2024 Quarter Highlights

- Third quarter 2024 total revenue of $613.6 million, net income

of $86.3 million, and EBITDA of $170.7 million

- Increased oil & gas royalty volumes to 864 MBOE, up 11.9%

year-over-year

- Completed $10.5 million in oil & gas mineral interest

acquisitions

- Declares quarterly cash distribution of $0.70 per unit, or

$2.80 per unit annualized

- Increased committed & priced sales tons for the 2025 full

year by 5.9 million tons to 22.5 million tons

Alliance Resource Partners, L.P. (NASDAQ: ARLP) ("ARLP" or the

"Partnership") today reported financial and operating results for

the three and nine months ended September 30, 2024 (the "2024

Quarter" and "2024 Period," respectively). This release includes

comparisons of results to the three and nine months ended September

30, 2023 (the "2023 Quarter" and "2023 Period," respectively) and

to the quarter ended June 30, 2024 (the "Sequential Quarter"). All

references in the text of this release to "net income" refer to

"net income attributable to ARLP." For a definition of EBITDA and

related reconciliation to its comparable GAAP financial measure,

please see the end of this release.

Total revenues in the 2024 Quarter decreased 3.6% to $613.6

million compared to $636.5 million for the 2023 Quarter primarily

as a result of reduced coal sales prices, which declined 2.1% due

in part to lower export pricing in Appalachia, and lower

transportation revenues. Net income for the 2024 Quarter was $86.3

million, or $0.66 per basic and diluted limited partner unit,

compared to $153.7 million, or $1.18 per basic and diluted limited

partner unit, for the 2023 Quarter as a result of lower revenues

and increased total operating expenses. EBITDA for the 2024 Quarter

was $170.7 million compared to $227.6 million in the 2023

Quarter.

Total revenues in the 2024 Quarter increased 3.4% compared to

$593.4 million in the Sequential Quarter primarily as a result of

increased coal sales volumes, which rose 6.7% to 8.4 million tons

sold compared to 7.9 million tons sold. Net income and EBITDA for

the 2024 Quarter decreased by 13.9% and 3.9%, respectively,

compared to the Sequential Quarter as a result of higher total

operating expenses, partially offset by increased revenues.

Total revenues decreased 4.3% to $1.86 billion for the 2024

Period compared to $1.94 billion for the 2023 Period primarily due

to lower coal sales and transportation revenues, partially offset

by higher oil & gas royalties and other revenues. Net income

for the 2024 Period was $344.5 million, or $2.64 per basic and

diluted limited partner unit, compared to $514.7 million, or $3.93

per basic and diluted limited partner unit, for the 2023 Period as

a result of lower revenues and increased total operating expenses,

partially offset by an increase in the fair value of our digital

assets. EBITDA for the 2024 Period was $583.4 million compared to

$747.7 million in the 2023 Period.

CEO Commentary

"We delivered sequential improvement in revenue, coal sales, and

minerals volumes during the third quarter, however revenues were

lower than our expectations primarily due to lower coal sales

volumes and pricing related to export sales from our MC Mining,

Mettiki and Hamilton operations, as well as shipping deferrals on

some of our higher priced domestic contracted commitments,"

commented Joseph W. Craft III, Chairman, President, and CEO.

"Segment Adjusted EBITDA Expense per ton sold was $46.11 during the

2024 Quarter, slightly higher than the Sequential Quarter and

increasing 11.9% year-over-year due to a longwall move at our

Tunnel Ridge operations and challenging mining conditions at all

three Appalachia operations that lowered recoveries and increased

costs related to roof control and maintenance. We took proactive

steps during the 2024 Quarter to more closely align production with

shipments at our MC Mining, Mettiki and Hamilton operations by

reducing production due to high stockpile levels at each operation

which also impacted our costs. As a result, coal inventory levels

declined by over 0.5 million tons in the 2024 Quarter."

Mr. Craft added, "We are pleased to report that all of the major

capital and mine infrastructure projects we have been investing in

over the last several years are wrapping up and are projected to be

on schedule to deliver lower mining expenses beginning next

year."

Mr. Craft concluded, "We realized another solid quarter of

year-over-year volumetric growth in our Oil & Gas Royalties

business. We continue to reap the benefits of a minerals portfolio

that is heavily weighted towards the Permian Basin, where top-tier

upstream operators are actively drilling and completing new wells

on our mineral acreage. Additionally, we continued to add to our

position in the Permian, successfully closing $10.5 million of

ground game acquisitions during the 2024 Quarter. As we have

mentioned previously, we believe the value and prospects for our

oil and gas royalty segment was a major contributor to the success

of our Senior Notes offering earlier this year. We remain committed

to growing this segment as a complement to our core coal

operations, and as we scale the business, we believe investors will

continue to recognize the intrinsic value the segment possesses as

a growth vehicle."

Segment Results and Analysis

% Change

2024 Third

2023 Third

Quarter /

2024 Second

% Change

(in millions, except per ton and per

BOE data)

Quarter

Quarter

Quarter

Quarter

Sequential

Coal Operations

(1)

Illinois Basin

Coal Operations

Tons sold

5.967

6.049

(1.4

)%

5.787

3.1

%

Coal sales price per ton sold

$

56.61

$

56.66

(0.1

)%

$

57.37

(1.3

)%

Segment Adjusted EBITDA Expense per

ton

$

37.79

$

35.25

7.2

%

$

37.35

1.2

%

Segment Adjusted EBITDA

$

114.6

$

132.4

(13.4

)%

$

118.0

(2.9

)%

Appalachia Coal

Operations

Tons sold

2.412

2.407

0.2

%

2.064

16.9

%

Coal sales price per ton sold

$

80.78

$

85.74

(5.8

)%

$

87.54

(7.7

)%

Segment Adjusted EBITDA Expense per

ton

$

65.42

$

54.84

19.3

%

$

66.26

(1.3

)%

Segment Adjusted EBITDA

$

37.5

$

74.8

(49.9

)%

$

45.3

(17.2

)%

Total Coal

Operations

Tons sold

8.379

8.456

(0.9

)%

7.851

6.7

%

Coal sales price per ton sold

$

63.57

$

64.94

(2.1

)%

$

65.30

(2.6

)%

Segment Adjusted EBITDA Expense per

ton

$

46.11

$

41.19

11.9

%

$

45.37

1.6

%

Segment Adjusted EBITDA

$

149.3

$

204.3

(27.0

)%

$

160.2

(6.9

)%

Royalties

(1)

Oil & Gas

Royalties

BOE sold (2)

0.864

0.772

11.9

%

0.817

5.8

%

Oil percentage of BOE

45.4

%

43.9

%

3.4

%

43.6

%

4.1

%

Average sales price per BOE (3)

$

39.87

$

44.19

(9.8

)%

$

44.60

(10.6

)%

Segment Adjusted EBITDA Expense

$

5.8

$

3.9

50.9

%

$

4.6

26.1

%

Segment Adjusted EBITDA

$

28.7

$

31.4

(8.5

)%

$

31.3

(8.2

)%

Coal

Royalties

Royalty tons sold

5.109

4.993

2.3

%

4.973

2.7

%

Revenue per royalty ton sold

$

3.26

$

3.36

(3.0

)%

$

3.33

(2.1

)%

Segment Adjusted EBITDA Expense

$

5.6

$

6.9

(18.4

)%

$

6.6

(15.7

)%

Segment Adjusted EBITDA

$

11.1

$

9.9

11.6

%

$

10.0

11.1

%

Total

Royalties

Total royalty revenues

$

51.3

$

53.1

(3.3

)%

$

53.0

(3.2

)%

Segment Adjusted EBITDA Expense

$

11.4

$

10.7

6.6

%

$

11.3

1.5

%

Segment Adjusted EBITDA

$

39.8

$

41.3

(3.7

)%

$

41.2

(3.5

)%

Consolidated

Total

Total revenues

$

613.6

$

636.5

(3.6

)%

$

593.4

3.4

%

Segment Adjusted EBITDA Expense

$

393.7

$

350.4

12.4

%

$

363.2

8.4

%

Segment Adjusted EBITDA

$

192.3

$

247.7

(22.4

)%

$

202.0

(4.8

)%

___________________

(1)

For definitions of Segment Adjusted EBITDA

Expense and Segment Adjusted EBITDA and related reconciliations to

comparable GAAP financial measures, please see the end of this

release. Segment Adjusted EBITDA Expense per ton is defined as

Segment Adjusted EBITDA Expense – Coal Operations (as reflected in

the reconciliation table at the end of this release) divided by

total tons sold.

(2)

Barrels of oil equivalent ("BOE") for

natural gas volumes is calculated on a 6:1 basis (6,000 cubic feet

of natural gas to one barrel).

(3)

Average sales price per BOE is defined as

oil & gas royalty revenues excluding lease bonus revenue

divided by total BOE sold.

Coal Operations

Total coal sales volumes for the 2024 Quarter increased 6.7%

compared to the Sequential Quarter while remaining relatively

consistent compared to the 2023 Quarter. Sequentially, tons sold

increased by 3.1% in the Illinois Basin due to higher sales volumes

from our River View and Hamilton mines. In Appalachia, tons sold

increased by 16.9% in the 2024 Quarter compared to the Sequential

Quarter primarily due to improved conditions on the Ohio River

allowing for higher shipments from our Tunnel Ridge operation. Coal

sales price per ton decreased by 5.8% in Appalachia compared to the

2023 Quarter as a result of reduced export price realizations from

our Mettiki and MC Mining operations. Compared to the Sequential

Quarter, coal sales prices decreased by 7.7% in Appalachia

primarily due to reduced domestic price realizations across the

region. ARLP ended the 2024 Quarter with total coal inventory of

2.0 million tons, representing an increase of 0.2 million tons and

a decrease of 0.5 million tons compared to the end of the 2023

Quarter and Sequential Quarter, respectively.

Segment Adjusted EBITDA Expense per ton for the 2024 Quarter

increased by 7.2% in the Illinois Basin compared to the 2023

Quarter due primarily to reduced production and higher beginning

inventory cost per ton at our Hamilton and River View mines.

Increased expenses and lower production at our Hamilton mine during

the 2024 Quarter was partially attributable to increased longwall

move days compared to the 2023 Quarter. In Appalachia, Segment

Adjusted EBITDA Expense per ton for the 2024 Quarter increased by

19.3% compared to the 2023 Quarter due to a longwall move at our

Tunnel Ridge operation, increased subsidence related expenses and

challenging mining conditions at all three operations that lowered

recoveries, and increased costs related to roof control and

maintenance.

Royalties

Oil & gas volumes increased to 864 MBOE in the 2024 Quarter,

representing an 11.9% and a 5.8% increase compared to the 2023

Quarter and Sequential Quarter, respectively, due to increased

drilling and completion activities on our interests and

acquisitions of additional oil & gas mineral interests. Segment

Adjusted EBITDA for the Oil & Gas Royalties segment decreased

8.5% and 8.2% in the 2024 Quarter compared to the 2023 Quarter and

Sequential Quarter, respectively, primarily due to reduced average

realized sales prices per BOE.

Segment Adjusted EBITDA for the Coal Royalties segment in the

2024 Quarter increased by $1.2 million and $1.1 million compared to

the 2023 Quarter and Sequential Quarter, respectively, as a result

of increased royalty tons sold and reduced expenses, partially

offset by reduced prices.

Balance Sheet and Liquidity

As of September 30, 2024, total debt and finance leases

outstanding were $497.4 million, including $400 million in recently

issued Senior Notes due 2029. The Partnership’s total and net

leverage ratios were 0.64 times and 0.39 times debt to trailing

twelve months Adjusted EBITDA, respectively, as of September 30,

2024. ARLP ended the 2024 Quarter with total liquidity of $657.7

million, which included $195.4 million of cash and cash equivalents

and $462.3 million of borrowings available under its revolving

credit and accounts receivable securitization facilities.

Distributions

ARLP is also announcing today that the Board of Directors of

ARLP’s general partner (the "Board") approved a cash distribution

to unitholders for the 2024 Quarter of $0.70 per unit (an

annualized rate of $2.80 per unit), payable on November 14, 2024,

to all unitholders of record as of the close of trading on November

7, 2024. The announced distribution is consistent with the cash

distributions for the 2023 Quarter and Sequential Quarter.

Outlook

"We have repeatedly warned about the impact of federal

regulations on grid reliability, influencing what we believe to be

the premature retirement of essential baseload power sources even

as significant demand growth from AI, data centers, and

manufacturing onshoring is being projected," commented Mr. Craft.

"This summer's PJM capacity auction results highlight these

concerns. Recognizing a potential crisis due to unexpectedly high

demand growth, the delayed construction of new generation, and

planned capacity retirements, particularly in our served markets,

PJM prioritized baseload capacity over interruptible sources. This

further supports recent third-party sources which indicate that

greater than 40% of previously announced baseload power plant

retirement dates have been deferred nationwide."

Mr. Craft concluded, "Many of our largest domestic customers

have been active on the contracting side of late. Since our last

update, we are in the process of finalizing commitments for 21.7

million tons over the 2025 to 2030 time period. We are also in

active discussions with other customers to add to future

commitments, that if secured, will lift our 2025 domestic sales

order book to a level near our historical contracted position

heading into the new calendar year. Looking longer-term, the

underlying coal demand fundamentals of non-traditional demand

growth is accelerating, particularly in the markets we serve in the

Midwest, Mid-Atlantic, and Southeast."

ARLP is maintaining the following guidance for the full year

ended December 31, 2024 (the "2024 Full Year") and updating our

committed and priced sales tons:

2024 Full Year

Guidance

Coal

Operations

Volumes (Million

Short Tons)

Illinois Basin Sales Tons

24.25 — 25.0

Appalachia Sales Tons

9.25 — 9.50

Total Sales Tons

33.50 — 34.50

Committed &

Priced Sales Tons

2024 — Domestic / Export / Total

28.2 / 5.2 / 33.4

2025 — Domestic / Export / Total

21.0 / 1.5 / 22.5

Coal Sales Price Per

Ton Sold (1)

Illinois Basin

$56.25 — $57.00

Appalachia

$83.00 — $84.00

Total

$63.75 — $64.50

Segment Adjusted

EBITDA Expense Per Ton Sold (2)

Illinois Basin

$36.00 — $38.00

Appalachia

$57.00 — $60.00

Total

$43.00 — $45.00

Royalties

Oil & Gas

Royalties

Oil (000 Barrels)

1,500 — 1,600

Natural gas (000 MCF)

5,800 — 6,200

Liquids (000 Barrels)

750 — 800

Segment Adjusted EBITDA Expense (% of Oil

& Gas Royalties Revenue)

~ 13.0%

Coal

Royalties

Royalty tons sold (Million Short Tons)

20.4 — 21.5

Revenue per royalty ton sold

$3.15 — $3.35

Segment Adjusted EBITDA Expense per

royalty ton sold

$1.15 — $1.25

Consolidated (Millions)

Depreciation, depletion and

amortization

$280 — $300

General and administrative

$80 — $85

Net interest expense

$34 — $36

Income tax expense

$17 — $19

Total capital expenditures

$420 — $460

Growth capital expenditures

$25 — $30

Maintenance capital expenditures

$395 — $430

__________________

(1)

Sales price per ton is defined as total

coal sales revenue divided by total tons sold.

(2)

Segment Adjusted EBITDA Expense is defined

as operating expenses, coal purchases, if applicable, and other

income or expense as adjusted to remove certain items from

operating expenses that we characterize as unrepresentative of our

ongoing operations.

Conference Call

A conference call regarding ARLP's 2024 Quarter financial

results is scheduled for today at 10:00 a.m. Eastern. To

participate in the conference call, dial (877) 407-0784 and request

to be connected to the Alliance Resource Partners, L.P. earnings

conference call. International callers should dial (201) 689-8560

and request to be connected to the same call. Investors may also

listen to the call via the "Investors" section of ARLP's website at

www.arlp.com.

An audio replay of the conference call will be available for

approximately one week. To access the audio replay, dial U.S. Toll

Free (844) 512-2921; International Toll (412) 317-6671 and request

to be connected to replay using access code 13749425.

Concurrent with this announcement we are providing qualified

notice to brokers and nominees that hold ARLP units on behalf of

non-U.S. investors under Treasury Regulation Section 1.1446-4(b)

and (d) and Treasury Regulation Section 1.1446(f)-4(c)(2)(iii).

Brokers and nominees should treat one hundred percent (100%) of

ARLP’s distributions to non-U.S. investors as being attributable to

income that is effectively connected with a United States trade or

business. In addition, brokers and nominees should treat one

hundred percent (100%) of the distribution as being in excess of

cumulative net income for purposes of determining the amount to

withhold. Accordingly, ARLP’s distributions to non-U.S. investors

are subject to federal income tax withholding at a rate equal to

the highest applicable effective tax rate plus ten percent (10%).

Nominees, and not ARLP, are treated as the withholding agents

responsible for withholding on the distributions received by them

on behalf of non-U.S. investors.

About Alliance Resource Partners, L.P.

ARLP is a diversified energy company that is currently the

largest coal producer in the eastern United States, supplying

reliable, affordable energy domestically and internationally to

major utilities, metallurgical and industrial users. ARLP also

generates operating and royalty income from mineral interests it

owns in strategic coal and oil & gas producing regions in the

United States. In addition, ARLP is evolving and positioning itself

as a reliable energy partner for the future by pursuing

opportunities that support the advancement of energy and related

infrastructure.

News, unit prices and additional information about ARLP,

including filings with the Securities and Exchange Commission

("SEC"), are available at www.arlp.com. For more information,

contact the investor relations department of ARLP at (918) 295-7673

or via e-mail at investorrelations@arlp.com.

The statements and projections used throughout this release are

based on current expectations. These statements and projections are

forward-looking, and actual results may differ materially. These

projections do not include the potential impact of any mergers,

acquisitions or other business combinations that may occur after

the date of this release. We have included more information below

regarding business risks that could affect our results.

FORWARD-LOOKING STATEMENTS: With the exception of historical

matters, any matters discussed in this press release are

forward-looking statements that involve risks and uncertainties

that could cause actual results to differ materially from projected

results. Those forward-looking statements include expectations with

respect to our future financial performance, coal and oil & gas

consumption and expected future prices, our ability to increase

unitholder distributions in future quarters, business plans and

potential growth with respect to our energy and infrastructure

transition investments, optimizing cash flows, reducing operating

and capital expenditures, infrastructure projects at our existing

properties, growth in domestic electricity demand, preserving

liquidity and maintaining financial flexibility, and our future

repurchases of units and senior notes, among others. These risks to

our ability to achieve these outcomes include, but are not limited

to, the following: decline in the coal industry's share of

electricity generation, including as a result of environmental

concerns related to coal mining and combustion, the cost and

perceived benefits of other sources of electricity and fuels, such

as oil & gas, nuclear energy, and renewable fuels and the

planned retirement of coal-fired power plants in the U.S.; our

ability to provide fuel for growth in domestic energy demand,

should it materialize; changes in macroeconomic and market

conditions and market volatility, and the impact of such changes

and volatility on our financial position; changes in global

economic and geo-political conditions or changes in industries in

which our customers operate; changes in commodity prices, demand

and availability which could affect our operating results and cash

flows; the outcome or escalation of current hostilities in Ukraine

and the Israel-Gaza conflict; the severity, magnitude and duration

of any future pandemics and impacts of such pandemics and of

businesses' and governments' responses to such pandemics on our

operations and personnel, and on demand for coal, oil, and natural

gas, the financial condition of our customers and suppliers and

operators, available liquidity and capital sources and broader

economic disruptions; actions of the major oil-producing countries

with respect to oil production volumes and prices could have direct

and indirect impacts over the near and long term on oil & gas

exploration and production operations at the properties in which we

hold mineral interests; changes in competition in domestic and

international coal markets and our ability to respond to such

changes; potential shut-ins of production by the operators of the

properties in which we hold oil & gas mineral interests due to

low commodity prices or the lack of downstream demand or storage

capacity; risks associated with the expansion of and investments

into the infrastructure of our operations and properties, including

the timing of such investments coming online; our ability to

identify and complete acquisitions and to successfully integrate

such acquisitions into our business and achieve the anticipated

benefits therefrom; our ability to identify and invest in new

energy and infrastructure transition ventures; the success of our

development plans for our wholly owned subsidiary, Matrix Design

Group, LLC, and our investments in emerging infrastructure and

technology companies; dependence on significant customer contracts,

including renewing existing contracts upon expiration; adjustments

made in price, volume, or terms to existing coal supply agreements;

the effects of and changes in trade, monetary and fiscal policies

and laws, and the results of central bank policy actions, including

interest rates, bank failures, and associated liquidity risks; the

effects of and changes in taxes or tariffs and other trade measures

adopted by the United States and foreign governments; legislation,

regulations, and court decisions and interpretations thereof, both

domestic and foreign, including those relating to the environment

and the release of greenhouse gases, such as the Environmental

Protection Agency's recently promulgated emissions regulations for

coal-fired power plants, mining, miner health and safety, hydraulic

fracturing, and health care; deregulation of the electric utility

industry or the effects of any adverse change in the coal industry,

electric utility industry, or general economic conditions;

investors' and other stakeholders' increasing attention to

environmental, social, and governance matters; liquidity

constraints, including those resulting from any future

unavailability of financing; customer bankruptcies, cancellations

or breaches to existing contracts, or other failures to perform;

customer delays, failure to take coal under contracts or defaults

in making payments; our productivity levels and margins earned on

our coal sales; disruptions to oil & gas exploration and

production operations at the properties in which we hold mineral

interests; changes in equipment, raw material, service or labor

costs or availability, including due to inflationary pressures;

changes in our ability to recruit, hire and maintain labor; our

ability to maintain satisfactory relations with our employees;

increases in labor costs, adverse changes in work rules, or cash

payments or projections associated with workers' compensation

claims; increases in transportation costs and risk of

transportation delays or interruptions; operational interruptions

due to geologic, permitting, labor, weather, supply chain shortage

of equipment or mine supplies, or other factors; risks associated

with major mine-related accidents, mine fires, mine floods or other

interruptions; results of litigation, including claims not yet

asserted; foreign currency fluctuations that could adversely affect

the competitiveness of our coal abroad; difficulty maintaining our

surety bonds for mine reclamation as well as workers' compensation

and black lung benefits; difficulty in making accurate assumptions

and projections regarding post-mine reclamation as well as pension,

black lung benefits, and other post-retirement benefit liabilities;

uncertainties in estimating and replacing our coal mineral reserves

and resources; uncertainties in estimating and replacing our oil

& gas reserves; uncertainties in the amount of oil & gas

production due to the level of drilling and completion activity by

the operators of our oil & gas properties; uncertainties in the

future of the electric vehicle industry and the market for EV

charging stations; the impact of current and potential changes to

federal or state tax rules and regulations, including a loss or

reduction of benefits from certain tax deductions and credits;

difficulty obtaining commercial property insurance, and risks

associated with our participation in the commercial insurance

property program; evolving cybersecurity risks, such as those

involving unauthorized access, denial-of-service attacks, malicious

software, data privacy breaches by employees, insiders or others

with authorized access, cyber or phishing attacks, ransomware,

malware, social engineering, physical breaches, or other actions;

and difficulty in making accurate assumptions and projections

regarding future revenues and costs associated with equity

investments in companies we do not control.

Additional information concerning these, and other factors

can be found in ARLP's public periodic filings with the SEC,

including ARLP's Annual Report on Form 10-K for the year ended

December 31, 2023, filed on February 23, 2024, and ARLP's

Quarterly Reports on Form 10-Q for the quarters ended March 31,

2024 and June 30, 2024, filed on May 9, 2024 and August 7, 2024,

respectively. Except as required by applicable securities laws,

ARLP does not intend to update its forward-looking

statements.

ALLIANCE RESOURCE PARTNERS,

L.P. AND SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF INCOME AND OPERATING DATA

(In thousands, except unit and

per unit data)

(Unaudited)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2024

2023

2024

2023

Tons Sold

8,379

8,456

24,904

25,829

Tons Produced

7,754

8,356

25,305

26,997

Mineral Interest Volumes (BOE)

864

772

2,579

2,296

SALES AND OPERATING REVENUES:

Coal sales

$

532,647

$

549,123

$

1,607,185

$

1,688,238

Oil & gas royalties

34,448

34,125

107,907

101,709

Transportation revenues

24,617

34,964

82,071

95,729

Other revenues

21,857

18,309

61,453

55,603

Total revenues

613,569

636,521

1,858,616

1,941,279

EXPENSES:

Operating expenses (excluding

depreciation, depletion and amortization)

384,844

339,099

1,100,308

1,012,224

Transportation expenses

24,617

34,964

82,071

95,729

Outside coal purchases

8,192

11,530

27,912

15,739

General and administrative

21,878

20,097

64,569

61,312

Depreciation, depletion and

amortization

72,971

65,393

204,974

199,582

Total operating expenses

512,502

471,083

1,479,834

1,384,586

INCOME FROM OPERATIONS

101,067

165,438

378,782

556,693

Interest expense, net

(9,527

)

(7,736

)

(26,553

)

(29,845

)

Interest income

2,175

2,669

5,535

8,084

Equity method investment loss

(2,327

)

(1,842

)

(3,032

)

(3,784

)

Change in fair value of digital assets

332

—

8,437

—

Other income (expense)

(681

)

223

(2,245

)

(173

)

INCOME BEFORE INCOME TAXES

91,039

158,752

360,924

530,975

INCOME TAX EXPENSE

4,123

3,401

12,932

11,641

NET INCOME

86,916

155,351

347,992

519,334

LESS: NET INCOME ATTRIBUTABLE TO

NONCONTROLLING INTEREST

(635

)

(1,652

)

(3,467

)

(4,660

)

NET INCOME ATTRIBUTABLE TO ARLP

$

86,281

$

153,699

$

344,525

$

514,674

NET INCOME ATTRIBUTABLE TO ARLP

GENERAL PARTNER

$

—

$

—

$

—

$

1,384

LIMITED PARTNERS

$

86,281

$

153,699

$

344,525

$

513,290

EARNINGS PER LIMITED PARTNER UNIT -

BASIC AND DILUTED

$

0.66

$

1.18

$

2.64

$

3.93

WEIGHTED-AVERAGE NUMBER OF UNITS

OUTSTANDING – BASIC AND DILUTED

128,061,981

127,125,437

127,932,095

127,198,805

ALLIANCE RESOURCE PARTNERS,

L.P. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands, except unit

data)

(Unaudited)

September 30,

December 31,

2024

2023

ASSETS

CURRENT ASSETS:

Cash and cash equivalents

$

195,429

$

59,813

Trade receivables

198,647

282,622

Other receivables

10,015

9,678

Inventories, net

177,503

127,556

Advance royalties

6,170

7,780

Digital assets

28,959

9,579

Prepaid expenses and other assets

9,785

19,093

Total current assets

626,508

516,121

PROPERTY, PLANT AND EQUIPMENT:

Property, plant and equipment, at cost

4,451,796

4,172,544

Less accumulated depreciation, depletion

and amortization

(2,290,205

)

(2,149,881

)

Total property, plant and equipment,

net

2,161,591

2,022,663

OTHER ASSETS:

Advance royalties

76,295

71,125

Equity method investments

36,902

46,503

Equity securities

92,541

92,541

Operating lease right-of-use assets

16,092

16,569

Other long-term assets

22,244

22,904

Total other assets

244,074

249,642

TOTAL ASSETS

$

3,032,173

$

2,788,426

LIABILITIES AND PARTNERS'

CAPITAL

CURRENT LIABILITIES:

Accounts payable

$

115,719

$

108,269

Accrued taxes other than income taxes

21,336

21,007

Accrued payroll and related expenses

32,733

29,884

Accrued interest

10,637

3,558

Workers' compensation and pneumoconiosis

benefits

15,790

15,913

Other current liabilities

46,662

28,498

Current maturities, long-term debt,

net

22,275

20,338

Total current liabilities

265,152

227,467

LONG-TERM LIABILITIES:

Long-term debt, excluding current

maturities, net

456,316

316,821

Pneumoconiosis benefits

131,727

127,249

Accrued pension benefit

7,005

8,618

Workers' compensation

36,981

37,257

Asset retirement obligations

148,849

146,925

Long-term operating lease obligations

13,838

13,661

Deferred income tax liabilities

32,019

33,450

Other liabilities

15,176

18,381

Total long-term liabilities

841,911

702,362

Total liabilities

1,107,063

929,829

COMMITMENTS AND CONTINGENCIES

PARTNERS' CAPITAL:

ARLP Partners' Capital:

Limited Partners - Common Unitholders

128,061,981 and 127,125,437 units outstanding, respectively

1,961,977

1,896,027

Accumulated other comprehensive loss

(58,623

)

(61,525

)

Total ARLP Partners' Capital

1,903,354

1,834,502

Noncontrolling interest

21,756

24,095

Total Partners' Capital

1,925,110

1,858,597

TOTAL LIABILITIES AND PARTNERS'

CAPITAL

$

3,032,173

$

2,788,426

ALLIANCE RESOURCE PARTNERS,

L.P. AND SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

Nine Months Ended

September 30,

2024

2023

CASH FLOWS FROM OPERATING

ACTIVITIES

$

634,711

$

730,298

CASH FLOWS FROM INVESTING

ACTIVITIES:

Property, plant and equipment:

Capital expenditures

(335,586

)

(295,356

)

Change in accounts payable and accrued

liabilities

9,191

(23,006

)

Proceeds from sale of property, plant and

equipment

1,385

3,436

Contributions to equity method

investments

(1,398

)

(2,257

)

Purchase of equity securities

—

(49,560

)

JC Resources acquisition

—

(64,999

)

Oil & gas reserve asset

acquisitions

(15,176

)

(13,902

)

Other

4,151

6,273

Net cash used in investing activities

(337,433

)

(439,371

)

CASH FLOWS FROM FINANCING

ACTIVITIES:

Borrowings under securitization

facility

75,000

—

Payments under securitization facility

(75,000

)

—

Proceeds from equipment financings

54,626

—

Payments on equipment financings

(8,926

)

(11,421

)

Borrowings under revolving credit

facilities

20,000

—

Payments under revolving credit

facilities

(20,000

)

—

Borrowing under long-term debt

400,000

75,000

Payments on long-term debt

(296,327

)

(120,080

)

Payment of debt issuance costs

(11,442

)

(11,744

)

Payments for purchases of units under unit

repurchase program

—

(19,432

)

Payments for tax withholdings related to

settlements under deferred compensation plans

(15,544

)

(10,334

)

Excess purchase price over the contributed

basis from JC Resources acquisition

—

(7,251

)

Cash retained by JC Resources in

acquisition

—

(2,933

)

Distributions paid to Partners

(272,707

)

(273,767

)

Other

(11,342

)

(7,745

)

Net cash used in financing activities

(161,662

)

(389,707

)

NET CHANGE IN CASH AND CASH

EQUIVALENTS

135,616

(98,780

)

CASH AND CASH EQUIVALENTS AT BEGINNING

OF PERIOD

59,813

296,023

CASH AND CASH EQUIVALENTS AT END OF

PERIOD

$

195,429

$

197,243

Reconciliation of Non-GAAP Financial Measures

Reconciliation of GAAP "net income

attributable to ARLP" to non-GAAP "EBITDA," "Adjusted EBITDA,"

"Distribution Coverage Ratio" and "Distributable Cash Flow" (in

thousands).

EBITDA is defined as net income attributable to ARLP before net

interest expense, income taxes and depreciation, depletion and

amortization and Adjusted EBITDA is EBITDA adjusted for certain

items that we characterize as unrepresentative of our ongoing

operations. Distributable cash flow ("DCF") is defined as Adjusted

EBITDA excluding equity method investment earnings, interest

expense (before capitalized interest), interest income, income

taxes and estimated maintenance capital expenditures and adding

distributions from equity method investments and litigation expense

accrual. Distribution coverage ratio ("DCR") is defined as DCF

divided by distributions paid to partners.

Management believes that the presentation of such additional

financial measures provides useful information to investors

regarding our performance and results of operations because these

measures, when used in conjunction with related GAAP financial

measures, (i) provide additional information about our core

operating performance and ability to generate and distribute cash

flow, (ii) provide investors with the financial analytical

framework upon which management bases financial, operational,

compensation and planning decisions and (iii) present measurements

that investors, rating agencies and debt holders have indicated are

useful in assessing us and our results of operations.

EBITDA, Adjusted EBITDA, DCF and DCR should not be considered as

alternatives to net income attributable to ARLP, net income, income

from operations, cash flows from operating activities or any other

measure of financial performance presented in accordance with GAAP.

EBITDA and DCF are not intended to represent cash flow and do not

represent the measure of cash available for distribution. Our

method of computing EBITDA, Adjusted EBITDA, DCF and DCR may not be

the same method used to compute similar measures reported by other

companies, or EBITDA, Adjusted EBITDA, DCF and DCR may be computed

differently by us in different contexts (i.e., public reporting

versus computation under financing agreements).

Three Months Ended

Nine Months Ended

Three Months Ended

September 30,

September 30,

June 30,

2024

2023

2024

2023

2024

Net income attributable to ARLP

$

86,281

$

153,699

$

344,525

$

514,674

$

100,187

Depreciation, depletion and

amortization

72,971

65,393

204,974

199,582

66,454

Interest expense, net

10,873

6,876

29,623

26,193

9,979

Capitalized interest

(3,521

)

(1,809

)

(8,605

)

(4,432

)

(2,786

)

Income tax expense

4,123

3,401

12,932

11,641

3,860

EBITDA

170,727

227,560

583,449

747,658

177,694

Litigation expense accrual (1)

—

—

15,250

—

—

Change in fair value of digital assets

(2)

(332

)

—

(8,437

)

—

3,748

Adjusted EBITDA

170,395

227,560

590,262

747,658

181,442

Equity method investment loss

2,327

1,842

3,032

3,784

152

Distributions from equity method

investments

849

904

2,849

2,878

1,118

Interest expense, net

(10,873

)

(6,876

)

(29,623

)

(26,193

)

(9,979

)

Income tax expense

(4,123

)

(3,401

)

(12,932

)

(11,641

)

(3,860

)

Deferred income tax benefit (3)

(765

)

(2,400

)

(1,834

)

(2,981

)

(962

)

Litigation expense accrual (1)

—

—

(15,250

)

—

—

Estimated maintenance capital expenditures

(4)

(60,171

)

(58,910

)

(196,367

)

(190,329

)

(65,471

)

Distributable Cash Flow

$

97,639

$

158,719

$

340,137

$

523,176

$

102,440

Distributions paid to partners

$

90,725

$

90,899

$

272,707

$

273,767

$

90,736

Distribution Coverage Ratio

1.08

1.75

1.25

1.91

1.13

___________________

(1)

Litigation expense accrual is a $15.3

million accrual relating to the settlement (which is subject to

court approval) of certain litigation as described in Item 1 of

Part II of ARLP’s Form 10-Q filed on August 7, 2024 with the SEC

for the period ended June 30, 2024.

(2)

On January 1, 2024, ARLP elected to early

adopt new accounting guidance which clarifies the accounting and

disclosure requirements for certain crypto assets. The new guidance

requires entities to measure certain crypto assets at fair value,

with the change in fair value included in net income.

(3)

Deferred income tax benefit is the amount

of income tax benefit during the period on temporary differences

between the tax basis and financial reporting basis of recorded

assets and liabilities. These differences generally arise in one

period and reverse in subsequent periods to eventually offset each

other and do not impact the amount of distributable cash flow

available to be paid to partners.

(4)

Maintenance capital expenditures are those

capital expenditures required to maintain, over the long-term, the

existing infrastructure of our coal assets. We estimate maintenance

capital expenditures on an annual basis based upon a five-year

planning horizon. For the 2024 planning horizon, average annual

estimated maintenance capital expenditures are assumed to be $7.76

per ton produced compared to an estimated $7.05 per ton produced in

2023. Our actual maintenance capital expenditures fluctuate

depending on various factors, including maintenance schedules and

timing of capital projects, among others.

Reconciliation of GAAP "Cash flows from

operating activities" to non-GAAP "Free cash flow" (in

thousands).

Free cash flow is defined as cash flows from operating

activities less capital expenditures and the change in accounts

payable and accrued liabilities from purchases of property, plant

and equipment. Free cash flow should not be considered as an

alternative to cash flows from operating activities or any other

measure of financial performance presented in accordance with GAAP.

Our method of computing free cash flow may not be the same method

used by other companies. Free cash flow is a supplemental liquidity

measure used by our management to assess our ability to generate

excess cash flow from our operations.

Three Months Ended

Nine Months Ended

Three Months Ended

September 30,

September 30,

June 30,

2024

2023

2024

2023

2024

Cash flows from operating activities

$

209,272

$

229,578

$

634,711

$

730,298

$

215,766

Capital expenditures

(110,298

)

(110,339

)

(335,586

)

(295,356

)

(101,442

)

Change in accounts payable and accrued

liabilities

4,247

2,624

9,191

(23,006

)

613

Free cash flow

$

103,221

$

121,863

$

308,316

$

411,936

$

114,937

Reconciliation of GAAP "Operating

Expenses" to non-GAAP "Segment Adjusted EBITDA Expense" and

Reconciliation of non-GAAP " EBITDA" to "Segment Adjusted EBITDA"

(in thousands).

Segment Adjusted EBITDA Expense is defined as operating

expenses, coal purchases, if applicable, and other income or

expense as adjusted to remove certain items from operating expenses

that we characterize as unrepresentative of our ongoing operations.

Transportation expenses are excluded as these expenses are passed

on to our customers and, consequently, we do not realize any margin

on transportation revenues. Segment Adjusted EBITDA Expense is used

as a supplemental financial measure by our management to assess the

operating performance of our segments. Segment Adjusted EBITDA

Expense is a key component of EBITDA in addition to coal sales,

royalty revenues and other revenues. The exclusion of corporate

general and administrative expenses from Segment Adjusted EBITDA

Expense allows management to focus solely on the evaluation of

segment operating performance as it primarily relates to our

operating expenses. Segment Adjusted EBITDA Expense – Coal

Operations represents Segment Adjusted EBITDA Expense from our

wholly-owned subsidiary, Alliance Coal, LLC ("Alliance Coal"),

which holds our coal mining operations and related support

activities.

Three Months Ended

Nine Months Ended

Three Months Ended

September 30,

September 30,

June 30,

2024

2023

2024

2023

2024

Operating expense

$

384,844

$

339,099

$

1,100,308

$

1,012,224

$

351,605

Litigation expense accrual (1)

—

—

(15,250

)

—

—

Outside coal purchases

8,192

11,530

27,912

15,739

10,608

Other expense (income)

681

(223

)

2,245

173

958

Segment Adjusted EBITDA Expense

393,717

350,406

1,115,215

1,028,136

363,171

Segment Adjusted EBITDA Expense – Non Coal

Operations (2)

(7,390

)

(2,116

)

(18,399

)

(6,945

)

(6,996

)

Segment Adjusted EBITDA Expense – Coal

Operations

$

386,327

$

348,290

$

1,096,816

$

1,021,191

$

356,175

___________________

(1)

Litigation expense accrual is a $15.3

million accrual relating to the settlement (which is subject to

court approval) of certain litigation as described in Item 1 of

Part II of ARLP’s Form 10-Q filed on August 7, 2024 with the SEC

for the period ended June 30, 2024.

(2)

Non Coal Operations represent activity

outside of Alliance Coal and primarily consist of Total Royalties,

our investments in the advancement of energy and related

infrastructure and various eliminations primarily between Alliance

Coal and our Coal Royalty segment.

Segment Adjusted EBITDA is defined as Adjusted EBITDA adjusted

for general and administrative expenses. Segment Adjusted EBITDA –

Coal Operations represents Segment Adjusted EBITDA from our

wholly-owned subsidiary, Alliance Coal, which holds our coal mining

operations and related support activities and allows management to

focus primarily on the operating performance of our Illinois Basin

and Appalachia segments.

Three Months Ended

Nine Months Ended

Three Months Ended

September 30,

September 30,

June 30,

2024

2023

2024

2023

2024

Adjusted EBITDA (See reconciliation to

GAAP above)

$

170,395

$

227,560

$

590,262

$

747,658

$

181,442

General and administrative

21,878

20,097

64,569

61,312

20,562

Segment Adjusted EBITDA

192,273

247,657

654,831

808,970

202,004

Segment Adjusted EBITDA – Non Coal

Operations (1)

(43,021

)

(43,322

)

(134,455

)

(132,735

)

(41,775

)

Segment Adjusted EBITDA – Coal

Operations

$

149,252

$

204,335

$

520,376

$

676,235

$

160,229

__________________

(1)

Non Coal Operations represent activity

outside of Alliance Coal and primarily consist of Total Royalties,

our investments in the advancement of energy and related

infrastructure and various eliminations primarily between Alliance

Coal and our Coal Royalty segment.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241028732058/en/

Investor Relations Contact Cary P. Marshall Senior Vice

President and Chief Financial Officer 918-295-7673

investorrelations@arlp.com

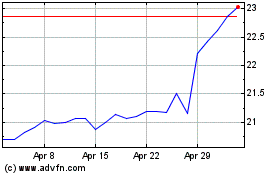

Alliance Resource Partners (NASDAQ:ARLP)

Historical Stock Chart

From Nov 2024 to Dec 2024

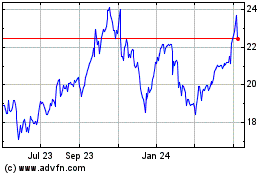

Alliance Resource Partners (NASDAQ:ARLP)

Historical Stock Chart

From Dec 2023 to Dec 2024