TIDMGSC

RNS Number : 9093R

GS Chain PLC

31 October 2023

31 O ctober 2023

GS CHAIN PLC

("GS Chain " or the "Company")

Audited Results

GS Chain (LSE: GSC) is pleased to announce its audited results

for the Period Ended 30 June 2023. The full audited financial

statements will be uploaded to the Company website:

https://gschain.world/ .

This announcement contains information which, prior to its

disclosure, constituted inside information as stipulated under

Regulation 11 of the Market Abuse (Amendment) (EU Exit) Regulations

2019/310 (as amended).

The directors of GS Chain Plc accept responsibility for this

announcement.

For further information please contact:

GS Chain Plc

Alan Austin, CEO alan@gschain.world

-------------------------

Leon Filipovic, Chairman leon@gschain.world

-------------------------

First Sentinel (Corporate Adviser)

-------------------------

Brian Stockbridge brian@first-sentinel.com

+44 20 3855 5551

-------------------------

CEO's Statement

Business strategy and objectives

GS Chain Plc was established to make acquisitions and published

its prospectus on 4 May 2022 for the admission of its ordinary

shares to the Main Market of the London Stock Exchange on 13 May

2022 under the symbol GSC.L.

The Company seeks to identify opportunities within the

technology sector, to conduct the necessary due diligence and

subsequently complete acquisitions that would benefit its short-

and long-term strategies. While the Board of Directors' experience

spans across a wide range of business sectors, the board will focus

its energy on the technology space; specifically targeting

companies that leverage state of the art technology in automotive,

fintech, real estate, banking, finance, telecommunications, and

blockchain industries. The Board may consider other sectors if they

believe such sectors present a suitable opportunity for the

Company.

The Company will leverage this expertise to create long term

shareholder value as they seek to acquire high quality companies

with long term compounding potential growth while aggressively

managing performance.

The Company's Board of Directors reflects the industry expertise

necessary to pursue this opportunity.

Review of activities for the year ended 30 June 2023

In order to better access a global shareholder base, during the

year the Company secured further global expansions into two more

markets, being the US and Germany respectively. The Company

commenced cross trading on the US OTCQB Market on 11 April 2023

under the symbol GSCHF and on the Frankfurt Börse on 30 May 2023

under the symbol K85.

The directors continued to seek and assess potential companies

for acquisition.

Board of Directors

Leon Filipovic has served as a director since the Company's

incorporation on 3 April 2021. Since July 2021 the Board was

enlarged by the appointment of Alan Austin as CEO and Sébastien

Guerin as Chief Operational Officer.

Since September 2021 Sanjay Nath has been appointed as a

Non-Executive Director and Mark Wilson as an Independent

Non-Executive Director.

There were no changes to the Board during the year ended 30 June

2023.

Alan Austin

Chief Executive Officer

Date: 2023/10/31

Financial Review

Loss for the year

For the year the Company recorded a loss of GBP688,242 (2022:

GBP303,404 loss). The biggest cost driver was GBP216,000 in accrued

directors' fees, GBP395,300 in professional fees, GBP16,000 in

consultancy fees and GBP48,252 in accounting and audit fees.

Balance Sheet

The total amount of assets on the balance sheet as per the

balance sheet date is GBP581,916 (2022: GBP953,838) consisting of

amounts owed to directors and the Company's cash reserves.

The Company's liabilities of GBP578,962 (2022: GBP262,642)

consist of loans from directors, accrued expenses and directors'

fees, as well as accounts payable.

Cash flow

Cash used in operations totalled GBP711,922 (2022:

GBP40,762).

Closing cash

As at 30 June 2023, the Company held GBP362,916 (2022:

GBP953,838) in the bank account.

Sébastien Guerin

Chief Operating Officer

Date: 2023/10/31

Directors' Report

The Directors present their report with the financial statements

of the Company for the year ended 30 June 2023.

The Company's Ordinary Shares were originally admitted to

listing on the London Stock Exchange, on the Official List pursuant

to Chapters 14 of the Listing Rules, which sets out the

requirements for Standard Listings, on 13 May 2022. On 11 April

2023 the Company commenced cross trading on the US OTCQB Market and

on 30 May 2023 the Company commenced cross trading on the German

Frankfurt Stock Exchange.

Principal Activities

The Company was established to make acquisitions and published

its prospectus on 4 May 2022 for the admission of its ordinary

shares to the Main Market of the London Stock Exchange on 13 May

2022 under the symbol of GSC.L. Additionally on 11 April 2023 the

Company commenced cross trading on the US OTCQB Market under the

symbol GSCHF and on 30 May 2023 commenced cross trading on the

German Frankfurt Stock Exchange under the symbol K85.

The Company will leverage its expertise to create long term

shareholder value as they seek to acquire high quality companies

with long-term compounding potential growth while aggressively

managing performance.

The Company seeks to identify opportunities within the

technology sector, to conduct the necessary due diligence and

subsequently complete acquisitions that would benefit its short-

and-long-term strategies.

While the Board of Directors' experience spans across a wide

range of business sectors, the Board will focus its energy on the

technology space, specifically targeting companies that leverage

state of the art technology in automotive, fintech, real estate,

banking, finance, telecommunications and blockchain industries. The

Board may consider other sectors if they believe such sectors

present a suitable opportunity for the Company.

Review of Business in the Year

Further details of the Company's business and expected future

development are also set out in the CEO's Statement and the

Financial Reviews on pages 1 and 2.

Directors

The Directors of the Company during the year and their

beneficial interest in the Ordinary shares of the Company at 30

June 2023 were as follows:

Director Position Appointed Resigned Ordinary Shares Options

A Austin CEO 09/07/2021 - - -

L Filipovic Chairman 03/04/2021 - 113,205,988 -

S Guerin COO 09/07/2021 - 113,200,000 -

S Nath* Director 29/09/2021 - 9,000,000 -

M Wilson Director 27/09/2021 - - -

*Sanjay Nath's daughter, Sonali Ohrie, and son, Sonal Ohrie,

individually hold 1,000,000 Ordinary shares, representing 0.25% of

the total issued Ordinary Shares.

Substantial Shareholders

As at 30 June 2023, the total number of issued Ordinary Shares

with voting rights in the Company was 399,985,888.

Aside from Leon Filipovic and Sébastien Guerin no other

shareholder owns more than 5% of the issued share capital of the

Company.

Financial instruments

Details of the use of financial instruments by the Company are

contained in accounting policies of these financial statements.

Dividends

The Directors do not propose a dividend in respect of the year

ended 30 June 2023.

Going Concern

The financial information has been prepared on the assumption

that the Company will continue as a going concern. Under the going

concern assumption, an entity is ordinarily viewed as continuing in

business for the foreseeable future with neither the intention nor

the necessity of liquidation, ceasing trading or seeking protection

from creditors pursuant to laws or regulations. In assessing

whether the going concern assumption is appropriate, the Chief

Operating Officer prepares and presents a cashflow, expenditure and

balance sheet projection for a period of at least 12 months from

the date of signing the financial statements which is reviewed and

approved by the Board. The Directors take into account this

information and all other available factors for the foreseeable

future, in particular for the twelve months from the date of

approval of the financial information.

The Company has cash reserves of GBP362,916 at 30 June 2023. In

assessing the Company's cashflow projections, the Directors have

identified a cash shortfall which will be addressed by the

provision of GBP500,000 in directors' loans. Furthermore, it has

been determined certain expenses - namely directors' fees - will be

deferred until an acquisition completes and this has been agreed at

the Board level. Additional sources of financing, where required,

will be discussed at the Board level and raised through the issue

of new shares or issue of debt where approved.

Energy and carbon reporting

The Company recognises it has a responsibility to the

environment and endeavours to be as environmentally friendly as

possible in its business activities. As the Company has consumed

less than 40 MWh of energy in the UK, the low energy exemption has

been applied. In assessing whether the threshold was met, the

Company has considered all energy from gas, electricity, and

transport usage as required by the UK Government's Guidance on

Streamlined Energy and Carbon Reporting.

Auditors

The auditors, Macalvins Limited, have expressed their

willingness to continue in office and a resolution to reappoint

them will be proposed at the Annual General Meeting.

Statement of Director's responsibilities

The directors are responsible for preparing the Report of the

Directors and the financial statements in accordance with

applicable law and regulations.

Company law requires the directors to prepare financial

statements for each financial year. Under that law the directors

have elected to prepare the financial statements in accordance with

UK-adopted international accounting standards. Under company law

the directors must not approve the financial statements unless they

are satisfied that they give a true and fair view of the state of

affairs of the Company and of the profit or loss of the Company for

that period. In preparing these financial statements, the directors

are required to:

-- select suitable accounting policies and then apply them consistently;

-- make judgements and accounting estimates that are reasonable and prudent;

-- prepare the financial statements on the going concern basis

unless it is inappropriate to presume that the Company will

continue in business.

The directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the Company's

transactions and disclose with reasonable accuracy at any time the

financial position of the Company and enable them to ensure the

financial statements comply with the Companies Act 2006. They are

also responsible for safeguarding the assets of the Company and

hence for taking reasonable steps for the prevention and detection

of fraud and other irregularities.

Statement as to Disclosure of Information to Auditors

So far as the directors are aware, there is no relevant audit

information (as defined by Section 418 of the Companies Act 2006)

of which the Company's auditors are unaware, and each director has

taken all the steps that he ought to have taken as a director in

order to make himself aware of any relevant audit information and

to establish that the Company's auditors are aware of that

information.

Auditors

The auditors, Macalvins Limited, will be proposed for

re-appointment at the forthcoming Annual General Meeting.

The maintenance and integrity of GS Chain Plc website is the

responsibility of the Directors.

The CEO's statement and Financial Review, all of which are

incorporated into this report, include a true and fair view of the

development and performance of the business and the position of the

Company taken as a whole, together with a description of the

principal risks and uncertainties that they face and provides

information necessary for shareholders to assess the Company's

performance, business model and strategies.

The financial statements, prepared in accordance with the

applicable set of accounting standards, give a true and fair view

of the assets, liabilities, financial position and profit or loss

of the issuer.

On behalf of the board

Leon Filipovic

Director

Date: 2023/10/31

STATEMENT OF PROFIT OR LOSS

FOR THE YEARED 30 JUNE 2023

----------------------------------- --------------------------------------------------------------------

2023 2022

Notes GBP GBP

Administrative expenses (688,242) (303,404)

Operating loss 4 (688,242) (303,404)

Income tax expense 7 - -

Loss and total comprehensive

income for the year (688,242) (303,404)

Earnings per share 8

Basic (0.17) (0.08)

Diluted (0.17) (0.08)

Earnings per share from continuing

operations

Basic (0.17) (0.08)

Diluted (0.17) (0.08)

STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEARED 30 JUNE 2023

---------------------------------------- ---------------------------------------------------------

2023 2022

GBP GBP

Loss for the year (688,242) (303,404)

Other comprehensive income: - -

Total comprehensive income for the year (688,242) (303,404)

STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2023

-------------------------------- --------------------------------------------------------------

2023 2022

Notes GBP GBP

Current assets

Trade and other receivables 10 219,000 -

Cash and cash equivalents 362,916 953,838

581,916 953,838

Current liabilities

Trade and other payables 16 178,962 262,642

Loans 11 400,000 -

578,962 262,642

Net current assets 2,954 691,196

Net assets 2,954 691,196

Equity

Called up share capital 17 66,798 66,798

Share premium account 18 927,802 927,802

Retained earnings (991,646) (303,404)

Total equity 2,954 691,196

The financial statements were approved by the board of directors

and authorised for issue on 2023/10/31 and

are signed on its behalf by:

..............................

Leon Filipovic

Director

Company registration number 13310485

STATEMENT OF CHANGES IN EQUITY

FOR THE YEARED 30 JUNE 2023

---------------------------------- ------------------------------------------------------------------------

Share Share Retained Total

capital premium earnings

account

Notes GBP GBP GBP GBP

Balance at 3 April 2021 - - - -

Period ended 30 June 2022:

Loss and total comprehensive

income for the year - - (303,404) (303,404)

Transactions with owners in their

capacity as owners:

Issue of share capital 17 66,798 927,802 - 994,600

-------

Balance at 30 June 2022 66,798 927,802 (303,404) 691,196

-------

Year ended 30 June 2023:

Loss and total comprehensive

income for the year - - (688,242) (688,242)

-------

Balance at 30 June 2023 66,798 927,802 (991,646) 2,954

=======

STATEMENT OF CASH FLOWS

FOR THE YEARED 30 JUNE 2023

2023 2022

Notes GBP GBP GBP GBP

Cash flows from operating

activities

Cash absorbed by operations 22 (771,922) (40,762)

Net cash outflow from operating

activities (771,922) (40,762)

Financing activities

Proceeds from issue of shares - 994,600

Proceeds from loans from

directors 400,000 -

Payments of loans to directors (219,000) -

-------

Net cash generated from

financing activities 181,000 994,600

Net (decrease)/increase

in cash and cash equivalents (590,922) 953,838

Cash and cash equivalents at beginning

of year / period 953,838 -

--------- ---------

Cash and cash equivalents at end

of year / period 362,916 953,838

========= =========

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEARED 30 JUNE 2023

1 Accounting policies

Company information

GS Chain Plc is a public company limited by shares incorporated

in England and Wales. The registered office is Ground Floor, 72

Charlotte Street, London, W1T 4QQ. The Company's principal

activities and nature of its operations are disclosed in the

directors' report.

1.1 Accounting convention

The financial statements have been prepared in accordance with

International Financial Reporting Standards (IFRS) as adopted for

use in the United Kingdom and with those parts of the Companies Act

2006 applicable to companies reporting under IFRS, except as

otherwise stated.

The financial statements are prepared in sterling, which is the

functional currency of the company. Monetary amounts in these

financial statements are rounded to the nearest GBP.

The financial statements have been prepared under the historical

cost convention except for certain financial instruments classified

as financial instruments measured at fair value. The principal

accounting policies adopted are set out below.

The Company has not traded or received income since

incorporation and so no accounting policy in respect of revenue

recognition is disclosed.

Reporting period

The comparative information included in these financial

statements are for the period 3 April 2021 to 30 June 2022. The

period was longer than 12 months due to it being the first period

since incorporation. The comparative amounts presented in the

financial statements (including the related notes) are therefore

not entirely comparable.

1.2 Going concern

The directors have at the time of approving the financial

statements, a reasonable expectation that the company has adequate

resources to continue in operational existence for the foreseeable

future. Thus, the directors continue to adopt the going concern

basis of accounting in preparing the financial statements. Further

details can be found in the Directors' report under the section

headed Going Concern.

1.3 Cash and cash equivalents

Cash represents cash in hand and deposits held on demand with

fintech specialised solutions. Cash equivalents are short-term,

highly-liquid investments with original maturities of three months

or less (as at their date of acquisition). Cash equivalents are

readily convertible to known amounts of cash and subject to an

insignificant risk of change in that cash value.

In the presentation of the Statement of Cash flows, cash and

cash equivalents also include bank overdrafts. Any such overdrafts

are shown within borrowings under 'current liabilities' on the

Statement of Financial Position.

1.4 Financial assets

Financial assets are recognised in the company's statement of

financial position when the company becomes party to the

contractual provisions of the instrument. Financial assets are

classified into specified categories, depending on the nature and

purpose of the financial assets.

Financial assets held at cost

Financial instruments are classified as financial assets

measured at cost where the objective is to hold these assets in

order to collect contractual cash flows, and the contractual cash

flows are solely payments of principal. They are initially

recognised at fair value plus transaction costs directly

attributable to their acquisition or issue, and are subsequently

carried at cost, less provision for impairment where necessary.

Impairment of financial assets

Financial assets carried at cost are assessed for indicators of

impairment at each reporting end date.

The expected credit losses associated with these assets are

estimated on a forward-looking basis. A broad range of information

is considered when assessing credit risk and measuring expected

credit losses, including past events, current conditions, and

reasonable and supportable forecasts that affect the expected

collectability of the future cash flows of the instrument.

Derecognition of financial assets

Financial assets are derecognised only when the contractual

rights to the cash flows from the asset expire, or when it

transfers the financial asset and substantially all the risks and

rewards of ownership to another entity.

1.5 Financial liabilities

The company recognises financial debt when the company becomes a

party to the contractual provisions of the instruments. Financial

liabilities are classified as either 'financial liabilities at fair

value through profit or loss' or 'other financial liabilities'.

Other financial liabilities

Other financial liabilities, including borrowings, trade

payables and other short-term monetary liabilities, are initially

measured and subsequently held at fair value net of transaction

costs directly attributable to the issuance of the financial

liability. For the purposes of each financial liability, interest

expense includes initial transaction costs and any premium payable

on redemption, as well as any interest or coupon payable while the

liability is outstanding.

Derecognition of financial liabilities

Financial liabilities are derecognised when, and only when, the

company's obligations are discharged, cancelled, or they

expire.

1.6 Equity instruments

Equity instruments issued by the company are recorded at the

proceeds received, net of direct issue costs. Dividends payable on

equity instruments are recognised as liabilities once they are no

longer at the discretion of the company.

1.7 Taxation

The tax expense represents the sum of the tax currently payable

and deferred tax.

Current tax

The tax currently payable is based on taxable profit for the

year. Taxable profit differs from net profit as reported in the

income statement because it excludes items of income or expense

that are taxable or deductible in other years and it further

excludes items that are never taxable or deductible. The company's

liability for current tax is calculated using tax rates that have

been enacted or substantively enacted by the reporting end

date.

Deferred tax

Deferred tax is the tax expected to be payable or recoverable on

differences between the carrying amounts of assets and liabilities

in the financial statements and the corresponding tax bases used in

the computation of taxable profit, and is accounted for using the

balance sheet liability method. Deferred tax liabilities are

generally recognised for all taxable temporary differences and

deferred tax assets are recognised to the extent that it is

probable that taxable profits will be available against which

deductible temporary differences can be utilised. Such assets and

liabilities are not recognised if the temporary difference arises

from goodwill or from the initial recognition of other assets and

liabilities in a transaction that affects neither the tax profit

nor the accounting profit.

The carrying amount of deferred tax assets is reviewed at each

reporting end date and reduced to the extent that it is no longer

probable that sufficient taxable profits will be available to allow

all or part of the asset to be recovered. Deferred tax is

calculated at the tax rates that are expected to apply in the

period when the liability is settled or the asset is realised.

Deferred tax is charged or credited in the income statement, except

when it relates to items charged or credited directly to equity, in

which case the deferred tax is also dealt with in equity. Deferred

tax assets and liabilities are offset when the company has a

legally enforceable right to offset current tax assets and

liabilities and the deferred tax assets and liabilities relate to

taxes levied by the same tax authority.

1.8 Employee benefits

The costs of short-term employee benefits are recognised as a

liability and an expense, unless those costs are required to be

recognised as part of the cost of inventories or non-current

assets.

The cost of any unused holiday entitlement is recognised in the

period in which the employee's services are received.

Termination benefits are recognised immediately as an expense

when the company is demonstrably committed to terminate the

employment of an employee or to provide termination benefits.

1.9 Foreign exchange

Transactions in currencies other than pounds sterling are

recorded at the rates of exchange prevailing at the dates of the

transactions. At each reporting end date, monetary assets and

liabilities that are denominated in foreign currencies are

retranslated at the rates prevailing on the reporting end date.

Gains and losses arising on translation in the period are included

in profit or loss.

1.10 Earnings per share

Basic earnings per share is calculated by dividing the profit

attributable to owners of the Company, excluding any costs of

servicing equity other than ordinary shares by the weighted average

number of ordinary shares outstanding during the financial year,

adjusted for bonus elements in ordinary shares issued during the

year and excluding treasury shares.

The Company is loss making throughout the period considered in

this Financial Information, therefore diluted earnings per share

has not been considered.

2 Adoption of new and revised standards and changes in accounting policies

Standards which are in issue but not yet effective

The standards and interpretations that are issued, but not yet

effective, up to the date of issuance of the Financial Information

are listed below. The Company intends to adopt these standards, if

applicable, when they become effective.

IAS 1 Amendments regarding the classification of liabilities as

current or non-current - effective 1 January 2023

IAS 1 Amendments regarding the disclosure of accounting policies

- effective 1 January 2023

IAS 1 Amendments regarding non-current liabilities with

covenants - effective 1 January 2024

IAS 8 Amendments regarding the definition of accounting

estimates - effective 1 January 2023

IAS 12 Amendments regarding deferred tax on leases and

decommissioning obligations - effective 1 January 2023

IFRS 10 and IAS 28 Amendments regarding the sale or contribution

of assets between an investor and its associate or joint venture -

effective 1 January 2024

IFRS 16 Amendments regarding a sale and leaseback transaction -

effective 1 January 2024

IFRS 17 Insurance contracts and subsequent withdrawal of IFRS 4

'Insurance Contracts', and amendments to IFRS 17 - effective 1

January 2023

The Company is evaluating the impact of the new and amended

standards above.

The Directors believe that these new and amended standards are

not expected to have a material impact on the Company's results or

shareholders' funds.

3 Critical accounting judgements and key sources of estimation uncertainty

In the application of the company's accounting policies, the

directors are required to make judgements, estimates and

assumptions about the carrying amount of assets and liabilities

that are not readily apparent from other sources. The estimates and

associated assumptions are based on historical experience and other

factors that are considered to be relevant. Actual results may

differ from these estimates.

The estimates and underlying assumptions are reviewed on an

ongoing basis. Revisions to accounting estimates are recognised in

the period in which the estimate is revised, if the revision

affects only that period, or in the period of the revision and

future periods if the revision affects both current and future

periods.

The estimates and assumptions which have a significant risk of

causing a material adjustment to the carrying amount of assets and

liabilities are outlined below.

Critical judgements

Going concern basis

The most significant judgement relates to the adoption of the

going concern basis given the Company has not recorded any revenue

since the date of incorporation.

The directors consider the Company's cash balances to be

sufficient given the cash burn rate of the Company since listing on

the London Stock Exchange to ensure the Company will be able to

continue as a going concern for a period of at least 12 months from

the authorisation of these financial statements.

Further details can be found in the Directors' report under the

section headed Going Concern .

4 Operating loss

2023 2022

Operating loss for the year is stated after charging/(crediting): GBP GBP

Fees payable to the company's auditor for the audit

of the company's financial statements 26,700 8,500

======== =======

5 Employees

The average monthly number of persons (including directors) employed

by the company during the year was:

2023 2022

Number Number

5 5

======== =======

Their aggregate remuneration comprised:

2023 2022

GBP GBP

Wages and salaries 216,000 195,175

Social security costs 2,900 -

-------- -------

218,900 195,175

======== =======

6 Directors' remuneration

2023 2022

GBP GBP

Remuneration for qualifying services 216,000 195,175

Remuneration disclosed above includes the following amount paid

respectively to the highest paid directors, of which there are four

such individuals paid equally (further details included in the

Directors' Remuneration report):

2023 2022

GBP GBP

Remuneration for qualifying services 48,000 45,025

Since the Company was registered as a public company on 28 July

2021 four of the directors receive a monthly fee of GBP4,000 and

one director receives a monthly fee of GBP2,000 under the terms of

their respective service agreements for their services to the

Company. From 27 June 2023 the directors have agreed to defer

payment of fees until such a time that a reverse takeover or

acquisition is completed.

7 Income tax expense Analysis of tax expense

No liability to UK corporation tax arose for the year ended 30

June 2023 or period ended 30 June 2022.

Factors affecting the tax expense

The charge for the year can be reconciled to the loss per the

statement of profit or loss as follows:

2023 2022

GBP GBP

Loss before taxation (688,242) (303,404)

Expected tax credit based on a corporation tax

rate of 19.00% (2022: 19.00%) (130,766) (57,647)

Unrecognised deferred tax assets 130,766 57,647

Taxation charge for the year

- -

At the year end, there were cumulative unrecognised deferred tax

assets of GBP188,413 (2022: GBP57,647) in respect of unutilised tax

losses. These have not been recognised as their recovery cannot be

determined with reasonable certainty.

Deferred tax assets in respect of carried forward losses are not

recognised in the financial statements.

8 Earnings per share

2023 2022

Number of shares Number Number

Weighted average number of ordinary

shares for basic earnings per

share 399,985,888 399,985,888

2023 2022

Earnings GBP GBP

Continuing operations

Loss for the period from continued

operations (688,242) (303,404)

Basic and diluted earnings per Pence per Pence per

share share share

From continuing operations (0.17) (0.08)

Basic earnings per share is calculated by dividing the earnings

attributable to ordinary shareholders by the weighted average

number of ordinary shares outstanding during the period.

Diluted earnings per share is calculated using the weighted

average number of shares adjusted to assume the conversion of all

dilutive potential ordinary shares.

9 Operating segments

The Board considers that during both the year ended 30 June 2023

and period ended 30 June 2022 the Company does not have specific

segments of operation.

Going forward the Company intends to focus on acquisitions in

the technology space; specifically targeting companies that

leverage state of the art technology in automotive, fintech, real

estate, banking, finance, telecommunications and blockchain

industries.

10 Trade and other receivables

2023 2022

Loans to directors GBP GBP

219,000 -

The directors consider that the carrying amounts of financial

assets held in the financial statements approximate to their fair

values-

Loans comprise solely of amounts loaned to directors. The loan

is interest free and repayable on demand.

11 Borrowings

2023 2022

Borrowings held at GBP GBP

cost:

Directors' loans 400 , 000 -

Loans comprise solely of amounts introduced by directors which

are for working capital requirements. The loan is interest free and

repayable on demand.

12 Fair value of financial liabilities

The directors consider that the carrying amounts of financial

liabilities held in the financial statements approximate to their

fair values.

13 Liquidity risk

The following table details the remaining contractual maturity

for the company's financial liabilities. The contractual maturity

is based on the earliest date on which the company may be required

to pay.

At 30 June 2022 Less than 1 year

GBP

Trade payables excluding accrued

expenses 56,859

Directors fees payable 195,175

252,034

=================

At 30 June 2023

Trade payables excluding accrued

expenses 19,403

Directors fees payable 123,175

Directors' loans 400,000

542,578

=================

Liquidity and capital risk management

The Company's capital structure consists of items in

shareholders' equity (deficiency). The Company's objectives when

managing capital are to safeguard the Company's ability to continue

as a going concern in order to provide returns for shareholders and

benefits for other stakeholders and to maintain an optimal capital

structure to reduce the cost of capital.

This was initially done through equity financing on

incorporation however since then the Company has moved to achieving

liquidity through loans from directors. Future financings are

dependent on market conditions. There were no other changes to the

Company's approach to capital management during the year.

The Company has adequate sources of capital to complete its

business plan, current obligations and ultimately the development

of its business over the long term, and will need to raise adequate

capital by obtaining equity financing and/or incurring debt.

Liquidity risk is the risk that the Company will not be able to

meet its financial obligations as they fall due. In conjunction

with the Company's capital risk management policy, the Company

ensures adequate liquidity is obtained and available to meet these

obligations. As at 30 June 2023, the Company had a cash balance of

GBP362,916 to settle current liabilities of GBP542,578. The Company

has mitigated liquidity risk by securing additional funding from

the directors since the reporting date, details of which can be

found in the note entitled Events after the reporting date.

14 Market risk

Market risk management

Interest rate risk

The Company does not currently have any financial instruments

that expose the Company to significant interest rate risk as the

Company does not have any debt that bears variable interest

rates.

Currency risk

The Company's financial instruments are currently all

denominated in British Pounds.

Price risk

The Company does not hold any equity securities and therefore is

not exposed to price risk.

Credit risk

The Company does not currently have any receivables and

therefore is not exposed to credit risk.

15 Business risk

As the Company is in its very early stages, business risk mainly

comprises effective cash management to ensure liabilities are met

as they fall due. The Board mitigates the impact of this by

periodically reviewing cash levels against forecasts and implements

strategies and actions to ensure sufficient cash is available for

the operation to continue as a going concern in order to meet the

Company's objectives.

16 Trade and other payables

2023 2022

GBP GBP

Trade payables 19,403 56,859

Accruals 36,384 10,608

Accrued directors fees 123,175 195,175

------- -------------------------

178,962 262,642

======= =========================

17 Share capital 2023 2022 2023 2022

Ordinary share capital Issued Number Number GBP GBP

and

fully paid Ordinary of 0.0167p 399,985,888 399,985,888 66,798 66,798

each

================ ================ ======= =========================

All Ordinary shares are allotted

and fully paid.

18 Share premium account 2023 2022

GBP GBP

At the beginning of the year

Issue 927,802

of new shares - - 927,802

------- -------------------------

At the end of the year 927,802 927,802

======= =========================

19 Events after the reporting date

Since the reporting period end date, director loans have been

issued to the Company totaling GBP500,000. These are interest free

and repayable on demand. The loan will not be recalled until such a

time that there are sufficient funds within the Company to enable

repayment and for the business to remain a going concern.

There are no other subsequent events since the reporting date to

disclose.

20 Related party transactions

Remuneration of key management personnel

The remuneration of key management personnel comprises solely of

the directors. This information is summarised in the note entitled

Directors' remuneration with further detail included in the

Directors' Remuneration Report.

Other transactions with related parties

Transactions with related parties include directors' fees and

loans which are disclosed in the following notes:

-- Directors' remuneration - fees paid to directors in the year

-- Trade and other receivables - loans made by the Company to directors

-- Trade and other payables - cumulative accrued directors fees

due to directors at the reporting date

-- Borrowings - loans made by directors to the Company

Of the above, directors' remuneration and accrued directors'

fees are arm's length transactions and conducted under normal

commercial terms. The directors' loans receivable and payable have

no right of offset and are not at arm's length or conducted under

normal commercial terms.

21 Controlling party

There is no one shareholder that owns greater than 50% of the

issued share capital of GS Chain Plc. The Company therefore does

not have an ultimate controlling party.

22 Cash absorbed by operations

2023 2022

GBP GBP

Loss for the year before income tax (688,242) (303,404)

Movements in working capital:

(Decrease)/increase in trade and

other payables (83,680) 262,642

Cash absorbed by operations (771,922) (40,762)

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACSKZMFGDMKGFZM

(END) Dow Jones Newswires

October 31, 2023 11:02 ET (15:02 GMT)

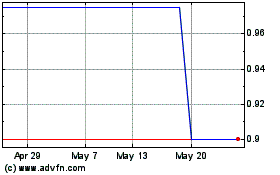

Gs Chain (LSE:GSC)

Historical Stock Chart

From Jan 2025 to Feb 2025

Gs Chain (LSE:GSC)

Historical Stock Chart

From Feb 2024 to Feb 2025