UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION

REQUIRED IN PROXY STATEMENT

SCHEDULE

14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment

No. )

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

| ☐ |

Preliminary

Proxy Statement |

| |

|

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

|

| ☒ |

Definitive

Proxy Statement |

| |

|

| ☐ |

Definitive

Additional Materials |

| |

|

| ☐ |

Soliciting

Material Pursuant to §240.14a-12 |

| ABEONA

THERAPEUTICS INC. |

| (Name

of Registrant as Specified in its Charter) |

| |

| |

| (Name

of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment

of Filing Fee (Check the appropriate box):

| ☒ |

No

fee required |

| |

|

| ☐ |

Fee

paid previously with preliminary materials |

| |

|

| ☐ |

Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

ABEONA

THERAPEUTICS INC.

6555

Carnegie Ave., 4th Floor

Cleveland,

OH 44103

646-813-4701

NOTICE

OF SPECIAL MEETING OF STOCKHOLDERS

to

be held on Friday, December 20, 2024

PLEASE

TAKE NOTICE that the 2024 Special Meeting of Stockholders (the “Special Meeting”) of Abeona Therapeutics Inc. (the “Company”)

will be held virtually over the Internet on Friday, December 20, 2024, at 9:00 a.m. Eastern Time, for the purpose of approving an increase

in the number of shares of Common Stock reserved for issuance under the Second Amended and Restated Abeona Therapeutics Inc. 2023

Equity Incentive Plan from 3,200,000 to 8,400,000 shares of Common Stock.

In

addition to the foregoing, the Special Meeting will include the transaction of such other business as may properly come before the Special

Meeting, or any adjournment(s), continuation(s), rescheduling(s) or postponement(s) thereof. The Board of Directors has fixed the close

of business on November 7, 2024 (the “Record Date”), as the record date for the determination of stockholders entitled to

receive notice of, and to vote at, the Special Meeting and any adjournment or postponement thereof. Only stockholders of record at the

close of business on the Record Date are entitled to notice of and to vote at the Special Meeting. A complete list of stockholders entitled

to vote at the Special Meeting will be available for inspection by stockholders at our offices during normal business hours, during the

10 days prior to the Special Meeting as well as during the Special Meeting at www.virtualshareholdermeeting.com/ABEO2024SM.

Information

relating to the proposals described above is set forth in the accompanying proxy statement. Please carefully review the proxy statement.

This Proxy Statement is available at www.proxyvote.com.

Stockholders

are invited to attend the Special Meeting to be held virtually over the Internet on Friday, December 20, 2024 at 9 a.m. Eastern Time.

YOUR VOTE IS IMPORTANT. If you do not expect to virtually attend the Special Meeting, or if you do plan to virtually attend but wish

to vote by proxy, please complete, date, sign and mail the enclosed proxy card in the return envelope provided addressed to Vote Processing,

c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. Proxies will also be accepted as follows: (1) via the Internet by accessing www.proxyvote.com

and following the on-screen instructions or scanning the QR code on the proxy card with your smartphone; (2) by calling toll-free at

1-800-690-6903 from any touch-tone telephone and following the instructions; (3) by signing, dating and returning your proxy card in

the prepaid enclosed envelope and (4) by attending the virtual Special Meeting at www.virtualshareholdermeeting.com/ABEO2024SM.

You should have your proxy card available in front of you when you log onto the Internet or call. You can vote online or by phone until

11:59 p.m. Eastern Time the day before the Special Meeting.

| By

Order of the Board of Directors, |

|

| |

|

| /s/

Vishwas Seshadri |

|

| Vishwas

Seshadri |

|

| President

& Chief Executive Officer |

|

Cleveland,

OH

November

12, 2024

TABLE

OF CONTENTS

PROXY

STATEMENT SUMMARY

This

summary highlights information contained elsewhere in this proxy statement. This summary does not contain all information that you should

consider, and you should review all of the information contained in the proxy statement before voting.

Special

Meeting of Stockholders

| Date: |

December

20, 2024 |

| |

|

| Time: |

9:00a.m.

Eastern Time |

| |

|

| Location: |

Online

only at www.virtualshareholdermeeting.com/ABEO2024SM. Stockholders will not be able to attend the Special Meeting in person. |

| |

|

| Record

Date: |

November

7, 2024 |

| |

|

| Voting: |

Stockholders

as of the Record Date are entitled to vote. Each share of common stock is entitled to one vote. |

Proposals

and Voting Recommendations

Proposal

No. |

|

Proposal |

|

Board

Recommendation |

| |

|

|

|

|

| 1 |

|

To

approve an increase in the number of shares of Common Stock reserved for issuance under the Second Amended and Restated Abeona

Therapeutics Inc. 2023 Equity Incentive Plan from 3,200,000 to 8,400,000 shares of Common Stock |

|

FOR |

| |

|

|

|

|

| 2 |

|

To

consider and vote upon an adjournment of the Special Meeting, if necessary, to solicit additional proxies if there are not sufficient

votes in favor of Proposal No. 1 |

|

FOR |

Voting

Methods

You

can vote in one of four ways:

| ● |

Visit

www.proxyvote.com to vote VIA THE INTERNET |

| |

|

| ● |

Call

toll-free at 1-800-690-6903 and follow the instructions to vote VIA TELEPHONE |

| |

|

| ● |

Sign,

date and return your proxy card in the prepaid enclosed envelope to vote BY MAIL |

| |

|

| ● |

Attend

the meeting to vote VIA THE INTERNET |

ABEONA

THERAPEUTICS INC.

6555

Carnegie Ave., 4th Floor

Cleveland,

OH 44103

(646)

813-4701

PROXY

STATEMENT

SPECIAL

MEETING OF STOCKHOLDERS

To

Be Held on Friday, December 20, 2024

This

proxy statement is furnished by Abeona Therapeutics Inc., a Delaware corporation (“we,” “us,” “Abeona”

or the “Company”), to holders of its common stock, par value $0.01 per share (“Common Stock”), in connection

with the solicitation of proxies by our Board of Directors (the “Board”) for use at our Special Meeting of Stockholders (the

“Special Meeting”), and at any and all adjournments or postponements thereof. This proxy statement and the accompanying form

of proxy is first being sent to holders of Common Stock on or about November 13, 2024. Our mailing address and the location of our principal

executive offices is 6555 Carnegie Ave., 4th Floor, Cleveland, OH 44103. Our telephone number is (646) 813-4701. The purposes of the

Special Meeting are set forth in the Notice of Special Meeting of Stockholders (the “Notice of Special Meeting”), which accompanies

this Proxy Statement.

We

have adopted a virtual format for our Special Meeting to provide a consistent experience to all stockholders regardless of location.

We have designed the virtual Special Meeting to provide substantially the same opportunities to participate as you would have at an in-person

meeting, including the ability to vote. Detailed instructions on how to vote and submit your questions at the Special Meeting may be

found online at www.virtualshareholdermeeting.com/ABEO2024SM.

All

shares of Common Stock represented by properly executed proxies or voting instruction forms will be voted at the Special Meeting in accordance

with the directions marked on the proxies or voting instruction forms, unless such proxies or voting instruction forms have previously

been revoked. If no directions are indicated on such proxies or voting instruction forms, they will be voted FOR Proposal 1 – to

approve an increase in the number of shares of Common Stock reserved for issuance under the Second Amended and Restated Abeona

Therapeutics Inc. 2023 Equity Incentive Plan from 3,200,000 to 8,400,000 shares of Common Stock.

If

any other matters are properly presented at the Special Meeting for action, the proxy holders will vote the proxies (which confer discretionary

authority upon such holders to vote on such matters) in accordance with their best judgment, subject to compliance with Rule 14a-4(c)

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Each proxy executed and returned by a stockholder

may be revoked at any time before it is voted by timely submission of a written notice of revocation or by submission of a duly executed

proxy bearing a later date (in either case directed to the Secretary of the Company not later than the day prior to the Special Meeting),

or, if a stockholder is virtually present at the Special Meeting, he or she may elect to revoke his or her proxy and request the right

to vote his or her shares of Common Stock personally.

If

your shares of Common Stock are registered directly in your name with our transfer agent, Odyssey Transfer and Trust Company, you are

considered a “stockholder of record” or a “registered stockholder” of those shares of Common Stock. You

should follow the instructions on the Notice of Special Meeting to ensure that your vote is counted. Alternatively, you may attend virtually

and vote at the Special Meeting.

If

your shares are held in an account at a bank, brokerage firm, or other similar organization (which we refer to as a “broker”),

then you are a beneficial owner of shares held in “street name.” In that case, you will have received these proxy materials

from the bank, brokerage firm, or other similar organization holding your account. As a beneficial owner, you will have to direct your

broker on how to vote the shares held in your account in accordance with your broker’s requirements.

At

the close of business on November 7, 2024, the record date for the Special Meeting (the “Record Date”), the number of issued

and outstanding shares of our Common Stock entitled to vote was 43,593,484. Each share of Common Stock entitles its holder to one vote

with respect to all matters submitted to stockholders for a vote at the Special Meeting. Because the only proposal to be voted on at

the special meeting is expected to be treated as a “non-routine” matter, banks, brokers and other nominees will not have

authority to vote on the proposal unless instructed, so we do not expect there to be any broker non-votes at the special meeting.

A

complete list of Company stockholders entitled to vote at the Special Meeting will be available at our principal executive offices during

normal business hours, at least 10 days prior to the Special Meeting and during the Special Meeting at www.virtualshareholdermeeting.com/ABEO2024SM.

According to the Company’s amended and restated bylaws (the “Bylaws”), the presence, through virtual attendance or

by proxy, of the holders of one-third of the shares of Common Stock outstanding and entitled to vote constitutes a quorum for the conduct

of business at the Special Meeting. Abstentions and broker non-votes are counted as present for purposes of determining whether a quorum

is present.

Proposals

1 and 2 will be approved upon the affirmative vote of a majority of the outstanding shares of Common Stock present through virtual attendance

or by proxy at the Special Meeting and entitled to vote on the respective Proposal. Stockholders may vote “FOR” or “AGAINST,”

or “ABSTAIN” from voting. Abstentions will have the effect of a vote “AGAINST” each of Proposals 1 and 2.

The

Board is not aware of any matters that will be brought before the Special Meeting other than those matters specifically set forth in

the Notice of Special Meeting. However, if any other matter properly comes before the Special Meeting, it is intended that the persons

named in the enclosed form of proxy, or their substitutes acting thereunder, will vote on such matter in accordance with the recommendations

of the Board, or, if no such recommendations are made, in accordance with their best judgment.

All

expenses in connection with solicitation of proxies will be borne by us. We will also request brokers, dealers, banks and voting trustees,

and their nominees, to make available the Notice of Special Meeting, this proxy statement, the accompanying form of proxy to beneficial

owners and will reimburse them for their expenses in forwarding these materials. We expect to solicit proxies primarily by mail, but

our directors, officers and employees may also solicit in person, by telephone or email, on behalf of the Board without additional compensation.

Stockholders

of record as of the Record Date can attend the Special Meeting online by logging onto our virtual forum at www.virtualshareholdermeeting.com/ABEO2024SM

and following the instructions provided on their proxy card, vote instruction card or “Important Notice Regarding the Availability

of Proxy Materials.” To participate in the Special Meeting, you will need the 16-digit control number included on your proxy card,

voter instruction card or “Important Notice Regarding the Availability of Proxy Materials.” If you do not have this control

number at the time of the Special Meeting, you will still be able to attend virtually, but you will not be able to vote or ask questions.

The

virtual Special Meeting platform is fully supported across browsers (Microsoft Edge, Firefox, Chrome, and Safari) and devices (desktops,

laptops, tablets, and cell phones) running the most updated version of applicable software and plugins. Attendees should ensure that

they have a strong Wi-Fi connection wherever they intend to participate in the virtual Special Meeting. Attendees should also give themselves

plenty of time to log in and ensure that they can hear streaming audio prior to the start of the virtual Special Meeting.

Compensation

of Directors

Compensation

for Board Service in 2023. Each director who is not also an Abeona employee is entitled to receive an annual board fee and an annual

committee fee for their service on each Board committee. These fees are paid in cash quarterly. In addition, we reimburse each director,

whether an employee or not, for the expense of attending Board and committee meetings. There were no additional fees paid for service

as a chairperson of a Board committee, with the exception of the Chairman of the Board who receives an additional $30,000 per year for

serving as Chairman. During 2023, the annual board fee was $50,000 and the annual committee fee was $7,500 per committee served.

In

addition, incumbent non-employee directors were each granted equity awards valued at $271,143 for service on the Board in 2023 consisting

of restricted stock. All equity awards were granted on a different date than any equity awards to executive officers. These equity awards

vest one year after the date of grant.

Director

Compensation Table – 2023

The

table below represents the compensation paid to each of our directors who served on the Board during the year ended December 31, 2023,

other than Dr. Seshadri, whose compensation as our President and Chief Executive Officer is set forth under “Executive Compensation

— Summary Compensation Table” below:

| | |

Fees | | |

| | |

| | |

| |

| | |

Earned or | | |

| | |

All | | |

| |

| | |

Paid | | |

Stock | | |

Other | | |

| |

| | |

in Cash | | |

Awards | | |

Compensation | | |

Total | |

| Name | |

($)(1) | | |

($)(2) (3) | | |

($) | | |

($) | |

| Leila Alland, M.D. | |

| 65,000 | | |

| 271,143 | | |

| - | | |

| 336,143 | |

| Mark J. Alvino | |

| 65,000 | | |

| 271,143 | | |

| - | | |

| 336,143 | |

| Michael Amoroso | |

| 80,000 | | |

| 271,143 | | |

| - | | |

| 351,143 | |

| Faith L. Charles | |

| 65,000 | | |

| 271,143 | | |

| - | | |

| 336,143 | |

| Paul Mann (4) | |

| 28,750 | | |

| - | | |

| 14,344 | | |

| 43,094 | |

| Christine Silverstein | |

| 53,750 | | |

| 271,143 | | |

| - | | |

| 324,893 | |

| Todd Wider, M.D. (5) | |

| 28,750 | | |

| - | | |

| 14,344 | | |

| 43,094 | |

| Donald A. Wuchterl | |

| 59,375 | | |

| 271,143 | | |

| - | | |

| 330,518 | |

| (1)

|

Amounts

shown reflect the annual board fee and annual committee fee(s) earned in 2023. |

| |

|

| (2)

|

Represents

the aggregate grant date fair value of 58,689 shares of Common Stock on June 14, 2023, the date the restricted stock awards

were granted ($4.62 per share) as reported on Nasdaq, computed in accordance with ASC 718. Our assumptions in determining fair value

are described in Note 10 of Notes to Consolidated Financial Statements in Part II, Item 8 of the Annual Report. Amounts shown do

not reflect the compensation actually received by the directors. |

| |

|

| (3) |

The

aggregate number of stock awards outstanding for each continuing director as of December 31, 2023 is 58,689. |

| |

|

| (4)

|

Mr.

Mann ceased serving on the Board as of May 17, 2023. His fees earned reflect the partial year of service and he also received a one-time

payment representing the cash value of his unvested equity on the termination date in exchange for a release of claims in connection

with his termination. |

| |

|

(5)

|

Dr.

Wider ceased serving on the Board as of May 17, 2023. His fees earned reflect the partial year of service and he also received a

one-time payment representing the cash value of his unvested equity on the termination date in exchange for a release of claims in

connection with his termination. |

Certain

Relationships and Related Transactions

On

occasion we may engage in certain related party transactions. Pursuant to our Audit Committee charter, our policy is that all related

party transactions are reviewed and approved by the Audit Committee. There were no related party transactions in 2023.

Equity

Compensation Plan Information

The

following table sets forth, as of December 31, 2023, information about shares of Common Stock outstanding and available for issuance

under our existing equity compensation plans.

| Plan Category | |

Number of securities to be issued upon exercise of outstanding options, warrants and rights(1) | | |

Weighted-average exercise price of outstanding options, warrants and rights | | |

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) | |

| | |

(a) | | |

(b) | | |

(c) | |

| Equity compensation plans approved by security holders: | |

| | | |

| | | |

| | |

| 2023 Equity Incentive Plan(2) | |

| — | | |

| — | | |

| 156,591 | |

| 2015 Equity Incentive Plan(3) | |

| 179,001 | | |

$ | 38.58 | | |

| — | |

| Equity compensation plans not approved by security holders(4) | |

| — | | |

| — | | |

| 859,400 | |

| Total | |

| 179,001 | | |

$ | 38.58 | | |

| 1,015,991 | |

| (1) |

A

total of 1,684,009, 632,410 and 131,750 unvested restricted shares of Common Stock under the 2023 Equity Incentive Plan, 2015

Equity Incentive Plan and 2023 Employment Inducement Equity Incentive Plan, respectively, were excluded from column (a) as those

shares are considered issued at the time of grant. Unvested restricted shares were also excluded from column (c) as they are no longer

available for future issuance. |

| (2) |

As

described in “Proposal 1: Approval of an Increase in the Number of Shares of Common Stock Reserved for Issuance Under

the Second Amended and Restated Abeona Therapeutics Inc. 2023 Equity Incentive Plan” we are seeking stockholder approval of

an increase the share reserve under the Second Amended and Restated Abeona Therapeutics Inc. 2023 Equity Incentive Plan by 5,200,000

shares, from 3,200,000 to 8,400,000 shares, at the Special Meeting. |

| (3) |

No

further grants may be made under the 2015 Equity Incentive Plan. |

| (4) |

On

September 23, 2023, the Company adopted the 2023 Employment Inducement Equity Incentive Plan to provide the Company with an ability

to grant equity incentive compensation as a material inducement for certain individuals to commence employment with the Company within

the meaning of Nasdaq Stock Market Rule 5635(c)(4) and, subject to the adjustment provisions of the 2023 Employment Inducement Equity

Incentive Plan, reserved 1,000,000 shares of Common Stock for issuance pursuant to equity awards granted under the 2023 Employment

Inducement Equity Incentive Plan. |

Security

Ownership of Certain Beneficial Owners and Management

The

Company has determined beneficial ownership of our Common Stock as of November 7, 2024, in accordance with the rules of the SEC. These

rules generally attribute beneficial ownership of securities to persons who possess sole or shared voting power or investment power with

respect to those securities. In addition, these rules require that the Company include shares of Common Stock issuable pursuant to the

vesting of restricted stock units and the exercise of stock options and warrants that are either immediately exercisable or exercisable

within 60 days of November 7, 2024. These shares are deemed to be outstanding and beneficially owned by the person holding those options

or warrants for the purpose of computing the percentage ownership of that person, but they are not treated as outstanding for the purpose

of computing the percentage ownership of any other person. Unless otherwise indicated, the persons or entities identified in this table

have sole voting and investment power with respect to all shares shown as beneficially owned by them, subject to applicable community

property laws.

| | |

Amount and

Nature of |

| |

| |

| | |

Beneficial

Ownership |

| |

| |

| | |

of Common |

| |

Percent of | |

| Name and Address of Beneficial Owner | |

Stock (1) |

| |

Common Stock(2) | |

| Directors and Named Executive Officers: | |

| |

| |

| | |

| Leila Alland, M.D. (3) | |

| 122,192 |

| |

| * | |

| Mark J. Alvino (4) | |

| 76,261 |

| |

| * | |

| Michael Amoroso (5) | |

| 192,033 |

| |

| * | |

| Faith L. Charles (6) | |

| 117,658 |

| |

| * | |

| Christine Silverstein (7) | |

| 117,986 |

| |

| * | |

| Donald A. Wuchterl (8) | |

| 118,438 |

| |

| * | |

| Vishwas Seshadri (9) | |

| 927,388 |

| |

| 2.1 | % |

| Brendan O’Malley (10) | |

| 290,080 |

| |

| * | |

| Joseph Vazzano (11) | |

| 365,217 |

| |

| * | |

| Bernhardt G. Zeiher(12) | |

| 11,044 |

| |

| * | |

| Eric Crombez(13) | |

| 11,044 |

| |

| * | |

| All Directors and Named Executive Officers as a group (consisting of 11 persons) | |

| 2,349,341 |

| |

| 5.4 | % |

| 5% Beneficial Owners: | |

| |

| |

| | |

| Adage Capital Partners, L.P. (14) | |

| 4,210,429 |

| |

| 9.7 | % |

| Nantahala Capital Management, L.P. (15) | |

| 2,499,781 |

| |

| 5.7 | % |

| Millennium

Management LLC(16) | |

| 2,301,628 |

| |

| 5.3 | % |

| Suvretta

Capital Management, LLC(17) | |

| 3,685,503 |

| |

| 8.5 | % |

| Janus

Henderson Group plc(18) | |

| 2,380,667 |

| |

| 5.5 | % |

| (1) |

Includes

outstanding shares of Common Stock held plus all shares of Common Stock issuable upon exercise of options, warrants and other rights

exercisable within 60 days after November 7, 2024. |

| |

|

| (2) |

Based

upon 43,593,484 shares of Common Stock issued and outstanding as of November 7, 2024. |

| |

|

| (3) |

Dr.

Alland is known to beneficially own an aggregate of 118,265 shares of our Common Stock and presently exercisable options for the

purchase of 3,927 shares pursuant to the 2015 Equity Incentive Plan. |

| |

|

| (4) |

Mr.

Alvino is known to beneficially own an aggregate of 72,334 shares of our Common Stock and presently exercisable options for the purchase

of 3,927 shares pursuant to the 2015 Equity Incentive Plan. |

| |

|

| (5) |

Mr.

Amoroso is known to beneficially own an aggregate of 144,365 shares of our Common Stock and presently exercisable options for the

purchase of 47,668 shares of our Common Stock pursuant to the 2015 Equity Incentive Plan. |

| |

|

| (6) |

Ms.

Charles is known to beneficially own an aggregate of 113,731 shares of our Common Stock and presently exercisable options for the

purchase of 3,927 shares of our Common Stock pursuant to the 2015 Equity Incentive Plan. |

| |

|

| (7) |

Ms.

Silverstein is known to beneficially own an aggregate of 97,471 shares of our Common Stock and presently exercisable options for

the purchase of 20,515 shares of our Common Stock pursuant to the 2015 Equity Incentive Plan. |

| |

|

| (8) |

Mr.

Wuchterl is known to beneficially own an aggregate of 114,511 shares of our Common Stock and presently exercisable options for the

purchase of 3,927 shares of our Common Stock pursuant to the 2015 Equity Incentive Plan. |

| |

|

| (9) |

Dr.

Seshadri is known to beneficially own an aggregate of 903,887 shares of our Common Stock and presently exercisable options for the

purchase of 23,501 shares of our Common Stock pursuant to the 2015 Equity Incentive Plan. |

| |

|

| (10) |

Dr.

O’Malley is known to beneficially own an aggregate of 273,289 shares of our Common Stock and presently exercisable options

for the purchase of 16,791 shares of our Common Stock pursuant to the 2015 Equity Incentive Plan. |

| |

|

| (11) |

Mr.

Vazzano is known to beneficially own an aggregate of 365,217 shares of our Common Stock. |

| |

|

(12)

|

Dr.

Zeiher is known to beneficially own an aggregate of 11,044 shares of our Common Stock. |

| (13) |

Dr.

Crombez is known to beneficially own an aggregate of 11,044 shares of our Common Stock. |

| |

|

| (14) |

Based

on information set forth in a Schedule 13G/A filed with the SEC on June 3, 2024 by Adage Capital Management, L.P., Robert Atchinson

and Phillip Gross. Adage Capital Management, L.P. (“ACM”), may be deemed to have beneficial ownership of the shares of

Common Stock directly held by Adage Capital Partners, L.P. (“ACP”) as the investment manager of ACP. Robert Atchinson

and Phillip Gross may be deemed to have beneficial ownership of such shares in their roles as managing director of entities affiliated

with ACM. The address of each of the reporting persons above is 200 Clarendon Street, 52nd Floor, Boston, MA 02116. |

| |

|

| (15) |

Based on information set forth in a Schedule 13G/A filed

with the SEC on February 14, 2024 by Nantahala Capital Management, LLC (“Nantahala”), Wilmot B. Harkey and Daniel Mack.

Nantahala may be deemed to be the beneficial owner of 2,499,781 shares of our Common Stock held by funds and separately managed accounts

under its control, and as the managing members of Nantahala, each of Wilmot B. Harkey and Daniel Mack may be deemed to be a beneficial

owner of those shares of our Common Stock. The 2,499,781 shares of our Common Stock includes 249,529 shares of our Common Stock which

may be acquired by Nantahala within sixty days through the exercise of warrants. Nantahala Capital Management, LLC’s address

is 130 Main St. 2nd Floor, New Canaan, CT 06840. |

| (16) |

Based

on information set forth in a Schedule 13G/A filed with the SEC on October 8, 2024 by Integrated Core Strategies (US) LLC, Millennium

Management LLC and related entities. Integrated Core Strategies (US) LLC may be deemed to have beneficial ownership of 2,267,875

shares of our Common Stock. The shares of our Common Stock potentially beneficially owned by Millennium Management LLC, Millennium

Group Management LLC and Israel A. Englander are held by entities subject to voting control and investment discretion by Millennium

Management LLC and/or other investment managers that may be controlled by Millennium Group Management LLC (the managing member of

Millennium Management LLC) and Mr. Englander (the sole voting trustee of the managing member of Millennium Group Management LLC).

The address of each of the reporting persons above is 399 Park Avenue, New York, NY 10022. |

| |

|

| (17) |

Based

on information set forth in a Schedule 13G filed with the SEC on May 13, 2024 by Suvretta Capital Management, LLC, Averill Master

Fund, Ltd. and Aaron Cowen. Suvretta Capital Management, LLC and Aaron Cowen may be deemed to have beneficial ownership of 3,685,503

shares of our Common Stock and Averill Master Fund, Ltd. may be deemed to have beneficial ownership of 3,273,770 shares of our Common

Stock. Suvretta Capital Management, LLC’s address is 540 Madison Avenue, 7th Floor, New York, NY 10022. Averill Master Fund,

Ltd.’s address is c/o Maples Corporate Services Limited, P.O. Box 309, Ugland House, Grand Cayman KY1-1104, Cayman Islands.

Aaron Cowen’s address is c/o Suvretta Capital Management, LLC 540 Madison Avenue, 7th Floor, New York, NY 10022. Averill Master Fund, Ltd.’s address is c/o Maples Corporate Services

Limited, P.O. Box 309, Ugland House, Grand Cayman KY1-1104, Cayman Islands. |

| |

|

| (18) |

Based on information set forth in a Schedule 13G

filed with the SEC on May 9, 2024 by Janus Henderson Group plc and Janus Henderson Biotech Innovation Master Fund Ltd., each of which

may be deemed to have beneficial ownership of 2,380,667 shares of our Common Stock. Janus Henderson Group plc’s address is 201

Bishopsgate, EC2M 3AE, United Kingdom. Janus Henderson Biotech Innovation Master Fund Ltd.’s address is c/o Janus Henderson Investors

US LLC, 151 Detroit Street, Denver, Colorado 80206.

|

To

our knowledge, except as noted above, no person or entity is the beneficial owner of more than 5% of the voting power of the Company’s

Common Stock.

Executive

Compensation

The

following table sets forth the aggregate compensation paid to: (i) our principal executive officer at the end of fiscal year 2023, Vishwas

Seshadri and (ii) our only other executive officers other than our principal executive officer who were serving as an executive officer

at the end of fiscal year 2023, Joseph Vazzano and Brendan O’Malley.

Summary

Compensation Table

| | |

| | |

| | |

| | |

| | |

| | |

Non-Equity | | |

All | | |

| |

| | |

| | |

| | |

| | |

Option | | |

Stock | | |

Incentive Plan | | |

Other | | |

| |

| Name and | |

| | |

Salary | | |

Bonus | | |

Awards | | |

Awards | | |

Compensation | | |

Compensation | | |

Total | |

| Principal Position | |

Year | | |

($) | | |

($)(1) | | |

($)(2) | | |

($)(2) | | |

($)(3) | | |

($)(4) | | |

($) | |

| Vishwas Seshadri | |

| 2023 | | |

| 555,000 | | |

| 533,333 | | |

| - | | |

| 1,357,409 | | |

| 388,500 | | |

| 13,200 | | |

| 2,847,442 | |

| President and Chief Executive Officer | |

| 2022 | | |

| 505,000 | | |

| 125,250 | | |

| - | | |

| 478,016 | | |

| 378,750 | | |

| 12,800 | | |

| 1,499,816 | |

| Joseph Vazzano (5) | |

| 2023 | | |

| 440,000 | | |

| 235,333 | | |

| - | | |

| 571,889 | | |

| 232,320 | | |

| 13,200 | | |

| 1,492,742 | |

| Chief Financial Officer | |

| 2022 | | |

| 390,600 | | |

| 65,100 | | |

| - | | |

| 224,070 | | |

| 231,235 | | |

| 12,200 | | |

| 923,205 | |

| Brendan O’Malley | |

| 2023 | | |

| 422,000 | | |

| 150,000 | | |

| - | | |

| 366,335 | | |

| 217,752 | | |

| 13,200 | | |

| 1,169,287 | |

| General Counsel | |

| 2022 | | |

| 390,600 | | |

| 65,100 | | |

| - | | |

| 224,070 | | |

| 231,235 | | |

| 12,200 | | |

| 923,205 | |

| (1) |

Reflects

cash retention bonuses paid on June 23, 2023 and December 15, 2022. The 2023 retention bonus was to make up for the shortfall in

equity that was granted as compared to the recommended market amount to be granted. The 2022 retention bonus was to retain key talent

to ensure continuity and stability of operations. |

| |

|

| (2) |

Reflects

aggregate grant date fair value for the fiscal years presented, computed in accordance with ASC 718, in respect of option awards

and restricted stock awards, as applicable. Our assumptions in determining fair value are described in Note 10 of Notes to Consolidated

Financial Statements in Part II, Item 8 of the Annual Report. Amounts shown do not reflect the compensation actually received by

the named executive officers. |

| |

|

| (3) |

Amounts

shown reflect target-based cash incentive bonuses earned with respect to the fiscal years presented. For Mr. Vazzano, 2022 amounts

are based on his annualized base salary and prorated for time worked. |

| |

|

| (4) |

Represents

employer matching contributions to the Company’s 401(k) Defined Contribution Plan. |

| |

|

| (5) |

Mr.

Vazzano was appointed as our Chief Financial Officer on March 14, 2022. |

Outstanding

Equity Awards at Fiscal Year-End

The

following table summarizes the aggregate number of option and stock awards held by our named executive officers (“NEOs”)

as of December 31, 2023.

| | |

| | |

Option

Awards | | |

Stock

Awards | |

| | |

| | |

Number

of | | |

Number

of | | |

| | |

| | |

Number

of | | |

Market

Value | |

| | |

| | |

Securities | | |

Securities | | |

| | |

| | |

Shares

or | | |

of

Shares or | |

| | |

| | |

Underlying | | |

Underlying | | |

| | |

| | |

Units | | |

Units

of | |

| | |

| | |

Unexercised | | |

Unexercised | | |

Option | | |

| | |

of

Stock | | |

Stock | |

| | |

| | |

Options | | |

Options | | |

Exercise | | |

Option | | |

That

Have | | |

That

Have | |

| | |

Grant | | |

(#) | | |

(#) | | |

Price | | |

Expiration | | |

Not

Vested | | |

Not

Vested | |

| Name | |

Date | | |

Exercisable | | |

Unexercisable | | |

($) | | |

Date | | |

(#) | | |

($)(1) | |

| | |

| 6/5/2023 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 336,826 | (3) | |

$ | 1,687,498 | |

| | |

| 9/28/2022 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 116,400 | (3) | |

$ | 583,164 | |

| Vishwas

Seshadri | |

| 10/15/2021 | | |

| 6,500 | | |

| 5,500 | (2) | |

$ | 22.75 | | |

| 10/15/2031 | | |

| 1,000 | (3) | |

$ | 5,010 | |

| | |

| 6/1/2021 | | |

| 10,000 | | |

| 6,000 | (2) | |

$ | 42.75 | | |

| 6/1/2031 | | |

| 4,000 | (3) | |

$ | 20,040 | |

| | |

| 6/5/2023 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 141,908 | (4) | |

$ | 710,959 | |

| | |

| 9/28/2022 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 54,563 | (4) | |

$ | 273,358 | |

| Joseph

Vazzano | |

| 7/21/2022 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 9,000 | (4) | |

$ | 45,090 | |

| | |

| 3/14/2022 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 4,500 | (4) | |

$ | 22,545 | |

| | |

| 6/5/2023 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 90,902 | (6) | |

$ | 455,419 | |

| | |

| 9/28/2022 | | |

| | | |

| | | |

| | | |

| | | |

| 54,563 | (6) | |

$ | 273,358 | |

| | |

| 9/20/2021 | | |

| 6,118 | | |

| 4,762 | (5) | |

$ | 30.25 | | |

| 9/20/2031 | | |

| 2,720 | (6) | |

$ | 13,627 | |

| | |

| 3/1/2021 | | |

| 2,752 | | |

| 1,248 | (5) | |

$ | 58.50 | | |

| 3/1/2031 | | |

| 1,000 | (6) | |

$ | 5,010 | |

| Brendan

O’Malley | |

| 5/20/2020 | | |

| 679 | | |

| 44 | (5) | |

$ | 28.75 | | |

| 3/16/2030 | | |

| 250 | (6) | |

$ | 1,253 | |

| | |

| 3/16/2020 | | |

| 1,198 | | |

| 79 | (5) | |

$ | 28.75 | | |

| 3/16/2030 | | |

| - | | |

$ | - | |

| | |

| 5/31/2019 | | |

| 2,200 | (5) | |

| - | | |

$ | 28.75 | | |

| 5/31/2029 | | |

| - | | |

$ | - | |

| (1) |

Calculated

based on our closing share price on December 29, 2023 of $5.01. |

| |

| (2) |

Dr.

Seshadri’s options to purchase shares of Common Stock will vest in the following periods: 12,000 options at $22.75 per share

granted on October 15, 2021 will be fully vested in October 2025 and 16,000 options granted on June 1, 2021 at $42.75 per share will

be fully vested in June 2025. |

| (3) |

Dr.

Seshadri’s restricted stock will vest in the following periods: 2,000 shares granted on October 15, 2021 will be fully vested

in October 2025; 8,000 shares granted on June 1, 2021 will be fully vested in June 2025; 155,200 shares granted on September 28,

2022 will be fully vested in September 2026; and 336,826 shares granted on June 5, 2023 will be fully vested in June 2026. |

| |

| (4) |

Mr.

Vazzano’s restricted stock will vest in the following periods: 8,000 shares granted on March 14, 2022 will be fully vested

in March 2026; 12,000 shares granted on July 21, 2022 will be fully vested in July 2026; 72,750 shares granted on September 28, 2022

will be fully vested in September 2026; and 141,908 shares granted on June 5, 2023 will be fully vested in June 2026. |

| |

| (5) |

Dr.

O’Malley’s options to purchase shares of Common Stock will vest in the following periods: 10,880 options granted on September

20, 2021 at $30.25 per share will be fully vested in September 2025; 4,000 options granted on March 1, 2021 at $58.50 per share will

be fully vested in March 2025; 723 options granted on May 20, 2020 at $28.75 per share will be fully vested in March 2024; 1,277

options granted on March 16, 2020 at $28.75 per share will be fully vested in March 2024 and 2,200 options granted on May 31, 2019

at $28.75 per share were fully vested as of May 2023. |

| |

| (6) |

Dr.

O’Malley’s restricted stock will vest in the following periods: 5,440 shares granted on September 20, 2021 will be fully

vested in September 2025; 2,000 shares granted on March 1, 2021 will be fully vested in March 2025; 750 shares granted on May 20,

2020 will be fully vested in March 2024; 72,750 shares granted on September 28, 2022 will be fully vested in September 2026; and

90,902 shares granted on June 5, 2023 will be fully vested in June 2026. |

Compensation

Pursuant to Agreements and Plans

Employment

Agreements

President

and Chief Executive Officer

Dr.

Seshadri entered into an employment agreement with the Company when he joined as SVP, Head of Research & Clinical Development on

June 1, 2021. In his role as SVP, Head of Research & Clinical Development, Dr. Seshadri received an annual base salary of $400,000

and was eligible for an annual discretionary bonus with a target of 40% of his annual base salary. On June 1, 2021, Dr. Seshadri was

granted stock options to purchase 16,000 shares of Common Stock pursuant to the Company’s 2015 Equity Incentive

Plan, with 25% vesting on June 1, 2022 and the remaining 75% vesting in 36 equal monthly installments thereafter. On June 1, 2021, Dr.

Seshadri was granted 12,000 restricted shares of Common Stock pursuant to the Company’s 2015 Equity Incentive Plan, with 6,000

shares vesting on June 1, 2022 and the remaining 6,000 shares vesting in three installments of 2,000 shares annually thereafter starting

on June 1, 2023.

On

October 15, 2021, Dr. Seshadri was appointed President, Chief Executive Officer, and Director. In his new role as President and Chief

Executive Officer, Dr. Seshadri was initially entitled to receive an annual base salary of $500,000 (which has been subsequently increased

as described above) and is eligible for an annual discretionary bonus with a target of 50% of his annual base salary. In connection with

his appointment to President and Chief Executive Officer, Dr. Seshadri was granted 2,000 shares of restricted stock and options to purchase

12,000 shares of Common Stock. The options vest 25% on the one-year anniversary of the grant date and the remaining 75% vest in 36 equal

monthly installments thereafter. The restricted stock will vest 25% on the one-year anniversary of the grant date and the remaining 75%

vest in equal annual installments over the following 36 months. Dr. Seshadri is eligible to participate in all employee benefit plans

that the Company may establish for similarly situated employees, if and to the extent he is eligible pursuant to the terms of such plans

and Company policies, which may be modified by the Company at its discretion.

Under

the terms of his employment agreement dated October 6, 2021, Dr. Seshadri and the Company may each terminate Dr. Seshadri’s employment

for any reason upon written notice to the other party. If Dr. Seshadri’s employment is terminated by the Company other than for

Cause, or by Dr. Seshadri for Good Reason (as each term is defined in his employment agreement), Dr. Seshadri will be entitled to (i)

a payment equal to the sum of his base salary plus his target annual bonus opportunity, (ii) payment equal to the cost of the premium

for his health coverage under the Company’s health plan for him and his dependents for the 12-month period following his termination

date, (iii) a pro-rata bonus for the year of termination and (iv) accelerated vesting equivalent to 12 months of continued employment

from the Termination Date (disregarding such termination for such purpose) with respect to all unvested equity and any other long-term

incentive awards granted to Dr. Seshadri and then outstanding on the Termination Date. The Company’s obligations in the preceding

sentence are conditioned upon, among other things, Dr. Seshadri’s execution and nonrevocation of a release of claims in favor of

the Company and its affiliates.

If

Dr. Seshadri remains continuously employed through the date of a Change in Control (as that term is defined in his employment agreement),

all outstanding equity compensation awards will become fully vested and exercisable immediately.

Chief

Financial Officer

The

Board appointed Mr. Vazzano as Chief Financial Officer effective March 14, 2022. He was entitled to an annual base salary of $360,000,

and a target annual bonus opportunity equal to 40% of his base salary. On March 14, 2022, Mr. Vazzano was granted 8,000 restricted shares

of Common Stock pursuant to the Company’s 2015 Equity Incentive Plan, with 25% vesting on each of March 14, 2023, March 14, 2024,

March 14, 2025 and March 14, 2026. Mr. Vazzano is eligible to participate in all employee benefit plans that the Company may establish

for similarly situated employees, if and to the extent he is eligible pursuant to the terms of such plans and Company policies, which

may be modified by the Company at its discretion.

Pursuant

to his employment agreement dated February 28, 2022, upon achievement of certain corporate actions effective July 2, 2022, Mr. Vazzano’s

annual base salary was increased to $400,000 (which has been subsequently increased as described above), and he was granted 12,000 restricted

shares of Common Stock pursuant to the Company’s 2015 Equity Incentive Plan, with 25% vesting on each of July 21, 2023, July 21,

2024, July 21, 2025 and July 21, 2026.

Under

the terms of his employment agreement, Mr. Vazzano and the Company may each terminate Mr. Vazzano’s employment for any reason upon

written notice to the other party. If Mr. Vazzano’s employment is terminated by the Company other than for Cause, or by Mr. Vazzano

for Good Reason (as each term is defined in his employment agreement), Mr. Vazzano will be entitled to (i) a payment equal to the sum

of 12 months of his annual base salary plus 12 months of his annual target annual bonus opportunity and (ii) payment equal to the cost

of the premium for his health coverage under the Company’s health plan for him and his dependents for the 12-month period following

his termination date. If Mr. Vazzano’s employment is terminated by the Company other than for Cause, or by Mr. Vazzano for Good

Reason (as each term is defined in his employment agreement) within 12 months following a Change of Control, Mr. Vazzano will be entitled

to (i) a payment equal to the sum of 12 months of his annual base salary plus 12 months of his annual target annual bonus opportunity

and (ii) payment equal to the cost of the premium for his health coverage under the Company’s health plan for him and his dependents

for the 12-month period following his termination date. The Company’s obligations in the preceding sentence are conditioned upon,

among other things, Mr. Vazzano’s execution and nonrevocation of a release of claims in favor of the Company and its affiliates.

If

Mr. Vazzano remains continuously employed through the date of a Change in Control (as that term is defined in his employment agreement),

all outstanding equity compensation awards will become fully vested and exercisable immediately.

General

Counsel

Dr.

O’Malley joined Abeona in 2019 as Chief IP Counsel. He was entitled to an annual base salary of $321,000, effective January 1,

2021 and a target annual bonus opportunity equal to 35% of his base salary. The amount of the annual bonus actually paid depended on

the extent to which the performance goals are achieved or exceeded as determined by the Board. Dr. O’Malley is eligible to participate

in all employee benefit plans that the Company may establish for similarly situated employees, if and to the extent he is eligible pursuant

to the terms of such plans and Company policies, which may be modified by the Company at its discretion.

On

September 20, 2021, Dr. O’Malley was appointed SVP, General Counsel. In this role, Dr. O’Malley received an annual base salary

of $372,000 (which has been subsequently increased as described above) and was eligible for an annual discretionary bonus with a target

of 40% of his annual base salary. In connection with his appointment as SVP, General Counsel, Dr. O’Malley was granted 5,440 shares

of restricted stock and options to purchase 10,880 shares of Common Stock. The options vest 25% on the one-year anniversary of

the grant date and the remaining 75% vest in 36 equal monthly installments thereafter. The restricted stock will vest 25% on the one-year

anniversary of the grant date and the remaining 75% vest in equal annual installments over the following 36 months.

Under

the terms of his employment agreement dated September 16, 2021, Dr. O’Malley and the Company may each terminate Dr. O’Malley’s

employment for any reason upon written notice to the other party. If Dr. O’Malley’s employment is terminated by the Company

other than for Cause, or by Dr. O’Malley for Good Reason (as each term is defined in his employment agreement), Dr. O’Malley

will be entitled to (i) a payment equal to the sum of 12 months of his annual base salary plus 12 months of his annual target annual

bonus opportunity and (ii) payment equal to the cost of the premium for his health coverage under the Company’s health plan for

him and his dependents for the 12-month period following his termination date. If Dr. O’Malley’s employment is terminated

by the Company other than for Cause, or by Dr. O’Malley for Good Reason (as each term is defined in his employment agreement) within

12-months following a Change of Control, Dr. O’Malley will be entitled to (i) a payment equal to the sum of 12 months of his annual

base salary plus 12 months of his annual target annual bonus opportunity and (ii) payment equal to the cost of the premium for his health

coverage under the Company’s health plan for him and his dependents for the 12-month period following his termination date. The

Company’s obligations in the preceding sentence are conditioned upon, among other things, Dr. O’Malley’s execution

and nonrevocation of a release of claims in favor of the Company and its affiliates.

If

Dr. O’Malley remains continuously employed through the date of a Change in Control (as that term is defined in his employment agreement),

all outstanding equity compensation awards will become fully vested and exercisable immediately.

Retirement

Benefits

The

Company’s executives are provided usual and customary retirement benefits available to all employees, including the NEOs. These

include a 401(k) plan, life insurance, accidental death and dismemberment insurance, medical and dental insurance, vision insurance,

long-term disability insurance and a Company-sponsored pension plan. We provide matching contributions under our 401(k) plan to all employees,

including the NEOs.

Compensation

Committee Discussion on Executive Compensation

The

Compensation Committee operates under a written charter adopted by the Board and is responsible for making all compensation decisions

for the Company’s directors and named executive officers, including determining base salary and annual incentive compensation amounts

and recommending stock option grants and other stock-based compensation under our equity incentive plans. The Compensation Committee

charter can be found on our website at www.abeonatherapeutics.com under “Investors & Media—Corporate Governance—Governance

Documents.”

Pay

Versus Performance

In

accordance with rules adopted by the SEC pursuant to the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, we are providing

the following disclosure, as it applies to smaller reporting companies, regarding executive “Compensation Actually Paid”

(“CAP”), as calculated under applicable SEC rules, for our principal executive officer(s) (“PEO(s)”) and our

other named executive officers (“non-PEO NEOs”) and certain financial performance measures for the fiscal years ended December

31, 2023, 2022 and 2021.

In

determining the CAP to our PEO(s) and the CAP to our non-PEO NEOs, we are required to make various adjustments to the total compensation

amounts that have been reported in the Summary Compensation Table (“SCT”), as the SEC’s valuation methods for this

section differ from those required in the SCT. Information regarding the methodology for calculating CAP to our PEO(s) and the CAP to

our non-PEO NEOs, including details regarding the amounts that were deducted from, and added to, the SCT totals to arrive at the values

presented for CAP, are provided in the footnotes to the table. Note that for non-PEO NEOs, compensation is reported as an average.

Pay

Versus Performance

| Year | |

Summary

Compensation

Table Total

for Dr.

Seshadri (1) | | |

Summary

Compensation

Table Total

for Mr.

Amoroso (1) | | |

Compensation

Actually Paid

to Dr.

Seshadri (1)(2) | | |

Compensation

Actually Paid

to Mr.

Amoroso (1)(2) | | |

Average

Summary

Compensation

Table Total

for Non-PEO

NEOs | | |

Average

Compensation

Actually Paid

to Non-PEO

NEOs | | |

Value of

Initial Fixed

$100

Investment

Based on

Total

Shareholder

Return | | |

Net

Income

(Loss) (in

thousands) | |

| 2023 | |

$ | 2,847,442 | | |

| — | | |

$ | 3,458,338 | | |

| — | | |

$ | 1,331,015 | | |

$ | 1,588,304 | | |

$ | 12.76 | | |

$ | (54,188 | ) |

| 2022 | |

$ | 1,499,816 | | |

| — | | |

$ | 1,304,561 | | |

| — | | |

$ | 656,543 | | |

$ | 513,329 | | |

$ | 7.85 | | |

$ | (39,696 | ) |

| 2021 | |

$ | 1,566,475 | | |

$ | 3,064,987 | | |

$ | 570,644 | | |

$ | 541,560 | | |

$ | 1,374,544 | | |

$ | 620,407 | | |

$ | 21.46 | | |

$ | (84,936 | ) |

(1)

During 2021, Mr. Amoroso served as our PEO from January 1, 2021 to October 14, 2021. Dr. Seshadri has served as our PEO since October

15, 2021.

(2)

Deductions from, and additions to, total compensation as reported in the SCT by year to calculate CAP include:

| | |

| |

| | |

| | |

| | |

| | |

| | |

Subtract | | |

| |

| | |

| |

| | |

| | |

| | |

| | |

| | |

Value of | | |

| |

| | |

| |

| | |

| | |

| | |

Add

Change | | |

Add

Change | | |

Equity Awards | | |

| |

| | |

| |

| | |

| | |

| | |

in | | |

in | | |

that | | |

| |

| | |

| |

| | |

| | |

Add | | |

Value of | | |

Value of | | |

Failed to | | |

| |

| | |

| |

Summary Compensation | | |

Subtract Stock | | |

Year-End Equity | | |

Prior

Equity | | |

Vested

Equity | | |

Meet Vesting | | |

Compensation Actually | |

| | |

| |

Table Total | | |

Awards | | |

Value | | |

Awards | | |

Awards | | |

Conditions | | |

Paid | |

| Year | |

Executive(s) | |

($) | | |

($) | | |

($) | | |

($) | | |

($) | | |

($) | | |

($) | |

| 2023 | |

Dr. Seshadri | |

| 2,847,442 | | |

| (1,357,409 | ) | |

| 1,687,498 | | |

| 246,521 | | |

| 34,285 | | |

| — | | |

| 3,458,338 | |

| | |

Other NEOs | |

| 2,662,029 | | |

| (938,224 | ) | |

| 1,166,378 | | |

| 253,501 | | |

| 32,924 | | |

| — | | |

| 3,176,609 | |

| 2022 | |

Dr. Seshadri | |

| 1,499,816 | | |

| (478,016 | ) | |

| 478,016 | | |

| (128,280 | ) | |

| (66,975 | ) | |

| — | | |

| 1,304,561 | |

| | |

Other NEOs | |

| 1,969,630 | | |

| (565,340 | ) | |

| 509,740 | | |

| (82,571 | ) | |

| (31,546 | ) | |

| (259,927 | ) | |

| 1,539,986 | |

| 2021 | |

Dr. Seshadri | |

| 1,566,475 | | |

| (1,303,070 | ) | |

| 307,239 | | |

| — | | |

| — | | |

| — | | |

| 570,644 | |

| | |

Mr. Amoroso | |

| 3,064,987 | | |

| (2,602,910 | ) | |

| 370,580 | | |

| (237,664 | ) | |

| (53,434 | ) | |

| — | | |

| 541,560 | |

| | |

Other NEOs | |

| 2,749,088 | | |

| (1,762,934 | ) | |

| 413,824 | | |

| (156,701 | ) | |

| (2,462 | ) | |

| — | | |

| 1,240,814 | |

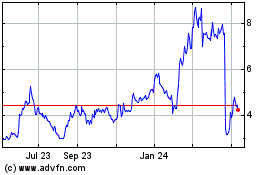

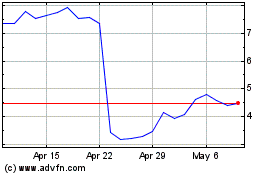

Description

of Relationship Between PEOs and Non-PEO NEO Compensation Actually Paid and Company Total Shareholder Return (“TSR”)

The

following chart sets forth the relationship between the average Compensation Actually Paid to our PEOs, the average of Compensation Actually

Paid to our Non-PEO NEOs, and the Company’s cumulative TSR over the three most recently completed fiscal years.

Description

of Relationship Between PEOs and Non-PEO NEO Compensation Actually Paid and Net Income

The

following chart sets forth the relationship between the average Compensation Actually Paid to our PEOs, the average of Compensation Actually

Paid to our Non-PEO NEOs, and our Net Income during the three most recently completed fiscal years.

Proposal

to Be Voted Upon

PROPOSAL

1

APPROVAL

OF AN Increase in the Number of Shares OF COMMON STOCK Reserved for Issuance Under the

Second Amended and Restated Abeona Therapeutics Inc. 2023 Equity Incentive Plan

On

November 1, 2024, the Board adopted, subject to stockholder approval, an amendment (the “Plan Amendment”) to the Amended

and Restated Abeona Therapeutics Inc. 2023 Equity Incentive Plan (the “2023 Equity Incentive Plan”) to increase the number

of shares of our Common Stock authorized for issuance thereunder from 3,200,000 to 8,400,000 shares. The Equity Incentive Plan as amended

by the Plan Amendment is referred to below as the “Second Amended and Restated 2023 Equity Incentive Plan.” Other than the

increase in the share reserve, no other substantive changes are contemplated to the Second Amended and Restated 2023 Equity Incentive

Plan.

Why

You Should Vote FOR the Amendment to the 2023 Equity Incentive Plan

Abeona’s

current overhang is 8.8% which is well below industry norms of a total overhang of 22.2% at the median (50th percentile) and 25.9% at

the 75th percentile. Overhang is calculated as the sum of outstanding options, unvested RSUs, and shares not subject to outstanding awards

and available for issuance (together, the “Numerator”) divided by the sum of the Numerator and shares of Common Stock

outstanding as of November 7, 2024.

As

of December 31, 2023, we had 84 full-time employees. As of November 7, 2024 this number has grown to 127 full-time employees and is expected

to significantly increase in 2025. As Abeona transitions from a research and development company to a commercial stage company, Abeona

is building out its’ manufacturing and commercial infrastructure. A key component of this build out is talent retention. Equity

incentive compensation programs play a pivotal role in our efforts to attract and retain key personnel essential to the Company’s

long-term growth commercially and our ultimate financial success. The Board of Directors and management are asking our stockholders to

approve the Plan Amendment to assist the Company in attracting and retaining qualified personnel. If our stockholders do not approve

the Plan Amendment we will be limited in our ability to continue to issue awards in numbers sufficient to attract and motivate the highly

skilled employees we need to recruit and retain, due to low share reserves remaining in the 2023 Equity Incentive Plan and the dilution

to our share reserve and outstanding equity awards from the increase in our stock outstanding from recent financing activities, and our

employees’ motivation and incentives will be negatively affected.

Offering

a broad-based equity compensation program is vital to attracting and retaining highly skilled people in the highly competitive life sciences

industry. The Company uses equity awards to increase incentives on the part of employees, non-employee directors, consultants and other

key advisors who provide important services to the Company. The Board of Directors and management believes that providing an equity stake

in the future success of our Company motivates these individuals to achieve our long-term business goals and to increase stockholder

value. Their innovation and productivity are critical to our success. Accordingly, approving the Plan Amendment is in the best interest

of our stockholders because equity awards help us to:

| ● |

attract,

motivate and retain talented employees and directors; |

| |

|

| ● |

align

employee and stockholder interests; and |

| |

|

| ● |

link

employee compensation with Company performance. |

The

Board of Directors and management strongly believe that the approval of the Plan Amendment will enable us to achieve our goals

in attracting and retaining our most valuable asset: our employees and other service providers.

In

its determination to approve the amendment to the 2023 Equity Incentive Plan, the Compensation Committee considered an analysis prepared

by independent compensation consultants engaged by the Compensation Committee and management, which included an analysis of our historical

share usage and other key metrics including burn rate, dilution, and overhang compared to the historical market data of 67 biotechnology

companies with a market capitalization ranging from $200 million to $500 million. This dataset showed a 3-year average net burn rate

of 5.4% at the median (50th percentile) and 7.1% at the 75th percentile. This same dataset also showed a total overhang of 22.2% at the

median (50th percentile) and 25.9% at the 75th percentile. As it relates to our equity grant practices, we would point out:

| |

● |

Current

Situation: Abeona needs the additional 5,200,000 shares of Common Stock requested in

the Plan Amendment to retain and motivate the talent necessary to execute our potential commercialization

of pz-cel, research and development objectives and long-term strategy. In our current cash

constrained environment, there is significant risk associated with an inability to timely

deliver equity compensation. As of November 7, 2024, we have only 40,473 shares of Common

Stock remaining for future grant under the 2023 Equity Incentive Plan. The additional

requested shares brings our overhang from 8.8% to 17.7% which is more in line with current

industry levels, but still below the median of peer companies.

|

| |

|

|

| |

● |

Historical

Annual Share Usage: Abeona has historically granted equity in a responsible and carefully

considered manner. Our 3-year average net burn rate is 4.7%. This average net burn rate is

well within market norms and below the median of market data for similarly situated companies.

Annual net burn rate is calculated by dividing (i) the sum of options and RSA’s granted

in the applicable year (inclusive of forfeitures and cancellations) by (ii) shares of Common

Stock outstanding as of fiscal year end.

|

| |

|

|

| |

● |

Median

(50th percentile) Overhang with Share Request: If approved, the proposal to add 5,200,000 shares of Common Stock would

result in an overhang of 16.7% for the 2023 Equity Incentive Plan (this would be equal to 17.7% if we included our inducement plan

which is reserved for new hires who are critical in order for us to scale up our manufacturing and commercial activities). This is

consistent with historical levels and slightly below the median of market data for similarly situated companies. Overhang is calculated

as the sum of outstanding options, unvested RSUs, and shares not subject to outstanding awards and available for issuance (together,

the “Numerator”) divided by the sum of the Numerator and shares of Common Stock outstanding as of November 7,

2024. |

Without

an appropriate reserve of shares of Common Stock to grant competitive equity-based incentives, we would be forced to consider cash replacement

alternatives to provide a market-competitive total compensation package necessary to attract, retain and motivate the talent critical

to our future successes. These cash replacement alternatives could, among other things, reduce the cash available for investment in growth

and development and cause a loss of employee motivation to achieve superior performance over a longer period of time. Equity-based incentives,

by contrast, directly align a portion of the compensation of our service providers with the economic interests of our stockholders.

For

that reason, the Company has structured the Second Amended and Restated 2023 Equity Incentive Plan to provide flexibility in designing

equity incentive programs with a broad array of equity incentives, such as stock options, stock appreciation rights (“SARs”),

stock awards and restricted stock units and implement competitive incentive compensation programs for its employees and non-employee

directors. The Second Amended and Restated 2023 Equity Incentive Plan will continue to be the only plan under which new equity awards

may be granted to our current employees and other service providers. If this Proposal 1 is not approved, then we would be at a disadvantage

against our competitors for recruiting, retaining and motivating individuals critical to our success and could be forced to increase

cash compensation, thereby reducing resources available to meet our business needs.

Dilution

Analysis

The

table below shows our potential dilution levels based on our Common Stock outstanding as of November 7, 2024, the new shares of Common

Stock requested for issuance under the Second Amended and Restated 2023 Equity Incentive Plan and our total equity awards outstanding

as of September 30, 2024. The Board believes that the number of shares of Common Stock requested under the Second Amended and

Restated 2023 Equity Incentive Plan represents a reasonable amount of potential equity dilution and will allow us to continue granting

equity awards.

| Stock Options Outstanding as of September 30, 2024 | |

| 177,138 | |

| Weighted Average Exercise Price of Stock Options Outstanding as of September 30, 2024 | |

$ | 38.62 | |

| Weighted Average Remaining Term of Stock Options Outstanding as of September 30, 2024 | |

| 6.09 years | |

| Outstanding Full Value Awards as of September 30, 2024(1) | |

| 3,268,414 | |

| Total Equity Awards Outstanding as of September 30, 2024(2) | |

| 3,445,552 | |

| Shares of Common Stock Available for Grant under

Other Plans as of September 30, 2024(3) | |

| 725,473 | |

| Shares of Common Stock Requested for the Second Amended and Restated 2023 Equity Incentive Plan | |

| 5,200,000 | |

| Total Potential Overhang under the 2023 Equity Incentive Plan(4) | |

| 9,371,025 | |

| Shares of Common Stock Outstanding as of November 7, 2024 | |

| 43,593,484 | |

| Fully Diluted Shares of

Common Stock(5) | |

| 52,964,509 | |

| Potential Dilution of 5,200,000 Shares of Common Stock as a Percentage of Fully Diluted Shares | |

| 9.8 | % |

(1)

“Full Value Awards” includes restricted stock awards granted under prior plans and as inducement awards that qualify for

the inducement grant exception to the shareholder approval requirements of the Nasdaq Stock Market set forth in Rule 5635(c)(4) (“Inducement

Awards”).

(2)

“Total Equity Awards” represents the sum of outstanding stock options and outstanding Full Value Awards, in each case as

of September 30, 2024.

(3)

“Shares of Common Stock Available for Grant under Other Plans” represents 40,473 shares of Common Stock still

available to be granted under the 2023 Incentive Plan and 685,000 shares of Common Stock available to be granted under the 2023

Employment Inducement Equity Incentive Plan.

(4)

“Total Potential Overhang” includes the sum of the total number of equity awards outstanding as of September 30, 2024, the

number of shares of Common Stock available for Grant under Other Plans as of September 30, 2024, and the number of shares requested

for the Second Amended and Restated 2023 Equity Incentive Plan.

(5)

“Fully Diluted Shares of Common Stock” reflects the sum of the total number of shares of Common Stock outstanding

as of November 7, 2024, the total number of equity awards outstanding as of September 30, 2024, the number of shares of Common Stock

available for Grant under Other Plans as of September 30, 2024, and the number of additional shares of Common Stock requested

for grant under the Second Amended and Restated 2023 Equity Incentive Plan.

Burn

Rate

In

connection with our stock-based compensation programs, we are committed to using equity incentive awards prudently and within reasonable

limits. Accordingly, we closely monitor our equity award “burn rate” each year. Our annual burn rate is determined by dividing

the number of shares of Common Stock subject to equity-based awards we grant in a calendar year by the weighted average number

of our fully-diluted shares of Common Stock outstanding for that calendar year. The average annual burn rate for the years 2023, 2022

and 2021 was 9.0%. We anticipate that the share reserve under the Second Amended and Restated 2023 Equity Incentive Plan will enable

us to fund our equity compensation program for approximately three years. While the Company believes this is a reasonable estimate of

how long the share reserve would last, the actual period for which the proposed Share reserve will fund our equity compensation program

may be shorter or longer than three years, depending on changes in our granting practices, stock price and headcount growth.

Highlights

of the Second Amended and Restated 2023 Equity Incentive Plan

The

Second Amended and Restated 2023 Equity Incentive Plan contains a number of provisions that we believe are consistent with best practices

in equity compensation and which protect the stockholders’ interests, as described below:

| ● |

No

evergreen authorization. The Second Amended and Restated 2023 Equity Incentive Plan does not contain an “evergreen”

Share reserve, meaning that the Share reserve will not be increased without further stockholder approval. |

| ● |

No

liberal share recycling provisions. The Second Amended and Restated 2023 Equity Incentive Plan prohibits the re-use of shares

of Common Stock withheld or delivered to satisfy the exercise price of a stock option or base price of a SAR or to satisfy tax

withholding requirements associated with any award. The Second Amended and Restated 2023 Equity Incentive Plan also prohibits “net

share counting” upon the exercise of stock options or SARs and prohibits the re-use of shares of Common Stock purchased

on the open market with the proceeds of option exercises. |

| |

|

| ● |

Limit

on awards to non-employee directors. The Second Amended and Restated 2023 Equity Incentive Plan imposes an aggregate limit on

the value of awards that may be granted, when aggregated with cash fees that may be paid, to each non-employee director for services

as a non-employee director in any year to $500,000 in total value. |

| |

|

| ● |

Minimum

vesting requirements. The Second Amended and Restated 2023 Equity Incentive Plan requires a one-year minimum vesting schedule

for awards, except that up to 5% of the shares of Common Stock reserved for issuance (subject to certain adjustments) are

available for grant without regard to this requirement, and awards granted to non-employee directors on the date of an annual stockholders’

meeting satisfy this requirement if they provide for vesting at the stockholders’ meeting immediately following the grant date

(but in any event not less than 50 weeks following the date of grant). |

| |

|

| ● |

Ban

on in-the-money stock options and SARs. The Second Amended and Restated 2023 Equity Incentive Plan prohibits the grant of stock

options or stock appreciation rights with an exercise price or base price that is less than fair market value on the date of grant. |

| |

|

| ● |

No

repricing or grant of discounted stock options or SARs. The Second Amended and Restated 2023 Equity Incentive Plan prohibits

repricing of options or SARs either by amending an existing award or substituting a new award for a cancelled award that has an exercise

price or base amount less than the exercise price or base amount applicable to the original award. |

| |

|

| ● |

No

single-trigger acceleration. The Second Amended and Restated 2023 Equity Incentive Plan does not provide for automatic vesting

acceleration of awards in connection with a change in control of the Company. |

| |

|

| ● |

No

dividends on unvested awards. The Second Amended and Restated 2023 Equity Incentive Plan prohibits dividends or dividend equivalents

to be granted in connection with stock options or SARs and prohibits payment of dividends or dividend equivalents on unvested awards

until the underlying awards have vested. |

| |

|

| ● |

Subject

to applicable clawback policies. Awards granted under the Second Amended and Restated 2023 Equity Incentive Plan are subject

to any applicable clawback or recoupment policies, share trading policies, and other policies that may be approved or implemented

by the Board or the Compensation Committee from time to time. |

| |

|

| ● |

Administered

by an independent committee. The Second Amended and Restated 2023 Equity Incentive Plan will be administered by an independent

committee of the Board. |

Summary

of the Second Amended and Restated 2023 Equity Incentive Plan

The

material terms of the Second Amended and Restated 2023 Equity Incentive Plan are summarized below. This summary of the Second Amended

and Restated 2023 Equity Incentive Plan is not intended to be a complete description of the Second Amended and Restated 2023 Equity Incentive

Plan and is qualified in its entirety by the actual text of the Second Amended and Restated 2023 Equity Incentive Plan attached hereto

as Appendix A. Capitalized terms used, but not defined, in the following summary have the meaning assigned to those terms in the Second

Amended and Restated 2023 Equity Incentive Plan.

Purpose

The