0001175596false--03-312024-06-30Q120241040 West Georgia Street769231211702894211702894004203300011755962024-04-012024-06-3000011755962021-04-302021-05-020001175596ahr:SalariesFeesAndBenefitsMember2024-04-012024-06-300001175596ahr:SalariesFeesAndBenefitsMember2023-04-012023-06-300001175596ahr:FormerVPExplorationMember2024-04-012024-06-300001175596ahr:UnitedMineralServicesLtdMember2024-04-012024-06-300001175596ahr:UnitedMineralServicesLtdMember2023-04-012023-06-300001175596ahr:FormerVPExplorationMember2023-04-012023-06-300001175596ahr:ChiefFinancialOfficersMember2024-04-012024-06-300001175596ahr:ChiefFinancialOfficersMember2023-04-012023-06-300001175596ahr:DirectorsAndOfficersMember2023-04-012023-06-300001175596ahr:DirectorsAndOfficersMember2024-04-012024-06-300001175596ahr:HunterDickinsonServicesIncMember2023-04-012023-06-300001175596ahr:ThomasWilsonCFOFeesMember2024-06-300001175596ahr:UnitedMineralServicesLtdMember2023-03-310001175596ahr:UnitedMineralServicesLtdMember2024-06-300001175596ahr:HunterDickinsonServicesIncMember2023-03-310001175596ahr:HunterDickinsonServicesIncMember2024-06-300001175596ahr:ThomasWilsonCFOFeesMember2023-03-310001175596ahr:TwentyTwentyThreeNonFlowTthroughWarrantsMember2023-12-310001175596ahr:TwentyTwentyThreeNonFlowTthroughWarrantsMember2023-12-022023-12-310001175596ahr:InvestorRelationsAgreementMember2024-03-012024-03-220001175596ahr:InvestorRelationsAgreementMember2023-04-012023-04-110001175596ahr:OrdinarySharesCapitalMember2024-03-310001175596ahr:OrdinarySharesCapitalMember2024-06-300001175596ahr:PropertyAgreementMember2023-09-080001175596ahr:PrivatePlacementNonFlowShareMember2023-11-282023-12-010001175596ahr:PrivatePlacementFlowShareMember2023-11-282023-12-010001175596ahr:PrivatePlacementNonFlowShareMember2023-12-010001175596ahr:PrivatePlacementFlowShareMember2023-12-010001175596ahr:WarrantssMember2024-06-300001175596ahr:WarrantsThreeMember2024-04-012024-06-300001175596ahr:WarrantsTwoMember2024-04-012024-06-300001175596ahr:WarrantsOneMember2024-04-012024-06-300001175596ahr:WarrantssMember2024-04-012024-06-300001175596ahr:WarrantsThreeMember2024-06-300001175596ahr:WarrantsTwoMember2024-06-300001175596ahr:WarrantsOneMember2024-06-300001175596ahr:ExercisePriceSixMember2024-04-012024-06-300001175596ahr:ExercisePriceFiveMember2024-04-012024-06-300001175596ahr:ExercisePriceFourMember2024-04-012024-06-300001175596ahr:ExercisePriceThreeMember2024-04-012024-06-300001175596ahr:ExercisePriceTwoMember2024-04-012024-06-300001175596ahr:ExercisePriceOneMember2024-04-012024-06-300001175596ahr:ExercisePriceSixMember2024-06-300001175596ahr:ExercisePriceFiveMember2024-06-300001175596ahr:ExercisePriceFourMember2024-06-300001175596ahr:ExercisePriceThreeMember2024-06-300001175596ahr:ExercisePriceTwoMember2024-06-300001175596ahr:ExercisePriceOneMember2024-06-3000011755962021-12-012021-12-1300011755962019-12-3100011755962019-12-052019-12-3100011755962022-06-1500011755962022-06-012022-06-1500011755962023-04-012024-03-3100011755962022-04-012023-03-3100011755962022-03-310001175596ahr:DukePropertyMineralMemberahr:DukeDistrictMember2024-03-310001175596ahr:JOYDistrictAgreementwithFreeportMember2024-03-310001175596ahr:DukeDistrictCappedRoyaltyMember2023-07-070001175596ahr:DukeDistrictCappedRoyaltyMember2024-04-012024-06-300001175596ahr:DukeDistrictCappedRoyaltyMember2023-07-012023-07-070001175596ahr:DukePropertyMineralMemberahr:DukeDistrictMember2024-06-300001175596ahr:DukePropertyMineralMemberahr:DukeDistrictMember2022-04-012023-03-310001175596ahr:OtherPropertyTransactionsMember2024-04-012024-06-300001175596ahr:OtherPropertyTransactionsMember2022-05-012022-05-160001175596ahr:DukePropertyMineralMemberahr:DukeDistrictMember2024-04-012024-06-300001175596ahr:DukePropertyMineralMemberahr:DukeDistrictMember2016-11-012016-11-300001175596ahr:JOYDistrictAgreementwithFreeportMember2024-04-012024-06-300001175596ahr:JOYDistrictAgreementwithFreeportMember2021-05-012021-05-110001175596ahr:PaulaPropertyMember2019-11-300001175596ahr:GoldFieldsToodoggoneExplorationCorporationMember2024-04-012024-06-300001175596ahr:GoldFieldsToodoggoneExplorationCorporationMember2019-01-310001175596ahr:GoldFieldsToodoggoneExplorationCorporationMember2019-01-012019-01-310001175596ahr:GoldFieldsToodoggoneExplorationCorporationMember2018-10-012018-10-310001175596ahr:GoldFieldsToodoggoneExplorationCorporationMember2019-12-310001175596ahr:PINEPropertyMember2019-12-310001175596ahr:JoyDistrictMember2018-10-310001175596ahr:PINEPropertyMember2018-10-012018-10-310001175596ahr:CascaderoCopperCorporationMember2018-10-012018-10-310001175596ahr:GoldFieldsToodoggoneExplorationCorporationMember2024-06-300001175596ahr:JoyPropertyMineralMember2016-11-012016-11-300001175596ahr:IKEPropertyMineralMember2024-06-300001175596ahr:IKEDistrictMember2024-04-012024-06-300001175596ahr:GranitePropertyMineralMember2024-04-012024-06-300001175596ahr:IKEPropertyMineralMember2024-04-012024-06-300001175596ahr:PaulaPropertyMember2019-11-012019-11-300001175596ahr:DukePropertyMineralMemberahr:DukeDistrictMember2022-11-012022-11-220001175596ahr:CarlyleCommoditiesCorpSharesMember2023-04-012023-06-300001175596ahr:CarlyleCommoditiesCorpSharesMember2024-06-300001175596ahr:CarlyleCommoditiesCorpSharesMember2024-03-310001175596ahr:CarlyleCommoditiesCorpSharesMember2024-04-012024-06-300001175596ahr:OtherMember2024-04-012024-06-300001175596ahr:CarlyleCommoditiesCorpOneMember2024-04-012024-06-300001175596ahr:CarlyleCommoditiesCorpMember2024-04-012024-06-300001175596ahr:HunterDickinsonServicesIncMember2024-04-012024-06-300001175596ifrs-full:RetainedEarningsMember2024-06-300001175596ahr:ShareWarrantReserveMember2024-06-300001175596ahr:InvestmentRevaluationReserveMember2024-06-300001175596ahr:ShareBasedPaymentReserveMember2024-06-300001175596ahr:CommonStockMember2024-06-300001175596ifrs-full:RetainedEarningsMember2024-04-012024-06-300001175596ahr:ShareWarrantReserveMember2024-04-012024-06-300001175596ahr:InvestmentRevaluationReserveMember2024-04-012024-06-300001175596ahr:ShareBasedPaymentReserveMember2024-04-012024-06-300001175596ahr:CommonStockMember2024-04-012024-06-300001175596ifrs-full:RetainedEarningsMember2024-03-310001175596ahr:ShareWarrantReserveMember2024-03-310001175596ahr:InvestmentRevaluationReserveMember2024-03-310001175596ahr:ShareBasedPaymentReserveMember2024-03-310001175596ahr:CommonStockMember2024-03-3100011755962023-06-300001175596ifrs-full:RetainedEarningsMember2023-06-300001175596ahr:ShareWarrantReserveMember2023-06-300001175596ahr:InvestmentRevaluationReserveMember2023-06-300001175596ahr:ShareBasedPaymentReserveMember2023-06-300001175596ahr:CommonStockMember2023-06-300001175596ifrs-full:RetainedEarningsMember2023-04-012023-06-300001175596ahr:ShareWarrantReserveMember2023-04-012023-06-300001175596ahr:InvestmentRevaluationReserveMember2023-04-012023-06-300001175596ahr:ShareBasedPaymentReserveMember2023-04-012023-06-300001175596ahr:CommonStockMember2023-04-012023-06-3000011755962023-03-310001175596ifrs-full:RetainedEarningsMember2023-03-310001175596ahr:ShareWarrantReserveMember2023-03-310001175596ahr:InvestmentRevaluationReserveMember2023-03-310001175596ahr:ShareBasedPaymentReserveMember2023-03-310001175596ahr:CommonStockMember2023-03-3100011755962023-04-012023-06-3000011755962024-06-3000011755962024-03-31iso4217:CADiso4217:USDxbrli:sharesiso4217:CADxbrli:sharesxbrli:pureiso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

As at August 29, 2024

Commission File Number: 000-49869

AMARC RESOURCES LTD. |

(Translation of registrant's name into English) |

14th Floor – 1040 W. Georgia Street

Vancouver, British Columbia

Canada V6E 4H1

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

☒ Form 20-F ☐ Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

SUBMITTED HEREWITH

Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Amarc Resources Ltd. (Registrant) | |

| | |

Date: August 29, 2024 | By: | /s/ Thomas Wilson | |

| | Thomas Wilson | |

| | Chief Financial Officer | |

EXHIBIT 99.1

AMARC RESOURCES LTD.

FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED

JUNE 30, 2024 and 2023

(Expressed in Canadian Dollars)

(Unaudited)

Notice to Reader |

|

|

In accordance with subsection 4.3(3) of National Instrument 51-102, management of the Company advises that the Company's auditors have not performed a review of these interim financial statements. |

Amarc Resources Ltd. | | | | | | | | | |

Condensed Interim Statements of Financial Position | | | | |

(Unaudited - Expressed in Canadian Dollars) | | | | | | | | | |

| | | | | | | | | |

| | | | | June 30, | | | March 31, | |

| | | | | 2024 | | | 2024 | |

| | Note | | | ($) | | | ($) | |

| | | | | | | | | |

ASSETS | | | | | | | | | |

| | | | | | | | | |

Current assets | | | | | | | | | |

Cash | | | 3 | | | | 5,262,832 | | | | 9,007,042 | |

Amounts receivable and other assets | | | 6 | | | | 269,913 | | | | 216,124 | |

Marketable securities | | | 4 | | | | 36,835 | | | | 41,587 | |

| | | | | | | 5,569,580 | | | | 9,264,753 | |

Non-current assets | | | | | | | | | | | | |

Restricted cash | | | 5 | | | | 534,828 | | | | 534,828 | |

Right-of-use asset | | | 14 | | | | 36,989 | | | | 42,033 | |

Total assets | | | | | | | 6,141,397 | | | | 9,841,614 | |

| | | | | | | | | | | | |

LIABILITIES AND SHAREHOLDERS' EQUITY | | | | | | | | | | | | |

| | | | | | | | | | | | |

Current liabilities | | | | | | | | | | | | |

Accounts payable and accrued liabilities | | | 8 | | | | 2,396,215 | | | | 1,128,808 | |

Advanced contributions received | | | 7(b,c) | | | | 938,377 | | | | 5,132,721 | |

Balances due to related parties | | | 12 | | | | 101,428 | | | | 147,333 | |

Flow through liability | | | 10 | | | | 769,231 | | | | 769,231 | |

Lease liability | | | 14 | | | | 24,154 | | | | 23,443 | |

| | | | | | | 4,229,405 | | | | 7,201,536 | |

| | | | | | | | | | | | |

Non-current liabilities | | | | | | | | | | | | |

Director's loan | | | 9 | | | | 825,540 | | | | 784,947 | |

Lease liability | | | 14 | | | | 22,452 | | | | 28,764 | |

Total liabilities | | | | | | | 5,077,397 | | | | 8,015,247 | |

| | | | | | | | | | | | |

Shareholders' equity (deficiency) | | | | | | | | | | | | |

Share capital | | | 11 | | | | 67,236,421 | | | | 67,236,421 | |

Reserves | | | 11 | | | | 4,678,090 | | | | 4,617,658 | |

Accumulated deficit | | | | | | | (70,850,511 | ) | | | (70,027,712 | ) |

| | | | | | | 1,064,000 | | | | 1,826,367 | |

| | | | | | | | | | | | |

Total liabilities and shareholders' equity | | | | | | | 6,141,397 | | | | 9,841,614 | |

|

Nature of operations and going concern (note 1) | | |

| | |

The accompanying notes are an integral part of these condensed interim financial statements. |

| | |

/s/ Robert A. Dickinson | | /s/ Scott D. Cousens |

| | |

Robert A. Dickinson | | Scott D. Cousens |

Director | | Director |

Amarc Resources Ltd. |

Condensed Interim Statements of Loss |

(Unaudited -Expressed in Canadian Dollars, except for weighted average number of common shares) |

|

| | | | | Three months ended June 30, | |

| | Note | | | 2024 | | | 2023 | |

| | | | | ($) | | | ($) | |

Expenses | | | | | | | | | |

Exploration and evaluation | | | 7 | | | | 4,745,133 | | | | 2,395,347 | |

Assays and analysis | | | | | | | 183,838 | | | | 360,966 | |

Drilling | | | | | | | 1,235,891 | | | | - | |

Environmental | | | | | | | 12,024 | | | | 17,470 | |

Equipment rental | | | | | | | 59,686 | | | | 37,466 | |

Freight | | | | | | | 68,558 | | | | 24,591 | |

Geological, including geophysical | | | | | | | 1,047,365 | | | | 804,324 | |

Graphics | | | | | | | 15,495 | | | | 10,982 | |

Helicopter and fuel | | | | | | | 962,389 | | | | 431,025 | |

Property acquisition and assessments costs | | | | | | | 112,917 | | | | 102,928 | |

Site activities | | | | | | | 744,338 | | | | 444,521 | |

Socioeconomic | | | | | | | 162,169 | | | | 44,806 | |

Technical data | | | | | | | 19,030 | | | | 14,453 | |

Travel and accommodation | | | | | | | 121,433 | | | | 101,815 | |

| | | | | | | | | | | | |

Administration | | | | | | | 273,288 | | | | 181,113 | |

Legal, accounting and audit | | | | | | | 8,483 | | | | 3,944 | |

Office and administration | | | 13(b) | | | | 99,653 | | | | 72,332 | |

Rent | | | | | | | 14,587 | | | | 12,595 | |

Shareholder communication | | | | | | | 109,438 | | | | 70,906 | |

Travel and accommodation | | | | | | | 18,237 | | | | 16,265 | |

Trust and regulatory | | | | | | | 22,890 | | | | 5,071 | |

| | | | | | | | | | | | |

Equity-settled share-based compensation | | | | | | | 65,184 | | | | 26,758 | |

| | | | | | | | | | | | |

Cost recoveries | | | 7 | | | | (4,211,577 | ) | | | (1,799,566 | ) |

| | | | | | | | | | | | |

| | | | | | | 872,028 | | | | 803,652 | |

Other items | | | | | | | | | | | | |

Finance income | | | | | | | (121,876 | ) | | | (85,956 | ) |

Interest expense – director's loans | | | 9 | | | | 24,932 | | | | 24,932 | |

Accretion expense - office lease | | | | | | | 1,440 | | | | 2,071 | |

Other fee income | | | 7 | | | | - | | | | (375,000 | ) |

Amortization of right-of-use asset | | | | | | | 5,044 | | | | 5,045 | |

Transaction cost – director's loans | | | 9 | | | | 40,593 | | | | 30,472 | |

Foreign exchange loss | | | | | | | 638 | | | | (220 | ) |

Net loss | | | | | | | 822,799 | | | | 404,996 | |

| | | | | | | | | | | | |

Other comprehensive loss | | | | | | | | | | | | |

Items that will not be reclassified subsequently to loss: | | | | | | | | | | | | |

Change in value of marketable securities | | | | | | | 4,752 | | | | 56,942 | |

Total other comprehensive loss | | | | | | | 827,551 | | | | 461,938 | |

| | | | | | | | | | | | |

Basic and diluted loss per share | | | | | | | 0.00 | | | | 0.00 | |

| | | | | | | | | | | | |

Weighted average number of common | | | | | | | | | | | | |

shares outstanding | | | | | | | 211,702,894 | | | | 186,602,894 | |

| | | | | | | | | | | | |

The accompanying notes are an integral part of these condensed interim financial statements. |

Amarc Resources Ltd. | | | | | | |

Condensed Interim Statements of Comprehensive (Loss) |

(Unaudited - Expressed in Canadian Dollars) | | | | | | |

| | | | | | |

| | Three months ended June 30, | |

| | 2024 | | | 2023 | |

| | | | | | |

Net (loss) | | $ | (822,799 | ) | | $ | (404,996 | ) |

| | | | | | | | |

Other comprehensive (loss): | | | | | | | | |

Items that will not be reclassified subsequently to profit and loss: |

Revaluation of marketable securities | | | (4,752 | ) | | | (56,942 | ) |

Total other comprehensive (loss) | | | (4,752 | ) | | | (56,942 | ) |

| | | | | | | | |

Comprehensive (loss) | | $ | (827,551 | ) | | $ | (461,938 | ) |

| | | | | | | | |

The accompanying notes are an integral part of these condensed interim financial statements. |

Amarc Resources Ltd. | | | | | | | | | | | | | |

Condensed Interim Statements of Changes in (Deficiency) Equity | | | | | | | |

(Unaudited - Expressed in Canadian Dollars, except for share information) | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | Share capital | | | Reserves | | | | | | | |

| | Number of shares (#) | | | Amount ($) | | | Share-based payments reserve ($) | | | Investment revaluation reserve ($) | | | Share warrants reserve($) | | | Deficit ($) | | | Total ($) | |

| | | | | | | | | | | | | | | | | | | | | |

Balance at April 1, 2023 | | | 186,602,894 | | | | 65,228,921 | | | | 2,650,490 | | | | (1,495,692 | ) | | | 3,135,098 | | | | (69,984,262 | ) | | | (465,445 | ) |

Net loss for the period | | | - | | | | - | | | | - | | | | - | | | | - | | | | (404,996 | ) | | | (404,996 | ) |

Other comprehensive loss for the period | | | - | | | | - | | | | - | | | | (56,942 | ) | | | - | | | | - | | | | (56,942 | ) |

Total comprehensive loss | | | - | | | | - | | | | - | | | | (56,942 | ) | | | - | | | | (404,996 | ) | | | (461,938 | ) |

Equity-settled share-based compensation | | | - | | | | - | | | | 26,758 | | | | - | | | | - | | | | - | | | | 26,758 | |

Balance at June 30, 2023 | | | 186,602,894 | | | | 65,228,921 | | | | 2,677,248 | | | | (1,552,634 | ) | | | 3,135,098 | | | | (70,389,258 | ) | | | (900,625 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance at April 1, 2024 | | | 211,702,894 | | | | 67,236,421 | | | | 3,075,950 | | | | (1,593,390 | ) | | | 3,135,098 | | | | (70,027,712 | ) | | | 1,826,367 | |

Net loss for the period | | | - | | | | - | | | | - | | | | - | | | | - | | | | (822,799 | ) | | | (822,799 | ) |

Other comprehensive loss for the period | | | - | | | | - | | | | - | | | | (4,752 | ) | | | - | | | | - | | | | (4,752 | ) |

Total comprehensive loss | | | - | | | | - | | | | - | | | | (4,752 | ) | | | - | | | | (818,126 | ) | | | (822,878 | ) |

Equity-settled share-based compensation | | | - | | | | - | | | | 65,184 | | | | - | | | | - | | | | - | | | | 65,184 | |

Balance at June 30, 2024 | | | 211,702,894 | | | | 67,236,421 | | | | 3,141,134 | | | | (1,598,142 | ) | | | 3,135,098 | | | | (70,850,511 | ) | | | 1,064,000 | |

The accompanying notes are an integral part of these condensed interim financial statements.

Amarc Resources Ltd. | | | | | | | | | |

Condensed Interim Statements of Cash Flows | | | | | | | |

(Unaudited - Expressed in Canadian Dollars) | | | | | | | | | |

| | | | | | | | | |

| | | | | Three months ended June 30, | |

| | Note | | | 2024 | | | 2023 | |

| | | | | ($) | | | ($) | |

Operating activities | | | | | | | | | |

Net (loss) for the period | | | | | | (822,799 | ) | | | (404,996 | ) |

Adjustments for: | | | | | | | | | | | |

Amortization of right-of-use asset | | | 14 | | | | 5,044 | | | | 5,045 | |

Equity-settled share-based compensation | | | | | | | 65,184 | | | | 26,758 | |

Office lease accretion per IFRS 16 | | | 14 | | | | 1,440 | | | | 2,071 | |

Office base rent recorded as lease reduction per IFRS 16 | | | 14 | | | | (7,041 | ) | | | (6,931 | ) |

Transaction cost – director's loans | | | 9 | | | | 40,593 | | | | 30,472 | |

| | | | | | | | | | | | |

Changes in working capital items | | | | | | | | | | | | |

Amounts receivable and other assets | | | | | | | (53,789 | ) | | | 100,636 | |

Accounts payable and accrued liabilities | | | | | | | 1,267,407 | | | | (462,042 | ) |

Advanced contributions received | | | 7(b,c) | | | | (4,194,344 | ) | | | 2,849,644 | |

Balances due to related parties | | | | | | | (45,905 | ) | | | 51,906 | |

Net cash provided by (used in) operating activities | | | | | | | (3,744,210 | ) | | | 2,192,563 | |

| | | | | | | | | | | | |

Net increase (decrease) in cash | | | | | | | (3,744,210 | ) | | | 2,192,563 | |

Cash, beginning balance | | | | | | | 9,007,042 | | | | 5,131,510 | |

Cash, ending balance | | | | | | | 5,262,832 | | | | 7,324,073 | |

AMARC RESOURCES LTD. Notes to the Condensed Interim Financial Statements. For three months ended June 30, 2024 and 2023 (Unaudited – Expressed in Canadian Dollars, unless otherwise stated) |

1. NATURE AND CONTINUANCE OF OPERATIONS

Amarc Resources Ltd. (“Amarc” or the “Company”) is a company incorporated under the laws of the Province of British Columbia (“BC”). Its principal business activity is the acquisition and exploration of mineral properties. The Company’s mineral property interests are located in BC. The address of the Company’s corporate office is 14th Floor, 1040 West Georgia Street, Vancouver, BC, Canada V6E 4H1.

The Company is in the process of exploring its mineral property interests and has not yet determined whether its mineral property interests contain economically recoverable mineral reserves. The Company’s continuing operations are entirely dependent upon the existence of economically recoverable mineral reserves, the ability of the Company to obtain the necessary financing to continue the exploration and development of its mineral property interests and to obtain the permits necessary to mine, and the future profitable production from its mineral property interest or proceeds from the disposition of its mineral property interests.

These Condensed Interim financial statements as at and for the three months ended June 30, 2024 (the “Financial Statements”) have been prepared on a going concern basis, which contemplates the realization of assets and the discharge of liabilities in the normal course of business for the foreseeable future. As at June 30, 2024 , the Company had cash of $5,262,832, working capital of $1,340,175, and an accumulated deficit of $70,850,511.

The Company will need to seek additional financing to meet its exploration and development objectives. The Company has a reasonable expectation that additional funds will be available when necessary to meet ongoing exploration and development costs. However, there can be no assurance that the Company will continue to be able to obtain additional financial resources or will achieve profitability or positive cash flows. If the Company is unable to obtain adequate additional financing, the Company will be required to re-evaluate its planned expenditures until additional funding can be raised through financing activities. These factors indicate the existence of a material uncertainty that casts significant doubt about the Company’s ability to continue as a going concern.

These Financial Statements do not include any adjustments to the recoverability and classification of recorded asset amounts and classification of liabilities that may be necessary should the Company be unable to continue as a going concern.

2. MATERIAL ACCOUNTING POLICY INFORMATION

The principal accounting policies applied in the preparation of these Financial Statements are described below. These policies have been consistently applied for all years presented, unless otherwise stated.

(a) Statement of compliance

These Financial Statements have been prepared in accordance with International Financial Reporting Standards (“IFRS”), as issued by the International Accounting Standards Board (“IASB”) and the International Financial Reporting Interpretations Committee (“IFRIC”) effective for the Company’s reporting year ended March 31, 2024. These Financial Statements do not include all of the information and footnotes required by International Financial Reporting Standards (“IFRS”) for complete financial statements for year-end reporting purposes. These Financial Statements should be read in conjunction with the Company’s consolidated financial statements as at and for the year ended March 31, 2024. Results for the reporting period ended June 30, 2024 are not necessarily indicative of future results. The accounting policies and methods of computation applied by the Company in these Financial Statements are the same as those applied by the Company in its more recent annual financial statements, which are filed under the Company’s provide on SEDAR at www.sedarplus.com

AMARC RESOURCES LTD. Notes to the Condensed Interim Financial Statements. For three months ended June 30, 2024 and 2023 (Unaudited – Expressed in Canadian Dollars, unless otherwise stated) |

The Board of Directors of the Company authorized these Financial Statements for issuance on August 29, 2024.

(b) Basis of presentation

These Financial Statements have been prepared on a historical cost basis, except for certain financial instruments classified as fair value through other comprehensive income, which are reported at fair value. In addition, these Financial Statements have been prepared using the accrual basis of accounting, except for cash flow information.

Certain comparative amounts have been reclassified to conform to the presentation adopted in the current period.

(c) Significant accounting estimates and judgements

The preparation of the Financial Statements in conformity with IFRS requires management to make judgements, estimates, and assumptions that affect the application of policies and reported amounts of assets and liabilities, income and expenses. Actual results may differ from these estimates.

The impacts of such estimates are pervasive throughout the Financial Statements, and may require accounting adjustments based on future occurrences. Revisions to accounting estimates are recognized in the period in which the estimate is revised and future periods if the revision affects both current and future periods. These estimates are based on historical experience, current and future economic conditions and other factors, including expectations of future events that are believed to be reasonable under the circumstances. Specific areas where significant estimates or judgments exist are:

| · | assessment of the Company’s ability to continue as a going concern; |

| | |

| · | the determination of categories of financial assets and financial liabilities; and |

| | |

| · | the carrying value and recoverability of the Company’s marketable securities. |

(d) Operating segments

The functional and presentational currency of the Company is the Canadian Dollar (“CAD”).

Transactions in currencies other than the functional currency of the Company are recorded at the rates of exchange prevailing on the dates of transactions. At each financial position reporting date, monetary assets and liabilities that are denominated in foreign currencies are translated at the rates of exchange prevailing at the date when the fair value was determined. Non-monetary items that are measured in terms of historical cost in a foreign currency are not re-translated. Gains and losses arising on translation are included in profit or loss for the year.

AMARC RESOURCES LTD. Notes to the Condensed Interim Financial Statements. For three months ended June 30, 2024 and 2023 (Unaudited – Expressed in Canadian Dollars, unless otherwise stated) |

3. CASH

The Company’s cash is invested in business accounts, which are available on demand by the Company.

4. MARKETABLE SECURITIES

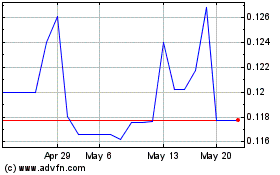

As at June 30, 2024, the fair value of its current holdings was $36,835 (March 31, 2024 - $41,587) and during the three months ended June 30, 2024 there was a negative change of fair value adjustment of $4,752 (June 30, 2023 – $56,942). The marketable securities include 550,000 units (shares and warrants) of Carlyle Commodities Corp., a Canadian public company listed on the TSX Venture Exchange.

As at June 30, 2024, the Company held the following marketable securities:

Company | | Shares/Warrants Held | | | Cost | | | Fair Value | | | Fair Value Increase (Decrease) | |

| | (#) | | | ($) | | | ($) | | | ($) | |

Carlyle Commodities Corp - Shares | | | 550,000 | | | | 907,500 | | | | 22,000 | | | | (885,500 | ) |

Carlyle Commodities Corp - Warrants | | | 550,000 | | | | 727,000 | | | | 1,000 | | | | (726,000 | ) |

Other | | | 1,680,729 | | | | 14,237 | | | | 13,835 | | | | (402 | ) |

Total | | | 2,780,729 | | | | 1,648,737 | | | | 36,835 | | | | (1,611,902 | ) |

5. RESTRICTED CASH

Restricted cash represents amounts held in support of exploration permits. The amounts are refundable subject to the consent of regulatory authorities upon completion of any required reclamation work on the related projects.

6. AMOUNTS RECEIVABLE AND OTHER ASSETS

| | June 30, 2024 | | | March 31, 2024 | |

| | ($) | | | ($) | |

Sales tax refundable | | | 214,219 | | | | 158,223 | |

Prepaid | | | 55,694 | | | | 57,901 | |

| | | 269,913 | | | | 216,124 | |

7. EXPLORATION AND EVALUATION EXPENSES AND COST RECOVERIES

Below is a summary of the Company’s major exploration property interests, together with the material property transactions.

(a) IKE District

The IKE Property mineral claims (a subset of the IKE District mineral tenure) carry a net smelter return (“NSR”) royalty obligation of 1%, subject to a $2 million cap and which the Company is able to purchase at any time by payment of the same amount. These claims carry an additional NSR royalty of 2%, subject to the Company retaining the right to purchase up to the entire royalty amount by the payment of up to $4 million. The Company has also agreed to make annual advance royalty payments of $50,000 to the holders of the 2% NSR royalty interest and, upon completion of a positive feasibility study, to issue to these same parties 500,000 common shares.

AMARC RESOURCES LTD. Notes to the Condensed Interim Financial Statements. For three months ended June 30, 2024 and 2023 (Unaudited – Expressed in Canadian Dollars, unless otherwise stated) |

The Granite Property mineral claims (a subset of the IKE District mineral tenure) are subject to a 2% NSR royalty which can be purchased for $2 million. In addition, there is an underlying 2.5% NSR royalty on certain mineral claims within the Granite Property, which can be purchased at any time for $1.5 million less any amount of royalty already paid.

The entire IKE District is subject to a 1% NSR royalty from mine production capped at a total of $5 million.

(b) JOY District

In November 2016, the Company entered into a purchase agreement with a private company wholly-owned by one of its directors to purchase 100% of the JOY Property mineral claims (a subset of the JOY District mineral tenure) for the reimbursement of the vendor’s direct acquisition costs of $335,299.

In addition, the Company concluded agreements with each of Gold Fields Toodoggone Exploration Corporation (“GFTEC”) and Cascadero Copper Corporation (“Cascadero”) in mid-2017 pursuant to which the Company can purchase 100% of the PINE Property mineral claims (a subset of the JOY District Mineral tenure).

In October 2018, Amarc acquired a 100% interest in Cascadero’s 49% interest in the PINE Property by completing total cash payments of $1 million and issuing 5,277,778 common shares.

In December 2019, the Company amended the GFTEC Agreement to purchase GFTEC’s 51% interest in the PINE Property. Under the terms of the amendment Amarc purchased outright GFTEC’s 51% interest in the PINE Property by issuing to GFTEC 5,000,000 common shares of the Company. As such, Amarc now holds a 100% interest in the PINE Property mineral claims.

The PINE Property is subject to a 3% underlying NSR royalty payable (“Underlying NSR”) to a former owner. The Company reached an agreement with the former owner to cap the 3% NSR royalty at $5 million payable from production for consideration totaling $100,000 and 300,000 common shares payable in stages through to January 31, 2019 (completed).

GFTEC retains a 2.5% net profits interest (“NPI”) royalty on mineral claims comprising approximately 96% of the PINE Property, which are subject to the Underlying NSR and a 1% NSR royalty on the balance of the claims that are not subject to the Underlying NSR. The NPI royalty can be reduced to 1.25% at any time through the payment to GFTEC of $2.5 million in cash or shares. The NSR royalty can be reduced to 0.5% through the payment to GFTEC of $2.5 million in cash or shares.

In November 2019 Amarc entered into a purchase agreement with two prospectors to acquire 100% of a single mineral claim, called the Paula Property, located internal to the wider JOY District mineral tenure. The claim is subject to a 1% NSR royalty payable from commercial production that is capped at $500,000.

JOY District Agreement with Freeport

On May 11, 2021, the Company and Freeport-McMoRan Mineral Properties Canada Inc. (“Freeport”), a wholly-owned subsidiary of Freeport-McMoRan Inc. (NYSE:FCX) entered into a Mineral Property Earn-in Agreement (the “Agreement”) whereby Freeport may acquire up to a 70% ownership interest of the Company’s JOY porphyry Cu-Au District Property.

AMARC RESOURCES LTD. Notes to the Condensed Interim Financial Statements. For three months ended June 30, 2024 and 2023 (Unaudited – Expressed in Canadian Dollars, unless otherwise stated) |

Under the terms of the Agreement, Freeport has a two-stage option to earn up to a 70% ownership interest in the mineral claims comprising the JOY District, plus other rights and interests, over a 10 year period.

To earn an initial 60% interest, Freeport is required to fund $35 million of work expenditures over a 5- year term.

These optional earn-in expenditures can be accelerated by Freeport at its discretion. Amarc will be operator during the initial earn-in period. Once Freeport has acquired such 60% interest, Amarc and Freeport will proceed to operate the JOY District through a jointly owned corporation with Freeport assuming project operatorship.

Upon Freeport earning such 60% interest, it can elect, in its sole discretion, to earn an additional 10% interest, for an aggregate 70% interest by sole funding a further $75 million within the following five years.

Once Freeport has finalized its earned ownership interest at either the 60% or 70% level, each party will be responsible for funding its own pro-rata share of project costs on a 60:40 or 70:30 basis.

The Company initially records the amounts of contributions received or receivable from Freeport pursuant to the Agreement as a liability (advanced contributions received) in the statements of financial position, and subsequently reallocates amounts as cost recoveries in the statements of (income) loss as the Company incurs the related expenditures. During the year ended March 31, 2024, the Company recorded advanced contributions balance of $1,187,195.

During the three months ended June 30, 2024, the $1,187,195 advanced contributions balance was fully reallocated as cost recoveries to offset the expenditures incurred pursuant to the Agreement.

(c) DUKE District

The DUKE District is located in central BC. In November 2016, the Company entered into a purchase agreement with a private company wholly-owned by one of its directors (Note 12(c)) to purchase a 100% interest in the DUKE Property mineral claims (a subset of the DUKE District mineral tenure) for the reimbursement of the vendor’s direct acquisition costs of $168,996.

DUKE District Agreement with Boliden

On November 22, 2022, the Company announced that it had entered into a Mineral Property Earn-in Agreement (the "Agreement") with Boliden Mineral Canada Ltd. (“Boliden”), a wholly-owned subsidiary of the Boliden Group. Under the terms of the Agreement, Boliden has a two-staged option to earn up to a 70% interest in the DUKE District.

To earn an initial 60% interest Boliden must fund $30 million of exploration and development expenditures within four years of the effective date of the Agreement, of which $5 million is a committed amount to be spent in calendar 2022 and early calendar 2023. Amarc will be the operator during this initial earn-in stage.

Upon earning a 60% interest, Boliden can elect to earn an additional 10% interest in the Duke District, for an aggregate 70% interest, by funding an additional $60 million of exploration and development expenditures at a minimum rate of $10 million per year over the ensuing six years. Once Boliden has earned a 60% interest it will also have the right to become the operator.

AMARC RESOURCES LTD. Notes to the Condensed Interim Financial Statements. For three months ended June 30, 2024 and 2023 (Unaudited – Expressed in Canadian Dollars, unless otherwise stated) |

Upon Boliden finalizing its earned ownership interest, Amarc and Boliden will form either a 60:40 or 70:30 unincorporated joint venture to further advance the DUKE District. At that stage, each party will be responsible for funding its own pro-rata share of project costs, or be subject to customary equity dilution, converting to a capped royalty if it falls below a 10% participating interest.

The Company initially records the amounts of contributions received or receivable from Boliden pursuant to the Agreement as a liability (advanced contributions received) in the statements of financial position, and subsequently recognizes amounts as cost recoveries in the statements of (income) loss as the Company incurs the related expenditures. During the three months ended June 30, 2024, the Company recorded advanced contributions balance of $938,377 (March 31, 2024 - $3,945,526).

During the three months ended June 30, 2024, the Company recorded a gross amount of cost recovery of $3,007,149 offsetting the expenditures incurred pursuant to the Agreement.

DUKE District Capped Royalty

Amarc holds 100% interest in the 722 km2 DUKE District which is largely free of any underlying royalty.

On July 7, 2023, the Company entered into a mineral property option agreement with an arms-length third party optionor to acquire a 100% interest in and to a property, subject to a 2% NSR royalty in the event of commercial production on the property, payable until $10 million has been paid after which the NSR shall cease. To acquire the property, the Company must issue 200,000 common shares and make annual cash payments of $5,000 to the optionor plus funding an annual scholarship for Indigenous students for a period of 10 years in the amount of $20,000 per year.

(d) Other property transactions

On December 16, 2020, the Company closed the sale of its Newton Property, located in south-central BC, to Isaac Mining Corp., an arms-length private company and a wholly-owned subsidiary of Carlyle Commodities Corp. Amarc retains a 2% NSR Royalty in the Newton Property.

On May 16, 2022, the Company entered into a mineral claims option agreement with an arms-length third party optionor to acquire a 100% interest in and to a property, subject to a 2% NSR royalty in the event of commercial production on the property, payable until $10,000,000 has been paid after which the NSR royalty reduces to 0.5%. The Company paid $100,000 during the year ended March 31, 2023 and shall pay $100,000 on or before May 31, 2023 and each year thereafter to, and including, May 31, 2031 until an aggregate of $1,000,000 has been paid to optionor.

8. ACCOUNTS PAYABLE AND ACCRUED LIABILITIES

| | June 30, 2024 | | | March 31, 2024 | |

| | ($) | | | ($) | |

Accounts payable | | | 2,086,135 | | | | 842,821 | |

Accrued liabilities | | | 310,080 | | | | 285,987 | |

Total | | | 2,396,215 | | | | 1,128,808 | |

AMARC RESOURCES LTD. Notes to the Condensed Interim Financial Statements. For three months ended June 30, 2024 and 2023 (Unaudited – Expressed in Canadian Dollars, unless otherwise stated) |

9. DIRECTOR’S LOAN

In December 2019, the Company entered into a loan extension and amendment agreement (the “Loan”) with a director and significant shareholder of the Company (the “Lender”), pursuant to which a previous loan agreement with a maturity date of November 26, 2019 was extended for five years or earlier pending the achievement of certain financing milestones. The Loan has a principal sum of $1,000,000, is unsecured and bears interest at a rate of 10% per annum. On December 13, 2021, a total of $160,000 in interest was paid.

Pursuant to the Loan, the Company issued to the Lender a loan bonus comprising of 16,000,000 common share purchase warrants (the “Warrants”) with an expiry of five years and an exercise price of $0.05 per share.

The Company entered into a Second Loan Amendment Agreement dated May 25, 2022, pursuant to which it agreed to a $100,000 increase to the existing Loan (the “Additional Loan”). The Additional Loan is unsecured, bears interest at a rate of 10% per annum and is repayable on or before the earlier of November 26, 2024, the occurrence of a default or on achievement of financing milestones.

In connection with the Additional Loan, the Company issued to the Lender a loan bonus comprising of 1,176,470 common share purchase warrants (the "Bonus Warrants"), each entitling the holder to acquire one common share of the Company until November 26, 2024 at a price of $0.085 per share.

On June 15, 2022, the Company obtained an additional short-term loan (the “Short-term Loan”) of $250,000 with an interest rate of 12% per annum from the Lender.

In January 2023, the Company repaid the Additional Loan and Short-term Loan, including accrued interest accrued to the date of repayment.

The change in the Loan balance is as follows:

| | Year ended | | | Year ended | |

| | March 31, 2024 | | | March 31, 2024 | |

| | ($) | | | ($) | |

Opening balance | | | 784,947 | | | | 648,005 | |

Amortization of transaction costs | | | 40,593 | | | | 136,942 | |

Closing balance | | | 825,540 | | | | 784,947 | |

| | | | | | | | |

| | Year ended | | | Year ended | |

| | March 31, 2024 | | | March 31, 2024 | |

| | ($) | | | ($) | |

Non-current portion | | | 825,540 | | | | 784,947 | |

Total | | | 825,540 | | | | 784,947 | |

| | | | | | | | |

Finance expenses | | Three months ended June 30, |

| | 2024 | | | 2023 | |

| | ($) | | | ($) | |

Interest on loan | | | 24,932 | | | | 24,932 | |

Amortization of transaction costs | | | 40,593 | | | | 30,472 | |

Total | | | 65,525 | | | | 55,404 | |

AMARC RESOURCES LTD. Notes to the Condensed Interim Financial Statements. For three months ended June 30, 2024 and 2023 (Unaudited – Expressed in Canadian Dollars, unless otherwise stated) |

10. FLOW THROUGH LIABILITY

During the year ended March 31, 2024, the Company issued 15,384,615 flow-through shares at a price of $0.13 per share for gross proceeds of $2,000,000 (the “Financing”) and recognized a flow-through premium liability of $769,231 based on the difference between the flow-through share price and the non-flow-through share price in the concurrent offering. During the year ended March 31, 2024, the Company did not incur qualifying exploration expenses, subsequent to the Financing. The flow-through premium liability outstanding relating to these flow-through shares is $769,231 as at June 30, 2024 and March 31, 2024.

11. SHARE CAPITAL AND RESERVES

(a) Authorized and outstanding share capital

The Company’s authorized share capital consists of an unlimited number of common shares without par value (“Common Shares”) and an unlimited number of preferred shares. All issued Common Shares are fully paid. No preferred shares have been issued.

On September 8, 2023, 100,000 common shares were issued pursuant to a property agreement at $0.075 per share.

On December 1, 2023, 15,384,615 flow-through shares were issued pursuant to a flow-through private placement at a price of $0.13 each, totaling $2,000,000.

On December 1, 2023, 9,615,385 non-flow-through shares were issued pursuant to a non-flow-through private placement at a price of $0.08 each, totaling $769,231.

As at June 30, 2024, the amount of flow-through proceeds remaining to be expensed is approximately $2,383,000 (March 31, 2024 - $2,383,000).

The BCMETC cannot be claimed by the Company on mineral exploration expenses related to meeting expenditure commitments pursuant to the issue of flow-through shares; however, the BCMETC itself, once received, may be used for any purpose.

There were no share issuances during the period ended June 30, 2024 for the Company.

As at June 30, 2024, there were 211,702,894 (March 31, 2024 – 211,702,894) Common Shares issued and outstanding.

(b) Share purchase options

On April 11, 2023, the Company granted 520,000 incentive stock options to certain associates to acquire an aggregate of 520,000 common shares at $0.125 per share, for a period of three years, of which 200,000 options were granted to insiders (Note 12(a)). All of the options are subject to the required TSX Venture Exchange acceptance and customary vesting provisions over 24 months. The fair value of these options at issue was determined to be $49,647 using the Black-Scholes pricing model and based on the following assumptions: risk-free rate of 3.56%; expected volatility of 123%; underlying market price of $0.13; strike price of $0.125; expiry term of 3 years; and dividend yield of nil.

On March 22, 2024 the Company granted 6,410,000 incentive stock options to certain associates to acquire an aggregate of 6,410,000 common shares at $0.105 per share, for a period of three to five years, of which 5,500,000 options were granted to insiders (Note 12(a)). All of the options are subject to the required TSX Venture Exchange acceptance and customary vesting provisions over 24 months. The fair value of these options at issue was determined to be $589,109 using the Black-Scholes pricing model and based on the following assumptions: risk-free rate of 3.48%; expected volatility of 95% for options with three year expiry term and 131% for options with five year expiry term; underlying market price of $0.11; strike price of $0.105; and dividend yield of nil.

AMARC RESOURCES LTD. Notes to the Condensed Interim Financial Statements. For three months ended June 30, 2024 and 2023 (Unaudited – Expressed in Canadian Dollars, unless otherwise stated) |

The following summarizes changes in the Company’s share purchase options:

| | June 30, 2024 | | | March 31, 2024 | |

| | Weighted Average Exercise Price | | | Number of Options | | | Weighted Average Exercise Price | | | Number of Options | |

Beginning balance | | | 0.102 | | | | 13,410,000 | | | | 0.100 | | | | 6,480,000 | |

Cancelled | | | 0.117 | | | | (1,100,000 | ) | | NA | | | | - | |

Granted | | NA | | | | - | | | | 0.107 | | | | 6,930,000 | |

Ending balance | | | 0.100 | | | | 12,310,000 | | | | 0.102 | | | | 13,410,000 | |

The following summarizes information on the options outstanding and exercisable as at June 30, 2024:

| | | | | Weighted Average Remaining | | | Number of | | | Number of | |

| | | | | Contractual | | | Options | | | Options | |

Exercise price | | | Expiry date | | Life (periods) | | | Outstanding | | | Exercisable | |

| | | | | | | | | | | | |

| $ | 0.05 | | | 4-Oct-24 | | | 0.26 | | | | 2,000,000 | | | | 2,000,000 | |

| $ | 0.12 | | | 9-Mar-25 | | | 0.69 | | | | 2,580,000 | | | | 1,719,998 | |

| $ | 0.11 | | | 8-Jul-27 | | | 3.02 | | | | 1,000,000 | | | | 1,000,000 | |

| $ | 0.125 | | | 11-Apr-26 | | | 1.78 | | | | 520,000 | | | | 346,666 | |

| $ | 0.105 | | | 22-Mar-29 | | | 4.73 | | | | 5,300,000 | | | | 2,650,000 | |

| $ | 0.105 | | | 22-Mar-27 | | | 2.73 | | | | 910,000 | | | | 705,000 | |

| | | | | | | 2.75 | | | | 12,310,000 | | | | 8,421,665 | |

(c) Share purchase warrants

The following common summarizes changes in the Company’s share purchase warrants:

| | June 30, 2024 | | | March 31, 2024 | |

| | Weighted Average Exercise Price | | | Number of Warrants | | | Weighted Average Exercise Price | | | Number of Warrants | |

Beginning balance | | | 0.06 | | | | 10,984,163 | | | | 0.06 | | | | 6,176,470 | |

Granted pursuant to a private placement | | | | | | | | | | | 0.08 | | | | 4,807,693 | |

Ending balance | | | 0.06 | | | | 10,984,163 | | | | 0.06 | | | | 10,984,163 | |

In December 2023, 4,807,693 share purchase warrants were issued pursuant to a non-flow-through private placement. The share purchase warrants have a strike price of $0.08, an expiry term of 5 years, and are subject to a blocker term that prohibits exercise of the warrants to the extent the holder would as a result of any exercise exceed 19.99% of the issued shares.

AMARC RESOURCES LTD. Notes to the Condensed Interim Financial Statements. For three months ended June 30, 2024 and 2023 (Unaudited – Expressed in Canadian Dollars, unless otherwise stated) |

The following summarizes information on the warrants outstanding as at June 30, 2024:

| | | | | Weighted Average | | | | |

| | | | | Remaining Contractual | | | Warrants | |

Exercise price | | | Expiry date | | Life (periods) | | | Outstanding | |

| | | | | | | | | |

| $ | 0.050 | | | 26-Nov-24 | | | 0.41 | | | | 5,000,000 | |

| $ | 0.085 | | | 26-Nov-24 | | | 0.41 | | | | 1,176,470 | |

| $ | 0.080 | | | 1-Dec-28 | | | 4.42 | | | | 4,807,693 | |

| | | | | | | 2.17 | | | | 10,984,163 | |

12. RELATED PARTY TRANSACTIONS

| | June 30, 2024 | | | March 31, 2024 | |

Balances due to related parties | | ($) | | | ($) | |

Hunter Dickinson Services Inc. | | | 101,428 | | | | 134,251 | |

United Mineral Services Ltd. | | | - | | | | 7,586 | |

Thomas Wilson (CFO fees) | | | - | | | | 5,496 | |

Total | | | 101,428 | | | | 147,333 | |

(a) Transactions with key management personnel

Key management personnel (“KMP”) are those persons that have the authority and responsibility for planning, directing, and controlling the activities of the Company, directly and indirectly, and by definition include all the directors of the Company.

Note 9 includes the details of a director’s loan. Note 7(b) and 7(c) includes the details of the acquisition of mineral property interests from a private entity wholly-owned by one of the directors of the Company.

During the three months ended June 30, 2024 and 2023, the Company’s President, Chief Executive Officer and Director and Corporate Secretary provided services to the Company under a service agreement with Hunter Dickinson Services Inc. (Note 12(b)).

During the three months ended June 30, 2024, the Company recorded share-based compensation expense of $60,432 (June 30, 2023 - $11,679) in relation to 6,750,000 (June 30, 2023 – 1,950,000) stock options issued to directors and officers of the Company in the prior year (Note 11 (b)).

During the three months ended June 30, 2024, the Company incurred fees totaling $15,703 (June 30, 2023 -$16,488) in respect of services provided by the Chief Financial Officer.

On June 25, 2024, the Company announced the resignation of the VP Exploration.

During the three months ended June 30, 2024, the Company incurred fees totaling $33,333 (2023 - nil) in respect of geological services provided by the former-VP Exploration.

AMARC RESOURCES LTD. Notes to the Condensed Interim Financial Statements. For three months ended June 30, 2024 and 2023 (Unaudited – Expressed in Canadian Dollars, unless otherwise stated) |

(b) Hunter Dickinson Services Inc.

Hunter Dickinson Inc. (“HDI”) and its wholly-owned subsidiary Hunter Dickinson Services Inc. (“HDSI”) are private companies established by a group of mining professionals. HDSI provides contract services for a number of mineral exploration and development companies, and also to companies that are outside of the mining and mineral development space. Amarc acquires services from a number of related and arms-length contractors, and it is at Amarc’s discretion that HDSI provides certain contract services.

The Company has one director in common with HDSI, namely Robert Dickinson. Also, the Company’s President, Chief Executive Officer and Director, and Corporate Secretary are contracted to work for the Company under an employee secondment agreement between the Company and HDSI.

Pursuant to an agreement dated July 2, 2010, HDSI provides certain cost effective technical, geological, corporate communications, regulatory compliance, and administrative and management services to the

Company, on a non-exclusive basis as needed and as requested by the Company. As a result of this relationship, the Company has ready access to a range of diverse and specialized expertise on a regular basis, without having to engage or hire full-time employees or experts. The Company benefits from the economies of scale created by HDSI which itself serves several clients both within and external to the exploration and mining sector.

The Company is not obligated to acquire any minimum amount of services from HDSI. The monetary amount of the services received from HDSI in a given period of time is a function of annually set and agreed charge-out rates for and the time spent by each HDSI employee engaged by the Company.

HDSI also incurs third-party costs on behalf of the Company. Such third-party costs include, for example, capital market advisory services, communication services and office supplies. Third-party costs are billed at cost, without markup.

There are no ongoing contractual or other commitments resulting from the Company’s transactions with HDSI, other than the payment for services already rendered and billed. The agreement may be terminated upon 60 days’ notice by either the Company or HDSI.

The following is a summary of transactions with HDSI that occurred during the reporting period:

| | Three months ended June 30, | |

| | 2024 | | | 2023 | |

(rounded to the nearest thousand CAD) | | ($) | | | ($) | |

Services received from HDSI and as requested by the Company | | | 429,000 | | | | 290,000 | |

Information technology – infrastructure and support services | | | 21,000 | | | | 15,000 | |

Office rent | | | 15,000 | | | | 13,000 | |

Reimbursement, at cost, of third-party expenses | | | | | | | | |

incurred by HDSI on behalf of the Company | | | 72,000 | | | | 81,000 | |

Total | | | 537,000 | | | | 399,000 | |

(c) United Mineral Services Ltd.

United Mineral Services Ltd. (“UMS”) is a private company wholly-owned by one of the directors of the Company. UMS is engaged in the acquisition and exploration of mineral property interests. During the three months ended June 30, 2024, the Company incurred fees of $4,901 (2023 - $nil) in respect of geological services provided by UMS.

AMARC RESOURCES LTD. Notes to the Condensed Interim Financial Statements. For three months ended June 30, 2024 and 2023 (Unaudited – Expressed in Canadian Dollars, unless otherwise stated) |

13. SUPPLEMENTARY INFORMATION TO THE STATEMENTS OF LOSS

(a) Salaries, fees and benefits

Salaries, fees and benefits included in exploration and evaluation expenses and administration expenses are as follows:

| | Three months ended June 30, | |

| | 2024(1) | | | 2023(1) | |

Salaries, fees and benefits | | ($) | | | ($) | |

Exploration and evaluation expenses | | | 2,456,000 | | | | 944,000 | |

Administration expenses(2) | | | 81,000 | | | | 56,000 | |

| | | 2,537,000 | | | | 1,000,000 | |

(1) rounded to the nearest thousand dollar

(2) includes salaries and benefits included in office and administration expenses (Note 13(b)) and other salaries and benefits expenses classified as administration expenses

(b) Office and administration expenses

Office and administration expenses include the following:

| | Three months ended June 30, | |

| | 2024(1) | | | 2023(1) | |

| | ($) | | | ($) | |

Salaries and Benefits | | | 81,000 | | | | 59,000 | |

Data processing and retention | | | 4,000 | | | | 3,000 | |

Insurance | | | 7,000 | | | | 7,000 | |

Other office expenses | | | 8,000 | | | | 5,000 | |

| | | 100,000 | | | | 74,000 | |

(1) rounded to the nearest thousand dollar

14. OFFICE LEASE – RIGHT OF USE ASSET AND LEASE LIABILITY

The Company subleases corporate offices in Vancouver, BC, from HDSI under a lease agreement dated May 1, 2021, and the lease expires on April 29, 2026.

AMARC RESOURCES LTD. Notes to the Condensed Interim Financial Statements. For three months ended June 30, 2024 and 2023 (Unaudited – Expressed in Canadian Dollars, unless otherwise stated) |

Right-of-use asset

A summary of the changes in the right-of-use asset for the three months ended June 30, 2024 and the year ended March 31, 2024 are as follows:

Right-of-use-asset | | ($) | |

Balance at March 31, 2023 | | | 62,208 | |

Amortization | | | (20,175 | ) |

Balance at March 31, 2024 | | | 42,033 | |

Amortization | | | (5,044 | ) |

Balance at June 30, 2024 | | | 36,989 | |

Lease liability

On May 1, 2021, the Company entered into the lease agreement, which resulted in the lease liability of $100,877 (undiscounted value of $134,766, discount rate used is 12.00%). This liability represents the monthly lease payment from May 1, 2021 to April 29, 2026, the end of the lease term less abatement granted by HDSI.

A summary of changes in the lease liability during the three months ended June 30, 2024 and the year ended March 31, 2024 are as follows:

Lease liability | | ($) | |

Balance at March 31, 2023 | | | 72,903 | |

Lease payment – base rent portion | | | (28,056 | ) |

Lease liability – accretion expense | | | 7,360 | |

Balance as at March 31, 2024 | | | 52,207 | |

Current portion | | | 23,443 | |

Long-term portion | | | 28,764 | |

| | | | |

Lease liability | | ($) | |

Balance at March 31, 2024 | | | 52,207 | |

Lease payment – base rent portion | | | (7,041 | ) |

Lease liability – accretion expense | | | 1,440 | |

Balance at June 30, 2024 | | | 46,606 | |

Current portion | | | 24,154 | |

Long-term portion | | | 22,452 | |

AMARC RESOURCES LTD. Notes to the Condensed Interim Financial Statements. For three months ended June 30, 2024 and 2023 (Unaudited – Expressed in Canadian Dollars, unless otherwise stated) |

The following is a schedule of the Company’s future lease payments (base rent portion) under the lease obligations:

Future lease payments (base rent portion only) | | ($) | |

Fiscal 2025 (July 1, 2024 to March 31, 2025) | | | 21,124 | |

Fiscal 2026 (April 1, 2025 to March 31, 2026) | | | 28,165 | |

Fiscal 2027 (April 1, 2026 to April 29, 2027) (Note 6) | | | 2,347 | |

Total undiscounted lease payments | | | 51,636 | |

Less: imputed interest | | | (5,030 | ) |

Lease liability as at June 30, 2024 | | | 46,606 | |

15. FINANCIAL RISK MANAGEMENT

(a) Capital management objectives

The Company’s primary objectives when managing capital are to safeguard the Company’s ability to continue as a going concern so that it can continue to provide returns for shareholders, and to have sufficient liquidity available to fund ongoing expenditures and suitable business opportunities as they arise.

The Company considers the components of shareholders’ equity as well as its cash as capital. The Company manages its capital structure and makes adjustments to it in light of changes in economic conditions and the risk characteristics of the underlying assets. In order to maintain or adjust the capital structure, the Company may issue equity, sell assets, or return capital to shareholders as well as issue or repay debt.

The Company’s investment policy is to invest its cash in highly liquid, short-term, interest-bearing investments having maturity dates of three months or less from the date of acquisition, which are readily convertible into known amounts of cash.

The Company is not subject to any imposed equity requirements.

There were no changes to the Company’s approach to capital management during the three months ended June 30, 2024.

(b) Carrying amounts and fair values of financial instruments

The Company’s marketable securities are carried at fair value based on quoted prices in active markets.

As at June 30, 2024 and March 31, 2024, the carrying values of the Company’s financial assets and financial liabilities approximate their fair values.

(c) Financial instrument risk exposure and risk management

The Company is exposed in varying degrees to a variety of financial instrument-related risks. The Board of Directors approves and monitors the risk management processes, inclusive of documented treasury policies, counterparty limits, and controlling and reporting structures. The type of risk exposure and the way in which such exposure is managed is provided as follows:

AMARC RESOURCES LTD. Notes to the Condensed Interim Financial Statements. For three months ended June 30, 2024 and 2023 (Unaudited – Expressed in Canadian Dollars, unless otherwise stated) |

Credit risk

Credit risk is the risk of potential loss to the Company if a counterparty to a financial instrument fair to meet its contractual obligations. The Company’s credit risk is primarily attributable to its liquid financial assets, including cash, and amounts receivable and other assets. The carrying values of these financial assets represent the Company’s maximum exposure to credit risk.

The Company limits the exposure to credit risk by only investing its cash in high-credit quality financial institutions in business and savings accounts, which are available on demand by the Company for its programs.

Liquidity risk

Liquidity risk is the risk that the Company will encounter difficulty in meeting the obligations associated with its financial liabilities that are settled by delivering cash or other financial assets. The Company ensures that there is sufficient cash in order to meet its short-term business requirements after taking into account the Company’s holdings of cash.

The Company has sufficient cash to meet its commitments associated with its financial liabilities in the near term, other than the amounts payable to related parties.

Interest rate risk

The Company is subject to interest rate risk with respect to its investments in cash. The Company’s policy is to invest cash at variable rates of interest and cash reserves are to be maintained in cash in order to maintain liquidity, while achieving a satisfactory return for shareholders. Fluctuations in interest rates when cash matures impact interest income earned.

As at June 30, 2024 and March 31, 2024, the Company’s exposure to interest rate risk was nominal.

Price risk

Equity price risk is defined as the potential adverse impact on the Company’s earnings due to movements in individual equity prices or general movements in the level of the stock market. The Company is subject to price risk in respect of its investments in marketable securities.

As at June 30, 2024 and March 31, 2024, the Company’s exposure to price risk was not significant in relation to these Financial Statements.

nullnullnull

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFiscal period values are FY, Q1, Q2, and Q3. 1st, 2nd and 3rd quarter 10-Q or 10-QT statements have value Q1, Q2, and Q3 respectively, with 10-K, 10-KT or other fiscal year statements having FY.

| Name: |

dei_DocumentFiscalPeriodFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fiscalPeriodItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThis is focus fiscal year of the document report in YYYY format. For a 2006 annual report, which may also provide financial information from prior periods, fiscal 2006 should be given as the fiscal year focus. Example: 2006.

| Name: |

dei_DocumentFiscalYearFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gYearItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.24.2.u1

Condensed Interim Statements of Financial Position - CAD ($)

|

Jun. 30, 2024 |

Mar. 31, 2024 |

| Current assets |

|

|

| Cash |

$ 5,262,832

|

$ 9,007,042

|

| Amounts receivable and other assets |

269,913

|

216,124

|

| Marketable securities |

36,835

|

41,587

|

| Total Current Assets |

5,569,580

|

9,264,753

|

| Non-current assets |

|

|

| Restricted cash |

534,828

|

534,828

|

| Right-of-use asset |

36,989

|

42,033

|

| Total assets |

6,141,397

|

9,841,614

|

| Current liabilities |

|

|

| Accounts payable and accrued liabilities |

2,396,215

|

1,128,808

|

| Advanced contributions received |

938,377

|

5,132,721

|

| Balances due to related parties |

101,428

|

147,333

|

| Flow through liability |

769,231

|

769,231

|

| Lease liability |

24,154

|

23,443

|

| Total current liabilities |

4,229,405

|

7,201,536

|

| Non-current liabilities |

|

|

| Director's loan |

825,540

|

784,947

|

| Lease liability |

22,452

|

28,764

|

| Total liabilities |

5,077,397

|

8,015,247

|

| Shareholders' equity (deficiency) |

|

|

| Share capital |

67,236,421

|

67,236,421

|

| Reserves |

4,678,090

|

4,617,658

|

| Accumulated deficit |

(70,850,511)

|

(70,027,712)

|

| Shareholders' equity (deficiency) |

1,064,000

|

1,826,367

|

| Total liabilities and shareholders' equity |

$ 6,141,397

|

$ 9,841,614

|

| X |

- References

+ Details

| Name: |

ahr_MarketableSecuritiesCurrentAssets |

| Namespace Prefix: |

ahr_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

debit |

| Period Type: |

instant |

|

| X |

- DefinitionThe amount of advances received representing contract liabilities for performance obligations satisfied at a point in time. [Refer: Contract liabilities; Performance obligations satisfied at point in time [member]] Reference 1: http://www.xbrl.org/2009/role/commonPracticeRef

-Name IAS

-Number 1

-IssueDate 2023-01-01

-Paragraph 78

-URI https://taxonomy.ifrs.org/xifrs-link?type=IAS&num=1&code=ifrs-tx-2023-en-r&anchor=para_78&doctype=Standard

-URIDate 2023-03-23

Reference 2: http://www.xbrl.org/2009/role/commonPracticeRef

-Name IAS

-Number 1

-IssueDate 2023-01-01

-Paragraph 55

-URI https://taxonomy.ifrs.org/xifrs-link?type=IAS&num=1&code=ifrs-tx-2023-en-r&anchor=para_55&doctype=Standard

-URIDate 2023-03-23

| Name: |

ifrs-full_Advances |

| Namespace Prefix: |

ifrs-full_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionThe amount of a present economic resource controlled by the entity as a result of past events. Economic resource is a right that has the potential to produce economic benefits. Reference 1: http://www.xbrl.org/2003/role/disclosureRef

-Name IFRS

-Number 13

-IssueDate 2023-01-01

-Paragraph 93

-Subparagraph a

-URI https://taxonomy.ifrs.org/xifrs-link?type=IFRS&num=13&code=ifrs-tx-2023-en-r&anchor=para_93_a&doctype=Standard

-URIDate 2023-03-23

Reference 2: http://www.xbrl.org/2003/role/disclosureRef

-Name IFRS

-Number 8

-IssueDate 2023-01-01

-Paragraph 28

-Subparagraph c

-URI https://taxonomy.ifrs.org/xifrs-link?type=IFRS&num=8&code=ifrs-tx-2023-en-r&anchor=para_28_c&doctype=Standard

-URIDate 2023-03-23

Reference 3: http://www.xbrl.org/2003/role/disclosureRef

-Name IFRS

-Number 13

-IssueDate 2023-01-01

-Paragraph 93

-Subparagraph b

-URI https://taxonomy.ifrs.org/xifrs-link?type=IFRS&num=13&code=ifrs-tx-2023-en-r&anchor=para_93_b&doctype=Standard

-URIDate 2023-03-23

Reference 4: http://www.xbrl.org/2003/role/disclosureRef

-Name IFRS

-Number 13

-IssueDate 2023-01-01

-Paragraph 93

-Subparagraph e

-URI https://taxonomy.ifrs.org/xifrs-link?type=IFRS&num=13&code=ifrs-tx-2023-en-r&anchor=para_93_e&doctype=Standard

-URIDate 2023-03-23

Reference 5: http://www.xbrl.org/2003/role/disclosureRef

-Name IFRS

-Number 8

-IssueDate 2023-01-01

-Paragraph 23

-URI https://taxonomy.ifrs.org/xifrs-link?type=IFRS&num=8&code=ifrs-tx-2023-en-r&anchor=para_23&doctype=Standard

-URIDate 2023-03-23

Reference 6: http://www.xbrl.org/2003/role/disclosureRef

-Name IAS

-Number 1

-IssueDate 2023-01-01

-Paragraph 55

-URI https://taxonomy.ifrs.org/xifrs-link?type=IAS&num=1&code=ifrs-tx-2023-en-r&anchor=para_55&doctype=Standard

-URIDate 2023-03-23

| Name: |

ifrs-full_Assets |

| Namespace Prefix: |

ifrs-full_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

debit |

| Period Type: |

instant |

|

| X |

- DefinitionThe amount of cash on hand and demand deposits. [Refer: Cash on hand] Reference 1: http://www.xbrl.org/2009/role/commonPracticeRef

-Name IAS

-Number 7

-IssueDate 2023-01-01

-Paragraph 45

-URI https://taxonomy.ifrs.org/xifrs-link?type=IAS&num=7&code=ifrs-tx-2023-en-r&anchor=para_45&doctype=Standard

-URIDate 2023-03-23

| Name: |

ifrs-full_Cash |

| Namespace Prefix: |

ifrs-full_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

debit |

| Period Type: |

instant |

|

| X |

- DefinitionThe amount of assets that the entity (a) expects to realise or intends to sell or consume in its normal operating cycle; (b) holds primarily for the purpose of trading; (c) expects to realise within twelve months after the reporting period; or (d) classifies as cash or cash equivalents (as defined in IAS 7) unless the asset is restricted from being exchanged or used to settle a liability for at least twelve months after the reporting period. [Refer: Assets] Reference 1: http://www.xbrl.org/2003/role/exampleRef

-Name IFRS

-Number 12

-IssueDate 2023-01-01

-Paragraph B10

-Subparagraph b

-URI https://taxonomy.ifrs.org/xifrs-link?type=IFRS&num=12&code=ifrs-tx-2023-en-r&anchor=para_B10_b&doctype=Appendix&subtype=B

-URIDate 2023-03-23

Reference 2: http://www.xbrl.org/2003/role/disclosureRef

-Name IFRS

-Number 12

-IssueDate 2023-01-01

-Paragraph B12

-Subparagraph b

-Clause i

-URI https://taxonomy.ifrs.org/xifrs-link?type=IFRS&num=12&code=ifrs-tx-2023-en-r&anchor=para_B12_b_i&doctype=Appendix&subtype=B

-URIDate 2023-03-23

Reference 3: http://www.xbrl.org/2003/role/disclosureRef

-Name IAS

-Number 1

-IssueDate 2023-01-01

-Paragraph 66

-URI https://taxonomy.ifrs.org/xifrs-link?type=IAS&num=1&code=ifrs-tx-2023-en-r&anchor=para_66&doctype=Standard

-URIDate 2023-03-23

| Name: |

ifrs-full_CurrentAssets |

| Namespace Prefix: |

ifrs-full_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

debit |

| Period Type: |

instant |

|

| X |

- References

+ Details

| Name: |

ifrs-full_CurrentAssetsAbstract |

| Namespace Prefix: |

ifrs-full_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe amount of current lease liabilities. [Refer: Lease liabilities] Reference 1: http://www.xbrl.org/2003/role/disclosureRef

-Name IFRS

-Number 16

-IssueDate 2023-01-01

-Paragraph 47

-Subparagraph b

-URI https://taxonomy.ifrs.org/xifrs-link?type=IFRS&num=16&code=ifrs-tx-2023-en-r&anchor=para_47_b&doctype=Standard

-URIDate 2023-03-23

| Name: |

ifrs-full_CurrentLeaseLiabilities |

| Namespace Prefix: |

ifrs-full_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionThe amount of liabilities that: (a) the entity expects to settle in its normal operating cycle; (b) the entity holds primarily for the purpose of trading; (c) are due to be settled within twelve months after the reporting period; or (d) the entity does not have the right at the end of the reporting period to defer settlement for at least twelve months after the reporting period. Reference 1: http://www.xbrl.org/2003/role/exampleRef

-Name IFRS

-Number 12

-IssueDate 2023-01-01

-Paragraph B10

-Subparagraph b

-URI https://taxonomy.ifrs.org/xifrs-link?type=IFRS&num=12&code=ifrs-tx-2023-en-r&anchor=para_B10_b&doctype=Appendix&subtype=B

-URIDate 2023-03-23

Reference 2: http://www.xbrl.org/2003/role/disclosureRef

-Name IFRS

-Number 12

-IssueDate 2023-01-01

-Paragraph B12

-Subparagraph b

-Clause iii

-URI https://taxonomy.ifrs.org/xifrs-link?type=IFRS&num=12&code=ifrs-tx-2023-en-r&anchor=para_B12_b_iii&doctype=Appendix&subtype=B

-URIDate 2023-03-23