Intermediate declaration by the Board of Directors

Regulatory News:

X-FAB (BOURSE:XFAB):

Highlights Q3 2024:

- Revenue was USD 206.4 million, within the guidance of USD

205-215 million, down 12% year-on-year (YoY) and up 1%

quarter-on-quarter (QoQ)

- Bookings at USD 217.1 million with a book to bill ratio at

1.05

- EBITDA at USD 50.3 million, down 23% YoY and up 5% QoQ

- EBITDA margin of 24.4%; excluding IFRS 15 impact, EBITDA margin

was 23.5%, compared to the guidance of 24-27%

- EBIT was USD 25.0 million, down 43% YoY and up 9% QoQ

Outlook:

- Q4 2024 revenue is expected to come in within a range of USD

195-205 million with an EBITDA margin in the range of 22-25%.

- The guidance is based on an average exchange rate of 1.10

USD/Euro and does not take the impact related to IFRS 15 into

account.

- X-FAB is adjusting the full-year revenue guidance from USD

860-880 million to USD 822-832 million; the full-year EBITDA margin

guidance has been adjusted to 23.4-24.0%.

Revenue breakdown per quarter:

in millions of USD

Q4 2022

Q1 2023

Q2 2023

Q3 2023

Q4 2023

Q1 2024

Q2 2024

Q3 2024

Q3 y-o-y growth

Automotive

104.4

120.9

131.1

135.3

151.8

135.6

142.4

146.0

8%

Industrial

42.3

46.9

51.3

53.7

54.3

52.6

34.4

31.5

-41%

Medical

14.6

17.6

16.2

17.0

16.4

14.5

13.2

12.1

-29%

Subtotal core business

161.3

185.4

198.7

206.1

222.5

202.6

190.1

189.6

-8%

87.9%

89.1%

90.8%

92.2%

92.8%

92.6%

93.7%

92.9%

CCC1

21.6

22.5

20.0

17.2

17.2

16.0

12.6

14.2

-17%

Others

0.7

0.2

0.2

0.2

0.1

0.1

0.1

0.1

-30%

Revenue*

183.6

208.1

218.9

223.5

239.8

218.7

202.8

204.0

-9%

Impact from revenue recognized over

time

0

0

8.3

10.4

-2.0

-2.6

2.3

2.4

Total revenue

183.6

208.1

227.1

233.8

237.7

216.2

205.1

206.4

-12%

1Consumer, Communications &

Computer

in millions of USD

Q4 2022

Q1 2023

Q2 2023

Q3 2023

Q4 2023

Q1 2024

Q2 2024

Q3 2024

Q3 y-o-y growth

CMOS

151.9

172.8

180.7

180.5

188.4

168.3

166.2

175.0

-3%

Microsystems

19.5

22.2

20.8

24.4

27.9

24.1

25.1

21.6

-11%

Silicon carbide

12.2

13.2

17.3

18.6

23.5

26.3

11.6

7.4

-60%

Revenue*

183.6

208.1

218.9

223.5

239.8

218.7

202.8

204.0

-9%

Impact from revenue recognized over

time

0

0

8.3

10.4

-2.0

-2.6

2.3

2.4

Total revenue

183.6

208.1

227.1

233.8

237.7

216.2

205.1

206.4

-12%

Business development

In the third quarter of 2024, X-FAB recorded revenues of USD

206.4 million, down 12% year-on-year and up 1% quarter-on-quarter,

thereof a positive impact from revenue recognized over time

amounting to USD 2.4 million. This compares to a guidance of USD

205-215 million.

Revenues in X-FAB’s core markets – automotive, industrial, and

medical – amounted to USD 189.6 million*, down 8% year-on-year and

accounted for a 93% share of total revenues*. Bookings were up 4%

year-on-year with a book-to-bill of 1.05 in the third quarter.

Backlog came in at USD 481.4 million, compared to USD 517.3 million

at the end of the previous quarter. The decrease in backlog is

related to orders worth USD 114 million for which delivery dates

had not yet been confirmed at the end of the quarter. These are

longer-term orders for delivery up to 2026.

In the third quarter, X-FAB’s automotive business grew 8%

year-on-year, while automotive bookings weakened due to year-end

inventory adjustments. X-FAB’s industrial and medical business

decreased 41% and 29% year-on-year respectively. Current market

trends and uncertainties have led to destocking activities and

delays across the entire supply chain, however, order intake in the

industrial and medical end markets picked up strongly in the third

quarter. The CCC (Consumer, Communication & Computer) business,

after bottoming out in recent quarters, grew by 13%

quarter-on-quarter with strong bookings and a book-to-bill of

2.06.

X-FAB’s CMOS business declined slightly year-on-year. Demand for

X-FAB’s popular 180nm CMOS platform remained healthy and new

prototypes were started for future high-volume applications in

X-FAB’s 110nm CMOS process. In line with market trends, X-FAB also

suffered from inventory corrections, particularly noticeable in the

350nm CMOS technology. The 0.6-micron CMOS technologies on 150mm

wafers, for which demand had significantly declined over recent

years, recorded an uptick in bookings after X-FAB had announced the

discontinuation of these technologies as per end of 2026. The

decision was taken to support the ongoing transition to the

microsystems business at the site in Erfurt, Germany. Customers

responded with high order volumes to ensure supply in the medium

term, while initiating activities to work on redesigns for

next-generation products. The upturn in the 0.6-micron business is

expected to contribute positively to revenues from the fourth

quarter onwards.

Third quarter silicon carbide sales continued to decline in a

persistently weak market environment and decreased 60%

year-on-year. Visibility remains low but SiC development activities

have been encouraging, especially for next-generation technologies

that come with improved device performance and a 30% increase in

dies per wafer. Combined with the recent reduction in SiC substrate

prices, this represents a potential 40% cost improvement for the

final SiC device, fostering the further adoption of silicon

carbide. As soon as the SiC power market picks up, these new

high-performance designs will contribute to the future growth of

X-FAB’s silicon carbide business.

In the third quarter, X-FAB’s microsystems business recorded a

decline of 11% year-on-year, reflecting current market weaknesses.

Inventory adjustments in the automotive industry and delays in new

model launches have particularly impacted the microsystems

business. The medical end market, typically a strong driver of

microsystems sales, has also been affected by destocking, but is

expected to contribute positively in the future due to healthy

bookings and high demand applications.

Quarterly prototyping revenues totaled USD 23.6 million*, down

14% year-on-year and up 12% against the previous quarter.

X-FAB adjusts its full-year revenue guidance to USD 822-832

million in response to current weaknesses and the impact on fourth

quarter revenues of an operational incident at the Malaysian

factory. Required rework of affected material will shift

approximately USD 15-20 million of sales into next year.

The fundamental drivers of X-FAB's business remain intact. These

include the growth of semiconductor content in cars, the

"electrification of everything" to drive the decarbonization of the

world, and the digitization in the medical sector to make

healthcare more efficient in an era of aging populations. X-FAB's

comprehensive set of technologies and expertise enable customers to

develop world-leading solutions for the most important challenges

facing the world today. X-FAB's business is expected to return to

robust growth once the current destocking cycle is completed.

Prototyping and production revenue* per quarter and end

market:

in millions

of USD

Revenue

Q3 2023

Q4 2023

Q1 2024

Q2 2024

Q3 2024

Automotive

Prototyping

6.2

10.0

6.7

7.6

9.3

Production

129.1

141.8

128.9

134.8

136.7

Industrial

Prototyping

14.3

10.5

10.7

8.9

8.2

Production

39.4

43.8

41.9

25.5

23.3

Medical

Prototyping

3.3

3.3

2.7

2.0

3.0

Production

13.7

13.1

11.8

11.2

9.1

CCC

Prototyping

3.3

3.5

3.1

2.5

3.0

Production

13.9

13.7

12.9

10.2

11.3

Operations update

In the third quarter, X-FAB continued its capacity expansion

program with the focus on its popular 180nm and 110nm CMOS

technologies at X-FAB France and X-FAB Sarawak. The newly

constructed cleanroom at X‑FAB’s Malaysian site is now ready for

the first equipment to be moved in.

The expansion of CMOS capacity is also critical to support

X-FAB's microsystems business. Microsystems are based on a CMOS

wafer to which specialized MEMS layers are added or systems are

integrated at wafer level. With the planned discontinuation of the

0.6-micron CMOS business, the Erfurt site is well on track to

entirely focus on the manufacturing of complex microsystems in the

future.

The SiC capacity expansion at the Texas fab, which has been

slowed in line with current demand weakness, will be resumed as

soon as the SiC market recovers and long-term customer commitments

require additional capacity. At the end of the quarter,

approximately half of the SiC capacity targeted in X-FAB's

three-year capacity expansion plan had been installed. In addition,

X-FAB aims to further increase the proportion of customers who

source their own SiC raw wafers and consign them to X-FAB,

resulting in a lower total billing as there is less pass-through

for substrates sourced by X-FAB. Due to both the lower installed

SiC capacity and the decision to optimize the proportion of

customer consigned SiC wafers, the original SiC revenue target of

USD 300-350 million in 2026 is no longer achievable. This will

result in changes to the timing and product mix of X-FAB's growth

path.

Total capital expenditures in the third quarter came in at USD

149.8 million, thereof about two thirds related to the expansion of

X-FAB Sarawak. X-FAB reiterates its capex projection for the full

year of 2024 in the amount of USD 550 million.

An operational incident at the Malaysian factory caused a

three-day production slowdown in the third quarter. This has been

fully resolved and rework of the affected material is underway.

Financial update

Third quarter EBITDA was USD 50.3 million with an EBITDA margin

of 24.4%. Excluding the positive impact from revenues recognized

over time, the EBITDA margin of the third quarter would have been

23.5%.

Profitability is not affected by exchange rate fluctuations as

X-FAB’s business is naturally hedged. At a constant USD/Euro

exchange rate of 1.09 as experienced in the previous year’s

quarter, the EBITDA margin would have been 0.1 percentage points

lower.

Cash and cash equivalents at the end of the third quarter

amounted to USD 315.9 million.

Management comments

Rudi De Winter, CEO of X-FAB Group, said: “While unfavorable

market developments and related inventory adjustments are impacting

our business in the short term, the long-term outlook remains

positive. I am confident in the unique technologies we offer and

the high-growth end markets we serve putting us in the right

position to address today's key challenges and deliver sustainable

growth over the long term. As soon as the market begins to recover,

order patterns will change rapidly. With the progress we are making

with our capacity expansion program, we will be well prepared to

meet our customers' needs, especially for our 180nm technologies,

and return to solid growth.”

X-FAB Quarterly Conference Call

X-FAB’s third quarter results will be discussed in a live

conference call/webcast on Thursday, October 24, 2024, at 6.30 p.m.

CEST. The conference call will be in English.

Please register here for the audiocast (listen only).

Please register here for the conference call (listen and ask

questions).

The fourth quarter 2024 results will be communicated on February

6, 2025.

About X-FAB

X-FAB is a global foundry group providing a comprehensive set of

specialty technologies and design IP to enable its customers to

develop world-leading semiconductor products that are manufactured

at X-FAB's six wafer fabs located in Malaysia, Germany, France, and

the United States. With its expertise in analog/mixed-signal

technologies, microsystems/MEMS and silicon carbide (SiC), X-FAB is

the development and manufacturing partner for its customers,

primarily serving the automotive, industrial and medical end

markets. X-FAB has approximately 4,500 employees and has been

listed on Euronext Paris since April 2017 (XFAB). For more

information, please visit www.xfab.com.

Forward-looking information

This press release may include forward-looking statements.

Forward-looking statements are statements regarding or based upon

our management’s current intentions, beliefs or expectations

relating to, among other things, X-FAB’s future results of

operations, financial condition, liquidity, prospects, growth,

strategies, or developments in the industry in which we operate. By

their nature, forward-looking statements are subject to risks,

uncertainties and assumptions that could cause actual results or

future events to differ materially from those expressed or implied

thereby. These risks, uncertainties and assumptions could adversely

affect the outcome and financial effects of the plans and events

described herein.

Forward-looking statements contained in this press release

regarding trends or current activities should not be taken as a

report that such trends or activities will continue in the future.

We undertake no obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise, unless legally required. You should not place undue

reliance on any such forward-looking statements, which speak only

as of the date of this press release.

The information contained in this press release is subject to

change without notice. No re-report or warranty, express or

implied, is made as to the fairness, accuracy, reasonableness, or

completeness of the information contained herein and no reliance

should be placed on it.

*excluding impact from revenue recognized over time according to

IFRS 15

Condensed consolidated statement of profit and loss

in thousands of USD

Quarter

ended 30 Sep 2024

unaudited

Quarter

ended 30 Sep 2023

unaudited

Quarter

ended 30 Jun 2024

unaudited

Nine months

ended 30 Sep 2024

unaudited

Nine months

ended 30 Sep 2023

unaudited

Revenue*

203,982

223,452

202,847

625,541

650,431

Impact from revenue recognized over

time

2,384

10,360

2,255

2,079

18,622

Total revenue

206,366

233,812

205,102

627,620

669,052

Revenues in USD in %

56

57

58

59

56

Revenues in EUR in %

44

43

42

41

44

Cost of sales

-155,162

-164,147

-160,236

-481,184

-474,551

Gross profit

51,204

69,665

44,866

146,436

194,501

Gross profit margin in %

24.8

29.8

21.9

23.3

29.1

Research and development expenses

-13,087

-10,782

-11,387

-35,581

-34,609

Selling expenses

-2,177

-1,999

-2,142

-6,857

-6,307

General and administrative expenses

-11,369

-11,583

-11,660

-35,840

-34,044

Rental income and expenses from investment

properties

534

977

394

2,362

3,438

Other income and other expenses

-147

-2,376

2,755

4,455

-864

Operating profit

24,957

43,902

22,825

74,976

122,115

Finance income

12,191

9,011

6,775

24,744

24,207

Finance costs

-10,945

-8,493

-7,419

-26,017

-26,977

Net financial result

1,246

518

-644

-1,273

-2,770

Profit before tax

26,204

44,420

22,181

73,703

119,345

Income tax

-254

-2,747

-2,359

-4,872

3,747

Profit for the period

25,950

41,673

19,822

68,831

123,092

Operating profit (EBIT)

24,957

43,902

22,825

74,976

122,115

Depreciation

25,345

21,808

25,028

74,137

63,891

EBITDA

50,302

65,711

47,853

149,113

186,006

EBITDA margin in %

24.4

28.1

23.3

23.8

27.8

Earnings per share

0.20

0.32

0.15

0.53

0.94

Weighted average number of shares

130,631,921

130,631,921

130,631,921

130,631,921

130,631,921

EUR/USD average exchange rate

1.09825

1.08842

1.07667

1.08704

1.08330

Amounts in the financial tables provided in this press release

are rounded to the nearest thousand except when otherwise

indicated, rounding differences may occur.

*excluding impact from revenue recognized over time in

accordance with IFRS 15

Condensed consolidated statement of financial

position

in thousands of USD

Quarter ended

30 Sep 2024

unaudited

Quarter ended

30 Sep 2023

unaudited

Year ended

31 Dec 2023

audited

ASSETS

Non-current assets

Property, plant, and equipment

1,005,438

653,024

734,488

Investment properties

7,478

7,319

7,171

Intangible assets

6,053

5,827

5,627

Other non-current assets

46

63

58

Deferred tax assets

83,277

79,155

83,772

Total non-current assets

1,102,293

745,387

831,116

Current assets

Inventories

284,146

260,961

269,227

Contract assets

26,090

26,027

24,010

Trade and other receivables

91,307

111,828

123,101

Other assets

45,154

52,005

50,659

Cash and cash equivalents

315,917

391,274

405,701

Total current assets

762,613

842,095

872,698

TOTAL ASSETS

1,864,905

1,587,482

1,703,814

EQUITY AND LIABILITIES

Equity

Share capital

432,745

432,745

432,745

Share premium

348,709

348,709

348,709

Retained earnings

249,557

141,904

180,159

Cumulative translation adjustment

465

-328

-301

Treasury shares

-770

-770

-770

Total equity

1,030,707

922,260

960,542

Non-current liabilities

Non-current loans and borrowings

333,757

49,244

235,318

Other non-current liabilities and

provisions

4,833

4,024

4,024

Total non-current liabilities

338,590

53,268

239,342

Current liabilities

Trade payables

48,962

69,811

90,681

Current loans and borrowings

33,492

214,778

25,659

Other current liabilities and

provisions

413,155

327,365

387,590

Total current liabilities

495,608

611,954

503,930

TOTAL EQUITY AND LIABILITIES

1,864,905

1,587,482

1,703,814

Condensed consolidated statement of cash flows

in thousands of USD

Quarter

ended 30 Sep 2024

unaudited

Quarter

ended 30 Sep 2023

unaudited

Quarter

ended 30 Jun 2024

unaudited

Nine months

ended 30 Sep 2024

unaudited

Nine months

ended 30 Sep 2023

unaudited

Income before taxes

26,204

44,420

22,181

73,703

119,345

Reconciliation of income before taxes

to cash flow arising from operating activities:

21,988

26,845

28,972

74,692

72,721

Depreciation and amortization, before

effect of grants and subsidies

25,345

21,808

25,028

74,137

63,891

Amortization of investment grants and

subsidies

-924

-753

-624

-2,221

-2,241

Interest income and expenses (net)

2,308

-105

959

2,961

1,992

Loss/(gain) on the sale of plant,

property, and equipment (net)

-312

-1,554

-2,020

-4,083

-3,174

Loss/(gain) on the change in fair value of

derivatives and financial assets (net)

1,144

0

0

1,144

0

Other non-cash transactions (net)

-5,573

7,448

5,629

2,754

12,252

Changes in working capital:

29,732

-38,694

7,487

36,420

101,875

Decrease/(increase) of trade

receivables

17,693

3,206

10,211

36,156

-39,277

Decrease/(increase) of other receivables

and other assets

1,361

3,417

12,244

20,191

-516

Decrease/(increase) of inventories

-6,559

-13,049

-604

-12,113

-44,238

Decrease/(increase) of contract assets

-2,384

-10,360

-2,255

-2,079

-26,027

(Decrease)/increase of trade payables

-3,323

-19,254

-14,369

-17,898

-189

(Decrease)/increase of other

liabilities

22,944

-2,653

2,260

12,164

212,123

Income taxes (paid)/received

914

-2,874

-1,227

-1,754

-3,383

Net cash from operating

activities

78,838

29,697

57,413

183,061

290,558

Cash flow from investing

activities:

Payments for property, plant, equipment

and intangible assets

-149,775

-83,964

-121,893

-376,648

-237,357

Acquisition of subsidiary, net of cash

acquired

0

0

-24,863

-1,634

0

Payments for loan investments to related

parties

0

-61

0

0

-237

Proceeds from loan investments related

parties

0

44

0

0

206

Proceeds from sale of property, plant, and

equipment

312

1,805

2,020

4,123

3,499

Interest received

2,644

3,139

2,984

9,060

6,709

Net cash used in investing

activities

-146,820

-79,038

-141,752

-365,099

-227,181

Condensed consolidated statement of cash flows –

con’t

in thousands of USD

Quarter

ended 30 Sep 2024

unaudited

Quarter

ended 30 Sep 2023

unaudited

Quarter

ended 30 Jun 2024

unaudited

Nine months

ended 30 Sep 2024

unaudited

Nine months

ended 30 Sep 2023

unaudited

Cash flow from (used in) financing

activities:

Proceeds from loans and borrowings

78,634

85,904

42,601

171,535

100,144

Repayment of loans and borrowings

-20,582

-79,067

-5,644

-120,339

-128,867

Receipts of sale and leaseback

arrangements

32,766

0

-5,147

59,234

0

Payments of lease installments

-5,080

-1,530

-3,061

-9,309

-4,315

Interest paid

-4,834

-1,892

-4,574

-13,466

-4,460

Cash flow from (used in) financing

activities

80,903

3,415

24,175

87,655

-37,498

Effect of changes in foreign currency

exchange rates on cash balances

12,941

-4,587

-1,250

4,599

-4,030

Increase/(decrease) of cash and cash

equivalents

12,921

-45,926

-60,164

-94,383

25,879

Cash and cash equivalents at the beginning

of the period

290,054

441,786

351,468

405,701

369,425

Cash and cash equivalents at the end

of

the period

315,917

391,274

290,054

315,917

391,274

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241024722290/en/

X-FAB Press Contact Uta Steinbrecher Investor Relations

X-FAB Silicon Foundries +49-361-427-6489

uta.steinbrecher@xfab.com

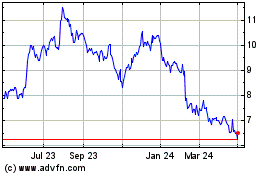

X-FAB Silicon Foundries (EU:XFAB)

Historical Stock Chart

From Oct 2024 to Nov 2024

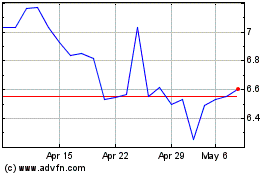

X-FAB Silicon Foundries (EU:XFAB)

Historical Stock Chart

From Nov 2023 to Nov 2024