 121 percent when compared to the $628 million shipped from backlog. As of December 31, 2024, backlog for capital equipment orders for Energy Equipment was $4.43 billion, an increase of $279 million from the fourth quarter of 2023.

First Quarter 2025 Outlook

The Company is providing financial guidance for the first quarter of 2025. Guidance is based on current outlook and plans and is subject to a number of known and unknown uncertainties and risks and constitutes “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934 as further described under the Cautionary Statement below. Actual results may differ materially from the guidance set forth below.

For the first quarter of 2025 management expects year-over-year consolidated revenues to be down one to three percent with Adjusted EBITDA between $235 million and $265 million.

Corporate Information

NOV repurchased 7.5 million shares of common stock for $112 million during the fourth quarter. For the full year, the Company repurchased 14.2 million shares of common stock for an aggregate amount of $229 million. Including dividends, NOV returned $337 million in capital to shareholders during 2024. The Company expects to return at least 50 percent of Excess Free Cash Flow (defined as cash flows from operations less capital expenditures and other investments, including acquisitions and divestitures) through a combination of steady, quarterly base dividends, opportunistic stock buybacks, and a supplemental dividend to true-up returns to shareholders on an annual basis.

During the fourth quarter of 2024, NOV recorded $7 million in Other Items, primarily related to severance and facility closure costs (see Reconciliation of Net Income to Adjusted EBITDA).

As of December 31, 2024, the Company had total debt of $1.74 billion, with $1.50 billion available on its primary revolving credit facility, and $1.23 billion in cash and cash equivalents.

Significant Achievements

NOV secured multiple orders for advanced gas processing and water treatment equipment packages on three newbuild floating production storage and offloading (FPSO) units destined for operations in Brazil and West Africa. The scope of work includes technologies and modules for natural gas dehydration, CO2 handling, and produced water treatment. NOV was also awarded a contract to deliver newbuild gas processing modules for the redeployment of an FPSO that will be operated in Turkey. The orders reflect NOV’s strong reputation and position in the offshore production equipment market.

NOV secured a contract to supply a drilling equipment package for a new jack-up rig to be built in Saudi Arabia. The package includes complete topside equipment, structures, drilling machinery, pipe handling, mud processing, and drilling controls, as well as the blowout preventer (BOP) and BOP control system. This award highlights NOV’s extensive experience in delivering complex drilling equipment packages, having successfully delivered more than 220 newbuild jack-up packages to the market over the last 15 years.

NOV was awarded a contract to supply an offshore mooring and injection system for a pioneering Carbon Capture and Storage project offshore Denmark. This project aims to safely and permanently store CO2 in depleted Danish North Sea reservoirs. Leveraging NOV’s extensive expertise in gas and fluid transfer, the offshore injection system will enable direct injection of CO2 from transport vessels to the reservoir. This project represents the first application of NOV technology to offshore CO2 injection and exemplifies the Company’s ability to serve as a critical supplier for advanced carbon capture projects.

NOV secured a contract to deliver Monoethylene Glycol (MEG) recovery and solids separation systems for a large-scale gas treatment facility in the Middle East. The MEG system will enable efficient recovery of hydrate inhibitors used to support production flowline integrity while the proprietary solids separation technology will remove production-related contaminants, thereby enhancing field productivity and operational efficiency. This award highlights NOV’s leadership in delivering innovative production solutions for use in demanding environments.

NOV secured contracts to supply its Bondstrand™ 2400-10C-ECP01 glass-reinforced epoxy (GRE) piping for the critical ballast piping systems across a major energy company’s Liquified Natural Gas (LNG) fleet expansion program. This includes 12 vessels, all of which will use the same innovative design. The order reflects NOV’s expertise in providing advanced composite solutions that enhance the performance and reliability of vessels, positioning the brand as a preferred partner among global LNG carriers.

NOV’s Max™ digital solutions continued to gain traction, with its Max Completions™ monitoring solution supporting frac operations for major operators in the Williston, Eagleford, and Haynesville Basins during the quarter, utilizing Remote Frac Monitoring (RFM) and frac valve positioning sensors to provide real-time well state information and operational visibility. Additionally, NOV secured initial deployments of its new Max Production™ optimization platform, which will leverage predictive analytics to optimize well performance and boost production efficiency. These milestones demonstrate NOV’s ability to deliver value with advanced digital technologies across completion and production operations.

NOV signed a tri-party Memorandum of Understanding (MoU) with the leading operator and a leading drilling contractor in Malaysia to accelerate the implementation of energy-efficient rig technologies, automation, and robotics solutions. The collaboration focuses on deploying NOV’s NOVOS™ automation system and robotics technology on the contractor’s rigs in Malaysia. The operator will provide strategic guidance and scalable opportunities, while the contractor will oversee system deployment and integration, and NOV will deliver the technology, technical support, and training for its advanced robotics and automation technologies that drive operational efficiencies and improve safety.

NOV has been awarded a contract to supply its proprietary static mixer heat transfer technology for a global chemical company’s polyethylene production project. This advanced technology significantly enhances heat exchanger efficiency across a range of applications. This award marks a continuation of a 20-year partnership, during which NOV has delivered a cumulative total of 50 miles of heat transfer inserts to support the customer’s polyethylene production projects.

NOV secured orders for three bespoke Arctic Mast coiled tubing units which will be deployed on the North Slope of Alaska. These orders were the result of months of detailed engineering and collaboration between the service company and NOV. Additionally, NOV delivered five coiled tubing spreads to a multinational well service company. These projects reflect NOV’s leadership in high-specification coiled tubing equipment.

NOV’s Fiber Glass Systems business unit secured multiple project awards from a major engineering, procurement, and construction company for the expansion of a large semiconductor fabrication site. This facility already uses a wide range of NOV’s composite pipes, fittings, and custom fiber-reinforced plastic equipment, including 40 dual laminate composite tanks and vessels NOV manufactured for the project in 2024. The additional awards signify NOV’s position as a trusted supplier of composite solutions for critical applications in the semiconductor industry.

NOV’s 3-1/8” TerraPULSE™ Agitator™ tool was successfully deployed for the first time in Saudi Arabia, marking a significant milestone in the global application of NOV’s unconventional resource and extended lateral-focused technologies. The TerraPULSE tool was run on 2-3/8” coiled tubing in conjunction with a milling bottom hole assembly (BHA) to efficiently mill out 67 composite frac plugs in a 10,000-foot horizontal lateral. Initially developed for the North American unconventional market, this deployment highlights NOV’s ability to deliver enhanced performance in international unconventional developments, further expanding the global reach of its advanced technology solutions.

NOV secured significant awards for Managed Pressure Drilling (MPD) equipment from two major independent offshore drilling contractors. These awards include the delivery of two RGH™ (Riser Gas Handling) systems, designed to safely divert wellbore flow away from the rig floor, enhancing safety and operational efficiency. The initial systems will operate in the Gulf of Mexico. Additionally, NOV was awarded a contract for its advanced offshore MPD system, featuring an integrated riser joint, spare umbilical, and umbilical termination head. This system will support the client’s first MPD well.

Fourth Quarter Earnings Conference Call

NOV will hold a conference call to discuss its fourth quarter 2024 results on February 5, 2025 at 10:00 AM Central Time (11:00 AM Eastern Time). The call will be broadcast simultaneously at www.nov.com/investors. A replay will be available on the website for 30 days.

About NOV

NOV (NYSE: NOV) delivers technology-driven solutions to empower the global energy industry. For more than 150 years, NOV has pioneered innovations that enable its customers to safely produce abundant energy while minimizing environmental impact. The energy industry depends on NOV’s deep expertise and technology to continually improve oilfield operations and assist in efforts to advance the energy transition towards a more sustainable future. NOV powers the industry that powers the world.

Visit www.nov.com for more information.

Non-GAAP Financial Measures

This press release contains certain non-GAAP financial measures that management believes are useful tools for internal use and the investment community in evaluating NOV’s overall financial performance. These non-GAAP financial measures are broadly used to value and compare companies in the oilfield services and equipment industry. Not all companies define these measures in the same way. In addition, these non-GAAP financial measures are not a substitute for financial measures prepared in accordance with GAAP and should therefore be considered only as supplemental to such GAAP financial measures. Additionally, Free Cash Flow and Excess Free Cash Flow do not represent the Company’s residual cash flow available for discretionary expenditures, as the calculation of these measures does not account for certain debt service requirements or other non-discretionary expenditures. Please see the attached schedules for reconciliations of the differences between the non-GAAP financial measures used in this press release and the most directly comparable GAAP financial measures.

This press release contains certain forward-looking non-GAAP financial measures, including Adjusted EBITDA. The Company has not provided a reconciliation of projected Adjusted EBITDA. Management cannot predict with a reasonable degree of accuracy certain of the necessary components of net income, such as other income (expense), which includes fluctuations in foreign currencies. As such, a reconciliation of projected net income to projected Adjusted EBITDA is not available without unreasonable effort. The actual amount of other income (expense), provision (benefit) for income taxes, equity income (loss) in unconsolidated affiliates, depreciation and amortization, and other amounts excluded from Adjusted EBITDA could have a significant impact on net income.

Cautionary Statement for the Purpose of the “Safe Harbor” Provisions of the Private Securities Litigation Reform Act of 1995

Statements made in this press release that are forward-looking in nature are intended to be “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 and may involve risks and uncertainties. Statements that are not historical facts, including statements about our beliefs and expectations, are forward-looking statements. Forward-looking statements typically are identified by use of terms such as “may,” “believe,” “plan,” “will,” “expect,” “anticipate,” “estimate,” “should,” “forecast,” and similar words, although some forward-looking statements are expressed differently. These statements may differ materially from the actual future events or results. Readers are referred to documents filed by NOV with the Securities and Exchange Commission, including the Annual Report on Form 10-K, which identify significant risk factors which could cause actual results to differ from those contained in the forward-looking statements. These statements speak only as of the date of this document, and we undertake no obligation to update or revise the statements, except as may be required by law.

Certain prior period amounts have been reclassified in this press release to be consistent with current period presentation.

CONTACT:

Amie D'Ambrosio

Director, Investor Relations

(713) 375-3826

Amie.DAmbrosio@nov.com

NOV INC.

CONSOLIDATED STATEMENTS OF INCOME (Unaudited)

(In millions, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Year Ended |

|

|

|

December 31, |

|

|

September 30, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2024 |

|

|

2023 |

|

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Energy Products and Services |

|

$ |

1,060 |

|

|

$ |

1,073 |

|

|

$ |

1,003 |

|

|

$ |

4,130 |

|

|

$ |

4,077 |

|

Energy Equipment |

|

|

1,287 |

|

|

|

1,305 |

|

|

|

1,219 |

|

|

|

4,888 |

|

|

|

4,669 |

|

Eliminations |

|

|

(39 |

) |

|

|

(35 |

) |

|

|

(31 |

) |

|

|

(148 |

) |

|

|

(163 |

) |

Total revenue |

|

|

2,308 |

|

|

|

2,343 |

|

|

|

2,191 |

|

|

|

8,870 |

|

|

|

8,583 |

|

Gross profit |

|

|

493 |

|

|

|

497 |

|

|

|

469 |

|

|

|

2,010 |

|

|

|

1,833 |

|

Gross profit % |

|

|

21.4 |

% |

|

|

21.2 |

% |

|

|

21.4 |

% |

|

|

22.7 |

% |

|

|

21.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general, and administrative |

|

|

286 |

|

|

|

336 |

|

|

|

275 |

|

|

|

1,134 |

|

|

|

1,182 |

|

Operating profit |

|

|

207 |

|

|

|

161 |

|

|

|

194 |

|

|

|

876 |

|

|

|

651 |

|

Interest Expense, net |

|

|

(13 |

) |

|

|

(16 |

) |

|

|

(10 |

) |

|

|

(53 |

) |

|

|

(60 |

) |

Equity income (loss) in unconsolidated affiliates |

|

|

(1 |

) |

|

|

18 |

|

|

|

— |

|

|

|

36 |

|

|

|

119 |

|

Other income (expense), net |

|

|

6 |

|

|

|

(28 |

) |

|

|

(10 |

) |

|

|

(28 |

) |

|

|

(98 |

) |

Income before income taxes |

|

|

199 |

|

|

|

135 |

|

|

|

174 |

|

|

|

831 |

|

|

|

612 |

|

Provision (benefit) for income taxes |

|

|

38 |

|

|

|

(460 |

) |

|

|

44 |

|

|

|

196 |

|

|

|

(373 |

) |

Net income |

|

|

161 |

|

|

|

595 |

|

|

|

130 |

|

|

|

635 |

|

|

|

985 |

|

Net income (loss) attributable to noncontrolling interests |

|

|

1 |

|

|

|

(3 |

) |

|

|

— |

|

|

|

— |

|

|

|

(8 |

) |

Net income attributable to Company |

|

$ |

160 |

|

|

$ |

598 |

|

|

$ |

130 |

|

|

$ |

635 |

|

|

$ |

993 |

|

Per share data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.41 |

|

|

$ |

1.52 |

|

|

$ |

0.33 |

|

|

$ |

1.62 |

|

|

$ |

2.53 |

|

Diluted |

|

$ |

0.41 |

|

|

$ |

1.51 |

|

|

$ |

0.33 |

|

|

$ |

1.60 |

|

|

$ |

2.50 |

|

Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

388 |

|

|

|

393 |

|

|

|

392 |

|

|

|

392 |

|

|

|

393 |

|

Diluted |

|

|

390 |

|

|

|

397 |

|

|

|

395 |

|

|

|

396 |

|

|

|

397 |

|

NOV INC.

CONSOLIDATED BALANCE SHEETS (Unaudited)

(In millions)

|

|

|

|

|

|

|

|

|

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

ASSETS |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

1,230 |

|

|

$ |

816 |

|

Receivables, net |

|

|

1,819 |

|

|

|

1,905 |

|

Inventories, net |

|

|

1,932 |

|

|

|

2,151 |

|

Contract assets |

|

|

577 |

|

|

|

739 |

|

Other current assets |

|

|

212 |

|

|

|

229 |

|

Total current assets |

|

|

5,770 |

|

|

|

5,840 |

|

|

|

|

|

|

|

|

Property, plant and equipment, net |

|

|

1,922 |

|

|

|

1,865 |

|

Lease right-of-use assets |

|

|

549 |

|

|

|

544 |

|

Goodwill and intangibles, net |

|

|

2,138 |

|

|

|

2,012 |

|

Other assets |

|

|

982 |

|

|

|

1,033 |

|

Total assets |

|

$ |

11,361 |

|

|

$ |

11,294 |

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

837 |

|

|

$ |

904 |

|

Accrued liabilities |

|

|

861 |

|

|

|

870 |

|

Contract liabilities |

|

|

492 |

|

|

|

532 |

|

Current portion of lease liabilities |

|

|

102 |

|

|

|

94 |

|

Current portion of long-term debt |

|

|

37 |

|

|

|

13 |

|

Accrued income taxes |

|

|

18 |

|

|

|

22 |

|

Total current liabilities |

|

|

2,347 |

|

|

|

2,435 |

|

|

|

|

|

|

|

|

Long-term debt |

|

|

1,703 |

|

|

|

1,712 |

|

Lease liabilities |

|

|

544 |

|

|

|

558 |

|

Other liabilities |

|

|

339 |

|

|

|

347 |

|

Total liabilities |

|

|

4,933 |

|

|

|

5,052 |

|

|

|

|

|

|

|

|

Total stockholders’ equity |

|

|

6,428 |

|

|

|

6,242 |

|

Total liabilities and stockholders’ equity |

|

$ |

11,361 |

|

|

$ |

11,294 |

|

NOV INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

(In millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Years Ended |

|

|

|

December 31, |

|

|

December 31, |

|

|

|

2024 |

|

|

2024 |

|

|

2023 |

|

Cash flows from operating activities: |

|

|

|

|

|

|

Net income |

|

$ |

161 |

|

|

$ |

635 |

|

|

$ |

985 |

|

Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

88 |

|

|

|

343 |

|

|

|

302 |

|

Deferred income taxes |

|

|

(4 |

) |

|

|

49 |

|

|

|

(489 |

) |

Working capital, net |

|

|

304 |

|

|

|

215 |

|

|

|

(584 |

) |

Other operating items, net |

|

|

42 |

|

|

|

62 |

|

|

|

(71 |

) |

Net cash provided by operating activities |

|

|

591 |

|

|

|

1,304 |

|

|

|

143 |

|

|

|

|

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

|

Purchases of property, plant and equipment |

|

|

(118 |

) |

|

|

(351 |

) |

|

|

(283 |

) |

Business acquisitions, net of cash acquired |

|

|

(46 |

) |

|

|

(298 |

) |

|

|

(22 |

) |

Business divestitures, net of cash disposed |

|

|

— |

|

|

|

176 |

|

|

|

— |

|

Other |

|

|

1 |

|

|

|

2 |

|

|

|

12 |

|

Net cash used in investing activities |

|

|

(163 |

) |

|

|

(471 |

) |

|

|

(293 |

) |

|

|

|

|

|

|

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

|

Borrowings against lines of credit and other debt |

|

|

1 |

|

|

|

420 |

|

|

|

184 |

|

Payments against lines of credit and other debt |

|

|

(9 |

) |

|

|

(431 |

) |

|

|

(192 |

) |

Cash dividends paid |

|

|

(29 |

) |

|

|

(108 |

) |

|

|

(79 |

) |

Share repurchases |

|

|

(112 |

) |

|

|

(229 |

) |

|

|

— |

|

Other |

|

|

(22 |

) |

|

|

(58 |

) |

|

|

(16 |

) |

Net cash used in financing activities |

|

|

(171 |

) |

|

|

(406 |

) |

|

|

(103 |

) |

Effect of exchange rates on cash |

|

|

(12 |

) |

|

|

(13 |

) |

|

|

— |

|

Increase (decrease) in cash and cash equivalents |

|

|

245 |

|

|

|

414 |

|

|

|

(253 |

) |

Cash and cash equivalents, beginning of period |

|

|

985 |

|

|

|

816 |

|

|

|

1,069 |

|

Cash and cash equivalents, end of period |

|

$ |

1,230 |

|

|

$ |

1,230 |

|

|

$ |

816 |

|

NOV INC.

RECONCILIATION OF CASH FLOWS FROM OPERATING ACTIVITIES TO FREE CASH FLOW AND EXCESS FREE CASH FLOW (Unaudited)

(In millions)

Presented below is a reconciliation of cash flows from operating activities to “Free Cash Flow” and "Excess Free Cash Flow". The Company defines Free Cash Flow as cash flows from operating activities less purchases of property, plant and equipment, or “capital expenditures” and Excess Free Cash Flow as cash flows from operations less capital expenditures and other investments, including acquisitions and divestitures. Management believes this is important information to provide because it is used by management to evaluate the Company’s operational performance and trends between periods and manage the business. Management also believes this information may be useful to investors and analysts to gain a better understanding of the Company’s results of ongoing operations. Free Cash Flow and Excess Free Cash Flow are not intended to replace GAAP financial measures.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Years Ended |

|

|

|

December 31, |

|

|

December 31, |

|

|

|

2024 |

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

Total cash flows provided by operating activities |

|

$ |

591 |

|

|

$ |

1,304 |

|

|

$ |

143 |

|

Capital expenditures |

|

|

(118 |

) |

|

|

(351 |

) |

|

|

(283 |

) |

Free Cash Flow |

|

$ |

473 |

|

|

$ |

953 |

|

|

$ |

(140 |

) |

Business acquisitions, net of cash acquired |

|

|

(46 |

) |

|

|

(298 |

) |

|

|

(22 |

) |

Business divestitures, net of cash disposed |

|

|

— |

|

|

|

176 |

|

|

|

— |

|

Excess Free Cash Flow |

|

$ |

427 |

|

|

$ |

831 |

|

|

$ |

(162 |

) |

NOV INC.

RECONCILIATION OF NET INCOME TO ADJUSTED EBITDA (Unaudited)

(In millions)

Presented below is a reconciliation of Net Income to Adjusted EBITDA. The Company defines Adjusted EBITDA as Operating Profit excluding Depreciation, Amortization, Gains and Losses on Sales of Fixed Assets, and, when applicable, Other Items. Adjusted EBITDA % is a ratio showing Adjusted EBITDA as a percentage of sales. Management believes this is important information to provide because it is used by management to evaluate the Company’s operational performance and trends between periods and manage the business. Management also believes this information may be useful to investors and analysts to gain a better understanding of the Company’s results of ongoing operations. Adjusted EBITDA and Adjusted EBITDA % are not intended to replace GAAP financial measures, such as Net Income and Operating Profit %. Other Items include gain on business divestiture, impairment, restructure, severance, facility closure costs and inventory charges and credits.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Year Ended |

|

|

|

December 31, |

|

|

September 30, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2024 |

|

|

2023 |

|

Operating profit: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Energy Products and Services |

|

$ |

112 |

|

|

$ |

94 |

|

|

$ |

114 |

|

|

$ |

475 |

|

|

$ |

507 |

|

Energy Equipment |

|

|

152 |

|

|

|

121 |

|

|

|

129 |

|

|

|

608 |

|

|

|

371 |

|

Eliminations and corporate costs |

|

|

(57 |

) |

|

|

(54 |

) |

|

|

(49 |

) |

|

|

(207 |

) |

|

|

(227 |

) |

Total operating profit |

|

$ |

207 |

|

|

$ |

161 |

|

|

$ |

194 |

|

|

$ |

876 |

|

|

$ |

651 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating profit %: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Energy Products and Services |

|

|

10.6 |

% |

|

|

8.8 |

% |

|

|

11.4 |

% |

|

|

11.5 |

% |

|

|

12.4 |

% |

Energy Equipment |

|

|

11.8 |

% |

|

|

9.3 |

% |

|

|

10.6 |

% |

|

|

12.4 |

% |

|

|

7.9 |

% |

Eliminations and corporate costs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Total operating profit % |

|

|

9.0 |

% |

|

|

6.9 |

% |

|

|

8.9 |

% |

|

|

9.9 |

% |

|

|

7.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Items, net: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Energy Products and Services |

|

$ |

3 |

|

|

$ |

50 |

|

|

$ |

3 |

|

|

$ |

7 |

|

|

$ |

53 |

|

Energy Equipment |

|

|

4 |

|

|

|

(1 |

) |

|

|

1 |

|

|

|

(118 |

) |

|

|

(14 |

) |

Corporate |

|

|

— |

|

|

|

6 |

|

|

|

1 |

|

|

|

2 |

|

|

|

12 |

|

Total other items |

|

$ |

7 |

|

|

$ |

55 |

|

|

$ |

5 |

|

|

$ |

(109 |

) |

|

$ |

51 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Gain)/loss on sales of fixed assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Energy Products and Services |

|

$ |

— |

|

|

$ |

1 |

|

|

$ |

1 |

|

|

$ |

— |

|

|

$ |

(1 |

) |

Energy Equipment |

|

|

— |

|

|

|

(1 |

) |

|

|

— |

|

|

|

— |

|

|

|

(4 |

) |

Corporate |

|

|

— |

|

|

|

1 |

|

|

|

— |

|

|

|

— |

|

|

|

2 |

|

Total (gain)/loss on sales of fixed assets |

|

$ |

— |

|

|

$ |

1 |

|

|

$ |

1 |

|

|

$ |

— |

|

|

$ |

(3 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation & amortization: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Energy Products and Services |

|

$ |

58 |

|

|

$ |

48 |

|

|

$ |

54 |

|

|

$ |

221 |

|

|

$ |

183 |

|

Energy Equipment |

|

|

29 |

|

|

|

28 |

|

|

|

29 |

|

|

|

115 |

|

|

|

111 |

|

Corporate |

|

|

1 |

|

|

|

1 |

|

|

|

3 |

|

|

|

7 |

|

|

|

8 |

|

Total depreciation & amortization |

|

$ |

88 |

|

|

$ |

77 |

|

|

$ |

86 |

|

|

$ |

343 |

|

|

$ |

302 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Energy Products and Services |

|

$ |

173 |

|

|

$ |

193 |

|

|

$ |

172 |

|

|

$ |

703 |

|

|

$ |

742 |

|

Energy Equipment |

|

|

185 |

|

|

|

147 |

|

|

|

159 |

|

|

|

605 |

|

|

|

464 |

|

Eliminations and corporate costs |

|

|

(56 |

) |

|

|

(46 |

) |

|

|

(45 |

) |

|

|

(198 |

) |

|

|

(205 |

) |

Total Adjusted EBITDA |

|

$ |

302 |

|

|

$ |

294 |

|

|

$ |

286 |

|

|

$ |

1,110 |

|

|

$ |

1,001 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA %: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Energy Products and Services |

|

|

16.3 |

% |

|

|

18.0 |

% |

|

|

17.1 |

% |

|

|

17.0 |

% |

|

|

18.2 |

% |

Energy Equipment |

|

|

14.4 |

% |

|

|

11.3 |

% |

|

|

13.0 |

% |

|

|

12.4 |

% |

|

|

9.9 |

% |

Eliminations and corporate costs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Total Adjusted EBITDA % |

|

|

13.1 |

% |

|

|

12.5 |

% |

|

|

13.1 |

% |

|

|

12.5 |

% |

|

|

11.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Adjusted EBITDA: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP net income attributable to Company |

|

$ |

160 |

|

|

$ |

598 |

|

|

$ |

130 |

|

|

$ |

635 |

|

|

$ |

993 |

|

Noncontrolling interests |

|

|

1 |

|

|

|

(3 |

) |

|

|

— |

|

|

|

— |

|

|

|

(8 |

) |

Provision (benefit) for income taxes |

|

|

38 |

|

|

|

(460 |

) |

|

|

44 |

|

|

|

196 |

|

|

|

(373 |

) |

Interest expense |

|

|

24 |

|

|

|

23 |

|

|

|

21 |

|

|

|

91 |

|

|

|

88 |

|

Interest income |

|

|

(11 |

) |

|

|

(7 |

) |

|

|

(11 |

) |

|

|

(38 |

) |

|

|

(28 |

) |

Equity (income) loss in unconsolidated affiliates |

|

|

1 |

|

|

|

(18 |

) |

|

|

— |

|

|

|

(36 |

) |

|

|

(119 |

) |

Other (income) expense, net |

|

|

(6 |

) |

|

|

28 |

|

|

|

10 |

|

|

|

28 |

|

|

|

98 |

|

(Gain)/loss on sales of fixed assets |

|

|

— |

|

|

|

1 |

|

|

|

1 |

|

|

|

— |

|

|

|

(3 |

) |

Depreciation and amortization |

|

|

88 |

|

|

|

77 |

|

|

|

86 |

|

|

|

343 |

|

|

|

302 |

|

Other Items, net: |

|

|

7 |

|

|

|

55 |

|

|

|

5 |

|

|

|

(109 |

) |

|

|

51 |

|

Total Adjusted EBITDA |

|

$ |

302 |

|

|

$ |

294 |

|

|

$ |

286 |

|

|

$ |

1,110 |

|

|

$ |

1,001 |

|

NOV Inc. Fourth Quarter and Full Year 2024 Earnings Presentation February 5, 2025 Exhibit 99.2

Safe Harbor / Forward-Looking Statements / Non-GAAP Financial Measures Statements in this presentation, including statements regarding future financial performance, are forward-looking statements within the meaning of the federal securities laws. Statements of hopes, beliefs, expectations, and predictions of future performance are subject to numerous risks and uncertainties, many of which are beyond the Company’s control. Actual results may differ materially from the results expressed or implied by the statements made herein or during any presentation of these materials. There are numerous factors that could adversely impact actual results, which include but are not limited to changes in the demand for or price of oil and/or natural gas; potential catastrophic events related to our operations, including weather events such as the effects of hurricanes and tropical storms or climate regulation; protection of intellectual property rights and against cyber-attacks; compliance with environmental laws; changes in government regulations and regulatory requirements, particularly those related to oil and natural gas exploration; compliance with laws related to income taxes and assumptions regarding the generation of future taxable income; risks of international operations, including risks relating to unsettled political conditions, war, the effects of terrorism, foreign exchange rates and controls, international trade and regulatory controls and sanctions, and doing business with national oil companies; changes in capital spending by customers; and delays or failures by customers to make payments owed to us and the resulting impact on our liquidity. NOV’s latest Form 10-K, Form 10-Q, and other Securities and Exchange Commission filings and published statements contain additional information concerning important risk factors which could cause the company’s results to differ materially from those described in the forward-looking statements. NOV is not undertaking any obligation to revise or update publicly any forward-looking statements for any reason. This presentation contains certain confidential, proprietary, technical and/or financial information related to the Company’s business and operations, including information concerning the Company’s business plans, contractual relationships and financial structure. No part of this presentation may be disclosed to any third party without the prior written consent of the Company. This presentation contains certain forward-looking non-GAAP financial measures, including Adjusted EBITDA. The Company has not provided a reconciliation of projected Adjusted EBITDA. Management cannot predict with a reasonable degree of accuracy certain of the necessary components of net income, such as other income (expense), which includes fluctuations in foreign currencies. As such, a reconciliation of projected net income to projected Adjusted EBITDA is not available without unreasonable effort. The actual amount of other income (expense), provision (benefit) for income taxes, equity income in unconsolidated affiliates, depreciation and amortization, and other amounts excluded from Adjusted EBITDA could have a significant impact on net income. Fourth Quarter 2024 Earnings Presentation © 2025 NOV Inc. All rights reserved.

NOV delivers technology-driven solutions to empower the global energy industry.�For more than 150 years, NOV has pioneered innovations that enable its customers to safely produce abundant energy while minimizing environmental impact. The energy industry depends on NOV’s deep expertise and technology to continually improve oilfield operations and assist in efforts to advance the energy transition�towards a more sustainable future. NOV powers the industry that powers the world. Fourth Quarter 2024 Earnings Presentation © 2025 NOV Inc. All rights reserved. 3

Full Year 2024 Highlights 1 Adjusted EBITDA and Free Cash Flow are non-GAAP financial measures. See appendix for a reconciliation to the nearest GAAP measures. © 2025 NOV Inc. All rights reserved. Fourth Quarter 2024 Earnings Presentation Book-to-Bill Orders of $2.75B 122% Adjusted EBITDA1 38% Incremental margin $1.11B Free Cash Flow1 86% of Adjusted EBITDA $953MM

Awarded order for MEG recovery and solids separation systems for a Middle East gas treatment facility The monoethylene glycol (MEG) system will enable efficient recovery of hydrate inhibitors used to support production flowline integrity while the proprietary solids separation technology will remove production-related contaminants enhancing field productivity and operational efficiency. Significant Achievements Secured contract to supply a drilling equipment package for a new jack-up rig in Saudi Arabia The package includes complete topside equipment, structures, drilling machinery, pipe handling, mud processing, and drilling controls, as well as the blowout preventer (BOP) and BOP control system. This award highlights NOV’s leadership in delivering complex drilling equipment packages, having successfully delivered more than 220 newbuild jack-up packages to the market over the last 15 years. © 2025 NOV Inc. All rights reserved. Fourth Quarter 2024 Earnings Presentation Awarded several orders for gas processing and water treatment equipment packages for FPSO vessels NOV secured multiple orders for advanced gas processing and water treatment equipment packages on three newbuild FPSO units destined for operations in Brazil and West Africa. NOV was also awarded a contract to deliver gas processing modules for the redeployment of an FPSO that will be operated in Turkey.

© 2025 NOV Inc. All rights reserved. Loading/offloading systems Process solutions Chokes and boarding valves Aftermarket support and service Lifting and handling systems Composite pipe, structures, tanks Turret, swivel and moorings, chain stoppers and tensioners Flexible pipe systems and subsea structures Fourth Quarter 2024 Earnings Presentation Offshore Production�Opportunity of $100MM - $700MM per FPSO depending on kit and operating environment

$1.29B $1.06B Energy Products and Services Energy Equipment 1% 16.3% 1% 14.4% Year-on-Year Revenue Adjusted EBITDA % 35% North America 65% International 54% Land 46% Offshore © 2025 NOV Inc. All rights reserved. Fourth Quarter 2024 Earnings Presentation $2.31B NOV 13.1% 1% Form 8-K containing earnings release for the fourth quarter of 2024 and full year ended December 31, 2024. 6% 6% Sequential Revenue 5% Q4 2024 Consolidated Revenue

in millions 4Q24 Sequential Variance Year-Over-Year Variance Revenue $1,060 +6% (1)% Adjusted EBITDA 173 +1% (10)% Adjusted EBITDA % 16.3% -80 bps -170 bps The decrease in revenue and adjusted EBITDA was primarily due to lower levels of global drilling activity, but this was partially offset by growing adoption of the Company’s new technologically advanced product offerings. © 2025 NOV Inc. All rights reserved. Fourth Quarter 2024 Earnings Presentation 49%�Services & Rentals 32%�Capital Equipment 19%�Product Sales 4Q24 Revenue Streams Energy Products and Services Provides critical technologies consumed in the drilling and completion processes

in millions 4Q24 Sequential Variance Year-Over-Year Variance Revenue $1,287 +6% (1)% Adjusted EBITDA 185 +16% +26% Adjusted EBITDA % 14.4% +140 bps +310 bps Ending Backlog 4,428 (1)% +7% Orders, net 757 21% Flat Book-to-Bill 121% © 2025 NOV Inc. All rights reserved. Fourth Quarter 2024 Earnings Presentation Profitability improved due to strong execution on higher margin projects from the segment’s backlog. 57%�Capital Equipment 43%�Aftermarket 4Q24 Revenue Streams Energy Equipment Designs, delivers, and supports advanced drilling, completion, and production solutions

NOV expects to return at least 50% of Excess Free Cash Flow2 © 2025 NOV Inc. All rights reserved. 1 Supplemental dividend is expected to be paid annually beginning in May 2025 to coincide with the annual shareholders meeting subject to the approval of the board of directors. 2 Excess Free Cash Flow is defined as cashflow from operations less capital expenditures and other investments, including acquisitions and divestitures. $337MM Returned to shareholders in FY24, representing 41% of Excess Free Cash Flow Maintain our asset base and invest in organic growth opportunities Enhance strategic growth initiatives Sustainable increases to the base dividend, opportunistic share repurchases, and annual supplemental dividend1 Balance Sheet Capex M&A Return Capital Investment grade rating critical to business model $351MM Capex in FY24 driven by build out of new technologies $122MM Acquisitions net of divestitures in FY24 <1x Net debt leverage ratio <2x Gross debt leverage ratio as of 4Q24 Fourth Quarter 2024 Earnings Presentation Capital Allocation

Year-Over-Year (Q1’24 vs Q1’25) NOV Revenue Down one to three percent Adj. EBITDA $235 million - $265 million EPS Revenue Flat to down two percent Adj. EBITDA $145 million - $165 million EE Revenue Down three to five percent Adj. EBITDA $135 million - $150 million © 2025 NOV Inc. All rights reserved. Fourth Quarter 2024 Earnings Presentation Guidance is based on current outlook and plans and is subject to a number of known and unknown uncertainties and risks and constitutes “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934 as further described under "Safe Harbor / Forward Looking Statements / Non-GAAP Financial Measures". Actual results may differ materially from the guidance set forth above. Outlook: Q1 2025 Outlook

We power the industry that powers the world. © 2025 NOV Inc. All rights reserved. Fourth Quarter 2024 Earnings Presentation Employees1 34K Locations 551 Countries 59 FY 2024 Revenue $8.87B FY 2024 Adjusted EBITDA $1.11B FY 2024 Free cash flow $953MM 1 Full time equivalent workers.

© 2025 NOV Inc. All rights reserved. Fourth Quarter 2024 Earnings Presentation 13 Appendix

Reconciliation of Net Income to Adjusted EBITDA (Unaudited) © 2025 NOV Inc. All rights reserved. Fourth Quarter 2024 Earnings Presentation in millions Three Months Ended Year Ended December 31, September 30, December 31, 2024 2023 2024 2024 2023 Revenue: Energy Products and Services $ 1,060 $ 1,073 $ 1,003 $ 4,130 $ 4,077 Energy Equipment 1,287 1,305 1,219 4,888 4,669 Eliminations (39 ) (35 ) (31 ) (148 ) (163 ) Total revenue 2,308 2,343 2,191 8,870 8,583 Adjusted EBITDA: Energy Products and Services $ 173 $ 193 $ 172 $ 703 $ 742 Energy Equipment 185 147 159 605 464 Eliminations and corporate costs (56 ) (46 ) (45 ) (198 ) (205 ) Total Adjusted EBITDA $ 302 $ 294 $ 286 $ 1,110 $ 1,001 Adjusted EBITDA %: Energy Products and Services 16.3 % 18.0 % 17.1 % 17.0 % 18.2 % Energy Equipment 14.4 % 11.3 % 13.0 % 12.4 % 9.9 % Eliminations and corporate costs — — — — — Total Adjusted EBITDA % 13.1 % 12.5 % 13.1 % 12.5 % 11.7 % Reconciliation of Adjusted EBITDA: GAAP net income attributable to Company $ 160 $ 598 $ 130 $ 635 $ 993 Noncontrolling interests 1 (3 ) — — (8 ) Provision (benefit) for income taxes 38 (460 ) 44 196 (373 ) Interest expense 24 23 21 91 88 Interest income (11 ) (7 ) (11 ) (38 ) (28 ) Equity (income) loss in unconsolidated affiliate 1 (18 ) — (36 ) (119 ) Other (income) expense, net (6 ) 28 10 28 98 (Gain)/loss on sales of fixed assets — 1 1 — (3 ) Depreciation and amortization 88 77 86 343 302 Other Items, net: 7 55 5 (109 ) 51 Total Adjusted EBITDA $ 302 $ 294 $ 286 $ 1,110 $ 1,001

Reconciliation of Cash Flows from Operating Activities to Free Cash Flow (Unaudited) © 2025 NOV Inc. All rights reserved. Fourth Quarter 2024 Earnings Presentation in millions Three Months Ended Years Ended December 31, December 31, 2024 2024 2023 Total cash flows provided by operating activities $ 591 $ 1,304 $ 143 Capital expenditures (118 ) (351 ) (283 ) Free Cash Flow $ 473 $ 953 $ (140 ) Business acquisitions, net of cash acquired (46) (298) (22) Business divestitures, net of cash disposed - 176 - Excess Free Cash Flow $ 427 $ 831 $ (162)

© 2025 NOV Inc. All rights reserved. Fourth Quarter 2024 Earnings Presentation

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

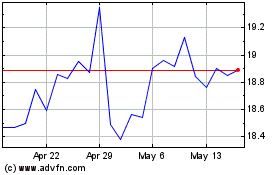

NOV (NYSE:NOV)

Historical Stock Chart

From Jan 2025 to Feb 2025

NOV (NYSE:NOV)

Historical Stock Chart

From Feb 2024 to Feb 2025