As

filed with the Securities and Exchange Commission on September 4, 2024.

Registration

Statement No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

F-1

REGISTRATION

STATEMENT Under The Securities Act of 1933

ALTA

GLOBAL GROUP LIMITED

(Exact

name of Registrant as specified in its charter)

| Australia |

|

7380 |

|

Not

applicable |

(State

or other jurisdiction of

incorporation or organization) |

|

(Primary

Standard Industrial

Classification Code Number) |

|

(I.R.S.

Employer

Identification

Number) |

Level

1, Suite 1, 29-33 The Corso

Manly,

New South Wales 2095

+61

1800 151 865

(Address,

including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Wimp

2 Warrior LLC

8

The Green, Ste R

Dover,

DE 19901

(302)

288-0670

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copy

of all communications including communications sent to agent for service, should be sent to:

Jeffrey

J. Fessler, Esq.

Seth

A. Lemings, Esq.

Sheppard,

Mullin, Richter & Hampton LLP

30

Rockefeller Plaza

New

York, NY 10112

Telephone:

(212) 653-8700

Facsimile:

(212) 653-8701 |

|

Mitchell

S. Nussbaum, Esq.

Norwood

P. Beveridge, Esq.

Lili

Taheri, Esq.

Loeb

& Loeb LLP

345

Park Avenue

New

York, NY 10154

Telephone:

(212) 407-4000

Facsimile:

(212) 407-4990 |

Approximate

date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, check the following box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging

growth company ☒

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided

pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

| † |

The

term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards

Board to its Accounting Standards Codification after April 5, 2012. |

The

Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act, or until this registration statement shall become effective on such date as the

Securities and Exchange Commission, acting pursuant to said Section 8(a) may determine.

The

information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration

statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities

and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS |

|

SUBJECT

TO COMPLETION |

|

DATED

SEPTEMBER 4, 2024 |

Up

to 3,619,303 Ordinary Shares

Up

to 3,619,303 Pre-Funded Warrants to Purchase up to 3,619,303 Ordinary Shares

Up

to 3,619,303 Ordinary Shares underlying such Pre-Funded Warrants

Alta

Global Group Limited

This

is a firm commitment public offering in the United States of ordinary shares, no par value (“Ordinary Shares”), of Alta Global

Group Limited, an Australian public company limited by shares.

Our

Ordinary Shares are listed on the NYSE American LLC (the “NYSE American”) under the symbol “MMA.” We have assumed

a public offering price of $3.73, which represents the last reported sale price of our Ordinary Shares as reported on the NYSE American

on September 3, 2024. The final public offering price will be determined through negotiation between us and the underwriters in the offering

and the assumed public offering price used throughout this prospectus may not be indicative of the actual offering price.

We

are also offering pre-funded warrants (the “Pre-Funded Warrants”) to purchase Ordinary Shares to those purchasers whose purchase

of Ordinary Shares in this offering would result in the purchaser, together with its affiliates and certain related parties, beneficially

owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding Ordinary Shares immediately following the consummation

of this offering, in lieu of Ordinary Shares. Each Pre-Funded Warrant is exercisable for one Ordinary Share and has an exercise price

of $0.001 per share. The assumed offering price per Pre-Funded Warrant is $3.73 less $0.001. Each Pre-Funded Warrant will be exercisable

immediately upon issuance and will expire when exercised in full. This offering also relates to the Ordinary Shares issuable upon exercise

of the Pre-Funded Warrants sold in this offering.

There

is no established public trading market for the Pre-Funded Warrants, and we do not expect a market to develop. We do not intend to apply

for listing of the Pre-Funded Warrants on any securities exchange or other nationally recognized trading system. Without an active trading

market, the liquidity of the Pre-Funded Warrants will be limited.

We

are an “emerging growth company” under the federal securities laws and have elected to comply with certain reduced public

company reporting requirements.

Investing

in our securities involves a high degree of risk. See “Risk Factors” beginning on page 12. Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

is truthful or complete. Any representation to the contrary is a criminal offense.

| | |

Per

Ordinary Share | | |

Per

Pre-Funded

Warrant | | |

Total | |

| Public offering price | |

US$ | | | |

US$ | | | |

US$ | | |

| Underwriting discounts and

commissions(1) | |

US$ | | | |

US$ | | | |

US$ | | |

| Proceeds to us, before expenses | |

US$ | | | |

US$ | | | |

US$ | | |

| (1) |

Underwriting

discounts and commissions do not include a non-accountable expense allowance equal to 1.0% of the public offering price payable to

the underwriters. We refer you to “Underwriting” beginning on page 104 for additional information regarding underwriters’

compensation. |

We

have granted a 45-day option to the representative of the underwriters to purchase up to 542,895 additional Ordinary Shares and/or Pre-Funded

Warrants solely to cover over-allotments, if any.

The

underwriters expect to deliver the Ordinary Shares and any Pre-Funded Warrants to purchasers against payment in U.S. dollars in New York,

New York, on or about , 2024.

ThinkEquity

The

date of this prospectus is , 2024

TABLE

OF CONTENTS

We

are incorporated under the laws of Australia. Certain of our directors and officers and certain other persons named in this prospectus

are citizens and residents of countries other than the United States, and all or a significant portion of the assets of the certain directors,

officers and other persons named in this prospectus are outside the United States. As a result, it may not be possible for you to effect

service of process within the United States upon such persons or to enforce against them or against us in U.S. courts any judgments predicated

upon the civil liability provisions of the federal securities laws of the United States. There is doubt as to the enforceability in Australia,

either in original actions or in actions for enforcement of judgments of U.S. courts, of civil liabilities predicated on U.S. federal

securities laws.

You

should rely only on the information contained in this prospectus or contained in any free writing prospectus filed with the SEC. Neither

we nor the underwriters have authorized anyone to provide any information or make any representation other than those contained in this

prospectus or in any free writing prospectus we have prepared. When you make a decision about whether to invest in the Ordinary Shares

or Pre-Funded Warrants, you should not rely upon any information other than the information in this prospectus. The information contained

in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any

sale of the Ordinary Shares or Pre-Funded Warrants. Our business, financial condition, operating results and prospects may have changed

since that date. This prospectus is not an offer to sell or solicitation of an offer to buy the Ordinary Shares or Pre-Funded Warrants

in any circumstances under which any such offer or solicitation is unlawful.

For

investors outside of the United States, we have not taken any action to permit this offering or to permit the possession or distribution

of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the

United States who come into possession of this prospectus must inform themselves about and observe any restrictions relating to the offering

of the Ordinary Shares and Pre-Funded Warrants and the distribution of this prospectus outside of the United States.

CONVENTIONS

THAT APPLY TO THIS PROSPECTUS

Unless

otherwise indicated or the context implies otherwise, any reference in this prospectus to:

| |

● |

“Alta”

refers to Alta Global Group Limited, an Australian public company limited by shares; |

| |

|

|

| |

● |

“the

Company,” “we,” “us,” or “our” refer to Alta and its consolidated subsidiaries, through

which it conducts its business; |

| |

|

|

| |

● |

“Shares”

or “Ordinary Shares” refers to Ordinary Shares of Alta; and |

| |

|

|

| |

● |

“Corporations

Act” means the Australian Corporations Act 2001 (Cth). |

PRESENTATION

OF FINANCIAL INFORMATION

Our

reporting and functional currency is the Australian dollar, and our financial statements included elsewhere in this prospectus are presented

in Australian dollars. The consolidated financial statements and related notes included elsewhere in this prospectus have been prepared

in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (the “IASB”)

and interpretations (collectively “IFRS”), differ in certain significant respects from generally accepted accounting principles

in the United States (“U.S. GAAP”). As a result, our financial statements may not be comparable to the financial statements

of U.S. companies. Because the U.S. Securities and Exchange Commission (the “SEC”) has adopted rules to accept financial

statements prepared in accordance with IFRS as issued by the IASB without reconciliation to U.S. GAAP from foreign private issuers such

as us, we are not providing a description of the principal differences between U.S. GAAP and IFRS.

All

references in this prospectus to “US$,” “U.S. dollars,” and “dollars” mean U.S. dollars and all references

to “A$” mean Australian dollars, unless otherwise noted.

Our

reporting and functional currency is the Australian dollar. As a result, except as otherwise stated, all amounts presented in this prospectus

will be in Australian dollars. No representation is made that the Australian dollar amounts referred to in this prospectus could have

been or could be converted into U.S. dollars at a particular rate.

INDUSTRY

AND MARKET DATA

This

prospectus includes information with respect to market and industry conditions and market share from third-party sources or that is based

upon estimates using such sources when available. We believe that such information and estimates are reasonable and reliable. We also

believe the information extracted from publications of third-party sources has been accurately reproduced. However, we have not independently

verified any of the data from third party sources. Similarly, our internal research is based upon the understanding of industry conditions,

and such information has not been verified by any independent sources. In addition, assumptions and estimates of our and our industry’s

future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described

under the caption “Risk Factors” of this prospectus. These and other factors could cause our future performance to differ

materially from our assumptions and estimates. See “Cautionary Note Regarding Forward-Looking Statements.”

TRADEMARKS,

SERVICE MARKS AND TRADENAMES

We

use our registered and unregistered trademarks in this prospectus. This prospectus also includes trademarks, tradenames and service marks

that are the property of other organizations. Solely for convenience, trademarks and tradenames referred to in this prospectus may appear

without the ® and ™ symbols, but those references are not intended to indicate in any way that we will

not assert, to the fullest extent under applicable law, our rights or that the applicable owner will not assert its rights, to these

trademarks and tradenames.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus contains forward-looking statements that are subject to a number of risks and uncertainties, many of which are beyond our

control. All statements, other than statements of historical fact included in this prospectus, regarding our strategy, future operations,

financial position, projected costs, prospects, plans and objectives of management are forward-looking statements. When used in this

prospectus, the words “could,” “believe,” “anticipate,” “intend,” “estimate,”

“expect,” “may,” “continue,” “predict,” “potential,” “project”

or the negative of these terms or other similar expressions are intended to identify forward-looking statements, although not all forward-looking

statements contain such identifying words.

Forward-looking

statements contained in this prospectus include, but are not limited to, statements with respect to:

| |

● |

our

goals and strategies, including with respect to the development and expansion of our business; |

| |

|

|

| |

● |

our

capital commitments and/or intentions with respect to our business, including the sufficiency of our liquidity and capital resources; |

| |

|

|

| |

● |

the

nature and extent of future competition in our industry and in the markets in which we operate or plan to operate; |

| |

|

|

| |

● |

the

price of, and our ability to successfully integrate, any acquired businesses; |

| |

|

|

| |

● |

the

expected cash flows from our business; |

| |

|

|

| |

● |

our

planned capital expenditures; and |

| |

|

|

| |

● |

our

intended use of proceeds from this offering. |

All

forward-looking statements speak only as of the date of this prospectus. You should not place undue reliance on these forward-looking

statements. Although we believe that our plans, objectives, expectations and intentions reflected in or suggested by the forward-looking

statements we make in this prospectus are reasonable, we cannot assure you that these plans, objectives, expectations or intentions will

be achieved. We disclose important factors that could cause our actual results to differ materially from our expectations under “Risk

Factors” and elsewhere in this prospectus. This prospectus also contains estimates and other statistical data made by independent

parties and by us relating to market size and growth and other data about our industry. These data involve a number of assumptions and

limitations, and you are cautioned not to give undue weight to such estimates. In addition, projections, assumptions and estimates of

our future performance and the future performance of the markets in which we operate are necessarily subject to a high degree of uncertainty

and risk. Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or

quantified and some of which are beyond our control, you should not rely on these forward-looking statements as predictions of future

events. Moreover, we operate in an evolving environment. New risk factors and uncertainties may emerge from time to time, and it is not

possible for management to predict all risk factors and uncertainties.

The

forward-looking statements made in this prospectus relate only to events or information as of the date on which the statements are made

in this prospectus. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements,

whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the

occurrence of unanticipated events.

PROSPECTUS

SUMMARY

This

summary provides a brief overview of information contained elsewhere in this prospectus and is qualified in its entirety by the more

detailed information and consolidated financial statements included elsewhere in this prospectus. Because it is abbreviated, this summary

does not contain all of the information that you should consider before investing in our securities. You should read the entire prospectus

carefully before making an investment decision, including the information presented under the headings “Risk Factors,” “Cautionary

Note Regarding Forward-Looking Statements” and “Management’s Discussion and Analysis of Financial Condition and Results

of Operations” and the historical consolidated financial statements and the related notes to those financial statements included

elsewhere in this prospectus.

Our

Mission

Our

mission is to empower community driven growth in the global martial arts and combat sports sector, leveraging technology to bridge the

gap between passion and participation.

Company

Overview

We

are a technology company that is enabling the global martial arts and combat sports industry to maximize the monetization opportunities

available to the sector by increasing consumer participation in the sport and building upon existing community offerings within the sector.

While we believe martial arts and combat sport gyms have a superb in-gym product, they are ripe for transformation when it comes to building

sales channels, enhancing customer onboarding, optimizing engagement and driving the growth and retention of members and membership revenues

within their gym communities.

We

believe that our platform represents a considerable opportunity to aggregate the vast global community ecosystem for martial arts and

combat sports, via a single platform solution that will define the sector’s digital transformation, converting one of the world’s

largest fan bases into participants. The Alta Platform serves as a comprehensive solution for martial arts and combat sports, offering

a blend of four core products: the Warrior Training Program, UFC Fight Fit Program, Alta Academy, and the Alta Community. To date, the

Warrior Training Program has been the core product we have monetized globally, which has been integral in enabling us to partner with

some of the best gyms and coaches globally, while building a passionate following from our participants and customers.

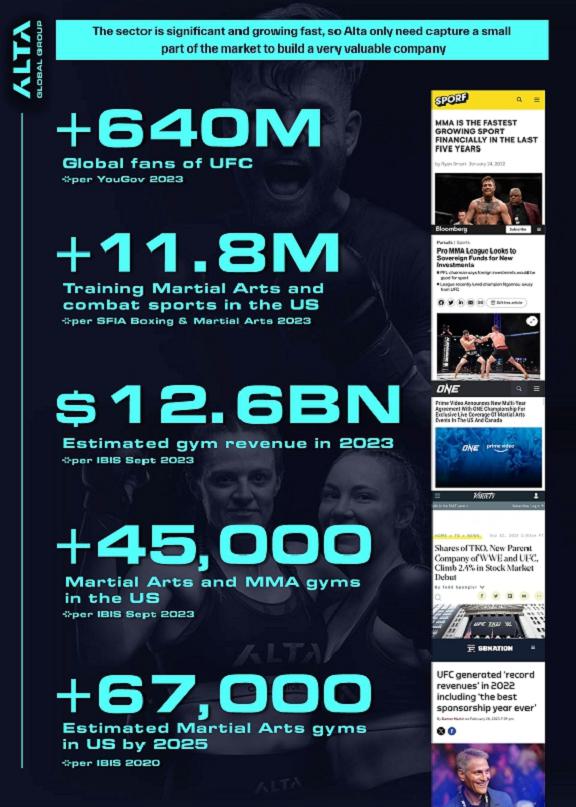

Mixed

martial arts (“MMA”) is one of the world’s fastest growing sports for participation and audience growth, with hundreds

of millions of passionate fans engaging in various levels of digital and physical participation every day. According to IBISWorld statistics,

there are currently over 45,597 martial arts and combat sports gyms in the US alone that are expected to generate over US$12.6 billion

in annual revenue in 2023. Additionally, according to Sports & Fitness Industry Association’s Single Sport Reports for Martial

Arts and Boxing Fitness, it is expected that more than 11.8 million people will engage in various martial arts and combat sports disciplines

in 2023.

There

are significant sector tailwinds which we benefit from, created by the large professional MMA leagues, including the UFC, Professional

Fighters League (“PFL”), ONE Championship and Bellator, whose marketing budgets and broadcast reach play a pivotal role in

growing the sport’s fan base. As a participant in the MMA sector, we target fan and consumer interest and aim to convert that interest

into engagement with our premium and immersive online and “in-gym” fitness and training experiences.

We

have successfully activated globally recognized coaches, athletes and influencers as ambassadors who continue to promote our vison and

the growth in adoption of our platform and its benefits. We believe the continuing engagement of our ambassadors will be a key element

to drive our expansion. Our network of partner gym communities includes some of the most renowned names in the combat sports sector,

including one of our cofounders, John Kavanagh, an MMA coach who is widely recognized for coaching UFC champion, Conor McGregor. Mr.

Kavanagh has assisted in the development of the training programs available exclusively on our platform and offers these programs at

his prominent gym, SBG Ireland, in Dublin. Mr. Kavanagh has also assisted us in engaging other globally recognized partner gym communities.

In addition, we have also secured key talent in the MMA sector by engaging ambassadors such as former UFC champion Daniel Cormier, UFC

broadcaster Laura Sanko and owner and head coach of City Kickboxing in Auckland, New Zealand, Eugene Bareman.

Since

our inception, we have accumulated deep sector knowledge of how martial arts and combat sports operate globally, enabling us to recognize

the unique preferences and needs of the gyms, coaches and consumers within this market. We have leveraged the extensive information in

our gym inventory and community database to create an optimal pathway to attract consumers to participate in our proprietary training

programs as well as training via the weekly timetable of our partner gyms. We have built a database containing over 4,000 records of

martial arts and combat sports gyms globally and have over 550 gyms on the Alta Platform. Our partner gym communities include martial

arts and combat sports gym operations that span a range of training disciplines including, but not limited to, jiu jitsu, boxing, wrestling,

MMA, Muay Thai, kickboxing, judo, karate, and Tae Kwon Do.

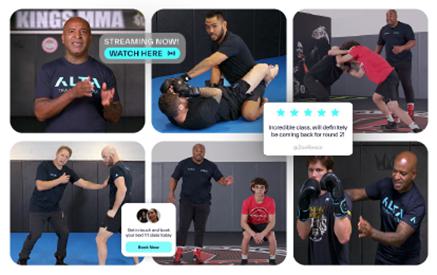

Since

2018, we have run over 206 Warrior Training Programs globally, and over 5,107 participants have subscribed to our Warrior Training Program,

an average of 25 participants per program. In fiscal year 2021, we ran 34 Warrior Training Programs with a total of 886 participants.

In fiscal year 2022, we ran 50 Warrior Training Programs with a total of 1,163 participants. In fiscal year 2023, we ran 36 Warrior Training

Programs with a total of 865 participants. Over the last three years, the average gross revenue per participant who subscribed to our

Warrior Training Program was A$1,496. The Warrior Training Program is a 100 lesson, 20-week syllabus that provides participants with

a comprehensive introduction to the foundations of the sport of mixed martial arts. Participants who complete the 20-week Warrior Training

Program have the opportunity to compete in a sanctioned amateur mixed martial arts contest against a fellow participant in their class

cohort. The Warrior Training Program thereby acts as an “on ramp” to learning the fundamentals of all disciplines of mixed

martial arts, including wrestling, Brazilian Jiu Jitsu, boxing, Thai boxing, Judo and other disciplines. At the conclusion of the Warrior

Training Program, participants may elect to continue their training subscription and specialize in a particular martial art they enjoyed

during their Warrior Training Program.

As

a result, our partner gyms have experienced incremental revenue growth because of increased participation within their community. Our

community development approach to acquiring participants has redefined the participation demographics for martial arts worldwide. Specifically,

we have strong female participation rates, and the average age of our members is mid to late 30s, with our oldest participants being

in their 60s. Additionally, participants can become valuable, long-standing members of our and their gym community after completing their

first Alta program.

We

have also entered into a Partner Referral Agreement with U Gym, LLC (“UFC Gym”). We have collaborated with UFC Gym to design

and launch a new 10-week Alta training program, called the UFC Fight Fit Program (“UFC Fight Fit Program”). UFC Gym has the

option to introduce the 10 week program across its network of over 150 global locations.

A

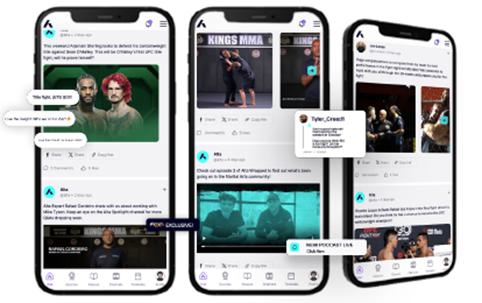

further opportunity to aggregate the sector is through our Alta Community product, which is an extension of our existing product offerings

and represents the first global, cloud-based community-led growth and management software for martial arts and combat sports. The Alta

Community is designed for participants, coaches, and operators who are collectively referred to as “members” of the Alta

Community. The Alta Community enables the creation of individual communities and also promotes connections among these communities and

their members, thus fostering a single global community. This solution is deliberately designed to optimize the management, growth, and

monetization of martial arts and combat sports communities. It strives to enhance the digital and in-gym experiences of Alta members,

making it easier for them to discover, participate in, contribute to, coach, and operate the best martial arts and combat sports communities

on a single platform. Importantly, this entire process is facilitated through a simple monthly subscription.

In

summary, by combining our proprietary training programs with the insights and connection driven approach of the Alta Community, we have

created a commercial environment that drives efficiency, growth, and is designed to deliver partner gyms and coaches a distinct competitive

advantage. The combination of Alta’s core products positions the business strongly as a first mover in the race to aggregate such

a vast and attractive sector by creating a personalized, inclusive and attractive “on ramp” for martial arts participation,

regardless of location.

Our

Footprint - Trainalta.com, Mixedmartialarts.com and Steppen

Each

day we strive to:

| |

● |

Increase

the number of published and active gyms. |

| |

● |

Activate

recurring revenue through each active gym by running Alta Programs, selling in-gym training subscriptions and enrolling customers

in our Alta Academy and Alta Community platform. Our mantra ‘increasing earnings at your gym’ enables us to increase

our ‘share of wallet’ and drive growth. |

| |

● |

Establish

a model that generates a steady stream of leads and prospects for our products. The user generated content available on mixedmartialarts.com,

Alta content available on the Alta Academy and testimonials endorsing our programs are enabling the creation of a self-sustaining

customer acquisition model. |

| |

● |

Build

a scalable technology stack that solves customer needs and is capable of being rolled out to other sports with community attributes

similar to martial arts and combat sports. |

This

focus has enabled us to achieve the following:

| Metrics |

|

March

31, 2024 (Actual) |

| Curated

Gym Network |

|

|

| Database |

|

4,299

gyms with global inventory accessible |

| Published |

|

3,028

gyms (1,025 in Oceania, 1,699 in the United States, 172 in the United Kingdom & Ireland and 132 in other locations) with global

inventory available |

| Active |

|

552

gyms registered on trainalta.com, gym profile claimed or created, and accepted terms and conditions for the Alta platform or Hype

platform and/or accepted previous license agreement to run the Warrior Training Program |

| Ambassadors |

|

5

globally recognized influencers |

| Athlete

Profiles/Talent |

|

Over

9,878 professional and amateur fighters |

| Participants/User

Accounts |

|

Over

543,518 monthly users of three Alta platforms |

| Website

Sessions |

|

Over

580,000 combined monthly website sessions of three Alta platforms |

| Monthly

User Engagements |

|

Over

600,000 monthly average user engagements (posts and reactions) |

| Follower

base |

|

Over

5,000,000 total social media followers (Meta, X and TikTok) |

| Page

Views |

|

Over

14,000,000 combined monthly pageviews of three Alta platforms |

| Coaching

Tutorial Videos |

|

Over

3,500 tutorial videos available on Alta platforms |

| |

|

|

| Enterprise |

|

|

| Enterprise |

|

UFC

Fit partnership expansion from pilot at San Jose |

Business

Progress

Since

July 1, 2023, we have increased our gym footprint, expanding into new territories including Illinois, Arizona and Hawaii. We have also

engaged major martial arts academies including Renzo Gracie, American Top Team and American Kickboxing Academy.

In

July 2023, we launched our first online offering, the Alta Academy, to complement and further leverage our in-gym training experiences

for our customers. This activates our multi-year exclusive content agreements with our key global talent, which is a critical element

of our top of funnel marketing systems to drive in-gym participation.

Since

launch of the Alta Academy, we have expanded our digital content, including the digital syllabus for the Warrior Training Program, and

extended our online training into other disciplines beyond MMA, including jiu jitsu, boxing, wrestling, and Muay Thai, among others,

with new masterclasses delivered by our elite coaching talent, including Rafael Cordeiro, Mike Angove, Nikki Lloyd-Griffiths.

In

September 2023, we launched four new membership tiers for Alta members, including an In-Gym Training membership tier, which leverages

underutilized capacity within our gym partner network and allows Alta members to train in our partner gyms.

In

September 2023, we launched the first iteration of the Alta Community platform, which we believe will drive the growth of the gym and

coaching communities though the provision of new content and channels. This included the launch of gym channels. The gym channels feature

is used to house multimedia content that pertains to a specific gym’s profile on the Alta Community. This currently includes multimedia

content such as gym walkthrough videos (point of view videos demonstrating the gym’s facility) as well as interviews with gym owners

and coaches.

In

September 2023, we successfully completed our pilot UFC Fit program with UFC Gym in San Jose. We are currently negotiating the roll-out

the UFC Fit program across the UFC Gym network.

In

September 2023, we completed the acquisition of the assets of Steppen Pty Ltd, a fitness technology company based in Australia (“Steppen”).

Steppen is a dynamic fitness app designed to inspire, guide, and support users on their fitness journey. The Steppen platform quickly

resonated with young fitness enthusiasts around the globe, particularly in the U.S., accumulating a large following quickly after its

global launch in mid-2021. The Steppen App has seen success with over 395,000 downloads, predominantly from the U.S., reaching over 1.8

million impressions on the Apple App Store. With a robust database of over 270,000 accounts, we believe that the Steppen App has established

a substantial user base. We plan to continue Steppen App’s operations and integrate key aspects of its proprietary Apple mobile

application technology, while exploring ways to optimize content and services for users, leveraging the acquired expertise and technology.

We believe the synergy from this acquisition is poised to drive growth, diversification, and market expansion for Alta in the burgeoning

health and wellness sector. As consideration for the asset acquisition, we issued Steppen an unsecured and non-redeemable convertible

promissory note (on the same terms as the private placement completed in June 2023 (the “Private Placement”)), with a principal

amount of US$ 64,977.

In

October 2023, we completed the acquisition of the assets of Mixed Martials Arts LLC, an independent

MMA media company, based in the U.S. Mixed Martial Arts LLC represents a valuable opportunity to us, as it is one of the last

independent MMA media companies not acquired by a major corporation, making it a novel asset in the digital MMA landscape. With a substantial

digital presence, the platform boasts more than 260,000 forum accounts, more than 350,000 monthly engaged sessions, and a significant

social media footprint, including over 5 million followers across Facebook pages. Mixed Martial Arts LLC has previously initiated effective

monetization strategies, generating peak annual revenues of up to US$600,000. With the right investment in technology and user engagement,

we believe there is considerable potential for revitalizing and growing the platform’s user base and revenue streams. As

consideration for the asset acquisition, we issued Mixed Martials Arts LLC an unsecured

and non-redeemable convertible promissory note (on the same terms as the recently completed Private Placement), with a principal amount

of US$250,000 and paid US$25,000 in cash.

In

October 2023, we launched ticketing services for live Alta events and seminars, including the Warrior Training Program finale events.

Since launching to March 31, 2024, we have generated ticketing revenue of A$144,817.

On

April 2, 2024, we completed our initial public offering, raising $6,500,000 by selling 1,300,000 shares at $5.00 per share. All previously

issued convertible notes were converted or redeemed. As of March 31, 2024, there are no convertible notes, host, or derivative liabilities

on the Consolidated Statement of Financial Position. Remaining interest and final fair value movement in derivative liability are reflected

in the Consolidated Statement of Profit or Loss.

Throughout

April 2024, we partnered with renowned combat sports figures, including Rafael Cordeiro (Mike Tyson’s coach) for online Muay Thai

training and former UFC champion Daniel Cormier for wrestling instructional videos, targeting both beginners and seasoned athletes.

In

May 2024, we celebrated success in expanding the global MMA community. The Warrior Training Program at SBG Ireland has historically attracted

over 700 new members, boosting gym memberships and revenue. MMA superstar Conor McGregor, an Alta investor, endorsed the program to help

drive global combat sports participation. We also announced a strategic partnership with Upper Management in Mexico to launch the Warrior

Training Program in multiple gyms and create content for the burgeoning Mexican MMA fanbase. Further, we also showcased our partnership

with City Kickboxing in New Zealand, transforming over 800 beginners into cage-ready athletes through the Warrior Training Program, significantly

boosting gym memberships and community engagement.

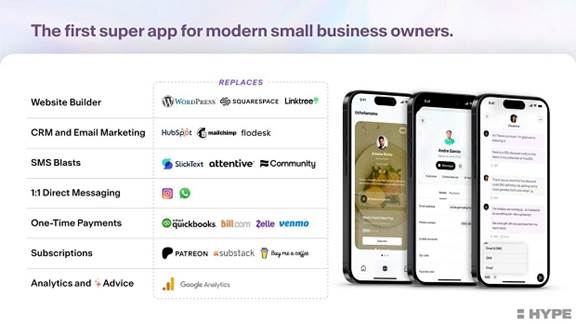

In

May 2024, we completed the acquisition of the assets of Hype Kit, Inc. (“Hype”) for USD$100,000, an all-in-one digital marketing

platform, designed to help small businesses grow in today’s age of social media. Hype’s software platform strengthens the

Company’s vision to convert 640 million MMA fans to participants by providing invaluable tools to our gym owner, coach, and athlete

partners to not only grow their revenues, but also operate more efficiently, save costs and enhance the offerings to their members and

community. This acquisition is expected to accelerate Alta’s technology roadmap, bringing forward new subscription revenue opportunities

for us, whilst creating cost synergies by materially reducing product development overhead and bringing valuable technology expertise,

skills and talent into the business.

In

June 2024, we partnered with legendary MMA coach Eric Nicksick and former UFC fighters Jessica-Rose Clark and Gilbert Melendez to help

strengthen our connection to 640 million global MMA fans.

Our

Next Growth Engines

The

growth engine of the Alta Platform is conceived as a dynamic, adaptable model, intentionally designed to reflect the ever-evolving landscape

of martial arts, ongoing technological advancements, and the shifting preferences within the global martial arts community. Rather than

being static, this strategy is crafted to be agile, accommodating new insights and market shifts.

Having

established product market fit across our operating territories with the Warrior Training Program, we expect that the next phase of our

growth will be driven by expanding our product set to meet the demand of the martial arts and combat sports community. Our extended subscription

based product suite aims to increase member engagement and lifetime value of each of our members (participants, gyms and coaches) in

the martial arts training ecosystem. For example, where a subscription to the Warrior Training Program historically had a start date

and an end date, our new product range and technology stack enables the Warrior Training Program to also be sold alongside an ongoing

in-gym training subscription (both before and after completion of the Warrior Training Program).

Central

to this strategy is the utilization of technology to catalyze growth that is primarily community-led. It establishes a digital-to-physical

bridge that enhances engagement and participation within physical gym settings. We believe our platforms are poised to become the primary

destination for passionate martial artists and commercial practitioners, presenting avenues for content consumption and active, personalized

involvement within the sport.

Our

platforms equip users with an array of options to navigate and tailor their martial arts experience. Our services are inclusive, reaching

out to a broad spectrum of users from beginners to seasoned fighters, and also provide resources for coaches and gym owners to grow their

businesses. These services are refined to match users’ progression within martial arts, ensuring that our platforms evolve concurrently

with technology and community input.

Most

recently, we delivered a bespoke product solution for a new enterprise partner, UFC Gym, which will allow us to refine our enterprise

offerings to other large fitness chains and provide us with valuable content and user led reviews and feedback. Our ability to grow is

further bolstered by a dedicated team of experts in the field that enhance our technology, ensuring that our platforms remain at the

forefront of user engagement.

We

monetize our product offerings through our membership tiers that are customized for different degrees of engagement, enabling users to

modify their level of participation as their relationship with martial arts deepens, or reduces. This modular approach guarantees accessibility

and flexibility, presenting a variety of interaction points for every segment of the martial arts community.

The

expansion of our platforms is engineered to boost user engagement, revenue generation and lifetime value of each Alta member, embodying

a growth-centric model that anticipates and meets the needs of our users while expanding their interaction with martial arts. This blueprint

is devised to position our platforms as a central, influential force within the martial arts community that fosters a robust, interconnected

global community.

Member

Acquisition Approach for the Alta Platform

Member

Acquisition Overview for the Alta Platform

We

are dedicated to expanding our member community by strategically acquiring new members who have a passion for martial arts or combat

sports and fitness. Our approach is data-driven and designed to align with the interests and behaviors of potential platform members.

Relationship/Platform:

| |

● |

By

offering practical solutions to improve the in-gym experience and pathways to participate in martial arts and combat sports, our

sales function combines with the utility of our platform to become an effective co-operative marketing acquisition strategy. We empower

gym owners with the knowledge and tools required to increase their revenue. This empowerment demonstrates that our platform is not

merely a product but an evolving business growth partnership. |

Direct

Targeted Marketing and Advertising:

| |

● |

Precision

Analytics: By leveraging our comprehensive data analytics and expansive member databases, we identify potential participants that

may be interested in MMA. These individuals are segmented and approached with personalized advertising campaigns across major digital

platforms, including Google, Meta, and TikTok, ensuring a high degree of relevancy and engagement. |

| |

|

|

| |

● |

Engagement-Driven

Campaigns: We create and disseminate high-impact marketing campaigns that tell evocative stories, incorporate user-generated content,

and feature interactive elements to captivate and involve MMA fans. Capitalizing on seasonal movements, major fight events, and the

inherent virality of the sport, we craft advertisements designed to resonate profoundly with our target audience, stimulating engagement

and fostering conversions. |

Cross-Promotional

Activities:

| |

● |

Alliances

with Marquee Brands: The Alta platform actively seeks and secures strategic alliances with premier brands such as UFC Fit. Through

these partnerships and data sharing protocols, we can reach a broader yet highly targeted audience, offering them an immersive experience

in the MMA lifestyle. |

| |

|

|

| |

● |

Custom-Tailored

Offers: We create exclusive promotional opportunities specifically for the members and customers of our partner brands. By providing

special incentives such as unique experiences during pinnacle events in the MMA calendar, we attract an audience already primed for

our offerings. |

Optimization

and Visibility:

| |

● |

Content

Optimization: We continuously refine the content on our digital properties, including Trainalta.com and MixedMartialArts.com, to

align with the search behaviors of MMA enthusiasts. Through keyword targeting and content strategies, we enhance our visibility,

particularly during periods of peak interest. |

| |

|

|

| |

● |

Technical

Readiness: Our platforms are optimized for high performance to accommodate increased traffic flow during major campaigns and high-interest

seasons, ensuring that new visitors encounter a seamless user experience, conducive to member conversion. |

Targeted

Seasonal Initiatives:

| |

● |

Seasonal

Marketing Initiatives: Our campaigns are also timed to coincide with key fitness milestones throughout the year, recognizing patterns

such as New Year’s fitness resolutions, spring training upticks, and summer readiness regimens. These initiatives are crafted

to appeal to fitness consumers, integrating lifestyle aspirations with the rigors and discipline of MMA training. |

| |

|

|

| |

● |

Experiential

Engagements: We design promotions that tie in with significant events and holidays, catering to the consumers’ desire for unique

and exclusive experiences augmented by MMA training and fitness regimens. |

By

integrating deep database insights and aligning with seasonal consumer behaviors, we believe our member acquisition strategy is fine-tuned

for effectiveness, ensuring we captivate a diverse audience ranging from the core MMA fan to the lifestyle-driven fitness enthusiast.

Our strategic approach positions us to expand our member base meaningfully and sustainably, driving the growth, monetization and vitality

of the Alta Community.

B2B

and Enterprise Sales Partnership Approach

We

understand the local nature of the martial arts and combat sports gym industry, where trust and personal relationships are paramount.

Our strategy is to access local markets through:

| |

● |

Industry

Experts: Our sales personnel are not just representatives; they are coaching and gym operation consultants who understand the benefits

of leveraging our platform, providing personalized solutions and fostering trust through demonstrating our platforms capability as

a complimentary tool in our partner gyms’ sales, marketing and community management approach. |

| |

|

|

| |

● |

Localized

Marketing: Implement targeted marketing campaigns that resonate with the local MMA culture and interests, utilizing local media,

community events, and regional online media destinations and communities. |

| |

|

|

| |

● |

Community

Engagement: Participate in and sponsor local competitive events, strengthen partnerships with our gym partners, and engage in community

service, reinforcing our commitment to our gym partners and their communities. |

| |

|

|

| |

● |

Referral

Programs: Leverage our platforms referral program that incentivizes our existing participants and gym partners to bring in their

network, leveraging their satisfaction and trust in our platforms brand. |

| |

|

|

| |

● |

Testimonials

and Success Stories: Showcase business growth stories from our current gym partners and endorsements from our high-profile coaches

to demonstrate the impact of our Warrior Training Program. |

| |

|

|

| |

● |

Search

Engine Optimization and Online Presence: Optimize our online presence to capture interest from potential gym partners searching for

options to grow their profile in their local area. |

| |

|

|

| |

● |

Social

Media Engagement: Actively engage with the local MMA and combat sports community on social media platforms to build a passionate

following and drive awareness. |

Our

commitment to evolution and adaptability is paramount. We maintain a feedback-informed approach to our offerings, ensuring that they

align with the evolving demands of the MMA and combat sports community. This adaptive strategy reflects our commitment to staying at

the forefront of combat sports training.

Our

Future Growth Strategy

We

believe there are significant opportunities to grow our business, and we intend to do this in established markets to take advantage of

the unique position we have created in the martial arts and combat sports sector. Since inception we have grown through positive customer

reviews, amplified through social media to attract new customers. In addition, we have partnered with globally respected martial arts

figures who greatly expand our organic reach through their social channels and networks.

We

will continue to invest in our product platform and further develop our partner eco-system. As our product offerings expand, we believe

there will be the opportunity to cross-sell our products into our gym partner network and increase adoption of our full product suite.

We

intend to continue to invest in technology to enhance the experience for all participants on the Alta Platform, namely customers, coaches

and gym owners, in order to drive lifetime value and expand sales channels through referrals and organic promotion.

While

we are currently focused on the martial arts and combat sports sector, over time, we believe that our technology and community platform

could be expanded to support many other sports which exhibit attributes similar to martial arts and combat sports. Once proven in the

vast addressable market of martial arts and combat sports, we feel many new sector opportunities will present themselves for similar

rollouts and monetization.

Risk

Factors Summary

Investing

in our securities involves significant risks. You should carefully consider the risks described in “Risk Factors” before

making a decision to invest in our securities. If we are unable to successfully address these risks and challenges, our business, financial

condition, results of operations, or prospects could be materially and adversely affected. In such case, the trading price of our Ordinary

Shares would likely decline, and you may lose all or part of your investment. Below is a summary of some of the risks we face:

| ● |

we

will require substantial capital to finance our operations, which may not be available to us on acceptable terms, or at all; |

| |

|

| ● |

we

have incurred operating losses in the past, may incur operating losses in the future, and may not achieve or maintain profitability

in the future; |

| |

|

| ● |

we

have disclosed that there is substantial doubt about our ability to continue as a going concern. We may require additional capital

in order to execute our business plan and continue the operation of our business. Any capital-raising transaction we are able to

complete may result in substantial dilution to our existing shareholders. Our auditors have issued an audit report that contains

an explanatory paragraph regarding the Company’s ability to continue as a going concern and their opinion is not modified with

respect to this matter; |

| |

|

| ● |

changes

in public and consumer tastes and preferences and industry trends could reduce demand for our services and content offerings and

adversely affect our business; |

| |

|

| ● |

our

in-gym programming has been and may in the future be materially impacted by the ongoing COVID-19 pandemic, and could be impacted

by similar events in the future; |

| |

|

| ● |

our

ability to generate revenue, is subject to many factors, including many that are beyond our control, such as general macroeconomic

conditions; |

| |

|

| ● |

we

rely on technology, such as our information systems, to conduct our business. Failure to protect our technology against breakdowns

and security breaches could adversely affect our business; |

| |

|

| ● |

the

unauthorized disclosure of sensitive or confidential client or customer information could harm our business and standing with our

clients and customers; |

| |

|

| ● |

exchange

rates may cause fluctuations in our results of operations; |

| |

|

| ● |

our

partner gyms could take actions that harm our business; |

| |

|

| ● |

our

success depends substantially on the value of our brand; |

| ● |

we

rely on contracts and relationships and a termination of any such contract or relationship may have a material adverse effect on

our business; |

| |

|

| ● |

our

planned growth could place strains on our management, employees, information systems and internal controls, which may adversely impact

our business; |

| |

|

| ● |

our

partner gyms may be unable to attract and retain members, which may materially and adversely affect our business, results of operations

and financial condition; |

| |

|

| ● |

if

we are unable to identify and secure suitable partner gyms, our revenue growth rate and profits may be negatively impacted; |

| |

|

| ● |

if

we are unable to retain our key employees, we may not be able to successfully manager our business and pursue our strategic objectives; |

| |

|

| ● |

use

of social media may adversely impact our reputation or subject us to fines or other penalties; |

| |

|

| ● |

we

may be unsuccessful in any strategic acquisitions and investments, and we may pursue acquisitions or investments for their strategic

value in spite of the risk of lack of profitability; |

| |

|

| ● |

we

are subject to risks associated with operating in international markets; |

| |

|

| ● |

we

may not be able to attract and retain key professional fighters or coaches; |

| |

|

| ● |

our

expansion into new markets may present increased risks due to our unfamiliarity with the area, different rules and regulations and

challenging operating environments; |

| |

|

| ● |

risks

related to government regulation; |

| |

|

| ● |

we

are an “emerging growth company,” and our election to comply with the reduced disclosure requirements as a public company

may make our securities less attractive to investors; |

| |

|

| ● |

if

we fail to establish and maintain proper internal controls, our ability to produce accurate financial statements or comply with applicable

regulations could be impaired; |

| |

|

| ● |

we

may issue additional Ordinary Shares in the future, which may dilute our existing shareholders, and we may also issue securities

that have rights and privileges that are more favorable than the rights and privileges accorded to our existing shareholders; |

| |

|

| ● |

as

a foreign private issuer, we are permitted and expect to follow certain home country corporate governance practices in lieu of certain

NYSE American requirements applicable to domestic issuers; |

| |

|

| ● |

as

a foreign private issuer, we are permitted to file less information with the SEC than a domestic issuer; |

| |

|

| ● |

we

may lose our foreign private issuer status, which would then require us to comply with the Exchange Act’s domestic reporting

regime and cause us to incur additional legal, accounting and other expenses; |

| |

|

| ● |

the

NYSE American may delist our Ordinary Shares from trading on its exchange, which could limit investors’ ability to make transactions

in our Ordinary Shares and subject us to additional trading restrictions; and |

| |

|

| ● |

anti-takeover

provisions in our Constitution and our right to issue preference shares could make a third-party acquisition of us difficult. |

Reverse

Share Split

On

January 24, 2024, we effectuated a four-for-five (4:5) reverse share split (the “Reverse Share Split”) of our Ordinary Shares.

No fractional shares were issued in connection with the Reverse Share Split as all fractional shares were rounded up to the next whole

share.

Corporate

Information

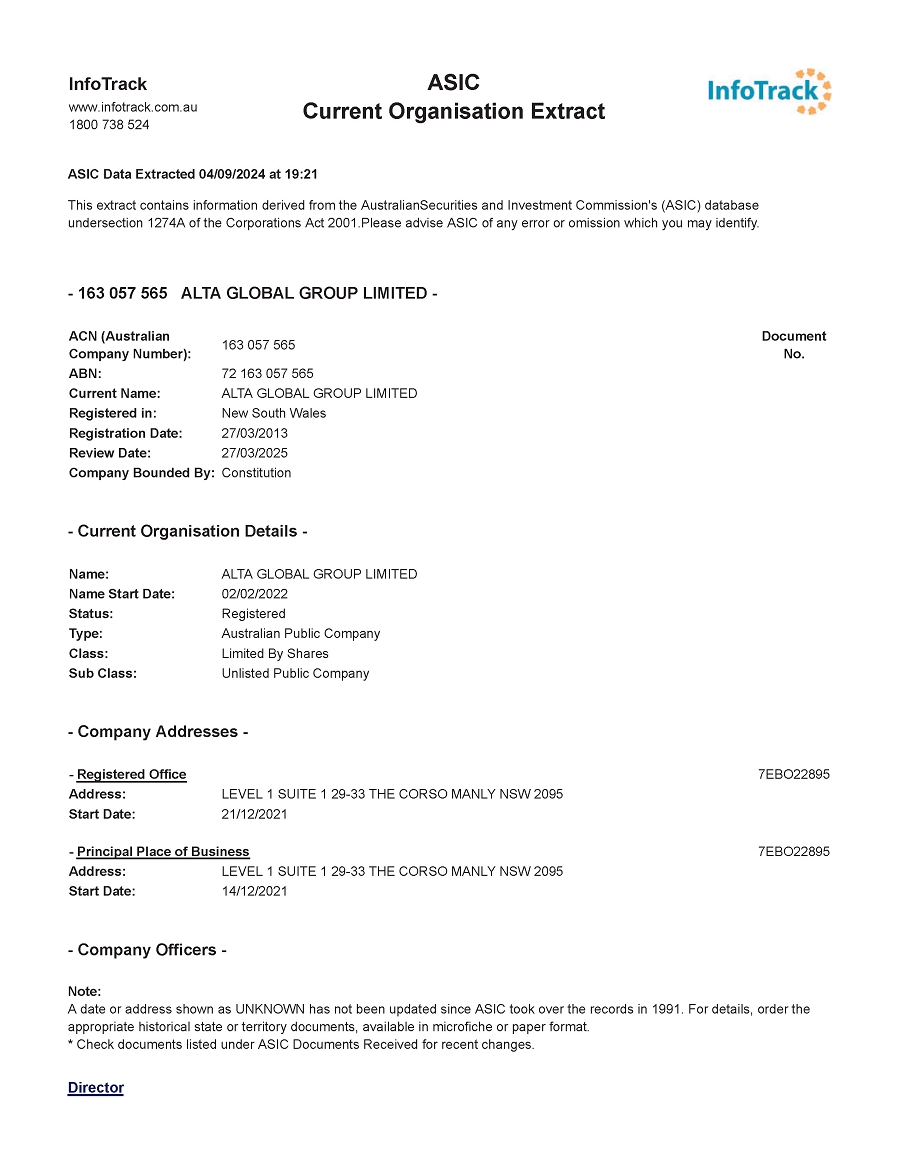

We

were incorporated on March 27, 2013 under the laws of Australia under the name Wimp 2 Warrior Limited and changed our name to Alta Global

Group Limited on February 2, 2022.

Our

principal executive offices are located at Level 1, Suite 1, 29-33 The Corso, Manly, New South Wales 2095, and our telephone number there

is +61 1800 151 865. Our website address is https://www.trainalta.com. The information contained on our website is not incorporated

by reference into this prospectus, and you should not consider any information contained on, or that can be accessed through, our website

as part of this prospectus or in deciding whether to purchase our securities.

Implications

of Being an Emerging Growth Company

As

a company with less than US$1.235 billion in revenues during our last fiscal year, we qualify as an emerging growth company as defined

in the Jumpstart Our Business Startups Act (“JOBS Act”) enacted in 2012. As an emerging growth company, we expect to take

advantage of reduced reporting requirements that are otherwise applicable to public companies. These provisions include, but are not

limited to:

| |

● |

being

permitted to present only two years of audited financial statements, in addition to any required unaudited interim financial statements,

with correspondingly reduced “Management’s Discussion and Analysis of Financial Condition and Results of Operations”

disclosure in this prospectus; |

| |

|

|

| |

● |

not

being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended (“Sarbanes-Oxley

Act”); |

| |

|

|

| |

● |

reduced

disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements; and |

| |

|

|

| |

● |

exemptions

from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute

payments not previously approved. |

We

may take advantage of these provisions until the last day of our fiscal year following the fifth anniversary of the completion of our initial public

offering, or June 30, 2029. However, if certain events occur prior to the end of such five-year period, including if we become a “large accelerated

filer,” our annual gross revenues exceed US$1.235 billion or we issue more than US$1.0 billion of non-convertible debt in any three-year

period, we will cease to be an emerging growth company prior to the end of such five-year period.

The

JOBS Act provides that an emerging growth company can take advantage of an extended transition period for complying with new or revised

accounting standards. As an emerging growth company, we intend to take advantage of an extended transition period for complying with

new or revised accounting standards as permitted by the JOBS Act. We have elected to take advantage of certain of the reduced disclosure

obligations in this prospectus and in the registration statement of which this prospectus is a part and may elect to take advantage of

other reduced reporting requirements in future filings. As a result, the information in this prospectus and that we provide to our shareholders

in the future may be different than what you might receive from other public reporting companies in which you hold equity interests.

Implications

of Being a Foreign Private Issuer

Upon

effectiveness of this registration statement, we will be considered a “foreign private issuer” as defined in Rule 405 under

the Securities Act of 1933, as amended (the “Securities Act”). In our capacity as a foreign private issuer, we are exempt

from certain rules under the Exchange Act that impose certain disclosure obligations and procedural requirements for proxy solicitations

under Section 14 of the Exchange Act. In addition, our officers, directors and principal shareholders are exempt from the reporting and

“short-swing” profit recovery provisions of Section 16 of the Exchange Act and the rules under the Exchange Act with respect

to their purchases and sales of our Ordinary Shares. Moreover, we are not required to file periodic reports and financial statements

with the SEC as frequently or as promptly as U.S. companies whose securities are registered under the Exchange Act. In addition, we are

not required to comply with Regulation FD, which restricts the selective disclosure of material information.

We

may take advantage of these exemptions until such time as we are no longer a foreign private issuer. We would cease to be a foreign private

issuer at such time as more than 50% of our outstanding voting securities are held by U.S. residents and any of the following three circumstances

applies: (1) the majority of our executive officers or directors are U.S. citizens or residents, (2) more than 50% of our assets are

located in the United States or (3) our business is administered principally in the United States.

As

a foreign private issuer, we have taken advantage of certain reduced disclosure and other requirements in this prospectus and may elect

to take advantage of other reduced reporting requirements in future filings. Accordingly, the information contained herein or that we

provide shareholders may be different than the information you receive from other public companies in which you hold equity securities.

THE

OFFERING

| Ordinary

Shares offered by us |

|

3,619,303

Ordinary Shares (or 4,162,198 Ordinary Shares if the underwriters exercise their option to purchase additional Ordinary Shares and/or

Pre-Funded Warrants in full). |

| |

|

|

| Pre-Funded

Warrants offered by us |

|

We

are also offering up 3,619,303 Pre-Funded Warrants to purchase up to up to 3,619,303 Ordinary Shares in lieu of Ordinary Shares to

any purchaser whose purchase of Ordinary Shares in this offering would otherwise result in such purchaser, together with its affiliates

and certain related parties, beneficially owning more than 4.99% (or, at the purchaser’s election, 9.99%) of our outstanding

Ordinary Shares immediately following the consummation of this offering. The exercise price of each Pre-Funded Warrant will equal

$0.001 per share. The Pre-Funded Warrants are immediately exercisable and will expire when exercised in full. This prospectus also

relates to the offering of the Ordinary Shares issuable upon exercise of the Pre-Funded Warrants. |

| |

|

|

| Ordinary

Shares to be outstanding immediately after this offering(1) |

|

13,947,989

Ordinary Shares (or 14,490,884 Ordinary Shares if the underwriters exercise their option to purchase additional Ordinary Shares and/or

Pre-Funded Warrants in full), assuming that we only sell Ordinary Shares and no Pre-Funded Warrants, subject to certain exclusions

noted in the table below. |

| |

|

|

| Option

to purchase additional Ordinary Shares and/or Pre-Funded Warrants |

|

We

have granted the underwriters an option for a period of 45 days from the date of this prospectus, to purchase up to an additional

542,895 Ordinary Shares and/or Pre-Funded Warrants, representing fifteen percent (15%) of the aggregate number of Ordinary Shares

and Pre-Funded Warrants sold in this offering. The purchase price of such additional Ordinary Shares is equal to the

public offering price for Ordinary Shares sold in the offering less the underwriting discount, if any, and the purchase price for

such additional Pre-Funded Warrants is equal to the public offering price for Pre-Funded Warrants, less the underwriting discount,

if any. |

| |

|

|

| Use

of proceeds |

|

We

estimate that the net proceeds from this offering will be approximately US$11,915,000 (or

approximately US$13,767,875 if the underwriters exercise their over-allotment option in full),

at an assumed public offering price of US$3.73 per Ordinary Share, after deducting the underwriting

discounts and commissions and estimated offering expenses payable by us.

We

intend to use the net proceeds from this offering for product development; to scale up our sales and marketing efforts; to redeem

an outstanding convertible note facility; and for general working capital and corporate purposes. We may also use a portion of the

net proceeds to acquire or invest in complementary businesses or technologies; however, we have no current commitments or obligations

to do so. See “Use of Proceeds” for a more complete description of the intended use of proceeds from this offering. |

| |

|

|

| Lock

Up |

|

In connection with our initial public offering in March 2024, our directors

and officers agreed with the underwriters, subject to certain exceptions, not to sell, transfer or dispose of, directly or indirectly,

any of our Ordinary Shares or securities convertible into or exercisable or exchangeable for our Ordinary Shares until March 27, 2025.

In addition, in respect of this offering, our directors and officers will agree with the underwriters, subject to certain exceptions,

not to sell, transfer or dispose of, directly or indirectly, any of our Ordinary Shares or securities convertible into or exercisable

or exchangeable for our Ordinary Shares for a period of three months after the date of this prospectus if the offering is consummated

after December 27, 2024. See “Shares Eligible for Future Sale” and “Underwriting” for more information. |

| |

|

|

| Risk

Factors |

|

An

investment in our securities involves significant risks. See “Risk Factors” on page 12 and other information included

in this prospectus for a discussion of factors to consider carefully before deciding to invest in our securities. |

| |

|

|

| Listing |

|

Our

Ordinary Shares are listed on the NYSE American under the symbol “MMA”. |

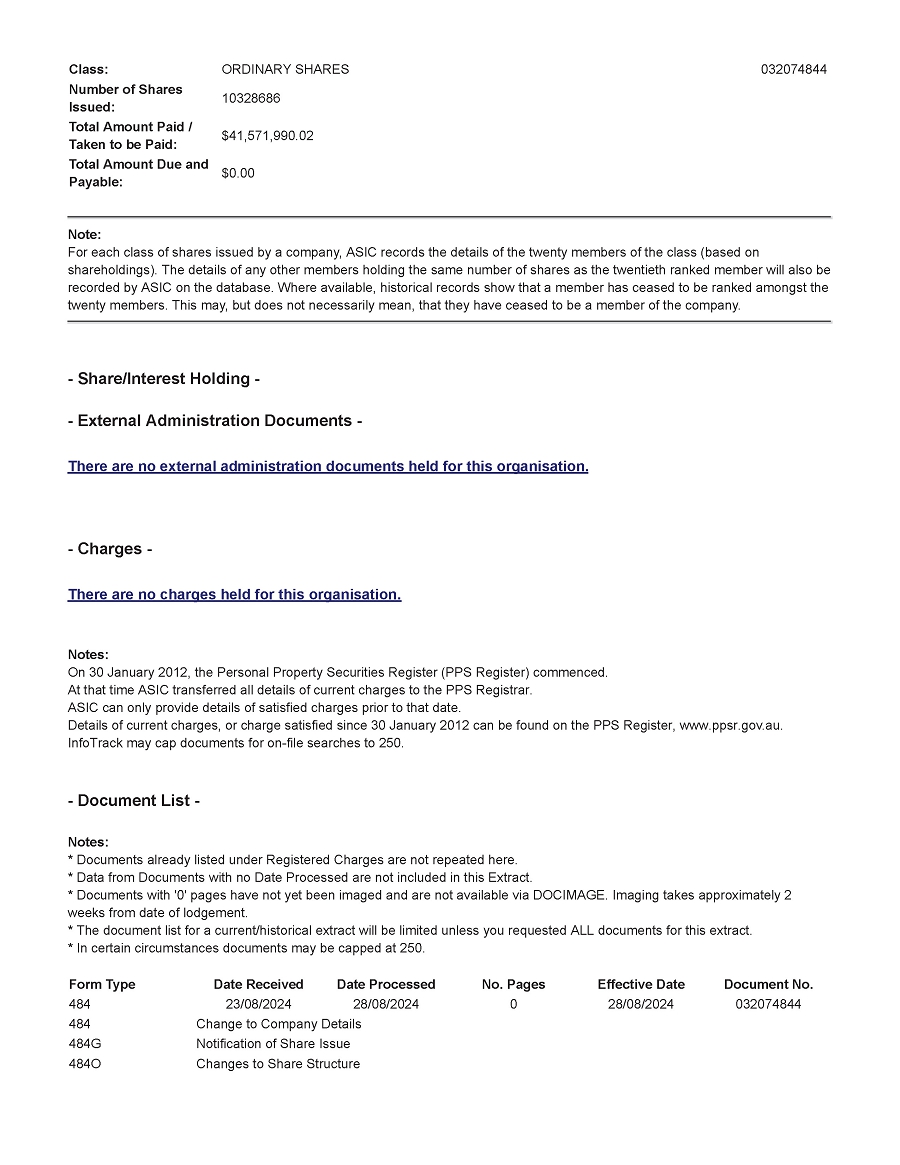

(1)

The number of Ordinary Shares that will be outstanding after this offering is based on 10,328,686 Ordinary Shares outstanding as of the

date of this prospectus and upon completion of this offering, and excludes:

| |

● |

1,532,641

Ordinary Shares issuable upon the exercise of options outstanding as of the date of this prospectus at a weighted average exercise

price of USD$2.82; |

| |

|

|

| |

● |

65,000

Ordinary Shares issuable upon the exercise of warrants outstanding as of the date of this prospectus at an exercise price of

USD$6.25; and |

| |

|

|

| |

● |

730,229

Ordinary Shares issuable upon the vesting of Restricted Units outstanding as of the date of this prospectus. |

Except

as otherwise indicated herein, all information in this prospectus assumes:

| |

● |

that we only sell Ordinary Shares and no Pre-Funded Warrants in this offering; |

| |

|

|

| |

● |

no exercise by the underwriters

of their option to purchase additional Ordinary Shares and/or Pre-Funded Warrants in this offering; and |

| |

|

|

| |

● |

no

exercise of the Representative’s warrants to purchase 180,965 Ordinary Shares (5% of the Ordinary Shares and Pre-Funded Warrants

sold in this offering) issuable to the representative of the underwriters in connection with this offering. |

SUMMARY

CONSOLIDATED FINANCIAL DATA

The

following summary consolidated financial data presented below as of and for the years ended June 30, 2023 and 2022 have been derived

from our audited consolidated financial statements as of and for the years ended June 30, 2023 and 2022 and related notes included elsewhere

in this prospectus.

The

following summary consolidated financial data presented below as of and for the nine months ended March 31, 2024 have been derived from

our unaudited interim condensed consolidated financial statements for the nine months ended March 31, 2024 and 2023 and related notes

included elsewhere in this prospectus.

Historical

results are not necessarily indicative of results to be expected in the future and the results for the year ended June 30, 2023 or nine

months ended March 31, 2024 are not necessarily indicative of the results that may be expected for any other period.

In

connection with the initial public offering of our Ordinary Shares in March 2024, all convertible notes that were on issue prior to the

initial public offering have either been converted into Ordinary Shares or redeemed. At March 31, 2024 there is no convertible note debt,

host or derivative liability, on the Consolidated Statement of Financial Position. The remaining interest on convertible notes and the

final fair value movement in derivative liability is reflected in the Consolidated Statement of Profit or Loss.

The

summary consolidated financial data should be read in conjunction with “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” and our consolidated financial statements and related notes thereto included elsewhere in

this prospectus.

Our

financial statements are presented in U.S. or Australian dollars, as indicated, and have been prepared in accordance with IFRS.

| | |

Year Ended June 30, | | |

Nine Months Ended March 31, | |

| | |

2023 (A$) | | |

2023 (US$) | | |

2022 (A$) | | |

2024 (A$) (unaudited) | | |

2024 (US$) (unaudited) | | |

2023 (A$) (unaudited) | |

| Consolidated Income Statement Data: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Revenue: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Revenue from Program Fees | |

$ | 937,415 | | |

$ | 630,974 | | |

$ | 2,050,044 | | |

$ | 954,621 | | |

$ | 622,795 | | |

$ | 766,499 | |

| Less: Contractual payments to gyms | |

| (574,025 | ) | |

| (386,376 | ) | |

| (1,215,191 | ) | |

| (556,098 | ) | |

| (362,798 | ) | |

| (462,026 | ) |

| Net Revenue from Program Fees | |

| 363,390 | | |

| 244,598 | | |

| 834,853 | | |

| 398,523 | | |

| 259,996 | | |

| 304,473 | |

| Other income | |

| 1,173,421 | | |

| 789,830 | | |

| 105,950 | | |

| 172,760 | | |

| 112,709 | | |

| 1,173,278 | |

| Total revenue | |

| 1,536,811 | | |

| 1,034,427 | | |

| 940,803 | | |

| 571,283 | | |

| 372,705 | | |

| 1,477,751 | |

| Expenses: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Program expenses | |

| 229,848 | | |

| 154,711 | | |

| 342,600 | | |

| 124,190 | | |

| 81,022 | | |

| 189,304 | |

| Employee salaries and benefits | |

| 4,219,655 | | |

| 2,840,250 | | |

| 4,664,013 | | |

| 3,908,674 | | |

| 2,550,019 | | |

| 3,292,873 | |

| Share Based Payments | |

| 2,365,384 | | |

| 1,592,140 | | |

| 1,546,983 | | |

| 3,650,976 | | |

| 2,381,897 | | |

| 1,774,037 | |

| Advertising fees | |

| 721,713 | | |

| 485,785 | | |

| 3,615,399 | | |

| 419,912 | | |

| 273,951 | | |

| 515,197 | |

| Professional fees | |

| 864,419 | | |

| 581,840 | | |

| 685,870 | | |

| 1,505,745 | | |

| 982,348 | | |

| 421,546 | |

| Rent | |

| 11,793 | | |

| 7,938 | | |

| 2,366 | | |

| 7,245 | | |

| 4,727 | | |

| 10,158 | |

| IT costs | |

| 633,220 | | |

| 426,220 | | |

| 640,403 | | |

| 416,340 | | |

| 271,620 | | |

| 477,121 | |

| Depreciation and amortization | |

| 360,021 | | |

| 242,330 | | |

| 260,651 | | |

| 483,338 | | |

| 315,330 | | |

| 312,293 | |

| Net foreign exchange gain | |

| (47,359 | ) | |

| (31,877 | ) | |

| (26,079 | ) | |

| (59,191 | ) | |

| (38,616 | ) | |

| (15,961 | ) |

| Finance costs | |

| 4,472,730 | | |

| 3,010,595 | | |

| 2,191,803 | | |

| 3,219,591 | | |

| 2,100,461 | | |

| 2,614,281 | |

| Other expenses | |

| 1,432,094 | | |

| 963,942 | | |

| 965,808 | | |

| 1,198,176 | | |

| 781,690 | | |

| 464,569 | |

| Fair value movement in derivative liability | |

| 6,870,729 | | |

| 4,624,688 | | |

| (2,751,564 | ) | |

| (3,400,685 | ) | |

| (2,218,607 | ) | |

| 4,666,982 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total Expenses | |

| 22,134,247 | | |

| 14,898,562 | | |

| 12,138,253 | | |

| 11,474,311 | | |

| 7,485,840 | | |

| 14,722,400 | |

| Loss before income tax expense | |

| (20,597,436 | ) | |

| (13,864,134 | ) | |

| (11,197,450 | ) | |

| (10,903,028 | ) | |

| (7,113,135 | ) | |

| (13,244,649 | ) |

| Income tax expense | |

| - | | |

| - | | |

| - | | |

| | | |

| | | |

| | |

| Loss after income tax expense for the year | |

| (20,597,436 | ) | |

| (13,864,134 | ) | |

| (11,197,450 | ) | |

| (10,903,028 | ) | |

| (7,113,135 | ) | |

| (13,244,649 | ) |

| Other comprehensive loss, net of tax | |

| (36,465 | ) | |

| (24,545 | ) | |

| (31,312 | ) | |

| (98,128 | ) | |

| (64,019 | ) | |

| (21,072 | ) |

| Total comprehensive loss for the year attributable to the members of Alta Global Group Limited | |

$ | (20,633,901 | ) | |

$ | (13,888,679 | ) | |

$ | (11,228,762 | ) | |

$ | (11,001,156 | ) | |

$ | (7,177,154 | ) | |

$ | (13,265,721 | ) |

| Basic loss per share | |

$ | (5.26 | )(1) | |

$ | (3.54 | )(1) | |

$ | (2.86 | )(1) | |

$ | (1.07 | )(2) | |

$ | (0.72 | )(2) | |

$ | (2.71 | )(2) |

| Diluted loss per share | |

$ | (5.26 | )(1) | |

$ | (3.54 | )(1) | |

$ | (2.86 | )(1) | |

$ | (1.07 | )(2) | |

$ | (0.72 | )(2) | |

$ | (2.71 | )(2) |

| |

(1) |

Please

refer to Note 27 to our audited consolidated financial statements included elsewhere in this prospectus for a calculation of basic

and diluted losses per share. |

| |

(2) |

Please