Rio2 Limited (“Rio2” or the “Company”) (TSXV: RIO; OTCQX: RIOFF;

BVL: RIO), is providing an update on construction activities at its

Fenix Gold Mine located in the Maricunga Gold Belt of the Atacama

Region, in Chile.

OVERVIEW

Pre-construction activities commenced at the

Fenix Gold Mine in 2022 prior to the Environmental Impact

Assessment (“EIA”) for the project being rejected by the Chilean

environmental regulators. Those activities included:

- ordering and securing of long lead

items for the construction of the adsorption, desorption, and gold

recovery (“ADR”) plant and associated infrastructure

- fabrication of ADR plant components

such as tanks and ADR plant foundation footings

- construction of a 565-person camp

and associated mess and office facilities at the Lince

infrastructure site, located 20km from the mine site

- water loading facilities at the

Nueva Atacama water treatment facilities located in Copiapo

The project’s EIA was subsequently approved in

December 2023 following a successful 18-month appeal process.

The Company recommenced construction activities

at the Fenix Gold Mine in October 2024 after successfully

completing a debt and equity financing for the construction of the

mine announced on October 29, 2024.

The projected construction capex for 2025 is

estimated to be USD 122 M (excluding Chilean VAT tax which is

refundable) with construction expected to be completed in November

2025. First gold production is currently guided for January

2026.

PLANT SITE

Bulk earthworks at the plant site have been

completed and concrete bases for the footings of the processing

plant have been poured. The ADR plant will be housed within a steel

framed building cladded with modular thermo-acoustic panels.

LEACH PAD

Earthworks have commenced on the leach pad

stability platform, which forms the base of the Phase 1 leach pad.

The leach pad has been designed to be built in four phases over the

17-year mine life of the 20,000 tonnes per day operations.

PREGNANT LEACH SOLUTION (“PLS”)

POND

Excavation earthworks for the PLS pond have

commenced adjacent to the ADR plant. The PLS pond will be lined

with a double HDPE geomembrane liner system and have an installed

capacity of 28,000 cubic metres. As determined by water balance

modelling in the 2023 Fenix Gold feasibility study, a larger major

events pond is currently planned to be built in year 6 of the mine

operation.

PERSONNEL

The recruitment activities for the Fenix Gold

Mine have focused on hiring key personnel for construction

activities and future mine operation roles. Personnel numbers at

the Fenix Gold Mine are increasing and, currently, over 531 staff

and contractors work on-site. At the end of Q4 2024, approximately

50% of the workforce were from the Atacama region, and 16% of

on-site personnel were women.

SAFETY

At the end of Q4 2024, the project achieved

161,917 person-hours worked with no lost time injuries

reported.

GRADE CONTROL DRILLING AND GEOPHYSICAL

SURVEY

In February, the Company will commence a 12,000m

grade control drilling program focused on the first three years of

production planned from the Fenix South and Fenix North pit areas.

Fenix South will be the first area drilled during the months of

February, March and April, and Fenix North will be drilled in

October and November. The Fenix South pit will be the principal

source of ore for the first year of mine production.

From February to March the Company will complete

a survey of 25,000 meters of CSAMT electromagnetic lines. This

survey will help the geological team identify silicified zones

associated with black banded veins, which are the main gold host at

the Fenix Gold deposit. The geophysical targets generated from this

work will allow the Company to focus its future exploration

drilling campaigns with the objective to grow the mineralized

resource at Fenix Gold. Resource expansion drilling is currently

planned to occur once gold production has commenced at the

mine.

Rio2 is also pleased to announce that Enrique

Garay has recently returned to the Company as Senior Vice President

- Geology to lead and oversee the Fenix Gold geological team in

preparation for mining toward the end of 2025 and future

exploration.

MINE EXPANSION STUDY & ASSOCIATED

EIA

A preliminary internal study completed by the

Rio2 technical team has indicated that the Fenix Gold Mine has the

potential to be expanded from its first phase 20,000 tonnes per day

ore mining rate to around 80,000 tonnes per day. Increasing the ore

mining rate to this level could see gold production rise from an

initial rate of approximately 100,000 oz per annum to a target

range of 250,000 – 300,000 oz per annum. To quantify and justify

this potential expansion, the Company has initiated a mine

expansion study with a target completion date by the end of 2025.

Long-term water options will be assessed for the study and the most

optimal water strategy will be selected and form a base case for

project economics. To put this potential expansion case on a fast

track to a construction decision, Rio2 has recently initiated

baseline studies for an EIA study on the project, which is

anticipated to be ready for review by the environmental regulators

in the Atacama Region by Q4 2026. As most of the required

infrastructure for the expanded project (apart from water which is

expected to be provided by a third-party provider) is within the

existing footprint of the currently approved EIA, the Company

expects the EIA process to advance relatively smoothly. Updates

will be provided as the expansion study and EIA progress.

Andrew Cox, President & CEO, commented,

“Site activities at the Fenix Gold Mine continue advancing to plan.

We are delighted with the team we are putting together and the

milestones achieved so far. We look forward to continued success as

we prepare the mine for first gold production in January 2026.”

Photos of the construction activities can be

found at (https://www.rio2.com/media/photos).To view a 3D VRIFY

version of Rio2’s corporate presentation please click the following

link: https://vrify.com/decks/17439 or visit the

Company’s website at www.rio2.com

STOCK OPTION GRANT

The board of directors of the Company has

approved the grant of an aggregate of 6,310,000 incentive stock

options (the “Options”), pursuant to the Company’s Stock Option

Plan, to a total of 72 directors, officers and employees of the

Company, its Peruvian subsidiary, Rio2 S.A.C., and its Chilean

subsidiaries, Fenix Gold Limitada and Lince S.A. The Options are

exercisable at a price of $0.70 per share (based on a 10% premium

over the closing price of C$0.63 on January 10, 2025) and will

expire five years from the grant date. The Options represent the

Company’s annual grant of long-term incentives consistent with the

Company’s regular yearly compensation.

FENIX GOLD PROJECT

The Fenix Gold Project is one of the largest

undeveloped gold oxide, heap leach projects in the Americas,

hosting a Measured and Indicated mineral resource (as such term is

defined in National Instrument 43-101 -Standards of Disclosure for

Mineral Projects, “NI 43-101”) of 4.8 million ounces of gold which

the Company believes will make a positive contribution to the

Atacama Region and Chile. The Project is an example of modern gold

mining where a full complement of technical, environmental, and

social considerations has been consulted and designed from the

outset. The Project represents a significant investment in the gold

mining business in Chile by a junior mining company of

approximately US$235M of initial and sustaining capital, generating

employment for at least 1,200 people during the construction phase

and 550 people during the 17-year operations phase. The mine being

contemplated will be a run-of-mine heap leach operation; no

crushing or tailings storage facilities are required, thereby

minimizing the overall impact and footprint of the Project.

The scientific and technical content of this

news release has been reviewed, approved and verified by Enrique

Garay, MSc P.Geo/FAIG who is a QP under NI 43-101. For additional

information regarding the Project, including key parameters,

assumptions and risks associated with its development, see the

independent technical report entitled “NI 43-101 Technical Report

on the Feasibility Study for the Fenix Gold Project” (the

“Feasibility Study”) pursuant to National Instrument 43-101

Standards of Disclosure for Mineral Projects (“NI 43-101”). The

Feasibility Study is dated October 16, 2023, with an effective date

of October 16, 2023, a copy of which document is available under

Rio2’s SEDAR+ profile at www.sedarplus.ca.

ABOUT RIO2 LIMITED

Rio2 is a mining company with a focus on

development and mining operations with a team that has proven

technical skills as well as successful capital markets track

record. Rio2 is focused on taking its Fenix Gold Project in Chile

to production in the shortest possible timeframe based on a staged

development strategy. Rio2 and its wholly owned subsidiary, Fenix

Gold Limitada, are companies with the highest environmental

standards and responsibility with the firm conviction that it is

possible to develop mining projects that respect the three pillars

(Social, Environment, Economics) of responsible development. As

related companies, we reaffirm our commitment to apply

environmental standards beyond those that are mandated by

regulators, seeking to protect and preserve the environment of the

territories that we operate in.

Forward-Looking Statements

This news release contains forward-looking

statements and forward-looking information (collectively

“forward-looking information”) within the meaning of applicable

securities laws relating to Rio2’s development of the Fenix Gold

Project and other aspects of Rio2’s future operations and plans.

In addition, without limiting the generality of the foregoing, this

news release contains forward-looking information pertaining to

the following: the development of a mine at the Project and related

construction activities; the expected capital required for such

mine; the expected timing of the first pour of gold; estimated

indicated and measured gold resources; expected mine life;

development and operating plans and expenditures; certain

anticipated economic benefits of a mine at the Project to the local

region; the potential to expand production from the first stage

mining rate and associated gold production along with the timing

for the completion of related studies and approvals; and other

matters ancillary or incidental to the foregoing.

All statements included herein, other than

statements of historical fact, may be forward-looking information

and such information involves various risks and uncertainties.

Forward-looking information is often, but not always, identified by

the use of words such as “seek”, “anticipate”, “plan”, “continue”,

“estimate”, “expect”, “may”, “will”, “project”, “predict”,

“potential”, “targeting”, “intend”, “could”, “might”, “should”,

“believe” and similar expressions. The forward-looking information

is based on certain key expectations and assumptions made by Rio2’s

management, including but not limited to: expectations concerning

prevailing commodity prices, exchange rates, interest rates,

applicable royalty rates and tax laws; capital efficiencies;

legislative and regulatory environment of Chile; future mining and

production rates and estimates of capital and operating costs;

expectations regarding the availability of debt financing;

estimates of reserves and resources; anticipated timing and results

of capital expenditures; the sufficiency of capital expenditures in

carrying out planned activities; results of operations;

performance; the anticipated timing and results of expansion

studies and related approvals; the availability and cost of

financing, labor and services; and Rio2’s ability to access capital

on satisfactory terms.

Rio2 believes the expectations reflected in

these forward-looking statements are reasonable, but no assurance

can be given that these expectations will prove to be correct and

such forward-looking statements in this news release should not be

unduly relied upon. A description of assumptions used to develop

such forward-looking information and a description of risk factors

that may cause actual results to differ materially from

forward-looking information can be found in Rio2's disclosure

documents on the SEDAR+ website at www.sedarplus.ca. These risks

and uncertainties include, but are not limited to: risks and

uncertainties relating to the completion of debt and equity

financing for the construction phase of the mine, market conditions

and management’s ability to anticipate and manage the factors and

risks referred to herein.

Forward-looking statements included in this news

release are made as of the date of this news release and such

information should not be relied upon as representing its views as

of any date subsequent to the date of this news release. Rio2 has

attempted to identify important factors that could cause actual

results, performance or achievements to vary from those current

expectations or estimates expressed or implied by the

forward-looking information. However, there may be other factors

that cause results, performance or achievements not to be as

expected or estimated and that could cause actual results,

performance or achievements to differ materially from current

expectations. Rio2 disclaims any intention or obligation to update

or revise any forward-looking statements, whether as a result of

new information, future events or otherwise, except as expressly

required by applicable securities legislation.

To learn more about Rio2 Limited, please visit:

www.rio2.com or Rio2's SEDAR+ profile at www.sedarplus.ca.

ON BEHALF OF THE BOARD OF RIO2

LIMITED

Alex BlackExecutive Chairman Email:

alex.black@rio2.comTel: +51 99279 4655

Kathryn Johnson Executive Vice President, CFO

& Corporate Secretary Email: kathryn.johnson@rio2.comTel: +1

604 762 4720

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts the responsibility for the adequacy

or accuracy of this release.

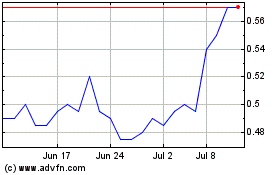

Rio2 (TSXV:RIO)

Historical Stock Chart

From Dec 2024 to Jan 2025

Rio2 (TSXV:RIO)

Historical Stock Chart

From Jan 2024 to Jan 2025