As filed with the Securities and Exchange

Commission on January 23, 2025

Registration Statement No. 333-279091

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment

No. 2

to

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

TechPrecision

Corporation

(Exact name

of registrant as specified in its charter)

| Delaware |

|

3440 |

|

51-0539828 |

(State or Other Jurisdiction of

Incorporation or Organization) |

|

(Primary Standard Industrial

Classification Code Number) |

|

(I.R.S. Employer

Identification Number) |

1 Bella Drive

Westminster, MA 01473

(978) 874-0591

(Address, including zip code, and telephone

number, including area code, of registrant’s principal executive offices)

Alexander Shen

Chief Executive Officer

1 Bella Drive

Westminster, MA 01473

(978) 874-0591

(Name, address, including zip code, and telephone

number,

including area code, of agent for service)

Copies to:

Cecil E. Martin, III

McGuireWoods LLP

500 East Pratt Street, Suite 1000

Baltimore, MD 21202

Approximate date of commencement of proposed sale to the public:

From time to time after this registration statement becomes effective.

If any of the securities being registered on this Form are to

be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: x

If this Form is filed to register additional securities for an

offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to

Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to

Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of

“large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging

growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

|

¨ |

|

Accelerated filer |

|

¨ |

| |

|

|

|

| Non-accelerated filer |

|

x |

|

Smaller reporting company |

|

x |

| |

|

|

|

| |

|

|

|

Emerging growth company |

|

¨ |

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this registration statement on such

date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically

states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities

Act or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant

to said Section 8(a), may determine.

The information in this preliminary prospectus

is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange

Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting an offer to buy these

securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED

JANUARY 23, 2025

Preliminary Prospectus

Up to 986,100 Shares of Common Stock

Warrants to Purchase Up to 666,100 Shares

of Common Stock

Up to 666,100 Shares of Common Stock Underlying

the Warrants

Up to 19,983 Shares of Common Stock Underlying

the Placement Agent Warrants

This prospectus relates to the offer and sale

from time to time by the selling securityholders named in this prospectus (including their permitted transferees, donees, pledgees and

other successors-in-interest) (collectively, the “Selling Securityholders”) of: (i) 320,000 shares of our common stock,

par value $0.0001 per share that were issued pursuant to the termination provision of that certain Stock Purchase Agreement (the “Votaw

Agreement”), dated November 22, 2023, between the Company and Doerfer Corporation, an Iowa corporation; (ii) 666,100

shares of our common stock issued to certain investors (the “Purchasers”) in a private placement pursuant to that certain

Securities Purchase Agreement (the “Purchase Agreement”), dated July 3, 2024, between the Company and the Purchasers;

(iii) the warrants (the “Purchaser Warrants”) to purchase up to 666,100 shares of common stock at an exercise price

of $3.45 per share issued to the Purchasers pursuant to the Purchase Agreement; (iv) up to 666,100 shares of our common stock issuable

upon the exercise of the Purchaser Warrants; and (v) up to 19,983 shares of our common stock issuable upon the exercise of warrants

(the “Placement Agent Warrants”, and together with the Purchaser Warrants, the “Warrants”) issued to Wellington

Shields & Co. LLC as placement agent (the “Placement Agent”) pursuant to the Placement Agent Agreement (the “Placement

Agent Agreement”) dated July 3, 2024 between the Company and the Placement Agent.

We will not receive any proceeds from the sale

of shares of common stock or the Warrants by the Selling Securityholders pursuant to this prospectus. We will pay the expenses, other

than underwriting discounts and commissions and certain expenses incurred by the Selling Securityholders in disposing of the securities,

associated with the sale of securities pursuant to this prospectus. However, we will receive proceeds from the exercise of the Warrants,

if exercised on a cash basis, which proceeds we intend to use for general corporate purposes.

We are registering the resale of the securities

described above pursuant to certain registration rights we have granted. Our registration of the resale of the securities covered by

this prospectus does not mean that the Selling Securityholders will offer or sell any of the securities. The Selling Securityholders

and any of their permitted transferees may offer, sell or distribute all or a portion of the securities covered by this prospectus in

a number of different ways and at varying prices. Additional information on the Selling Securityholders, and the times and manner in

which they may offer and sell the securities covered by this prospectus, is provided under “Selling Securityholders,” “Determination

of Offering Price” and “Plan of Distribution” in this prospectus.

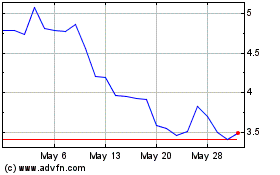

Our common stock is quoted for trading under

the symbol “TPCS” on The Nasdaq Capital Market. On January 22, 2025, the closing price of our common stock was $3.225

per share.

There is no established trading market for

the Purchaser Warrants. We do not intend to list the Purchaser Warrants on any securities exchange or other trading market. We do not

expect an active trading market to develop for the Purchaser Warrants. Without an active trading market, the liquidity of the Purchaser

Warrants will be limited.

You should read this prospectus and any prospectus

supplement or amendment carefully before you invest in our securities.

Investing in our securities involves risks

that are described in the “Risk Factors” section beginning on page 6 of this prospectus.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of the securities to be issued under this prospectus or determined if

this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is ,

2025.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of the registration statement

that we filed with the Securities and Exchange Commission, or the “SEC,” pursuant to which the Selling Securityholders named

herein may, from time to time, offer and sell or otherwise dispose of the shares of our common stock covered by this prospectus. As permitted

by the rules and regulations of the SEC, the registration statement filed by us includes additional information not contained in

this prospectus.

This prospectus and the documents incorporated

by reference into this prospectus include important information about us, the securities being offered and other information you should

know before investing in our securities. You should not assume that the information contained in this prospectus is accurate on any date

subsequent to the date set forth on the front cover of this prospectus or that any information we have incorporated by reference is correct

on any date subsequent to the date of the document incorporated by reference, even though this prospectus is delivered or shares of common

stock are sold or otherwise disposed of on a later date. It is important for you to read and consider all information contained in this

prospectus, including the documents incorporated by reference therein, in making your investment decision. You should also read and consider

the information in the documents to which we have referred you under “Where You Can Find More Information” and “Incorporation

of Certain Information by Reference” in this prospectus.

You should rely only on this prospectus and the

information incorporated or deemed to be incorporated by reference in this prospectus. We have not, and the Selling Securityholders have

not, authorized anyone to give any information or to make any representation to you other than those contained or incorporated by reference

in this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus does

not constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful

to make such offer or solicitation in such jurisdiction.

Unless otherwise indicated, information contained

or incorporated by reference in this prospectus concerning our industry, including our general expectations and market opportunity, is

based on information from our own management estimates and research, as well as from industry and general publications and research,

surveys and studies conducted by third parties. Management estimates are derived from publicly available information, our knowledge of

our industry and assumptions based on such information and knowledge, which we believe to be reasonable. In addition, assumptions and

estimates of our and our industry’s future performance are necessarily uncertain due to a variety of factors, including those described

in “Risk Factors” beginning on page 6 of this prospectus. These and other factors could cause our future performance

to differ materially from our assumptions and estimates.

We and the Selling Securityholders take no responsibility

for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer

to sell only the securities offered hereby and only under circumstances and in jurisdictions where it is lawful to do so. No dealer,

salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus, any applicable

prospectus supplement or any free writing prospectuses prepared by or on behalf of us or to which we have referred you or are incorporated

by reference. This prospectus is not an offer to sell securities, and it is not soliciting an offer to buy securities, in any jurisdiction

where the offer or sale is not permitted.

For investors outside the United States: neither

we nor the Selling Securityholders have done anything that would permit this offering or possession or distribution of this prospectus

in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who

come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of our securities

and the distribution of this prospectus outside the United States.

This prospectus contains summaries of certain

provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information.

All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have

been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is

a part, and you may obtain copies of those documents as described in this prospectus under “Where You Can Find More Information.”

This prospectus contains references to trademarks,

trade names and service marks belonging to other entities. Solely for convenience, trademarks, trade names and service marks referred

to in this prospectus may appear without the ® or TM symbols,

but such references are not intended to indicate, in any way, that the applicable licensor will not assert, to the fullest extent under

applicable law, its rights to these trademarks and trade names. We do not intend our use or display of other entities’ trade names,

trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other entities.

PROSPECTUS SUMMARY

This summary highlights selected information

from this prospectus and does not contain all of the information that may be important to you in making an investment decision. This

summary is qualified in its entirety by the more detailed information included elsewhere in this prospectus and/or incorporated by reference

herein. Before making your investment decision with respect to our securities, you should carefully read this entire prospectus, including

the information in our filings with the SEC incorporated by reference into this prospectus.

References in this prospectus to the “Company,”

“we,” “us,” “our” and similar words refer to TechPrecision Corporation and its subsidiaries, unless

the context indicates otherwise, while references to “TechPrecision” refer to TechPrecision Corporation and not its subsidiaries.

Our Business

Through our wholly owned subsidiaries, we are

a manufacturer of large-scale metal fabricated and machined precision components and equipment. These components are used in a variety

of markets, primarily defense and aerospace, and secondarily precision industrial. All our operations and customers are in the United

States, or “U.S.”

We work with our customers to manufacture components

in accordance with the customers’ drawings and specifications. Our work complies with specific military specifications and standards

as well as national and international codes and standards required by our customers. We believe that we have earned our reputation through

outstanding technical expertise, attention to detail, and a total commitment to quality and excellence in customer service.

About Us

We are a Delaware corporation organized in February 2005

under the name Lounsberry Holdings II, Inc. On February 24, 2006, we acquired all of the issued and outstanding capital stock

of our wholly owned subsidiary Ranor, Inc., or “Ranor.” Ranor, together with its predecessors, has been in continuous

operation since 1956. On March 6, 2006, following the acquisition of Ranor, we changed our corporate name to TechPrecision Corporation.

From February 24, 2006 until our acquisition of Stadco in August 2021, our primary business

was the business of Ranor.

On August 25, 2021, the Company completed

its acquisition of Stadco, a company in the business of manufacturing high-precision parts, assemblies and tooling for aerospace, defense,

research and commercial customers (the “Stadco Acquisition”). As a result of the Stadco Acquisition, Stadco became our wholly

owned indirect subsidiary.

General

The manufacturing operations of our Ranor subsidiary

are situated on approximately 65 acres in North Central Massachusetts. Leveraging our 145,000 square foot facilities, Ranor provides

a full range of custom solutions to transform material into precision finished welded components and precision finished machined components

up to 100 tons: manufacturing engineering, materials management and traceability, high-precision heavy fabrication (in-house fabrication

operations include cutting, press and roll forming, welding, heat treating, assembly, blasting and painting), heavy high-precision machining

(in-house machining operations include CNC programming, finishing, and assembly), QC inspection including portable CMM, NonDestructive

Testing, and final packaging.

All manufacturing at Ranor is performed in

accordance with customer requirements. Ranor is an ISO 9001:2015 certificate holder. Ranor is a US defense-centric company with over

95% of its revenue in the defense sector. Ranor is registered and compliant with ITAR.

The manufacturing operations of our Stadco

subsidiary are situated in an industrial self-contained multi-building complex comprised of approximately 183,000 square feet under roof

in Los Angeles, California. Stadco manufactures large mission-critical components on several high-profile military aircraft, military

helicopter, and military space programs. Stadco has been a critical supplier to a blue-chip customer base that includes some of the largest

OEMs and prime contractors in the defense and aerospace industries. Stadco also manufactures tooling, molds, fixtures, jigs and dies

used in the production of defense-centric aircraft components.

Our Stadco subsidiary, similar to Ranor, provides

a full range of custom solutions: manufacturing engineering, materials management and traceability, high-precision fabrication (in-house

fabrication operations include waterjet cutting, press forming, welding, and assembly) and high-precision machining (in-house machining

operations include CNC programming, finishing, and assembly), QC inspection including both fixed and portable CMM NonDestructive Testing,

and final packaging. In addition, Stadco features a large electron beam welding cell, and two NonDestructive Testing work cells, a unique

mission-critical technology set.

All manufacturing at Stadco is performed in

accordance with customer requirements. Stadco is an AS 9100 D and ISO 9001:2015 certificate holder and a NADCAP NonDestructive Testing

certificate holder. Stadco is a US defense-centric company with over 60% of its revenue in the defense sector. Stadco is registered and

compliant with ITAR.

Custom Manufacturing

We manufacture a variety of components in accordance

with our internal core competencies and external customer needs and requirements. We also provide manufacturing engineering services

to assist customers in optimizing their engineering designs for manufacturability. We do not design the components we manufacture; we

custom manufacture according to customer “build-to-print” requirements and specifications. Accordingly, we do not distribute

the components that we manufacture on the open market, and we do not market any products. We do not own the intellectual property rights

to any proprietary marketed product, and we do not manufacture in anticipation of orders. Our custom manufacturing operations do not

commence on any project before we receive and accept a customer’s purchase order. We only accept contracts that cover specific

components within the capability of our resources.

We primarily target repeating custom programs

with relatively mature and stable designs in order to provide long-term solutions for our customers. The multi-unit work is repeat work

or a single product with multiple quantity releases. Secondarily, our activities include a variety of both multi-unit and one-off requirements.

The one-off work is typically either a prototype or a unique, one-of-a-kind component.

Changes in regulations and market demand for

our manufacturing expertise can be significant and sudden, and require us to adapt to the needs of the customers that we serve Understanding

this dynamic, we focus on the defense industry in order to reliably pivot with our defense customers to jointly develop the capability

to transform our workforce to manufacture components in accordance with our own and our external customers’ changing requirements.

We primarily serve customers in the defense

and aerospace; secondarily in the nuclear, and precision industrial sectors. Within these sectors, we have manufactured custom components

for US Navy submarines and aircraft carriers, USMC military helicopters, US defense and civilian aerospace programs, and components for

nuclear power plants.

Corporate Information

Our executive offices are located at 1 Bella Drive,

Westminster, Massachusetts 01473, and our telephone number is (978) 874-0591. Our website is www.techprecision.com. Information on our

website, or any other website, is not incorporated by reference in this prospectus. We have included our website address in this prospectus

solely as an inactive textual reference.

THE OFFERING

| Shares of Common Stock that may be offered and sold from time to time by the Selling

Securityholders named herein |

Up to an aggregate of 1,672,183 shares of our common stock, consisting of: (i) 320,000 shares

of our common stock that were issued pursuant to the termination provision of the Votaw Agreement; (ii) 666,100 shares of our

common stock issued to the Purchasers in a private placement pursuant to the Purchase Agreement; (iii) up to 666,100 shares

of common stock issuable upon the exercise of the Purchaser Warrants; and (iv) up to 19,983 shares of our common stock issuable

upon the exercise of the Placement Agent Warrants. |

| |

|

| Purchaser Warrants that may be offered and sold from time to time by the Selling Securityholders

named herein |

Up to 666,100 Purchaser Warrants |

| |

|

| Shares of common stock outstanding |

9,662,525 shares of common stock as of January 22, 2025. |

| |

|

| Use of proceeds |

All of the shares of common stock offered by the Selling Securityholders pursuant to this prospectus

will be sold by the Selling Securityholders for their respective accounts. We will not receive any of the proceeds from these sales.

However, we will receive proceeds from the exercise of the Warrants, if exercised on a cash basis, which proceeds we intend to use

for general corporate purposes. |

| |

|

| Plan of distribution |

The Selling Securityholders and any of their permitted transferees may offer, sell or distribute all

or a portion of the securities covered by this prospectus in a number of different ways and at varying prices. Our registration of

the resale of the securities covered by this prospectus does not mean that the Selling Securityholders will offer or sell any of

the securities. See “Plan of Distribution.” |

| |

|

| Market for our common stock |

Our common stock is quoted for trading under the symbol “TPCS” on The Nasdaq Capital Market.

We do not intend to list the Purchaser Warrants on any stock exchange or other trading market. |

| |

|

| Risk factors |

Any investment in the Common Stock offered hereby is speculative and involves a high degree of risk.

You should carefully consider the information set forth under “Risk Factors” in this prospectus. |

The number of shares of common stock to be

outstanding after this offering:

| · | excludes

214,207 shares reserved for issuance under the 2016 TechPrecision Equity Incentive Plan; |

| · | excludes

587,500 shares issuable upon the exercise of options to purchase common stock at a weighted

average exercise price of $1.65 per share; and |

| · | excludes

25,000 shares issuable upon the exercise of outstanding warrants to purchase common stock. |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains

predictive or “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All

statements other than statements of current or historical fact contained in this prospectus, including statements that express our intentions,

plans, objectives, beliefs, expectations, strategies, predictions or any other statements relating to our future activities or other

future events or conditions are forward-looking statements. The words “anticipate,” “believe,” “continue,”

“could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,”

“project,” “will,” “should,” “would” and similar expressions, as they relate to us, are

intended to identify forward-looking statements.

These statements are

based on current expectations, estimates and projections made by management about our business, our industry and other conditions affecting

our financial condition, results of operations or business prospects. These statements are not guarantees of future performance and involve

risks, uncertainties and assumptions that are difficult to predict. Therefore, actual outcomes and results may differ materially from

what is expressed or forecasted in, or implied by, the forward-looking statements due to numerous risks and uncertainties. Factors that

could cause such outcomes and results to differ include, but are not limited to, risks and uncertainties arising from:

| · | our reliance on individual

purchase orders, rather than long-term contracts, to generate revenue; |

| · | our ability to

balance the composition of our revenue and effectively control operating expenses; |

| · | external factors

that may be outside of our control, including health emergencies, like epidemics or pandemics,

California wildfires, the conflicts in Eastern Europe and the Middle East, price inflation,

interest rate increases, and supply chain inefficiencies; |

| · | the availability of

appropriate financing facilities impacting our operations, financial condition and/or liquidity; |

| · | our ability to receive

contract awards through competitive bidding processes; |

| · | our ability to maintain

standards to enable us to manufacture products to exacting specifications; |

| · | our ability to enter

new markets for our services; |

| · | our reliance on a

small number of customers for a significant percentage of our business; |

| · | competitive pressures

in the markets we serve; |

| · | changes in the availability

or cost of raw materials and energy for our production facilities; |

| · | restrictions in our

ability to operate our business due to our outstanding indebtedness; |

| · | government regulations

and requirements; |

| · | pricing and business

development difficulties; |

| · | changes in government

spending on national defense; |

| · | our ability to make

acquisitions and successfully integrate those acquisitions with our business; |

| · | our failure to maintain

effective internal controls over financial reporting; |

| · | our ability to remediate

the material weaknesses in our internal control over financial reporting that have been identified; |

| · | general industry and

market conditions and growth rates; |

| · | our ability to continue

as a going concern; and |

| · | those risks incorporated

by reference in “Risk Factors” elsewhere in this prospectus, as well as

those described in any other filings which we make with the SEC. |

Any forward-looking statements speak only

as of the date on which they are made, and we undertake no obligation to publicly update or revise any forward-looking statements to

reflect events or circumstances that may arise after the date of this prospectus, except as required by applicable law. Investors should

evaluate any statements made by us in light of these important factors.

MARKET AND INDUSTRY DATA AND FORECASTS

We obtained the industry and market data used

throughout this prospectus from our own internal estimates and research, as well as from independent market research, industry and general

publications and surveys, governmental agencies, publicly available information and research, surveys and studies conducted by third

parties. Internal estimates are derived from publicly available information released by industry analysts and third-party sources, our

internal research and our industry experience, and are based on assumptions made by us based on such data and our knowledge of our industry

and market, which we believe to be reasonable. In some cases, we do not expressly refer to the sources from which this data is derived.

In addition, while we believe the industry and market data included in this prospectus is reliable and based on reasonable assumptions,

such data involve material risks and other uncertainties and are subject to change based on various factors, including those discussed

in the section titled “Risk Factors.” These and other factors could cause results to differ materially from those

expressed in the estimates made by the independent parties or by us.

RISK FACTORS

Our business, results

of operations and financial condition and the industry in which we operate are subject to various risks. Accordingly, investing in our

securities involves a high degree of risk. We have listed in the documents incorporated by reference herein, including our

Annual Report on Form 10-K for the fiscal year ended March 31, 2024 and the Quarterly Reports for the quarterly periods

ended June 30,

2024 and September 30, 2024 (not necessarily in order of importance or probability of occurrence), the most significant risk factors

applicable to us, but they do not constitute all of the risks that may be applicable to us. New risks may emerge from time to time, and

it is not possible for us to predict all potential risks or to assess the likely impact of all risks. Before making an investment decision,

you should carefully consider these risks as well as other information we include or incorporate by reference in this prospectus and

any prospectus supplement. This prospectus also contains forward-looking statements that involve risks and uncertainties. Our actual

results could differ materially from those anticipated in the forward-looking statements as a result of a number of factors, including

the risks described below. See the section titled “Cautionary Note Regarding Forward-Looking Statements.”

USE OF PROCEEDS

All of the shares of common stock offered by

the Selling Securityholders pursuant to this prospectus will be sold by the Selling Securityholders for their respective accounts. We

will not receive any of the proceeds from these sales. However, we will receive proceeds from the exercise of the Warrants, if exercised

on a cash basis, which proceeds we intend to use for general corporate purposes.

DIVIDEND POLICY

We currently intend to retain all available funds

and any future earnings to fund the growth and development of our business. We have never declared or paid any cash dividends on our

capital stock. We do not intend to pay cash dividends on our common stock in the foreseeable future, and additionally, our credit facility

with Berkshire Bank restricts our ability to pay or declare any cash dividends or make other distributions to our stockholders in money

or property. Investors should not purchase our common stock with the expectation of receiving cash dividends.

Any future determination to declare dividends

will be made at the discretion of our board of directors and will depend on our financial condition, operating results, capital requirements,

general business conditions, and other factors that our board of directors may deem relevant.

DETERMINATION OF OFFERING PRICE

We cannot currently determine the price or prices

at which the shares of common stock may be sold by the Selling Securityholders under this prospectus.

There is no established public trading market

for the Purchaser Warrants, and we do not expect trading markets to develop. In addition, we do not intend to apply for listing of the

Purchaser Warrants on any securities exchange or recognized trading system. As described in the section entitled “Plan of Distribution,”

the price at which the Purchaser Warrants will be sold will depend, in part, on the manner and timing of such sales, but, in any event,

we expect such price will likely be derived from the market price of our Common Stock traded on Nasdaq.

The exercise price of the Purchaser Warrants

was determined based on the trading price of our Common Stock when we agreed to issue the Purchaser Warrants.

DESCRIPTION OF SECURITIES TO BE REGISTERED

TechPrecision Corporation has one class of

securities registered under Section 12 of the Securities Act of 1934, as amended (the “Securities Act”); our common

stock. The following description of our common stock is a summary and is qualified in its entirety by reference to our Certificate of

Incorporation (as amended by that certain Certificate of Designation for Series A Convertible Preferred Stock, and as further amended

by that certain Certificate of Amendment to Certificate of Designation for Series A Convertible Preferred Stock, the “Certificate

of Incorporation”) and our Amended and Restated By-Laws (the “By-Laws”), which are included as exhibits to the registration

statement on Form S-1 of which this prospectus forms a part. We encourage you to read the Certificate of Incorporation and By-Laws

as well as the applicable provisions of the General Corporation Law of the State of Delaware, as amended (the “DGCL”), for

more information.

Authorized Shares

We

are authorized to issue 50,000,000 shares of common stock, par value $.0001 per share, and 10,000,000 shares of preferred stock, par

value $.0001 per share. As of January 22, 2025, we had 9,662,525 shares

of common stock and no shares of preferred stock outstanding.

Common Stock

Voting Rights

Holders of common stock

are entitled to one vote for each share held on all matters submitted to a vote of stockholders and do not have cumulative voting rights.

Accordingly, holders of a majority of the shares of common stock entitled to vote in any election of directors may elect all of the directors

standing for election.

Dividends

Holders of common stock

are entitled to receive proportionately any dividends as may be declared by our board of directors, subject to any preferential dividend

rights of outstanding preferred stock. Pursuant to the certificate of designation relating to the series A preferred stock, we are prohibited

from paying dividends on our common stock while any preferred stock is outstanding.

Liquidation

Upon our liquidation,

dissolution or winding up, the holders of common stock are entitled to receive proportionately our net assets available after the payment

of all debts and other liabilities and subject to the prior rights of any outstanding preferred stock.

Other Rights

Holders of common stock

have no preemptive, subscription, redemption or conversion rights. The rights, preferences and privileges of holders of common stock

are subject to, and may be adversely affected by, the rights of the holders of shares of any series of preferred stock that we may designate

and issue in the future. All of our shares of common stock are fully paid and nonassessable. The common stock is not subject to any redemption

or sinking fund provisions.

Listing

Our common stock is listed

on The Nasdaq Capital Market under the symbol “TPCS.”

Purchaser Warrants

Exercisability

Each

of the Purchaser Warrants is exercisable beginning six months after issuance and has a term of exercise equal to five years from the

date of issuance. The Purchaser Warrants may be exercised by means of a “cashless exercise” at the holder’s option,

such that the holder may use the appreciated value of the Purchaser Warrants (the difference between the market price of the underlying

shares of Common Stock and the exercise price of the underlying Purchaser Warrants) to exercise the Purchaser Warrants without the payment

of any cash. Each warrant entitles the holder thereof to purchase one share of common stock.

Exercise

Price

The

exercise price per share for the Purchaser Warrants is $4.00. The exercise price is subject to adjustment for stock splits, reverse stock

splits, stock dividends and similar transactions.

Listing

The

Purchaser Warrants will not be listed on a stock exchange.

Rights as a Stockholder

Except

as otherwise provided in the warrants or by virtue of such holder’s ownership of shares of our common stock, the holder of a Purchaser

Warrant does not have the rights or privileges of a holder of our common stock, including any voting rights, until the holder exercises

the Purchaser Warrant.

Governing Law

The

Purchaser Warrants are governed by New York law.

Anti-Takeover Effects of Various Provisions

of Delaware Law and TechPrecision’s Certificate of Incorporation and By-Laws

Provisions of the DGCL

and our Certificate of Incorporation and By-Laws could make it more difficult to acquire TechPrecision by means of a tender offer, a

proxy contest or otherwise, or to remove incumbent officers and directors. These provisions, including those summarized below, may encourage

certain types of coercive takeover practices and takeover bids.

Delaware Anti-Takeover Statute. TechPrecision

is subject to Section 203 of the DGCL, an anti-takeover statute. In general, Section 203 of the DGCL prohibits a publicly

held Delaware corporation from engaging in a “business combination” with an “interested stockholder” for a period

of three years following the time the person became an interested stockholder, unless the business combination or the acquisition of

shares that resulted in a stockholder becoming an interested stockholder is approved in a prescribed manner. Generally, a “business

combination” includes a merger, asset or stock sale or other transaction resulting in a financial benefit to the interested stockholder.

Generally, an “interested stockholder” is a person who, together with affiliates and associates, owns (or within three years

prior to the determination of interested stockholder status did own) 15% or more of a corporation’s voting stock. The existence

of this provision would be expected to have an anti-takeover effect with respect to transactions not approved in advance by TechPrecision’s

board of directors, including discouraging attempts that might result in a premium over the market price for the shares of common stock

held by TechPrecision’s stockholders.

Removal. Subject to the rights of any holders

of any outstanding series of our preferred stock, stockholders may remove our directors with or without cause. Removal will require the

affirmative vote of holders of a majority of our voting stock.

Size of Board and Vacancies. Our By-Laws

provide that the number of directors be fixed exclusively by the board of directors. Any vacancies created on our board of directors

resulting from any increase in the authorized number of directors or the death, resignation, retirement, disqualification, removal from

office or other cause will be filled by a majority of the board of directors then in office, even if less than a quorum is present, or

by a sole remaining director. Any director appointed to fill a vacancy on our board of directors will be appointed until the next annual

meeting and until his or her successor has been elected and qualified.

Requirements for Advance Notification of Stockholder

Nominations and Proposals. Our By-Laws establish advance notice procedures with respect to stockholder proposals and nomination

of candidates for election as directors other than nominations made by or at the direction of its board of directors or a committee of

our board of directors.

Undesignated Preferred Stock. Our

board of directors is authorized to issue up to 10,000,000 shares of preferred stock without additional stockholder approval, which preferred

stock could have voting rights or conversion rights that, if exercised, could adversely affect the voting power of the holders of common

stock. The issuance of shares of preferred stock may have the effect of delaying, deferring or preventing a change in control of the

Company without any action by the Company’s stockholders.

Limitation on Liability of Directors and Indemnification of Directors

and Officers

Elimination of Liability of Directors. The

DGCL authorizes corporations to limit or eliminate the personal liability of directors to corporations and their stockholders for monetary

damages for breaches of directors’ fiduciary duties as directors, and our Certificate of Incorporation includes such an exculpation

provision. Our Certificate of Incorporation provides that, to the fullest extent permitted by the DGCL, no director will be personally

liable to us or to our stockholders for monetary damages for breach of fiduciary duty as a director. While our Certificate of Incorporation

provides directors with protection from awards for monetary damages for breaches of their duty of care, it does not eliminate this duty.

Accordingly, our Certificate of Incorporation has no effect on the availability of equitable remedies such as an injunction or rescission

based on a director’s breach of his or her duty of care. The provisions apply to an officer of TechPrecision only if he or she

is a director of TechPrecision and is acting in his or her capacity as director, and do not apply to officers of TechPrecision who are

not directors.

Indemnification of Directors, Officers and

Employees. Our By-Laws require us to indemnify any person who was or is a party or is threatened to be made a party to, or was

otherwise involved in, a legal proceeding by reason of the fact that he or she is or was a director, officer or employee of TechPrecision

or, while a director, officer or employee of TechPrecision, is or was serving at our request in a fiduciary capacity with another enterprise

(including any corporation, partnership, limited liability company, joint venture, trust, association or other unincorporated organization

or other entity and any employee benefit plan), to the fullest extent authorized by the DGCL, as it exists or may be amended, against

all expense, liability and loss (including attorneys’ fees, judgments, fines, U.S. Employee Retirement Income Security Act of 1974,

as amended, excise taxes or penalties and amounts paid in settlement by or on behalf of such person) actually and reasonably incurred

in connection with such service. We are authorized under our By-Laws to carry directors’ and officers’ insurance protecting

us, any director, officer or employee of ours or, against any expense, liability or loss, whether or not we have the power to indemnify

the person under the DGCL. We may, to the extent authorized from time to time, indemnify any of our agents to the fullest extent permitted

with respect to directors, officers and employees in our By-Laws.

The limitation of liability

and indemnification provisions in our Certificate of Incorporation and By-Laws may discourage stockholders from bringing a lawsuit against

our directors for breach of fiduciary duty. These provisions also may reduce the likelihood of derivative litigation against our directors

and officers, even though such an action, if successful, might otherwise benefit us and our stockholders. By its terms, the indemnification

provided for in our By-Laws is not exclusive of any other rights that the indemnified party may be or become entitled to under any law,

agreement, vote of stockholders or directors, provisions of our Certificate of Incorporation or By-Laws or otherwise. Any amendment,

alteration or repeal of our By-Laws’ indemnification provisions is, by the terms of our By-Laws, prospective only and will not

adversely affect the rights of any indemnity in effect at the time of any act or omission occurring prior to such amendment, alteration

or repeal.

PRIVATE PLACEMENT OF COMMON STOCK AND WARRANTS

On July 3, 2024, we entered into the Purchase

Agreement with the Purchasers pursuant to which we agreed to sell in a private placement at an aggregate purchase price of approximately

$2.3 million, (i) 666,100 shares (the “PIPE Shares”) of our common stock, par value $0.0001 per share, and (ii) the

Purchaser Warrants to purchase up to 666,100 shares of tour Common Stock (and together with the PIPE Shares, the “PIPE Securities”).

The combined purchase price for one Share and one Purchaser Warrant was $3.45. The Placement Agent acted as placement agent in

the offering. The closing of the offering occurred on July 8, 2024 (the “Closing Date”).

Each of the Purchaser Warrants shall be exercisable

beginning six months after the Closing Date and have a term of exercise equal to five years from the date of issuance with an exercise

price of $4.00 per share. The exercise price for the Purchaser Warrants is subject to adjustment for stock splits, reverse stock

splits, stock dividends and similar transactions. The Purchaser Warrants may be exercised by means of a “cashless exercise”

at the holder’s option, such that the holder may use the appreciated value of the Purchaser Warrants (the difference between the

market price of the underlying shares of Common Stock and the exercise price of the underlying Purchaser Warrants) to exercise the Purchaser

Warrants without the payment of any cash.

In connection with the Purchase Agreement,

the Company is required to file an initial registration statement with the Securities and Exchange Commission (“SEC”) covering

the resale of the shares of common stock to be issued to the Purchasers and shares of common stock underlying the Purchaser Warrants

within 30 calendar days of the Closing Date and to have the registration statement declared effective as soon as reasonably practicable

thereafter, and in any event no later than 60 days following the Closing Date. The Company is subject to customary penalties and

liquidated damages in the event it does not meet certain filing and effectiveness deadlines set forth in the Purchase Agreement, including

a penalty paid in cash equal to 1% of the subscription amount paid with respect to the affected securities on the date such penalty is

incurred and on each monthly anniversary of such date until cured. If the Company fails to pay any liquidated damages pursuant to the

Purchase Agreement in full within seven days after the date payable, the Company will pay interest thereon at a rate of 12% per annum

(or such lesser maximum amount that is permitted to be paid by applicable law) to the applicable Purchasers, accruing daily from the

date such liquidated damages are due until such amounts, plus all such interest thereon, are paid in full.

In connection

with the private placement, the Company entered into the Placement Agent with the Placement Agent pursuant to which the Placement Agent

received a cash fee equal to 7% of the gross proceeds of the private placement. The Company also reimbursed the Placement Agent

for certain reasonable and documented out-of-pocket legal, due diligence, travel and other transaction fees incurred, in an aggregate

amount not to exceed $90,000. In addition, pursuant to the Placement Agent Agreement, the Company issued to the Placement Agent,

the Placement Agent Warrants to purchase up to 19,983 shares of common stock. The Placement Agent Warrants will be exercisable

at any time and from time to time, in whole or in part, during the four and one-half year period commencing 180 days from the Closing

Date at an exercise price of $4.30 per share. The Company also agreed to register the resale of the shares underlying the Placement

Agent Warrants on this registration statement.

SELLING SECURITYHOLDERS

This prospectus relates to the resale by the

Selling Securityholders from time to time of up to an aggregate of 1,672,183 shares of common stock and 666,100 Purchaser Warrants. The

Selling Securityholders may from time to time offer and sell any or all of the securities set forth below pursuant to this prospectus

and any accompanying prospectus supplement. When we refer to the “Selling Securityholders” in this prospectus, we mean the

person listed in the table below, their permitted transferees and others who later come to hold any of the Selling Securityholder’s

interest in the common stock other than through a public sale.

The following table sets forth, as of the date

of this prospectus, the name of the Selling Securityholders, the aggregate number of shares of common stock beneficially owned, the aggregate

number of shares of common stock that the Selling Securityholders may offer pursuant to this prospectus and the number of shares of common

stock beneficially owned by the Selling Securityholders after the sale of the securities offered hereby. The percentage of beneficial

ownership of after the offered securities are sold is calculated based on 9,662,525 shares of common stock outstanding as of January

22, 2025.

We have determined beneficial ownership in accordance

with the rules of the SEC and the information is not necessarily indicative of beneficial ownership for any other purpose. Unless

otherwise indicated below, to our knowledge, the persons and entities named in the tables have sole voting and sole investment power

with respect to all securities that they beneficially own, subject to community property laws where applicable.

We cannot advise you as to whether the Selling

Securityholders will in fact sell any or all of such common stock. In addition, the Selling Securityholders may sell, transfer or otherwise

dispose of, at any time and from time to time, the common stock in transactions exempt from the registration requirements of the Securities

Act after the date of this prospectus. For purposes of this table, we have assumed that the Selling Securityholders will have sold all

of the securities covered by this prospectus upon the completion of the offering.

Selling Securityholder information for each additional

Selling Securityholder, if any, will be set forth by prospectus supplement to the extent required prior to the time of any offer or sale

of such Selling Securityholder’s shares pursuant to this prospectus. Any prospectus supplement may add, update, substitute, or

change the information contained in this prospectus, including the identity of each Selling Securityholder and the number of shares registered

on its behalf. A Selling Securityholder may sell or otherwise transfer all, some or none of such shares in this offering. See “Plan

of Distribution.”

| | |

Before the Offering | | |

After the Offering | |

| Name of Selling Securityholder | |

Number of

Shares

of

Common Stock

Beneficially

Owned | | |

Number of

Shares

of

Common Stock

Being Offered | | |

Number of

Purchaser

Warrants

Beneficially Owned | | |

Number of

Purchaser

Warrants

Being Offered | | |

Number of

Shares

of

Common Stock

Beneficially

Owned | | |

% | | |

Number of

Purchaser

Warrants

Beneficially Owned | | |

% | |

Doerfer Corporation

1801 E Bremer Ave

Waverly, IA 50677 | |

| 320,000 | | |

| 320,000 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | |

Andrew Berger

1120 West Hill Dr

Gates Mills, OH 44040 | |

| 14,400 | | |

| 14,400 | | |

| 7,200 | | |

| 7,200 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | |

SM Berger & Company Inc.

30100 Chagrin Blvd #111

Cleveland, OH 44124 | |

| 14,400 | | |

| 14,400 | | |

| 7,200 | | |

| 7,200 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | |

Terence Cryan

2 Hampshire Rd

Bronxville, NY 10708 | |

| 19,000 | | |

| 19,000 | | |

| 9,500 | | |

| 9,500 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | |

EJL Living Trust (1) (2)

5605

Midwood Rd

Bethesda, MD 20814 | |

| 121,550 | | |

| 57,800 | | |

| 28,900 | | |

| 28,900 | | |

| 63,750 | | |

| * | | |

| 0 | | |

| 0 | |

Gregory Shrock

1015 Washington Ave, Apt 1G

Brooklyn, NY 11225 | |

| 288,600 | | |

| 288,600 | | |

| 144,300 | | |

| 144,300 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | |

Laureen E. Blatt (3)

37

Bridle Path

St. James, NY 11780 | |

| 1,185,600 | | |

| 503,600 | | |

| 251,800 | | |

| 251,800 | | |

| 682,000 | | |

| 7.1 | | |

| 0 | | |

| 0 | |

Michael Paxton

1421 Huron Trail

Plano, TX 75075 | |

| 43,400 | | |

| 43,400 | | |

| 21,700 | | |

| 21,700 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | |

Potomac Capital Partners V, LP (4) (5)

299 Park Avenue, 21st Floor

New York, NY 10171 | |

| 200,817 | | |

| 144,800 | | |

| 72,400 | | |

| 72,400 | | |

| 56,017 | | |

| * | | |

| 0 | | |

| 0 | |

Gerald Yanowitz (6)

30 Merrill Circle

South

Moraga, CA 94556 | |

| 78,500 | | |

| 43,400 | | |

| 21,700 | | |

| 21,700 | | |

| 35,100 | | |

| * | | |

| 0 | | |

| 0 | |

Harold Zirkin Living Trust (7) (8)

5630 Wisconsin Avenue, #1703

Chevy Chase, MD 20815 | |

| 377,800 | | |

| 202,800 | | |

| 101,400 | | |

| 101,400 | | |

| 175,000 | | |

| 1.8 | | |

| 0 | | |

| 0 | |

Wellington Shields & Co. LLC (9)

140 Broadway

New York, New York 10005 | |

| 9,991 | | |

| 9,991 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | |

Howard Brous (10)

c/o Wellington Shields &

Co. LLC

140 Broadway

New York, New York 10005 | |

| 9,992 | | |

| 9,992 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | | |

| 0 | |

*Less than 1%

| (1) | E. John Lazerow is the trustee of the EJL Living Trust, and as

a result, may be deemed to have sole voting and investment control of the shares held by

the EJL Living Trust. |

| (2) | Includes 28,900 shares of common stock issuable upon exercise

of warrants and 63,750 shares of common stock acquired prior to the private placement. |

| (3) | Includes 251,800 shares of common stock issuable upon exercise

of warrants and 682,000 shares of common stock acquired prior to the private placement. The

number of shares of common stock beneficially owned does not give effect to any beneficial

ownership limitations of the Purchaser Warrants. |

| (4) | Paul J. Solit is the managing member of Potomac Capital Management

V LLC, the general partner of Potomac Capital Partners V, LP, and as a result, may be deemed

to have voting and investment control of the shares held by Potomac Capital Partners V, LP. |

| (5) | Includes 72,400 shares of common stock issuable upon exercise

of warrants and 56,017 shares of common stock acquired prior to the private placement. |

| (6) | Includes 21,700 shares of common stock issuable upon exercise

of warrants and 35,100 shares of common stock acquired prior to the private placement. |

| (7) | Harold Zirkin is the trustee of the Harold Zirkin Living Trust,

and as a result, may be deemed to have sole voting and investment control of the shares held

by the Harold Zirkin Living Trust. |

| (8) | Includes 101,400 shares of common stock issuable upon exercise

of warrants and 175,000 shares of common stock acquired prior to the private placement. |

| (9) | Includes 9,991 shares of common stock issuable upon exercise

of warrants. |

| (10) | Includes 9,992 shares of common stock issuable upon exercise

of warrants. |

MATERIAL UNITED STATES

FEDERAL INCOME TAX CONSIDERATIONS

The following is a discussion of certain material

U.S. federal income tax consequences of the acquisition, ownership and disposition of our shares of common stock, which we refer to as

our securities. This discussion applies only to securities that are held as capital assets for U.S. federal income tax purposes and is

applicable only to holders who are receiving our securities in this offering.

This discussion is a summary only and does not

describe all of the tax consequences that may be relevant to you in light of your particular circumstances, including but not limited

to the alternative minimum tax, the Medicare tax on certain investment income and the different consequences that may apply if you are

subject to special rules that apply to certain types of investors (such as the effects of Section 451 of the Code), including

but not limited to:

| · | financial institutions

or financial services entities; |

| · | retirement plans,

individual retirement accounts or other tax-deferred accounts; |

| · | governments or agencies

or instrumentalities thereof; |

| · | regulated investment

companies; |

| · | “controlled

foreign corporations,” “passive foreign investment companies,” and corporations

that accumulate earnings to avoid U.S. federal income tax; |

| · | real estate investment

trusts; |

| · | expatriates or former

long-term residents of the United States; |

| · | persons that actually

or constructively own five percent or more of our voting shares; |

| · | dealers or traders

subject to a mark-to-market method of accounting with respect to the securities; |

| · | persons holding the

securities as part of a “straddle,” hedge, integrated transaction or similar

transaction; |

| · | U.S. holders (as defined

below) whose functional currency is not the U.S. dollar; |

| · | persons subject to

alternative minimum tax; |

| · | partnerships or other

pass-through entities for U.S. federal income tax purposes and any beneficial owners of such

entities; and |

This discussion is based on the Code, and administrative

pronouncements, judicial decisions and final, temporary and proposed Treasury regulations as of the date hereof, which are subject to

change, possibly on a retroactive basis, and changes to any of which subsequent to the date of this prospectus may affect the tax consequences

described herein. This discussion does not address any aspect of state, local or non-U.S. taxation, or any U.S. federal taxes (e.g.,

gift and estate taxes) other than income taxes.

We have not sought, and will not seek, a ruling

from the IRS as to any U.S. federal income tax consequence described herein. The IRS may disagree with the discussion herein, and its

determination may be upheld by a court. Moreover, there can be no assurance that future legislation, regulations, administrative rulings

or court decisions will not adversely affect the accuracy of the statements in this discussion. You are urged to consult your tax advisor

with respect to the application of U.S. federal tax laws to your particular situation, as well as any tax consequences arising under

the laws of any state, local or foreign jurisdiction.

This discussion does not consider the tax treatment

of partnerships or other pass-through entities or persons who hold our securities through such entities. If a partnership (or other entity

or arrangement classified as a partnership or other pass-through entity for United States federal income tax purposes) is the beneficial

owner of our securities, the United States federal income tax treatment of a partner or member in the partnership or other pass-through

entity generally will depend on the status of the partner or member and the activities of the partnership or other pass-through entity.

If you are a partner or member of a partnership or other pass-through entity holding our securities, we urge you to consult your own

tax advisor.

THIS DISCUSSION IS ONLY A SUMMARY OF CERTAIN UNITED STATES FEDERAL

INCOME TAX CONSIDERATIONS ASSOCIATED WITH THE ACQUISITION, OWNERSHIP AND DISPOSITION OF OUR SECURITIES. EACH PROSPECTIVE INVESTOR IN

OUR SECURITIES IS URGED TO CONSULT ITS OWN TAX ADVISOR WITH RESPECT TO THE PARTICULAR TAX CONSEQUENCES TO SUCH INVESTOR OF THE ACQUISITION,

OWNERSHIP AND DISPOSITION OF OUR SECURITIES, INCLUDING THE APPLICABILITY AND EFFECT OF ANY UNITED STATES FEDERAL NON-INCOME, STATE,

LOCAL, AND NON-U.S. TAX LAWS.

U.S. Holders

This section applies to you if you are a “U.S.

holder.” A U.S. holder is a beneficial owner of our shares of common stock who or that is, for U.S. federal income tax purposes:

| · | an individual who

is a citizen or resident of the United States; |

| · | a corporation (or

other entity taxable as a corporation) organized in or under the laws of the United States,

any state thereof or the District of Columbia; or |

| · | an estate the income

of which is includible in gross income for U.S. federal income tax purposes regardless of

its source; or |

| · | a trust, if (i) a

court within the United States is able to exercise primary supervision over the administration

of the trust and one or more U.S. persons (as defined in the Code) have authority to control

all substantial decisions of the trust or (ii) it has a valid election in effect under

Treasury Regulations to be treated as a U.S. person. |

Taxation of Distributions. If we pay distributions

in cash or other property (other than certain distributions of our stock or rights to acquire our stock) to U.S. holders of shares of

our common stock, such distributions generally will constitute dividends for U.S. federal income tax purposes to the extent paid from

our current or accumulated earnings and profits, as determined under U.S. federal income tax principles. Distributions in excess of current

and accumulated earnings and profits will constitute a return of capital that will first be applied against and reduce (but not below

zero) the U.S. holder’s adjusted tax basis in our common stock. Any remaining excess will be treated as gain realized on the sale

or other disposition of the common stock and will be treated as described under “U.S. Holders — Gain or Loss on Sale,

Taxable Exchange or Other Taxable Disposition of common stock” below.

Dividends we pay to a U.S. holder that is a taxable

corporation generally will qualify for the dividends received deduction if the requisite holding period is satisfied. With certain exceptions

(including, but not limited to, dividends treated as investment income for purposes of investment interest deduction limitations), and

provided certain holding period requirements are met, dividends we pay to a non-corporate U.S. holder may constitute “qualified

dividends” that will be subject to tax at the maximum tax rate accorded to long-term capital gains. If the holding period requirements

are not satisfied, then a corporation may not be able to qualify for the dividends received deduction and would have taxable income equal

to the entire dividend amount, and non-corporate holders may be subject to tax on such dividend at regular ordinary income tax rates

instead of the preferential rate that applies to qualified dividend income.

Gain or Loss on Sale, Taxable Exchange or Other

Taxable Disposition of Common Stock. Upon a sale or other taxable disposition of our common stock, a U.S. holder generally will recognize

capital gain or loss in an amount equal to the difference between the amount realized and the U.S. holder’s adjusted tax basis

in the common stock. Any such capital gain or loss generally will be long-term capital gain or loss if the U.S. holder’s holding

period for the common stock so disposed of exceeds one year. If the holding period requirements are not satisfied, any gain on a sale

or taxable disposition of the shares would be subject to short-term capital gain treatment and would be taxed at regular ordinary income

tax rates. Long-term capital gains recognized by non-corporate U.S. holders will be eligible to be taxed at reduced rates. The deductibility

of capital losses is subject to limitations.

Generally, the amount of gain or loss recognized

by a U.S. holder is an amount equal to the difference between (i) the sum of the amount of cash and the fair market value of any

property received in such disposition and (ii) the U.S. holder’s adjusted tax basis in its common stock disposed. A U.S. holder’s

adjusted tax basis in its common stock generally will equal the U.S. holder’s acquisition cost for the common stock, less any prior

distributions treated as a return of capital. In the case of any shares of common stock originally acquired as part of an investment

unit, additional considerations may apply to the determination of a U.S. holder’s adjusted tax basis in its common stock.

Information Reporting and Backup Withholding.

In general, information reporting requirements may apply to dividends paid to a U.S. holder and to the proceeds of the sale or other

disposition of our shares of common stock, unless the U.S. holder is an exempt recipient. Backup withholding may apply to such payments

if the U.S. holder fails to provide a taxpayer identification number, a certification of exempt status or has been notified by the IRS

that it is subject to backup withholding (and such notification has not been withdrawn).

Any amounts withheld under the backup withholding

rules generally should be allowed as a refund or a credit against a U.S. holder’s U.S. federal income tax liability provided

the required information is timely furnished to the IRS.

Non-U.S. Holders

This section applies to you if you are a “Non-U.S.

holder.” As used herein, the term “Non-U.S. holder” means a beneficial owner of our common stock who is not a U.S.

Holder or any other person that is for U.S. federal income tax purposes:

| · | a non-resident alien

individual (other than certain former citizens and residents of the U.S. subject to U.S.

tax as expatriates), |

| · | a foreign corporation,

or |

| · | an estate or trust

that is not a U.S. holder. |

The term “Non-U.S. Holder” generally does not include

an individual who is present in the United States for 183 days or more in the taxable year of disposition of the securities. If you are

such an individual, you should consult your tax advisor regarding the U.S. federal income tax consequences of the acquisition, ownership

or sale or other disposition of our securities.

Taxation of Distributions. In general,

any distributions we make to a Non-U.S. holder of shares of our common stock, to the extent paid out of our current or accumulated earnings

and profits (as determined under U.S. federal income tax principles), will constitute dividends for U.S. federal income tax purposes

and, provided such dividends are not effectively connected with the Non-U.S. holder’s conduct of a trade or business within the

United States, we will be required to withhold tax from the gross amount of the dividend at a rate of 30%, unless such Non-U.S. holder

is eligible for a reduced rate of withholding tax under an applicable income tax treaty and provides proper certification of its eligibility

for such reduced rate (usually on an IRS Form W-8BEN or W-8BEN-E). Any distribution not constituting a dividend will be treated

first as reducing (but not below zero) the Non-U.S. holder’s adjusted tax basis in its shares of our common stock and, to the extent

such distribution exceeds the Non-U.S. holder’s adjusted tax basis, as gain realized from the sale or other disposition of the

common stock, which will be treated as described under “Non-U.S. Holders — Gain on Sale, Taxable Exchange or Other Taxable

Disposition of common stock” below. If we are unable to determine, at a time reasonably close to the date of payment of a distribution

on our common stock, what portion, if any, of the distribution will constitute a dividend, then we may withhold U.S. federal income tax

on the basis of assuming that the full amount of the distribution will be a dividend. If we or another withholding agent apply over-withholding,

a non-U.S. holder may be entitled to a refund or credit of any excess tax withheld by timely filing an appropriate claim with the IRS.

The withholding tax does not apply to dividends

paid to a Non-U.S. holder who provides a Form W-8ECI, certifying that the dividends are effectively connected with the Non-U.S.

holder’s conduct of a trade or business within the United States. Instead, the effectively connected dividends will be subject

to regular U.S. income tax as if the Non-U.S. holder were a U.S. resident, subject to an applicable income tax treaty providing otherwise.

A Non-U.S. corporation receiving effectively connected dividends may also be subject to an additional “branch profits tax”

imposed at a rate of 30% (or a lower treaty rate).

Any documentation provided to an applicable withholding

agent may need to be updated in certain circumstances. The certification requirements described above also may require a non-U.S. holder

to provide its U.S. taxpayer identification number.

Gain on Sale, Taxable Exchange or Other Taxable

Disposition of Common Stock. A Non-U.S. holder generally will not be subject to U.S. federal income or withholding tax in respect

of gain recognized on a sale, taxable exchange or other taxable disposition of our common stock, unless:

| · | the gain is effectively

connected with the conduct of a trade or business by the Non-U.S. holder within the United

States (and, under certain income tax treaties, is attributable to a United States permanent

establishment or fixed base maintained by the Non-U.S. holder); |

| · | the non-U.S. holder

is a nonresident alien individual who is present in the United States for a period or periods

aggregating 183 days or more in the taxable year of the disposition and certain other conditions

are met, in which case the non-U.S. holder will be subject to a 30% tax (or such lower rate

as may be specified by an applicable income tax treaty) on the amount by which the non-U.S.

holder’s capital gains allocable to U.S. sources exceed capital losses allocable to

U.S. sources during the taxable year of the disposition (without taking into account any

capital loss carryovers); or |

| · | we are or have been

a “U.S. real property holding corporation” for U.S. federal income tax purposes

at any time during the shorter of the five-year period ending on the date of disposition

or the period that the Non-U.S. holder held our common stock, and, in the case where shares

of our common stock are regularly traded on an established securities market, the Non-U.S.

holder has owned, directly or constructively, more than 5% of our common stock at any time

within the shorter of the five-year period preceding the disposition or such Non-U.S. holder’s

holding period for the shares of our common stock. There can be no assurance that our common

stock will be treated as regularly traded on an established securities market for this purpose.

Generally, a corporation is a U.S. real property holding corporation if the fair market value

of its U.S. real property interests, as defined in the Code and applicable U.S. Treasury

Regulations, equals or exceeds 50% of the sum of the fair market value of its worldwide real

property interests plus its other assets used or held for use in a trade or business. Although

there can be no assurance, we do not believe that we are, or have been, a U.S. real property

holding corporation for U.S. federal income tax purposes, or that we are likely to become

one in the future. |

Unless an applicable treaty provides otherwise,

gain described in the first bullet point above will be subject to tax at generally applicable U.S. federal income tax rates as if the

Non-U.S. holder were a U.S. resident. Any gains described in the first bullet point above of a Non-U.S. holder that is a foreign corporation

may also be subject to an additional “branch profits tax” at a 30% rate (or lower treaty rate).

If the third bullet point above applies to a Non-U.S.

holder, gain recognized by such holder on the sale, exchange or other disposition of our common stock will be subject to tax at generally

applicable U.S. federal income tax rates. In addition, a buyer of our common stock from any such holder may be required to withhold U.S.

income tax at a rate of 15% of the amount realized upon such disposition if our common stock is not treated as regularly traded on an

established securities market.

Information Reporting and Backup Withholding.

Information returns will be filed with the IRS in connection with payments of dividends and the proceeds from a sale or other disposition

of our shares of common stock. A Non-U.S. holder may have to comply with certification procedures to establish that it is not a United

States person in order to avoid information reporting and backup withholding requirements. The certification procedures required to claim

a reduced rate of withholding under a treaty will satisfy the certification requirements necessary to avoid the backup withholding as

well. The amount of any backup withholding from a payment to a Non-U.S. holder will be allowed as a credit against such holder’s

U.S. federal income tax liability and may entitle such holder to a refund, provided that the required information is timely furnished

to the IRS.

FATCA Withholding Taxes. Provisions commonly

referred to as “FATCA” impose withholding of 30% on payments of dividends (including constructive dividends) on our common

stock to “foreign financial institutions” (which is broadly defined for this purpose and in general includes investment vehicles)

and certain other Non-U.S. entities unless various U.S. information reporting and due diligence requirements (generally relating to ownership

by U.S. persons of interests in or accounts with those entities) have been satisfied by, or an exemption applies to, the payee (typically

certified as to by the delivery of a properly completed IRS Form W-8BEN-E). Foreign financial institutions located in jurisdictions

that have an intergovernmental agreement with the United States governing FATCA may be subject to different rules. Under certain circumstances,

a Non-U.S. holder might be eligible for refunds or credits of such withholding taxes, and a Non-U.S. holder might be required to file

a U.S. federal income tax return to claim such refunds or credits. Prospective investors should consult their tax advisers regarding

the effects of FATCA on their investment in our securities.

The preceding discussion of material U.S. federal