Goodfellow Reports Its Results for the Fiscal Year Ended November 30, 2019

14 February 2020 - 8:49AM

Goodfellow Inc. (TSX: GDL) announced today its financial results

for the fourth quarter ended November 30, 2019. The Company

reported a net income of $0.3 million or $0.03 per share compared

to a net income of $0.2 million or $0.02 per share a year ago.

Consolidated sales for the three months ended November 30, 2019

were $107.1 million compared to $112.7 million last year. Sales in

Canada were stable compared to the same period a year ago, while

sales in the United States decreased 5% (on a Canadian dollar

basis) and export sales decreased 50% compared to the same period a

year ago. On the operating side, selling, administrative and

general expenses decreased overall by $0.4 million.

For the fiscal year ended November 30, 2019, the

Company reported a net income of $3.1 million or $0.36 per share

compared to a net income of $2.6 million or $0.30 per share a year

ago. Consolidated sales for the fiscal year ended November 30, 2019

were $449.6 million compared to $475.2 million last year. Sales in

Canada decreased 3% compared to the same period a year ago, while

sales in the United States decreased 14% (on a Canadian dollar

basis) and export sales decreased 20% compared to the same period a

year ago. On the operating side, selling, administrative and

general expenses decreased overall by $3.6 million.

Despite challenging conditions in North America

and overseas, Goodfellow’s core business activities showed great

signs of resilience in 2019 to sustain the trend of improved

profitability. The Company has invested in measures to improve its

productivity and strengthen its position as the leader in custom

orders & value-added manufacturing of wood products.

The Board of directors of Goodfellow Inc.

declared an eligible dividend of $0.10 per share payable on March

13, 2020, to shareholders of record at the close of business on

February 28, 2020.

Goodfellow Inc. is a distributor of lumber

products, building materials and floor coverings. Goodfellow shares

trade on the Toronto Stock Exchange under the symbol GDL.

|

From: |

Goodfellow Inc.Patrick GoodfellowPresident and

CEOTel: 450 635-6511Fax: 450

635-3730Internet:

info@goodfellowinc.com |

|

GOODFELLOW INC. |

|

|

| Consolidated Statements of Comprehensive

Income |

|

|

| For the years ended November 30, 2019 and

2018 |

| (in thousands of dollars, except per share amounts) |

|

|

| Unaudited |

|

|

| |

|

|

| |

Years ended |

|

|

November 30 2019 |

November 30 2018 |

| |

$ |

$ |

| |

|

|

|

Sales |

449,587 |

475,207 |

| Expenses |

|

|

|

Cost of goods sold |

364,545 |

387,311 |

|

Selling, administrative and general expenses |

77,639 |

81,161 |

|

Gain on disposal of property, plant and equipment |

(3) |

(18) |

|

Net financial costs |

3,137 |

3,476 |

|

|

445,318 |

471,930 |

| |

|

|

| Earnings before income taxes |

4,269 |

3,277 |

| |

|

|

| Income taxes |

1,215 |

706 |

| |

|

|

| Net

earnings |

3,054 |

2,571 |

| |

|

| Items that will not subsequently be reclassified to net

earnings |

|

|

| |

|

|

|

Remeasurement of defined benefit plan obligation, |

|

|

|

net of taxes of $265 ($318 in 2018) |

(723) |

858 |

| |

|

|

| Total comprehensive

income |

2,331 |

3,429 |

| |

|

|

|

|

|

|

| Net earnings per share

– Basic |

0.36 |

0.30 |

| Net earnings per share

- Diluted |

0.35 |

0.30 |

|

GOODFELLOW INC. |

|

|

| Consolidated Statements of Financial

Position |

|

| (in thousands of dollars) |

|

|

|

Unaudited |

|

|

| |

As at |

As at |

|

|

November 302019 |

November 302018 |

| |

$ |

$ |

| Assets |

|

|

| Current Assets |

|

|

|

Cash |

2,364 |

2,578 |

|

Trade and other receivables |

48,498 |

50,008 |

|

Inventories |

87,339 |

92,544 |

|

Prepaid expenses |

2,563 |

3,143 |

| Total Current Assets |

140,764 |

148,273 |

| |

|

|

| Non-Current Assets |

|

|

|

Property, plant and equipment |

32,838 |

34,356 |

|

Intangible assets |

3,927 |

4,444 |

|

Defined benefit plan asset |

2,222 |

2,704 |

|

Investment in a joint venture |

25 |

25 |

|

Other assets |

805 |

916 |

| Total Non-Current Assets |

39,817 |

42,445 |

|

Total Assets |

180,581 |

190,718 |

| |

|

|

| Liabilities |

|

|

| Current liabilities |

|

|

|

Bank indebtedness |

31,204 |

42,835 |

|

Trade and other payables |

29,048 |

29,192 |

|

Income taxes payable |

734 |

409 |

|

Provision |

1,470 |

336 |

|

Dividend payable |

856 |

- |

|

Current portion of obligations under finance leases |

15 |

14 |

| Total Current Liabilities |

63,327 |

72,786 |

| |

|

|

| Non-Current Liabilities |

|

|

|

Provision |

- |

1,317 |

|

Obligations under finance leases |

28 |

43 |

|

Deferred income taxes |

3,209 |

3,652 |

|

Defined benefit plan obligation |

609 |

57 |

| Total

Non-Current Liabilities |

3,846 |

5,069 |

| Total

Liabilities |

67,173 |

77,855 |

| |

|

|

| Shareholders’ Equity |

|

|

|

Share capital |

9,424 |

9,152 |

|

Retained earnings |

103,984 |

103,711 |

| |

113,408 |

112,863 |

|

Total Liabilities and Shareholders’ Equity |

180,581 |

190,718 |

|

GOODFELLOW INC. |

|

|

| Consolidated Statements of Cash Flows |

|

|

| For the years ended November 30, 2019 and

2018 |

| (in thousands of

dollars)Unaudited |

|

|

|

|

Years ended |

| |

November 30 2019 |

November 30 2018 |

| |

$ |

$ |

| Operating Activities |

|

|

|

Net earnings |

3,054 |

2,571 |

|

Adjustments for: |

|

|

|

Depreciation |

3,479 |

3,690 |

|

Accretion expense on provision |

14 |

50 |

|

(Decrease) increase in provision |

(197) |

219 |

|

Income taxes |

1,215 |

706 |

|

Gain on disposal of property, plant and equipment |

(3) |

(18) |

|

Interest expense |

2,134 |

2,502 |

|

Funding in deficit of pension plan expense |

47 |

20 |

|

Other assets |

111 |

(35) |

|

Share-based compensation |

(79) |

- |

|

|

9,775 |

9,705 |

| |

|

|

|

Changes in non-cash working capital items |

6,856 |

3,391 |

|

Interest paid |

(2,154) |

(2,535) |

|

Income taxes (paid) recovered |

(1,069) |

1,045 |

|

|

3,633 |

1,901 |

| Net Cash Flows

from Operating Activities |

13,408 |

11,606 |

| |

|

|

| Financing Activities |

|

|

|

Proceeds from borrowings under bank loans |

115,000 |

88,000 |

|

Repayment of borrowings under bank loans |

(113,000) |

(92,000) |

|

Proceeds from borrowings under banker’s acceptances |

40,000 |

31,000 |

|

Repayment of borrowings under banker’s acceptances |

(53,000) |

(37,000) |

|

Repayment of finance lease liabilities |

(14) |

(137) |

|

Dividend Paid |

(851) |

- |

|

|

(11,865) |

(10,137) |

| |

|

|

| Investing Activities |

|

|

|

Acquisition of property, plant and equipment |

(968) |

(1,159) |

|

Increase in intangible assets |

(176) |

(212) |

|

Proceeds on disposal of property, plant and equipment |

18 |

72 |

|

Dividends from the joint venture |

- |

260 |

|

|

(1,126) |

(1,039) |

| |

|

|

| Net cash inflow |

417 |

430 |

| Cash position, beginning of year |

743 |

313 |

|

Cash position, end of year |

1,160 |

743 |

| |

|

|

| Cash position is comprised of: |

|

|

|

Cash |

2,364 |

2,578 |

|

Bank overdraft |

(1,204) |

(1,835) |

|

|

1,160 |

743 |

|

GOODFELLOW INC. |

|

|

|

| Consolidated Statements of Change in Shareholders’

Equity |

|

|

| For the years ended November 30, 2019 and

2018 |

| (in thousands of dollars) |

|

|

|

| Unaudited |

|

|

|

|

|

Share Capital |

Retained Earnings |

Total |

| |

$ |

$ |

$ |

| |

|

|

|

| Balance as at November

30, 2017 |

9,152 |

100,282 |

109,434 |

| |

|

|

|

|

Net earnings |

- |

2,571 |

2,571 |

|

Other comprehensive income |

- |

858 |

858 |

|

|

|

|

|

|

Total comprehensive income |

- |

3,429 |

3,429 |

| |

|

|

|

| |

|

|

|

|

Balance as at November 30, 2018 |

9,152 |

103,711 |

112,863 |

| |

|

|

|

|

Net earnings |

- |

3,054 |

3,054 |

|

Other comprehensive income |

- |

(723) |

(723) |

|

|

|

|

|

|

Total comprehensive income |

- |

2,331 |

2,331 |

| |

|

|

|

| Transactions with owners of the Company |

|

|

|

| |

|

|

|

|

Dividend |

- |

(1,707) |

(1,707) |

|

|

|

|

|

|

Share-based payment |

272 |

(351) |

(79) |

| |

|

|

|

|

Balance as at November 30, 2019 |

9,424 |

103,984 |

113,408 |

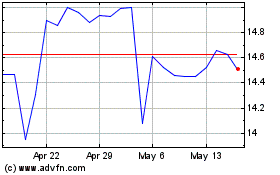

Goodfellow (TSX:GDL)

Historical Stock Chart

From Dec 2024 to Jan 2025

Goodfellow (TSX:GDL)

Historical Stock Chart

From Jan 2024 to Jan 2025