UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of August, 2024.

Commission File Number 001-38755

Suzano S.A.

(Exact name of registrant as specified in its charter)

SUZANO INC.

(Translation of Registrant’s Name into English)

Av. Professor Magalhaes Neto, 1,752

10th Floor, Rooms 1010 and 1011

Salvador, Brazil 41 810-012

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☑ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Enclosures:

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: August 15, 2024

| | | | | | | | |

| | SUZANO S.A. |

| | |

| By: | /s/ Marcelo Feriozzi Bacci |

| Name: | Marcelo Feriozzi Bacci |

| Title: | Chief Financial and Investor Relations Officer |

SUZANO S.A.

Publicly Held Company

CNPJ/MF No. 16.404.287/0001-55

NIRE No. 29.300.016.331

MINUTES OF THE EXTRAORDINARY BOARD OF DIRECTORS’ MEETING

HELD ON AUGUST 15th, 2024

1. Date, Time, and Venue: On August 15th, 2024, at 9:00 am, through the Company’s videoconference system, a meeting of its Board of Directors (“Board”) was held.

2. Attendance: The following Directors attended the Meeting, representing its entirety: David Feffer (Chairman of the Board of Directors), Daniel Feffer (Vice-Chairman of the Board of Directors), Nildemar Secches (Vice-Chairman of the Board of Directors), Gabriela Feffer Moll, Maria Priscila Rodini Vansetti Machado, Paulo Rogerio Caffarelli, Paulo Sergio Kakinoff, Rodrigo Calvo Galindo and Walter Schalka. Also attended the meeting, as guests, Mrs. José Alberto de Abreu, President, Marcelo Feriozzi Bacci, Finance and Investor Relations Executive Officer and Mr. Marcos Moreno Chagas Assumpção, as secretary.

3. Call: The meeting has been timely called under article 13 of the Company’s Bylaws and clause 6.1 of the Board’s Internal Regulations.

4. Chairman and Secretary: The meeting was chaired by Mr. David Feffer and Mr. Marcos Moreno Chagas Assumpção acted as secretary.

5. Agenda: To resolve on and authorize: (i) the subsidiary of the Company named Suzano International Finance B.V. (“Suzano International”), (a) to establish and register a program for the issuance of debt instruments denominated in Renminbi, with an aggregate amount of up to RMB20,000,000,000.00 (twenty billion Renminbi) (“Program”), under which Suzano International may issue debt instruments denominated in Renminbi (“Panda Bonds”), of which all payment obligations of Suzano International will be guaranteed by the Company, in the interbank bond market of the People’s Republic of China; (b) to carry out a financial operation with an aggregate amount of up to RMB1,200,000,000.00 (one billion and two hundred million Renminbi), with a maturity term of up to 3 (three) years, which will be carried out through the issuance of debt securities for placement on the Chinese market, under the terms of the Program ("Bond Issuance"); (c) to use the funds raised in full from the Bond Issue for the operational activities necessary for the development of eucalyptus forest plantation in Brazil for commercial use, with internationally recognized forest certifications, and the proceeds from the Bond Issue will not be used for the purchase of land or payment of labor remuneration (“Use of Proceeds”); (d) the Company's Board of Officers to decide, at its sole discretion, on the convenience and opportunity of carrying out the Bond Issue, and on the other characteristics of such operation, including, but not limited to, the interest payment term and maturity of the securities, subject to the registration of the Program and

(Continuation of the Minutes of the Extraordinary of the Board of Director’s Meeting of Suzano S.A., held on August 15, 2024)

the approval of the Bond Issue by the National Association of Financial Market Institutional Investors of China (“NAFMII”) and other applicable bodies; (ii) the granting, by the Company, of a corporate guarantee for the obligations to be assumed by Suzano International within the scope of the Bond Issue and the Panda Bonds to be issued under the Program; (iii) the Company’s Board of Officers, Suzano International and the Company to carry out derivative operations in a total aggregate amount equal to the amount of the Bond Issue; and (iv) the Company’s Board of Officers, Suzano International, the Company and other subsidiaries of the Company to take all the steps necessary to formalize and effect the resolutions set forth in the preceding items, if approved, including the negotiation, execution, formalization and, as necessary to comply with regulatory obligations under the Program and the Bond Issue, publication and/or disclosure of all the following documents (“Transaction Documents”): (a) Base Offering Circular to be entered into under the Program, and updated from time to time during the term of the Program; (b) Supplemental Offering Circular to be entered into under the Bond Issue and each subsequent issue of Panda Bonds issued under the Program; (c) the Program-Level Underwriting Agreement; (d) the Supplemental Underwriting Agreement, to be entered into for each Panda Bond issued under the Program; (e) the Letter of Guarantee to be issued by the Company in guarantee of the Panda Bonds to be issued under the Program; and (f) such other documents, notices, amendments and forms as may be necessary or required for the execution of the Bond Issue and/or the Program.

6. Minutes in Summary Form: The Directors, unanimously and without reservations, resolved to draw up these minutes in summary form.

7. Resolutions: The attending Directors, with a favorable opinion from the Management and Finance Committee, unanimously and without reservations, decided to:

7.1. Approve the establishment and registration of the Program; (b) the Bond Issuance; (c) the Use of Proceeds; and (d) the Company's Board of Officers to decide, at its sole discretion, on the convenience and opportunity of carrying out the Bond Issuance, and on the other characteristics of such operation, including, but not limited to, the interest payment term and the maturity of the bonds, subject to the registration of the Program and the approval of the Bond Issuance by NAFMII and other applicable bodies.

7.2. Approve the granting by the Company of a corporate guarantee for the obligations to be assumed by Suzano International under the Bond Issue and the Panda Bonds to be issued under the Program.

7.3. Authorize the Company’s Board of Officers, Suzano International and the Company to carry out derivative operations in a total aggregate amount equal to the amount of the Bond Issue contracted in item (i), being authorized to carry out derivatives in an amount greater than that contracted in item (i) only and exclusively for the readjustment of the total amount hedged to the debt amount in case of possible events of early payment of its principal amount.

(Continuation of the Minutes of the Extraordinary of the Board of Director’s Meeting of Suzano S.A., held on August 15, 2024)

7.4. Authorize the Company’s Board of Officers, Suzano International, the Company and other subsidiaries of the Company to take all the steps necessary to formalize and effect the resolutions set forth in the preceding items, including (a) the negotiation, execution, formalization and, as necessary to comply with regulatory obligations under the Program and the Bond Issue, publication and/or disclosure of all Transaction Documents; (b) any and all documents necessary for the registration of the Program and the Bond Issue with the NAFMII, in accordance with the laws and regulations of the People's Republic of China; and (c) the hiring of service providers, including the legal advisors, the independent auditors, the green certification provider, Chengxin International Credit Rating Co. , Ltd. and the appointment of the underwriters.

8. Closing: There being no further matters to be discussed, the meeting was closed. The minutes of the Meeting were drafted, read, and will be signed electronically by all the Board members taking part, with the signatures having retroactive effect to the date of the meeting. It is noted that the documents and presentations that underpinned the matters discussed at this meeting have been archived on the Governance Portal. Signatures: Board Members: David Feffer, Daniel Feffer, Nildemar Secches, Gabriela Feffer Moll, Maria Priscila Rodini Vansetti Machado, Paulo Rogerio Cafarelli, Paulo Sergio Kakinoff, Rodrigo Calvo Galindo e Walter Schalka. This is a true copy of the original minutes drawn up in the Company’s records.

São Paulo, SP, August 15th, 2024.

_________________________________

Marcos Moreno Chagas Assumpção

Secretary

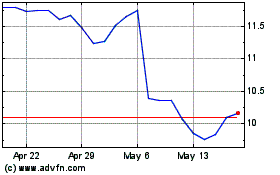

Suzano (NYSE:SUZ)

Historical Stock Chart

From Sep 2024 to Oct 2024

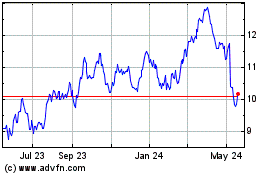

Suzano (NYSE:SUZ)

Historical Stock Chart

From Oct 2023 to Oct 2024