GoHealth, Inc. (NASDAQ: GOCO) (“GoHealth” or the “Company”), a

leading health insurance marketplace and Medicare-focused digital

health company, today announced financial results for the three and

nine months ended September 30, 2024.

Third Quarter Highlights

- Third quarter 2024 net revenues of $118.3 million, a $13.7

million decrease compared to $132.0 million in the prior year

period.

- Third quarter 2024 Submissions were 166,195, a 2.9% increase

compared to 161,550 Submissions in the prior year period, with

strong contributions from GoHealth’s internal captive agents,

partially offset by a decline in Submissions from the external

GoPartner Solutions (“GPS”) agents.

- Third quarter 2024 net income of $15.4 million, an improvement

of $71.6 million compared to a net loss of $56.2 million in the

prior year period.

- Third quarter 2024 Adjusted EBITDA(1) of negative $12.1

million, a decrease of $0.6 million compared to negative $11.5

million in the prior year period.

- Third quarter 2024 trailing twelve months (“TTM”) positive cash

flow from operations of $35.1 million, an increase of $38.3 million

compared to TTM negative cash flow from operations of $3.2 million

in the prior year period.

- Refinanced Credit Facility, establishing new five-year term

with new lender group.

- Completed the strategic acquisition of e-TeleQuote Insurance,

Inc. (“e-TeleQuote”), adding approximately $90.5 million in

contract assets and $22.5 million in cash (inclusive of the

Company’s initial $5.0 million investment), and recording a $77.4

million gain on bargain purchase, reinforcing GoHealth’s

aspirations to expand its market leadership and operational

capacity.

- Achieved an 11.0% improvement in Direct Operating Cost per

Submission(2) in the third quarter of 2024 compared to the prior

year period, through advancements in artificial intelligence

(“AI”), automation, and marketing efficiencies, along with targeted

operational improvements.

- Appointed Brendan Shanahan as Chief Financial Officer, who

brings over 30 years of healthcare and financial strategy expertise

to GoHealth.

“Our third-quarter results underscore the strength of our

ongoing transformation into a Medicare engagement company. We’ve

helped over 650,000 consumers navigate Medicare options through

tools like PlanFit CheckUp, and with the addition of e-TeleQuote’s

400 agents, we’re prepared to efficiently serve the demand surge we

are seeing in this year’s Medicare Annual Enrollment Period

(“AEP”). We believe these developments reinforce GoHealth’s

leadership in the eBroker space, positioning us for sustained

growth and profitability,” said Vijay Kotte, CEO of GoHealth.

“The acquisition of e-TeleQuote not only added $90.5 million in

contract assets and $22.5 million in cash (inclusive of our initial

$5.0 million investment), but also provided a substantial gain on

bargain purchase of $77.4 million, boosting our financial

position,” Kotte continued. “This strategic move expanded our agent

capacity ahead of a pivotal AEP, which we believe will enable us to

capitalize on market demand. As the competitive landscape shifts,

GoHealth aims to stand out, ready to support the millions of

consumers facing benefit reductions or coverage losses.”

“GoHealth’s third-quarter results reflect disciplined cost

management, as we reduced our Direct Operating Cost per

Submission(2) by 11.0%, despite broader market challenges. These

efficiency gains and a focus on high-quality lead generation

underscore our commitment to driving profitable growth, especially

as we progress through AEP,” said Brendan Shanahan, CFO of

GoHealth. “With over $77 million gained through the e-TeleQuote

acquisition, we believe we’re positioned with the liquidity and

flexibility needed to drive long-term value, even as we expand our

agent base during this critical AEP.”

“This AEP, we’re seeing unprecedented disruption, with over two

million consumers losing coverage and more than six million

experiencing reduced benefits. We believe GoHealth’s investments in

AI-driven technology, an expanded agent network, and our focus on

consumer engagement uniquely position us to lead through these

market changes, delivering both growth and improved customer

experience,” said Kotte.

| (1) |

Adjusted

EBITDA is a non-GAAP measure. For a definition of Adjusted EBITDA

and a reconciliation to the most comparable GAAP measure, please

see below. |

| (2) |

Direct Operating Cost per Submission is an operating metric.

For a definition of Direct Operating Cost per Submission and an

explanation of its calculation, please see below. |

| |

|

Conference Call Details

The Company will host a conference call today, Thursday,

November 7, 2024 at 8:00 a.m. (ET) to discuss its financial

results. A live audio webcast of the conference call will be

available via GoHealth's Investor Relations website,

https://investors.gohealth.com/. A replay of the call will be

available via webcast for on-demand listening shortly after the

completion of the call.

About GoHealth, Inc.

GoHealth is a leading health insurance marketplace and

Medicare-focused digital health company whose purpose is to

compassionately ensure consumers’ peace of mind when making

healthcare decisions so they can focus on living life. For many of

these consumers, enrolling in a health insurance plan is confusing

and difficult, and seemingly small differences between health plans

may lead to significant out-of-pocket costs or lack of access to

critical providers and medicines. GoHealth’s proprietary technology

platform leverages modern machine-learning algorithms, powered by

over two decades of insurance purchasing behavior, to reimagine the

process of matching a health plan to a consumer’s specific needs.

Its unbiased, technology-driven marketplace coupled with highly

skilled licensed agents has facilitated the enrollment of millions

of consumers in Medicare plans since GoHealth’s inception. For more

information, visit https://www.gohealth.com.

| Investor

Relations: |

| John Shave |

| JShave@gohealth.com |

| |

| Media

Relations: |

|

Pressinquiries@gohealth.com |

| |

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, (the “Securities Act”), and Section 21E of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”). These

forward-looking statements are made in reliance upon the safe

harbor provision of the Private Securities Litigation Reform Act of

1995. All statements other than statements of historical facts

contained in this press release may be forward-looking statements.

Statements regarding our future results of operations and financial

position, business strategy and plans and objectives of management

for future operations, including, among others, statements

regarding our expected growth, future capital expenditures, debt

service obligations, adoption and use of artificial intelligence

technologies, the impact on our business from the acquisition of

e-TeleQuote Insurance, Inc. (“e-TeleQuote”) and our ability to

successfully integrate e-TeleQuote’s operations, technologies and

employees into our business, are forward-looking statements.

In some cases, you can identify forward-looking statements by

terms such as “may,” “will,” “should,” “aims,” “expects,” “plans,”

“anticipates,” “could,” “intends,” “targets,” “projects,”

“contemplates,” “believes,” “estimates,” “predicts,” “potential,”

“likely,” “future” or “continue” or the negative of these terms or

other similar expressions. The forward-looking statements in this

press release are only predictions, projections and other

statements about future events that are based on current

expectations and assumptions. Accordingly, we caution you that any

such forward-looking statements are not guarantees of future

performance and are subject to risks, assumptions and uncertainties

that are difficult to predict. Although we believe that the

expectations reflected in these forward-looking statements are

reasonable as of the date made, actual results may prove to be

materially different from the results expressed or implied by the

forward-looking statements.

These forward-looking statements speak only as of the date of

this press release and are subject to a number of important factors

that could cause actual results to differ materially from those in

the forward-looking statements, including the factors described in

the sections titled “Summary Risk Factors,” “Risk Factors” and

“Management’s Discussion and Analysis of Financial Condition and

Results of Operations” in our Annual Report on Form 10-K for the

fiscal year ended December 31, 2023 (“2023 Annual Report on Form

10-K”) and in our other filings with the Securities and Exchange

Commission. The factors described in our 2023 Annual Report on Form

10-K should not be construed as exhaustive and should be read

together with the other cautionary statements included in this

press release, as well as the cautionary statements and other risk

factors set forth in the Quarterly Report on Form 10-Q for the

first fiscal quarter ended March 31, 2024, the Quarterly Report on

Form 10-Q for the second fiscal quarter ended June 30, 2024, the

forthcoming Quarterly Report on Form 10-Q for the third quarter

ended September 30, 2024 and in our other filings with the

Securities and Exchange Commission.

You should read this press release and the documents that we

reference in this press release completely and with the

understanding that our actual future results may be materially

different from what we expect. We qualify all of our

forward-looking statements by these cautionary statements. Except

as required by applicable law, we do not plan to publicly update or

revise any forward-looking statements contained herein, whether as

a result of any new information, future events, changed

circumstances or otherwise.

Non-GAAP Financial Measures

Throughout this press release, we use a number of non-GAAP

financial measures. Non-GAAP financial measures are supplemental

measures of our performance that are derived from our consolidated

financial information, but which are not presented in our Condensed

Consolidated Financial Statements prepared in accordance with U.S.

generally accepted accounting principles (“GAAP”). We define these

non-GAAP financial measures as follows:

- “Adjusted EBITDA” represents, as applicable for the period,

EBITDA as further adjusted for certain items summarized in the

table furnished below in this press release.

- “Adjusted EBITDA Margin” refers to Adjusted EBITDA divided by

net revenues.

- “EBITDA” represents net income (loss) before interest expense,

income tax expense (benefit) and depreciation and amortization

expense.

We believe that excluding certain items from our GAAP results

allows management to better understand our consolidated financial

performance from period to period and better project our future

consolidated financial performance as forecasts are developed at a

level of detail different from that used to prepare GAAP-based

financial measures. Moreover, we believe these non-GAAP financial

measures provide our stakeholders with useful information to help

them evaluate our operating results by facilitating an enhanced

understanding of our operating performance and enabling them to

make more meaningful period to period comparisons. Adjusted EBITDA

is the primary financial performance measure used by management to

evaluate the business and monitor the results of operations, as

well as a basis for certain compensation programs sponsored by the

Company. There are limitations to the use of the non-GAAP financial

measures presented in this press release. For example, our non-GAAP

financial measures may not be comparable to similarly titled

measures of other companies. Other companies, including companies

in our industry, may calculate non-GAAP financial measures

differently than we do, limiting the usefulness of those measures

for comparative purposes.

The non-GAAP financial measures are not meant to be considered

as indicators of performance in isolation from or as a substitute

for the most directly comparable financial measures prepared in

accordance with GAAP and should be read only in conjunction with

financial information presented on a GAAP basis. Reconciliations of

each of EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin to its

most directly comparable GAAP financial measure are presented in

the tables furnished below in this press release. We encourage you

to review the reconciliations in conjunction with the presentation

of the non-GAAP financial measures for each of the periods

presented. In future periods, we may exclude similar items, may

incur income and expenses similar to these excluded items and may

include other expenses, costs and non-routine items.

Key Performance Indicators

In addition to traditional financial metrics, we rely upon

certain business and operating metrics to evaluate our business

performance and facilitate our operations. The most relevant

business and operating metrics are as follows:

- “Direct Operating Cost of Submission” is an operating metric

that represents costs directly attributable to Submissions

generated during a particular period and excludes costs that are

indirect or fixed. Direct Operating Cost of Submission is comprised

of the portion of the respective operating expenses for revenue

share, marketing and advertising and consumer care and enrollment

that are directly related to the Submissions generated in the

particular period. Direct Operating Cost of Submission, most

recently referred to as “Direct Cost of Submission,” reflects a

name change only.

- “Direct Operating Cost per Submission” is an operating metric

that represents the average performance of Submissions generated

during a particular period. Direct Operating Cost per Submission

refers to (x) Direct Operating Cost of Submission for a particular

period divided by (y) the number of Submissions generated for such

period. Direct Operating Cost per Submission, most recently

referred to as “Direct Cost per Submission” reflects a name change

only.

- “Sales/Direct Operating Cost of Submission” represents (x) the

numerator of Sales per Submission, as defined below, divided by (y)

Direct Operating Cost of Submission. Sales/Direct Operating Cost of

Submission, most recently referred to as “Sales/Direct Cost of

Submission” reflects a name change only.

- “Sales per Submission” is an operating metric that represents

the average performance of Submissions generated during a

particular period. Sales per Submission measures revenues only from

the Submissions generated in the period and excludes items that are

unrelated to such Submissions, including any impact of revenue

adjustments recorded in the period, but relating to performance

obligations satisfied in prior periods. Sales per Submission equals

(x) the sum of (i) agency revenues, comprised of the expected

amount of initial commission revenue and any renewal commissions to

be paid from the health plan partners on such placement as long as

the policyholder remains with the same insurance product, as well

as partner marketing and other revenue and (ii) non-agency

revenues, comprised of the enrollment and engagement services for

which cash is collected in advance or in close proximity to the

point in time revenue is recognized, divided by (y) the number of

Submissions generated for such period.

- “Submission” refers to either (i) a completed application with

our licensed agent that is submitted to the health plan partner and

subsequently approved by the health plan partner during the

indicated period, excluding applications through our Non-Encompass

BPO Services or (ii) a transfer by our agent to the health plan

partner through the Encompass operating model during the indicated

period.

Direct Operating Cost of Submission, Direct Operating Cost per

Submission, Sales/Direct Operating Cost of Submission, Sales per

Submission and Submissions are key operating metrics we use to

understand our underlying financial performance and trends.

Certain Definitions and Key Terms

As used in this press release, unless the context otherwise

requires:

- “LTV” refers to the Lifetime Value of Commissions, which we

define as aggregate commissions estimated to be collected over the

estimated life of all commissionable Submissions for the relevant

period based on multiple factors, including but not limited to,

contracted commission rates, health plan partner mix and expected

policy persistency with applied constraints.

- “Non-Encompass BPO Services” refer to programs in which

GoHealth-employed agents are dedicated to certain health plans and

agencies we partner with outside of the Encompass operating

model.

The following tables set forth the components of our results of

operations for the periods indicated (unaudited):

| |

|

|

Three months ended Sep. 30, |

|

|

|

|

| |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

| (in

thousands, except percentages and per share amounts) |

|

|

Dollars |

|

% of Net Revenues |

|

Dollars |

|

% of Net Revenues |

|

$ Change |

|

% Change |

| Net revenues |

|

|

$ |

118,292 |

|

|

100.0 |

% |

|

$ |

132,037 |

|

|

100.0 |

% |

|

$ |

(13,745 |

) |

|

(10.4) % |

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue share |

|

|

|

19,683 |

|

|

16.6 |

% |

|

|

35,992 |

|

|

27.3 |

% |

|

|

(16,309 |

) |

|

(45.3) % |

|

Marketing and advertising |

|

|

|

45,270 |

|

|

38.3 |

% |

|

|

39,416 |

|

|

29.9 |

% |

|

|

5,854 |

|

|

14.9 |

% |

|

Consumer care and enrollment |

|

|

|

45,556 |

|

|

38.5 |

% |

|

|

46,472 |

|

|

35.2 |

% |

|

|

(916 |

) |

|

(2.0) % |

|

Technology |

|

|

|

9,801 |

|

|

8.3 |

% |

|

|

11,652 |

|

|

8.8 |

% |

|

|

(1,851 |

) |

|

(15.9) % |

|

General and administrative |

|

|

|

17,140 |

|

|

14.5 |

% |

|

|

12,967 |

|

|

9.8 |

% |

|

|

4,173 |

|

|

32.2 |

% |

|

Amortization of intangible assets |

|

|

|

23,514 |

|

|

19.9 |

% |

|

|

23,514 |

|

|

17.8 |

% |

|

|

— |

|

|

— |

% |

| Total operating expenses |

|

|

|

160,964 |

|

|

136.1 |

% |

|

|

170,013 |

|

|

128.8 |

% |

|

|

(9,049 |

) |

|

(5.3) % |

| Income (loss) from

operations |

|

|

|

(42,672 |

) |

|

(36.1) % |

|

|

(37,976 |

) |

|

(28.8) % |

|

|

(4,696 |

) |

|

12.4 |

% |

| Interest expense |

|

|

|

19,086 |

|

|

16.1 |

% |

|

|

17,565 |

|

|

13.3 |

% |

|

|

1,521 |

|

|

8.7 |

% |

| Gain on bargain purchase |

|

|

|

(77,363 |

) |

|

(65.4) % |

|

|

— |

|

|

— |

% |

|

|

(77,363 |

) |

|

NM |

| Other (income) expense,

net |

|

|

|

250 |

|

|

0.2 |

% |

|

|

771 |

|

|

0.6 |

% |

|

|

(521 |

) |

|

(67.6) % |

| Income (loss) before income

taxes |

|

|

|

15,355 |

|

|

13.0 |

% |

|

|

(56,312 |

) |

|

(42.6) % |

|

|

71,667 |

|

|

(127.3) % |

| Income tax (benefit)

expense |

|

|

|

(11 |

) |

|

— |

% |

|

|

(108 |

) |

|

(0.1) % |

|

|

97 |

|

|

(89.8) % |

| Net income (loss) |

|

|

$ |

15,366 |

|

|

13.0 |

% |

|

$ |

(56,204 |

) |

|

(42.6) % |

|

$ |

71,570 |

|

|

(127.3) % |

| Net income (loss) attributable

to non-controlling interests |

|

|

|

8,591 |

|

|

7.3 |

% |

|

|

(32,294 |

) |

|

(24.5) % |

|

|

40,885 |

|

|

(126.6) % |

| Net income (loss)

attributable to GoHealth, Inc. |

|

|

$ |

6,775 |

|

|

5.7 |

% |

|

$ |

(23,910 |

) |

|

(18.1) % |

|

$ |

30,685 |

|

|

(128.3) % |

| Net Income (Loss) Margin |

|

|

|

13.0 |

% |

|

|

|

(42.6) % |

|

|

|

|

|

|

| Net income (loss) per

share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) per share of

Class A common stock — basic |

|

|

$ |

0.58 |

|

|

|

|

$ |

(2.61 |

) |

|

|

|

|

|

|

| Net income (loss) per share of

Class A common stock — diluted |

|

|

$ |

0.46 |

|

|

|

|

$ |

(2.61 |

) |

|

|

|

|

|

|

| Weighted-average shares of

Class A common stock outstanding — basic |

|

|

|

10,077 |

|

|

|

|

|

9,489 |

|

|

|

|

|

|

|

| Weighted-average shares of

Class A common stock outstanding — diluted |

|

|

|

14,580 |

|

|

|

|

|

9,489 |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP financial

measures: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA |

|

|

$ |

60,860 |

|

|

|

|

$ |

(12,482 |

) |

|

|

|

|

|

|

|

Adjusted EBITDA |

|

|

$ |

(12,106 |

) |

|

|

|

$ |

(11,475 |

) |

|

|

|

|

|

|

|

Adjusted EBITDA Margin |

|

|

(10.2) % |

|

|

|

(8.7) % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NM = Not meaningful

| |

|

|

Nine months ended Sep. 30, |

|

|

|

|

| |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

| (in

thousands, except percentages and per share amounts) |

|

|

Dollars |

|

% of Net Revenues |

|

Dollars |

|

% of Net Revenues |

|

$ Change |

|

% Change |

| Net revenues |

|

|

$ |

409,762 |

|

|

100.0 |

% |

|

$ |

457,974 |

|

|

100.0 |

% |

|

$ |

(48,212 |

) |

|

(10.5) % |

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue share |

|

|

|

78,376 |

|

|

19.1 |

% |

|

|

117,876 |

|

|

25.7 |

% |

|

|

(39,500 |

) |

|

(33.5) % |

|

Marketing and advertising |

|

|

|

136,049 |

|

|

33.2 |

% |

|

|

124,428 |

|

|

27.2 |

% |

|

|

11,621 |

|

|

9.3 |

% |

|

Consumer care and enrollment |

|

|

|

132,731 |

|

|

32.4 |

% |

|

|

134,035 |

|

|

29.3 |

% |

|

|

(1,304 |

) |

|

(1.0) % |

|

Technology |

|

|

|

28,921 |

|

|

7.1 |

% |

|

|

31,706 |

|

|

6.9 |

% |

|

|

(2,785 |

) |

|

(8.8) % |

|

General and administrative |

|

|

|

50,457 |

|

|

12.3 |

% |

|

|

73,440 |

|

|

16.0 |

% |

|

|

(22,983 |

) |

|

(31.3) % |

|

Amortization of intangible assets |

|

|

|

70,542 |

|

|

17.2 |

% |

|

|

70,543 |

|

|

15.4 |

% |

|

|

(1 |

) |

|

— |

% |

|

Operating lease impairment charges |

|

|

|

— |

|

|

— |

% |

|

|

2,687 |

|

|

0.6 |

% |

|

|

(2,687 |

) |

|

(100.0) % |

| Total operating expenses |

|

|

|

497,076 |

|

|

121.3 |

% |

|

|

554,715 |

|

|

121.1 |

% |

|

|

(57,639 |

) |

|

(10.4) % |

| Income (loss) from

operations |

|

|

|

(87,314 |

) |

|

(21.3) % |

|

|

(96,741 |

) |

|

(21.1) % |

|

|

9,427 |

|

|

(9.7) % |

| Interest expense |

|

|

|

55,133 |

|

|

13.5 |

% |

|

|

51,721 |

|

|

11.3 |

% |

|

|

3,412 |

|

|

6.6 |

% |

| Gain on bargain purchase |

|

|

|

(77,363 |

) |

|

(18.9) % |

|

|

— |

|

|

— |

% |

|

|

(77,363 |

) |

|

NM |

| Other (income) expense,

net |

|

|

|

332 |

|

|

0.1 |

% |

|

|

739 |

|

|

0.2 |

% |

|

|

(407 |

) |

|

(55.1) % |

| Income (loss) before income

taxes |

|

|

|

(65,416 |

) |

|

(16.0) % |

|

|

(149,201 |

) |

|

(32.6) % |

|

|

83,785 |

|

|

(56.2) % |

| Income tax (benefit)

expense |

|

|

|

(122 |

) |

|

— |

% |

|

|

(225 |

) |

|

— |

% |

|

|

103 |

|

|

(45.8) % |

| Net income (loss) |

|

|

$ |

(65,294 |

) |

|

(15.9) % |

|

$ |

(148,976 |

) |

|

(32.5) % |

|

$ |

83,682 |

|

|

(56.2) % |

| Net income (loss) attributable

to non-controlling interests |

|

|

|

(36,857 |

) |

|

(9.0) % |

|

|

(86,945 |

) |

|

(19.0) % |

|

|

50,088 |

|

|

(57.6) % |

| Net income (loss)

attributable to GoHealth, Inc. |

|

|

$ |

(28,437 |

) |

|

(6.9) % |

|

$ |

(62,031 |

) |

|

(13.5) % |

|

$ |

33,594 |

|

|

(54.2) % |

| Net Income (Loss) Margin |

|

|

(15.9) % |

|

|

|

(32.5) % |

|

|

|

|

|

|

| Net income (loss) per

share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) per share of

Class A common stock — basic |

|

|

$ |

(3.14 |

) |

|

|

|

$ |

(7.04 |

) |

|

|

|

|

|

|

| Net income (loss) per share of

Class A common stock — diluted |

|

|

$ |

(3.14 |

) |

|

|

|

$ |

(7.04 |

) |

|

|

|

|

|

|

| Weighted-average shares of

Class A common stock outstanding — basic |

|

|

|

9,922 |

|

|

|

|

|

9,194 |

|

|

|

|

|

|

|

| Weighted-average shares of

Class A common stock outstanding — diluted |

|

|

|

9,922 |

|

|

|

|

|

9,194 |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP financial measures: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA |

|

|

$ |

68,679 |

|

|

|

|

$ |

(18,580 |

) |

|

|

|

|

|

|

|

Adjusted EBITDA |

|

|

$ |

2,479 |

|

|

|

|

$ |

18,091 |

|

|

|

|

|

|

|

|

Adjusted EBITDA Margin |

|

|

|

0.6 |

% |

|

|

|

|

4.0 |

% |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

NM = Not meaningful

The following tables set forth the reconciliations of GAAP net

income (loss) to EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin

for the periods indicated (unaudited):

| |

|

|

Three months ended Sep. 30, |

|

Nine months ended Sep. 30, |

|

(in thousands) |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net

revenues |

|

|

$ |

118,292 |

|

|

$ |

132,037 |

|

|

$ |

409,762 |

|

|

$ |

457,974 |

|

| Net income (loss) |

|

|

|

15,366 |

|

|

|

(56,204 |

) |

|

|

(65,294 |

) |

|

|

(148,976 |

) |

|

Interest expense |

|

|

|

19,086 |

|

|

|

17,565 |

|

|

|

55,133 |

|

|

|

51,721 |

|

|

Income tax expense (benefit) |

|

|

|

(11 |

) |

|

|

(108 |

) |

|

|

(122 |

) |

|

|

(225 |

) |

|

Depreciation and amortization expense |

|

|

|

26,419 |

|

|

|

26,265 |

|

|

|

78,962 |

|

|

|

78,900 |

|

| EBITDA |

|

|

|

60,860 |

|

|

|

(12,482 |

) |

|

|

68,679 |

|

|

|

(18,580 |

) |

|

Gain on bargain purchase(1) |

|

|

|

(77,363 |

) |

|

|

— |

|

|

|

(77,363 |

) |

|

|

— |

|

|

Share-based compensation expense (benefit)(2) |

|

|

|

2,859 |

|

|

|

(545 |

) |

|

|

6,534 |

|

|

|

16,159 |

|

|

Professional services(3) |

|

|

|

818 |

|

|

|

1,213 |

|

|

|

818 |

|

|

|

1,213 |

|

|

Legal fees(4) |

|

|

|

654 |

|

|

|

339 |

|

|

|

1,331 |

|

|

|

14,692 |

|

|

Severance costs(5) |

|

|

|

66 |

|

|

|

— |

|

|

|

2,480 |

|

|

|

1,920 |

|

|

Operating lease impairment charges(6) |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2,687 |

|

| Adjusted EBITDA |

|

|

$ |

(12,106 |

) |

|

$ |

(11,475 |

) |

|

$ |

2,479 |

|

|

$ |

18,091 |

|

| Net Income (Loss) Margin |

|

|

|

13.0 |

% |

|

(42.6) % |

|

(15.9) % |

|

(32.5) % |

| Adjusted EBITDA Margin |

|

|

(10.2) % |

|

(8.7) % |

|

|

0.6 |

% |

|

|

4.0 |

% |

|

(1) |

Represents the excess of the acquisition-date fair value of the net

assets acquired over the acquisition-date fair value of the

consideration transferred related to the acquisition of

e-TeleQuote. |

| (2) |

Represents non-cash share-based

compensation expense (benefit) relating to equity awards as well as

share-based compensation expense (benefit) relating to liability

classified awards that will be settled in cash. |

| (3) |

Represents costs primarily

associated with non-recurring consulting fees and other

professional services. |

| (4) |

Represents legal fees, settlement

accruals and other expenses related to certain acquisitions,

litigation, Credit Agreement amendments and other non-routine legal

or regulatory matters. |

| (5) |

Represents severance costs and

other fees associated with a reduction in workforce unrelated to

restructuring activities. |

| (6) |

Represents operating lease

impairment charges, reducing the carrying value of the associated

right-of-use (“ROU”) assets and leasehold improvements to the

estimated fair values. |

| |

|

The table below depicts the disaggregation of revenue and is

consistent with how the Company evaluates its financial performance

(unaudited):

| |

|

|

Three months ended Sep. 30, |

|

Nine months ended Sep. 30, |

|

(in thousands) |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

| Medicare Revenue |

|

|

|

|

|

|

|

|

|

|

Agency Revenue |

|

|

|

|

|

|

|

|

|

|

Commission Revenue(1) |

|

|

$ |

77,868 |

|

$ |

76,579 |

|

$ |

228,154 |

|

$ |

261,513 |

|

Partner Marketing and Other Revenue |

|

|

|

14,408 |

|

|

21,300 |

|

|

47,926 |

|

|

71,619 |

|

Total Agency Revenue |

|

|

|

92,276 |

|

|

97,879 |

|

|

276,080 |

|

|

333,132 |

|

Non-Agency Revenue |

|

|

|

24,377 |

|

|

33,510 |

|

|

130,723 |

|

|

106,586 |

| Total Medicare Revenue |

|

|

|

116,653 |

|

|

131,389 |

|

|

406,803 |

|

|

439,718 |

| Other Revenue |

|

|

|

|

|

|

|

|

|

|

Non-Encompass BPO Services Revenue |

|

|

|

— |

|

|

— |

|

|

— |

|

|

9,322 |

|

Other Revenue |

|

|

|

1,639 |

|

|

648 |

|

|

2,959 |

|

|

8,934 |

| Total Other Revenue |

|

|

|

1,639 |

|

|

648 |

|

|

2,959 |

|

|

18,256 |

| Total Net

Revenues |

|

|

$ |

118,292 |

|

$ |

132,037 |

|

$ |

409,762 |

|

$ |

457,974 |

|

(1) |

Commission revenue excludes commissions generated through the

Company’s Non-Encompass BPO Services as well as from the sale of

individual and family plan insurance products. |

| |

|

The following table summarizes share-based compensation expense

(benefit) by operating function for the periods indicated

(unaudited):

| |

|

|

Three months ended Sep. 30, |

|

Nine months ended Sep. 30, |

|

(in thousands) |

|

|

|

2024 |

|

|

2023 |

|

|

|

2024 |

|

|

2023 |

| Marketing and advertising |

|

|

$ |

75 |

|

$ |

149 |

|

|

$ |

203 |

|

$ |

378 |

| Customer care and

enrollment |

|

|

|

189 |

|

|

519 |

|

|

|

841 |

|

|

1,847 |

| Technology |

|

|

|

293 |

|

|

676 |

|

|

|

780 |

|

|

2,365 |

| General and

administrative(1) |

|

|

|

2,302 |

|

|

(1,889 |

) |

|

|

4,710 |

|

|

11,569 |

| Total share-based

compensation expense (benefit) |

|

|

$ |

2,859 |

|

$ |

(545 |

) |

|

$ |

6,534 |

|

$ |

16,159 |

|

(1) |

For the three and nine months ended September 30, 2024 and 2023,

share-based compensation expense (benefit) includes expense

(benefit) related to the stock appreciation rights (“SARs”), which

are liability classified awards. |

| |

|

The following table sets forth our balance sheets for the

periods indicated (unaudited):

|

(in thousands, except per share amounts) |

|

|

Sep. 30, 2024 |

|

Dec. 31, 2023 |

| Assets |

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

|

$ |

35,527 |

|

|

$ |

90,809 |

|

|

Accounts receivable, net of allowance for doubtful accounts of $2

in 2024 and $27 in 2023 |

|

|

|

6,862 |

|

|

|

250 |

|

|

Commissions receivable - current |

|

|

|

270,383 |

|

|

|

336,215 |

|

|

Prepaid expense and other current assets |

|

|

|

21,271 |

|

|

|

49,166 |

|

| Total current assets |

|

|

|

334,043 |

|

|

|

476,440 |

|

| Commissions receivable -

non-current |

|

|

|

627,341 |

|

|

|

575,482 |

|

| Operating lease ROU asset |

|

|

|

20,449 |

|

|

|

21,995 |

|

| Property, equipment, and

capitalized software, net |

|

|

|

30,418 |

|

|

|

26,843 |

|

| Intangible assets, net |

|

|

|

326,011 |

|

|

|

396,554 |

|

| Other long-term assets |

|

|

|

2,891 |

|

|

|

2,256 |

|

| Total

assets |

|

|

$ |

1,341,153 |

|

|

$ |

1,499,570 |

|

| Liabilities, Redeemable

Convertible Preferred Stock and Stockholders’ Equity |

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

|

$ |

15,285 |

|

|

$ |

17,705 |

|

|

Accrued liabilities |

|

|

|

49,475 |

|

|

|

86,254 |

|

|

Commissions payable - current |

|

|

|

80,899 |

|

|

|

118,732 |

|

|

Short-term operating lease liability |

|

|

|

5,541 |

|

|

|

5,797 |

|

|

Deferred revenue |

|

|

|

42,696 |

|

|

|

52,403 |

|

|

Current portion of long-term debt |

|

|

|

65,000 |

|

|

|

75,000 |

|

|

Other current liabilities |

|

|

|

23,075 |

|

|

|

14,122 |

|

| Total current liabilities |

|

|

|

281,971 |

|

|

|

370,013 |

|

| Non-current liabilities: |

|

|

|

|

|

|

Commissions payable - non-current |

|

|

|

177,023 |

|

|

|

203,255 |

|

|

Long-term operating lease liability |

|

|

|

36,187 |

|

|

|

39,547 |

|

|

Deferred tax liabilities |

|

|

|

24,995 |

|

|

|

— |

|

|

Long-term debt, net of current portion |

|

|

|

416,332 |

|

|

|

422,705 |

|

|

Other non-current liabilities |

|

|

|

7,363 |

|

|

|

9,095 |

|

| Total non-current

liabilities |

|

|

|

661,900 |

|

|

|

674,602 |

|

| Commitments and

Contingencies |

|

|

|

|

|

| Series A redeemable convertible

preferred stock — $0.0001 par value; 50 shares authorized; 50

shares issued and outstanding as of both September 30, 2024 and

December 31, 2023. Liquidation preference of $53.7 million and

$50.9 million as of September 30, 2024 and December 31, 2023,

respectively. |

|

|

|

52,023 |

|

|

|

49,302 |

|

| Stockholders’ equity: |

|

|

|

|

|

|

Class A common stock – $0.0001 par value; 1,100,000 shares

authorized; 10,440 and 9,823 shares issued; 10,121 and 9,651 shares

outstanding as of September 30, 2024 and December 31, 2023,

respectively. |

|

|

|

1 |

|

|

|

1 |

|

|

Class B common stock – $0.0001 par value; 615,980 and 616,018

shares authorized; 12,775 and 12,814 shares issued and outstanding

as of September 30, 2024 and December 31, 2023, respectively. |

|

|

|

1 |

|

|

|

1 |

|

|

Preferred stock – $0.0001 par value; 20,000 shares authorized

(including 50 shares of Series A redeemable convertible preferred

stock authorized and 200 shares of Series A-1 convertible preferred

stock authorized); 50 shares issued and outstanding as of both

September 30, 2024 and December 31, 2023. |

|

|

|

— |

|

|

|

— |

|

|

Series A-1 convertible preferred stock— $0.0001 par value; 200

shares authorized; no shares issued and outstanding as of both

September 30, 2024 and December 31, 2023. |

|

|

|

— |

|

|

|

— |

|

|

Treasury stock – at cost; 319 and 173 shares of Class A common

stock as of September 30, 2024 and December 31, 2023,

respectively. |

|

|

|

(4,124 |

) |

|

|

(2,640 |

) |

|

Additional paid-in capital |

|

|

|

665,020 |

|

|

|

654,059 |

|

|

Accumulated other comprehensive income (loss) |

|

|

|

(141 |

) |

|

|

(127 |

) |

|

Accumulated deficit |

|

|

|

(448,717 |

) |

|

|

(420,280 |

) |

| Total stockholders’ equity

attributable to GoHealth, Inc. |

|

|

|

212,040 |

|

|

|

231,014 |

|

| Non-controlling interests |

|

|

|

133,219 |

|

|

|

174,639 |

|

| Total stockholders’ equity |

|

|

|

345,259 |

|

|

|

405,653 |

|

| Total liabilities,

redeemable convertible preferred stock and stockholders’

equity |

|

|

$ |

1,341,153 |

|

|

$ |

1,499,570 |

|

| |

|

|

|

|

|

|

|

|

|

The following table sets forth the net cash provided by (used

in) operating activities for the periods presented (unaudited):

|

Net cash provided by (used in) operating

activities |

|

Nine months ended

Sep. 30, |

|

Trailing Twelve

Months ended Sep. 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| |

|

$ |

(36,211 |

) |

|

$ |

37,840 |

|

$ |

35,091 |

|

$ |

(3,159 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In addition to traditional financial metrics, we rely upon

certain business and operating metrics to evaluate our business

performance and facilitate our operations. Below are the most

relevant business and operating metrics for our single operating

and reportable segment.

The following table presents the number of Submissions for the

periods presented:

|

Submissions |

|

Three months ended Sep. 30, |

|

|

|

|

|

|

2024 |

|

2023 |

|

Change |

|

% Change |

|

|

166,195 |

|

161,550 |

|

4,645 |

|

|

2.9% |

|

|

|

|

|

|

|

|

|

|

|

Nine months ended Sep. 30, |

|

|

|

|

|

|

2024 |

|

2023 |

|

Change |

|

% Change |

|

|

534,737 |

|

538,032 |

|

(3,295 |

) |

|

(0.6)% |

|

|

|

|

|

|

|

|

|

|

|

The following table presents the Sales per Submission for the

periods presented:

|

Sales Per Submission |

|

Three months ended Sep. 30, |

|

|

|

|

|

|

|

2024 |

|

|

2023 |

|

$ Change |

|

% Change |

|

|

$ |

702 |

|

$ |

813 |

|

$ |

(111 |

) |

|

(13.7)% |

| |

|

|

|

|

|

|

|

| |

Nine months ended Sep. 30, |

|

|

|

|

| |

|

2024 |

|

|

2023 |

|

$ Change |

|

% Change |

| |

$ |

761 |

|

$ |

817 |

|

$ |

(56 |

) |

|

(6.9)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The following table presents the Direct Operating Cost per

Submission for the periods presented:

|

Direct Operating Cost Per Submission |

|

Three months ended Sep. 30, |

|

|

|

|

|

|

|

2024 |

|

|

2023 |

|

$ Change |

|

% Change |

|

|

$ |

663 |

|

$ |

745 |

|

$ |

(82 |

) |

|

(11.0)% |

| |

|

|

|

|

|

|

|

| |

Nine months ended Sep. 30, |

|

|

|

|

| |

|

2024 |

|

|

2023 |

|

$ Change |

|

% Change |

| |

$ |

647 |

|

$ |

679 |

|

$ |

(32 |

) |

|

(4.7)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The following are our Direct Operating Cost of Submission (in

thousands) and Sales/Direct Operating Cost of Submission for the

periods presented:

| |

|

|

Three months ended Sep. 30, |

|

Nine months ended Sep. 30, |

|

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

| Direct Operating Cost of

Submission |

|

|

$ |

110,245 |

|

$ |

120,362 |

|

$ |

346,112 |

|

$ |

365,612 |

| Sales/Direct Operating Cost of

Submission |

|

|

|

1.1 |

|

|

1.1 |

|

|

1.2 |

|

|

1.2 |

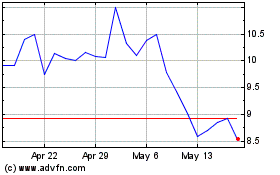

GoHealth (NASDAQ:GOCO)

Historical Stock Chart

From Dec 2024 to Jan 2025

GoHealth (NASDAQ:GOCO)

Historical Stock Chart

From Jan 2024 to Jan 2025