Westwood Holdings Group, Inc. (NYSE: WHG) today reported fourth

quarter earnings. Significant items include:

- Investment strategies beating their

primary benchmarks included LargeCap Value, Dividend Select,

Multi-Asset Income, Intermediate Fixed Income, Credit

Opportunities, Global Real Estate, MLP SMA and MLP High

Conviction.

- Multi-Asset Income, Global Real

Estate and MLP SMA all posted top quartile rankings in their peer

universes.

- Westwood Salient Enhanced Midstream

Income ETF (MDST) reached $73 million in assets by year-end amid

strong trading volumes.

- Quarterly revenues totaled $25.6

million versus the third quarter’s $23.7 million and $23.2 million

a year ago. Comprehensive income of $2.1 million compared with $0.1

million in the third quarter and $2.6 million in the fourth

quarter of 2023.

- Annual comprehensive income

included an after-tax charge of $2.7 million due to an increase in

the fair value of contingent consideration from our 2022 Salient

acquisition, reflecting increased revenues.

- Non-GAAP Economic Earnings of $3.4

million for the quarter compared with $1.1 million in the third

quarter and $2.8 million in the fourth quarter of 2023.

- Westwood held $44.6 million in cash

and liquid investments at December 31, 2024, down $3.7 million

from September 30, 2024. Stockholders’ equity totaled $120.3

million as of December 31, 2024 and we continue to have no

debt.

- Westwood's Board of Directors

authorized the addition of $5.0 million to the previous share

repurchase program, resulting in $5.5 million available for share

repurchases.

- We declared a cash dividend of

$0.15 per common share, payable on April 1, 2025 to

stockholders of record on March 3, 2025.

Brian Casey, Westwood’s CEO, commented, “We

celebrated the second anniversary of the acquisition of Salient

Partners’ asset management business and are very pleased to report

that the strategic combination continues to exceed our

expectations. Our enhanced capabilities in energy and real estate

income strategies have broadened our product reach while improving

our average fee rate. We successfully launched two innovative

exchange-traded funds (“ETFs”) within the Westwood Engineered Beta

(“WEBs”) partnership that we formed with ETF industry veteran Ben

Fulton. The WEBs Defined Volatility SPY ETF (DVSP) and the WEBs

Defined Volatility QQQ ETF (DVQQ) are designed to provide a more

stable investment experience across market conditions using a

dynamic, rules-based strategy to adjust exposure to equity markets

based on real-time volatility. We are working hard across our sales

channels to inform advisors and strategists about the benefits of

all of our new ETFs, including Westwood Salient Enhanced Midstream

Income ETF (MDST) and Westwood Salient Enhanced Energy Income ETF

(WEEI), and we are looking forward to gaining traction and scale.

Lastly, our pipeline for our traditional business is much improved

compared with last year and we anticipate healthy opportunities for

2025 and beyond.”

Revenues increased from the third quarter and

2023’s fourth quarter primarily due to higher average assets under

management (“AUM”) and higher performance fees.

Firmwide assets under management and advisement

totaled $17.6 billion, consisting of $16.6 billion in AUM and

assets under advisement (“AUA”) of $1.0 billion.

Fourth quarter comprehensive income of $2.1

million compared to $0.1 million in the third quarter on higher

revenues and changes in the fair value of contingent consideration,

partially offset by higher income taxes. Diluted EPS of $0.24

compared to $0.01 per share for the third quarter. Non-GAAP

Economic Earnings were $3.4 million, or $0.39 per share, compared

to the third quarter’s $1.1 million, or $0.13 per share.

Fourth quarter comprehensive income of $2.1

million compared to last year’s fourth quarter of $2.6 million

following higher revenues, offset by changes in the fair value of

contingent consideration and higher employee expenses driven by

performance-related incentive compensation. Diluted EPS of $0.24

compared with $0.32 per share for 2023’s fourth quarter. Non-GAAP

Economic Earnings of $3.4 million, or $0.39 per share, compared to

$2.8 million, or $0.34 per share, in the fourth quarter of

2023.

2024 comprehensive income of $2.2 million

compared to $9.5 million in 2023 on higher revenues and lower

income taxes, offset by changes in the fair value of contingent

consideration, higher employee expenses driven by higher

performance-related incentive compensation, and life insurance

proceeds received in 2023. Diluted EPS was $0.26 per share compared

with $1.17 per share for 2023. Economic EPS of $0.82 compared with

$2.26 in 2023.

Economic Earnings and Economic EPS are non-GAAP

performance measures that are explained and reconciled with the

most comparable GAAP numbers in the attached tables.

Westwood will host a conference call to discuss

fourth quarter and fiscal year 2024 results and other business

matters at 4:30 p.m. Eastern time today. To join the conference

call, please register here:

https://register.vevent.com/register/BI823ff804a3ee4809b6e9b55dcda1c3a0

After registering, you will be provided with a

dial-in number containing a personalized PIN.

To view the webcast, please register

here:

https://edge.media-server.com/mmc/p/4d3bsq89

Once registered, an email will be sent with

important details for this conference call, as well as a unique

Registrant ID.

ABOUT WESTWOOD HOLDINGS

GROUP

Westwood Holdings Group, Inc. is a focused

investment management boutique and wealth management firm.

Founded in 1983, Westwood offers a broad array

of investment solutions to institutional investors, private wealth

clients and financial intermediaries. The firm specializes in

several distinct investment capabilities: U.S. Value Equity,

Multi-Asset, Energy & Real Assets, Income Alternatives,

Tactical Absolute Return and Managed Investment Solutions, which

are available through separate accounts, the Westwood Funds® family

of mutual funds, exchange-traded funds (“ETFs”) and other pooled

vehicles. Westwood benefits from significant, broad-based employee

ownership and trades on the New York Stock Exchange under the

symbol “WHG.” Based in Dallas, Westwood also maintains offices in

Chicago, Houston and San Francisco.

For more information on Westwood, please visit

westwoodgroup.com.

Forward-looking Statements

Statements in this press release that are not

purely historical facts, including, without limitation, statements

about our expected future financial position, results of operations

or cash flows, as well as other statements including without

limitation, words such as “anticipate,” “believe,” “expect,”

“could,” and other similar expressions, constitute forward-looking

statements within the meaning of Section 27A of the Securities

Act of 1933, as amended, and Section 21E of the Securities

Exchange Act of 1934, as amended. Actual results and the timing of

some events could differ materially from those projected in or

contemplated by the forward-looking statements due to a number of

factors, including, without limitation: the composition and market

value of our AUM and AUA; our ability to maintain our fee structure

in light of competitive fee pressures; risks associated with

actions of activist stockholders; distributions to our common

stockholders have included and may in the future include a return

of capital; inclusion of foreign company investments in our AUM;

regulations adversely affecting the financial services industry;

our ability to maintain effective cyber security; litigation risks;

our ability to develop and market new investment strategies

successfully; our reputation and our relationships with current and

potential customers; our ability to attract and retain qualified

personnel; our ability to perform operational tasks; our ability to

select and oversee third-party vendors; our dependence on the

operations and funds of our subsidiaries; our ability to maintain

effective information systems; our ability to prevent misuse of

assets and information in the possession of our employees and

third-party vendors, which could damage our reputation and result

in costly litigation and liability for our clients and us; our

stock is thinly traded and may be subject to volatility;

competition in the investment management industry; our ability to

avoid termination of client agreements and the related investment

redemptions; the significant concentration of our revenues in a

small number of customers; we have made and may continue to make

business combinations as a part of our business strategy, which may

present certain risks and uncertainties; our relationships with

investment consulting firms; our ability to identify and execute on

our strategic initiatives; our ability to declare and pay

dividends; our ability to fund future capital requirements on

favorable terms; our ability to properly address conflicts of

interest; our ability to maintain adequate insurance coverage; our

ability to maintain an effective system of internal controls; and

the other risks detailed from time to time in Westwood’s SEC

filings, including, but not limited to, its annual report on Form

10-K for the year ended December 31, 2023 and its quarterly

report on Form 10-Q for the quarters ended March 31, 2024, June 30,

2024 and September 30, 2024. You are cautioned not to place undue

reliance on these forward-looking statements, which speak only as

of the date of this press release. Except as required by law,

Westwood is not obligated to publicly release any revisions to

these forward-looking statements to reflect events or circumstances

after the date of this press release or to reflect the occurrence

of unanticipated events.

SOURCE: Westwood Holdings Group, Inc.

(WHG-G)

CONTACT:

Westwood Holdings Group, Inc.

Terry Forbes

Chief Financial Officer and Treasurer

(214) 756-6900

WESTWOOD HOLDINGS GROUP, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF

COMPREHENSIVE INCOME(in thousands, except per

share and share amounts)(unaudited)

| |

|

Three Months Ended |

| |

|

December 31, 2024 |

|

September 30, 2024 |

|

December 31, 2023 |

|

REVENUES: |

|

|

|

|

|

|

|

Advisory fees: |

|

|

|

|

|

|

|

Asset-based |

|

$ |

18,025 |

|

|

$ |

17,774 |

|

|

$ |

16,657 |

|

|

Performance-based |

|

|

1,393 |

|

|

|

— |

|

|

|

710 |

|

|

Trust fees |

|

|

5,635 |

|

|

|

5,447 |

|

|

|

5,124 |

|

|

Trust performance-based |

|

|

482 |

|

|

|

— |

|

|

|

349 |

|

|

Other, net |

|

|

47 |

|

|

|

498 |

|

|

|

389 |

|

|

Total revenues |

|

|

25,582 |

|

|

|

23,719 |

|

|

|

23,229 |

|

|

|

|

|

|

|

|

|

|

EXPENSES: |

|

|

|

|

|

|

|

Employee compensation and benefits |

|

|

14,090 |

|

|

|

13,572 |

|

|

|

12,367 |

|

|

Sales and marketing |

|

|

641 |

|

|

|

644 |

|

|

|

810 |

|

|

Westwood mutual funds |

|

|

880 |

|

|

|

798 |

|

|

|

783 |

|

|

Information technology |

|

|

2,450 |

|

|

|

2,572 |

|

|

|

2,367 |

|

|

Professional services |

|

|

717 |

|

|

|

1,812 |

|

|

|

1,239 |

|

|

General and administrative |

|

|

3,044 |

|

|

|

2,991 |

|

|

|

2,933 |

|

|

(Gain) loss from change in fair value of contingent

consideration |

|

|

1,199 |

|

|

|

1,824 |

|

|

|

(113 |

) |

|

Total expenses |

|

|

23,021 |

|

|

|

24,213 |

|

|

|

20,386 |

|

|

Net operating income (loss) |

|

|

2,561 |

|

|

|

(494 |

) |

|

|

2,843 |

|

|

Net change in unrealized appreciation (depreciation) on private

investments |

|

|

— |

|

|

|

— |

|

|

|

(18 |

) |

|

Net investment income (loss) |

|

|

593 |

|

|

|

587 |

|

|

|

561 |

|

|

Other income |

|

|

219 |

|

|

|

374 |

|

|

|

365 |

|

|

Income before income taxes |

|

|

3,373 |

|

|

|

467 |

|

|

|

3,751 |

|

|

Provision for income taxes |

|

|

1,274 |

|

|

|

308 |

|

|

|

1,168 |

|

|

Net income |

|

$ |

2,099 |

|

|

$ |

159 |

|

|

$ |

2,583 |

|

|

Total comprehensive income |

|

$ |

2,099 |

|

|

$ |

159 |

|

|

$ |

2,583 |

|

|

Less: Comprehensive income attributable to noncontrolling

interest |

|

|

43 |

|

|

|

54 |

|

|

|

7 |

|

|

Comprehensive income attributable to Westwood Holdings Group,

Inc. |

|

$ |

2,056 |

|

|

$ |

105 |

|

|

$ |

2,576 |

|

|

|

|

|

|

|

|

|

|

Earnings per share: |

|

|

|

|

|

|

|

Basic |

|

$ |

0.25 |

|

|

$ |

0.01 |

|

|

$ |

0.32 |

|

|

Diluted |

|

$ |

0.24 |

|

|

$ |

0.01 |

|

|

$ |

0.32 |

|

| |

|

|

|

|

|

|

|

Weighted average shares outstanding: |

|

|

|

|

|

|

|

Basic |

|

|

8,271,614 |

|

|

|

8,123,714 |

|

|

|

8,007,896 |

|

|

Diluted |

|

|

8,756,976 |

|

|

|

8,488,372 |

|

|

|

8,184,736 |

|

| |

|

|

|

|

|

|

|

Economic Earnings |

|

$ |

3,377 |

|

|

$ |

1,084 |

|

|

$ |

2,806 |

|

|

Economic EPS |

|

$ |

0.39 |

|

|

$ |

0.13 |

|

|

$ |

0.34 |

|

| |

|

|

|

|

|

|

|

Dividends declared per share |

|

$ |

0.15 |

|

|

$ |

0.15 |

|

|

$ |

0.15 |

|

WESTWOOD HOLDINGS GROUP, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF

COMPREHENSIVE INCOME(in thousands, except per

share and share amounts)(unaudited)

| |

|

Year Ended December 31, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

REVENUES: |

|

|

|

|

|

Advisory fees: |

|

|

|

|

|

Asset-based |

|

$ |

69,755 |

|

|

$ |

67,391 |

|

|

Performance-based |

|

|

1,393 |

|

|

|

1,265 |

|

|

Trust fees |

|

|

21,422 |

|

|

|

20,242 |

|

|

Trust performance-based |

|

|

482 |

|

|

|

349 |

|

|

Other, net |

|

|

1,669 |

|

|

|

534 |

|

|

Total revenues |

|

|

94,721 |

|

|

|

89,781 |

|

|

|

|

|

|

|

|

EXPENSES: |

|

|

|

|

|

Employee compensation and benefits |

|

|

56,011 |

|

|

|

52,918 |

|

|

Sales and marketing |

|

|

2,668 |

|

|

|

2,990 |

|

|

Westwood mutual funds |

|

|

3,254 |

|

|

|

3,133 |

|

|

Information technology |

|

|

9,662 |

|

|

|

9,650 |

|

|

Professional services |

|

|

5,468 |

|

|

|

5,132 |

|

|

General and administrative |

|

|

11,947 |

|

|

|

12,512 |

|

|

(Gain) loss from change in fair value of contingent

consideration |

|

|

4,881 |

|

|

|

(2,768 |

) |

|

Acquisition expenses |

|

|

— |

|

|

|

209 |

|

|

Total expenses |

|

|

93,891 |

|

|

|

83,776 |

|

|

Net operating income |

|

|

830 |

|

|

|

6,005 |

|

|

Net change in unrealized appreciation (depreciation) on private

investments |

|

|

— |

|

|

|

6 |

|

|

Net investment income (loss) |

|

|

2,183 |

|

|

|

1,191 |

|

|

Other income |

|

|

1,002 |

|

|

|

6,241 |

|

|

Income before income taxes |

|

|

4,015 |

|

|

|

13,443 |

|

|

Income tax provision |

|

|

1,804 |

|

|

|

2,872 |

|

|

Net income |

|

$ |

2,211 |

|

|

$ |

10,571 |

|

|

Total comprehensive income |

|

$ |

2,211 |

|

|

$ |

10,571 |

|

|

Less: Comprehensive income (loss) attributable to noncontrolling

interest |

|

|

(4 |

) |

|

|

1,051 |

|

|

Comprehensive income attributable to Westwood Holdings

Group, Inc. |

|

$ |

2,215 |

|

|

$ |

9,520 |

|

|

|

|

|

|

|

|

Earnings per share: |

|

|

|

|

|

Basic |

|

$ |

0.27 |

|

|

$ |

1.20 |

|

|

Diluted |

|

$ |

0.26 |

|

|

$ |

1.17 |

|

| |

|

|

|

|

|

Weighted average shares outstanding: |

|

|

|

|

|

Basic |

|

|

8,163,465 |

|

|

|

7,964,423 |

|

|

Diluted |

|

|

8,515,779 |

|

|

|

8,112,139 |

|

| |

|

|

|

|

|

Economic Earnings |

|

$ |

6,965 |

|

|

$ |

18,342 |

|

|

Economic EPS |

|

$ |

0.82 |

|

|

$ |

2.26 |

|

| |

|

|

|

|

|

Dividends declared per share |

|

$ |

0.60 |

|

|

$ |

0.60 |

|

WESTWOOD HOLDINGS GROUP, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED BALANCE

SHEETS(in thousands, except par value and share

amounts)(unaudited)

| |

|

December 31, 2024 |

|

December 31, 2023 |

|

ASSETS |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

18,847 |

|

|

$ |

20,422 |

|

|

Accounts receivable |

|

|

14,453 |

|

|

|

14,394 |

|

|

Investments at fair value (amortized cost of $26,788 and

$32,982) |

|

|

27,694 |

|

|

|

32,915 |

|

|

Investments under measurement alternative |

|

|

10,747 |

|

|

|

7,247 |

|

|

Equity method investments |

|

|

4,250 |

|

|

|

4,284 |

|

|

Income taxes receivable |

|

|

295 |

|

|

|

205 |

|

|

Other assets |

|

|

6,780 |

|

|

|

5,553 |

|

|

Goodwill |

|

|

39,501 |

|

|

|

39,501 |

|

|

Deferred income taxes |

|

|

2,244 |

|

|

|

726 |

|

|

Operating lease right-of-use assets |

|

|

2,559 |

|

|

|

3,673 |

|

|

Intangible assets, net |

|

|

21,668 |

|

|

|

24,803 |

|

|

Property and equipment, net of accumulated depreciation of $8,424

and $10,078 |

|

|

951 |

|

|

|

1,444 |

|

|

Total assets |

|

$ |

149,989 |

|

|

$ |

155,167 |

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

Liabilities: |

|

|

|

|

| Accounts payable and accrued

liabilities |

|

$ |

6,413 |

|

|

$ |

6,130 |

|

| Dividends payable |

|

|

2,466 |

|

|

|

2,367 |

|

| Compensation and benefits

payable |

|

|

10,924 |

|

|

|

9,539 |

|

| Operating lease

liabilities |

|

|

3,197 |

|

|

|

4,552 |

|

| Contingent consideration |

|

|

4,657 |

|

|

|

10,133 |

|

|

Total liabilities |

|

|

27,657 |

|

|

|

32,721 |

|

|

Stockholders’ Equity: |

|

|

|

|

|

Common stock, $0.01 par value, authorized 25,000,000

shares, issued 12,137,080 and 11,856,737, respectively and

outstanding 9,234,575 and 9,140,760, respectively |

|

|

122 |

|

|

|

119 |

|

|

Additional paid-in capital |

|

|

202,239 |

|

|

|

201,622 |

|

|

Treasury stock, at cost – 2,902,505 and 2,715,977,

respectively |

|

|

(88,277 |

) |

|

|

(85,990 |

) |

|

Retained earnings |

|

|

6,207 |

|

|

|

4,650 |

|

|

Total Westwood Holdings Group, Inc. stockholders’

equity |

|

|

120,291 |

|

|

|

120,401 |

|

|

Noncontrolling interest in consolidated

subsidiary |

|

|

2,041 |

|

|

|

2,045 |

|

|

Total equity |

|

|

122,332 |

|

|

|

122,446 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

149,989 |

|

|

$ |

155,167 |

|

WESTWOOD HOLDINGS GROUP, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS(in

thousands)(unaudited)

| |

|

Year ended December 31, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

Cash flows from operating activities: |

|

|

|

|

|

Net income |

|

$ |

2,211 |

|

|

$ |

10,571 |

|

|

Adjustments to reconcile net income to net cash provided by (used

in) operating activities: |

|

|

|

|

|

Depreciation |

|

|

602 |

|

|

|

670 |

|

|

Amortization of intangible assets |

|

|

4,148 |

|

|

|

4,149 |

|

|

Net change in unrealized (appreciation) depreciation on

investments |

|

|

(790 |

) |

|

|

(839 |

) |

|

Stock-based compensation expense |

|

|

5,537 |

|

|

|

6,518 |

|

|

Deferred income taxes |

|

|

(1,518 |

) |

|

|

1,036 |

|

|

Non-cash lease expense |

|

|

1,115 |

|

|

|

1,103 |

|

|

Loss on asset disposition |

|

|

— |

|

|

|

69 |

|

|

Gain on remeasurement of lease liabilities |

|

|

— |

|

|

|

(119 |

) |

|

Fair value change of contingent consideration |

|

|

4,881 |

|

|

|

(2,768 |

) |

|

Gain on insurance settlement |

|

|

— |

|

|

|

(5,000 |

) |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

Net (purchases) sales of investments – trading securities |

|

|

6,046 |

|

|

|

(16,609 |

) |

|

Accounts receivable |

|

|

(59 |

) |

|

|

135 |

|

|

Other assets |

|

|

(1,227 |

) |

|

|

660 |

|

|

Accounts payable and accrued liabilities |

|

|

283 |

|

|

|

(447 |

) |

|

Compensation and benefits payable |

|

|

1,385 |

|

|

|

851 |

|

|

Income taxes receivable |

|

|

(90 |

) |

|

|

241 |

|

|

Operating lease liabilities |

|

|

(1,402 |

) |

|

|

(1,406 |

) |

|

Net cash provided by (used in) operating activities |

|

|

21,122 |

|

|

|

(1,185 |

) |

|

Cash flows from investing activities: |

|

|

|

|

|

Acquisitions, net of cash acquired |

|

|

— |

|

|

|

(741 |

) |

|

Insurance settlement proceeds |

|

|

— |

|

|

|

5,000 |

|

|

Purchases of investments |

|

|

(3,500 |

) |

|

|

— |

|

|

Purchases of property and equipment |

|

|

(109 |

) |

|

|

(147 |

) |

|

Additions to internally developed software |

|

|

(1,004 |

) |

|

|

— |

|

|

Net cash provided by (used in) investing activities |

|

|

(4,613 |

) |

|

|

4,112 |

|

|

Cash flows from financing activities: |

|

|

|

|

|

Purchases of treasury stock |

|

|

(1,348 |

) |

|

|

— |

|

|

Restricted stock returned for payment of taxes |

|

|

(939 |

) |

|

|

(862 |

) |

|

Payment of contingent consideration in acquisition |

|

|

(10,357 |

) |

|

|

— |

|

|

Cash dividends |

|

|

(5,440 |

) |

|

|

(5,502 |

) |

|

Net cash used in financing activities |

|

|

(18,084 |

) |

|

|

(6,364 |

) |

|

Net increase (decrease) in cash and cash

equivalents |

|

|

(1,575 |

) |

|

|

(3,437 |

) |

|

Cash and cash equivalents, beginning of

period |

|

|

20,422 |

|

|

|

23,859 |

|

|

Cash and cash equivalents, end of period |

|

$ |

18,847 |

|

|

$ |

20,422 |

|

| |

|

|

|

|

|

Supplemental cash flow information: |

|

|

|

|

|

Cash paid during the period for income taxes |

|

$ |

3,431 |

|

|

$ |

1,594 |

|

|

Right-of-use assets obtained in exchange for operating lease

liabilities |

|

$ |

— |

|

|

$ |

173 |

|

|

Accrued dividends |

|

$ |

2,466 |

|

|

$ |

2,368 |

|

WESTWOOD HOLDINGS GROUP, INC. AND

SUBSIDIARIESReconciliation of Comprehensive Income

Attributable to Westwood Holdings Group, Inc. to Economic

Earnings(in thousands, except per share and share

amounts)(unaudited)

As supplemental information, we are providing

non-GAAP performance measures that we refer to as Economic Earnings

and Economic EPS. We provide these measures in addition to, not as

a substitute for, Comprehensive income attributable to Westwood

Holdings Group, Inc. and earnings per share, which are reported on

a GAAP basis. Our management and Board of Directors review Economic

Earnings and Economic EPS to evaluate our ongoing performance,

allocate resources, and review our dividend policy. We believe that

these non-GAAP performance measures, while not substitutes for GAAP

Comprehensive income attributable to Westwood Holdings Group, Inc.

or earnings per share, are useful for management and investors when

evaluating our underlying operating and financial performance and

our available resources. We do not advocate that investors consider

these non-GAAP measures without also considering financial

information prepared in accordance with GAAP.

We define Economic Earnings as Comprehensive

income attributable to Westwood Holdings Group, Inc. plus non-cash

equity-based compensation expense, amortization of intangible

assets and deferred taxes related to goodwill. Although

depreciation on fixed assets is a non-cash expense, we do not add

it back when calculating Economic Earnings because depreciation

charges represent an allocation of the decline in the value of the

related assets that will ultimately require replacement. Although

gains and losses from changes in the fair value of contingent

consideration are non-cash, we do not add or subtract those back

when calculating Economic Earnings because gains and losses on

changes in the fair value of contingent consideration are

considered regular following an acquisition. In addition, we do not

adjust Economic Earnings for tax deductions related to restricted

stock expense or amortization of intangible assets. Economic EPS

represents Economic Earnings divided by diluted weighted average

shares outstanding.

| |

|

Three Months Ended |

| |

|

December 31,2024 |

|

September 30,2024 |

|

December 31,2023 |

|

Comprehensive income attributable to Westwood Holdings

Group, Inc. |

|

$ |

2,056 |

|

|

$ |

105 |

|

|

$ |

2,576 |

|

|

Stock-based compensation expense |

|

|

1,216 |

|

|

|

1,409 |

|

|

|

1,407 |

|

|

Intangible amortization |

|

|

1,063 |

|

|

|

1,011 |

|

|

|

1,073 |

|

|

Tax benefit from goodwill amortization |

|

|

(97 |

) |

|

|

156 |

|

|

|

125 |

|

|

Tax impact of adjustments to GAAP comprehensive income |

|

|

(861 |

) |

|

|

(1,597 |

) |

|

|

(2,375 |

) |

|

Economic Earnings |

|

$ |

3,377 |

|

|

$ |

1,084 |

|

|

$ |

2,806 |

|

|

Earnings per share |

|

$ |

0.23 |

|

|

$ |

0.01 |

|

|

$ |

0.31 |

|

|

Stock-based compensation expense |

|

|

0.14 |

|

|

|

0.17 |

|

|

|

0.17 |

|

|

Intangible amortization |

|

|

0.13 |

|

|

|

0.12 |

|

|

|

0.13 |

|

|

Tax benefit from goodwill amortization |

|

|

(0.01 |

) |

|

|

0.02 |

|

|

|

0.02 |

|

|

Tax impact of adjustments to GAAP comprehensive income |

|

|

(0.10 |

) |

|

|

(0.19 |

) |

|

|

(0.29 |

) |

|

Economic EPS |

|

$ |

0.39 |

|

|

$ |

0.13 |

|

|

$ |

0.34 |

|

|

Diluted weighted average shares |

|

|

8,756,976 |

|

|

|

8,488,372 |

|

|

|

8,184,736 |

|

| |

|

Year Ended December 31, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

Comprehensive income attributable to Westwood Holdings

Group, Inc. |

|

$ |

2,215 |

|

|

$ |

9,520 |

|

|

Stock-based compensation expense |

|

|

5,537 |

|

|

|

6,518 |

|

|

Intangible amortization |

|

|

4,148 |

|

|

|

4,149 |

|

|

Tax benefit from goodwill amortization |

|

|

340 |

|

|

|

500 |

|

|

Tax impact of adjustments to GAAP comprehensive income (loss) |

|

|

(5,275 |

) |

|

|

(2,345 |

) |

|

Economic Earnings |

|

$ |

6,965 |

|

|

$ |

18,342 |

|

|

Earnings per share |

|

$ |

0.26 |

|

|

$ |

1.17 |

|

|

Stock-based compensation expense |

|

|

0.65 |

|

|

|

0.80 |

|

|

Intangible amortization |

|

|

0.49 |

|

|

|

0.52 |

|

|

Tax benefit from goodwill amortization |

|

|

0.04 |

|

|

|

0.06 |

|

|

Tax impact of adjustments to GAAP comprehensive income (loss) |

|

|

(0.62 |

) |

|

|

(0.29 |

) |

|

Economic EPS |

|

$ |

0.82 |

|

|

$ |

2.26 |

|

|

Diluted weighted average shares |

|

|

8,515,779 |

|

|

|

8,112,139 |

|

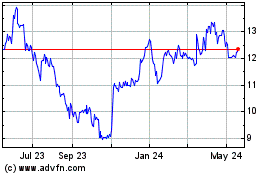

Westwood (NYSE:WHG)

Historical Stock Chart

From Jan 2025 to Feb 2025

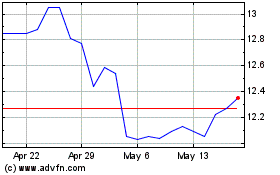

Westwood (NYSE:WHG)

Historical Stock Chart

From Feb 2024 to Feb 2025