0001047127false00010471272025-02-102025-02-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

February 10, 2025

AMKOR TECHNOLOGY, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | |

| Delaware | | 000-29472 | | 23-1722724 |

| | | | | |

| (State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

2045 EAST INNOVATION CIRCLE

TEMPE, AZ 85284

(Address of principal executive offices, including zip code)

(480) 821-5000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered |

| Common Stock, $0.001 par value | AMKR | The NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On February 10, 2025, Amkor Technology, Inc. announced in a press release its financial performance for the fourth quarter and year ended December 31, 2024. The information in this Current Report on Form 8-K, including the exhibit attached hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liability under that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit | | Description |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| AMKOR TECHNOLOGY, INC.

| |

| By: | /s/ Megan Faust | |

| | Megan Faust | |

| | Executive Vice President, Chief Financial Officer and Treasurer | |

|

Date: February 10, 2025

Amkor Technology Reports Financial Results

for the Fourth Quarter and Full Year 2024

TEMPE, Ariz. -- February 10, 2025 -- Amkor Technology, Inc. (Nasdaq: AMKR), a leading provider of semiconductor packaging and test services, today announced financial results for the fourth quarter and full year ended December 31, 2024.

Fourth Quarter 2024 Highlights:

•Fourth quarter net sales $1.63 billion

•Net income $106 million, earnings per diluted share $0.43

Full Year 2024 Highlights:

•Net sales $6.32 billion

•Gross profit $933 million, operating income $438 million

•Net income $354 million, earnings per diluted share $1.43

•EBITDA $1.09 billion

•Net cash from operations $1.09 billion, free cash flow $359 million

"In 2024, weakness in the automotive and industrial and communications end markets contributed to a full year decline. In contrast, we achieved record revenue in our computing end market with growth in ARM-based PCs and AI devices,” said Giel Rutten, Amkor’s president and chief executive officer. “During the year, we also successfully ramped our new facility in Vietnam, secured CHIPS funding to bolster U.S. manufacturing, and set a new record for Advanced SiP revenue. We remain confident in our long-term strategy and continue to invest in technology for advanced packaging and our broad geographic footprint with a focus on industry megatrends.”

Financial Results

| | | | | | | | | | | | | | | | | |

| ($ in millions, except per share data) | Q4 2024 | Q3 2024 | Q4 2023 | 2024 | 2023 |

| Net sales | $1,629 | $1,862 | $1,752 | $6,318 | $6,503 |

| Gross margin | 15.1% | 14.6% | 15.9% | 14.8% | 14.5% |

| Operating income | $134 | $149 | $159 | $438 | $470 |

| Operating income margin | 8.3% | 8.0% | 9.1% | 6.9% | 7.2% |

| Net income attributable to Amkor | $106 | $123 | $118 | $354 | $360 |

| Earnings per diluted share | $0.43 | $0.49 | $0.48 | $1.43 | $1.46 |

| EBITDA (1) | $302 | $309 | $326 | $1,091 | $1,135 |

| Net cash provided by operating activities | | | | $1,089 | $1,270 |

| Annual free cash flow (1) | | | | $359 | $534 |

(1) EBITDA and free cash flow are non-GAAP measures. The reconciliations to the comparable GAAP measures are included below under “Selected Operating Data.”

At December 31, 2024, total cash and short-term investments was $1.65 billion, and total debt was $1.16 billion.

On November 13, 2024, Amkor’s Board of Directors announced a 5% increase in the quarterly cash dividend on the company’s common stock, from $0.07875 per share to $0.08269 per share. The Board of Directors

also approved a special cash dividend of $0.40546 per share, or approximately $100 million, on the company’s common stock. The increased quarterly dividend and special dividend were each paid on December 23, 2024. The declaration and payment of future dividends, as well as any record and payment dates, are subject to the approval of the Board of Directors.

Business Outlook

The following information presents Amkor’s guidance for the first quarter 2025 (unless otherwise noted):

•Net sales of $1.225 billion to $1.325 billion

•Gross margin of 10.0% to 13.0%

•Net income of $3 million to $43 million, or $0.01 to $0.17 per diluted share

•Full year 2025 capital expenditures of approximately $850 million

Conference Call Information

Amkor will conduct a conference call on Monday, February 10, 2025, at 5:00 p.m. Eastern Time. This call may include material information not included in this press release. To access the live audio webcast and the accompanying slide presentation, visit the Investor Relations section of Amkor’s website, located at ir.amkor.com. The live call can also be accessed by dialing 1-877-407-4019 or 1-201-689-8337.

About Amkor Technology, Inc.

Amkor Technology, Inc. is the world's largest US headquartered OSAT (outsourced semiconductor assembly and test) service provider. Since its founding in 1968, Amkor has pioneered the outsourcing of IC packaging and test services and is a strategic manufacturing partner for the world’s leading semiconductor companies, foundries, and electronics OEMs. Amkor provides turnkey manufacturing services for the communication, automotive and industrial, computing, and consumer industries, including but not limited to smartphones, electric vehicles, data centers, artificial intelligence and wearables. Amkor’s operational base includes production facilities, research and development centers and sales and support offices located in key electronics manufacturing regions in Asia, Europe and the United States. For more information visit amkor.com.

Jennifer Jue

Vice President, Investor Relations and Finance

480-786-7594

jennifer.jue@amkor.com

AMKOR TECHNOLOGY, INC.

Selected Operating Data

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q4 2024 | | Q3 2024 | | Q4 2023 | | 2024 | | 2023 |

| Net Sales Data: | | | | | | | | | |

| Net sales (in millions): | | | | | | | | | |

| Advanced Products (1) | $1,357 | | $1,568 | | $1,430 | | $5,175 | | $5,033 |

| Mainstream Products (2) | 272 | | 294 | | 322 | | 1,143 | | 1,470 |

| Total net sales | $1,629 | | $1,862 | | $1,752 | | $6,318 | | $6,503 |

| | | | | | | | | |

| | | | | | | | | |

| Packaging services | 88 | % | | 90 | % | | 89 | % | | 89 | % | | 88 | % |

| Test services | 12 | % | | 10 | % | | 11 | % | | 11 | % | | 12 | % |

| | | | | | | | | |

| Net sales from top ten customers | 73 | % | | 74 | % | | 71 | % | | 72 | % | | 69 | % |

| | | | | | | | | |

End Market Distribution Data: | | | | | | | | | |

| Communications (smartphones, tablets) | 44 | % | | 52 | % | | 56 | % | | 48 | % | | 50 | % |

| Computing (data center, infrastructure, PC/laptop, storage) | 21 | % | | 16 | % | | 13 | % | | 19 | % | | 16 | % |

| Automotive, industrial and other (ADAS, electrification, infotainment, safety) | 17 | % | | 16 | % | | 19 | % | | 18 | % | | 21 | % |

| Consumer (AR & gaming, connected home, home electronics, wearables) | 18 | % | | 16 | % | | 12 | % | | 15 | % | | 13 | % |

| Total | 100 | % | | 100 | % | | 100 | % | | 100 | % | | 100 | % |

| | | | | | | | | | |

| Gross Margin Data: | | | | | | | | | |

| Net sales | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % |

| Cost of sales: | | | | | | | | | |

| Materials | 54.8 | % | | 58.4 | % | | 56.5 | % | | 55.1 | % | | 55.1 | % |

| Labor | 9.9 | % | | 8.7 | % | | 9.1 | % | | 9.9 | % | | 9.9 | % |

| Depreciation | 8.4 | % | | 7.4 | % | | 8.2 | % | | 8.5 | % | | 8.9 | % |

| Other manufacturing | 11.8 | % | | 10.9 | % | | 10.3 | % | | 11.7 | % | | 11.6 | % |

| Gross margin | 15.1 | % | | 14.6 | % | | 15.9 | % | | 14.8 | % | | 14.5 | % |

(1) Advanced products include flip chip, memory and wafer-level processing and related test services.

(2) Mainstream products include all other wirebond packaging and related test services.

AMKOR TECHNOLOGY, INC.

Selected Operating Data

In this press release, we refer to EBITDA, which is not defined by U.S. GAAP. We define EBITDA as net income before interest expense, income tax expense and depreciation and amortization. We believe EBITDA to be relevant and useful information to our investors because it provides additional information in assessing our financial operating results. Our management uses EBITDA in evaluating our operating performance, and our ability to service debt, and our ability to fund capital expenditures and pay dividends. However, EBITDA has certain limitations in that it does not reflect the impact of certain expenses on our consolidated statements of income, including interest expense, which is a necessary element of our costs because we have borrowed money in order to finance our operations, income tax expense, which is a necessary element of our costs because taxes are imposed by law, and depreciation and amortization, which is a necessary element of our costs because we use capital assets to generate income. EBITDA should be considered in addition to, and not as a substitute for, or superior to, operating income, net income or other measures of financial performance prepared in accordance with U.S. GAAP. Furthermore, our definition of EBITDA may not be comparable to similarly titled measures reported by other companies. Below is our reconciliation of EBITDA to U.S. GAAP net income.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Non-GAAP Financial Measures Reconciliation: | | | | | | | | | |

| (in millions) | Q4 2024 | | Q3 2024 | | Q4 2023 | | 2024 | | 2023 |

| EBITDA Data: | | | | | | | | | |

| Net income | $ | 106 | | | $ | 123 | | | $ | 119 | | | $ | 356 | | | $ | 362 | |

| Plus: Interest expense | 17 | | | 16 | | | 15 | | | 65 | | | 59 | |

| Plus: Income tax expense | 30 | | | 19 | | | 33 | | | 75 | | | 82 | |

| Plus: Depreciation & amortization | 149 | | | 151 | | | 159 | | | 595 | | | 632 | |

| EBITDA | $ | 302 | | | $ | 309 | | | $ | 326 | | | $ | 1,091 | | | $ | 1,135 | |

AMKOR TECHNOLOGY, INC.

Selected Operating Data

In this press release, we refer to free cash flow, which is not defined by U.S. GAAP. We define free cash flow as net cash provided by operating activities less payments for property, plant and equipment, plus proceeds from the sale of, insurance recovery for and grants for property, plant and equipment, if applicable. We believe free cash flow to be relevant and useful information to our investors because it provides them with additional information in assessing our liquidity, capital resources and financial operating results. Our management uses free cash flow in evaluating our liquidity, our ability to service debt, our ability to fund capital expenditures and our ability to pay dividends and the amount of dividends to be paid. However, free cash flow has certain limitations, including that it does not represent the residual cash flow available for discretionary expenditures since other, non-discretionary expenditures, such as mandatory debt service, are not deducted from the measure. The amount of mandatory versus discretionary expenditures can vary significantly between periods. This measure should be considered in addition to, and not as a substitute for, or superior to, other measures of liquidity or financial performance prepared in accordance with U.S. GAAP, such as net cash provided by operating activities. Furthermore, our definition of free cash flow may not be comparable to similarly titled measures reported by other companies. Below is our reconciliation of free cash flow to U.S. GAAP net cash provided by operating activities.

| | | | | | | | | | | |

| Non-GAAP Financial Measures Reconciliation: | | | |

| (in millions) | 2024 | | 2023 |

| Free Cash Flow Data: | | | |

| Net cash provided by operating activities | $ | 1,089 | | | $ | 1,270 | |

| Less: Payments for property, plant and equipment | (744) | | | (749) | |

| Plus: Proceeds from sale of and grants for property, plant and equipment | 14 | | | 13 | |

| Free cash flow | $ | 359 | | | $ | 534 | |

AMKOR TECHNOLOGY, INC.

CONSOLIDATED STATEMENTS OF INCOME

(In thousands, except per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended December 31, | | For the Year Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net sales | $ | 1,629,118 | | | $ | 1,751,811 | | | $ | 6,317,692 | | | $ | 6,503,065 | |

| Cost of sales | 1,382,408 | | | 1,472,702 | | | 5,384,480 | | | 5,559,912 | |

| Gross profit | 246,710 | | | 279,109 | | | 933,212 | | | 943,153 | |

| Selling, general and administrative | 69,427 | | | 78,842 | | | 331,806 | | | 295,393 | |

| Research and development | 42,848 | | | 41,603 | | | 162,951 | | | 177,473 | |

| | | | | | | |

| Total operating expenses | 112,275 | | | 120,445 | | | 494,757 | | | 472,866 | |

| Operating income | 134,435 | | | 158,664 | | | 438,455 | | | 470,287 | |

| Interest expense | 17,079 | | | 15,478 | | | 64,945 | | | 59,000 | |

| | | | | | | |

| Other (income) expense, net | (18,233) | | | (8,342) | | | (57,506) | | | (32,554) | |

| Total other (income) expense, net | (1,154) | | | 7,136 | | | 7,439 | | | 26,446 | |

| Income before taxes | 135,589 | | | 151,528 | | | 431,016 | | | 443,841 | |

| Income tax expense | 29,788 | | | 32,516 | | | 75,481 | | | 81,710 | |

| Net income | 105,801 | | | 119,012 | | | 355,535 | | | 362,131 | |

| Net income attributable to noncontrolling interests | (152) | | | (1,450) | | | (1,523) | | | (2,318) | |

| Net income attributable to Amkor | $ | 105,649 | | | $ | 117,562 | | | $ | 354,012 | | | $ | 359,813 | |

| | | | | | | |

| Net income attributable to Amkor per common share: | | | | | | | |

| Basic | $ | 0.43 | | | $ | 0.48 | | | $ | 1.44 | | | $ | 1.46 | |

| Diluted | $ | 0.43 | | | $ | 0.48 | | | $ | 1.43 | | | $ | 1.46 | |

| Shares used in computing per common share amounts: | | | | | | | |

| Basic | 246,654 | | | 245,799 | | | 246,344 | | | 245,628 | |

| Diluted | 247,864 | | | 247,243 | | | 247,818 | | | 247,176 | |

*We periodically assess the estimated useful lives of our property, plant and equipment. Based on our assessment of test equipment and its increased interchangeability enabling broader and longer use, we extended the estimated useful lives of test equipment from five years to seven years as of January 1, 2024. As a result, depreciation expense was reduced by approximately $13 million and $59 million for the three months ended and the year ended December 31, 2024, respectively. This benefited net income by approximately $11 million and $49 million and diluted earnings per share by $0.05 and $0.20 for each period, respectively.

AMKOR TECHNOLOGY, INC.

CONSOLIDATED BALANCE SHEETS

(In thousands)

(Unaudited)

| | | | | | | | | | | |

| December 31, |

| 2024 | | 2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 1,133,553 | | | $ | 1,119,818 | |

| | | |

| Short-term investments | 512,984 | | | 474,869 | |

| Accounts receivable, net of allowances | 1,055,013 | | | 1,149,493 | |

| Inventories | 310,910 | | | 393,128 | |

| Other current assets | 61,012 | | | 58,502 | |

| Total current assets | 3,073,472 | | | 3,195,810 | |

| Property, plant and equipment, net | 3,576,148 | | | 3,299,445 | |

| Operating lease right of use assets | 109,730 | | | 117,006 | |

| Goodwill | 17,947 | | | 20,003 | |

| | | |

| | | |

| Restricted cash | 759 | | | 799 | |

| Other assets | 166,272 | | | 138,062 | |

| Total assets | $ | 6,944,328 | | | $ | 6,771,125 | |

| | | |

| LIABILITIES AND EQUITY | | | |

| Current liabilities: | | | |

| Short-term borrowings and current portion of long-term debt | $ | 236,029 | | | $ | 131,624 | |

| Trade accounts payable | 712,887 | | | 754,453 | |

| Capital expenditures payable | 123,195 | | | 106,368 | |

| Short-term operating lease liability | 26,827 | | | 33,616 | |

| Accrued expenses | 356,337 | | | 358,414 | |

| Total current liabilities | 1,455,275 | | | 1,384,475 | |

| Long-term debt | 923,431 | | | 1,071,832 | |

| | | |

| Pension and severance obligations | 70,594 | | | 87,133 | |

| Long-term operating lease liabilities | 57,983 | | | 56,837 | |

| Other non-current liabilities | 253,880 | | | 175,813 | |

| Total liabilities | 2,761,163 | | | 2,776,090 | |

| | | |

| Amkor stockholders’ equity: | | | |

| Preferred stock | — | | | — | |

| Common stock | 293 | | | 292 | |

| Additional paid-in capital | 2,031,643 | | | 2,008,170 | |

| Retained earnings | 2,335,132 | | | 2,159,831 | |

| Accumulated other comprehensive income | 7,510 | | | 16,350 | |

| Treasury stock | (225,033) | | | (222,335) | |

| Total Amkor stockholders’ equity | 4,149,545 | | | 3,962,308 | |

| Noncontrolling interests in subsidiaries | 33,620 | | | 32,727 | |

| Total equity | 4,183,165 | | | 3,995,035 | |

| Total liabilities and equity | $ | 6,944,328 | | | $ | 6,771,125 | |

AMKOR TECHNOLOGY, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

| | | | | | | | | | | |

| For the Year Ended December 31, |

| 2024 | | 2023 |

| Cash flows from operating activities: | | | |

| Net income | $ | 355,535 | | | $ | 362,131 | |

| Depreciation and amortization | 594,663 | | | 631,508 | |

| | | |

| | | |

| Other operating activities and non-cash items | 25,303 | | | 39,654 | |

| Changes in assets and liabilities | 113,367 | | | 236,727 | |

| Net cash provided by operating activities | 1,088,868 | | | 1,270,020 | |

| | | |

| Cash flows from investing activities: | | | |

| Payments for property, plant and equipment | (743,796) | | | (749,467) | |

| Proceeds from sale of property, plant and equipment | 3,981 | | | 8,444 | |

| | | |

| Proceeds from foreign exchange forward contracts | 47,045 | | | 44,013 | |

| Payments for foreign exchange forward contracts | (88,623) | | | (75,786) | |

| Payments for short-term investments | (568,711) | | | (657,583) | |

| Proceeds from sale of short-term investments | 65,502 | | | 94,242 | |

| Proceeds from maturities of short-term investments | 474,097 | | | 379,344 | |

| Other investing activities | 10,181 | | | 4,883 | |

| Net cash used in investing activities | (800,324) | | | (951,910) | |

| | | |

| Cash flows from financing activities: | | | |

| Proceeds from revolving credit facilities | — | | | 370,000 | |

| Payments of revolving credit facilities | — | | | (370,000) | |

| Proceeds from short-term debt | 5,012 | | | 20,712 | |

| Payments of short-term debt | (9,731) | | | (19,448) | |

| Proceeds from long-term debt | 172,651 | | | 168,335 | |

| Payments of long-term debt | (177,214) | | | (175,427) | |

| Payments of finance lease obligations | (72,255) | | | (66,398) | |

| Payments of dividends | (178,605) | | | (74,686) | |

| Other financing activities | (290) | | | (2,295) | |

| Net cash used in financing activities | (260,432) | | | (149,207) | |

| | | |

| Effect of exchange rate fluctuations on cash, cash equivalents and restricted cash | (14,417) | | | (10,692) | |

| | | |

| Net increase in cash, cash equivalents and restricted cash | 13,695 | | | 158,211 | |

| Cash, cash equivalents and restricted cash, beginning of period | 1,120,617 | | | 962,406 | |

| Cash, cash equivalents and restricted cash, end of period | $ | 1,134,312 | | | $ | 1,120,617 | |

Forward-Looking Statement Disclaimer

This press release contains forward-looking statements within the meaning of the federal securities laws. You are cautioned not to place undue reliance on forward-looking statements, which are often characterized by terminology such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue” or “intend,” by the negative of these terms or other comparable terminology or by discussions of strategy, plans or intentions. All forward-looking statements in this press release are made based on our current expectations, forecasts, estimates and assumptions. Because such statements include risks and uncertainties, actual results may differ materially from those anticipated in such forward-looking statements as a result of various factors, including, but not limited to, the following:

•dependence on the cyclical and volatile semiconductor industry and vulnerability to industry downturns and declines in global economic and financial conditions;

•dependence on key customers or concentration of customers in certain end markets, such as mobile communications and automotive;

•changes in costs, quality, availability and delivery times of raw materials, components and equipment;

•health conditions or pandemics, such as COVID-19, impacting labor availability and operating capacity, capital availability, the supply chain and consumer demand for our customers’ products and services;

•fluctuations in operating results and cash flows;

•our substantial indebtedness;

•dependence on international factories and operations and risks relating to trade restrictions and regional conflict;

•the effects of business, economic, political, legal and regulatory impacts or conflicts upon our global operations;

•fluctuations in interest rates and changes in credit risk;

•competition with established competitors in the packaging and test business, the internal capabilities of integrated device manufacturers and new competitors, including foundries and contract manufacturers;

•difficulty funding our liquidity needs, including as a result of disruptions to the banking system and capital markets;

•our substantial investments in equipment and facilities to support the demand of our customers;

•difficulty attracting, retaining or replacing qualified personnel;

•difficulty achieving the relatively high-capacity utilization rates necessary to realize satisfactory gross margins given our high percentage of fixed costs;

•maintaining an effective system of internal controls;

•the absence of backlog and the short-term nature of our customers’ commitments;

•our continuing development and implementation of changes to, and maintenance and security of, our information technology systems;

•the historical downward pressure on the prices of our packaging and test services;

•challenges with integrating diverse operations;

•fluctuations in our manufacturing yields;

•any changes in tax laws, taxing authorities not agreeing with our interpretation of applicable tax laws, including whether we continue to qualify for conditional reduced tax rates, or any requirements to establish or adjust valuation allowances on deferred tax assets;

•our ability to develop new proprietary technology, protect our proprietary technology, operate without infringing the proprietary rights of others and implement new technologies;

•conditions to, and obligations related to, the receipt of government incentives;

•environmental, health and safety liabilities and expenditures;

•warranty claims, product return and liability risks, and the risk of negative publicity if our products fail, as well as the risk of litigation incident to our business;

•natural disasters and other calamities, political instability, hostilities or other disruptions;

•restrictive covenants in the indentures and agreements governing our current and future indebtedness;

•the possibility that we may decrease or suspend our quarterly dividend;

•significant severance plan obligations associated with our manufacturing operations in Korea; and

•the ability of certain of our stockholders to effectively determine or substantially influence the outcome of matters requiring stockholder approval.

Other important risk factors that could affect the outcome of the events set forth in these statements and that could affect our operating results and financial condition are discussed in the company’s Annual Report on Form 10-K for the year ended December 31, 2023 (the “Form 10-K”) and from time to time in our other reports filed with or furnished to the Securities and Exchange Commission (“SEC”). You should carefully consider the trends, risks and uncertainties described in this press release, the Form 10-K and other reports filed with or furnished to the SEC before making any investment decision with respect to our securities. If any of these trends, risks or uncertainties continues or occurs, our business, financial condition or operating results could be materially and adversely affected, the trading prices of our securities could decline, and you could lose part or all of your investment. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by this cautionary statement. We assume no obligation to review or update any forward-looking statements to reflect events or circumstances occurring after the date of this press release except as may be required by applicable law.

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

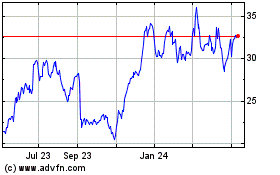

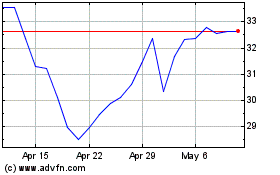

Amkor Technology (NASDAQ:AMKR)

Historical Stock Chart

From Jan 2025 to Feb 2025

Amkor Technology (NASDAQ:AMKR)

Historical Stock Chart

From Feb 2024 to Feb 2025