false

0001651562

0001651562

2025-01-24

2025-01-24

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

WASHINGTON, D.C.

20549

__________________________________________________

FORM 8-K

__________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 24, 2025

__________________________________________________

COURSERA, INC.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-40275 |

|

45-3560292 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

2440 West El Camino Real, Suite 500

Mountain View, California |

|

|

|

94040 |

| (Address of Principal Executive Offices) |

|

|

|

(Zip Code) |

Registrant's Telephone Number, Including Area Code: (650) 963-9884

Not Applicable

(Former Name or Former Address, if Changed Since

Last Report)

__________________________________________________

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.00001 par value per share |

|

COUR |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 5.02 | Departure of Directors or Certain Officers; Election

of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers |

On January 24, 2025, the Board of Directors (the

“Board”) of Coursera, Inc. (the “Company”, “we”, “us”

and “our”) appointed Gregory Hart to serve as the Company’s President and Chief Executive Officer and

as a Class III director on the Company’s Board, effective on February 3, 2025 (the “Start Date”), replacing

Jeffrey Maggioncalda, our current President and Chief Executive Officer and a Class III director, in connection with Mr. Maggioncalda’s

retirement from those roles, effective as of the Start Date.

Mr. Hart, 55, previously served as Chief Operating

Officer at Compass, Inc., a real estate technology company, from May 2022 to December 2023 and as Chief Product Officer from April 2020

to April 2022. Prior to that, Mr. Hart held various leadership positions at Amazon, Inc., where he served for 23 years, including leading

Amazon’s Prime Video global business, leading the Amazon Echo business, and as Technical Advisor to Jeff Bezos, Amazon’s founder

and Chief Executive Officer. Mr. Hart holds a B.A. in English Literature from Williams College.

Pursuant to the terms of the offer letter agreement

with Mr. Hart (the “CEO Offer Letter”), Mr. Hart will receive an initial annual base salary of $590,000 and

will be eligible to participate in the Company’s annual cash bonus program, with a target bonus opportunity equal to 100% of base

salary, subject to performance conditions and approval by the Board. For the 2025 fiscal year, the bonus will be prorated based on the

Start Date, and payment will be contingent upon his continued employment through the applicable bonus payment date.

As part of Mr. Hart’s compensation package,

the Leadership, Diversity, Equity, Inclusion and Compensation Committee of the Board recommended, and the Board approved, Mr. Hart to

be granted new hire equity awards consisting of restricted stock units (“RSUs”), time-based stock options, and

performance-based stock options. The number of RSUs awarded will be calculated as $16 million divided by the 30-trading day trailing simple

moving average closing price of the Company’s common stock ending on the Start Date (the “Base Stock Price”),

rounded up to the nearest whole share. The number of time-based stock options awarded will be calculated as $16 million divided by the

Base Stock Price, multiplied by two, and rounded up to the nearest whole share. The number of performance-based stock options awarded

will be calculated as $6 million divided by the Base Stock Price, multiplied by two, and rounded up to the nearest whole share.

The RSUs will vest over four years, with 25%

vesting on the first anniversary of the Start Date, and the remainder vesting in equal quarterly installments thereafter on the

Company’s regular quarterly vesting dates, subject to Mr. Hart’s continued employment through each such vesting date.

The time-based stock options will have an exercise price equal to the closing price of the Company’s common stock on the grant

date and will vest over four years, with 25% vesting on the first anniversary of the Start Date, and the remainder vesting in equal

quarterly installments thereafter, subject to continued employment. The performance-based stock options will also have an

exercise price equal to the closing price of the Company’s common stock on the grant date and will vest upon satisfaction of

both time- and market-based vesting conditions. The time-based vesting condition is consistent with the vesting schedule of the

time-based stock options, and the market-based vesting condition is satisfied when the trailing simple moving average closing price

of the Company’s common stock over a 60-trading day period equals or exceeds 150% of the Base Stock Price.

In the event of a termination by the Company without

cause (as defined in the CEO Offer Letter) or by Mr. Hart for good reason (as defined in the CEO Offer Letter) outside of a change in

control period (as described in the CEO Offer Letter), subject to execution and non-revocation of a release of claims, Mr. Hart will be

eligible to receive a lump sum cash payment equal to 12 months of base salary, a lump sum cash payment equal to 100% of his target annual

bonus for the year of termination plus any earned but unpaid prior year bonus, and a cash payment equal to the cost of continued health

coverage for up to 12 months, subject to eligibility. If such a termination occurs within the change in control period, and subject to

execution and non-revocation of a release of claims, Mr. Hart will be eligible to receive a lump sum cash payment equal to 18 months of

base salary, a lump sum cash payment equal to 150% of his target annual bonus for the year of termination plus any earned but unpaid prior

year bonus, a cash payment equal to the cost of continued health coverage for up to 18 months, and full acceleration of all outstanding

time-based equity awards (including performance-based awards for which the applicable goals were achieved prior to termination, but excluding

performance-based awards for which the applicable goals have not been satisfied). Performance-based awards for which the applicable goals

have not been satisfied will be treated subject to the terms of the applicable award agreement.

In connection with his appointment, we will enter

into the Company’s standard form of indemnification agreement with Mr. Hart. There are no arrangements or understandings between

Mr. Hart and any other persons pursuant to which he was appointed as President, Chief Executive Officer, or Class III director, no family

relationships between Mr. Hart and any Company director or executive officer, and Mr. Hart is not a party to any transaction with any

related person required to be disclosed pursuant to Item 404(a) of Regulation S-K.

The foregoing description of the CEO Offer Letter

does not purport to be complete and is subject to, and is qualified in its entirety by, the complete text of the CEO Offer Letter, which

the Company expects to file as an exhibit to its Annual Report on Form 10-K for the fiscal year ended December 31, 2024, which upon filing

will be incorporated herein by reference.

| Item 7.01 | Regulation FD Disclosure |

On January 29, 2025, the Company issued a press

release announcing the transition described in Item 5.02 above. A copy of such press release is attached hereto as Exhibit 99.1 and incorporated

by reference herein. The information in Item 7.01 of this Current Report on Form 8-K is furnished and shall not be deemed “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject

to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing of the Company under the

Securities Act of 1933 or the Exchange Act.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

|

COURSERA, INC. |

| |

|

|

|

| Date: January 29, 2025 |

|

By: |

/s/ Alan B. Cardenas |

| |

|

|

Alan B. Cardenas |

| |

|

|

Senior Vice President, General Counsel, and Secretary |

Exhibit 99.1

Coursera Announces Leadership Transition

| • | Greg Hart appointed CEO and Member of the Board, effective February 3, 2025 |

| • | Jeff Maggioncalda to retire as CEO |

January 29, 2025, 4:10 PM Eastern Time

MOUNTAIN VIEW, Calif. (BUSINESS WIRE) – Coursera, Inc.

(NYSE: COUR) today announced that Jeff Maggioncalda has decided to retire as President and Chief Executive Officer, and as a Member of

the Board. Greg Hart has been named President and CEO, and Member of the Board, effective February 3, 2025.

Co-Founder and Chairman of the Board Andrew Ng said, “Greg is

an exceptional and proven leader with over 25 years of experience in leading technology-driven businesses across multiple industries.

At Amazon, he led the development and launch of Alexa, an early, innovative and much-loved consumer AI product, and scaled Prime Video

globally. Greg has a track record in creating consumer demand, driving growth, and improving operational performance at scale. Following

an extensive and thoughtful succession planning process, the Board is confident that Greg is the right leader to deliver Coursera’s

next chapter of growth and advance our mission to transform lives through learning.”

Commenting on his appointment, Greg Hart said, “Coursera is a

special company with a profound mission, and I am honored to step into the role of CEO. Working closely with our global community of partners,

I see tremendous opportunities to deliver even more value to learners seeking to grow their skills in a rapidly changing job market, and

to companies looking to upskill their workforce to maintain a competitive advantage. Our foundation is solid, the demand for learning

is nearly limitless, and I look forward to working closely with the Board and our highly talented team to drive meaningful innovations,

expand access, and accelerate our growth opportunities.”

Ng added, “On behalf of the Board, I want to thank Jeff for his

significant contributions to Coursera over the past seven years. Under his leadership, Coursera increased registered learners by more

than 100 million, increased revenue by 10x, completed its IPO, and became profitable, all while successfully incorporating new technologies

such as Generative AI and navigating the business through the pandemic. He has fostered a deeply passionate workforce dedicated to delivering

on our mission. His work has helped to solidify the foundation from which we will continue to build for the future. Together with Jeff,

our Board of Directors planned this succession to ensure a seamless leadership transition.”

Jeff Maggioncalda said, “It’s been a privilege to lead

Coursera through such an important phase of growth and to empower learners around the world with knowledge and skills to transform their

lives. I am incredibly proud of what we accomplished together and confident that Greg will take Coursera to even greater heights. It has

been an honor to be part of an exceptionally talented team at Coursera, dedicated to serving the world through learning.”

About Greg Hart

Greg brings over 25 years of international technology-driven leadership,

with a strong focus on customer-focused innovation and operational discipline. At Amazon, where he spent 23 years, Greg played a pivotal

role in scaling businesses globally. He served as Technical Advisor to founder and CEO Jeff Bezos and was asked to build and lead the

Amazon Alexa/Echo organization, overseeing its development from inception through its 2014 launch and beyond, establishing it as a pioneering

AI-based consumer product distributed on over 100 million devices. Greg also led Amazon’s Prime Video global business, including

the company’s foray into live sports and implementing the live streaming technology on the platform.

From 2020 to 2023, Greg helped Compass, the largest residential real

estate brokerage in the US, go public and, as Chief Product Officer, oversaw the completion of the company’s industry-leading technology

platform. He later served as Chief Operating Officer, driving operational efficiency and positive free cash flow during a challenging

real estate market. He joined the Bose Corporation Board of Directors in December 2024. Greg holds a Bachelor of Arts degree from Williams

College and is an inventor or co-inventor on 71 US patents.

Disclosure Information

In compliance with disclosure obligations under Regulation FD, Coursera

announces material information to the public through a variety of means, including filings with the Securities and Exchange Commission

(“SEC”), press releases, company blog posts, public conference calls, and webcasts, as well as via Coursera’s investor

relations website.

About Coursera

Coursera was launched in 2012 by Andrew Ng and Daphne Koller with

a mission to provide universal access to world-class learning. It is now one of the largest online learning platforms in the world,

with 162 million registered learners as of September 30, 2024. Coursera partners with over 350 leading universities and industry

leaders to offer a broad catalog of content and credentials, including courses, Specializations, Professional Certificates, and

degrees. Coursera’s platform innovations enable instructors to deliver scalable, personalized, and verified learning

experiences to their learners. Institutions worldwide rely on Coursera to upskill and reskill their employees, citizens, and

students in high-demand fields such as GenAI, data science, technology, and business. Coursera is a Delaware public benefit

corporation and a B Corp.

Contacts

For media: Arunav Sinha, press@coursera.org

For investors: Cam Carey, ir@coursera.org

v3.24.4

Cover

|

Jan. 24, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 24, 2025

|

| Entity File Number |

001-40275

|

| Entity Registrant Name |

COURSERA, INC.

|

| Entity Central Index Key |

0001651562

|

| Entity Tax Identification Number |

45-3560292

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

2440 West El Camino Real, Suite 500

|

| Entity Address, City or Town |

Mountain View

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94040

|

| City Area Code |

650

|

| Local Phone Number |

963-9884

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.00001 par value per share

|

| Trading Symbol |

COUR

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

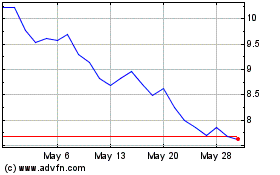

Coursera (NYSE:COUR)

Historical Stock Chart

From Dec 2024 to Jan 2025

Coursera (NYSE:COUR)

Historical Stock Chart

From Jan 2024 to Jan 2025