Microbix Biosystems Inc. (

TSX: MBX, OTCQX: MBXBF,

Microbix®), a life sciences innovator, manufacturer, and

exporter, reports results for its first quarter of fiscal 2024

ended December 31, 2023 (“

Q1”), with record

quarterly revenues and a record quarterly profit, reflective of

ongoing progress to increase sales from its diagnostic-test related

ingredients and devices, and material licensing revenues from its

fully-funded program to revalidate and relaunch its approved drug,

Kinlytic® urokinase (“

Kinlytic”).

Management DiscussionResults

for Q1 demonstrate strong growth in sales of each of Microbix’s

test ingredients (“Antigens”) and its test quality

assessment products (“QAPs™”), which were

collectively up by 80% year-over-year. In addition, Microbix

recognized and received material licensing payments relating to

Kinlytic. Collectively, the resulting revenues of over C$ 8.4

million led to strong net earnings and set the stage for a record

full-year fiscal 2024. Microbix believes sales growth will continue

for Antigens and QAPs, alongside satisfaction with the progress of

Kinlytic toward FDA re-approval and re-launch into the United

States market.

Quarter Ending December 31, 2023

(“Q1”)

Q1 revenue was $8,407,884, a 236% increase from

Q1 2023 revenues of $2,502,072. Antigen sales grew by 95% to

$1,953,677 (Q1 F2023 - $1,003,608), while QAPs grew by 69% to

$2,248,236 (Q1 F2023 - $1,333,503). Revenue from royalties

decreased to $119,311 (Q1 F2023 - $164,762). Q1 revenues were also

greatly influenced by the recognition of $4,086,000 in Kinlytic

licensing milestone payments (Q1 F2023 – nil).

Q1 gross margin was 74%, significantly up from

Q1 2023 gross margins of 47%. Gross margins were primarily impacted

by Kinlytic licensing revenues, to which no COGS were attached.

Without the impact of the Kinlytic licensing revenues, our gross

margins of 49% were up from 47% last year.

Operating and finance expenses in Q1 increased

by 52% relative to Q1 2023 principally due to consulting fees

related to our Kinlytic licensing agreement that were absorbed into

G&A. In addition, Q1 costs reflect the ongoing costs of our new

IT systems which began in the latter half of fiscal 2023, and

amortization relating to the reversal of the impairment of the

Kinlytic intangible asset which began at the end of fiscal

2023.

Increased sales and higher gross margins were

partially offset by increased operating expenses (due to increased

investment into business growth and infrastructure). The above

results led to a Q1 operating income and net income of $2,455,379

versus a Q1 2023 operating loss and net loss of ($1,299,262). Cash

provided by operating activities was $1,338,952, compared to cash

used in operating activities of ($713,867) in Q1 2023.

At the end of Q1, Microbix’s current ratio

(current assets divided by current liabilities) was 8.53 and its

debt to equity ratio (total debt over shareholders’ equity) was

0.35, both measures having improved from the prior year first

quarter (Q1 2023) and the immediately preceding fourth quarter (Q4

2023).

|

Financial Highlights |

|

|

|

|

| |

|

|

|

|

| As at and

for the quarter ended |

December 31,

2023 |

|

December 31,

2022 |

|

|

|

|

|

|

|

|

Total Revenue |

$ |

8,407,884 |

|

$ |

2,502,072 |

|

|

| |

|

|

|

|

|

Gross Margin |

|

6,222,331 |

|

|

1,185,975 |

|

|

|

SG&A Expenses |

|

3,168,248 |

|

|

1,963,201 |

|

|

|

R&D Expense |

|

484,219 |

|

|

424,958 |

|

|

|

Financial Expenses |

|

114,485 |

|

|

97,078 |

|

|

| |

|

|

|

|

| Operating

Income for the period |

|

2,455,379 |

|

|

(1,299,262 |

) |

|

| Net Income

and Comprehensive Income for the period |

|

2,455,379 |

|

|

(1,299,262 |

) |

|

| |

|

|

|

|

| Cash

Provided (Used) by Operating Activities |

|

1,338,952 |

|

|

(713,867 |

) |

|

| |

|

|

|

|

| |

December 31,

2023 |

|

September 30,

2023 |

|

| |

|

|

|

|

|

Cash |

|

12,782,855 |

|

|

11,606,487 |

|

|

|

Accounts receivable |

|

3,806,759 |

|

|

4,119,771 |

|

|

|

Total current assets |

|

23,701,362 |

|

|

22,302,006 |

|

|

|

Total assets |

|

36,706,649 |

|

|

35,653,024 |

|

|

|

Total current liabilities |

|

2,778,229 |

|

|

4,349,942 |

|

|

|

Total liabilities |

|

9,481,092 |

|

|

11,028,537 |

|

|

|

Total shareholders' equity |

|

27,225,557 |

|

|

24,624,487 |

|

|

|

Current ratio |

|

8.53 |

|

|

5.13 |

|

|

|

Debt to equity ratio |

|

0.35 |

|

|

0.45 |

|

|

| |

|

|

|

|

Corporate OutlookMicrobix will

continue to drive sales growth across all of its business lines,

and work to keep improving percentage gross margins and driving

bottom-line results. Management currently expects Microbix to

generate meaningful year-over-year growth in revenues and net

earnings across full-year fiscal 2024.

Adelaide Capital will host a live webinar with

management, on Wednesday, February 14 at 10am ET. Please register

here:

https://us02web.zoom.us/webinar/register/WN_N3yHVFwcQNq0bA3MeJHPSg

.

It will also be live-streamed to YouTube at:

https://www.youtube.com/channel/UC7Jpt_DWjF1qSCzfKlpLMWw.

A replay of the webinar will also be made available

on Adelaide Capital’s YouTube channel.

About Microbix Biosystems

Inc.Microbix Biosystems Inc. creates proprietary

biological products for human health, with over 100 skilled

employees and annualized sales targeting C$ 2.0 million per month.

It makes a wide range of critical ingredients and devices for the

global diagnostics industry, notably antigens for immunoassays and

its laboratory quality assessment products (QAPs™) that support

clinical lab proficiency testing, enable assay development and

validation, or help ensure the quality of clinical diagnostic

workflows. Its antigens drive the antibody tests of approximately

100 diagnostics makers, while QAPs are sold to clinical lab

accreditation organizations, diagnostics companies, and clinical

labs. Microbix QAPs are now available in over 30 countries,

supported by a network of international distributors. Microbix is

ISO 9001 & 13485 accredited, U.S. FDA registered, Australian

TGA registered, Health Canada establishment licensed, and provides

CE marked products.

Microbix also applies its biological expertise

and infrastructure to develop other proprietary products and

technologies, most notably Kinlytic® urokinase, a biologic

thrombolytic drug used to treat blood clots, and viral transport

medium (DxTM™), to stabilize patient samples for lab-based

molecular diagnostic testing. Microbix is traded on the TSX and

OTCQX, and headquartered in Mississauga, Ontario, Canada.

Forward-Looking InformationThis

news release includes “forward-looking information,” as such term

is defined in applicable securities laws. Forward-looking

information includes, without limitation, discussion of financial

results or the outlook for the business, risks associated with its

financial results and stability, its current or future products,

development projects such as those referenced herein, sales to

foreign jurisdictions, engineering and construction, production

(including control over costs, quality, quantity and timeliness of

delivery), foreign currency and exchange rates, maintaining

adequate working capital and raising further capital on acceptable

terms or at all, and other similar statements concerning

anticipated future events, conditions or results that are not

historical facts. These statements reflect management’s current

estimates, beliefs, intentions, and expectations; they are not

guarantees of future performance. The Company cautions that all

forward looking information is inherently uncertain, and that

actual performance may be affected by many material factors, some

of which are beyond the Company’s control. Accordingly, actual

future events, conditions and results may differ materially from

the estimates, beliefs, intentions, and expectations expressed or

implied in the forward-looking information. All statements are made

as of the date of this news release and represent the Company’s

judgement as of the date of this new release, and the Company is

under no obligation to update or alter any forward-looking

information.

Please visit www.microbix.com or

www.sedarplus.ca for recent Microbix news and filings.

For further information, please contact Microbix

at:

|

Cameron Groome, CEO(905) 361-8910 |

Jim Currie, CFO(905) 361-8910 |

Deborah Honig, Investor RelationsAdelaide Capital Markets(647)

203-8793 ir@microbix.com |

Copyright © 2024 Microbix Biosystems Inc.

Microbix®, DxTM™, Kinlytic®, & QAPs™ are trademarks of Microbix

Biosystems Inc.

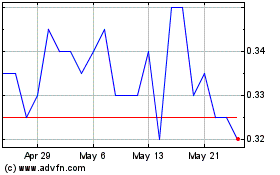

Microbix Biosystems (TSX:MBX)

Historical Stock Chart

From Dec 2024 to Jan 2025

Microbix Biosystems (TSX:MBX)

Historical Stock Chart

From Jan 2024 to Jan 2025