Company’s Hydroconn Smart Water Connector Cable

Reports Record Setting Year

Geospace Technologies Corporation (NASDAQ: GEOS) (“the

“Company") today announced a net loss of $6.6 million after fourth

quarter non-cash charges of $17.3 million on revenue of $135.6

million, for its fiscal year ended September 30, 2024. This

compares with net income of $12.2 million on revenue of $124.5

million for the comparable year-ago period. Excluding the non-cash

charges, fiscal year 2024 adjusted net income is $10.7 million.

This compares with adjusted net income of $12.2 million for the

comparable year-ago period.

For the fourth quarter ended September 30, 2024, the Company

reported a net loss of $12.9 on revenue of $35.4 million. This

compares with net income of $4.4 million on revenue of $29.3

million for the comparable year-ago period. Excluding the non-cash

charges, adjusted net income is $4.4 million for the fourth quarter

ended September 30, 2024. This compares with adjusted net income of

$4.4 million for the comparable year-ago period.

During fourth quarter ended September 30, 2024, the Company

recorded a non-cash charge of $14.5 million from the divestiture of

its Russian legal entity and a $2.8 million charge from an

impairment of intangible assets. The divestiture of the Russian

legal entity has virtually no effect on the Company’s net assets as

most of the charge came from cumulative unrealized foreign currency

translation losses previously recorded within shareholders’

equity.

Management’s Comments Richard J. (“Rich”) Kelley,

President and CEO of the Company said, “We started the fourth

quarter of fiscal year 2024 strongly with significant contributions

from our Oil and Gas Markets segment with more than $20 million in

sales and rental announcements for our OBX seabed nodes in August.

This followed a trend for the fiscal year of multi-million-dollar

contracts for this product line and contributed to an overall

increase in revenue from the prior fiscal year.

In our Adjacent Markets segment, we enjoyed a record-setting

year for our Hydroconn® line of smart water meter cables. The

market continues to recognize our leading technology and resulting

growth outpaces the industry. We also had our first successful

international sale of our Aquana products. The Aquana product line

generates further traction in smart water markets, for both

municipal and multi-family residential applications. We believe

that our focus on Smart Water going forward will continue to drive

growth for the organization.

While the financials indicate a net loss for the year due to two

non-cash charges, we are pleased to have 24-months of consecutive

adjusted net income, indicating our core business remains

profitable. While examining the increasing conflict in Ukraine and

potential complications with Russian sanctioned entities,

management and the board of directors determined the most prudent

action would be to divest of our Russian entity. This divestment

resulted in a loss which had minimal effect on the value of the net

assets of the Company. Additionally, our fiscal year financial

reporting reflects another one-time charge related to a non-cash

intangible asset impairment related to our subsidiary, Quantum

Technology Sciences.

This announcement will be the last time we will report earnings

with these business segments of Oil and Gas Markets, Adjacent

Markets and Emerging Markets. Beginning with our release in early

February, we will provide financial information using our three new

business segments announced in September – Smart Water, Energy

Solutions, and Intelligent Industrial.

Other highlights of note this year included the Company’s

addition in the Russell stock indexes, the Russell 2000®, Russell

3000®, and Russell Micro-Cap® Index.

Lastly, we would like to thank Rick Wheeler, our outgoing CEO.

Rick dedicated almost 30 years to Geospace, leading the company

through successful and tumultuous times in the industry. His

guidance and foresight provided stability and opportunities for

growth through diversification. His management and leadership

allowed Geospace to remain a strong presence in the seismic

equipment market while taking advantage of their Engineering and

manufacturing capabilities to explore new opportunities in adjacent

markets. Rick will remain as a member of the board of directors and

we wish him all the best in his retirement.”

Oil and Gas Markets Segment Revenue from the Company’s

Oil and Gas Markets segment totaled $17.5 million for the three

months ended September 30, 2024. This compares to $17.8 million in

revenue for the same period a year ago. For the fiscal year,

revenue from this segment totaled $77.5 million versus $74.0

million for the same prior year period for an increase of 5%. The

insignificant decrease for the three-month period is due to

increased sales of our OBX nodal products from our rental fleet

offset by lower utilization of our ocean bottom node rental fleet.

The twelve-month increase in revenue is due to increased sales of

ocean bottom nodal products like the Mariner and from our rental

fleet, offset by lower utilization of our ocean bottom node rental

fleet and lower demand for seismic sensors and marine products.

Adjacent Markets Segment For the 3-month period ended

September 30, 2024, revenue from the Company’s Adjacent Markets

segment totaled $17.6 million for an increase of 65% when compared

to $10.6 million from the same prior year period. Revenue from the

twelve-month period was $55.6 million an increase of 13%, when

compared to revenue from the same prior year period of $49 million.

The increase for the three-month period is due to strong sales of

Hydroconn®, the Company’s smart water meter cable and connector

products and initial sales from the Aquana product line. The

increase in the 12-months period is the result of increased sales

of the Company’s smart water meter cable and connector products.

The fourth quarter of fiscal year 2024 was the highest level of

quarterly revenue for Hydroconn® as well as fiscal year 2024

produced the highest annual revenue for the product line.

Emerging Markets Segment The Company’s Emerging Markets

segment generated revenue of $0.2 million and $2.2 million for the

three-month and full year periods ended September 30, 2024. This

compares with $0.8 million and $1.2 million for the similar three-

and twelve-month periods of the previous year.

Conference Call Information Geospace Technologies will

host a conference call to review its fourth quarter and fiscal year

2024 financial results on November 22, 2024, at 10:00 a.m. Eastern

Time (9 a.m. Central). Participants can access the call at

(800)267-6316 (US) or (203)518-9783 (International). Please

reference the conference ID: GEOSQ424 prior to the start of the

conference call. A replay will be available for approximately 60

days and may be accessed through the Investor Relations tab of our

website at www.geospace.com.

About Geospace Technologies Geospace Technologies is a

global technology and instrumentation manufacturer specializing in

vibration sensing and highly ruggedized products which serve

energy, industrial, government and commercial customers worldwide.

The Company’s products blend engineering expertise with advanced

analytic software to optimize energy exploration, enhance national

and homeland security, empower water utility and property managers,

and streamline electronic printing solutions. With more than four

decades of excellence, the Company’s more than 450 employees across

the world are dedicated to engineering and technical quality.

Geospace is traded on the U.S. NASDAQ stock exchange under the

ticker symbol GEOS and has been added to the Russell 2000®, Russell

3000®, and Russell Micro-cap®. For more information, visit

www.geospace.com.

Forward Looking Statements

This news release contains “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended.

These forward-looking statements can be identified by terminology

such as “may,” “will,” “should,” “could,” “intend,” “expect,”

“plan,” “budget,” “forecast,” “anticipate,” “believe,” “estimate,”

“predict,” “potential,” “continue,” “evaluating” or similar words.

Statements that contain these words should be read carefully

because they discuss future expectations, contain projections of

our future results of operations or of our financial position or

state other forward-looking information. Examples of forward-

looking statements include, statements regarding our expected

operating results and expected demand for our products in various

segments. These forward-looking statements reflect our current

judgment about future events and trends based on currently

available information. However, there will likely be events in the

future that we are not able to predict or control. The factors

listed under the caption “Risk Factors” in our most recent Annual

Report on Form 10-K which is on file with the Securities and

Exchange Commission, as well as other cautionary language in such

Annual Report, any subsequent Quarterly Report on Form 10- Q, or in

our other periodic reports, provide examples of risks,

uncertainties and events that may cause our actual results to

differ materially from the expectations we describe in our

forward-looking statements.

Such examples include, but are not limited to, the failure of

the Quantum or OptoSeis® or Aquana technology transactions to yield

positive operating results and decreases in commodity price levels

which could reduce demand for our products, the failure of our

products to achieve market acceptance (despite substantial

investment by us) our sensitivity to short term backlog, delayed or

cancelled customer orders, product obsolescence resulting from poor

industry conditions or new technologies, bad debt write-offs

associated with customer accounts, inability to collect on

promissory notes, lack of further orders for our OBX rental

equipment, failure of our Quantum products to be adopted by the

border and perimeter security market, or a decrease in such market

due to governmental changes, and infringement or failure to protect

intellectual property. The occurrence of the events described in

these risk factors and elsewhere in our most recent Annual Report

on Form 10-K or in our other periodic reports could have a material

adverse effect on our business, results of operations and financial

position, and actual events and results of operations may vary

materially from our current expectations. We assume no obligation

to revise or update any forward- looking statement, whether written

or oral, that we may make from time to time, whether as a result of

new information, future developments or otherwise, except as

required by applicable securities laws and regulations.

GEOSPACE TECHNOLOGIES

CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF

OPERATIONS (in thousands, except share and per share amounts)

(unaudited)

Three Months Ended

Year Ended

September 30,

2024

September 30,

2023

September 30,

2024

September 30,

2023

Revenue:

Products

$

32,602

$

16,357

$

116,036

$

73,333

Rental

2,836

12,958

19,562

51,176

Total revenue

35,438

29,315

135,598

124,509

Cost of revenue:

Products

16,302

12,053

69,318

55,136

Rental

3,206

3,034

13,707

17,683

Total cost of revenue

19,508

15,087

83,025

72,819

Gross profit

15,930

14,228

52,573

51,690

Operating expenses:

Selling, general and administrative

7,241

6,475

26,554

25,952

Research and development

4,775

3,766

16,251

15,863

Other intangible asset impairment

2,761

—

2,761

—

Provision for (recovery of) credit

losses

(26

)

(97

)

(110

)

(138

)

Total operating expenses

14,751

10,144

45,456

41,677

Gain on disposal of property

—

—

—

1,315

Income from operations

1,179

4,084

7,117

11,328

Other income (expense):

Loss on sale of subsidiary

(14,539

)

—

(14,539

)

—

Interest expense

(43

)

(34

)

(187

)

(134

)

Interest income

604

168

1,558

539

Foreign currency transaction gains

(losses), net

(17

)

401

(270

)

994

Other, net

(39

)

(86

)

(143

)

(158

)

Total other income (expense), net

(14,034

)

449

(13,581

)

1,241

Income (loss) before income taxes

(12,855

)

4,533

(6,464

)

12,569

Income tax expense

5

95

114

363

Net income (loss)

$

(12,860

)

$

4,438

$

(6,578

)

$

12,206

Income (loss) per common share:

Basic

$

(1.00

)

$

0.34

$

(0.50

)

$

0.93

Diluted

$

(1.00

)

$

0.33

$

(0.50

)

$

0.92

Weighted average common shares

outstanding:

Basic

12,797,653

13,188,489

13,151,600

13,146,085

Diluted

12,797,653

13,399,442

13,151,600

13,215,066

GEOSPACE TECHNOLOGIES

CORPORATION AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (in

thousands, except share and per share amounts)

(unaudited)

AS OF SEPTEMBER 30,

2024

2023

ASSETS

Current assets:

Cash and cash equivalents

$

6,895

$

18,803

Short-term investments

30,227

14,921

Trade accounts and notes receivable,

net

21,868

21,373

Inventories, net

26,222

18,430

Assets held for sale

1,841

—

Prepaid expenses and other current

assets

2,313

2,251

Total current assets

89,366

75,778

Non-current inventories, net

18,031

24,888

Rental equipment, net

14,186

21,587

Property, plant and equipment, net

21,083

24,048

Non-current trade accounts and note

receivable, net

6,375

—

Operating right-of-use assets

464

714

Goodwill

736

736

Other intangible assets, net

1,649

4,805

Other non-current assets

304

486

Total assets

$

152,194

$

153,042

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable trade

$

8,003

$

6,659

Operating lease liabilities

173

257

Other current liabilities

9,021

12,882

Total current liabilities

17,197

19,798

Non-current operating lease

liabilities

339

512

Deferred tax liabilities, net

34

16

Total liabilities

17,570

20,326

Commitments and contingencies

Stockholders’ equity:

Preferred stock, 1,000,000 shares

authorized, no shares issued and outstanding

—

—

Common stock, $.01 par value, 20,000,000

shares authorized, 14,206,082 and 14,030,481 shares issued,

respectively; and 12,709,381 and 13,188,489 shares outstanding,

respectively

142

140

Additional paid-in capital

97,342

96,040

Retained earnings

55,282

61,860

Accumulated other comprehensive loss

(4,257

)

(17,824

)

Treasury stock, at cost, 1,496,701 shares

and 841,992 shares, respectively

(13,885

)

(7,500

)

Total stockholders’ equity

134,624

132,716

Total liabilities and stockholders’

equity

$

152,194

$

153,042

GEOSPACE TECHNOLOGIES

CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH

FLOWS (in thousands) (unaudited)

YEAR ENDED SEPTEMBER

30,

2024

2023

Cash flows from operating activities:

Net income (loss)

$

(6,578

)

$

12,206

Adjustments to reconcile net income (loss)

to net cash provided by (used in) operating activities:

Deferred income tax expense

18

3

Rental equipment depreciation

10,859

11,766

Property, plant and equipment

depreciation

3,512

3,704

Amortization of intangible assets

395

768

Intangible assets impairment expense

2,761

—

Accretion of discounts on short-term

investments

(566

)

(144

)

Stock-based compensation expense

1,304

1,374

Provision for (recovery of) credit

losses

(110

)

(138

)

Inventory obsolescence expense

589

2,229

Loss on sale of subsidiary

14,539

—

Realized foreign currency translation gain

from dissolution of foreign subsidiary

—

38

Gross profit from sale of rental

equipment

(30,998

)

(4,424

)

Loss on disposal of equipment

16

244

Gain on disposal of property

—

(1,315

)

Effects of changes in operating assets and

liabilities:

Trade accounts and notes receivable

6,593

(5,561

)

Inventories

(10,985

)

(11,026

)

Other assets

(199

)

442

Accounts payable trade

2,746

41

Other liabilities

(2,979

)

5,351

Net cash provided by (used in) operating

activities

(9,083

)

15,558

Cash flows from investing activities:

Purchase of property, plant and

equipment

(3,857

)

(3,964

)

Investment in rental equipment

(8,321

)

(9,920

)

Proceeds from the sale of property, plant

and equipment

9

4,406

Proceeds from the sale of rental

equipment

31,964

11,478

Purchase of short-term investments

(32,078

)

(24,782

)

Proceeds from the sale of short-term

investments

17,338

10,900

Cash disposed from sale of subsidiary

(1,231

)

—

Net cash provided by (used in) investing

activities

3,824

(11,882

)

Cash flows from financing activities:

Payments of contingent consideration

—

(175

)

Debt issuance costs

—

(350

)

Purchase of treasury stock

(6,385

)

—

Net cash used in financing activities

(6,385

)

(525

)

Effect of exchange rate changes on

cash

(264

)

(457

)

Increase (decrease) in cash and cash

equivalents

(11,908

)

2,694

Cash and cash equivalents, beginning of

fiscal year

18,803

16,109

Cash and cash equivalents, end of fiscal

year

$

6,895

$

18,803

GEOSPACE TECHNOLOGIES

CORPORATION AND SUBSIDIARIES SUMMARY OF SEGMENT REVENUE AND

OPERATING INCOME (LOSS) (in thousands) (unaudited)

Three Months Ended

Year Ended

September 30, 2024

September 30, 2023

September 30, 2024

September 30, 2023

Oil and Gas Markets segment revenue:

Traditional seismic exploration product

revenue

$

2,496

$

2,674

$

9,812

$

12,183

Wireless seismic exploration product

revenue

14,768

14,928

67,059

60,848

Reservoir product revenue

261

152

584

962

17,525

17,754

77,455

73,993

Adjacent Markets segment revenue:

Industrial product revenue

14,568

7,609

43,060

36,859

Imaging product revenue

3,037

3,038

12,565

12,180

17,605

10,647

55,625

49,039

Emerging Markets segment revenue:

Border and perimeter security product

revenue

235

841

2,222

1,234

Corporate

73

73

296

243

Total revenue

$

35,438

$

29,315

$

135,598

$

124,509

Three Months Ended

Year Ended

September 30, 2024

September 30, 2023

September 30, 2024

September 30, 2023

Operating income (loss):

Oil and Gas Markets segment

$

4,008

$

5,939

$

13,134

$

15,759

Adjacent Markets segment

4,661

2,342

14,152

11,490

Emerging Markets segment

(3,769

)

(736

)

(6,193

)

(4,003

)

Corporate

(3,721

)

(3,461

)

(13,976

)

(11,918

)

Total operating income

$

1,179

$

4,084

$

7,117

$

11,328

GEOSPACE TECHNOLOGIES

CORPORATION AND SUBSIDIARIES NON-GAAP MEASURES (in

thousands)

Three Months Ended

Year Ended

September 30, 2024

September 30, 2023

September 30, 2024

September 30, 2023

Net income (loss)

$

(12,860

)

$

4,438

$

(6,578

)

$

12,206

Adjustments:

Loss on sale of subsidiary

14,539

—

14,539

—

Intangible assets impairment expense

2,761

—

2,761

—

Total adjustments

17,300

—

17,300

—

Adjusted net income

$

4,440

$

4,438

$

10,722

$

12,206

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241121527471/en/

Media Contact: Caroline Kempf ckempf@geospace.com

321.341.9305

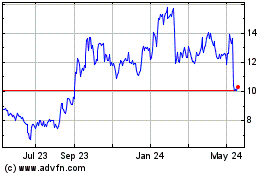

Geospace Technologies (NASDAQ:GEOS)

Historical Stock Chart

From Nov 2024 to Dec 2024

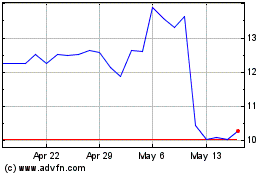

Geospace Technologies (NASDAQ:GEOS)

Historical Stock Chart

From Dec 2023 to Dec 2024