Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

31 August 2024 - 7:02AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of August, 2024.

Commission File Number 001-38755

Suzano S.A.

(Exact name of registrant as specified in its charter)

SUZANO INC.

(Translation of Registrant’s Name into English)

Av. Professor Magalhaes Neto, 1,752

10th Floor, Rooms 1010 and 1011

Salvador, Brazil 41 810-012

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☑ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Enclosures:

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: August 30th, 2024

| | | | | | | | |

| | SUZANO S.A. |

| | |

| By: | /s/ Marcelo Feriozzi Bacci |

| Name: | Marcelo Feriozzi Bacci |

| Title: | Chief Financial and Investor Relations Officer |

SUZANO S.A.

Publicly Held Company

Corporate Taxpayer ID (CNPJ/MF) No. 16.404.287/0001-55

Company Registry (NIRE) 29.3.0001633-1

MATERIAL FACT

São Paulo, August 30th, 2024 – Suzano S.A. (“Company”) (B3: SUZB3 / NYSE: SUZ), in compliance with the provisions of Law No. 6,404, dated as of December 15th, 1976, as amended, of CVM Resolution No. 44, dated as of August 23rd, 2021, and of CVM Resolution No. 80, dated as of March 29th, 2022, as amended, in line with corporate governance best practices, and in addition to the information disclosed through the Material Fact of June 12th, 2024, hereby informs its shareholders and the market in general the conclusion, on this date, of the acquisition by the Company of a minority stake of 15.00% (fifteen percent) of the shares of Lenzing Aktiengesellschaft (“Lenzing”) held by B&C Group (“B&C”) (“Transaction”), since the applicable conditions for the acquisition of the aforementioned minority stake have been fulfilled.

On this date, the Shareholders Agreement becomes effective, establishing the main terms of the partnership between the Company and B&C, including:

a.the right of Suzano to hold two seats on Lenzing’s Supervisory Board; and

b.the right of Suzano to alter the controlling position of Lenzing through the acquisition of an additional 15.00% (fifteen percent) of the shares of Lenzing held by B&C as part of a mandatory takeover offer to be conducted by Suzano for all shares of Lenzing in accordance with the Austrian Takeover Law at a price to be determined also in accordance with the requirements of the same Law. This right may be exercised by Suzano from the day following the first anniversary of the Closing of the Transaction until the end of 2028.

In consideration for the acquired shares, the Company settled the Transaction on this date, at the price, as informed to the market in advance, of EUR 39.70 (thirty-nine Euros and seventy cents) per share, with a total acquisition purchase price of EUR 229,971,261.90 (two hundred twenty-nine million nine hundred seventy-one thousand two hundred and sixty-one Euros and ninety cents).

Lenzing is a global specialty fiber company headquartered in Lenzing, Austria, with manufacturing facilities strategically located across the world. Renowned for its sustainable practices, Lenzing specializes in producing wood-based cellulose fibers (lyocell, modal and viscose). With an annual production capacity exceeding 1 million tons, it leads the industry in eco-friendly fiber production. Lenzing´s fibers are utilized in various applications, including clothing, home textiles, hygiene products, and non-woven materials. Such a company is committed to innovation and environmental stewardship, which underscores its position as a leader in the sustainable textile industry.

The Company reiterates that the Transaction is aligned with the wide public knowledge of Suzano’s strategic avenues to “Expand Boldly into New Markets” and “Play a Leading Role in Sustainability”, representing its long-term confidence in value creation through competitive and scalable operations of sustainable wood-based textiles.

The Company reinforces that the Transaction does not have materiality to its financial leverage and/or indebtedness.

Lastly, as per information disclosed in this Material Fact, Suzano reiterates its commitment to keep shareholders and the market in general informed about matters of interest to its shareholders and the market.

São Paulo, August 30th, 2024.

Marcelo Feriozzi Bacci

Chief Financial and Investor Relations Officer

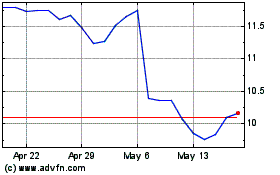

Suzano (NYSE:SUZ)

Historical Stock Chart

From Sep 2024 to Oct 2024

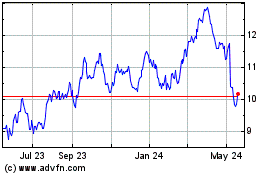

Suzano (NYSE:SUZ)

Historical Stock Chart

From Oct 2023 to Oct 2024