Sprott Resource Holdings Inc. Provides Update on Strategic Review by Independent Board Members

19 February 2020 - 1:00AM

Sprott Resource Holdings Inc. (“

SRHI” or the

“

Company”) (TSX: SRHI) provides an update on the

strategic review by the Special Committee of the Board of Directors

(the “

Board”).

On February 11, 2019, the Company announced that

in consultation with its significant shareholders including Sprott

Inc., the Board formed a Special Committee of the Board

comprised of four Independent Directors and chaired by

Terry Lyons, the Chairman of the Board. The Special

Committee reviewed and evaluated potential measures to address

the Company's market valuation, with the aim of maximizing

shareholder value. The Special Committee engaged financial and

legal advisors to assist in its evaluation.

During the period of strategic review, the

Special Committee oversaw a change in the Chief Executive Officer

and divested holdings in non-core assets of Virginia Energy

Resources Inc. and InPlay Oil Corp. For an extended period, it

was also restricted from seeking potential partners for the Minera

Tres Valles (“MTV”) asset as the Company

negotiated and completed the $45 million prepaid facility (the

“Facility”) with the lenders to MTV.

The Special Committee has been dissolved but its

strategic review continues at the Board level. The conclusion of

the Special Committee was to complete a transition to focus the

Company’s investment thesis as a pure-play copper-mining company,

to continue to pursue alternatives to divesting its portfolio of

investments in order to further support MTV and to continue to look

for strategic alternatives for the Company.

SRHI continues to hold an investment in Corsa

Coal Corp (CSO:TSXV) valued at $4.1 million as at February 13,

2020. Alternatives for this block are being considered. In

addition, SRHI has investments in Beretta Farms Inc.

(“Beretta”) and Lac Otelnuk Mining Ltd.

(“Lac Otelnuk”). SRHI continues to look for

opportunities to monetize its investment in Beretta and in

conjunction with our partner BaoWu Steel, SRHI is taking steps to

unwind the Lac Otelnuk joint venture and return capital to the

partners, of which a wholly-owned subsidiary of SRHI is a 40%

partner.

As part of its mandate, the Special Committee

reviewed certain strategic alternatives relating to the Company’s

interest in MTV, but ultimately it was determined that the ongoing

efforts to optimize operations and better capitalize MTV provided

the best potential to maximize shareholder value. Following

the execution of the Facility, the Board is investigating strategic

alternatives for MTV. There is no guarantee that the Company

will reach resolution on the strategic alternatives for MTV.

With the continued support of Sprott Inc., the

Company has reached an agreement to amend the Management Services

Agreement (“MSA”) with Sprott Consulting

Limited Partnership (“SCLP”, a 100% owned entity

of Sprott Inc.) whereby SCLP will continue to provide management

services, eliminating the management fee and reducing the

termination notice period as described in the MSA to three months;

in return the Company will bear some of the direct costs of

SCLP-provided management representing a significant cost savings to

the Company.

About Sprott Resource Holdings Inc.

SRHI is a publicly-listed diversified resource

holding company focused on the natural resource industry. SRHI is

currently focused on expanding its cash-flowing copper mining

operation in Chile and divesting of its legacy investments. Based

in Toronto, SRHI is part of the Sprott Group of Companies and seeks

to deploy capital to provide our investors with exposure to

attractive commodities. For more information about SRHI, please

visit www.sprottresource.com.

Cautionary Statement Regarding Forward-Looking

Information

Certain statements in this news release, contain

forward-looking information (collectively referred to herein as the

"Forward-Looking Statements") within the meaning

of applicable Canadian securities laws, including statements

pertaining to: the outcome of SRHI’s strategic review including in

respect of its investments in Beretta and Lac Otelnuk and success

in SRHI’s strategic alternatives for MTV.

Although SRHI believes that the Forward-Looking

Statements are reasonable, they are not guarantees of future

results, performance or achievements. A number of factors or

assumptions have been used to develop the Forward-Looking

Statements, including there being no significant disruptions

affecting the development and operation of MTV; the availability of

certain consumables (including water) and services and the prices

for power, acid and other key supplies being approximately

consistent with assumptions in the Technical Studies; labour and

materials costs being approximately consistent with assumptions in

the Technical Studies; fixed operating costs being approximately

consistent with assumptions in the Technical Studies; the

availability of financing for MTV’s planned development activities;

assumptions made in mineral resource and mineral reserve estimates

and the financial analysis based on the mineral reserve estimate

and in the case of the PEA, the mineral resource estimate,

including (as applicable), but not limited to, geological

interpretation, grades, commodity price assumptions, metallurgical

performance, extraction and mining recovery rates, hydrological and

hydrogeological assumptions, capital and operating cost estimates,

and general marketing, political, business and economic

conditions.

Actual results, performance or achievements

could vary materially from those expressed or implied by the

Forward-Looking Statements should assumptions underlying the

Forward-Looking Statements prove incorrect or should one or more

risks or other factors materialize, including:

possible variations in grade or recovery rates; copper price

fluctuations and uncertainties; delays in obtaining governmental

approvals or financing; risks associated with the mining industry

in general (e.g., operational risks in development, exploration and

production; delays or changes in plans with respect to exploration

or development projects or capital expenditures; the uncertainty of

estimates and projections relating to mineral reserves, production,

costs and expenses; and labour, health, safety and environmental

risks) and risks associated with the other portfolio companies'

industries; performance of the counterparties; risks associated

with investments in emerging markets; general economic, market and

business conditions; market volatility that would affect the

ability to enter or exit investments; failure to secure financing

in the future on terms acceptable to the Company, if at all;

commodity price fluctuations and uncertainties; the financial

situation of MTV deteriorates; the inability of SRHI to deal with

its investments in Beretta and Lac Otelnuk as expected; and a lack

of success in SRHI’s strategic alternatives for MTV; those risks

disclosed under the heading "Risk Management" in SRHI’s

Management’s Discussion and Analysis for the three and nine-months

ended September 30, 2019; and those risks disclosed under the

heading "Risk Factors" or incorporated by reference into SRHI’s

Annual Information Form dated March 6, 2019. The

Forward-Looking Statements speak only as of the date hereof, unless

otherwise specifically noted, and SRHI does not assume any

obligation to publicly update any Forward-Looking Statements,

whether as a result of new information, future events or otherwise,

except as may be expressly required by applicable Canadian

securities laws.

Investor contact information:

Michael HarrisonInterim CEO and Director(416)

543-8487mharrison@sprott.com

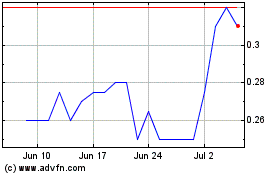

Corsa Coal (TSXV:CSO)

Historical Stock Chart

From Dec 2024 to Jan 2025

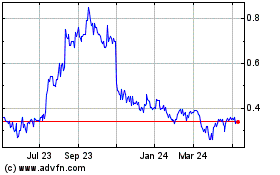

Corsa Coal (TSXV:CSO)

Historical Stock Chart

From Jan 2024 to Jan 2025