Kutcho Copper Expands High-grade Mineral Resources

04 March 2019 - 11:30PM

InvestorsHub NewsWire

Kutcho Copper

Expands High-grade Mineral Resources to 17.26 MT of Measured &

Indicated at 2.61% CuEq1 and 10.71MT of Inferred at

1.67% CuEq1;

Kutcho Copper

Expands High-grade Mineral Resources to 17.26 MT of Measured &

Indicated at 2.61% CuEq1 and 10.71MT of Inferred at

1.67% CuEq1;

Outlines Additional Near Resource

Targets

Vancouver, B.C. --

March 4th, 2019 -- InvestorsHub NewsWire -- Kutcho Copper Corp.

(TSXV: KC) (OTC: KCCFF)

(“Kutcho Copper” or the “Company”) is pleased to

provide an updated mineral resource estimate that will be used as

the basis for its upcoming Feasibility Study on its 100% owned

Kutcho high grade copper-zinc project located in British Columbia

(“Kutcho Project”). The mineral resource estimate was prepared

under the direction of Robert Sim, P.Geo, with the assistance of

Bruce Davis, PhD, FAusIMM, by SIM Geological Inc.

(SGI).

“We are

pleased to announce an updated mineral resource estimate for the

Kutcho Project that incorporates the significant work and new

drilling conducted by Kutcho Copper during our first full year of

ownership. The updated mineral resource includes a substantial 84%

increase in inferred mineral resources compared to the 2017

resource estimate*. In addition, there remains significant

exploration potential between, below and along strike from the

existing mineral resources, providing further upside opportunities

to grow the size of the project. This expanded mineral resource

will form the foundation for the Feasibility

Study, which is slated to be

completed in Q2/Q3 2019”, stated Vince Sorace, President & CEO

of Kutcho

Copper.

Kutcho Project - Estimate of

Mineral Resources

| Class |

Tonnes

(000) |

CuEq

(%) |

Cu

(%) |

Zn

(%) |

Au

(g/t) |

Ag

(g/t) |

| Main

Deposit |

| Measured |

5,831 |

2.66 |

1.92 |

2.78 |

0.48 |

28.7 |

| Indicated |

9,003 |

2.20 |

1.62 |

2.13 |

0.40 |

29.2 |

| Measured +

Indicated |

14,834 |

2.38 |

1.74 |

2.38 |

0.43 |

29.0 |

| Inferred |

1,902 |

1.98 |

1.31 |

2.16 |

0.48 |

29.7 |

| Esso

Deposit |

| Indicated |

2,425 |

3.98 |

2.52 |

4.76 |

0.81 |

64.0 |

| Inferred |

1,025 |

2.30 |

1.60 |

2.23 |

0.52 |

41.4 |

| Sumac

Deposit |

| Inferred |

7,779 |

1.52 |

1.10 |

1.60 |

0.17 |

16.9 |

| Combined – All

Deposits |

| Measured |

5,831 |

2.66 |

1.92 |

2.78 |

0.48 |

28.7 |

| Indicated |

11,428 |

2.58 |

1.81 |

2.68 |

0.49 |

36.5 |

| Measured +

Indicated |

17,259 |

2.61 |

1.85 |

2.72 |

0.49 |

33.9 |

| Inferred |

10,706 |

1.67 |

1.18 |

1.76 |

0.26 |

21.5 |

-

The estimates in the table

are considered to be amenable to underground extraction methods.

The base case cut-off grade is 1.2% CuEq based on the formula

CuEq = (Cu% x 0.825) + (Zn% x 0.302) + (Ag g/t x 0.004) +

(Au g/t x 0.262). Mineral resources are not mineral reserves

because the economic viability has not been

demonstrated.

-

Estimate assumes Mining

(underground) US $34.00/t, Processing US $18.00/t, US G&A

$10/t, copper price US $3.00/lb, zinc price US $1.25/t, gold price

US $1350/oz, silver price US $17.00/oz, copper payable recovery

82.5%, zinc payable recovery 72.5%, silver payable recovery 45%,

gold payable recovery 40%

-

Effective date of resource

estimate February 22nd, 2019

-

Inferred mineral resources

are considered too speculative geologically to have economic

considerations applied to them that would enable them to be

categorized as mineral reserves. There is also no certainty that

these inferred mineral resources will be converted to the measured

and indicated categories through further drilling, or into mineral

reserves, once economic considerations are

applied.

-

Assumptions used to derive

the cut-off grades in order to meet the NI43-101 requirement for

mineral resource estimates to demonstrate “reasonable prospects for

eventual economic extraction”. The cut-off grades to be used in the

upcoming feasibility study may vary from those used to limit the

mineral resources reported herein, as the inputs to that study are

determined. No inference is implied in the changes to the

assumptions used in the cut-off grade calculations from the prior

mineral resource estimates as to what will be used in the upcoming

feasibility, as those assumptions remain to be

determined.

Updated Mineral

Resource Metrics

-

38 new drill hole

intersections through the Main and Esso deposits utilized to update

the new mineral resource calculation (3 at Esso, 35 at

Main);

-

2018 drilling successfully

delineated additional mineral resources along the down-dip edge of

Main, which remains open to further expansion;

and

-

Drilling defined a large

contiguous body of Measured resources at Main (Figure

1).

“The definition of an

updated, robust and larger resource estimate is a significant

milestone for the Company”, stated Rob Duncan, COO for Kutcho

Copper. “Based on new drill hole data and an independent mineral

resource estimation at Kutcho, we have expanded the mineral

resources at Kutcho and demonstrated potential for further reserve

growth in the upcoming Feasibility Study.”

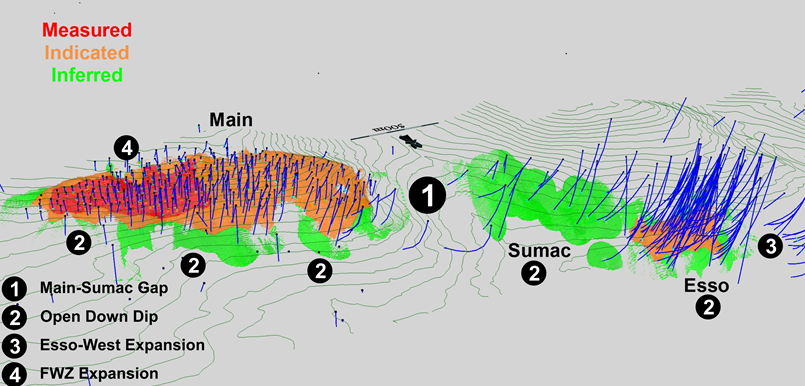

Figure 1: Resources by category looking SW with

Exploration

Targets

High Priority Near

Resource Targets

Four excellent

targets exist on the Kutcho project that are located between, below

or along strike from existing mineral resources (Figure

1). These targets represent high probability drill areas

that could result in significant accretive value to the

project;

-

The Main-Sumac

Gap identifies a 400 m by 380m

panel between the Main and Sumac lenses that is untested by

drilling. A conductive geophysical anomaly coincides with the area

and is 360 m long. K003, the most eastern hole to intersect the

Sumac lens and located on the western margin of the gap returned

5.12 m of 1.29% Cu, 0.49% Zn and 7 g/t

Ag.

-

Open Down

Dip: Significant portions of all

three lenses remain open down dip outside of current resources

including over 36% of Main, 50% of Esso and 100% of

Sumac.

-

The Esso-West

Expansion target lies 300 m west

of the Esso deposit where 150m of a 1500 m long geophysical anomaly

has been drill tested. Drilling returned several mineralized

intercepts including 7.2 m of 2.0% Cu, 5.2% Zn and ~17 g/t Ag in

hole E094B3. There remains 300 m of untested Kutcho horizon between

hole E094B3 and Esso, along with an additional 1000 m of untested

horizon to the west of hole E094B3. (Off western edge of

map)

-

Footwall Zone

(FWZ) lies beneath the Main zone

and represents a stacked massive sulphide horizon that is open in

all directions. The last drill hole to the east and down dip

intersected 1.5 m of 3.54% Cu, 6.94% Zn, 316.9 g/t Ag and 1.47 g/t

Au in hole E057.

Mineral Resource

Estimation Methodology

Mineral

resource estimates are generated using a total of 362 drill holes

at the Main deposit, 118 drill holes at the Esso deposit, and 29

drill holes in the vicinity of the Sumac deposit. Drill holes are

collared from surface and extend to depths of 700m below surface in

some areas. Mineral resource estimates are derived from

three-dimensional block models with nominal block sizes measuring 5

x 2.5 x 5m (LxWxH). Resource estimates were generated using

drill hole sample assay results and the interpretation of

geological models which relate to the spatial distribution of

copper, zinc, gold and silver in the deposits. Interpolation

characteristics were defined based on the geology, drill hole

spacing, and geostatistical analysis of the data. The effects of

potentially anomalous high-grade sample data, composited to 1 metre

intervals, are controlled using both traditional top-cutting as

well as limiting the distance of influence during block grade

interpolation. Block grades are estimated using ordinary kriging

and have been validated using a combination of visual and

statistical methods to ensure they are appropriate representations

of the underlying sample data. Resources in the Measured category

are delineated with drill holes on a regular 25m pattern. Resources

in the Indicated category are delineated with holes on a nominal

50m pattern and Inferred class resources extend to a maximum

distance of 100m from a drill hole. It is assumed that the Kutcho

deposits would be mined using underground extraction methods. Based

on projected technical and economic parameters, the deposits form

consistent zones of mineralization, above a projected base case

cut-off threshold of 1.2%CuEq, that are considered to be amenable

to underground mining methods.

Qualified Person

Robert Sim, P.Geo.

Independent consultant to the Company and a Qualified Person as

defined by National Instrument 43-101 ("NI 43-101") has reviewed

and approved the contents of this news release related to the

mineral resource estimate. All samples were collected in accordance

with industry standards. Splits from the drill core samples were

submitted to the ALS sample preparation laboratory in Whitehorse,

Yukon Territory, Canada, and then transferred to ALS' laboratory in

Vancouver, British Columbia, Canada for fire assay and ICP

analysis. The precision and accuracy of results is tested through

the systematic inclusion of standards, blanks and check assays. The

mineral resource estimate referenced in this press release was

prepared in November 2018 by Robert Sim, P.Geo., an independent

Qualified Person as defined by NI 43-101. Kutcho's additional

disclosure of a technical or scientific nature in this press

release has been reviewed and approved by Mr. Rory Kutluoglu, B.Sc,

P.Geo., Kutcho's Vice President of Exploration and Development, who

serves as a Qualified Person under the definition of National

Instrument 43-101. In the opinion of the QP, the mineral resource

estimate reported herein is a reasonable representation of the

mineralization found at the Kutcho project at the current level of

sampling. The mineral resources were estimated in conformity with

generally accepted CIM Estimation of Mineral Resources and Mineral

Reserves Best Practices Guidelines (November 23, 2003) and is

reported in accordance with NI 43-101.

About

Kutcho Copper Corp.

Kutcho Copper Corp. is a Canadian resource

development company focused on expanding and developing the Kutcho

high grade copper-zinc project in northern British Columbia.

Committed to social responsibility and the highest environmental

standards, the Company intends to progress the Kutcho Project

through feasibility and permitting to a positive construction

decision.

Vince Sorace

President & CEO, Kutcho Copper Corp.

For

further information regarding Kutcho Copper Corp., please email

Michael Rapsch, VP Corporate Communications at mrapsch@kutcho.ca or

visit our website at www.kutcho.ca.

Cautionary Note Regarding Forward-Looking

Statements

Neither the TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

This

news release contains certain statements that may be deemed

“forward-looking statements” with respect to the Company within the

meaning of applicable securities laws. Forward-looking statements

are statements that are not historical facts and are generally, but

not always, identified by the words “expects”, “plans”,

“anticipates”, “believes”, “intends”, “estimates”, “projects”,

“potential”, “indicates”, “opportunity”, “possible” and similar

expressions, or that events or conditions “will”, “would”, “may”,

“could” or “should” occur. Although Kutcho Copper believes the

expectations expressed in such forward-looking statements are based

on reasonable assumptions, such statements are not guarantees of

future performance, are subject to risks and uncertainties, and

actual results or realities may differ materially from those in the

forward-looking statements. Such material risks and uncertainties

include, but are not limited to, the Company’s ability to raise

sufficient capital to fund its obligations under its property

agreements going forward, to maintain its mineral tenures and

concessions in good standing, to explore and develop the Kutcho

project or its other projects, to repay its debt and for general

working capital purposes; changes in economic conditions or

financial markets; the inherent hazards associates with mineral

exploration and mining operations, future prices of copper and

other metals, changes in general economic conditions, accuracy of

mineral resource and reserve estimates, the potential for new

discoveries, the potential to convert inferred resources to

indicated or measured resources, the potential to optimize the mine

plan, the ability of the Company to obtain the necessary permits

and consents required to explore, drill and develop the Kutcho

project and if obtained, to obtain such permits and consents in a

timely fashion relative to the Company’s plans and business

objectives for the projects; the general ability of the Company to

monetize its mineral resources; and changes in environmental and

other laws or regulations that could have an impact on the

Company’s operations, compliance with environmental laws and

regulations, aboriginal title claims and rights to consultation and

accommodation, dependence on key management personnel and general

competition in the mining industry. Forward-looking statements are

based on the reasonable beliefs, estimates and opinions of the

Company’s management on the date the statements are made. Except as

required by law, the Company undertakes no obligation to update

these forward-looking statements in the event that management’s

beliefs, estimates or opinions, or other factors, should

change.

Kutcho Copper (TSXV:KC)

Historical Stock Chart

From Oct 2024 to Nov 2024

Kutcho Copper (TSXV:KC)

Historical Stock Chart

From Nov 2023 to Nov 2024

Real-Time news about Kutcho Copper Corp (TSX Venture Exchange): 0 recent articles

More Kutcho Copper Corp News Articles