Athabasca Minerals Transfers Firebag Frac Sand Project to Wholly Owned Subsidiary AMI Silica

05 October 2018 - 9:01PM

Athabasca Minerals Inc. (TSX Venture: ABM) (“Athabasca” or the

“Corporation”) announces the transfer of the Firebag Frac Sand Mine

(“Firebag Assets”) to its wholly owned subsidiary AMI Silica Inc.

(“AMI”) effective October 1, 2018. The transfer includes

Corporation’s right, title and interest, both legal and equitable,

in the Firebag Assets to AMI in exchange for 33,302,650 Class A

common shares of AMI at the fair market value of CDN $30,375,000.

The Firebag Assets will be recorded on the consolidated balance

sheet of the Corporation at cost, with cumulative exploration costs

to date for the Firebag Assets being CDN $1,141,355 (as of most

recent financial results for the period ending June 30, 2018).

Athabasca received 33,302,650 Class A common shares with a paid up

capital of CDN $4.00 as consideration for the transfer of the

Firebag Assets. The transfer of the Firebag Assets is subject to

TSX Venture Exchange acceptance.

Athabasca commissioned an arm’s length

independent firm, Evans & Evans Inc. (“Evans & Evans”), to

complete a fair market value report titled “Comprehensive Valuation

Report” on the Firebag Assets in Q3 2018. Evans and Evans relied on

technical reports previously disclosed by the Corporation as

follows; National Instrument 43-101 Technical Report, Inferred Frac

Sand Resource Estimate for the Firebag Property, Northeastern

Alberta, Canada (“Firebag Technical Report”) prepared for Athabasca

by APEX Geoscience Ltd. effective September 19, 2014 and the

Preliminary Economic Assessment – Firebag River Sand Property

(“Firebag PEA”) prepared by Norwest Corporation effective November

26, 2014, with both reports being current. As the Firebag Assets

are at the near development stage, two market approaches were used

to determine the fair market value, specifically a Mergers &

Acquisitions Method and a Guideline Public Company Method. In

undertaking the Guideline Public Company Method, Evans and Evans

did use two separate metrics. Evans and Evans used a market

approach in arriving at a fair market value range for the Firebag

Assets. Specifically, Evans and Evans used a multiple of price /

tonne of resource based on a review of certain silica sand

transactions similar to the Firebag Assets as at the valuation

date. Evans and Evans identified 21 transactions focused on

properties in Canada and the United States. The fair market value

of the Firebag Assets relied heavily on information provided by the

management of Athabasca, The Firebag Technical Report and data from

industry participants and competitors as indicative in determining

the determination of the fair market value of the Firebag Assets as

at the valuation date. In undertaking due diligence work, Evans

& Evans determined that the fair market value for 100% of the

Firebag Assets is in the range of CDN $30,375,000 to $32,510,000.

Evans and Evans did not visit the Firebag Property and entirely

relied upon the Firebag PEA and Firebag Technical Report as

outlined above. Evans and Evans has relied on such expert’s

technical and due diligence work as well as the Corporation’s

management disclosure with respect to the Firebag Assets.

Evans & Evans is a leading Canadian boutique

Investment Banking firm with offices and affiliates in Canada, the

U.S. and Asia. A copy of the Comprehensive Valuation Report will be

available on SEDAR. The Comprehensive Valuation Report has not been

reviewed by the TSX Venture Exchange for compliance with Exchange

Policy, including Appendix 3G Valuation Standards and Guidelines

For Minerals Properties.

AMI received approval of a development permit

for industrial sand processing, storage and distribution facilities

in Mayerthorpe, Alberta in Q3 2018. The Mayerthorpe facility

intends to process sand from the Firebag mine located 95 km north

of Fort McMurray, with construction expected to commence in the

first-half of 2019 subject to securing financing. The planned

operation will supply industrial proppants for use in the oil and

gas sector as well as products for the construction sector.

The transfer of the Firebag Assets to AMI Silica

creates an industrial sand business that is well positioned to

provide premium domestic frac sand for the oil and gas sector in

Western Canada and for other industrial applications. Robert

Beekhuizen, CEO of Athabasca Minerals and President of AMI Silica

stated, “As outlined in the June AGM for Athabasca Minerals, this

announcement demonstrates our continued commitment to restructuring

our business and creating shareholder value through our management

model that creates enterprises as subsidiaries with distinct value

propositions.”

AMI Silica Leadership

Robert Beekhuizen, PresidentAnshul Vishal, Vice President,

Business and Project DevelopmentMark Smith, Vice President,

FinanceSamuel Parayil, Manager, Project and OperationsDavis

Fattedad, Director, Commercial

About AMI Silica IncAMI Silica

Inc, a wholly-owned subsidiary of Athabasca Minerals which

integrates its mine assets with processing, transportation,

logistics, and last-mile delivery solutions to create market

opportunity for premium domestic Alberta sand to satisfy Canadian

regional industry needs.Website: www.amisilica.com

About Athabasca Minerals IncThe

Corporation is a resource development, management, and marketing

company focused on delivering aggregates across industries in

Western Canada in support of construction demand and activities.

The Corporation also has industrial mineral land holdings for the

purpose of locating and developing supply sources of industrial

minerals. Website: www.athabascaminerals.com

For further Information on Athabasca Minerals and AMI

Silica please contact:

Dean StuartT: 403-617-7609E: dean@boardmarker.net

Robert Beekhuizen, Chief Executive OfficerT: 780 465 5696

Neither the TSX Venture Exchange

nor its Regulation Services Provider (as that term is defined in

the policies of the TSX Venture Exchange) accepts responsibility

for the adequacy or accuracy of this release.

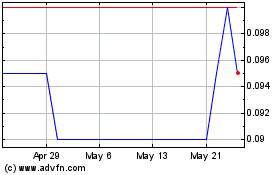

Aben Minerals (TSXV:ABM)

Historical Stock Chart

From Jan 2025 to Feb 2025

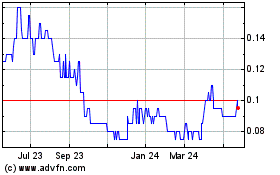

Aben Minerals (TSXV:ABM)

Historical Stock Chart

From Feb 2024 to Feb 2025