Current Report Filing (8-k)

14 April 2021 - 6:11AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event Reported): April 13, 2021

Gladstone Capital Corporation

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

Maryland

|

|

814-00237

|

|

54-2040781

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification Number)

|

|

|

|

|

|

1521 Westbranch Drive, Suite 100

McLean, Virginia

|

|

22102

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

(703) 287-5800

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of

the registrant under any of the following provisions:

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17

CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading symbol

|

|

Name of each exchange

on which registered

|

|

Common Stock, $0.001 par value per share

|

|

GLAD

|

|

The Nasdaq Stock Market LLC

|

|

5.375% Notes due 2024, $25.00 par value per note

|

|

GLADL

|

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of

1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new

or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On April 13, 2021, Gladstone Capital Corporation (the “Company”) amended and restated its existing advisory agreement, as amended (the

“Agreement”), with Gladstone Management Corporation, a registered investment adviser (the “Adviser”), by entering into the Third Amended and Restated Investment Advisory and Management Agreement between the Company and the

Adviser (the “Amended Agreement”). The Company’s entrance into the Amended Agreement was approved unanimously by its board of directors (the “Board”), including, specifically, its independent directors. The Amended Agreement

maintains the revised “hurdle rate” included in the calculation of the Incentive Fee for the period beginning April 1, 2021 through March 31, 2022, which was previously amended for the period beginning April 1, 2020 through

March 31, 2021 to increase the hurdle rate from 1.75% per quarter (7% annualized) to 2.00% per quarter (8% annualized) and increase the excess Incentive Fee hurdle rate from 2.1875% per quarter (8.75% annualized) to 2.4375% per quarter

(9.75% annualized). The calculation of the other fees in the Advisory Agreement remain unchanged. The revised Incentive Fee calculation will begin with the fee calculations for the quarter ending June 30, 2021. All other terms of the Advisory

Agreement remained the same. All capitalized terms not defined in this Current Report on Form 8-K are defined in the Amended Agreement.

The description above is only a summary of the material provisions of the Amended Agreement and is qualified in its entirety by reference to a copy of the

Amended Agreement, which will be filed with the Company’s next periodic report.

Item 7.01. Regulation FD Disclosure.

On April 13, 2021, the Company issued a press release, filed herewith as Exhibit 99.1, announcing that its board of directors declared monthly cash

distributions for its common stock for each of April, May and June 2021.

The information disclosed under this Item 7.01, including Exhibit 99.1 hereto,

is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities and Exchange Act of 1934, and shall not be deemed incorporated by reference into any filing made under the Securities Act of 1933, except

as expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

Gladstone Capital Corporation

|

|

|

|

|

|

|

Date: April 13, 2021

|

|

|

|

By:

|

|

/s/ Nicole Schaltenbrand

|

|

|

|

|

|

|

|

Nicole Schaltenbrand

|

|

|

|

|

|

|

|

Chief Financial Officer & Treasurer

|

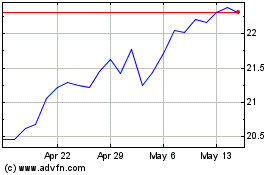

Gladstone Capital (NASDAQ:GLAD)

Historical Stock Chart

From Jan 2025 to Feb 2025

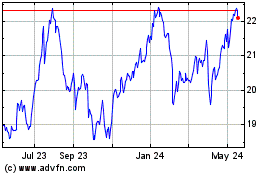

Gladstone Capital (NASDAQ:GLAD)

Historical Stock Chart

From Feb 2024 to Feb 2025