UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of September 2024

Commission File Number: 001-38638

NIO Inc.

(Registrant’s Name)

Building 19, No. 1355, Caobao Road, Minhang

District

Shanghai, People’s Republic of China

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F

x Form 40-F

¨

EXPLANATORY NOTE

On September 5,

2024, Hong Kong time, we published our unaudited financial results for the second quarter and six months ended June 30, 2024 as our

interim report for the six months ended June 30, 2024 (the “HK Interim Report”) under Rule 13.48(1) of the

Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited (the “Hong Kong Listing Rules”)

on the website of The Stock Exchange of Hong Kong Limited. Pursuant to the Hong Kong Listing Rules, our HK Interim Report contains supplemental

disclosure of reconciliation of the material differences between our consolidated financial statements prepared under U.S. GAAP and International

Financial Reporting Standards, which is attached hereto as exhibit 99.1.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

NIO Inc. |

| |

|

|

|

| |

By |

: |

/s/ Yu Qu |

| |

Name |

: |

Yu Qu |

| |

Title |

: |

Chief Financial Officer |

Date:

September 5, 2024

Exhibit 99.1

Reconciliation between U.S. GAAP and IFRS Accounting

Standards

The

Company’s consolidated financial statements for its primary listing in the United States are prepared in accordance with the accounting

principles generally accepted in the United States of America (the “U.S. GAAP”). As a secondary listed issuer of the

Hong Kong Stock Exchange, the Company is required to include a reconciliation statement in our annual financial statements starting from

the first full financial year commencing on or after January 1, 2022, and in all subsequent financial statements (including interim

financial statements)1.

For our interim reporting with

the Hong Kong Stock Exchange for the six month period ended June 30, 2024, we have prepared and included as Appendix, the reconciliation

statement of the unaudited condensed consolidated statement of comprehensive loss for the six months ended June 30, 2024 and the

unaudited condensed consolidated balance sheets as of June 30, 2024 of the Company, its subsidiaries and consolidated VIEs (collectively

referred to as “the Group”) between the accounting policies adopted by the Group of the relevant period in accordance

with U.S. GAAP and the International Financial Reporting Standards issued by the International Accounting Standards Board (the “IFRS

Accounting Standards”) (together, the “Reconciliation Statement”).

PricewaterhouseCoopers, the auditor

of the Company in Hong Kong, has performed a limited assurance engagement on the Reconciliation Statement in accordance with International

Standard on Assurance Engagements 3000 (Revised) “Assurance Engagements Other Than Audits or Reviews of Historical Financial Information”.

|

1 |

According to footnote 17 to the Chapter 2.1 of the Guide for New Listing Applicants published

by the Hong Kong Stock Exchange, a secondary listed issuer listed in the U.S. is not required to prepare a reconciliation statement in

respect of its U.S. GAAP quarterly financial statements which are published pursuant to overseas rules and regulations. |

Appendix

Reconciliation between U.S. GAAP and IFRS Accounting

Standards

The unaudited condensed consolidated statement of

comprehensive loss and the unaudited condensed

consolidated balance sheets are prepared in accordance with U.S. GAAP, which differ in certain respects from IFRS Accounting Standards.

The effects of material differences between the unaudited interim condensed consolidated financial information of the Group

prepared under U.S. GAAP and IFRS Accounting Standards are as follows:

Reconciliation of unaudited condensed consolidated

statement of comprehensive loss

| | |

For

the six months ended June 30, 2024 | |

| | |

Amounts

under

U.S. GAAP | | |

IFRS

adjustments | | |

Amounts

under IFRS

Accounting

Standards | |

| | |

| | |

RMB

(in thousands) | | |

| |

| | |

| | |

Share-based

compensation | | |

Convertible

notes | | |

Derivative

financial

instrument-

capped

call options | | |

Redeemable

non-

controlling

interests | | |

Available-

for-sale

securities | | |

Equity

securities

without

readily

debt determinable

fair value | | |

Leases | | |

Warranty

Accrual | | |

Software | | |

| |

| | |

| | |

Note (i) | | |

Note (ii) | | |

Note (iii) | | |

Note (iv) | | |

Note (v) | | |

Note (vi) | | |

Note (vii) | | |

Note (viii) | | |

Note (ix) | | |

| |

| Cost of revenues | |

(25,178,158 | ) | |

15,686 | | |

– | | |

– | | |

– | | |

– | | |

– | | |

85,798 | | |

126,786 | | |

– | | |

(24,949,888 | ) |

| Research and development | |

(6,082,738 | ) | |

226,530 | | |

– | | |

– | | |

– | | |

– | | |

– | | |

11,460 | | |

– | | |

– | | |

(5,844,748 | ) |

| Selling,

general and administrative | |

(6,754,256 | ) | |

106,596 | | |

– | | |

– | | |

– | | |

– | | |

– | | |

113,444 | | |

– | | |

– | | |

(6,534,216 | ) |

| Loss

from operations | |

(10,603,371 | ) | |

348,812 | | |

– | | |

– | | |

– | | |

– | | |

– | | |

210,702 | | |

126,786 | | |

– | | |

(9,917,071 | ) |

| Interest and investment

income | |

713,524 | | |

– | | |

(43,867) | | |

– | | |

– | | |

– | | |

24,480 | | |

– | | |

– | | |

– | | |

694,137 | |

| Interest expenses | |

(347,016 | ) | |

– | | |

196,364 | | |

– | | |

(162,546 | ) | |

– | | |

– | | |

(299,762 | ) | |

(73,545 | ) | |

– | | |

(686,505 | ) |

| Loss on extinguishment

of debt | |

(11,326 | ) | |

– | | |

11,326 | | |

– | | |

– | | |

– | | |

– | | |

– | | |

– | | |

– | | |

– | |

| Fair value changes

on financial instruments measured at fair value through profit or loss | |

– | | |

– | | |

– | | |

(49,838 | ) | |

– | | |

– | | |

– | | |

– | | |

– | | |

– | | |

(49,838 | ) |

| Fair

value changes of convertible notes | |

– | | |

– | | |

2,367,552 | | |

– | | |

– | | |

– | | |

– | | |

– | | |

– | | |

– | | |

2,367,552 | |

| Loss

before income tax expense | |

(10,221,551 | ) | |

348,812 | | |

2,531,375 | | |

(49,838 | ) | |

(162,546 | ) | |

– | | |

24,480 | | |

(89,060 | ) | |

53,241 | | |

– | | |

(7,565,087 | ) |

| Net

loss | |

(10,230,560 | ) | |

348,812 | | |

2,531,375 | | |

(49,838 | ) | |

(162,546 | ) | |

– | | |

24,480 | | |

(89,060 | ) | |

53,241 | | |

– | | |

(7,574,096 | ) |

| | |

| |

| |

| |

| |

For

the six months ended June 30, 2024 | |

| |

| |

| |

| |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Amounts | |

| | |

Amounts | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

under

IFRS | |

| | |

under | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Accounting | |

| | |

U.S.

GAAP | |

| |

| |

| |

IFRS

adjustments | |

| |

| |

| |

Standards | |

| | |

| |

| |

| |

| |

RMB

(in thousands) | |

| |

| |

| |

| |

| | |

| |

| |

| |

| |

| |

| |

Equity | |

| |

| |

| |

| |

| | |

| |

| |

| |

Derivative | |

| |

| |

securities | |

| |

| |

| |

| |

| | |

| |

| |

| |

financial | |

Redeemable | |

Available- | |

without | |

| |

| |

| |

| |

| | |

| |

| |

| |

instrument- | |

non- | |

for-sale | |

readily | |

| |

| |

| |

| |

| | |

| |

Share-based | |

Convertible | |

capped | |

controlling | |

debt | |

determinable | |

| |

Warranty | |

| |

| |

| | |

| |

compensation | |

notes | |

call

options | |

interests | |

securities | |

fair

value | |

Leases | |

Accrual | |

Software | |

| |

| | |

| |

Note

(i) | |

Note

(ii) | |

Note

(iii) | |

Note

(iv) | |

Note

(v) | |

Note

(vi) | |

Note

(vii) | |

Note

(viii) | |

Note

(ix) | |

| |

| Fair

value change on convertible notes due to own credit

risk | |

| – | |

| – | |

| (99,099 | ) |

| – | |

| – | |

| – | |

| – | |

| – | |

| – | |

| – | |

| (99,099 | ) |

| Changes

in the fair value of equity instruments at fair value through

other comprehensive income or loss | |

| – | |

| – | |

| – | |

| – | |

| – | |

| – | |

| (24,480 | ) |

| – | |

| – | |

| – | |

| (24,480 | ) |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Total

other comprehensive income | |

| 96,951 | |

| – | |

| (99,099 | ) |

| – | |

| – | |

| – | |

| (24,480 | ) |

| – | |

| – | |

| – | |

| (26,628 | ) |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Total

comprehensive loss | |

| (10,133,609 | ) |

| 348,812 | |

| 2,432,276 | |

| (49,838 | ) |

| (162,546 | ) |

| – | |

| – | |

| (89,060 | ) |

| 53,241 | |

| – | |

| (7,600,724 | ) |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Accretion

on redeemable non-controlling interests to redemption value | |

| (162,546 | ) |

| – | |

| – | |

| – | |

| 162,546 | |

| – | |

| – | |

| – | |

| – | |

| – | |

| – | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Comprehensive

loss attributable to ordinary shareholders of NIO Inc | |

| (10,287,337 | ) |

| 348,812 | |

| 2,432,276 | |

| (49,838 | ) |

| – | |

| – | |

| – | |

| (89,060 | ) |

| 53,241 | |

| – | |

| (7,591,906 | ) |

| | |

| | |

| |

| | |

| |

For the six months ended June 30, 2023 | | |

| |

| | |

| |

| |

| | |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

Amounts | |

| | |

Amounts | | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

under IFRS | |

| | |

under | | |

| |

| | |

| |

| | |

| |

| | |

| |

| | |

| |

Accounting | |

| | |

U.S. GAAP | | |

| |

| | |

| |

IFRS adjustments | | |

| |

| | |

| |

Standards | |

| | |

| | |

| |

| | |

| |

RMB (in thousands) | | |

| |

| | |

| |

| |

| | |

| | |

| |

| | |

| |

| | |

| |

Equity | | |

| |

| | |

| |

| |

| | |

| | |

| |

| | |

Derivative | |

| | |

| |

securities | | |

| |

| | |

| |

| |

| | |

| | |

| |

| | |

financial | |

Redeemable | | |

Available- | |

without | | |

| |

| | |

| |

| |

| | |

| | |

| |

| | |

instrument- | |

non- | | |

for-sale | |

readily | | |

| |

| | |

| |

| |

| | |

| | |

Share-based | |

Convertible | | |

capped | |

controlling | | |

debt | |

determinable | | |

| |

Warranty | | |

| |

| |

| | |

| | |

compensation | |

notes | | |

call options | |

interests | | |

securities | |

fair value | | |

Leases | |

Accrual | | |

Software | |

| |

| | |

| | |

Note (i) | |

Note (ii) | | |

Note (iii) | |

Note (iv) | | |

Note (v) | |

Note (vi) | | |

Note (vii) | |

Note (viii) | | |

Note (ix) | |

| |

| Cost of revenues | |

| (19,198,961 | ) | |

(820 | ) |

| – | | |

– | |

| – | | |

– | |

| – | | |

42,537 | |

| 58,426 | | |

– | |

| (19,098,818 | ) |

| Research and development | |

| (6,420,183 | ) | |

(165,744 | ) |

| – | | |

– | |

| – | | |

– | |

| – | | |

13,081 | |

| – | | |

– | |

| (6,572,846 | ) |

| Selling, general and administrative | |

| (5,302,531 | ) | |

(29,348 | ) |

| – | | |

– | |

| – | | |

– | |

| – | | |

86,206 | |

| – | | |

– | |

| (5,245,673 | ) |

| | |

| | | |

| |

| | | |

| |

| | | |

| |

| | | |

| |

| | | |

| |

| | |

| Loss from operations | |

| (11,185,963 | ) | |

(195,912 | ) |

| – | | |

– | |

| – | | |

– | |

| – | | |

141,824 | |

| 58,426 | | |

– | |

| (11,181,625 | ) |

| | |

| | | |

| |

| | | |

| |

| | | |

| |

| | | |

| |

| | | |

| |

| | |

| Interest expenses | |

| (151,103 | ) | |

– | |

| 56,448 | | |

– | |

| (147,237 | ) | |

– | |

| – | | |

(220,638 | ) |

| (51,778 | ) | |

– | |

| (514,308 | ) |

| Fair value changes on financial instruments measured at fair value through profit or loss | |

| – | | |

– | |

| – | | |

(56,517 | ) |

| – | | |

– | |

| – | | |

– | |

| – | | |

– | |

| (56,517 | ) |

| Fair value changes of convertible notes | |

| – | | |

– | |

| (376,547 | ) | |

– | |

| – | | |

– | |

| – | | |

– | |

| – | | |

– | |

| (376,547 | ) |

| | |

| | | |

| |

| | | |

| |

| | | |

| |

| | | |

| |

| | | |

| |

| | |

| Loss before

income tax expense | |

| (10,768,939 | ) | |

(195,912 | ) |

| (320,099 | ) | |

(56,517 | ) |

| (147,237 | ) | |

– | |

| – | | |

(78,814 | ) |

| 6,648 | | |

– | |

| (11,560,870 | ) |

| | |

| | | |

| |

| | | |

| |

| | | |

| |

| | | |

| |

| | | |

| |

| | |

| Income tax expense | |

| (26,345 | ) | |

– | |

| – | | |

– | |

| – | | |

– | |

| – | | |

– | |

| – | | |

– | |

| (26,345 | ) |

| | |

| | | |

| |

| | | |

| |

| | | |

| |

| | | |

| |

| | | |

| |

| | |

| Net loss | |

| (10,795,284 | ) | |

(195,912 | ) |

| (320,099 | ) | |

(56,517 | ) |

| (147,237 | ) | |

– | |

| – | | |

(78,814 | ) |

| 6,648 | | |

– | |

| (11,587,215 | ) |

| |

For the

six months ended June 30, 2023 | |

| |

Amounts

under

U.S. GAAP | | |

IFRS

adjustments |

|

| Amounts

under IFRS

Accounting

Standards | |

| |

| | |

RMB

(in thousands) |

|

| | |

| |

| | |

Share-based

compensation | |

| Convertible

notes | |

|

Derivative

financial instrument-

capped

call options | |

| Redeemable

non-

controlling

interests | |

| Available-

for-sale

debt

securities |

| Equity

securities

without

readily

determinable

fair value |

| Leases | |

| Warranty

Accrual |

| Software |

|

| | |

| |

| | |

Note

(i) | |

| Note

(ii) | |

| Note

(iii) | |

| Note

(iv) | |

| Note

(v) |

| Note

(vi) |

| Note

(vii) | |

| Note

(viii) |

| Note

(ix) |

|

| | |

Fair

value change on convertible

notes due to own credit risk |

– | | |

– | |

| (64,824 | ) |

| – | |

| – | |

| – |

| – |

| – | |

| – |

| – |

|

| (64,824 | ) |

Total

other comprehensive income |

272,867 | | |

– | |

| (64,824 | ) |

| – | |

| – | |

| – |

| – |

| – | |

| – |

| – |

|

| 208,043 | |

| Total

comprehensive loss |

(10,522,417 | ) | |

(195,912 | ) |

| (384,923 | ) |

| (56,517 | ) |

| (147,237 | ) |

| – |

| – |

| (78,814 | ) |

| 6,648 |

| – |

|

| (11,379,172 | ) |

| Accretion

on redeemable non-controlling interests to redemption value |

(147,237 | ) | |

– | |

| – | |

| – | |

| 147,237 | |

| – |

| – |

| – | |

| – |

| – |

|

| – | |

Comprehensive

loss attributable to ordinary shareholders of NIO Inc |

(10,652,698 | ) | |

(195,912 | ) |

| (384,923 | ) |

| (56,517 | ) |

| – | |

| – |

| – |

| (78,814 | ) |

| 6,648 |

| – |

|

| (11,362,216 | ) |

Reconciliation of unaudited condensed consolidated

balance sheets

| |

|

As

of June 30, 2024 |

|

| |

|

Amounts

under

U.S. GAAP |

|

|

IFRS

adjustments |

|

|

Amounts

under IFRS

Accounting

Standards |

|

| |

|

|

|

|

RMB

(in thousands) |

|

|

|

|

| |

|

|

|

|

Share-based

compensation |

|

|

Convertible

notes |

|

|

Derivative

financial

instrument-

capped

call options |

|

|

Redeemable

non-

controlling

interests |

|

|

Available-

for-sale

debt

securities |

|

|

Equity

securities

without

readily

determinable

fair value |

|

|

Leases |

|

|

Warranty

Accrual |

|

|

Software |

|

|

|

|

| |

|

|

|

|

Note

(i) |

|

|

Note

(ii) |

|

|

Note

(iii) |

|

|

Note

(iv) |

|

|

Note

(v) |

|

|

Note

(vi) |

|

|

Note

(vii) |

|

|

Note

(viii) |

|

|

Note

(ix) |

|

|

|

|

| Prepayments

and other current assets |

|

5,032,716 |

|

|

– |

|

|

– |

|

|

– |

|

|

500,000 |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

5,532,716 |

|

| Financial

assets at fair value through profit or loss |

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

173,208 |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

173,208 |

|

| Financial

assets at fair value through other comprehensive income or loss |

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

480,195 |

|

|

– |

|

|

– |

|

|

– |

|

|

480,195 |

|

| Property,

plant and equipment, net |

|

24,517,864 |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

(454,632 |

) |

|

24,063,232 |

|

| Intangible

assets, net |

|

29,648 |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

454,632 |

|

|

484,280 |

|

| Long-term

investments |

|

5,375,958 |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

(173,208 |

) |

|

(480,195 |

) |

|

– |

|

|

– |

|

|

– |

|

|

4,722,555 |

|

| Right-of-use

assets |

|

11,563,603 |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

(385,419 |

) |

|

– |

|

|

– |

|

|

11,178,184 |

|

| Total

assets |

|

100,515,815 |

|

|

– |

|

|

– |

|

|

– |

|

|

500,000 |

|

|

– |

|

|

– |

|

|

(385,419 |

) |

|

– |

|

|

– |

|

|

100,630,396 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Current

portion of long-term borrowings |

|

4,211,017 |

|

|

– |

|

|

(3,579,016 |

) |

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

632,001 |

|

| Accruals

and other liabilities |

|

13,295,715 |

|

|

– |

|

|

(80,767 |

) |

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

13,214,948 |

|

| Financial

liabilities measured at amortized cost |

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

4,961,563 |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

4,961,563 |

|

| Long-term

borrowings |

|

11,614,644 |

|

|

– |

|

|

(8,088,413 |

) |

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

3,526,231 |

|

| Financial

liabilities at fair value through profit or loss |

|

– |

|

|

– |

|

|

9,218,066 |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

9,218,066 |

|

| Other

non-current liabilities |

|

7,289,020 |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

(637,620 |

) |

|

– |

|

|

6,651,400 |

|

| Total

liabilities |

|

79,799,362 |

|

|

– |

|

|

(2,530,130 |

) |

|

– |

|

|

4,961,563 |

|

|

– |

|

|

– |

|

|

– |

|

|

(637,620 |

) |

|

– |

|

|

81,593,175 |

|

| Redeemable

non-controlling interests |

|

4,461,563 |

|

|

– |

|

|

– |

|

|

– |

|

|

(4,461,563 |

) |

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

| MEZZANINE

EQUITY |

|

4,461,563 |

|

|

– |

|

|

– |

|

|

– |

|

|

(4,461,563 |

) |

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

| Additional

paid- in capital |

|

119,068,225 |

|

|

1,551,060 |

|

|

– |

|

|

(614,849 |

) |

|

7,833,200 |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

127,837,636 |

|

| Accumulated

other comprehensive loss |

|

529,942 |

|

|

– |

|

|

(549,700 |

) |

|

– |

|

|

– |

|

|

– |

|

|

62,591 |

|

|

– |

|

|

– |

|

|

– |

|

|

42,833 |

|

| Accumulated

deficit |

|

(100,979,776 |

) |

|

(1,551,060 |

) |

|

3,079,830 |

|

|

614,849 |

|

|

(7,833,200 |

) |

|

– |

|

|

(62,591 |

) |

|

(385,419 |

) |

|

637,620 |

|

|

– |

|

|

(106,479,747 |

) |

| Total

shareholders’ equity |

|

16,254,890 |

|

|

– |

|

|

2,530,130 |

|

|

– |

|

|

– |

|

|

– |

|

|

– |

|

|

(385,419 |

) |

|

637,620 |

|

|

– |

|

|

19,037,221 |

|

| |

|

As

of December 31, 2023 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amounts |

|

| |

|

Amounts |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

under

IFRS |

|

| |

|

under |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounting |

|

| |

|

U.S.

GAAP |

|

|

IFRS

adjustments |

|

|

Standards |

|

| |

|

|

|

|

RMB

(in thousands) |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

Derivative |

|

|

|

|

|

|

|

|

securities |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

financial |

|

|

Redeemable |

|

|

Available- |

|

|

without |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

instrument- |

|

|

non- |

|

|

for-sale |

|

|

readily |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Share-based |

|

|

Convertible |

|

|

capped |

|

|

controlling |

|

|

debt |

|

|

determinable |

|

|

|

|

|

Warranty |

|

|

|

|

|

|

|

| |

|

|

|

|

compensation |

|

|

notes |

|

|

call

options |

|

|

interests |

|

|

securities |

|

|

fair

value |

|

|

Leases |

|

|

Accrual |

|

|

Software |

|

|

|

|

| |

|

|

|

|

|

|

Note

(i) |

|

|

|

Note

(ii) |

|

|

|

Note

(iii) |

|

|

|

Note

(iv) |

|

|

|

Note

(v) |

|

|

|

Note

(vi) |

|

|

|

Note

(vii) |

|

|

|

Note

(viii) |

|

|

|

Note

(ix) |

|

|

|

|

|

| Financial

assets at fair value through profit or loss |

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

120,000 |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

120,000 |

|

| Financial

assets at fair value through other comprehensive income or loss |

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

391,205 |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

391,205 |

|

| Property,

plant and equipment, net |

|

|

24,847,004 |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

(593,797 |

) |

|

|

24,253,207 |

|

| Intangible

assets, net |

|

|

29,648 |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

593,797 |

|

|

|

623,445 |

|

| Long-term

investments |

|

|

5,487,216 |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

(120,000 |

) |

|

|

(391,205 |

) |

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

4,976,011 |

|

| Right-of-use

assets |

|

|

11,404,116 |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

(296,359 |

) |

|

|

– |

|

|

|

– |

|

|

|

11,107,757 |

|

| Derivative

financial instruments |

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

49,838 |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

49,838 |

|

| Total

assets |

|

|

117,383,202 |

|

|

|

– |

|

|

|

– |

|

|

|

49,838 |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

(296,359 |

) |

|

|

– |

|

|

|

– |

|

|

|

117,136,681 |

|

| Current

portion of long-term borrowings |

|

|

4,736,087 |

|

|

|

– |

|

|

|

(3,286,640 |

) |

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

1,449,447 |

|

| Accruals

and other liabilities |

|

|

15,556,354 |

|

|

|

– |

|

|

|

(124,627 |

) |

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

15,431,727 |

|

| Financial

liabilities measured at amortized cost |

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

3,860,384 |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

3,860,384 |

|

| Long-term

borrowings |

|

|

13,042,861 |

|

|

|

– |

|

|

|

(11,575,725 |

) |

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

1,467,136 |

|

| Financial

liabilities at fair value through profit or loss |

|

|

– |

|

|

|

– |

|

|

|

14,889,138 |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

14,889,138 |

|

| Other

non-current liabilities |

|

|

6,663,805 |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

(584,379 |

) |

|

|

– |

|

|

|

6,079,426 |

|

| Total

liabilities |

|

|

87,787,186 |

|

|

|

– |

|

|

|

(97,854 |

) |

|

|

– |

|

|

|

3,860,384 |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

(584,379 |

) |

|

|

– |

|

|

|

90,965,337 |

|

| Redeemable

non-controlling interests |

|

|

3,860,384 |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

(3,860,384 |

) |

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

| MEZZANINE

EQUITY |

|

|

3,860,384 |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

(3,860,384 |

) |

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

| Additional

paid-in capital |

|

|

117,717,254 |

|

|

|

1,899,872 |

|

|

|

– |

|

|

|

(614,849 |

) |

|

|

7,670,654 |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

126,672,931 |

|

| Accumulated

other comprehensive loss |

|

|

432,991 |

|

|

|

– |

|

|

|

(450,601 |

) |

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

87,071 |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

69,461 |

|

| Accumulated

deficit |

|

|

(90,758,034 |

) |

|

|

(1,899,872 |

) |

|

|

548,455 |

|

|

|

664,687 |

|

|

|

(7,670,654 |

) |

|

|

– |

|

|

|

(87,071 |

) |

|

|

(296,359 |

) |

|

|

584,379 |

|

|

|

– |

|

|

|

(98,914,469 |

) |

| Total

shareholders’ equity |

|

|

25,735,632 |

|

|

|

– |

|

|

|

97,854 |

|

|

|

49,838 |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

(296,359 |

) |

|

|

584,379 |

|

|

|

– |

|

|

|

26,171,344 |

|

Basis of Preparation

The Directors of the Company are

responsible for preparation of the Reconciliation Statement in accordance with the relevant requirements of the Hong Kong Listing Rules and

relevant guidance in Chapter 2.1 of the Guide for New Listing Applicants. The Reconciliation Statement was prepared based on the Group’s

unaudited interim condensed consolidated financial information for the six months ended June 30, 2024 prepared under U.S. GAAP, with

adjustments made (if any) thereto in arriving at the unaudited financial information of the Group prepared under IFRS Accounting Standards.

The adjustments reflect the differences between the Group’s accounting policies under U.S. GAAP and IFRS Accounting Standards.

| (i) | Share-based compensation |

Under U.S. GAAP, the

Group has elected to recognize compensation expense using the straight-line method for all employee equity awards granted with graded

vesting over the requisite service period.

Under IFRS Accounting

Standards, the graded vesting method is required to recognize compensation expense for all employee equity awards granted with graded

vesting.

Under U.S. GAAP, the

convertible notes are measured at amortized cost, with any difference between the initial carrying value and the repayment amount recognized

as interest expense using effective interest method over the period from issuance date to maturity date.

Under

IFRS Accounting Standards, the Group’s convertible notes are designated as at fair value through profit

or loss such that the convertible notes are initially recognized at fair value. Subsequent to initial recognition, the amounts of

changes in fair value of the convertible notes that are attributed to changes in own credit risk are presented in other

comprehensive income and the remaining fair value changes are presented in the profit or loss.

| (iii) | Derivative financial instruments-capped call options |

Under U.S. GAAP, the

costs for the capped call options are recorded as deduction of additional paid-in capital within total shareholders’ deficit.

Under IFRS Accounting

Standards, the capped call options are recognized as financial assets at fair value through profit or loss such that they are initially

recognized at fair value and subsequent to initial recognition, the amounts of changes in fair value are recognized in the profit or loss.

| (iv) | Redeemable non-controlling interests |

Under U.S. GAAP,

SEC guidance provides for mezzanine-equity (temporary equity) category in addition to the financial liability and permanent equity

categories. The purpose of this “in-between” category is to indicate that a security may not be a permanent part of equity.

The Group classifies the redeemable non-controlling interests as mezzanine equity in the consolidated balance sheets and are

recorded initially at fair value, net of issuance costs. The Group recognizes accretion to the respective redemption value of the

redeemable non-controlling interests over the period starting from issuance date to the earliest redemption date. In addition, the

Group recognizes the receivables from a redeemable non-controlling shareholder as a reduction of mezzanine equity.

Under IFRS Accounting

Standards, the Group’s obligation to purchase its own equity instruments for cash under a forward contract is recognized initially

at the present value of the redemption amount and reclassified from equity. Subsequently, the financial liability is measured at amortized

cost using the effective interest rate method in accordance with IFRS Accounting Standards. In addition, the Group recognizes the receivables

from a redeemable non-controlling shareholder in assets given the Group has a contractual right to receive cash.

| (v) | Available-for-sale debt securities |

Under U.S. GAAP, the

available-for-sale debt securities classified within Level 3 are valued based on a model utilizing unobservable inputs which require significant

management judgment and estimation. The Group reports available-for-sale debt securities at fair value at each balance sheet date with

the aggregate unrealized gains and losses, net of tax, reflected in other comprehensive income.

Under IFRS Accounting

Standards, since those debt investments could not meet the definition of the equity instrument from the perspective of issuer, and the

contractual cashflow of these financial assets does not represent solely payments of principal and interest, thus they should be reclassified

from long-term investments to financial assets measured at fair value through profit or loss such that they are initially recognized at

fair values and subsequent to initial recognition, the amounts of changes in fair value are recognized in the profit or loss.

| (vi) | Equity securities without readily determinable fair value |

Under U.S. GAAP, the

Group elected to measure an equity security without a readily determinable fair value using a measurement alternative that measures the

securities at cost minus impairment, if any, plus or minus changes resulting from qualifying observable price changes.

Under IFRS Accounting

Standards, the Group elected to measure the investments in equity instruments at fair value through other comprehensive income or loss

(FVOCI). Fair value changes of these investments were recognized in the other comprehensive income or loss.

Under U.S. GAAP, for

operating leases, the amortization of right-of-use assets and the interest expense element of lease liabilities are recorded together

as lease expenses, which results in a straight-line recognition effect in profit or loss.

Under IFRS Accounting

Standards, the right-of-use assets are generally depreciated on a straight-line basis while the interest expense related to the lease

liabilities are measured under the effective interest method, which results in higher expenses in earlier periods and lower expenses in

later periods. The amortization of the right-of-use assets is recorded as lease expense and the interest expense is required to be presented

in separate line item.

Under U.S. GAAP, the

Group elected to record the warranty accrual without considering the discount impact given that the timing of cash payments for the warranty

accrual is not fixed or determinable by the Group.

Under IFRS Accounting

Standards, there is not an accounting policy choice and the initial amount of the warranty accrual is the present value of the anticipated

cash flows expected to be required to settle the obligation. The carrying amount of the warranty accrual increases in each period to reflect

the passage of time with said increase recognized as an interest expense.

Under U.S. GAAP, software

is not presented as intangible assets and so the Group records software in property, plant and equipment.

Under IFRS Accounting

Standards, software is reported under the intangible assets category. Accordingly, software is reclassified from property, plant and equipment

to intangible assets.

APPENDIX

I

Weighted Voting Rights Structure

Our Company is controlled through

weighted voting rights (“WVR”). Under our WVR structure, each Class A ordinary share entitles the holder to exercise

one vote, and each Class C ordinary share entitles the holder to exercise eight votes, on any resolution tabled at our general meetings,

subject to Rule 8A.24 of the Hong Kong Listing Rules that requires certain matters (the “Reserved Matters”)

to be voted on a one vote per share basis.

Our WVR structure enables our

founder, Mr. Bin Li (the “ WVR Beneficiary”), controlling the Class C ordinary shares through Originalwish

Limited, mobike Global Ltd. and NIO Users Limited, to exercise voting control over our Company notwithstanding the WVR Beneficiary does

not hold a majority economic interest in the share capital of our Company. This will enable us to benefit from the continuing vision

and leadership of our WVR Beneficiary who will control our Company with a view to our long-term prospects and strategy.

Shareholders and prospective

investors are advised to be aware of the potential risks of investing in our Company with a WVR structure, in particular that the interests

of the WVR Beneficiary may not necessarily always be aligned with those of the shareholders as a whole, and that the WVR Beneficiary

will be in a position to exert significant influence over the affairs of our Company and the outcome of shareholders’ resolutions,

irrespective of how other shareholders vote. Shareholders and prospective investors should make the decision to invest in our Company

only after due and careful consideration.

As of June 30, 2024, Mr. Bin

Li was interested in and controlled through (a) Originalwish Limited, 89,013,451 Class C ordinary shares, (b) mobike Global

Ltd., 26,454,325 Class C ordinary shares, (c) NIO Users Limited, 14,967,776 Class A ordinary shares and 33,032,224 Class

C ordinary shares, and (d) NIO Users Community Limited, 2,000,000 Class

A ordinary shares, which in total amounts to 16,967,776 Class A ordinary shares and

148,500,000 Class C ordinary shares on an aggregate

basis, representing approximately 38.5% of the voting rights in our Company

with respect to shareholders’ resolutions relating to matters other than certain Reserved Matters, calculated based on 2,090,434,842

issued and outstanding ordinary shares as of June 30, 2024, comprising of 1,941,934,842 Class A ordinary shares (excluding

7,366,381 Class A ordinary shares issued and reserved for future issuance upon the exercising or vesting of awards granted under

our stock incentive plans) and 148,500,000 Class C ordinary shares.

NIO Users Community Limited is

a British Virgin Islands company wholly owned by NIO Users Limited. NIO Users Limited is a British Virgin Islands holding company wholly

owned by Maples Trustee Services (Cayman) Limited in its capacity as trustee of NIO Users Trust, a trust in which Mr. Bin Li is

the settlor, protector, investment advisor

and the only existing de facto beneficiary as of June 30, 2024. Mr. Bin

Li has the power to direct the trustee with respect to the retention or disposal of, and the exercise of any voting and other

rights attached to, the shares held by NIO Users Community Limited and NIO Users Limited in our Company. Originalwish Limited and mobike

Global Ltd. are British Virgin Island companies wholly owned by Mr. Bin Li.

In

the event that the holder of Class C ordinary shares elects to convert the Class C ordinary shares to

Class A ordinary shares, each Class C ordinary share may be converted into one Class A ordinary

share on a one-to-one ratio. Upon the conversion of all the issued and outstanding Class C ordinary shares, our Company will

re-designate them into 148,500,000 Class A ordinary shares, representing approximately 7.1% of the total issued and outstanding

shares of our Company (excluding 7,366,381 Class A ordinary shares issued and reserved for future issuance upon the exercising or

vesting of awards granted under our stock incentive plans) as of June 30, 2024.

The WVR attached to the Class C

ordinary shares will cease when the WVR Beneficiary no longer has any beneficial ownership of any of the Class C ordinary shares,

in accordance with Rule 8A.22 of the Hong Kong Listing Rules. This may occur:

| |

(i) |

upon the occurrence of any of the circumstances set out in Rule 8A.17 of the Hong Kong Listing

Rules, in particular where the WVR Beneficiary is: (1) deceased; (2)

no longer a member of the board;

(3) deemed by The Stock Exchange of Hong Kong Limited (the “Hong Kong

Stock Exchange”) to be

incapacitated for the purpose of performing his duties as a director; or (4) deemed

by the Hong Kong Stock Exchange to no longer meet the requirements of a director set out in the Hong Kong Listing Rules; |

| (ii) | when the WVR Beneficiary has transferred

to another person the beneficial ownership of, or economic interest in, all of the Class C

ordinary shares or the voting rights attached to them, other than in the circumstances permitted

by Rule 8A.18 of the Hong Kong Listing Rules; |

| (iii) | where a vehicle holding Class C

ordinary shares on behalf of a WVR Beneficiary no longer complies with Rule 8A.18(2) of

the Hong Kong Listing Rules; or |

| (iv) | when all of the Class C ordinary

shares have been converted to Class A ordinary shares. |

Roles of WVR Beneficiary in NIO Users Trust

During the six months ended June 30,

2024, Mr. Bin Li is the settlor, the protector, the investment advisor and the only existing de facto beneficiary of NIO Users Trust

and continues to retain the voting rights of the shares in our Company controlled by NIO Users Trust and held by NIO Users Limited. Mr. Li

has been the only existing de facto beneficiary who has been specifically named and identified under the trust deed (the “Trust

Deed”) of NIO Users Trust and has full control over the NIO Users Trust as the sole settlor, sole protector and sole investment

advisor since its establishment, although two

other categories of beneficiaries were written in the Trust Deed, including

(i) charities (which refers to any company, body or trust which is (a) charitable in the place

where it is situated, registered, incorporated or established and (b) charitable under the laws of the Cayman Islands) and (ii) any

person or class of persons added to the class of beneficiaries by the protector by deed delivered to the trustee. As of June 30,

2024, no charity has been identified as the beneficiary and no other person or class of persons has been added by Mr. Li as the

protector to the class of beneficiaries. Therefore, Mr. Li has the sole control over the voting rights attached to the shares, including

Class C ordinary shares, held by NIO Users Limited and Mr. Li is the only person with economic interest in the trust fund.

Any changes to the roles of the

(i) protector, (ii) investment advisor or (iii) beneficiary of NIO Users Trust will have material impact on our WVR structure

due to the power entrusted to them (in the case of the investment advisor and the protector) or the economic interests vested in them

(in the case of the beneficiary) in the Class C ordinary shares held by NIO Users Limited. Upon the change of any of such roles

to any person other than Mr. Bin Li, the beneficial ownership of, or the economic interest in, the Class C ordinary shares

or the control over the voting rights attached to the shares held by NIO Users Limited will no longer be solely vested in Mr. Bin

Li. Mr. Bin Li may cease to be a protector or investment advisor in the event of death, resignation by written notice to the trustee,

or refusal, unfitness or incapacity to act. In such circumstances, the Class C ordinary shares held by NIO Users Limited will be

automatically converted to Class A ordinary shares pursuant to Rule 8A.18(1) of the Hong Kong Listing Rules.

During the six months ended June 30,

2024, there has been no material change to the powers, rights and obligations of the (i) protector, (ii) investment advisor,

or (iii) beneficiary of NIO Users Trust that would have any material impact on our WVR structure.

Nominating and ESG Committee

The applicable requirements in

relation to corporate governance as set out in Chapter 8A of the Hong Kong Listing Rules became applicable to us since March 10,

2022, the date on which listing of and dealings in our Class A ordinary shares first commenced on the Hong Kong Stock Exchange.

We have established the Nominating

and ESG Committee in compliance with Rules 8A.27, 8A.28 and 8A.30 of the Hong Kong Listing Rules. All of the members of the Nominating

and ESG Committee are independent directors, namely, Ms. Yu Long, Mr. Denny Ting Bun Lee and Mr. Hai Wu. Ms. Yu Long

is the chairwoman of the Nominating and ESG Committee.

The following is a summary of

work that has been performed by the Nominating and ESG Committee during the six months ended June 30, 2024 in respect of its corporate

governance functions as well as other functions under its terms of reference:

| · | Made

recommendations on the frequency and structure of board meetings and monitored the functioning

of the committees of the board. |

| · | Reviewed

and monitored the adequacy of the policies and practices of our Company on corporate governance

and on compliance with legal and regulatory requirements. |

| · | Reviewed

our Company’s compliance with the Corporate Governance Code set out in Appendix C1

to the Hong Kong Listing Rules (the “Corporate Governance Code”)

to the extent required by Chapter 8A of the Hong Kong Listing Rules and our Company’s

disclosure for compliance with Chapter 8A of the Hong Kong Listing Rules. |

| · | Reviewed

and monitored the management of conflicts of interest between our Company and its subsidiaries

and consolidated affiliated entities (the “Group”), and/or the shareholders

on one hand and the WVR Beneficiary on the other. |

| · | Reviewed

and monitored all risks related to the WVR structure, including any connected transactions

between the Group on one hand and any WVR Beneficiary on the other, and made recommendation

to the board on any such transaction. |

| · | Reviewed

the arrangements for the training and continuous professional development of directors and

senior management (in particular, Chapter 8A of the Hong Kong Listing Rules and knowledge

in relation to the risks relating to the weighted voting rights structure). |

| · | Sought

to ensure effective and ongoing communication between our Company and its shareholders, particularly

with regard to the requirements of Rule 8A.35 of the Hong Kong Listing Rules. |

| · | Reviewed

the structure, size and composition (including the skills, knowledge and experience) of the

board as a whole. |

| |

· |

Identified and interviewed individuals suitably qualified to become board members and select or make

recommendations to the board on the selection of individuals nominated for directorships. |

| |

· |

Made recommendations to the board on the appointment or re-appointment of directors and succession

planning for directors. |

| |

· |

Reviewed committee assignments and the policy on the rotation of committee memberships and/or

chairpersonships.

|

| |

|

|

| |

· |

Reported on the work of the Nominating and ESG Committee on a half-yearly basis covering areas of

its terms of reference. |

| |

· |

Advised the board periodically with respect to significant developments in the law and practice of

corporate governance as well as our Company’s compliance with applicable laws and regulations, and made recommendations to

the board on all matters of corporate governance and on any corrective action to be taken. |

| |

· |

Evaluated the performance of the Nominating and ESG Committee by: (i) reviewing whether the committee

charter appropriately addresses the matters that are or should be within the work scope of the Nominating

and ESG Committee; and (ii) address matters that the Nominating and ESG Committee considers relevant

to its performance.

|

| |

|

|

| |

· |

Reviewed the remuneration and terms of engagement of the compliance advisor. |

In particular, the Nominating

and ESG Committee has confirmed to the board it is of the view that our Company has adopted sufficient corporate governance measures

to manage the potential conflict of interest between our Group or shareholder on one hand and WVR Beneficiary on the other, in order

to ensure that the operations and management of our Company are in the interests of the shareholders as a whole indiscriminately. These

measures include the Nominating and ESG Committee (i) reviewing and monitoring transactions contemplated to be entered into by the

Group and making a recommendation to the board on any matter where there is a potential conflict of interest, and (ii) ensuring

that (a) any transactions between our Group and WVR Beneficiary are disclosed and dealt with in accordance with the requirements

of the Hong Kong Listing Rules applicable to us, (b) the terms of transactions between our Group and WVR Beneficiary are fair

and reasonable and in the interest of our Company and shareholders as a whole, (c) any directors who have a conflict of interest

abstain from voting on the relevant board resolution, and (d) the compliance advisor is consulted on any matters related to transactions

between our Group and the WVR Beneficiary or involving a potential conflict of interest. The Nominating and ESG Committee recommended

the board continue the implementation of these measures and periodically review their efficacy towards these objectives.

Miscellaneous

Shareholders’

protection during the period while our Company maintains its secondary listing status on the Hong Kong Stock Exchange

In the thirteenth amended and

restated articles of association of our Company (the “Thirteenth Amended and Restated Articles”), we refer to the

period commencing from the date on which any of our shares first become secondary listed on the Hong Kong Stock Exchange to and including

the date immediately before the day which the secondary listing is withdrawn from the Hong Kong Stock Exchange as the relevant period

(the “Relevant Period”).

During the Relevant Period:

| (i) | NIO Users Trust will not have any director

nomination right; |

| (ii) | we shall have only one class of shares with

enhanced or weighted voting rights; |

| (iii) | our directors shall not have the power

to, amongst others, authorize the division of shares, designate a new share class with enhanced

voting rights or the issue of preferred shares; and |

| (iv) | certain restrictions on the WVR structure

of our Company under Chapter 8A of the Hong Kong Listing

Rules shall be applicable, such as, amongst others, no further increase in

the proportion of Class C ordinary shares to the total number of shares in issue, and

only a director or a director holding vehicle is permitted to hold Class C ordinary

shares and automatic conversion of Class C ordinary shares into Class A ordinary

shares under certain circumstances. |

Notwithstanding the above and

at any time after the Relevant Period, the provisions which are subject to the Relevant Period will continue to apply in the circumstances

where our Company has a change of listing status on the Hong Kong Stock Exchange other than in the case where the secondary listing of

our Company is withdrawn from the Hong Kong Stock Exchange (referred to in scenario (a) below) pursuant to the applicable Hong Kong

Listing Rules.

Given certain shareholder protection

under the Hong Kong Listing Rules will only be applicable during the Relevant Period, shareholders may be afforded less protection

after the Relevant Period as compared with other companies secondary listed in Hong Kong. In particular, Rules 8A.07, 8A.09, 8A.13,

8A.14, 8A.15, 8A.16, 8A.17, 8A.18, 8A.19, 8A.21, 8A.22, 8A.23 and 8A.24 of the Hong Kong Listing Rules will be rendered no longer

applicable after the Relevant Period pursuant to the Thirteenth Amended and Restated Articles. Furthermore, after the Relevant Period,

(i) NIO Users Trust shall be entitled to nominate one director to the board; and (ii) in the event that Mr. Bin Li is

not an incumbent director and the board is composed of no less than six directors, NIO Users Trust shall be entitled to nominate one

extra director to the board. In addition, after the Relevant Period, our directors will also have the power to, amongst others, authorize

the division of shares, designate a new share class with enhanced voting rights, or issue preferred shares. Prospective investors are

advised to be aware of the potential risks involved in any potential change of listing venue. For instance, if our shares are no longer

traded on the Hong Kong Stock Exchange, investors may lose the shareholder protection mechanisms afforded under the relevant Hong Kong

Listing Rules.

Our Company may only cease to

be secondary listed under Chapter 19C of the Hong Kong Listing Rules under one of the following situations:

| (a) | withdrawal,

in the case where we are primary listed on another stock exchange and voluntarily withdraw

its secondary listing on the Hong Kong Stock Exchange; |

| (b) | migration

of the majority of trading to the Hong Kong Stock Exchange’s markets, in the case where

the majority of trading in our listed shares migrates to the Hong Kong Stock Exchange’s

markets on a permanent basis; |

| (c) | primary conversion, i.e., a voluntary

conversion by our Company to a dual-primary listing on the Hong Kong Stock Exchange; |

| (d) | overseas delisting, where the shares or

depositary receipts issued on our shares cease to be listed on the stock exchange which it

is primary listed; |

| (e) | if the Hong Kong Stock Exchange cancels

the listing of our securities; and |

| (f) | if the SFC directs the Hong Kong Stock

Exchange to cancel the listing of our securities. |

The scenarios under which we

may cease to be secondary listed on the Hong Kong Stock Exchange are subject to the changing market conditions, our listing or delisting

in other jurisdictions, our compliance with the Hong Kong Listing Rules and other factors beyond our control. As a result, there

are substantial uncertainties relating to applicability of the shareholders’ rights and protection under the aforementioned provisions

of the Thirteenth Amended and Restated Articles, particularly in the case where we delist from the Hong Kong Stock Exchange.

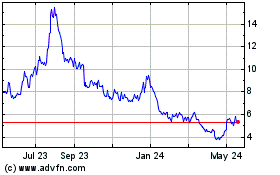

NIO (NYSE:NIO)

Historical Stock Chart

From Feb 2025 to Mar 2025

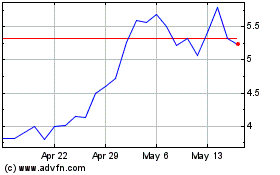

NIO (NYSE:NIO)

Historical Stock Chart

From Mar 2024 to Mar 2025